Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

An Analytical Study of the Growth of Loan Schemes in HDFC Bank

Authors: Dr. Supriya Rai , Palak Agarwal, Damini D Bamb, Kishu Dokania, Hitesh Dhoka, Parvath AV

DOI Link: https://doi.org/10.22214/ijraset.2024.58402

Certificate: View Certificate

Abstract

This study conducts an in-depth analysis of the growth trajectory of loan schemes within HDFC Bank, a leading player in the banking industry. Through an exploration of the diverse loan products offered by the bank, their performance metrics, and the strategic drivers behind their expansion, this research aims to unveil the key factors contributing to the successful growth of HDFC Bank\'s loan portfolio. Utilizing a combination of quantitative data analysis, case studies, and expert insights, this study provides a comprehensive perspective on the strategies and elements propelling the sustained growth of loan schemes at HDFC Bank.

Introduction

I. INTRODUCTION

Private banks, which offer a wide range of financial goods and services, are essential in the dynamic terrain of the modern banking business for influencing economic growth. Among these options, loan schemes stand out as a crucial tool that fills the gap between a person's or a business's financial demands and the resources that are available. The expansion of loan programs within private banks has drawn a lot of attention because of the possible effects it could have on the banking industry as well as the overall economy. The purpose of this study is to offer a thorough analytical investigation of the variables influencing the expansion of loan programs in private banks, as well as their effects and the tactics used to promote this growth.

Private banks, which are essential to the modern financial environment, have a significant impact on economic growth thanks to their wide range of financial services and products. The expansion of loan programs among these options is a key factor in bridging the gap between business and individual financial needs and capital availability. Due to the possible effects on the banking industry as well as the overall economy, the expanding use of lending programs by private banks has attracted a lot of attention. This paper conducts a thorough analytical investigation of the factors driving the growth of loan programs within private banks, their ramifications, and the strategic approaches used to foster this supremacy.

Loan programs are crucial in today's banking environment for promoting financial inclusion and accelerating economic growth. In this study, one of India's top financial organizations, HDFC Bank, explores the dynamic world of loan program growth. Through its wide selection of lending products, strong customer base, and strategic market positioning, HDFC Bank has carved out a unique character. This study sheds light on the tactics and methods sustaining HDFC Bank's sustained growth by exploring the elements that have contributed to the achievement and growth of its loan portfolio.

Banks play a critical role in directing money for a variety of uses, from personal aspirations to business endeavors, in an economic climate that is continually changing. At the heart of this function are loan programs, which serve as accelerators for both personal and societal development. With its wide-ranging reach and large array of loan options, HDFC Bank has experienced substantial growth in recent years. It is crucial for the banking sector, as well as policymakers, analysts, and potential borrowers, to comprehend the dynamics underlying this rise. Numerous goods and services are offered by HDFC Bank, such as wholesale and retail banking, treasury, vehicle, motorcycle, and personal loans, as well as loans secured by real estate, consumer durable loans, lifestyle loans, and credit cards. Payzapp and SmartBuy are two additional digital goods that go along with this assortment.

A. Background

As a division of the Housing Development Finance Corporation, HDFC Bank was established in 1994 and has its registered office in Mumbai, Maharashtra, India. The company's first corporate office and a full-service branch were opened by Manmohan Singh, who was the Union Finance Minister at the time, in Sandoz House in Worli. Few of us are aware that HDFC Bank was once a corporate banker before it became well-known as a retail lender. However, these bankers have always been risk-averse; therefore, they would only lend to top blue-chip corporations where safety was guaranteed despite lower margins.

The bank's distribution network consisted of 8,344 branches and 19,727 ATMs spread over 3,811 cities as of June 1, 2023. In FY 2017, it set up 4,30,000 point-of-sale terminals and produced 2.35 billion (23.5 million) debit cards and 1.2 billion (12 million) credit cards. As of June 1, 2023, it had a base of 1,77,000 permanent employees.

For the purchase or building of residential homes, the corporation offers housing financing to both private individuals and businesses. Loans for the purchase and construction of residential units, loans for the purchase of land, loans for home improvements, loans for home extensions, loans for non-residential premises for professionals, and loans secured by property are among the types of loans offered by the company. Repayment options: step-up repayment facility and flexand ae loan It is among India's largest lenders of housing loans. The organization reported in its Annual Report for the fiscal year 2012–13 that over the course of its 35-year existence, it has disbursed over INR 456,000 crore for the construction of 4.4 million housing units.

Through its subsidiary, HDFC Standard Life Insurance Company Limited, the business has been offering life insurance since the year 2000. 33 individual products and 8 group products are available. By providing products, it cross-sells via the network of the HDFC group. It serves more than 965 sites from its 451 offices spread over India. As of September 30, 2013, their market share for life insurance in India was 4.6%. HDFC Life employs more than 15,000 people.

The business provides general insurance products like property, marine, aviation, and liability in the corporate segment and automobile, health, travel, home, and personal accident insurance in the retail segment, which accounts for 47% of the company's overall revenue. The company offers various types of general insurance, including:

In the corporate segment, insurance products include property, marine, aviation, and liability; in the retail segment, which generates 47% of the company's overall income, insurance products include auto, health, travel, home, and personal accident insurance.

HDFC Bank owns 26.14% of the stock. For a fee, HDFC Bank sources mortgages for HDFC. Retail and wholesale banking, as well as treasury functions, makeup HDFC Bank's main business segments. With a market value of 941,386 crore ($120 billion) as of April 2023, it was the third-largest publicly traded corporation in India.

To help vulnerable segments of society, HDFC Bank takes part in government-sponsored programs. The Bank takes part in a number of federal and state government initiatives.

Several programs run by the federal and state governments in which the bank is involved:

- Prime Minister's Employment Generation Programme (PMEGP)

- PM Street Vendor Atma Nirbhar Nidhi (PM SANNidhi)

- Chief Minister Employment Generation Programme (CMEGP)

- National Urban Livelihoods Mission (NULM)

- Mukhyamantri Swarojgar Yojna (MSY)

- Unemployed Youth Employment Generation Programme (UYEGP)

Additionally, the Bank takes part in state and federal government programs.

With the introduction of new technology, the banking industry has developed very quickly in recent years. Today, it is not only limited to depositing and lending but also includes a variety of loans and advances, digital services, insurance plans, cards, broking services, etc. As a result, the banks face fierce competition from their rivals. As a reminder, these insights are based on the situation as of September 2021. Changes may have occurred since then, and for the most current and accurate information regarding HDFC Bank's loan offerings, terms, and conditions, it's recommended to visit the official HDFC Bank website or directly contact their customer service. Certainly, let's delve deeper into the details of each loan scheme offered by HDFC Bank as of September 2021

B. Scopes

- Personal Loans: HDFC Bank's personal loans stand as a versatile financial solution, catering to a multitude of life's demands. Whether faced with unexpected medical expenses, planning a dream wedding, seeking funds for adventurous travel, or consolidating existing debts, personal loans provide a flexible and rapid means of acquiring funds. These loans are particularly attractive due to their unsecured nature, sparing borrowers the need to pledge collateral. This inclusivity makes personal loans accessible to a diverse range of individuals, enabling them to swiftly bridge financial gaps and fulfill immediate requirements.

- Home Loans: HDFC Bank's home loans go beyond just providing financial support; they embody the aspirations of individuals to own a home. Covering a spectrum of residential needs, these loans facilitate the purchase of new properties, the realization of dream homes through construction, or the enhancement of existing residences via renovation. The competitive interest rates offered, along with options for adjustable repayment tenures, make these loans an appealing choice for prospective homeowners. These loans not only contribute to personal aspirations but also play a role in bolstering the real estate sector.

- Car Loans: HDFC Bank's car loans resonate with the desires of individuals to own their dream vehicles without immediate financial constraints. This financial offering spans both new and used cars, accompanied by attractive interest rates and adaptable repayment periods. This array of choices extends from the stylish allure of sedans to the practicality of hatchbacks, allowing borrowers to bring their automotive aspirations to fruition. Car loans not only enhance personal mobility but also contribute to the automotive industry's growth and sustainability.

- Business Loans: Recognizing the pivotal role of small and medium enterprises (SMEs) in the economy, HDFC Bank's business loans emerge as a crucial support system. Tailored to SMEs' dynamic requirements, these loans serve as a financial backbone for expanding operations, securing working capital, acquiring essential equipment, and addressing diverse commercial needs. By providing this vital financial boost, HDFC Bank's business loans foster growth, drive innovation, and empower SMEs to play a significant role in shaping the economic landscape.

- Education Loans: Higher education's pursuit, whether within India or overseas, often involves substantial financial commitments. HDFC Bank's education loans assume the role of an educational enabler, bridging the gap between aspirations and affordability. Covering a spectrum of educational expenses, including tuition fees, living costs, and related expenditures, these loans alleviate the financial burden on students and their families. This commitment to accessible education reinforces the bank's role in facilitating the pursuit of knowledge and skill development.

- Loan Against Property (LAP): HDFC Bank's Loan Against Property (LAP) introduces a unique financial dimension by allowing individuals to leverage the value of their property. This collateral-backed loan unlocks the potential within real estate assets, providing a versatile solution. The funds obtained through LAP can be channeled into diverse needs, such as expanding businesses, covering unforeseen medical expenses, or consolidating existing debts. This offering taps into the intrinsic value of properties, transforming them into valuable resources to address financial requirements.

- Gold Loans: Capitalizing on the cultural and financial significance of gold in India, HDFC Bank's gold loans offer an expedient avenue for accessing funds. By pledging gold jewelry as collateral, borrowers can secure short-term financing for both personal and business needs. This approach not only preserves the cultural relevance of gold but also presents a swift and straightforward mechanism for obtaining financial support. Gold loans bridge the gap between traditional value and modern financial necessities.

C. Limitations

- Eligibility Criteria: HDFC Bank's loan schemes are tailored to suit different financial needs, but they come with specific eligibility criteria that borrowers must meet for loan approval. These criteria encompass a range of factors, including the applicant's monthly income, credit score, employment stability, and even the value of collateral offered (if applicable). These criteria serve as benchmarks to assess the borrower's ability to repay the loan. Meeting these criteria is essential, as they determine the likelihood of loan approval and the terms under which the loan will be offered. It's crucial for potential borrowers to thoroughly understand these eligibility requirements to increase their chances of securing the desired loan.

- Interest Rates and Fees: When considering any loan scheme, one of the most critical aspects is the interest rate and associated fees. HDFC Bank offers different loan products with varying interest rates, and these rates play a significant role in determining the overall cost of borrowing. Additionally, processing fees and other charges can influence the total amount the borrower needs to repay. Therefore, it's imperative for borrowers to carefully analyze and understand the interest rates, fees, and charges associated with their chosen loan scheme. This understanding will help them make informed decisions regarding their borrowing needs and ensure that the chosen loan aligns with their financial capabilities.

- Documentation: Applying for a loan requires the submission of several documents to establish the borrower's identity, financial standing, and loan purpose. These documents can include proof of identity, income documents (such as salary slips or income tax returns), residential address proof, and property details (for specific loan types). While this documentation is essential for a successful loan application, it can also be a time-consuming and meticulous process. Borrowers should prepare to gather and verify these documents thoroughly to expedite the application process and ensure accurate verification by the bank.

- Risk of Default: Borrowers must realistically assess their ability to repay the borrowed amount within the stipulated time frame. Defaulting on loan payments can have severe consequences, including negatively impacting the borrower's credit score. Moreover, HDFC Bank, like any other lending institution, has the right to take legal action to recover the outstanding loan amount. Borrowers must carefully consider their financial situation, current and future income prospects, and any potential challenges that might hinder their ability to make timely payments.

- Market Conditions: Interest rates for loans are subject to the ever-changing dynamics of the financial market and the broader economy. Economic conditions, inflation rates, and monetary policy decisions can all influence interest rates. Borrowers need to be aware that the interest rate they receive at the time of loan approval might vary in the future based on market fluctuations. Keeping an eye on market trends and economic indicators can help borrowers make more informed decisions regarding their borrowing strategies.

- Collateral Requirement: Secured loans, such as loans Against Property (LAP) and gold loans, are backed by collateral provided by the borrower. While this collateral offers security to the bank, it also exposes the borrower to the risk of losing the pledged asset in the event of loan default. Borrowers should assess whether they are comfortable providing collateral and consider the potential consequences of defaulting on the loan, as they could lose valuable assets.

- Terms and Conditions: Borrowers should meticulously review the terms and conditions of their chosen loan. This includes not only interest rates and fees but also clauses related to prepayment charges, foreclosure options, repayment schedules, and any other terms that might impact the loan's flexibility. Understanding these terms is crucial to avoiding surprises down the line and ensuring that the loan aligns with the borrower's financial goals.

- Customer Service and Support: The level of customer service and support provided by the bank can significantly impact the borrowing experience. Opting for a bank like HDFC that offers excellent customer service ensures that borrowers can receive timely assistance with their queries, concerns, and the loan application process. Good customer support can ease the journey of obtaining a loan, making it more transparent and less stressful.

Keep in mind that this information is based on the situation as of September 2021. Changes might have occurred since then, and it's advisable to verify the current loan offerings, terms, and conditions directly from the HDFC Bank website or by reaching out to their customer service.

II. LITERATURE REVIEW

By Preeti Singh and Saikat Das : HDFC Bank wants to ride India's consumer boom after home loan dominance:-The sixth-largest lender in the world, HDFC Bank Ltd., aims to utilize house lending as a vehicle to attract more borrowers for its consumer financing products, including loans for TVs, cars, and air conditioners. In the upcoming months, the Mumbai-based bank will transform around 530 offices that were previously focused on mortgages into locations offering full-fledged banking services, according to Kaizad Bharucha. The merger between HDFC Ltd. and HDFC Bank has allowed their company to offer house loans at over three times as many locations, and that's just the beginning, according to the deputy managing director of HDFC Bank.

By Paresh Sukthankar: July 21: The second-largest private sector lender in the nation, HDFC Bank, has allayed concerns about the possibility of bad loans by claiming that an increase in non-performing assets is not "unrealistic" given the current state of the economy. Executive director Paresh stated, "To some extent, some increase in non-performing assets (NPAs) is something we don't see as unrealistic.

By Nupur anand: 30 april: The second-largest private sector bank in the nation, HDFC Bank, which has hitherto been mostly recognized for its retail banking, is now aggressively expanding its corporate loan book. With this effort, the book has increased by more than a factor of two over the past three years, going from 47,000 crore to more than 1 lakh crore at the end of FY16. Executive director at HDFC Bank Kaizad Bharucha noted that a variety of strategies, including a greater emphasis on term loans, better product customization, and providing a wide range of products to customers with whom the lender already has a relationship, have helped the firm reach milestones.

By HDFC: June 16 2022: In Uttar Pradesh, the bank has 170 gold loan desks: Today, HDFC Bank revealed that it had expanded its branch network in Uttar Pradesh by 51 gold loan desks. 170 bank locations in the state will now be able to offer gold loans thanks to the installation of 51 new gold loan desks. In the current fiscal year, the bank is trying to enable all of its branches in the state to conduct gold loans. With few paperwork and clear fees, this institution will enable consumers to maximize their idle gold. There are gold loans available with terms ranging from three months to three years.

By Andy Mukherjee : 7.04.2022 : A financial mega merger that's all in the family:- after 45 years in business the underwriter of homes for millions of Indians is moving in with its 28 year old banking offspring. The joint family arrangement makes sense for both housing development finance corp and hdfc bank ltd. mortgages will get more competitive as lenders come under pressure to beg interest rates to benchmark not in their control, such as the central bank’s repo rate.

By Sangeeta Ohja : 10.07.2023 : HDFC Bank extends special fixed deposit (FD) scheme for senior citizens. Interest rate, other details here : HDFC Bank senior fixed deposit program: HDFC Bank has once more extended the senior fixed deposit program, which offers higher interest rates.

Senior citizen-specific FD from HDFC Bank. In May 2020, Senior Citizen Care FD was introduced amid the covid epidemic.According to the bank's website, the deadline for investments in the Senior Citizen Care FD plan has been extended until November 7, 2023.

By Paresh: December 7: There is room for future rate reductions, according to HDFC Bank, as loan growth is lagging behind deposit growth. A modest uptick has occurred, but more critically, deposit growth is now surpassing loan growth. Deposit rates will be reduced as a result, and deposit rate reductions typically precede lending rate reductions. Banks cannot reset their base rate until they lower their deposit rates. The general trend of the rates is downward, thus increases in deposit rates would need to be followed by meaningful changes in base rates.

By Money Today : 1. 07. 2023 : What current HDFC home loan customers need to know about the merging of HDFC and HDFC Bank: Housing Development Finance Corporation (HDFC), a mortgage lender, and HDFC Bank, the biggest private sector bank in the country, officially merged on July 1. The merger received final clearance from the boards of HDFC Ltd. and HDFC Bank on June 30. The record date has been set for July 13, according to the private lender. HDFC branches will stay operating after the merger, although HDFC Bank will be displayed on the signboards. Therefore, as of July 1, the mortgage lender Housing Development Finance Corporation will be no more.

By Kethvi Jadhav : 03.07.2023 : What Changes for the Existing Home Loan Borrowers of HDFC Ltd. After Merger with HDFC Bank : Banks and Non-Banking Finance Companies have different benchmarking processes for house loans. Since October 2019, banks have been required to tie the interest rates of all floating-rate consumer loans to an external benchmark-based lending rate, NBFCs are not required to tie their retail loans to a third-party benchmark.The Reserve Bank of India (RBI), which oversees all banks in India, regulates HDFC Ltd., which is presently doing business as HDFC Bank. Prior to the merger, HDFC Ltd. operated as an NBFC and established its own interest rate standards. However, the switch to EBLR has improved transparency and market responsiveness by tying house loan interest rates to an external benchmark rate selected by the RBI.

By Ajay Ramanathan:01.09.2023 :Bank loans rose 19.8% in July on HDFC merger impact on-food credit stood at Rs 147.8 trillion as on July 29. In comparison, non-food credit had risen 15.1% y-o-y.Personal loan growth has coincided with the RBI's increased vigilance over the rise in the proportion of unsecured personal loans. Loans to this sector increased 6% year over year to Rs 34 trillion as of July 29. Loans specifically to micro and small businesses increased by 10.2% year over year. Loans to large and medium-sized businesses increased by 4.3% and 9.7% year over year, respectively.As of July 29, loans to NBFCs have increased by 24% year over year to Rs 13.8 trillion.

Arora, Usha & Sharma, Bhavna & Bansal, Monica. (2009). An Analytical Study of Growth of Credit Schemes of Selected Banks. The Icfai University Journal of Services Marketing. Vol. VII. 52-65. This study has been conducted to analyze and compare the performance (in terms of loan disbursement and non-performing assets) of credit schemes of selected banks for the last five years. A positive relationship is also found between total loan disbursement and total Non-Performing Assets Outstanding (NPA O/S) of selected banks. This paper is divided into two parts. In the first part, bank-wise as well as year-wise comparisons are done with the help of Compound Annual Growth Rate (CAGR), mean and standard deviation; and in the second part, a positive relationship is found between total loan disbursement and total NPA O/S of selected banks with the help of a correlation technique.

By Tandon Deepak and Batra Dharminder kumar:On 5th March 2022 Deepak Parekh made a statement that Gruh Finance (NBFC) was like his own daughter and that he intended to merge the same with Bandhan bank which would be like a proverbial bridegroom. This would provide synergies with the Housing sector, which was on a growth path, while NBFC ‘Gruh Finance’ was not into the Housing domain. This would require that HDFC Bank’s promoter holding would be diluted. He envisaged that with the merger of India’s most valuable lender and the nation’s largest mortgage financier will be able to create what could be the world’s fifth-most valuable bank. Since the steps have been taken, the merger process is almost complete, albeit one key step remains about the listing in bourses that investors would be watching closely. The likely announcement awaited the nod on or before July 2023. Parekh knew that with just one step away, his own creation was on the anvil of becoming a bank worth US $ 168 billion serving millions of investors and customers across the word !!

By Dr Jadhav Babasaheb R and Mr Sajida Tushar:“A Study on Factors affecting the growth of personal loan as a product at HDFC Bank”. Objectives of this study were to understand the different factors affecting the growth of personal loan. This study therefore sought to find out the factors affecting the growth of personal loans in HDFC Bank. Personal loans are the fastest growing products of unsecured credit facilities in spite of high interest rates, due to smart positioning of the product by financial institutions. Personal loans are the easy option of people for financial requirements as they do not attract collateral and with a little practical formality to obtain them. The research focuses on the current trend of personal loans and the factors that influence the trend from different perceptions of borrowers.

The research also reviews that the recent growth in personal loan is healthier in the banking system and at the same time, the consumers are utilizing it for the right purposes. This study observed that there is a growth in dispersal of personal loans by HDFC Bank. The report provides comprehensive analysis of the trend, information and insight on to the driver supporting the growth of personal loans in HDFC Bank. The study adopted a descriptive design in its methodology. The target population was personal loan customers of HDFC Bank. A random sample method is used to collect data from customers using questionnaires.100 respondents; i.e. 20 each from 5 branches. Randomly 20 customers from each branch having personal loans were picked to complete a questionnaire. Primary data was collected by questionnaire method. The outcome was that the level of interest rate was found to have influenced the decision on where to borrow to a great extent and the respondents suggested its reduction. It was also evident that competition from other banks affected the respondents' demand for personal loans in HDFC. The conditions and procedures are the least important factor affecting the demand for personal loans.

By Sharma & Singh, 2017:Researchers have evaluated the financial performance of HDFC Bank in relation to its loan portfolio growth. They have examined the contribution of loan schemes to the bank's profitability and overall financial health.

By(Chopra & Agarwal, 2018): Researchers have assessed how regulatory changes, such as the introduction of the Goods and Services Tax (GST) and changes in lending rate calculation methods, have affected HDFC Bank's loan products and pricing strategies.

III. RESEARCH METHODOLOGY

A. Objectives Of The Study

- To evaluate the financial performance of HDFC Bank.

- To analyze the liquidity and solvency position of the bank.

- To find the changes in the trends of the bank using trend analysis.

B. Limitations Of The Study

- The study is restricted to only the five financial years i.e.2015,2016,2017,2018 and 2019.

- The study is completely based on secondary data and the accuracy of the analysis depends on the data obtained.

C. Scope of The Study

The study's focus is restricted to gathering financial information that is annually released in the company's annual reports. The analysis is carried out to offer potential fixes. The study ran from 2011 to 2014 for a total of 4 years. The past, present, and future performance of firms can be examined using the trend analysis, and this study has been divided into short-term and long-term analyses. The company should make enough money to grow its operations in addition to meeting the owner's expectations.

D. Data Collection Method

Primary Data: Information collected from internal guide and finance manager. Primary data is first-hand information. Secondary Data: Company balance sheet and profit and loss account.

E. Secondary Data

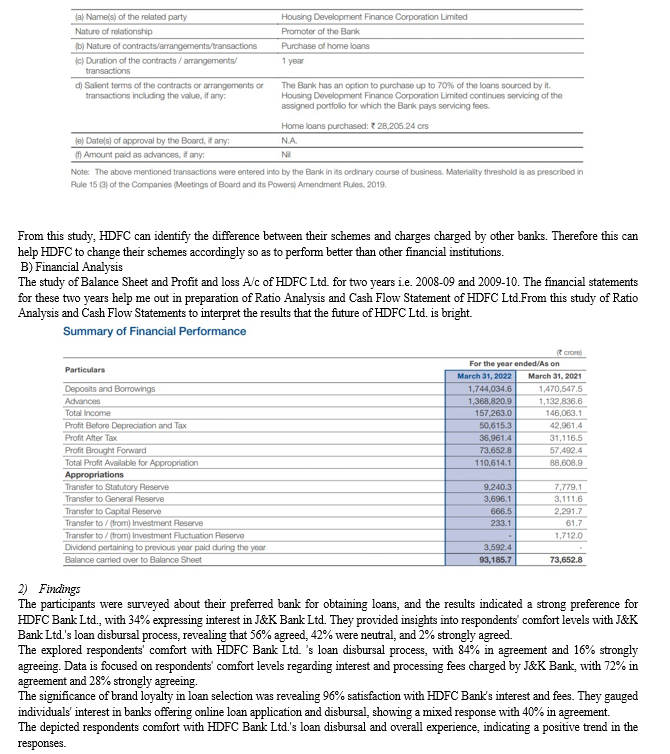

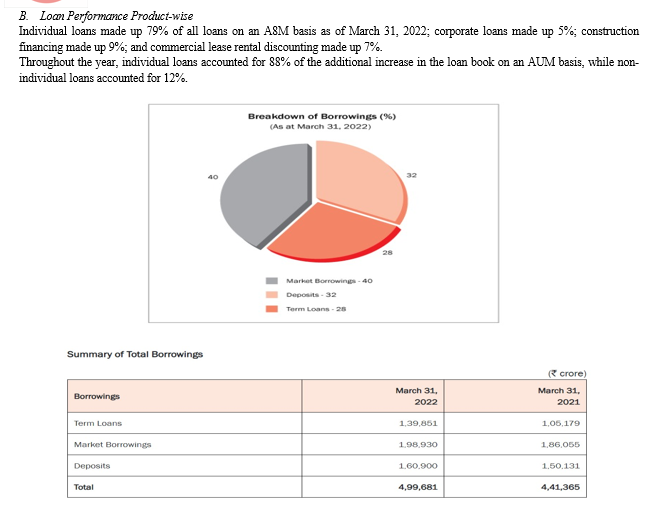

ANNUAL HDFC REPORT: As on March 31, 2023, your Bank’s Total Balance Sheet stood at ` 2,466,081 crore, an increase of 19.2 per cent over ` 2,068,535 crore on March 31, 2022. Total Deposits rose by 20.8 per cent to ` 1,883,395 crore from ` 1,559,217 crore. Savings Account Deposits grew by 9.9 per cent to ` 562,493 crore while Current Account Deposits rose by 14.3 per cent to ` 273,496 crore. Time Deposits stood at ` 1,047,406 crore, representing an increase of 29.6 percent. CASA Deposits accounted for 44.4 per cent of Total Deposits. Advances stood at ` 1,600,586 crore, representing an increase of 16.9 per cent. Domestic Loan Portfolio of ` 1,572,454 crore grew by 17.6 per cent over March 31, 2022.

The Personal Loans segment has experienced strong growth, with the overall portfolio touching ` 171,676 crore by the end of the year. The Bank's increased focus on the Government segment and top corporates has contributed to improved portfolio quality. The launch of Xpress car loans, offering seamless end-to-end digital disbursement, has driven a 17 per cent year-on-year growth in the Auto Loan portfolio. Your Bank has exhibited significant growth in gold loans, surpassing other gold financiers, thanks to an expanded branch network. The Home Loan portfolio has exhibited significant growth, surpassing industry growth rates and capturing a larger market share.

HDFC Securities Limited (HSL) synopsis of its performance across key parameters is as below:

|

KEY PARAMETERS |

FY 23 (` crore) |

FY 22 (` crore) |

% Increase |

|

Net Interest Income |

5416 |

5037 |

7.9 |

|

Profit after Tax |

1959 |

1011 |

93.7 |

|

Loan Disbursements |

44802 |

29033 |

64.8 |

|

Assets under Management (AUM) as at year end |

70084 |

61444 |

14 |

F. Sample Design

- Demographic Census covers all banks located in the Bhopal area of Madhya Pradesh

- Model Framework All Customers and Bankers.

- ANOVA Model Technology it is possible, a technology used that is deliberately designed and ready to identify respondents to a study. Equivalent feedback providers from all groups of people are guaranteed to minimize sample error.

- The Elements Model The Elements Model is a learning feature for each respondent

- Sample Size 425 Question papers are still being distributed but 415 are returned with the correct answer from the Bhopal respondents. The researcher collected data after building positive relationships with respondents.

- Secondary Data Researcher collects second data from various research essays and journals, books, journals, reports (government / company, newspaper, television) in print format and online from various sources.

- Collecting Tools to be used for data collection the questionnaire will be used to measure all variables. Data will be collected in terms of 1-5 LIGERT, measurement process and test type (Y / N).

- Tools used for data analysis Internal stability b. Honesty c. Facts analysis d. Testing T. Frequency analysis f. Postponement g. CFA (Modeling Equation Modeling) by AMOS

- Software used for statistical analysis Data collected with the help of various statistics using SPSS software is analyzed by the researcher. The Social Science (SPSS) version 20.0 version of Windows 7 will be used for data analysis and hypothesis testing. The data collected will be processed using Microsoft Excel 2010 with the help of various types of puzzles, charts and charts for Windows 7

G. Data Collection Tools

To conduct a "Trend Analysis" of the data obtained from secondary sources. The study's scope is outlined below in terms of the concepts used and the time period covered.

First, only HDFC Bank Limited is included in the study of trend analysis.

The second reason the study is limited to this time frame is time constraints. The analysis is based on the annual reports of the corporation for a period of 4 years, from 2010–11 to 2013–14.

IV. DATA ANALYSIS AND INTERPRETATION

A. Data Analysis

1) Comparison of Home Loans

The comparative study of HDFC home loan products and processes was conducted with similar services offered by other financial institutions.. The study illustrates prevailing rate of interests, percentage of funding, tenure of home loan and fees , documentation and repayment options features etc. being launched in other banks.

C. Implications of Research

The research and growth of loan schemes in HDFC Bank imply potential benefits such as increased financial inclusion, expanded customer base, and enhanced revenue streams. However, it also poses risks related to credit quality and market dynamics that need careful management. Research on loan schemes in HDFC Bank can provide insights into the bank's lending practices, interest rates, and eligibility criteria. Understanding these aspects can help borrowers make informed decisions, while also shedding light on the bank's risk management and financial health. It could also contribute to discussions on the broader economic landscape, financial inclusion, and the impact of banking policies on individuals and businesses.

Conclusion

A. Suggestions It has been observed that men make up the bulk of those who request loans. The government\'s decision to waive interest rates for female applicants should prompt banks to introduce initiatives aimed at encouraging more women to apply for loans. It has been observed that respondents felt more at ease approaching private banks such as J&K Bank and HDFC Bank regarding their loan preferences; nonetheless, there were only a small number of respondents in the sample who expressed dissatisfaction with the current situation. Banks could start running some advertising campaigns to spread the word about the loan programs to a larger audience and expedite the process of educating people about the safe reasons. It has been observed that more applicants are requesting personal loans. As a result, the banks ought to move forward with increasing the visibility of their other loans so that consumers are aware of them and know that doing so would lead to the creation of further loans.It has been observed that respondents prefer HDFC Bank Ltd. more when it comes to loan disbursement and approval. B. Recommendations The first obvious place to start is with reliability. Bank clients want to know that their assets are secure and held by reliable organizations. Making sure bank staff members have adequate training so they can all provide thorough and up-to-date information at all times would be one approach to provide this peace of mind. Strong institutional coherence and dependability can be fostered by uniform policies and competent personnel. Again, responsiveness would go a long way toward making HDFC Bank be seen as responsive when it is combined with a well-trained workforce and prompt resolution of customer-related issues. Employees ought to be motivated to offer pertinent solutions to banking clients in a way that more closely reflects a desire to assist than a sales pitch. In the banking sector, customers are equally satisfied with intangibles and tangibles. People often return again and time again to the same bank branch. This is typically a spot close to their place of employment or residence. It makes sense that clients would grow accustomed to and comfortable with these branch banks, just as they would with a local grocery or convenience store. It becomes sense to train bank staff to identify these frequent clients, learn their identities, and start figuring out what basic services they need. Acquiring comprehension of customers\' requirements will enable bank colleagues to provide improved services, perhaps decreasing customers\' banking expenses and raising their investment potential. This may potentially lead to higher profitability for banks since, when seen as providing better customer service, they will inadvertently turn into a convenient and enjoyable place to \"shop.\" C. Conclusion All one needs is the courage to innovate, the skill to understand clientele and the desire to give them the best. Likewise concluding by mentioning the following points that would help HDFC in improvising their working styles and performance. 1) Most of the customers face problems regarding the rate of interest. HDFC must inform its customers about the change in ROI, It automatically changes but there is decrease in rate of interest, it doesn’t change automatically. 2) Any change in the policies must be intimated to all the customers. HDFC should provide proper information to its customers. 3) There is lot of formalities in the loan disbursement process. Too much documentation is done . Customer is no aware of all the formalities. Therefore paperwork should be more friendly and clear . 4) Customers should be given proper information about EMI. They are generally not told how their EMI are calculated they should know EMI is calculated and of what amount. 5) After sale service is an issue of concern. Customers facing problems are not attended on time. Employees are generally cooperative only when the loan is sanctioned and disbursed. Therefore after sale service should be improved up to the satisfaction level of the customer. 6) Website of HDFC should give more options and features to customers so that they get maximum information sitting at home 7) Employees of HDFC should be more prompt towards customer’s grievances and problems 8) HDFC should provide personalized services to customers. 9) Comparative pricing in terms of lower interest rates and front end changes should be adopted. 10) Companies should enter into tie ups with reputed builders and development authorities. 11) HDFC should increase their reach by penetrating into rural and semi urban areas .They should also capitalize on present customer base by generating referrals 12) Aggressive marketing and great publicity through newspapers, hoarding, websites and other media should be done.

References

[1] Nagalekshmi V S, Vineetha S Das (2018). Impact of Mergers in Banking Sector: A Case Study.International Journal of Research and Scientific Innovation (IJRSI),| Volume V, Issue VII, 100-102. [2] Murad Mohammad Galif Al-Kaseasbah and Abdel KarimSalimIssaAlbkour (2018) “Financial Performance of Indian Banking Sector: A Case study of SBI and ICICI Bank”. Mediterranean Journal of Basic and Applied Sciences (MJBAS). Vol.2, Issue 2, ISSN: 2581- 5059 (Online) pp 126-137. [3] Priyangajha (2018) “Analyzing Financial Performance (2011-18) of Public Sector Banks (PNB) and Private Sector Banks (ICICI) in India”. ICTACT Journal of Management StudiesAugust 2018 vol.04, Issue 03, ISSN: 2395-1664 (online) pp 793-799. [4] Vinod Kumar and BhawnaMalhotra(2017).A camel model analysis of Private Banks in India,EPRA International Journal of Economic and Business Review, Volume - 5, Issue- 7,87- 93. [5] Jaiswal and Jain (2016) “A Comparative Study of Financial Performance of SBI and ICICI Banks in India”. International Journal of Scientific Research in Computer Science and Engineering, 4(3), 1-6. Studia Rosenthaliana (Journal for the Study of Research) Volume XI, Issue XI, November-2019. [6] Gupta (2014) “An Empirical study of Financial Performance of ICICI Bank – A Comparative Analysis.IITM Journal of Business Studies (JBS). [7] Tirkeyi and Salem (2013) “A Comparative Study of Financial Statement of ICICI and HDFC Through Ratio Analysis”. International Journal of Accounting and Financial Management Research (IJAFMR). [8] Dr. A.Murthy and Dr. S.GurusamyManagement Accounting Theory & Practice Vijay Nicole Imprints Private Limited.Chennai. Anthony B. Sanders, Barriers to homeownership and housing quality: The impact of the international mortgage market, Journal of Housing Economics. [9] Naik D.D, Housing Finance Pamphlet 163, Commerce Publication, Bombay, 1981. [10] J.P. Sah selected papers. up. Cit, 2011. [11] Manorama Year Book, with a special feature on 50 years of Indian freedom and Democracy and development?, 32nd year of publication, 1997, pp. 600. [12] Krishnamachari S M, Mobilization of Finance for Rural Housing, Yojana Publication Division, New Delhi, 26 1980. [13] Satyanarayana C P, Housing rural poor and their living conditions, Gain Publishing House, Delhi, 1987, 15. [14] India year Book, Director. Publication Division, Ministry of information and Broadcasting, Government of India publication, New Delhi, 1988-89, 597. [15] Andra C. Ghent and Michael T. Owyang,, Is housing the business cycle? Evidence from US cities, Journal of Urban Economics, 67(3), 2010, 336-35. [16] Despande, Cheap and healthy house for the middle classes in India - United Book Corporation, Pune, 1975.. [17] Rangwala S.C., ?Town Planning R.C. Patel?, Charotar Book Stall, 1998.. [18] GopinathRao, C.H., Ownership of flats: Sai Ganesh offset printers – Santhome, Madras 4, 1988. [19] Dr.HarichandranC., Housing Development Finance, Yojana Publication Division, New Delhi,35,1989. [20] Chacko K.O., Annual General Body meeting of cooperative societies: A tutorial review, A Seminar on \'Housing Finance, 1989. [21] MadhavRao, A.G. Murthy and Annamalai G, Modem Trend in housing in Developing Countries, (Oxford and IBH Publishing Company, New Delhi, 1985, 341). ---------------------------------------------------------------------

Copyright

Copyright © 2024 Dr. Supriya Rai , Palak Agarwal, Damini D Bamb, Kishu Dokania, Hitesh Dhoka, Parvath AV. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET58402

Publish Date : 2024-02-12

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online