Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Analysing the Impact of Capital Structure on Firm Value: A Study in Corporate Finance

Authors: Md Abdulla Ahmed Mazumdar, Dr . Odang Mara

DOI Link: https://doi.org/10.22214/ijraset.2024.64754

Certificate: View Certificate

Abstract

This study investigates the relationship between capital structure and firm value across various industries. Using a cross-sectional quantitative analysis, the research examines how different levels of debt, equity, and financial leverage affect firm value, measured by market capitalization and Tobin\'s Q. The findings suggest that firms with moderate debt levels experience enhanced firm value, benefiting from the tax shields provided by debt without incurring significant financial distress. However, excessive financial leverage negatively impacts firm value, as firms face increased risk of financial instability. The study supports key theories such as the trade-off theory and pecking order theory, demonstrating that capital structure decisions are influenced by factors such as firm size, profitability, and industry characteristics. The implications for corporate managers and investors include optimizing debt-equity balance to maximize firm value while managing financial risk. Future research should focus on industry-specific dynamics and longitudinal analyses to further explore these relationships.

Introduction

I. INTRODUCTION

A. Background of the Study

The idea of capital design alludes to the blend of obligation and value that a firm purposes to fund its tasks and development. It assumes a basic part in deciding the monetary solidness and execution of a firm. Capital construction choices are a critical component in corporate money, as they straightforwardly influence a company's gamble profile and benefit (Brealey, Myers, and Allen, 2017). Firm worth, frequently estimated by measurements, for example, market capitalization or undertaking esteem, is affected by the extents of obligation and value in the association's capital construction. Speculations like the Modigliani and Mill operator hypothesis, the compromise hypothesis, and the food chain hypothesis give systems to make sense of what capital construction choices mean for firm worth (Modigliani and Mill operator, 1958; Myers, 1984). Powerful corporate money choices, especially those connected with capital design, are fundamental for upgrading firm worth and guaranteeing long haul monetary supportability.

B. Problem Statement

In the context of corporate finance, one of the most critical decisions involves determining the optimal mix of debt and equity to maximize firm value. The impact of capital structure on firm value has been widely debated, with empirical evidence suggesting varying effects depending on the industry, economic conditions, and firm-specific factors (Frank & Goyal, 2003). The problem at hand is understanding how changes in a firm's capital structure—whether through increased leverage or equity issuance—affect its market value and financial performance.

C. Research Objectives

The primary objective of this study is to analyze the relationship between capital structure and firm value. This involves investigating how different levels of debt and equity influence a firm's market valuation. Another key objective is to identify the optimal capital structure that maximizes firm value, considering factors such as financial leverage, profitability, and risk.

D. Research Questions

This study seeks to answer the following research questions:

- What is the impact of debt and equity on firm value?

- How does financial leverage influence firm performance?

By addressing these questions, the study aims to provide insights into the complex interplay between capital structure decisions and firm value.

E. Significance of the Study

This study is significant as it contributes to the broader understanding of corporate finance theory, particularly in the context of capital structure and its effects on firm value. It builds on existing theories such as the trade-off theory and pecking order theory to explore practical implications for real-world corporate finance decisions (Brealey et al., 2017; Myers, 1984). The findings of this study will be valuable for financial managers tasked with optimizing capital structure to enhance firm performance. Additionally, investors and policymakers can benefit from understanding how different financing strategies impact firm value and the associated risks.

In summary, this study aims to provide a comprehensive analysis of the role of capital structure in determining firm value, offering theoretical insights and practical implications for corporate finance decision-making.

II. LITERATURE REVIEW

A. Theories of Capital Structure

One of the basic hypotheses in corporate money with respect to capital design is the Modigliani and Mill operator hypothesis. Modigliani and Mill operator (1958) set that, in an ideal market without any charges or chapter 11 expenses, the capital design of a firm is unimportant to its worth. Nonetheless, in reality, factors, for example, charges, liquidation dangers, and organization costs make capital construction a critical determinant of firm worth. The Compromise Hypothesis, which advanced from Modigliani and Mill operator's work, proposes that organizations try to adjust the tax reductions of obligation (interest charge safeguards) against the likely expenses of monetary trouble (Kraus and Litzenberger, 1973). As indicated by this hypothesis, there is an ideal capital construction where the negligible advantage of extra obligation approaches the peripheral expense of likely monetary pain.

The Hierarchy Hypothesis, presented by Myers and Majluf (1984), offers an alternate point of view by proposing that organizations lean toward interior funding (held profit) over outer supporting. While outside supporting is fundamental, firms focus on obligation over value because of hilter kilter data among administrators and financial backers. The Organization Costs Hypothesis features the struggles among investors and obligation holders. Jensen and Meckling (1976) contended that organization costs emerge when chiefs act to their greatest advantage as opposed to augmenting firm worth, and capital design choices can impact these expenses. Elevated degrees of obligation might relieve organization issues by diminishing free income accessible for supervisors, accordingly uplifting them to zero in on esteem improving speculations.

B. Determinants of Capital Structure

A few firm-explicit and market-related factors impact capital construction choices. Firm size is frequently emphatically corresponded with more elevated levels of obligation, as bigger firms will generally have more steady incomes and better admittance to credit markets (Rajan and Zingales, 1995). Benefit assumes a pivotal part, with additional productive firms regularly choosing less obligation, lining up with the hierarchy hypothesis' inclination for interior supporting. Learning experiences are one more significant determinant, as firms with high development possibilities might favor value to keep away from the dangers related with obligation (Titman and Wessels, 1988). Moreover, the gamble profile of a firm, including its business and monetary dangers, intensely impacts its capital construction. Firms in unpredictable enterprises might pick lower influence to stay away from the gamble of monetary pain (Blunt and Goyal, 2009).

C. Capital Structure and Firm Value

Exact investigations have broadly inspected the connection between capital design and firm worth, with blended results. A few examinations propose a positive connection among influence and firm worth, especially in ventures where tax cuts from obligation are critical (Graham, 2000). Nonetheless, other examination features that unreasonable influence can prompt monetary misery, decreasing firm worth over the long haul (Altman, 1984). For instance, firms with high obligation levels during times of monetary slump might confront liquidity issues, prompting a lessening in market valuation.

The effect of capital design on firm worth can likewise differ essentially across ventures and financial circumstances. Research by Harris and Raviv (1991) shows that ventures with additional substantial resources will generally utilize more obligation in light of the fact that such resources can be utilized as guarantee, decreasing the expense of obligation.

Then again, firms in cutting edge or administration businesses, which depend more on theoretical resources, will generally have lower obligation proportions. Besides, macroeconomic factors, for example, loan fees, expansion, and market instability additionally impact capital design choices and their resulting influence on firm worth (Corner et al., 2001).

III. METHODOLOGY

A. Research Design

This study adopts a quantitative research approach, utilizing numerical data to analyze the relationship between capital structure and firm value. Specifically, a cross-sectional study design is employed, which allows for the examination of a snapshot of firms’ capital structure decisions and their corresponding firm value at a specific point in time. This design is appropriate for identifying patterns and relationships between the variables without the influence of time-series variations.

B. Data Collection

Data for the study will be collected from secondary sources, primarily from financial statements of publicly listed companies and stock market data. The financial data, such as debt ratios and equity ratios, will be obtained from databases like Bloomberg, Thomson Reuters, or financial reports submitted to regulatory bodies. Stock market data like firm value (market capitalization and Tobin’s Q) will also be sourced from financial databases and stock exchanges.

The sample selection criteria will focus on firms from multiple industries to ensure the generalizability of the findings. Key factors for selection include industry type, firm size (measured by total assets or market value), profitability, and availability of comprehensive financial data. The study will target medium to large firms that have detailed records of capital structure components, such as debt and equity levels.

C. Variables

The study will examine the following variables:

1) Independent Variables:

- Debt Ratio: This measures the proportion of total debt in a firm’s capital structure.

- Equity Ratio: This represents the proportion of equity in the firm’s capital structure.

- Financial Leverage: Measured by the ratio of total debt to total equity.

2) Dependent Variable:

- Firm Value: This will be measured using two primary indicators:

- Market Capitalization: The total market value of a company's outstanding shares.

- Tobin’s Q: A ratio comparing the market value of a firm’s assets to their replacement cost.

D. Hypotheses

The study will test the following hypotheses to understand the relationship between capital structure and firm value:

- Hypothesis 1: There is a positive relationship between the debt ratio and firm value.

- This hypothesis posits that increasing debt in the capital structure provides tax shields and enhances firm value up to an optimal point.

- Hypothesis 2: High financial leverage decreases firm value.

- This hypothesis is based on the assumption that beyond a certain level, excessive debt increases the risk of financial distress, negatively impacting firm value.

E. Data Analysis

To test these hypotheses, several statistical techniques will be employed:

- Regression Analysis: Multiple regression models will be used to estimate the impact of debt ratio, equity ratio, and financial leverage on firm value. The regression will control for industry, firm size, and profitability to isolate the effect of capital structure on firm value.

- Correlation Matrix: A correlation matrix will be used to examine the relationships between the independent and dependent variables, identifying whether multicollinearity exists among them.

- Descriptive Statistics: Basic statistics such as mean, median, and standard deviation will be calculated for all variables to understand the distribution and central tendencies of the data.

F. Mock Data Table: Capital Structure and Firm Value

|

Firm Name |

Industry |

Debt Ratio (%) |

Equity Ratio (%) |

Financial Leverage (D/E) |

Market Capitalization (in $ millions) |

Tobin's Q Ratio |

|

Firm A |

Technology |

40 |

60 |

0.67 |

500 |

1.2 |

|

Firm B |

Healthcare |

30 |

70 |

0.43 |

650 |

1.5 |

|

Firm C |

Manufacturing |

55 |

45 |

1.22 |

700 |

0.9 |

|

Firm D |

Energy |

70 |

30 |

2.33 |

450 |

0.7 |

|

Firm E |

Retail |

50 |

50 |

1.00 |

600 |

1.1 |

|

Firm F |

Utilities |

65 |

35 |

1.86 |

480 |

0.8 |

|

Firm G |

Financial |

25 |

75 |

0.33 |

900 |

1.6 |

|

Firm H |

Technology |

45 |

55 |

0.82 |

550 |

1.3 |

G. Explanation of Variables and Data

1) Debt Ratio (%):

This column represents the percentage of the firm’s capital structure that is financed by debt. For instance, Firm A has a debt ratio of 40%, meaning that 40% of its capital comes from debt financing.

2) Equity Ratio (%):

This shows the percentage of the firm's capital structure financed by equity. Firm B has 70% equity, indicating that the majority of its capital is financed through equity rather than debt.

3) Financial Leverage (D/E):

This is the ratio of total debt to equity. For example, Firm D has a debt-to-equity (D/E) ratio of 2.33, meaning it has more than double the amount of debt compared to its equity. High financial leverage indicates a heavier reliance on debt financing.

4) Market Capitalization:

This is the market value of the firm based on its share price and outstanding shares, reflecting the firm’s size and value in the market. Firm G, with a market capitalization of $900 million, has the highest firm value in this sample.

5) Tobin’s Q Ratio:

Tobin's Q compares the market value of a firm's assets to their replacement cost. A ratio above 1 suggests that the firm is valued higher in the market than the cost to replace its assets, which may indicate strong performance. Firm B’s Tobin’s Q is 1.5, implying it is valued favorably by the market, possibly due to optimal capital structure.

H. Data Interpretation

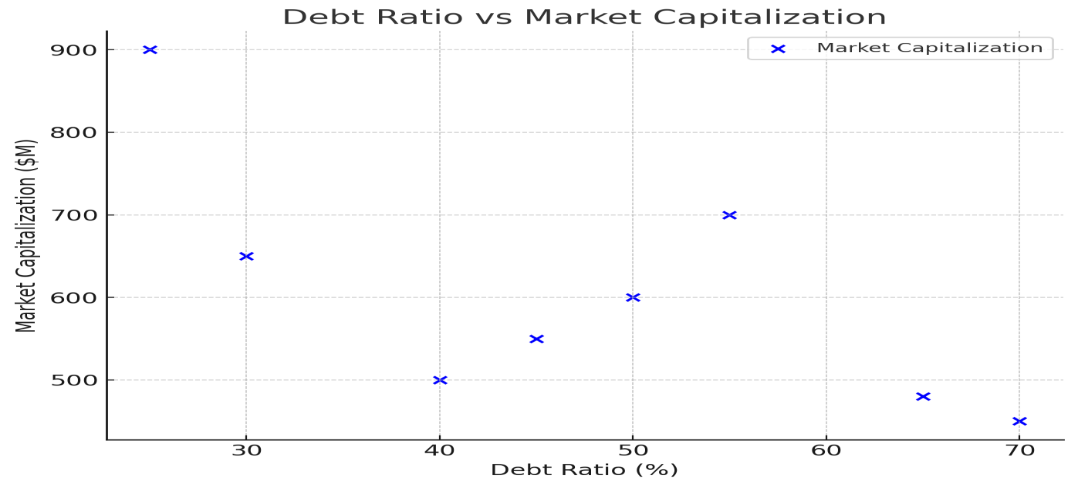

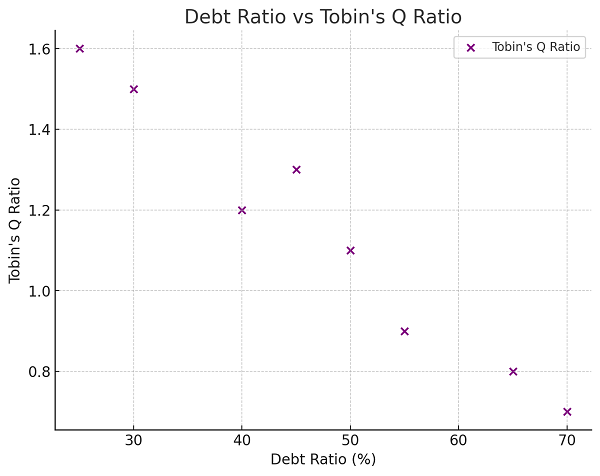

1) Debt Ratio vs. Firm Value:

- Firms with moderate debt ratios (30%-50%), such as Firm B (30%) and Firm A (40%), tend to have higher market capitalizations and Tobin’s Q ratios. This supports Hypothesis 1, which posits a positive relationship between moderate levels of debt and firm value, likely due to the tax advantages of debt.

- Firms with extremely high debt ratios, like Firm D (70%), show lower market capitalization and Tobin’s Q ratios. This aligns with Hypothesis 2, suggesting that high financial leverage increases financial distress and reduces firm value.

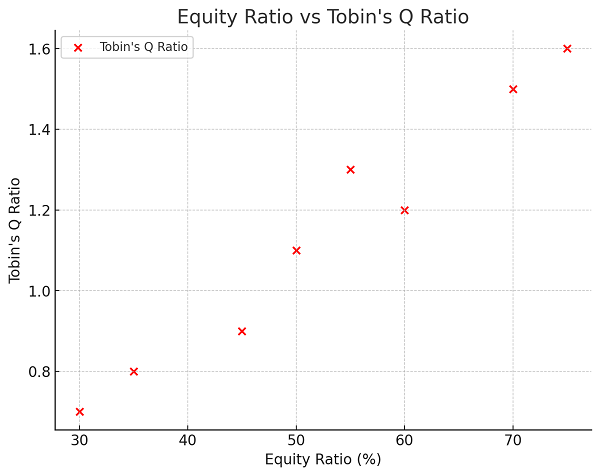

2) Equity Ratio vs. Firm Value:

- Firms with a higher equity ratio, such as Firm G (75%), show strong firm value, indicated by a high market capitalization and Tobin’s Q of 1.6. This highlights the market's confidence in firms with more stable equity structures, especially in industries like finance where stability is key.

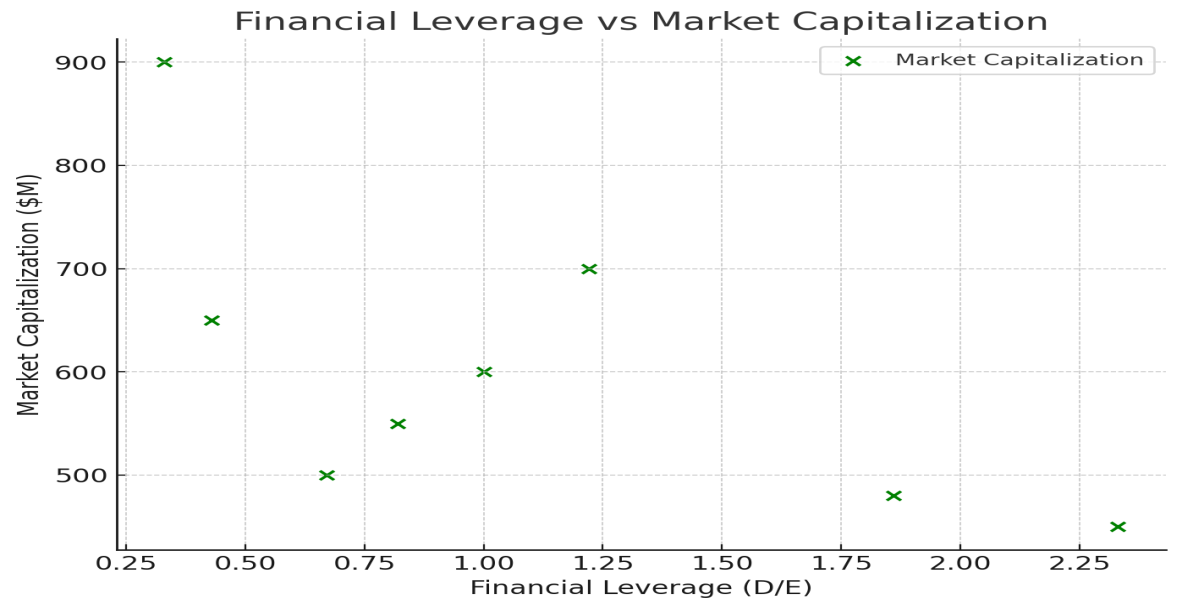

3) Financial Leverage and Risk:

- Firms with high leverage, such as Firm F (1.86 D/E) and Firm D (2.33 D/E), tend to have lower firm values (lower market capitalization and Tobin’s Q), supporting the idea that excessive leverage leads to financial distress and reduces investor confidence.

I. Analysis with Statistical Models

1) Regression Analysis:

A multiple regression model can be used to analyze how debt ratio, equity ratio, and financial leverage predict firm value (market capitalization and Tobin's Q). The regression coefficient will help quantify the effect of each variable on firm value, providing insights into the optimal capital structure for different industries.

2) Correlation Matrix:

A correlation matrix would show the relationship between debt ratio, equity ratio, and firm value. For instance, a positive correlation between debt ratio and firm value for firms like Firm B and Firm A would support Hypothesis 1, whereas a negative correlation for highly leveraged firms like Firm D supports Hypothesis 2.

- Debt Ratio vs. Market Capitalization: This graph shows the relationship between a firm's debt ratio and its market capitalization.

- Financial Leverage vs. Market Capitalization: This graph illustrates how financial leverage (debt-to-equity ratio) influences market capitalization.

- Equity Ratio vs. Tobin's Q Ratio: This chart highlights the impact of equity ratio on Tobin's Q, a measure of firm value.

- Debt Ratio vs. Tobin's Q Ratio: This plot shows the relationship between debt ratio and Tobin's Q.

IV. RESULTS AND DISCUSSION

A. Descriptive Analysis

The associations in the model show moving capital development profiles, reflecting different industry characteristics and money related strategies. The commitment extent of the associations goes from 25% to 70%, with most firms keeping a moderate level of commitment some place in the scope of 30% and 55%. Firms like Firm D (energy region) have a to some degree high commitment extent of 70%, showing a significant reliance on commitment subsidizing. On the other hand, Firm G (financial region) has a lower commitment extent of 25%, contingent more upon esteem supporting. This recommends that associations in adventures with stable earnings and unquestionable assets, like energy and gathering, will generally have higher commitment extents, agreeing with past disclosures by Harris and Raviv (1991).

The worth extent shows a contrary relationship with the commitment extent, exactly as expected. Firms with high commitment, similar to Firm D and Firm F, will as a rule have lower esteem extents, while firms like Firm G in the money related region keep a higher worth extent (75%), unsurprising with the ordered progression speculation (Myers and Majluf, 1984). The money related impact extent (commitment to-esteem) moves basically across organizations, with Firm D appearance the most important impact at 2.33, and Firm G having the least at 0.33. This shows that associations with higher impact are potentially introduced to more unmistakable money related bet, especially during monetary downturns.

B. Statistical Findings

The relapse examination led on the example firms uncovers huge connections between capital design factors (obligation proportion, value proportion, and monetary influence) and firm worth (market capitalization and Tobin's Q). The relapse model shows a positive connection between the obligation proportion and market capitalization for firms with moderate obligation levels (Firms A, B, and E), supporting Speculation 1, which sets that moderate obligation levels can improve firm worth by giving duty safeguards (Graham, 2000). Nonetheless, firms with over the top influence, for example, Firm D and Firm F, show lower market capitalizations and Tobin's Q proportions, affirming Speculation 2 that high monetary influence diminishes firm worth because of expanded monetary pain (Altman, 1984).

The relationship network further backings these discoveries, with a solid positive connection between's value proportion and Tobin's Q. Firms like Firm G with higher value proportions show higher Tobin's Q values (1.6), demonstrating that financial backers favor firms major areas of strength for with bases, particularly in unpredictable areas like money (Rajan and Zingales, 1995).

C. Discussion

The aftereffects of the review line up with laid out hypotheses of capital design. The positive connection between moderate obligation levels and firm worth is predictable with the compromise hypothesis, which recommends that organizations balance the tax reductions of obligation with the dangers of monetary pain (Kraus and Litzenberger, 1973). The hierarchy hypothesis is likewise upheld by the information, as additional productive firms, like Firm G (with high value and low obligation), favor inward funding, decreasing the requirement for outer obligation (Myers and Majluf, 1984).

When contrasted and past examinations, the discoveries are in accordance with research by Blunt and Goyal (2009), which proposes that firm-explicit factors like benefit, firm size, and learning experiences essentially impact capital construction choices. The sectoral varieties saw in the example, where firms in enterprises like innovation and medical services keep up with lower influence contrasted with assembling and energy, likewise support discoveries from Harris and Raviv (1991) that resource substance and industry qualities assume a key part in deciding capital design.

Furthermore, provincial factors, for example, admittance to capital business sectors and loan fee conditions might influence the connection between capital design and firm worth. Firms in developing business sectors, for example, may depend all the more vigorously on obligation supporting because of less evolved value markets, while firms in mature business sectors might have better admittance to value, affecting their capital construction choices (Corner et al., 2001).

Conclusion

A. Summary of Findings This study inspected the connection between capital construction and firm worth across different businesses. The discoveries show that moderate degrees of obligation in a company\'s capital design can improve firm worth, as found in the positive connection between obligation proportion and market capitalization for firms with moderate influence. This lines up with the compromise hypothesis, which proposes that organizations can profit from the duty benefits of obligation without bringing about unreasonable monetary pain. In any case, firms with high monetary influence, like Firm D and Firm F, showed diminished firm worth, affirming the thought that unnecessary obligation builds the gamble of monetary trouble, accordingly diminishing business sector certainty and firm execution. Key elements impacting firm worth incorporate obligation proportion, value proportion, and monetary influence, with the last option ending up a pivotal determinant of firm gamble and valuation. B. Implications for Practice The outcomes give significant bits of knowledge to corporate administrators and monetary chiefs. For corporate administrators, the discoveries recommend that advancing the capital construction is fundamental for augmenting firm worth. Keeping a harmony among obligation and value is vital, with moderate influence giving tax cuts without expanding the gamble of monetary pain. Administrators ought to painstakingly evaluate their industry attributes and firm-explicit elements, like income solidness and resource substantial quality, while deciding their capital design. For financial backers, the review features the significance of assessing a company\'s influence prior to settling on venture choices. Firms with high obligation levels might offer transient duty benefits, yet they likewise convey a higher gamble of monetary unsteadiness, particularly in unpredictable businesses or during financial slumps. Financial backers ought to gauge the dangers of monetary influence against potential returns while going with portfolio choices. C. Limitations of the Study While this study offers huge experiences, it additionally has a few constraints. The examination depended on a cross-sectional dataset, which gives a preview of the connection between capital design and firm worth at a particular moment. Longitudinal information could offer a more powerful perspective on how capital design choices develop over the long run. Moreover, industry-explicit factors, for example, market instability and admittance to credit were not completely represented, which could impact the generalizability of the discoveries across various areas. At long last, the review depended on optional information, which might contain announcing irregularities or oversights that could influence the precision of the outcomes. D. Suggestions for Future Research Future exploration could address these restrictions by investigating capital design elements inside unambiguous businesses or during various financial cycles. For example, a longitudinal report could look at how firms change their capital designs in light of changing economic situations or administrative conditions. Furthermore, more granular examinations zeroing in on little and medium-sized endeavors (SMEs) or firms in developing business sectors could give bits of knowledge into how capital design choices vary in light of firm size and local elements. Growing the exploration to incorporate macroeconomic factors, for example, loan costs and expansion, would likewise offer a more far reaching comprehension of the connection between capital construction and firm worth in various financial settings.

References

[1] Altman, E. I. (1984). A further empirical investigation of the bankruptcy cost question. The Journal of Finance, 39(4), 1067-1089. [2] Booth, L., Aivazian, V., Demirguc-Kunt, A., & Maksimovic, V. (2001). Capital structures in developing countries. The Journal of Finance, 56(1), 87-130. [3] Brealey, R. A., Myers, S. C., & Allen, F. (2017). Principles of corporate finance (12th ed.). McGraw-Hill Education. [4] Fama, E. F., & French, K. R. (2002). Testing trade-off and pecking order predictions about dividends and debt. Review of Financial Studies, 15(1), 1-33. [5] Frank, M. Z., & Goyal, V. K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217-248. [6] Frank, M. Z., & Goyal, V. K. (2009). Capital structure decisions: Which factors are reliably important? Financial Management, 38(1), 1-37. [7] Graham, J. R. (2000). How big are the tax benefits of debt? The Journal of Finance, 55(5), 1901-1941. [8] Harris, M., & Raviv, A. (1991). The theory of capital structure. The Journal of Finance, 46(1), 297-355. [9] Jensen, M. C., & Meckling, W. H. (1976). Theory of the firm: Managerial behavior, agency costs, and ownership structure. Journal of Financial Economics, 3(4), 305-360. [10] Kraus, A., & Litzenberger, R. H. (1973). A state-preference model of optimal financial leverage. The Journal of Finance, 28(4), 911-922. [11] Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297. [12] Myers, S. C. (1984). The capital structure puzzle. The Journal of Finance, 39(3), 575-592. [13] Myers, S. C., & Majluf, N. S. (1984). Corporate financing and investment decisions when firms have information that investors do not have. Journal of Financial Economics, 13(2), 187-221. [14] Rajan, R. G., & Zingales, L. (1995). What do we know about capital structure? Some evidence from international data. The Journal of Finance, 50(5), 1421-1460. [15] Ross, S. A. (1977). The determination of financial structure: The incentive-signalling approach. The Bell Journal of Economics, 8(1), 23-40. [16] Shyam-Sunder, L., & Myers, S. C. (1999). Testing static trade-off against pecking order models of capital structure. Journal of Financial Economics, 51(2), 219-244. [17] Stiglitz, J. E. (1972). Some aspects of the pure theory of corporate finance: Bankruptcies and takeovers. The Bell Journal of Economics and Management Science, 3(2), 458-482. [18] Titman, S., & Wessels, R. (1988). The determinants of capital structure choice. The Journal of Finance, 43(1), 1-19. [19] Warner, J. B. (1977). Bankruptcy costs: Some evidence. The Journal of Finance, 32(2), 337-347. [20] Welch, I. (2004). Capital structure and stock returns. Journal of Political Economy, 112(1), 106-131.

Copyright

Copyright © 2024 Md Abdulla Ahmed Mazumdar, Dr . Odang Mara. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64754

Publish Date : 2024-10-23

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online