Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Analysing the Factors Behind Exchange Rate Fluctuations in India

Authors: Mohammad Samal Shah

DOI Link: https://doi.org/10.22214/ijraset.2024.59951

Certificate: View Certificate

Abstract

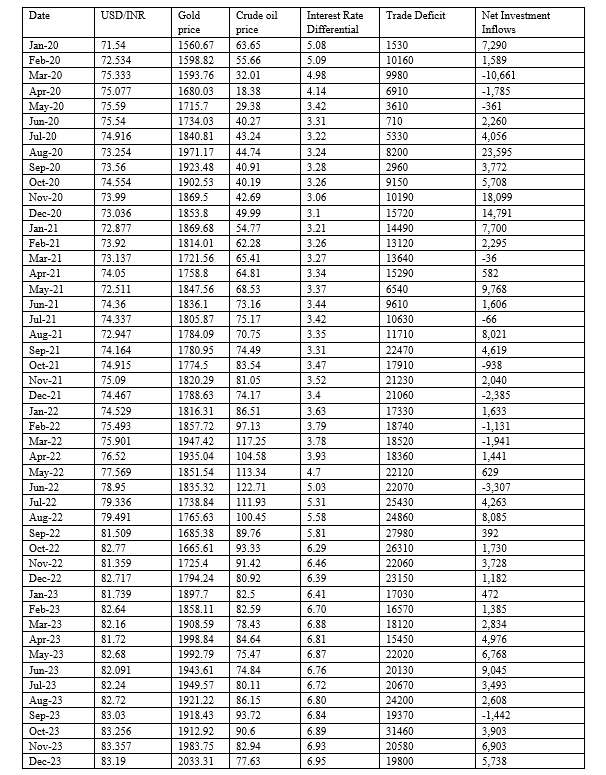

The study gives an overview of the various determinants of the exchange rate movements in India. Out of the multiple factors affecting the Rupee-Dollar value the impact of Interest rate differential, Trade deficit of India, Foreign Net investment inflows to India, Oil prices, and Gold prices (in the short term) on the exchange rate has been studied using Regression analysis and correlation and the role they played by the above mentioned variables in determining the exchange rate during the Global Financial Crisis of 2008-2010 and during the Covid-19 Period from 2020-2023. Exchange rate fluctuations play a crucial role in shaping the economy of a country, and India is no exception. The exchange rate of the Indian rupee against major world currencies is subject to constant fluctuations, influenced by a multitude of domestic and global factors. These fluctuations have significant implications for various stakeholders, including businesses, consumers, investors, and policymakers. Several factors contribute to the exchange rate fluctuations in India. One of the primary factors is the demand and supply dynamics of foreign exchange. Factors such as trade balance, foreign direct investments, portfolio investments, remittances impact the demand for and supply of foreign currency, Crude oil prices, Gold prices, and thereby affecting the exchange rate. In addition, macroeconomic variables like inflation, interest rates, and economic growth also play a crucial role in determining exchange rate movements. For instance, a high inflation rate in India compared to trading partner countries can lead to a depreciation of the rupee. Global economic conditions and geopolitical events are other significant factors influencing exchange rate fluctuations in India. Economic developments in major trading partners, changes in global commodity prices, and geopolitical tensions can all impact investor sentiment and capital flows, leading to fluctuations in the exchange rate. For example, uncertainties related to Brexit or trade tensions between major economies can trigger volatility in currency markets. Monetary policy decisions by the Reserve Bank of India (RBI) also play a crucial role in influencing exchange rates. Interest rate changes, open market operations, and forex interventions by the central bank can impact the value of the rupee vis-a-vis other currencies. The RBI often intervenes in the foreign exchange market to stabilize the rupee or prevent extreme volatility. Apart from these factors, market speculation, investor sentiment, and technological advancements in the financial markets can also contribute to exchange rate fluctuations. High-frequency trading, algorithmic trading, and the use of complex financial instruments by market participants can amplify exchange rate movements and increase volatility.

Introduction

I. INTRODUCTION

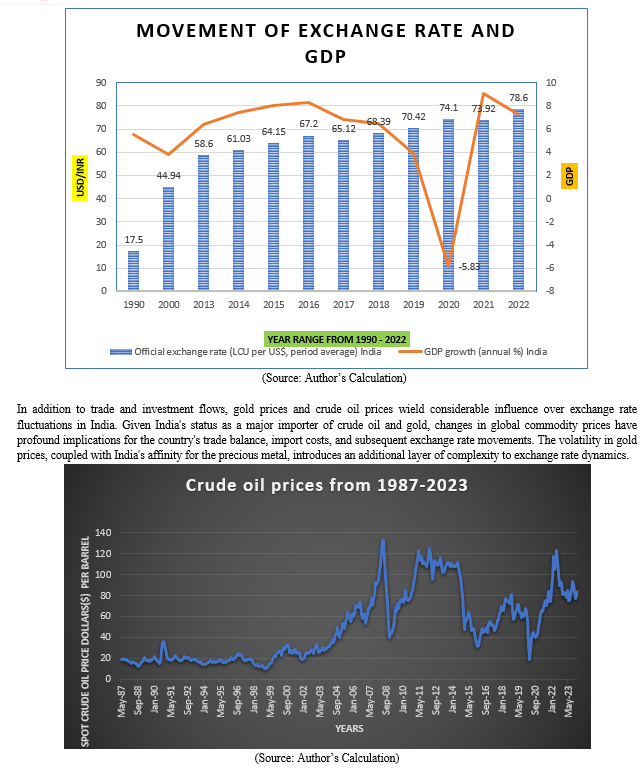

Changes in exchange rates have a significant impact on the economic environment in India, a vibrant rising market that is becoming more and more visible on the international scene. The Indian rupee's fluctuating exchange rate compared to major currencies like the US dollar, the euro, and the British pound highlights the complex interaction between local and international variables that affect currency fluctuations. India is the sixth biggest economy in the world, thus its exchange rate movements are quite important. They affect trade, investment, inflation, and general economic stability, among other areas.

The imbalance between the value of imports and exports, or the trade deficit, is one of the main factors influencing India's exchange rate changes. The ongoing trade imbalance with China puts pressure on demand for foreign exchange, which drives up and down the value of the dollar. Additionally, changes in net investment inflows—which include remittances, foreign direct investments, and portfolio investments—also impact currency movements by adding to the demand-supply dynamics of foreign exchange.

In light of this, the study's objective is to present a thorough examination of the several factors that influence exchange rate swings in India, with an emphasis on the trade deficit, net investment inflows, gold and crude oil prices, and interest rate differentials. This research aims to clarify the complex relationships between these factors and exchange rate movements by using regression analysis and correlation techniques. This will help to shed light on these factors' roles during times of economic turbulence, such as the Global Financial Crisis of 2008–2010 and the Covid-19 pandemic of 2020–2023. This research intends to add to the body of knowledge on exchange rate dynamics in India by carefully examining these aspects and offering insightful analysis that will be useful to academics, entrepreneurs, investors, and policymakers. This research aims to provide insights into strategic decision-making and policy development that promote stability and resilience in the face of currency volatility by clarifying the fundamental determinants of exchange rate variations.

A. Rationale For The Study And Motivation

- Rationale for the Study

Exchange rate fluctuations have profound implications for the economy of India, impacting various sectors such as trade, investment, inflation, and overall economic stability. Understanding the factors driving these fluctuations is crucial for policymakers, businesses, and investors to formulate effective strategies. India's exchange rate policies directly influence its trade competitiveness, capital flows, and monetary policy effectiveness. Therefore, a comprehensive analysis of the factors affecting exchange rate fluctuations is essential for policymakers to design appropriate monetary and fiscal policies to maintain stability and promote economic growth.

Exchange rate fluctuations significantly impact businesses engaged in international trade, affecting their competitiveness, profitability, and risk exposure. Understanding the underlying factors driving these fluctuations enables businesses to make informed decisions regarding pricing strategies, hedging mechanisms, and expansion into foreign markets. Despite extensive research on exchange rate determination, the specific factors influencing exchange rate fluctuations in the context of India may differ due to its unique economic, political, and institutional characteristics. Therefore, conducting empirical research on this topic contributes to the academic literature by providing insights into the dynamics of exchange rate movements in the Indian context.

Gold is traditionally considered a safe-haven asset, and its price often moves in response to economic uncertainties and geopolitical tensions. Changes in gold prices can influence demand for the US dollar and other currencies, leading to exchange rate fluctuations. In times of uncertainty, a higher gold price could lead to some investors shifting away from the rupee towards the perceived safety of other currencies. India is a major importer of crude oil. Changes in global crude oil prices have a significant impact on India's trade balance and import costs. An increase in oil prices puts pressure on the Indian rupee due to the increased demand for foreign exchange to pay for oil imports. Additionally, rising oil prices can lead to inflation, further affecting the exchange rate. A persistent trade deficit, meaning India imports more goods and services than it exports, can put downward pressure on the rupee. This arises from the need to obtain foreign currency to cover import costs. If the trade deficit widens, the increased demand for foreign currency for imports can lead to rupee depreciation.

2. Motivation

Exchange rate fluctuations can introduce volatility into the economy, impacting businesses, consumers, and investors. Understanding the drivers behind these fluctuations helps in mitigating risks and seizing opportunities arising from currency movements. India's export-oriented industries heavily depend on favourable exchange rates to remain competitive in the global market. Analysing the factors affecting exchange rates provides insights into how changes in currency values can affect India's export competitiveness and trade balance. Exchange rate fluctuations influence the attractiveness of India as an investment destination for foreign investors. By examining the factors driving these fluctuations, investors can better assess the risks and returns associated with investing in Indian assets, including stocks, bonds, and real estate. India's central bank, the Reserve Bank of India (RBI), plays a crucial role in managing exchange rate volatility through various policy interventions. Understanding the factors affecting exchange rates helps policymakers formulate effective monetary and exchange rate policies to maintain macroeconomic stability and promote sustainable economic growth. Exchange rate determination is a fundamental topic in international economics and finance. Investigating the specific factors influencing exchange rate fluctuations in India contributes to the broader academic understanding of exchange rate dynamics and their implications for emerging market economies.

Exchange rate fluctuations in India refer to the periodic changes in the value of the Indian rupee against other major currencies such as the US dollar, Euro, and British pound. These fluctuations have a significant impact on the country's economy as they influence trade competitiveness, foreign investment inflow, inflation rates, and overall economic stability. Several factors contribute to exchange rate fluctuations in India. One of the primary drivers is the demand and supply dynamics of foreign exchange in the market. When there is a high demand for the Indian rupee due to factors such as strong economic growth or foreign investment inflow, the exchange rate appreciates. On the other hand, if there is a surge in demand for foreign currencies or capital outflow, the rupee depreciates. Monetary policy decisions by the Reserve Bank of India (RBI) also play a crucial role in influencing exchange rates.

Interest rate changes by the RBI can impact the attractiveness of Indian assets to foreign investors, leading to fluctuations in the currency value. In addition, inflation rates in India compared to other countries can affect exchange rates as higher inflation erodes the purchasing power of the rupee, making it less valuable relative to other currencies. Global economic trends and geopolitical events also have a significant impact on exchange rate movements in India.

Factors such as trade tensions, economic growth prospects, and financial market volatility in major economies can lead to fluctuations in currency values. For instance, a slowdown in the global economy can weaken demand for Indian exports, putting pressure on the rupee exchange rate. Moreover, speculative activities in the foreign exchange market can amplify exchange rate fluctuations. Traders and investors may engage in currency trading based on expectations of future exchange rate movements, leading to short-term volatility in the currency markets. Overall, exchange rate fluctuations in India are a complex phenomenon influenced by a combination of domestic and global factors. Monitoring and managing these fluctuations are essential for policymakers to ensure stability in the economy and promote sustainable growth.

B. Statement Of The Research Problem

Problem Statement:

Fluctuations in exchange rates in India are intricately influenced by a myriad of factors, forming a dynamic interplay that shapes the value of the Indian rupee. The balance of demand and supply of foreign currency serves as a foundational determinant, swayed by elements such as trade balance, foreign investments, and remittances. Moreover, the spectre of inflation rates looms large, with high inflation in India relative to other nations often precipitating depreciation of the rupee, as it erodes the currency's purchasing power and prompts investors to seek refuge elsewhere. Interest rates, set by the Reserve Bank of India, wield considerable sway, with higher rates alluring foreign investors seeking lucrative returns, consequently bolstering the rupee, while lower rates can induce depreciation. Political stability and economic performance further influence investor sentiment, with positive growth and stability bolstering confidence and strengthening the rupee. Global economic factors, ranging from crude oil prices to geopolitical tensions, exert their gravitational pull, tethering the rupee's fate to the ebbs and flows of the international landscape. Meanwhile, India's foreign exchange reserves stand as a bastion of stability, buffering against excessive volatility and instilling confidence in the rupee's value. Speculative activities, market sentiment, and government interventions add layers of complexity, injecting short-term fluctuations into the exchange rate dynamics. Additionally, the reliance on oil imports and the nation's penchant for gold importation create additional pressure points, with trade deficits and interest rate differentials further entwining the fabric of exchange rate movements. In this intricate dance, each element plays its part, orchestrating a symphony of exchange rate fluctuations that reflect the multifaceted realities of India's economic landscape.

C. Review Of Literature

Mirchandani (2013) conducted study to examine the many macroeconomic factors that cause rapid fluctuations in a currency's exchange rate. The interest rate, inflation rate, GDP, current account, foreign direct investment, and USD/INR are the factors that were examined. His research revealed a robust direct or indirect relationship between the exchange rate and other factors including interest rates, inflation rates, GDP growth rates, and foreign direct investment. Since the correlation value was negligible, there was no connection discovered between the current account and the exchange rate.

From 1993 to 2013, Sahu et al. (2014) conducted research to look at the dynamic links between the price of oil, the exchange rate, and the Indian stock market. WTI crude oil price per barrel (in dollars), the USD INR exchange rates, and the monthly closing values of the S&P BSE Sensex were the variables under investigation. The results showed that there is a long-term co-integrating relationship between the price of crude oil, the exchange rate, and the Indian stock market, but that neither the price of crude oil nor the exchange rate is observed to significantly affect the prices of Indian stocks. These relationships were established using the Co-Integration Test, Vector Error Correction Model (VECM), Variance Decomposition Test, and Impulse Response Analysis to determine the long- and short-term dynamic relationship between the variables, and the Granger Causality Test to determine the direction of causality.

The nature of exchange rate volatility was experimentally studied by Kamble & Honrao (2014). The analysis used monthly data on the bilateral exchange rate between the Rupee and the US dollar. The empirical investigation was conducted from January 2011 to September 2013. The GARCH (1, 1) model was used to examine the Indian rupee's foreign exchange rate volatility relative to the US dollar. Nearly all of the ARCH and GARCH models' parameter estimations were significant at the 5% level. The growth in capital movements and the internal and international challenges affecting both India and the United States of America are blamed for the foreign currency market's volatility.

The goal of Kanika & Singh's (2015) study was to determine which macroeconomic variables, and how they interact, influence the value of the Indian rupee. The factors are the rate of inflation, interest rates on loans, rate of foreign direct investment, rate of growth of the gross domestic product, and current account deficit. Research is exploratory and analytical in nature, generating a posteriori hypothesis through data-set analysis and the search for plausible relationships between variables. With SPSS, regression and correlation have been performed. The results indicate that the five chosen independent factors included for this study have a significant impact on exchange rate.

Lodha (2017) investigated the relationship between the prices of crude oil, gold, and the USD/INR exchange rate over the long and short terms. The Johansen Cointegration test was used to evaluate the long-term connection. The data, however, showed that there was no long-term connection among the factors. With the use of the VAR model and the Granger causality test, the study also looks at the short-term link. According to the findings, there is a unidirectional Granger causality from the price series of gold to crude oil, but a bidirectional Granger causality between crude oil and the USD/INR exchange rate.

Thilak venkatesan, M.S Ponnamma (2017) The study concluded that there is a long-term association between FDI and the variations in the value of the Indian rupee. The ARDL model was employed in this study to estimate the importance of macroeconomic factors on the exchange rate. We may conclude that certain variables that have been shown to have a major impact on volatility also have an impact on the total exchange rate. The short-term effects, however, are less clear-cut since they are probably dependent on certain economic characteristics. Higher rates of inflation had a negative effect on the exchange rate as compared to other nations since they have a negative influence on the foreign exchange rate. According to the Granger causality study, FDI is impacted by inflation.

Satyananda Sahoo, RBI (2012) In his study, "Volatility Transmission in the Exchange Rate of the Indian Rupee," the author examined the volatility that impacted the Indian Rupee exchange rate between 2005 and 2011 and the exchange rates of the Brazilian Real, the Russian Ruble, the South Korean Won, the Singapore Dollar, the Japanese Yen, the Swiss Franc, the British Pound Sterling, and the Euro. The results corroborated the hypothesis that fluctuations in the exchange rates of the major currencies, among other things, contribute to fluctuations in the daily exchange rate of the Indian Rupee.

The findings of the study (Gurusamy, 2013) Verify that changes in actual exports and imports are cointegrated with changes in the GDP, international economic activity, and exchange rate. The results of their analysis indicate that increased exchange rate volatility tends to lower real exports in India, suggesting that real exports (and imports) are significantly harmed by changes or variations in the exchange rate.

As per the research study of Saini and Dhameja (2014) Exchange rates are affected by a number of variables, including world events, BSE Sensex returns, crude oil prices, and RBI intervention. They claim that the performance of the BSE Sensex and the dollar are negatively correlated, meaning that when the BSE Sensex yields higher returns, the value of the rupee increases. The Indian rupee's value decreases in response to rising crude oil prices. The Reserve Bank of India (RBI) utilizes its foreign exchange reserves to intervene in the market to control excessive exchange rate volatility in India.

Divakaran D & Gireeshkumar G (2014) are a number of variables that affect an economy's rate of exchange, including supply and demand for dollars and rupees, the health of the economy, the price of crude oil, the current account deficit, forex reserves, economic growth, demand for gold, variations in interest rates, and inflation levels.

Khattak N R et. al. (2012) The study employed the Ordinary Least Square Method and Johansen Co Integration Techniques to investigate the relationship between long-term exchange rate levels and various factors, including the money supply, gross domestic product, foreign exchange reserves, trade balance, interest rates, and price increases.

According to Hsieh (2009), the depreciation of domestic currency is caused by an increase in real money, higher interest rates, and an increase in inflation. The appreciation of currency is a result of both increasing government expenditure and stock prices. According to Egert's (2010) research, fluctuations in the price of gold and an understanding of risk levels impact the exchange rate.

Uddin et.al. (2013), The real exchange rate and macroeconomic factors are found to be cointegrating in the USD against Bangladeshi currency research. Currency depreciation is caused by an increase in the money supply and the cost of repaying debt, whereas currency strengthening is caused by an increase in foreign exchange reserves. The value of the national currency is inversely correlated with the stability of the political system.

D. Identification Of Research Gaps

Recent tightening cycles by the changing role of the US Federal Reserve's monetary policy and its impact on emerging market currencies such as the Indian rupee. It suggests potential research areas to explore the quantifiable effects of actions like interest rate hikes, forward guidance, and balance sheet adjustments by the Federal Reserve on the stability of India's exchange rate. The pandemic and geopolitical tensions have led to conversations around reducing reliance on global supply chains. Research could explore how India's trade patterns might shift in this context, the potential for greater domestic manufacturing, and how trade flows (and consequently the demand for foreign currency) could be impacted, affecting exchange rates. And also Research could examine the potential impact of India's ambitious renewable energy goals on its oil import reliance. It could investigate whether reduced oil imports over the long term might create more exchange rate stability, and how quickly that could occur.

The Reserve Bank of India is exploring a digital rupee. Research could delve into potential effects this might have on the traditional foreign exchange market, capital flows, and ultimately, exchange rate volatility. There is an area where research could aim to quantify market participants' expectations by surveying large institutional investors, banks, and exporters about their outlook on the Indian Rupee and incorporating their forward-looking views into the analysis. Also research could identify a more niche gap by focusing on how exchange rate changes affect specific industries of the Indian economy that are highly dependent on imports/exports (like technology, pharmaceuticals, or textiles).

While abstract mentions FDI and portfolio investments, research could explore how factors like India's ESG (Environmental, Social, Governance) ratings or improvements in the ease of doing business ranking might attract more sustainable or long-term foreign investment, potentially having a stabilizing effect on exchange rates. India's growing ties with nations through initiatives like the Indo-Pacific Economic Framework, could be explored. Examine the potential for bilateral trade agreements settled in local currencies (like the Rupee-Ruble arrangement) and their impact on the demand for US dollars in the context of India's trade, with subsequent exchange rate implications. There is a research gap where examining behavioural biases of market participants amplify exchange rate movements in India. Research might analyse if trends like herding behaviour, overconfidence, or the impact of news sentiment contribute to excess volatility beyond what is explained by traditional economic fundamentals.

E. Theoretical Underpinnings

The theoretical underpinnings of this master thesis paper involve several economic theories and concepts related to exchange rate determination and fluctuations. The following study primarily focuses on the determinants of exchange rate movements in India, specifically examining the impact of interest rate differential, trade deficit, foreign net investment inflows, oil prices, and gold prices on the exchange rate.

- Purchasing Power Parity (PPP) Theory: The Purchasing Power Parity (PPP) theory posits that exchange rates between two currencies will adjust to equalize the purchasing power of each currency. In practical terms, this means that if inflation is higher in one country, its currency should depreciate to maintain parity with currencies from countries experiencing lower inflation rates. In the case of India, when the inflation rate is relatively high, it erodes the purchasing power of the Indian rupee compared to currencies from nations with lower inflation. This diminishing purchasing power reduces India's competitiveness in global markets as its exports become relatively more expensive, dampening demand. Simultaneously, imports become costlier for Indian consumers and businesses, further exacerbating trade imbalances and diminishing demand for the Indian currency internationally. Consequently, the adverse effects on India's trade balance and currency demand can lead to a depreciation of the Indian rupee in foreign exchange markets. This adjustment reflects the decreased purchasing power of the Indian currency relative to others, in line with the principles of PPP. Thus, understanding the implications of inflation on exchange rates is crucial for policymakers, as high inflation can undermine a country's trade competitiveness and have detrimental effects on its currency valuation in international markets.

- Interest Rate Parity (IRP) Theory: The Interest Rate Parity (IRP) theory asserts that the disparity in interest rates between two countries should align with the anticipated change in the exchange rate. Essentially, if one country offers higher interest rates compared to another, investors are expected to flock to the higher-yielding market, triggering an appreciation of the currency in that country. In the context of India, the study explores how changes in interest rate differentials influence the exchange rate, assuming that an increase in interest rates or a more hawkish monetary policy stance would entice foreign investors to invest in Indian bonds, seeking greater returns. When interest rates rise in India or when the central bank adopts a hawkish stance, it tends to attract foreign investors looking to capitalize on higher yields. This influx of foreign capital, as investors purchase Indian bonds, leads to increased demand for the Indian currency. Consequently, the exchange rate appreciates as the increased demand for the rupee strengthens its value against other currencies. This scenario illustrates the application of the IRP theory, where interest rate differentials influence capital flows and subsequently impact exchange rates.

- Balance of Payments (BOP) Theory: The study delves into the multifaceted dynamics of the exchange rate by examining the interplay between trade deficit, foreign investment inflows, and other components of the balance of payments. Central to this analysis is the recognition that trade deficit and foreign investment play pivotal roles in shaping a country's currency valuation. In particular, a robust economy characterized by high consumer spending, strong demand, and robust economic growth tends to attract foreign investment inflows, bolstering confidence in the domestic currency and leading to its appreciation. Conversely, countries experiencing sluggish economic growth may encounter challenges in attracting foreign investment, leading to diminished confidence in their currencies. In such instances, investors may seek more stable and promising opportunities elsewhere, thereby exerting downward pressure on the exchange rate. Therefore, the study underscores the significance of economic fundamentals in determining exchange rate movements, emphasizing how factors such as trade deficit and foreign investment inflows can influence currency valuation and market sentiment. Understanding these dynamics is essential for policymakers and market participants alike in navigating the complexities of global financial markets and formulating effective strategies to manage exchange rate risks.

- Commodity Currency Theory: The Commodity Currency Theory, explored in the study, sheds light on the influence of crude oil and gold prices on exchange rates, particularly focusing on short-term fluctuations.

These commodities, regarded as safe-haven assets, wield significant influence over exchange rates, especially for countries heavily reliant on commodity exports like India. When crude oil prices surge due to geopolitical tensions or supply disruptions, countries exporting oil experience strengthened economic prospects and currency appreciation. Conversely, declines in oil prices may exert downward pressure on the currencies of oil-exporting nations. Similarly, gold prices, serving as a hedge against inflation and currency devaluation, can sway exchange rates, particularly during periods of economic uncertainty or geopolitical unrest. In the context of India, a major player in both oil production and gold consumption, fluctuations in crude oil and gold prices hold substantial sway over the Indian rupee's exchange rate. Recognizing the interplay between commodity prices and exchange rates is crucial for policymakers and investors to navigate the complexities of the global economy and effectively manage currency risks.

II. RESEARCH METHODOLOGY

Exchange rate fluctuations in India are influenced by a multitude of factors, both domestic and international. The methodology used to study exchange rate fluctuations in India involves a comprehensive examination of economic fundamentals, crude oil prices, Gold Prices, Net investment inflows, interest rate differential, and trade deficit. By carefully analysing these factors, researchers and policymakers can gain insights into the drivers of exchange rate movements and develop strategies to manage the impact of fluctuations on the Indian economy.

Establishing the scope of the study is crucial for delineating the boundaries within which research will be conducted and ensuring that the objectives are achievable within the available resources and timeframe.

A. Scope Of The Study

The study aims to discuss the fluctuating movement in the USD-INR exchange rate over the past decade, highlighting the trends and patterns observed during different periods. The study aims to emphasize the importance of understanding exchange rate fluctuations for businesses, investors, and the overall Indian economy. the study is to examine the factors affecting the exchange rate fluctuation of the Indian Rupee against the US Dollar. The study focusses on the impact of five variables which are interest rate differential, trade deficit of India, foreign net investment inflows to India, Crude oil prices, and gold prices (in the short term). And have used regression analysis and correlation analysis to assess the connection between these factors and the exchange rate. The study also explores the role these variables played in determining the exchange rate during two specific crisis periods the Global Financial Crisis of 2008-2010 and the Covid-19 pandemic period from 2020-2023.

B. Research Objectives

- To examine the role played by the selected relevant factors in determining the exchange rate during the Global Financial Crisis of 2008-2010.

- To assess the extent to which the selected factors were able to explain the exchange rate fluctuations during the Covid-19 period, 2020-2023.

- To identify the significance of the impact of each individual factor on the exchange rate movements through statistical analysis.

C. Framing Of Research Hypotheses

Research hypotheses are statements that propose a relationship between variables, providing a framework for empirical investigation and analysis. The null hypotheses tested are:

H0: There is no significant impact on the rupee-dollar exchange rate in the short term due to Gold price, Crude oil, Interest rate, Trade deficit and Foreign net investment inflows in India.

H1: Gold price, crude oil price, interest rate differential, trade deficit of India, or foreign investment inflows in India individually or collectively have a significant impact on the rupee-dollar exchange rate in the short term.

D. Research Design

- Research Approach

This study primarily adopts a quantitative research approach, focusing on the collection and analysis of numerical data related to exchange rates, interest rate differentials, trade deficits, net investment flows, crude oil prices, gold prices for the period of 2008-2010 and also during the period from 2020-2023 by using regression analysis and correlation analysis. So as to check the following factors affecting the exchange rate fluctuations in India.

2. Sampling method

The study focused on analysing the impact of selected factors on the exchange rate fluctuations of the Indian Rupee against the US Dollar (USD/INR).

The sample size consisted of monthly data points for two distinct periods:

- Covid-19 period: January 2020 to December 2023 (4 years of monthly data)

- Global Financial Crisis period: January 2008 to December 2010 (3 years of monthly data)

The unit of analysis is a single monthly data point within the selected periods. Each data point includes values for your chosen independent variables (oil prices, gold prices, etc.) and the dependent variable (USD/INR exchange rate) for a given month. The sampling method employed was a purposive sampling approach, Purposive sampling was chosen to selectively capture data from specific time periods and variables relevant to the study's objectives, optimizing efficiency and ensuring focused analysis. The study aimed to capture the impact of these variables on the exchange rate fluctuations (USD/INR) during the selected time periods.

3. Data Analysis Techniques

The study primarily uses regression analysis and correlation analysis as the data analysis technique. The study was conducted through regression analysis and correlation analysis to assess the impact of selected independent variables (gold prices, crude oil prices, interest rate differential, trade deficit, and foreign investment inflows) on the dependent variable (USD/INR exchange rate). The regression analysis included techniques such as:

- Analysis of Variance (ANOVA) to check the overall significance of the model

- Model summary and R-squared to determine the extent to which the independent variables explain the exchange rate fluctuations

- Regression coefficients and significance tests to evaluate the impact of individual independent variables

- Variance Inflation Factor (VIF) to assess multicollinearity among the independent variables

Ethical Considerations: The following research study does not explicitly mention ethical considerations, as it primarily relies on publicly available secondary data sources. However, the sources of data appropriately and have not engaged in any unethical practices, such as data manipulation or misrepresentation of findings. The research design follows a quantitative approach, utilizing secondary data and statistical techniques to analyse the factors affecting exchange rate fluctuations in India.

E. Methods For Data Collection & Variables Of The Study

The effectiveness of any research study heavily depend on the methods employed for data collection and the variables selected for analysis. In the context of this study on Exchange rate fluctuations and its factors affecting in India, the methods for data collection encompass various sources, while the variables under consideration are crucial factors that influence Exchange rate dynamics. This section provides a detailed overview of the methods for data collection and the key variables of the study.

- Data collection Method

The study relied on secondary data sources for collecting the required information. The relevant data was gathered from the websites of the Reserve Bank of India (RBI), the Federal Reserve Bank of St. Louis, Investing.com, World Bank, Trading Economics, London Bullion Market Association, US energy information administration.

To study the exchange rate dynamics during the Covid-19 Period, an additional dataset was collected for three years, from January 2008 to December 2010 during global financial crisis period, using monthly observations.

The following variables were selected for statistical testing in the research study:

- Gold prices (in USD terms)

- Crude oil prices (Brent crude, in USD per barrel)

- Interest rate differential based on US and India 3-month bond yields

- Trade deficit of India (in USD terms)

- Foreign investment inflows in India (FDI and FII, in USD terms)

The exchange rate of the Indian Rupee against the US Dollar (USD/INR) was considered the dependent variable, and the above-mentioned factors were treated as independent variables.

For the following study data was collected monthly-wise for two distinct time periods from these sources:

- Covid-19 Analysis Period: January 2020 to December 2023 (4 years of monthly data)

- Financial Crisis Period: January 2008 to December 2010 (3 years of monthly data)

2. Variables of the Study

- Dependent Variables: The dependent variable in this study is the exchange rate of the Indian Rupee against the US Dollar (USD/INR). The following study aimed to understand the factors influencing the fluctuations in the USD/INR exchange rate.

- Independent Variables: The independent variables selected for the statistical analysis are:

- Gold prices (in USD terms)

- Crude oil prices (Brent crude, in USD per barrel)

- Interest rate differential based on US and India 3-month bond yields

- Trade deficit of India (in USD terms)

- Foreign investment inflows in India (FDI and FII, in USD terms)

These independent variables represent various macroeconomic factors that are hypothesized to have an impact on the exchange rate movements in India.

3. Control Variables: The use of control variables in the statistical analysis. However, control variables are typically used in regression analyses to account for potential confounding factors or to isolate the effects of the independent variables on the dependent variable.

In the context of this study, potential control variables could have included:

- Inflation rates (in India and the US)

- GDP growth rates (in India and the US)

By including control variables, the following study could have potentially controlled for the effects of other factors that might influence the exchange rate but were not directly included in the analysis as independent variables.

III. DATA ANALYSIS AND INTERPRETATION

A. Techniques For Data Analysis

When analysing exchange rate fluctuations in India and the factors affecting them, the techniques that have been employed to gather and analyse data effectively. Here are some commonly used techniques:

The techniques for data analysis can be outlined as follows:

- Regression Analysis: Regression analysis is the primary technique employed in this study. The following study conducted regression analysis to assess the impact of selected independent variables (gold prices, crude oil prices, interest rate differential, trade deficit, and foreign investment inflows) on the dependent variable (USD/INR exchange rate).

- Correlation Analysis: Correlation analysis is a statistical technique used to measure the strength and direction of the linear relationship between two variables. In the context of this study, correlation analysis has been employed to examine the relationships between the independent variables (oil prices, interest rate differential, Gold prices, trade deficit, net investment inflows) and the dependent variable (exchange rate).

B. Hypotheses Testing And Methods

Hypotheses testing is a critical aspect of empirical research, it allows to assess the validity of proposed relationships and draw meaningful conclusions from the data. In the context of this study on Analyzing the factors behind exchange rate fluctuations in India, hypotheses testing will be conducted to examine whether the factors like Trade deficit, net investment inflows, Crude oil prices, Spot Gold prices, Interest rate differential affect the exchange rate fluctuations and also affecting the economy. this section outlines the hypotheses testing process and the methods that will be employed to assess statistical significance.

- Hypotheses Testing Procedure:

a. Step 1: Model Specification

This step involves defining the regression model and correlational model that will be used to analyse the relationship between the exchange rate (dependent variable) and the factors that may affect it (independent variables). In this following study using a multiple linear regression model, which considers the impact of several independent variables simultaneously on the dependent variable.

b. Step 2: Data Preparation

This step involves collecting data on the exchange rate and the chosen independent variables (interest rate differential, trade deficit, foreign investment inflows, oil prices, and gold prices) for the specified period (e.g., the past decade).

The data from the provided excerpt seems to be collected from the following sources:

- Trade deficit: Trading Economics

- Spot gold prices: London Bullion Market Association (LBMA)

- Interest rate differential, Net investment inflows: Reserve Bank of India (RBI) for this data as it is the central bank of India and maintains databases on economic and financial metrics.

- Crude Oil Prices: US energy information administration.

c. Step 3: Regression Estimation

This step involves using Microsoft Excel data analysis tool to estimate the coefficients of the regression model and also conducting another statistical test which is correlational analysis. These coefficients represent the strength and direction of the relationship between each independent variable and the exchange rate.

d. Step 4: Hypotheses Testing

- The null hypothesis (H?) typically states that there is no statistically significant relationship between an independent variables and the exchange rate where independent variables are trade deficit, net investment inflows, crude oil prices, gold prices, interest rate differential.

- The alternative hypothesis (H?) states that there is a statistically significant relationship between the independent variables and the exchange rate.

- The p-value is used to assess the evidence against the null hypothesis. A p-value less than a chosen significance level (0.05) indicates that we can reject the null hypothesis and conclude that the independent variable has a statistically significant effect on the exchange rate.

e. Step 5: Interpretation of Results

This step involves interpreting the estimated coefficients of the regression model and the results of the hypothesis tests. The coefficients indicate the magnitude and direction of the effect of each independent variable on the exchange rate.

2. Criteria for statistical significance

- Statistical significance will be assessed based on p-values, confidence intervals, and effect sizes.

- Hypotheses will be considered statistically significant if the p-value is less than a predetermined significance level, that is 0.05 (at 95% confidence level)

- Confidence intervals will be used to estimate the range of possible values for coefficients, providing additional insights into the precision of estimates

C. Data Interpretation

For the purpose of analysing this data, regression analysis and correlational analysis was run using Ms-Excel. The ANOVA output of regression is used to check significance of the impact of the selected independent variables on the dependent variable in totality. The model summary provides the R square, which signifies the extent to which the exchange rate depends on the factors selected, as per the sample taken. The regression analysis also provides the significance of the impact of each individual independent variable on the dependent variable in the model created. To ensure absence of multicollinearity among the independent variables having significant impact on the dependent variable, the variance inflation factor (VIF) is checked for those variables using Real Statistics.

This provides an insight on the extent to which the selected factors played a role in determining the exchange rate during the global financial crisis of 2008 and during the covid-19 period of 2020.

Table 2: Dependent and independent variables used for the data analysis period January 2008 to December 2010

|

Date |

USD/INR |

Gold price |

Crude oil price |

Interest Rate Differential |

Net Investment Inflows |

Trade Deficit |

|

Jan-08 |

39.28 |

889.595 |

92.18 |

5.331 |

8506 |

7955.3 |

|

Feb-08 |

39.92 |

922.298 |

94.99 |

5.614 |

-3234 |

5688.2 |

|

Mar-08 |

40.03 |

268.434 |

103.64 |

5.866 |

2838 |

6319.6 |

|

Apr-08 |

40.46 |

909.705 |

109.07 |

5.948 |

2869 |

11856.5 |

|

May-08 |

42.16 |

888.663 |

122.8 |

5.515 |

3644 |

10757 |

|

Jun-08 |

42.93 |

889.488 |

132.32 |

7.18 |

-618 |

9769.7 |

|

Jul-08 |

42.483 |

939.772 |

132.72 |

7.58 |

1755 |

12595 |

|

Aug-08 |

43.87 |

839.025 |

113.24 |

7.274 |

2921 |

15763.9 |

|

Sep-08 |

46.815 |

829.932 |

97.23 |

7.74 |

1159 |

15346.6 |

|

Oct-08 |

49.325 |

806.62 |

71.58 |

6.708 |

-3746 |

11738.4 |

|

Nov-08 |

49.575 |

760.863 |

52.45 |

7.014 |

509 |

12324.9 |

|

Dec-08 |

48.62 |

816.092 |

39.95 |

4.723 |

1392 |

6088.1 |

|

Jan-09 |

48.85 |

858.69 |

43.44 |

4.457 |

2119 |

5359.1 |

|

Feb-09 |

51 |

943.163 |

43.32 |

4.346 |

403 |

3121.3 |

|

Mar-09 |

50.57 |

924.273 |

46.54 |

4.492 |

1067 |

3680.3 |

|

Apr-09 |

49.725 |

890.2 |

50.18 |

3.218 |

4617 |

6865 |

|

May-09 |

47.12 |

928.645 |

57.3 |

3.163 |

7734 |

7719.9 |

|

Jun-09 |

47.75 |

945.67 |

68.61 |

3.157 |

2824 |

9448.7 |

|

Jul-09 |

47.825 |

934.228 |

64.44 |

3.065 |

6508 |

7382.2 |

|

Aug-09 |

48.69 |

949.375 |

72.51 |

3.288 |

4748 |

8862.3 |

|

Sep-09 |

47.375 |

996.591 |

67.65 |

3.173 |

6607 |

6903 |

|

Oct-09 |

46.925 |

1043.159 |

72.77 |

3.189 |

5254 |

11129.8 |

|

Nov-09 |

46.535 |

1127.036 |

76.66 |

3.285 |

2974 |

10063.8 |

|

Dec-09 |

46.41 |

1134.724 |

74.46 |

3.589 |

3075 |

11758 |

|

Jan-10 |

46.125 |

1117.963 |

76.17 |

3.902 |

5181 |

9709.9 |

|

Feb-10 |

46.105 |

1095.413 |

73.75 |

4.026 |

1947 |

10406.1 |

|

Mar-10 |

44.825 |

1113.337 |

78.83 |

4.093 |

6515 |

9372.8 |

|

Apr-10 |

44.275 |

1148.688 |

84.82 |

3.935 |

5494 |

13535.8 |

|

May-10 |

46.375 |

1205.434 |

75.95 |

4.838 |

2301 |

12465.2 |

|

Jun-10 |

46.445 |

1232.92 |

74.76 |

5.173 |

2630 |

7981.6 |

|

Jul-10 |

46.405 |

1192.966 |

75.58 |

5.653 |

10899 |

12715.4 |

|

Aug-10 |

47.065 |

1215.81 |

77.04 |

5.958 |

890 |

9357.2 |

|

Sep-10 |

44.57 |

1270.977 |

77.84 |

6.138 |

12695 |

10527.6 |

|

Oct-10 |

44.325 |

1342.024 |

82.67 |

6.731 |

30096 |

13380.9 |

|

Nov-10 |

45.8 |

1369.886 |

85.28 |

6.733 |

-18183 |

6267.3 |

|

Dec-10 |

44.713 |

1390.553 |

91.45 |

7.073 |

512 |

8161.7 |

NOTE: FOR BOTH TABLE 1 AND TABLE 2

- Gold price in USD per Ounce

- Crude oil price: Brent, USD per barrel

- Interest Rate Differential (%)

- Trade Deficit (USD in million)

- Net Investment Inflows (USD in million)

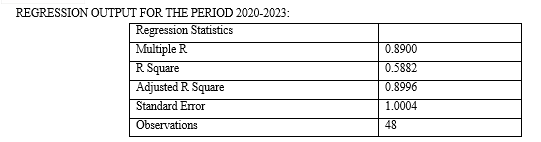

- Multiple R: This is the correlation coefficient between your independent variables (gold price, crude oil, interest rate, trade deficit, net investment inflows.) and the dependent variable (USD/INR exchange rate). A (0.8900) value this high indicates a very strong positive correlation. This means that combined set of independent variables has a strong association with changes in the exchange rate.

- R Square: This represents the percentage of variation in the USD/INR exchange rate that regression model explains. About 58.8% of the variation in the exchange rate can be accounted for by the linear relationship with the selected independent variables. This is considered a fairly good fit for a model in this context.

- Adjusted R Square: This is a modified version of R-squared that takes into account the number of independent variables in the following model. It prevents overestimation of how well the model fits the data, especially when we have many independent variables. The fact that it's high (0.8996) suggests your model is likely doing a good job even after this adjustment.

- Standard Error: This indicates the average amount that the particular model's predictions deviate from the actual exchange rate values. A lower standard error (1.0004) means the model tends to be more accurate in its predictions.

- Observations: This is the number of data points used in regression analysis (likely 48 months from 2020-2023).

|

ANOVA |

|

|

|

|

|

|

|

df |

SS |

MS |

F |

Significance F |

|

Regression |

5 |

277.0100 |

40.5158 |

33.0404 |

0.0000 |

|

Residual |

42 |

49.4699 |

1.5609 |

|

|

|

Total |

47 |

310.0040 |

|

||

df (Degrees of Freedom):

- Regression: Number of independent variables in the model (5)

- Residual: Number of data points (48) minus the number of parameters estimated in the model (including intercept and coefficients, likely 6 total)

- Total: Sum of regression and residual df (always equals the total observations - 1)

a. Highly Significant Model: The Significance F value of 0.0000 (likely rounded) is extremely small. This means it's highly unlikely that the relationship between the independent variables and the exchange rate occurred by chance. The model has overall statistical significance.

b. F-statistic: The F-statistic (33.04) demonstrates that the model explains a substantial amount of the variation observed in the exchange rate. This implies that the relationship between the independent variables and the exchange rate is unlikely to be a mere coincidence. Instead, it strongly suggests that changes in these independent variables influence fluctuations in the exchange rate.

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

|

Intercept |

64.8768 |

5.9001 |

8.9657 |

0.0000 |

|

Gold price |

0.0018 |

0.0043 |

4.5782 |

0.0006 |

|

Crude oil price |

-0.0324 |

0.0187 |

-4.3232 |

0.0048 |

|

Interest Rate Differential |

3.0671 |

0.3666 |

5.3828 |

0.0199 |

|

Trade Deficit |

0.0001 |

0.0000 |

3.3646 |

0.0612 |

|

Net Investment Inflows |

-0.0002 |

0.0001 |

-2.0064 |

0.0420 |

- Coefficients: These represent the estimated change in the exchange rate (USD/INR) associated with a one-unit increase in the corresponding independent variable. For example, if the coefficient for gold price is 0.0018, it suggests that a $1 increase in the price of gold is associated with a 0.0008-rupee depreciation (increase) in the exchange rate (assuming all other variables are held constant).

- Gold price: The p-value (0.0006) for the gold price variable is less than the significance level (usually set at 0.05), indicating statistical significance. Therefore, changes in the gold price have a significant impact on the exchange rate of the Indian rupee. If the gold price increases (holding other variables constant), it suggests that the Indian rupee is likely to depreciate against the US dollar. Conversely, a decrease in the gold price may lead to rupee appreciation.

- Crude oil price: Similar to the gold price variable, the p-value (0.0048) for the crude oil price variable is less than the significance level, indicating statistical significance. An increase in crude oil prices typically leads to higher import costs for India, putting pressure on the rupee and potentially causing depreciation. Conversely, a decrease in crude oil prices may result in rupee appreciation.

- Interest Rate Differential: The p-value (0.0199) for the interest rate differential variable is extremely low, indicating high statistical significance. The interest rate differential between India and other countries influences capital flows and currency exchange rates. A higher interest rate in India compared to other countries can attract foreign investment, leading to rupee appreciation. Conversely, a lower interest rate may lead to capital outflows and rupee depreciation.

- Trade Deficit: The p-value (0.0612) for the trade deficit variable is greater than the significance level, suggesting that it may not be statistically significant in explaining exchange rate movements at the chosen level of significance (0.05). However, a positive trade deficit implies that India imports more goods and services than it exports, which can exert downward pressure on the rupee, potentially causing depreciation.

- Net Investment Inflows: The p-value (0.0420) for net investment inflows is slightly above the conventional significance level. Nonetheless, it suggests that net investment inflows have a statistically significant impact on the exchange rate. Positive net investment inflows indicate foreign investment entering the country, which can lead to rupee appreciation. Conversely, negative net investment inflows may result in rupee depreciation.

REGRESSION OUTPUT FOR THE PERIOD 2008-2010:

|

Regression Statistics |

|

|

Multiple R |

0.852239636 |

|

R Square |

0.626312398 |

|

Adjusted R Square |

0.680697797 |

|

Standard Error |

1.705430307 |

|

Observations |

36 |

- Multiple R: The value (0.8522) indicates a strong positive correlation between your independent variables (trade deficit, net investment inflows, etc.) and the dependent variable (USD/INR exchange rate). This means your combination of independent variables is fairly closely associated with the exchange rate changes.

- R-Square: Approximately 62.6% of the variation in the USD/INR exchange rate can be explained by the linear relationship with your selected independent variables. This is considered a moderately good fit for a model in this context.

- Adjusted R-Square: This value (0.6806) suggests that your model is likely to perform well even after considering the complexity arising from the number of independent variables. The fact that it's fairly high is a positive sign.

- Standard Error: This value (1.7054) indicates the average amount that your model's predictions deviate from the actual exchange rate values. While a lower standard error is always better, the value needs to be evaluated in the context of how much the exchange rate itself typically fluctuates.

- Observations: This confirms that you used 36 data points for your analysis, representing 36 months of data from January 2008 to December 2010

|

ANOVA |

|||||

|

|

df |

SS |

MS |

F |

Significance F |

|

Regression |

5 |

231.5568 |

46.3113 |

15.9228 |

0.00 |

|

Residual |

30 |

87.2547 |

2.9084 |

|

|

|

Total |

35 |

318.8115 |

|

||

df (Degrees of Freedom):

- Regression: Number of independent variables in the model (5)

- Residual: Number of data points (36) minus the number of parameters estimated in the model (including intercept and coefficients, likely 6 total)

- Total: Sum of regression and residual df (always equals the total observations - 1)

a. Highly Significant Model: The Significance F value of 0.0000 (likely rounded) is extremely small. This means it's highly unlikely that the relationship between the independent variables and the exchange rate occurred by chance. The model has overall statistical significance.

b. F-statistic: A high F-statistic (15.922) means the model explains a significant amount of the variation in the exchange rate. This suggests that the relationship between the independent variables and the exchange rate is unlikely to be just a random coincidence. Instead, it supports the idea that changes in these independent variables influence fluctuations in the exchange rate.

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

|

Intercept |

52.7978 |

1.8227 |

28.9657 |

0 |

|

Gold price |

0.0004 |

0.0013 |

0.2875 |

0.7756 |

|

Crude oil price |

-0.1246 |

0.0162 |

-7.6945 |

0.0034 |

|

Interest Rate Differential |

0.0541 |

0.2412 |

0.2245 |

0.0238 |

|

Net Investment Inflows |

-0.0001 |

0.0000 |

-2.2498 |

0.0319 |

|

Trade Deficit |

0.0002 |

0.0001 |

2.3363 |

0.2634 |

- Coefficients: These represent the estimated change in the exchange rate (USD/INR) associated with a one-unit increase in the corresponding independent variable. For example, if the coefficient for gold price is 0.0004, it suggests that a $1 increase in the price of gold is associated with a 0.01-rupee appreciation (increase) in the exchange rate (assuming all other variables are held constant).

- Gold price: The p-value (0.7756) for the gold price variable is much higher than the conventional significance level of 0.05. This suggests that changes in the gold price are not statistically significant in explaining the fluctuations in the exchange rate of the Indian rupee. Therefore, fluctuations in the gold price are unlikely to have a significant impact on the appreciation or depreciation of the rupee.

- Crude oil price: The p-value (0.0034) for the crude oil price variable is less than the significance level, indicating statistical significance. An increase in crude oil prices typically leads to higher import costs for India, which can put pressure on the rupee and potentially cause depreciation. Conversely, a decrease in crude oil prices may result in rupee appreciation.

- Interest Rate Differential: The p-value (0.0238) for the interest rate differential variable is below the significance level, suggesting statistical significance. The interest rate differential between India and other countries influences capital flows and currency exchange rates. A higher interest rate in India compared to other countries can attract foreign investment, leading to rupee appreciation. Conversely, a lower interest rate may lead to capital outflows and rupee depreciation.

- Net Investment Inflows: The p-value (0.0319) for net investment inflows is slightly above the conventional significance level. Nonetheless, it suggests that net investment inflows have a statistically significant impact on the exchange rate. Positive net investment inflows indicate foreign investment entering the country, which can lead to rupee appreciation. Conversely, negative net investment inflows may result in rupee depreciation.

- Trade Deficit: The p-value (0.2634) for the trade deficit variable is much higher than the significance level, indicating that it is not statistically significant in explaining exchange rate movements at the chosen level of significance (0.05). Therefore, fluctuations in the trade deficit are unlikely to have a significant impact on the appreciation or depreciation of the Indian rupee.

CORRELATION OUTPUT FOR THE PERIOD 2008-2010

|

Attributes |

USD/INR |

|

Gold price |

-0.968086426 |

|

Crude oil price |

0.803219316 |

|

Interest Rate Differential |

0.380743177 |

|

Net Investment Inflows |

0.103653194 |

|

Trade Deficit |

-0.235065733 |

- Gold price: The negative correlation coefficient (-0.9680) suggests a strong negative relationship between the gold price and the USD/INR exchange rate. As the gold price increases, the Indian rupee is likely to appreciate against the US dollar. Conversely, a decrease in the gold price may lead to rupee depreciation.

- Crude oil price: The positive correlation coefficient (0.8032) indicates a strong positive relationship between crude oil price and the USD/INR exchange rate. As the crude oil price increases, the Indian rupee is likely to depreciate against the US dollar. Conversely, a decrease in crude oil prices may lead to rupee appreciation.

- Interest Rate Differential: The positive correlation coefficient (0.3807) suggests a moderate positive relationship between the interest rate differential and the USD/INR exchange rate. A higher interest rate in India compared to other countries may lead to rupee appreciation, while a lower interest rate may result in rupee depreciation.

- Net Investment Inflows: The positive correlation coefficient (0.1036) indicates a weak positive relationship between net investment inflows and the USD/INR exchange rate. Positive net investment inflows may lead to rupee appreciation, while negative net investment inflows may result in rupee depreciation, though the effect is relatively weak.

- Trade Deficit: The negative correlation coefficient (-0.2350) suggests a weak negative relationship between the trade deficit and the USD/INR exchange rate. A higher trade deficit (indicating more imports than exports) may lead to rupee depreciation, while a lower trade deficit (or trade surplus) may result in rupee appreciation, though the effect is relatively weak.

CORRELATION OUTPUT FOR THE PERIOD 2020-2023

|

Attributes |

USD/INR |

Correlation |

|

Gold price |

-0.1992 |

Negative Correlation |

|

Crude oil price |

0.4261 |

Positive Correlation |

|

Interest Rate Differential |

0.7837 |

Positive Correlation |

|

Trade Deficit |

-0.7928 |

Negative Correlation |

|

Net Investment Inflows |

0.3126 |

Positive Correlation |

- Gold price: The negative correlation coefficient (-0.1992) suggests a weak negative relationship between the gold price and the USD/INR exchange rate. As the gold price increases, there might be a slight tendency for the Indian rupee to depreciate against the US dollar. Conversely, a decrease in the gold price may lead to a slight appreciation of the rupee.

- Crude oil price: The positive correlation coefficient (0.4261) indicates a moderate positive relationship between crude oil price and the USD/INR exchange rate. As the crude oil price increases, the Indian rupee is likely to depreciate against the US dollar. Conversely, a decrease in crude oil prices may lead to rupee appreciation.

- Interest Rate Differential: The high positive correlation coefficient (0.7837) suggests a strong positive relationship between the interest rate differential and the USD/INR exchange rate. A higher interest rate in India compared to other countries may lead to significant rupee appreciation, while a lower interest rate may result in depreciation.

- Trade Deficit: The negative correlation coefficient (-0.7928) indicates a strong negative relationship between the trade deficit and the USD/INR exchange rate. A higher trade deficit (indicating more imports than exports) may lead to rupee depreciation, while a lower trade deficit (or trade surplus) may result in rupee appreciation.

- Net Investment Inflows: The positive correlation coefficient (0.3126) suggests a weak positive relationship between net investment inflows and the USD/INR exchange rate. Positive net investment inflows may lead to rupee appreciation, while negative net investment inflows may result in rupee depreciation, though the effect is relatively weak.

IV. FINDINGS AND RECOMMENDATIONS

A. Findings

- As per statistical methods, since gold prices and trade deficit did not prove to be impacting the exchange rate significantly. According to the Regression Analysis model including only the independent variables that had significant impact on the exchange rate are Crude oil, Interest rate differential and Net investment inflows.

- The variance inflation factor is a simple test to assess multicollinearity in the regression model. It identifies correlation and the strength of that correlation between independent variables. VIFs between 1 and 5 suggest the presence of moderate multicollinearity, not critical enough to take corrective measures. Since the VIF of the independent variables are as low as 2.58, 1.42 and 2.55, we reject the possibility of presence of multicollinearity.

- The regression equation derived from the model will predict the exchange rate significantly well as the p value of the F statistic is less than our level of significance of 5%.

- The output of the regression model for the year 2008-2010 states that the factors which affect the exchange rate fluctuations are crude oil, Net investment inflows, Interest rate differential whereas gold prices and trade deficit did not have an impact on the exchange rate fluctuations for INR currency. Similarly, the output of the regression model for the year 2020-2023 states that the factors which affect the exchange rate fluctuations are crude oil, Net investment inflows, Interest rate differential and gold prices whereas trade deficit did not have an impact on the exchange rate fluctuations for INR currency.

- The correlation output for the year 2008-2010 states that net investment inflows, interest rate differential, crude oil have positive correlation with respect to the exchange rate this means as these independent variables increase the rupee value depreciates stating that these factors affect the exchange rate fluctuations. Whereas gold prices, and trade deficit had negative correlation stating that when the values of gold prices and trade deficit increases the rupee value appreciates as it is negative correlation the exchange rate fluctuations are not affected with these independent variables. Similarly, the correlation output for the year 2020-2023 states that net investment inflows, interest rate differential, crude oil have positive correlation with respect to the exchange rate Whereas gold prices, and trade deficit have negative correlation just like for the years 2008-2010 there by experiencing same exchange rate fluctuations with respect to independent variables as mentioned for years 2008-2010.

B. Recommendations

Numerous internal and foreign variables impact the changes of exchange rates in India. This is a summary of some important elements and suggestions for handling currency rate concerns. The state of the world economy has a big impact on currency rates. The demand for Indian currency is influenced by variables including interest rate differentials, inflation rates, and economic growth rates in major economies like the US, China, and the Eurozone. Predicting changes in currency rates may be made easier by staying up to date on global economic trends and policy. The Reserve Bank of India's (RBI) monetary policies directly affect the value of currency. The RBI sets interest rates, which have an impact on capital flows into and out of India and, ultimately, the currency rate. observing the policy declarations of the RBI and actions can provide insights into potential exchange rate movements.

The competitiveness of Indian goods and services in global markets is impacted by the disparities in inflation between India and its trade partners. The Indian rupee may weaken if inflation there is higher than that of its trade partners. Stabilizing the exchange rate may be achieved by putting monetary and fiscal policies into action to reduce inflation. The difference between imports and exports, or India's trade balance, has a big influence on the currency rate. The Indian rupee is under pressure from a trade imbalance because more foreign exchange is needed to pay for imports. The trade balance and exchange rate can be stabilized and improved by supporting domestic manufacturing and encouraging exports through trade policy. The demand for Indian assets is impacted by capital flows from FDI and FII, which in turn affects the currency rate. In order to boost investor confidence and support the currency rate, governments should implement measures to draw in foreign investment, facilitate corporate transactions, and preserve political stability. A stable currency rate and investor confidence depend on political stability and policy clarity. Exchange rate volatility can be caused by a number of factors, including geopolitical tensions, elections, and government policy uncertainties. Policy frameworks that are open and consistent can help reduce these risks. Exchange rate volatility may be made worse by speculative activity in the foreign exchange market. Keeping an eye on and controlling speculative trading activity through appropriate measures can help stabilize the exchange rate.

V. LIMITATIONS OF THE STUDY

When conducting a study on exchange rate fluctuations in India and the factors affecting them, there are several limitations that was encountered. However, based on the methodology and findings, some potential limitations can be inferred:

- Limited scope of factors: A certain subset of macroeconomic variables, such as interest rate differentials, trade deficits, inflows of foreign investment, oil and gold prices, were the focus of the study. However, the research did not take into consideration other pertinent elements that can also have an impact on exchange rate swings. These factors include inflation rates, the money supply, fiscal policies, and political or geopolitical developments.

- Short-term focus: The analysis period covered only three years (2020-2023) and from the years (2008-2010), which may not be sufficient to capture long-term trends and patterns in exchange rate movements. The study's findings may be specific to the short-term dynamics during the selected period and may not necessarily generalize to longer time horizons.

- Exclusive focus on USD/INR exchange rate: The study's exclusive focus was on changes in the Indian Rupee's exchange rate with the US Dollar (USD/INR). However, other significant currencies that were not taken into account in the research, including the Euro, the Japanese Yen, or the Chinese Renminbi, can have an impact on exchange rate movements. The study's conclusions are unique to the Indian setting and might not apply to other nations or economic situations. Due to variations in economic structures, trade agreements, and regulations, the variables affecting exchange rate swings may differ between economies.

- Assumption of linearity: The study employed linear regression analysis and correlation analysis, which assumes a linear relationship between the independent variables and the dependent variable (exchange rate). However, the relationship between macroeconomic factors and exchange rates may be non-linear or exhibit complex dynamics, which may not be fully captured by linear models.

- Data frequency and availability: The study relied on monthly data, which may not capture high-frequency fluctuations or intraday volatility in exchange rates.

VI. SUGGESTIONS

- Examination of price elasticity of demand for imports and exports can elucidate how sensitive quantities demanded of these goods are to changes in exchange rates, offering insights into trade dynamics.

- Investigating substitution effects between domestic and foreign goods helps understand consumer behaviour in response to exchange rate fluctuations and their preferences for different products.

- Incorporating inflation expectations alongside actual inflation rates provides a more comprehensive understanding of how inflation influences currency decisions and exchange rate movements.

- Exploration of interest rate differentials between India and major trading partners helps discern how disparities in interest rates impact capital flows and exchange rate dynamics.

- Analysis of implications of different interest rates, such as short-term versus long-term rates, offers insights into how varying interest rate structures affect currency markets and investment decisions.

- Investigation into the impact of global economic uncertainty on the Indian rupee's performance sheds light on the currency's behaviour during times of market instability.

- Determination of whether the Indian rupee acts as a safe-haven currency during periods of risk aversion provides valuable insights into investor behaviour and currency preferences.

- Differentiating between foreign direct investment (FDI) and foreign portfolio investment (FPI) inflows helps understand how different types of capital flows influence exchange rate dynamics.

- Assessment of how India's integration into global value chains affects its sensitivity to exchange rate fluctuations reveals the country's exposure to global economic trends.

- Analysis of the impact of exchange rate fluctuations on the cost of imported inputs and production costs offers insights into India's competitiveness in international markets.

- Evaluation of the effectiveness of the Reserve Bank of India's communication strategies in managing expectations assesses the central bank's role in shaping market sentiment and exchange rate stability.

- Investigation into market microstructure elements like liquidity, transaction costs, and market depth provides insights into the underlying factors contributing to short-term exchange rate volatility.

VII. SCOPE FOR FUTURE RESEARCH

There are several promising avenues for future research on exchange rate fluctuations in India and the factors affecting them. Some potential areas for exploration include:

- Exploring additional macroeconomic factors: The study focused on a limited set of macroeconomic factors (interest rate differential, trade deficit, foreign investment inflows, oil prices, and gold prices) in determining exchange rate fluctuations. Future research could explore the impact of other factors such as inflation rates, money supply, fiscal policies, and political or geopolitical events on exchange rate movements.

- Investigating long-term effects: The current study analysed the impact of the selected factors on exchange rate fluctuations in the short term (3 years). Future research could examine the long-term effects of these factors on exchange rate movements, which may provide valuable insights for policymakers and long-term investors.

- Sector-specific analysis: Future studies could investigate the impact of exchange rate fluctuations on specific sectors of the Indian economy, such as agriculture, manufacturing, services, or exports/imports. This could help identify sectors that are particularly vulnerable or resilient to currency fluctuations, informing targeted policy interventions.

- Comparative analysis across countries: While this study focused on India, future research could conduct a comparative analysis of exchange rate determinants across different countries or regions. Such an analysis could shed light on the similarities and differences in the factors influencing exchange rates in different economic environments.

- Modelling and forecasting: Building upon the findings of this study, future research could develop more advanced econometric models or machine learning techniques to forecast exchange rate movements based on the identified significant factors. Accurate forecasting models could aid businesses, investors, and policymakers in making informed decisions.

- Assessing policy interventions: Future studies could evaluate the effectiveness of various policy interventions and monetary measures implemented by the Reserve Bank of India (RBI) and the Indian government in managing exchange rate fluctuations. Such research could provide valuable insights for policymakers in designing effective strategies for exchange rate stability.

- Exploring new data sources: With the advent of big data and alternative data sources, future research could explore the use of non-traditional data sources, such as social media sentiment, news analytics, or high-frequency trading data, to gain additional insights into the factors influencing exchange rate movements.

These are some potential areas for future research that could build upon the findings and limitations of the current study, contributing to a more comprehensive understanding of exchange rate dynamics and their implications for the Indian economy.

Conclusion