Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Advance Sequential Models for Asset Trading: Leveraging LSTM & RNN with Stochastic RSI and MACD Indicators

Authors: S. Sreevishnu, R. Shyam, Ms. S. Saraswathi. M. E

DOI Link: https://doi.org/10.22214/ijraset.2024.60282

Certificate: View Certificate

Abstract

The goal of stock market prediction is to forecast a company\'s financial stocks\' future worth. The application of machine learning, which creates predictions based on the values of the current stock market indices by training on their prior values, is a recent trend in stock market prediction technologies. Machine learning utilises many models to facilitate accurate and reliable prediction. The study focuses on stock value prediction using regression and LSTM-based machine learning. Considered factors are volume, low, high, open, and closed. We also employ algorithmic trading, which is a technique for automatically executing orders based on pre-programmed trading instructions that take volume, price, and time into account. This kind of trading aims to take advantage of a computer\'s speed and computational power in comparison to human traders. Algorithmic trading has become more popular in the twenty-first century, prompting traders to respond. According to a 2019 research, 92% of traders use algorithms rather than people. The moving average convergence & divergence and the relative strength index are our primary tools. One technical tool employed in financial market analysis is the relative strength index, or RSI. Charting a stock\'s historical and present strength or weakness with retail and institutional traders is the goal. Investment banks, mutual funds, pension funds, and hedge funds all utilise it extensively when they need to perform trades. based on the closing prices of a recent trading period, too fast for a human or the market. It is important to distinguish the indicator from relative strength. The RSI measures the speed and size of price changes and is categorised as a momentum oscillator. The rate at which prices rise or fall is known as momentum. The ratio of higher closes to lower closes, where closures are defined as averages of absolute values of price changes, is the relative strength, or RS. The RSI determines momentum by dividing higher closes by overall closes, or stocks with more or stronger positive moves. The RSI is most commonly employed during a 14-day period and is scaled from 0 to 100, with 70 and 30 representing the high and low readings, respectively. Alternately shorter or longer outlooks are associated with shorter or longer time frames. Although they happen less frequently, high and low levels—80 and 20, or 90 and 10—indicate increased momentum. J. Welles Wilder created the relative strength index, which was first published in the June 1978 issue of commodities magazine and in his 1978 book New concepts in technical trading systems, and in commodities magazine in the June 1978 issue.

Introduction

I. INTRODUCTION

A financial instrument used to symbolise ownership in a corporation that represents a proportionate assertion on its assets and earnings is referred to as a stock or share, often known as a company's equity. A shareholder who owns stock is considered to own a portion of the business, which is equivalent to the number of shares held relative to the total number of outstanding shares of the company. An individual holding 100,000 shares in a business with one million outstanding shares, for instance, would own 10% of the company. The majority of firms have outstanding shares with values in the billions or even millions of dollars. Technical indications are also utilised. A technical indicator in financial technical analysis is a mathematical computation that forecasts the direction of financial markets using historical price, volume, or, in the case of future contracts, open interest data.

A key component of technical analysis are technical indicators, which are usually represented as chart patterns with the aim of predicting the direction of the market.

Typically, indicators are superimposed over price chart data to show the direction of the price movement and if the price is in a "overbought" or "oversold" state.

To improve results, traders have created numerous technical indicators and are constantly creating new versions. In order to determine how well new indicators would have predicted future occurrences, they are frequently back tested using historical price and volume data. A fake sign in the technical analysis suggests future value developments, which presents an inaccurate picture of the actual financial situation. A number of factors, such as timing slacks, inconsistent information sources, smoothing techniques, or even the computation used to generate the pointer, might result in false signals. By examining price movements and chart patterns in search of potential trading opportunities, technical analysis attempts to capture the psychology and sentiment of the market. Since indicators are not infallible, traders should exercise caution when selecting traders only on the basis of them.

II. EXISTING SYSTEM

Under Individual Grant AP086801, the Korea Institute for Advanced Study (KIAS) provided assistance for Eunho Koo's study. Grant NRF - 2017R1E1A1A03070886 from the National Research Foundation of Korea, issued by the Korea Government, provided funding for Geonwoo Kim's research. Precisely estimating volatility is among the most crucial responsibilities in making financial decisions.

Recently, hybrid models that combine GARCH-type models with artificial neural networks have been constructed, and the models' performance benefits have been proven to be exceptional.

III. PROPOSED SYSTEM

One of the most popular methods of managing finances is stock investing, and many individuals utilise technical indicators to determine when to purchase and sell stocks. This study suggests a unique way to make the most out of the widely used technical indicator, the Relative Strength Index (RSI). To identify the optimal approach and maximise profit, we first broaden all the possibilities in RSI by eliminating the constraint of the classic RSI's default parameters.

IV. ALGORITHM USED

The source of the dataset was Yahoo Finance. We regarded the data from Oracle Corporation (ORCL) as moderately volatile and the data from Intuit Inc. (INTU), which was likewise gathered from Yahoo Finance, as highly fluctuating.

We gathered data for 20 years (from June 30, 2000, to July 21, 2020) for each of these datasets, and there are 5044 cases total in each dataset Traded volume, date, adjusted close price, high price, low price, close price, and adjusted close price are the seven properties that are present in every dataset.

The datasets that were gathered contained very few null values. It can effectively handle the null values because they have the potential to upset the real pattern of the price movement. Using the mean of the price for the preceding 30 days is a commonly used technique to replace the null value. This is how we resolved the problem. Additionally, we gathered information in one-day time interval format. Thus, pre-processing was not required for our one-day proposed Model. Nevertheless, we had to transform one-day time interval data into three-day and five-day time-interval datasets for the two-day and five-day models.

We modified things in the following ways for this reason.

- The first day of the three and five-day periods.

- Open price: The starting price for the first day of the three and five-day periods.

- Highest price: The most expensive price during the course of three and five days.

- Cheapest pricing: The lowest pricing for the full three and five-day periods.

- Close Price: The final day's closing price for the three and five-day periods.

- Traded Volume: The total amount of money exchanged over the course of three days and days.

Yahoofinancer.com is the source of the price data sets for the stock tickers because it is the API that is being utilised. Preprocessing involves resizing the photos in accordance with system specifications and filtering the price data in accordance with those requirements before pushing the data into the array and processing it using an LSTM model.

The data is divided into 80 and 20 percent to satisfy the model's needs. Twenty percent of the data is used for testing, while the remaining eighty percent is used for training. The construction of the trading model, which is done using the RSI algorithm, is the next stage. Testing is done to make sure the project is viable. Following completion of all of this work, the model is implemented.

V. MODULE DESCRIPTION

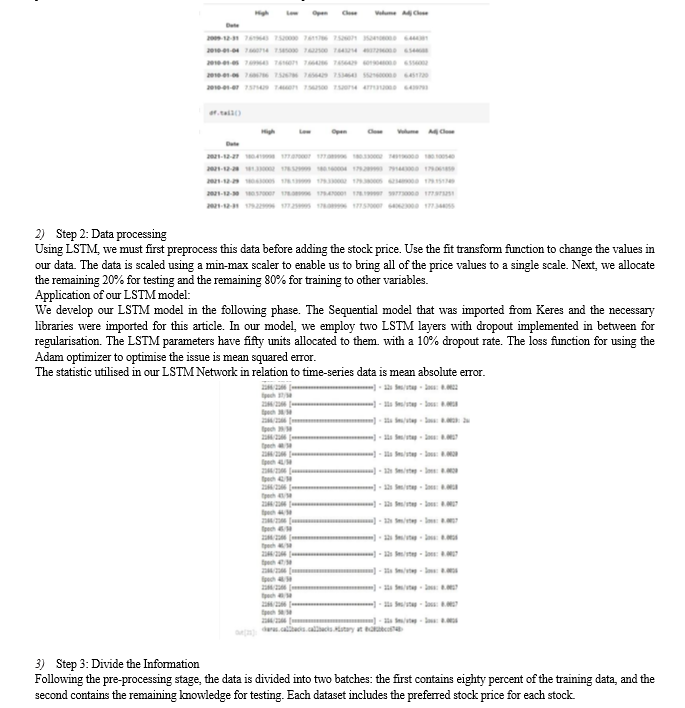

1) Step1: Gathering data

Yahoo Finance was the source of the dataset.

We regarded the data from Oracle Corporation (ORCL) as moderately volatile and the data from Intel lit Inc. (INTU), which was also gathered from Yahoo Finance, as highly fluctuating. We have 5044 instances in each of these datasets, which we gathered during a 20-year period (December 9, 2009, to December 31, 2021). The date, open price, low price, close price, adjusted close price, and traded volume are the seven attributes that are present in each dataset.

import numpy

import ta

import pandas

9) Step 9: Obtaining the Information

- At this point, we obtain the data from Yahoo Finance and further provide the ticker name, initial data, data account, and interval.

- Additionally, we obtain the data frame pertaining to the price's high, low, close, and open. Additionally, we utilise the "ta" library to obtain the trend generated in the moving average convergence and divergence as well as the momentum formed in the relative strength index.

10) Step 10: Describe the process by which trigger signals are obtained

- First, we look for the intersection of the %k and %d lines.

- The %K line establishes a price range by comparing the lowest low and highest high points of a specific time frame. It then shows the most recent closing price as a range and as a percentage of this range. The %D line represents the %K moving average. On a scale from 1 to 100, these two lines are displayed, with key trigger levels at 20 and 80.

- We build a Boolean mask that enables value filtering in numpy arrays.

11) Step 11: Identifying the Buy and Sell Triggers

- Now that we have defined get triggers, we are using the data frame as the inputs, which gives the amount of lags—that is, the precise number of time steps you wish to travel back.

- Next, we set buy="True" as the default argument.

- Currently, we execute an if statement on the purchase and attach the mask to it.

- The mask will contain the values %K < 20 and %D < 20 for the if condition and the values %K >80 and %D > 80 for the else condition.

- We now refer to the function as "get triggers" in order to obtain the buy triggers.

12) Step:12: Conditions for buying and selling (RSI, MACD, Stochastic, and Trigger)

- The buying trigger will be the first condition once we construct a new column. Afterwards, our %K line must be in the range of 20 to 80.

- It is also necessary for our %D to match.

- Then, our MACD should be greater than 0 and our RSI more than 50.

- Currently, the criteria for the sell triggers will be: the RSI must be less than 50; the %K line must be between 20 and 80; and the %D must match the %K conditions.

- MACD ought to be less than zero.

13) Step13: Purchasing and Disposing of Dates

- We now need to obtain the dates for purchasing and selling, therefore we're going to create two empty lists and fill them with loop logic.

- In order to check if our buying column contains a buy signal, we are using a for loop to loop the size of the data frame and restrict it by 1.

- We are currently adding dates to our purchases. Similarly, when it comes to selling.

14) Step 14: Steer clear of multiple or useless positions

- It's possible that we will receive purchase dates and not have any selling dates towards the conclusion of the data frame.

- In order to prevent such, we are setting up a variable that will deduct the length of the selling dates from the length of the buying dates.

- The last portion of the buying dates will be removed if the difference is not zero because we are unable to calculate the gains from those trades if we purchased the asset but did not sell it.

15) Step 15: Calculating profits

- This is where we figure out the profits' average.

- It could range from 0.1 percent to more than that.

- It is low since we don't account for the possible leverage.

Step 16: Signal Visualisation

- If we want to see the techniques in action, we can plot the chart with the buy/sell signals using matplotlib.

VI. RESULT

Conclusion

We come to the conclusion that a profit between 15% and 40% is really not that bad. There are numerous methods to make this programme better, including: Adjust the practice variable first. 1) This variable determines how long the trade will be made after the RSI value. Play around with this value to discover a trend and improve it for greater outcomes. 2) Locate the top business Which stock performs best according to this algorithm? To assess, try this programme out on several businesses. 3) An improved approach introducing the ideas of smart money to eliminate the need for indicators. 4) Applying risk management allows us to remain in the market for a longer period of time without depleting user cash.

References

[1] B. G. Malkiel and E. F. Fama, “Efficient capital markets: A review of theory and empirical work,” The journal of Finance, vol. 25, no. 2, pp. 383–417, 1970 [2] Hegazy O, Soliman OS, Salam MA (2013) A machine learning model for stock market prediction. Int J Computer Sci Telecommunication (IJCST) 4(12 [3] Naeini MP, Taremian H, Hashemi HB (2010) Stock market value prediction using neural networks. IEEE [4] S. K. Chandar, “Grey wolf optimization neural network model for stock price prediction,” Soft Com-putting, vol. 25, no. 1, pp. 649–658, 2021. [5] Naeini MP, Taremian H, Hashemi HB (2010) Stock market value prediction using neural networks. IEEE.

Copyright

Copyright © 2024 S. Sreevishnu, R. Shyam, Ms. S. Saraswathi. M. E. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET60282

Publish Date : 2024-04-14

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online