Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

A Comprehensive Exploration of the Capital Asset Pricing Model

Authors: Keya Khot

DOI Link: https://doi.org/10.22214/ijraset.2024.58393

Certificate: View Certificate

Abstract

In this comprehensive paper, we embark on a journey to explore the Capital Asset Pricing Model (CAPM) in both theoretical depth and practical breadth. Beginning with an introduction that traces its historical origins and fundamental principles, we delve into the model\'s theoretical underpinnings, elucidating its core concepts and underlying assumptions. Transitioning from theory to practice, we provide a detailed roadmap for the CAPM\'s real-world implementation, offering practical insights through examples and case studies. Throughout, we address the model\'s significance as a foundational pillar of finance, its enduring relevance in contemporary markets, and the practical nuances and limitations that both newcomers and seasoned professionals must navigate to make informed investment decisions. This paper aims to empower readers with a comprehensive understanding of the CAPM, bridging the gap between its theoretical elegance and its practical utility in today\'s multifaceted financial landscape.

Introduction

I. INTRODUCTION

The Capital Asset Pricing Model (CAPM) stands as an enduring and foundational concept within the domain of finance. It represents a critical theoretical framework that illuminates the intricate interplay between risk and return in the world of investments. Our paper, "An Introduction and Implementation of CAPM Model," embarks on a journey to unravel the CAPM, offering a comprehensive exploration that traverses both its theoretical foundations and its practical applications in contemporary financial markets. The CAPM's historical significance is deeply rooted, tracing its origins to the pioneering work of Nobel laureate William Sharpe and the ground-breaking contributions of Jack Treynor and John Lintner in the 1960s. As we delve into the model's historical underpinnings, we discover that it has been instrumental in shaping the field of finance, offering a fundamental framework for investors, portfolio managers, and financial analysts to gauge and quantify the inherent risks and potential rewards associated with investment decisions. At its core, the CAPM posits a compelling relationship between an asset's expected return and its systematic risk, as encapsulated by the beta coefficient. Our exploration takes us through these theoretical foundations, where we dissect key components of the model, including the risk-free rate and the market risk premium. We also scrutinize the model's assumptions, acknowledging its simplicity while recognizing the inherent limitations that arise in today's complex financial environment. However, this paper ventures beyond theory to offer practical insights into the CAPM's application. By elucidating the intricate steps involved in the implementation of the model, we equip our readers with the tools to estimate expected returns, assess risk, and make well-informed investment decisions. Real-world examples and case studies provide a tangible perspective, highlighting the CAPM's relevance in constructing portfolios, managing risk, and navigating the dynamic landscape of contemporary finance. As we navigate this comprehensive exploration, our aim is to bridge the gap between theory and practice, empowering both newcomers to finance seeking a strong foundational understanding and experienced professionals seeking to harness the CAPM's enduring relevance in guiding investment decisions. In an era of multifaceted financial markets, our paper endeavours to provide a roadmap for effectively leveraging the CAPM's insights in the pursuit of financial success.

II. LITERATURE REVIEWS

The Capital Asset Pricing Model (CAPM) is a pivotal theory in finance, designed to determine the required rate of return for securities. Developed by Sharpe and Lintner, it extends the earlier work of Markowitz's mean-variance model, underpinned by assumptions of investor risk aversion, homogeneous expectations, and risk-free borrowing and lending opportunities. However, its practical application has faced controversy due to empirical evidence suggesting its inadequacy.

Fama and French (2004) have pointed out that the CAPM's empirical performance has been questioned, casting doubts on its real-world utility. In response, alternative models such as the Arbitrage Pricing Model (APT) have gained traction. The Sharpe-Lintner model, an extension of CAPM, introduces risk-free borrowing and lending, enabling investors to optimize portfolios by combining risky assets and a risk-free rate to reach the capital market line. The CAPM equation itself connects an asset's expected return to the risk-free rate and its beta coefficient, a measure of its sensitivity to market movements. To address these limitations, efforts have been made to relax CAPM's assumptions, with Friend and Blume (1970) proposing the consideration of differential borrowing and lending rates as a potential factor impacting CAPM's empirical accuracy. In essence, while CAPM remains foundational in finance, its practical application has been challenged, prompting exploration into alternative models and a reassessment of its assumptions to enhance its relevance in real-world investment decisions. The article "Implementing the Capital Asset Pricing Model in Forecasting Stock Returns" by Juniawan Mandala Putra et al., delves into the utilization of the Capital Asset Pricing Model (CAPM) for predicting stock returns. The authors conduct meticulous qualitative research, applying both deductive and inductive reasoning approaches, to unravel the complexities and relationships prevalent in the financial realm. They meticulously dissect the historical evolution of CAPM, linking its roots to Harry Markowitz's foundational portfolio theory, elucidating its pivotal role in deducing a corporation's capital costs and appraising the performance of investment portfolios.

In the research article by Melissa Vergara-Fernandez, Conrad Heilmann, and Marta Szymanowska, titled "Describing Model Relations: The Case of the Capital Asset Pricing Model (CAPM) Family in Financial Economics," the authors explore the nuanced relationships within the CAPM model’s family. Concentrating on the persistent prominence of CAPM in financial methodologies and applications, the authors scrutinize the model’s empirical vulnerabilities and issues related to its testability.

In the innovative research paper, "Capital Asset Pricing Model 2.0: Account of Business and Financial Risk" by Peter Brusov, Tatiana Filatova, and Veniamin Kulik, a refreshed approach to the Capital Asset Pricing Model (CAPM) is presented. This renewed perspective enriches the conventional CAPM by incorporating both business and financial risks, recognizing that companies frequently engage in debt financing, which introduces additional financial risk. The authors ingeniously intertwine the foundations of CAPM with the Modigliani–Miller (MM) theorem, cultivating a more holistic lens through which risks are analysed. Contrasting the prevalent method by Hamada, which is more phenomenological, their approach leans heavily towards providing analytical solutions, uncovering certain limitations in Hamada’s long-standing model.

III. METHODS

The CAPM is a pivotal concept in finance, playing a significant role in various aspects such as portfolio management, capital budgeting, and performance evaluation. It is instrumental in estimating the expected returns on an asset and evaluating the cost of capital. Here are some points highlighting its significance:

Risk-Return Relationship: CAPM offers a structured approach that elucidates the connection between risk and anticipated returns. It achieves this clarity by incorporating fundamental concepts such as the risk-free rate and the market risk premium. CAPM becomes a pivotal tool for investors, enabling them to evaluate whether the expected return on an investment justifiably rewards the risk involved. Having this insight is essential for investors to make informed and strategic investment choices.

- Portfolio Management: CAPM holds a significant position in the realm of portfolio management. It facilitates investors in estimating the anticipated returns and systematic risks (beta) tied to each asset. This allows for the formulation of diversified portfolios geared towards enhancing the balance between risk and return. Utilizing diversification as a central tactic diminishes unsystematic risk, a risk intrinsic to specific assets, which can be mitigated through maintaining a broad-based portfolio. CAPM assists investors in pinpointing assets that augment the risk-adjusted return of their overall portfolio positively.

- Cost of Capital: Corporations deem the estimation of capital costs as a pivotal aspect when deliberating on investment opportunities, assessing new ventures, and setting the suitable hurdle rate for capital budgeting pursuits. CAPM emerges as a valuable tool in this context, furnishing a methodology to determine the cost of equity capital. This is indicative of the return that investors anticipate for channelling their investments into the company’s stocks. Such equity cost is instrumental in deriving the weighted average cost of capital (WACC), an aggregate measure reflecting the costs associated with equity and debt capital. Precise computation of the WACC is imperative for the meticulous evaluation of prospective investment avenues, ensuring they align with the company’s stipulated minimum rate of return criteria.

- Performance Evaluation: CAPM can also be used as a benchmark for assessing the performance of investment managers or mutual funds. If an investment manager achieves returns that consistently exceed what would be expected based on the CAPM, it may indicate skill or superior stock selection. Conversely, underperformance relative to CAPM expectations may raise questions about the manager's ability to add value.

- Market Efficiency: CAPM is closely linked to the concept of market efficiency. It assumes that all investors have access to the same information and that markets are efficient, meaning that asset prices reflect all available information. CAPM provides a benchmark for evaluating whether assets are priced appropriately given their risk levels. Deviations from CAPM-expected returns can suggest opportunities for arbitrage if investors believe an asset is either overvalued or undervalued based on the model.

- Capital Allocation: CAPM assists in the allocation of capital within a firm. By understanding the cost of equity capital, companies can allocate resources to projects or divisions that offer returns exceeding this cost, thus maximizing shareholder value. It also aids in optimizing the capital structure by determining the right mix of equity and debt financing.

IV. COMPONENTS EXPLAINED

A. Risk-Free Rate Rf

The risk-free rate is the return on an investment with no risk of financial loss. It is typically associated with investments such as government bonds or Treasury bills. The risk-free rate serves as the foundational return that investors expect for an investment without taking on additional risk. It is a fundamental element in financial valuation and investment analysis. The risk-free rate can vary based on economic conditions, monetary policy, and the time horizon of the investment.

B. Beta βi

Beta used to capture the sensitivity of returns of asset to the movements in the market portfolio. It quantifies the systematic risk of an investment. Beta helps investors understand the risk profile of an investment relative to the market. It informs about the asset’s volatility and how it may respond to market fluctuations. Beta is calculated based on historical data, typically through regression analysis, where the asset’s returns are regressed against the market returns.

C. Market Risk Premium ERm- Rf

The market risk premium represents the additional return that investors require for holding a risky market portfolio instead of risk-free assets. It is a key measure that illustrates the compensation investors seek for bearing market risk. It is essential for understanding the risk and return dynamics of investing in risky assets. Influence: The market risk premium is influenced by factors such as economic conditions, investor risk aversion, and overall market volatility.

D. Expected Market Return ERm

The expected market return is the return investors anticipate from the overall market portfolio, which comprises all risky assets. It serves as a benchmark for evaluating individual assets and portfolios, helping to understand whether an investment is outperforming or underperforming the market.The expected market return is often estimated based on historical market performance and future market outlook. Each component plays a vital role in the CAPM, contributing to the model's utility in assessing the expected return of an asset and aiding investors in making informed investment decisions based on risk and return considerations

V. CALCULATIONS AND FORMULAS

A. Daily Returns

To unveil the daily return, a pivotal metric offering insights into the daily performance of each asset, the dataset was subjected to a meticulous calculation. This involved subtracting the previous day’s closing price from the current day’s closing price, the result of which was then divided by the previous day’s closing price. The first step in our analysis involved calculating the daily returns for each asset and the market portfolio.

VI. DIVERSIFIABLE RISK AND NON-DIVERSIFIABLE RISK

Diversifiable risk (also called unsystematic or idiosyncratic risk) and non-diversifiable risk (also called systematic or market risk) are two primary types of risks that investors encounter in the financial markets.

Let's dive into both with definitions and examples:

- Company-Specific News: Suppose a pharmaceutical company fails a major drug trial. The stock price of that particular company may decline sharply, but this event might not affect other pharmaceutical companies or the broader market.

- Industry-Specific Events: Consider a scandal in the automobile industry related to emissions cheating. While this might negatively affect automobile manufacturers and suppliers, it's less likely to impact tech companies or banks.

- Management Issues: A company might face internal issues, such as a change in management or a major labour strike, which affects its performance.

Non-Diversifiable Risk (Systematic Risk):This type of risk affects the overall market or large segments of the market, and it cannot be eliminated by diversification. Even if you hold a diversified portfolio, you will still be exposed to this kind of risk. Examples:

a. Economic Factors: A global recession, rising interest rates, or high inflation can affect almost all companies regardless of their individual circumstances.

b. Political Events: Changes in government, major geopolitical events, or wars can influence the entire market or large sectors.

c. Natural Disasters: Large-scale natural events, like hurricanes, earthquakes, or pandemics, can have widespread effects on many sectors of the economy.

d. Market Sentiment: General investor sentiment can drive market-wide movements. If investors become broadly pessimistic, markets might drop, whereas if they become broadly optimistic, markets might rise.

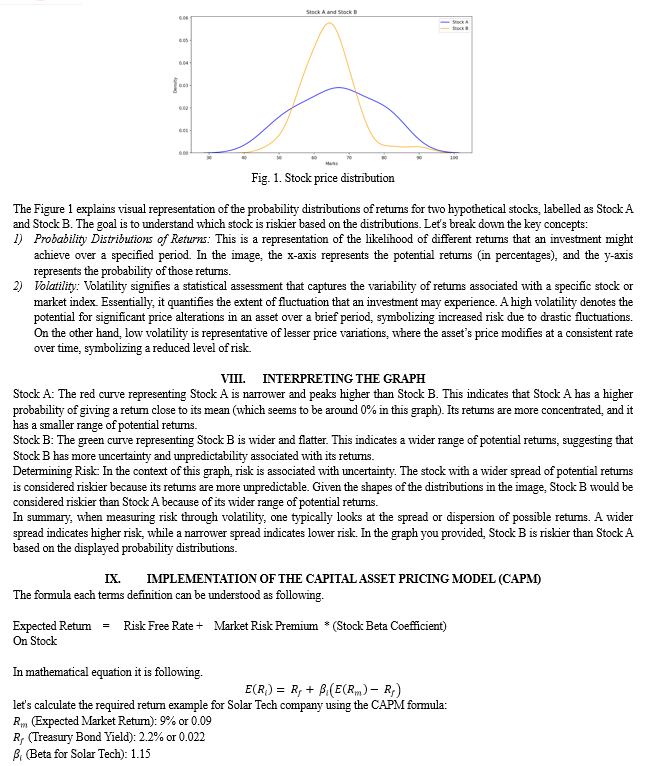

VII. MEASURING RISK

The standard deviation captures both diversifiable and non-diversifiable risks, serving as a comprehensive measure of total risk associated with an investment or a portfolio.

Essentially, when analysing a single asset, the standard deviation provides insight into the asset's overall volatility in returns. However, when this asset is combined with others in a diversified portfolio, part of its individual risk (diversifiable risk) can be offset by the varying performances of other assets in the portfolio.

Conclusion

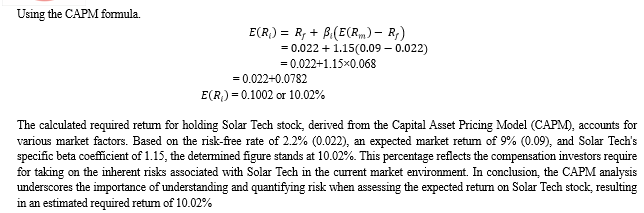

In our exploratory journey through the realms of the Capital Asset Pricing Model (CAPM), we have navigated the intricate interplay between theoretical foundations and practical implementations. Embarking from the historical origins and fundamental principles, we have traversed the landscapes of risk, return, and the equilibrium in capital markets as envisioned by the CAPM. Through our exploration, the model unveiled itself as a powerful tool, essential for delineating the expected returns on assets and illuminating the architecture of risk and return in investment portfolios. Its foundational role in investment analysis and portfolio management has been underscored, revealing its influence on asset selection, portfolio optimization, and strategic investment decisions. In the vast domain of corporate finance, the CAPM emerged as a beacon guiding the determination of cost of equity and capital budgeting decisions, facilitating organizations in steering towards investments that resonate with enhanced shareholder value. Furthermore, our expedition ventured into the practical terrains of the CAPM through a meticulous implementation. A vivid panorama of calculations and numerical explorations painted a comprehensive picture of the model in action, substantiated by empirical data. Our journey through the mathematical pathways illuminated the significance of beta in representing systematic risk and the essence of expected returns in echoing the compensations for the undertaken risks.

References

[1] Elbannan, M.A., 2015. The capital asset pricing model: an overview of the theory. International Journal of Economics and Finance, 7(1), pp.216-228. [2] Fama, E.F. and French, K.R., 2004. The capital asset pricing model: Theory and evidence. Journal of economic perspectives, 18(3), pp.25-46. [3] Vergara-Fernández, M., Heilmann, C. and Szymanowska, M., 2023. Describing model relations: The case of the capital asset pricing model (CAPM) family in financial economics. Studies in History and Philosophy of Science, 97, pp.91-100. [4] Alamsyah, S., Inayati, N.I. and Rahman, F.N., 2022. Implementation of CAPM in Determination of Stock Investment Decisions in Lq45 Index (Year 2017-2021). Dinasti International Journal of Economics, Finance & Accounting, 3(4), pp.348-359. [5] Tendean, J.D. and Sunaryo, T., 2022. Implementation of CAPM and Performance Analysis of Stock Portfolio with Risk-Adjusted Return on LQ45 Stock. Budapest International Research and Critics Institute-Journal (BIRCI-Journal), 5(2), pp.16287-16301. [6] BRUSOV, P., Filatova, T. and Kulik, V., 2023. Capital Asset Pricing Model 2.0: Account of Business and Financial Risk. [7] Mandala, J., Soehaditama, J.P., Hernawan, M.A., Yulihapsari, I.U. and Sova, M., 2023. Implementing the Capital Asset Pricing Model in Forecasting Stock Returns: A Literature Review. Indonesian Journal of Business Analytics, 3(2), pp.171-182. [8] Subekti, R. and Rosadi, D., 2020, July. Modified capital asset pricing model (CAPM) into sharia framework. In Journal of Physics: Conference Series (Vol. 1581, No. 1, p. 012021). IOP Publishing. [9] Wijaya, E. and Ferrari, A., 2020. Stocks investment decision making capital asset pricing model (CAPM). Jurnal Manajemen, 24(1), pp.93-108. [10] Sembiring, F.M., 2022. How Well is the Implementation of CAPM in Condition of Market Anomaly? Case in Market Overreaction Anomaly at Indonesia Stock Exchange. INFLUENCE: INTERNATIONAL JOURNAL OF SCIENCE REVIEW, 4(1), pp.166-178. [11] Nugraha, N.M. and Susanti, N., 2019. Investment Decisions Using CAPM in the Coal Mining Sub-Sector Period 2012-2016. Global Business & Management Research, 11(1). [12] Susanti, E., Grace, E. and Ervina, N., 2020. The investing decisions during the Covid-19 PANDEMIC by using the capital asset pricing Model (CAPM) method in lq 45 INDEX COMPANIES. International Journal of Science, Technology & Management, 1(4), pp.409-420. [13] Raiter, P.A., 2019. An implementation of sharpe’s capital asset pricing model. [14] Ayub, U., Kausar, S., Noreen, U., Zakaria, M. and Jadoon, I.A., 2020. Downside risk-based six-factor capital asset pricing model (CAPM): A new paradigm in asset pricing. Sustainability, 12(17), p.6756. [15] O’Neill, M., 2021. The validity of the capital asset pricing model, in the Modern Irish Market (Doctoral dissertation, Dublin, National College of Ireland). [16] Quill, T., 2020. Valuation techniques under construction—About the dissemination of the CAPM in German judicial valuation. Schmalenbach Business Review, 72(2), pp.299-341. He, Z., O’Connor, F. and Thijssen, J., 2022. Identifying proxies for risk-free assets: Evidence from the zero-beta capital asset pricing model. Research in International Business and Finance, 63, p.101775. [17] Subekti, R. and Rosadi, D., 2022. Toward the Black–Litterman with Shariah-compliant asset pricing model: a case study on the Indonesian stock market during the COVID-19 pandemic. International Journal of Islamic and Middle Eastern Finance and Management, 15(6), pp.1150-1164. [18] Dmello, A., Jadhav, A., Kale, J. and Deshpande, A., 2022, January. Evaluating MPT and CAPM to Optimise Investment Portfolio of BSE Securities. In 2022 International Conference for Advancement in Technology (ICONAT) (pp. 1-5). IEEE. [19] Yang, C., 2019. Research on China’s exchange online financial market: An exchange online financial capital asset pricing model. American Journal of Industrial and Business Management, 9(04), p.1045. [20] Xiao, C., 2022, March. An empirical test of CAPM before and after the pandemic outbreak. In 2022 7th International Conference on Financial Innovation and Economic Development (ICFIED 2022) (pp. 2449-2457). Atlantis Press. [21] Mandala, J., Soehaditama, J.P., Hernawan, M.A., Yulihapsari, I.U. and Sova, M., 2023. Implementing the Capital Asset Pricing Model in Forecasting Stock Returns: A Literature Review. Indonesian Journal of Business Analytics, 3(2), pp.171-182. [22] Wedagama, D.N.W., Hakim, D.B., Juanda, B. and Andati, T., 2022. Implementation of Capm, Fama-French Three-Factor, and Five-Factor in Indonesia Stock Exchange and Cement Industry Sector. International Journal of Economics and Financial Issues, 12(2), p.52. [23] ?akovi?, M., Andraši?, J. and Cicmil, D., 2022. TESTING THE APPLICABILITY OF THE CAPM MODEL USING SELECTED SHARES LISTED ON THE BELGRADE STOCK EXCHANGE. Facta Universitatis, Series: Economics and Organization, pp.183-197. [24] He, Z., O’Connor, F. and Thijssen, J., 2022. Identifying proxies for risk-free assets: Evidence from the zero-beta capital asset pricing model. Research in International Business and Finance, 63, p.101775. [25] Pedersen, J., 2022. Functional Data Analysis: Estimating Beta in the Capital Asset Pricing Model for High-frequency US Stock Data. Available at SSRN 4310423.

Copyright

Copyright © 2024 Keya Khot. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET58393

Publish Date : 2024-02-11

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online