Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Analyzing Economy at Municipal level - A Case Study of Vaniyambadi Municipality

Authors: Abraham A, Vijay Vignesh P

DOI Link: https://doi.org/10.22214/ijraset.2024.63512

Certificate: View Certificate

Abstract

The Vaniyambadi Municipality case study is highlighted in this paper\'s analysis of municipal economics. The economy has a big impact on urban planning and is essential to the development and well-being of cities. The paper highlights the value of effective revenue collection and management by looking at the Vaniyambadi Municipality\'s organizational structure and revenue administration. There is also discussion of the challenges the municipality faces, such as its reliance on government grants and subsidies, growing expenses, and declining investment income. The article provides ways to address these issues, including increasing income, decreasing reliance on handouts, and developing a long-term financial plan. Examining revenue and expense accounts reveals concerning trends that highlight the need for financial sustainability. The article explores the organizational structure, historical context and population statistics for the Vaniyambadi Municipality. It discusses the several economic sectors primary, secondary, and tertiary and how they impact the local economy. The document\'s conclusion lists challenges with expenditure and revenue generation and underlines how urgently these problems must be resolved if Vaniyambadi Municipality is to continue to be sustainable in the long run.

Introduction

I. INTRODUTION

A municipality must do an economic analysis research in order to make well-informed decisions and implement efficient urban planning. Several important demands are met by this study, the first of which is the effective use of available resources. By having a thorough understanding of the economy, policymakers may create measures that promote both financial stability and sustainable growth. The survey also identifies industries with room for expansion, which makes it easier to develop Programmes and policies that promote local economic growth and job possibilities. It is essential for assessing and determining sources of income, directing the application of tax laws, and drawing capital for the financial stability of the municipality. In order to promote sustainable development, the economic landscape evaluation helps priorities and plan infrastructure projects based on available funding and community requirements. Additionally, it has a direct impact on people's quality of life by affecting access to healthcare, education, and other necessities. Long-term planning requires evaluating economic sustainability in order to avoid relying too much on unsustainable methods. In addition, the analysis promotes partnerships in business, draws in investments, and helps manage risks related to unexpected shocks or economic downturns. For towns, an economic analysis study is essentially a cornerstone, offering a thorough grasp of the financial landscape to traverse obstacles and seize development prospects. The destiny of cities and metropolitan regions is mostly determined by economic factors, which are an integral part of urban planning. The complex network of economic relationships, resources, and activities that affect the well-being and vibrancy of metropolitan regions is referred to as the economy in urban planning. Included are the generation of wealth, equitable income distribution, job opportunities, and the community's overall economic well-being. In order to support economic growth and stability, urban planners are tasked with developing plans that will draw businesses, allocate land for various uses, enhance transit networks, address housing affordability, promote sustainability, and ensure equity and inclusion. Thus, the economy is a vital force that urban planners may use to create thriving, sustainable, and inclusive urban environments.

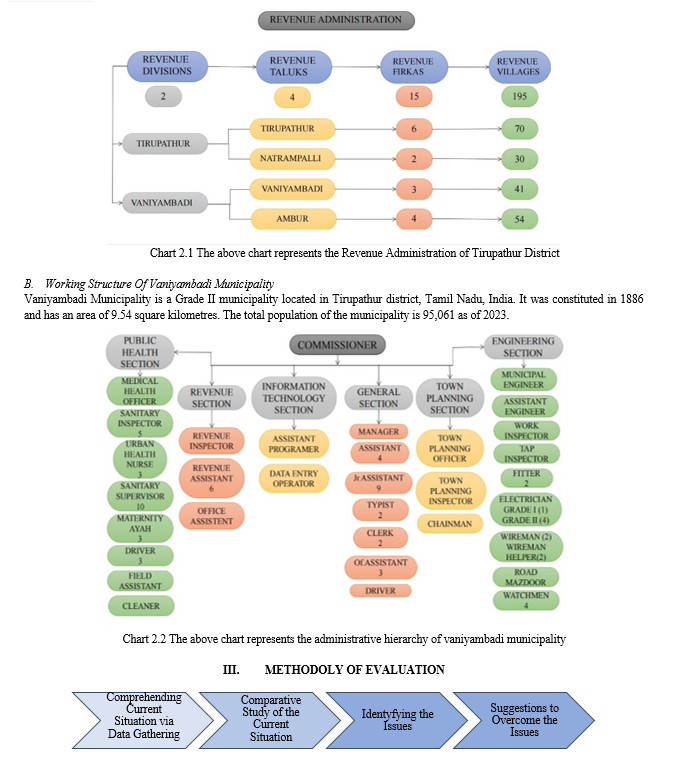

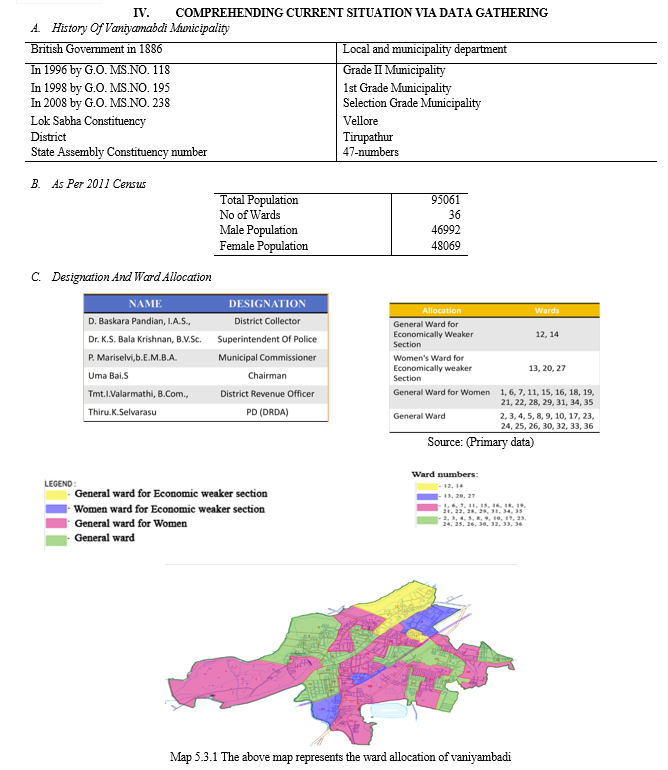

II. STRUCTURE OF VANIYAMBADI MUNCICPALITY

A. Revenue Administration

It is the vital aspect of governance, as it directly impacts a government's ability to deliver public services and maintain economic stability. Effective and transparent revenue collection and management are essential for the well-being and development of a region or nation.

D. Municipal Committee’s

Municipal Committees are essential in the governance and development of towns in vaniyambadi. They play a vital role in providing essential services, maintaining infrastructure, and ensuring the overall well-being of the local population of vaniyambadi. These committees are an integral part of local democracy and contribute to the sustainable growth and development of vaniyambadi. Municipal Committees face various challenges related to infrastructure development, waste management, traffic congestion, and limited resources.

E. Economic Sector

An economic sector refers to a segment of the city's economy that comprises businesses and organizations engaged in similar activities. These activities contribute to the city's overall economic output and employment, and each sector plays a specific role in shaping the urban environment. By actively managing and fostering the development of various economic sectors, urban planners can contribute to creating a vibrant, resilient, and sustainable city.

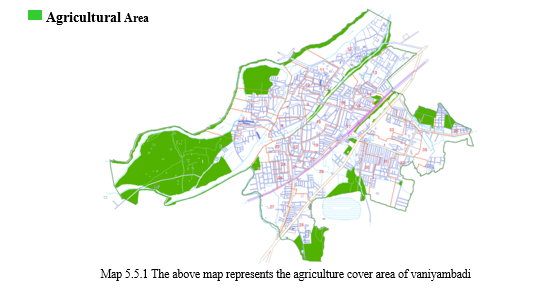

- Primary Sector

The primary sector of vaniyambadi act as the foundation of an economy, providing essential resources for both sustenance and industrialization.

Its performance has a direct impact on the overall economic well-being of a nation, making it a crucial sector to monitor and support for sustainable development

a. Horticulture

In Vaniyambadi it is a vital branch of agriculture that contributes to food security, economic growth, and environmental sustainability. It encompasses a wide range of plants and practices, from the cultivation of nutritious crops to the beautification of landscapes. As global demands for food and green spaces increase, horticulture continues to play a crucial role in meeting these needs while addressing environmental and resource challenges. In Vaniyambadi, mostly comprises of coconut grove, banana grove and also in some area’s spinach is farmed.

b. Animal Husbandry

In Vaniyambadi Animal husbandry is a crucial aspect of agriculture that provides essential resources, supports livelihoods, and contributes to food security and the economy. As the world's population continues to grow, responsible and sustainable practices in animal husbandry are essential to meet the increasing demand for animal-based products while addressing environmental and ethical concerns where the animals are raised for its skin, meat, dairy products and other by products.

c. Revenue

- About 30 tons of vegetables are sold in Ulavar Sandhai.

- Madhanoor, Nathampalli, Jolarpet, Alangayum are the places where farmers are coming to vaniyambadi market to sell vegetables.

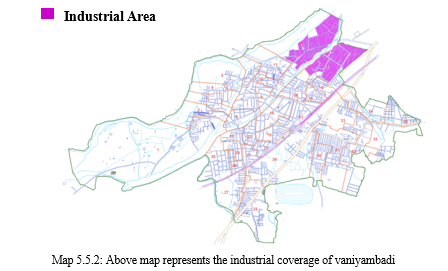

2. Secondary Sector

The industrial sector is a critical driver of economic growth, technological advancement, and job creation in many countries. In Vaniyambadi It plays a central role in transforming raw materials into finished products that fulfil consumer needs and drive economic prosperity. As the world continues to evolve, the industrial sector will adapt to new challenges and opportunities, shaping the future of economies and societies of vaniyambadi through tanning industries. Some industrial products in vaniyambadi have export potential, leading to international trade and economic competitiveness on a global scale. The industrial sector is influenced by market demand, which can fluctuate due to economic cycles and global events.

a. Revenue

- Each tanning industry generates around 3 - 5 lakhs per month.

- Some noted industries generate more than 8 lakhs by exports to other countries.

b. Industrial Area

- Economic sector in vaniyambadi is the tanning industry in industrial zone includes 134 industries in working condition.

- Due to lack of water and covid situation some industries can’t withstand these crises.

- Only raw materials have been exported in major quantity other than finished products of leather materials.

3. Teritary Sector

In vaniyambadi this sector plays a central role in modern economies by providing a wide range of services that meet the diverse needs of individuals and businesses. It drives economic growth, offers employment opportunities, and enhances the overall quality of life. As technology and consumer demands continue to evolve, the tertiary sector will adapt and expand to meet new challenges and opportunities. Vaniyambadi economic landscape encompasses a thriving leather goods industry, including purses, bags, belts, and clothing. In addition, the town hosts a bustling commercial sector featuring numerous restaurants, small retailers, meat shops, electronic stores, and hardware outlets. Notably, Vaniyambadi is also known for its active catering industry, catering to a variety of events and functions. This diverse sector contributes significantly to the local economy and reflects the town's rich business diversity.

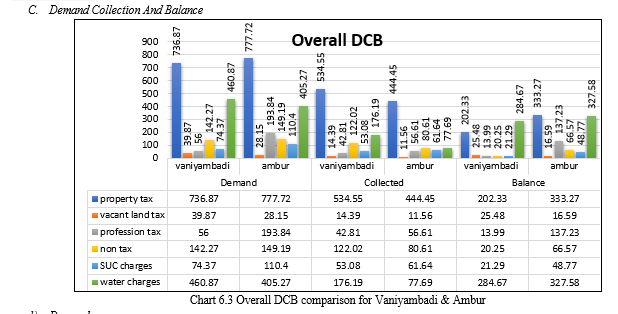

- Demand

The total demand for all taxes and charges in 2021-2022 was ?66,57,68,249.43. The highest demand was for property tax, followed by vacant land tax and profession tax. The demand for non-tax, SUC charges, and water charges was relatively low.The total demand for all taxes and charges in 2022-2023 is ?73,68,77,718.77. This shows an increase of 10.7% from the previous year. The highest demand is still for property tax, followed by vacant land tax and profession tax. The demand for non-tax, SUC charges, and water charges has also increased from the previous year.

2. Collection

The total collection for all taxes and charges in 2021-2022 was ?53,45,54,769.23. This represents a collection rate of 80.2%. The highest collection rate was for property tax, followed by vacant land tax and profession tax. The collection rate for non-tax, SUC charges, and water charges was relatively low.The total collection for all taxes and charges in 2022-2023 is ?56,61,19,193.94. This represents a collection rate of 76.8%. This shows a decrease in the collection rate from the previous year. The highest collection rate is still for property tax, followed by vacant land tax and profession tax. The collection rate for non-tax, SUC charges, and water charges has also decreased from the previous year.

3. Balance

The total balance for all taxes and charges in 2021-2022 was ?13,12,13,480.2. The highest balance was for property tax, followed by vacant land tax and profession tax. The balance for non-tax, SUC charges, and water charges was relatively low.The total balance for all taxes and charges in 2022-2023 is ?17,07,58,524.83. This shows an increase in the balance from the previous year. The highest balance is still for property tax, followed by vacant land tax and profession tax. The balance for non-tax, SUC charges, and water charges has also increased from the previous year

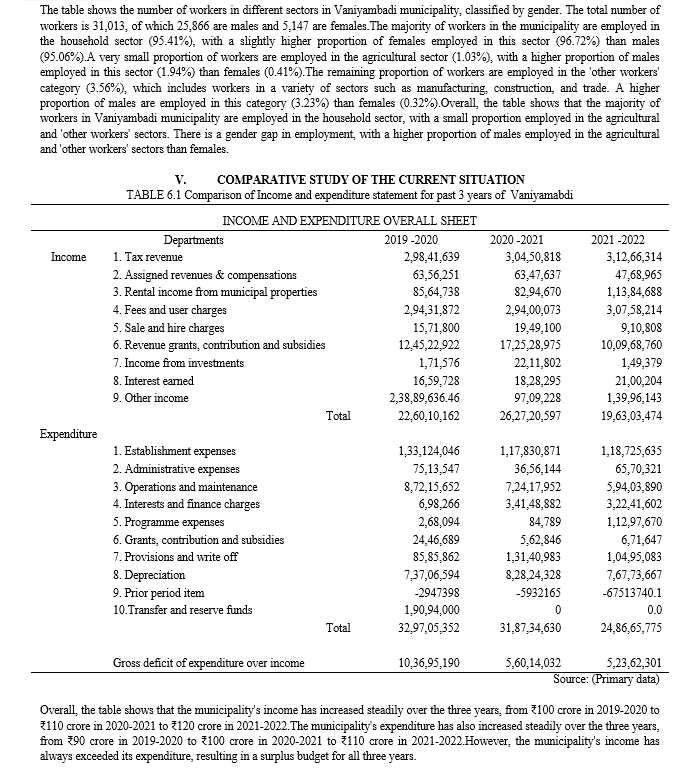

D. Analysis Of DCB (Demand, Collection, Balance

The table shows that the collection rate for all taxes and charges in Vaniyambadi municipality has decreased from 80.2% in 2021-2022 to 76.8% in 2022-2023. This is a matter of concern, as it means that the municipality is losing out on revenue that could be used to provide essential services and invest in infrastructure.The highest balance is for property tax, followed by vacant land tax and profession tax. The municipality should take steps to improve the collection of these taxes. This could be done by offering incentives to taxpayers who pay their taxes on time, and by taking strict action against defaulters.The collection rate for all taxes and charges has decreased from 80.2% in 2021-2022 to 76.8% in 2022-2023. The highest balance is for property tax, followed by vacant land tax and profession tax. The municipality should take steps to improve the collection of these taxes.

VI. IDENTIFYING THE ISSUES

A. Income Generation Of Vaniyambadi

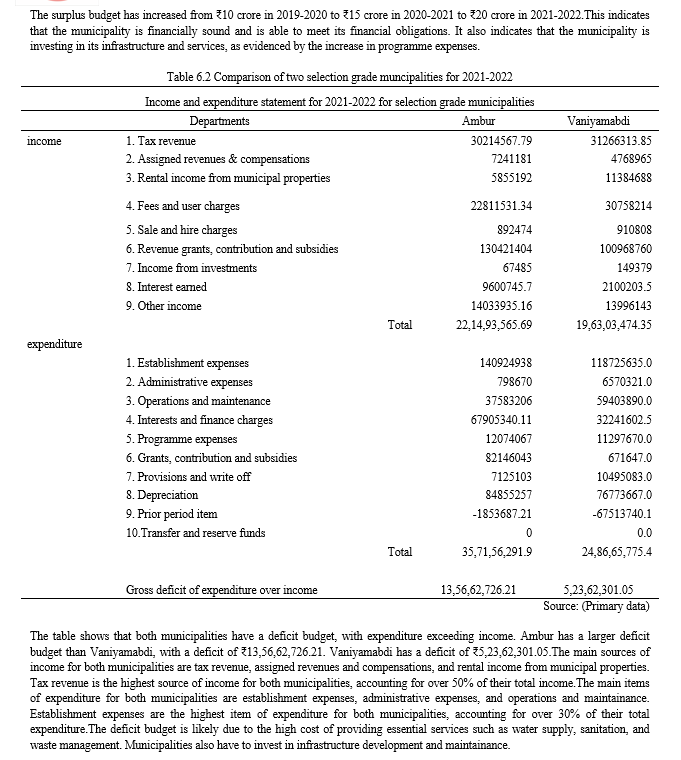

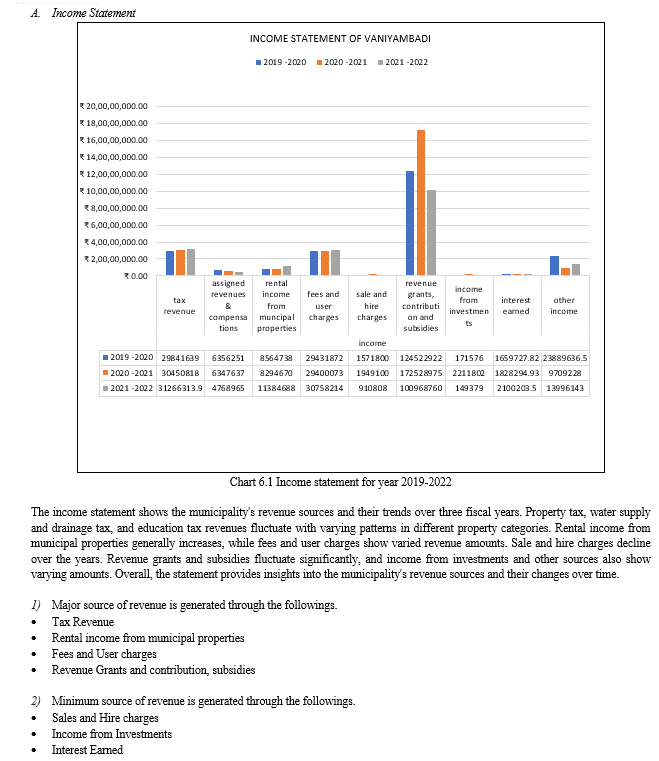

- Revenue grants, contribution and subsidies: This category of income has increased by over 40% from 2019-20 to 2020-21, and by a further 10% from 2020-21 to 2021-22. This suggests that Vaniyambadi is becoming increasingly reliant on government grants and subsidies to fund its operations. This could be a concern if the government reduces or eliminates these grants and subsidies in the future.

- Income from investments: This category of income has declined by over 90% from 2019-20 to 2021-22. This suggests that Vaniyambadi is generating less income from its investments, which could be due to a number of factors, such as lower interest rates or losses on investments.

- Other income: This category of income has declined by over 60% from 2019-20 to 2021-22. This suggests that Vaniyambadi is generating less income from other sources, such as fees and user charges. This could be due to a number of factors, such as a decrease in the demand for services or lower fees and charges.

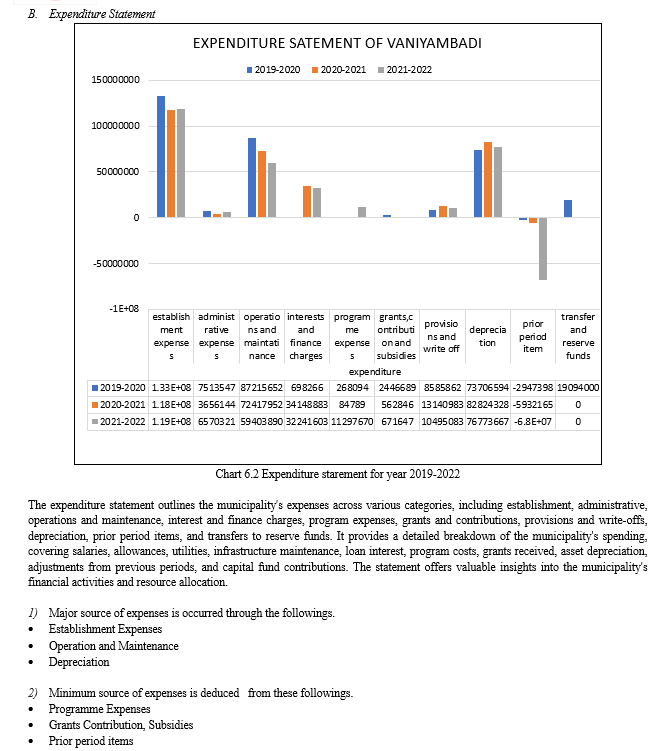

B. Expenditure Generated In Vaniyambadi

- Establishment expenses: This category of expenditure has increased by over 30% from 2019-20 to 2021-22. This suggests that Vaniyambadi is spending more on salaries, benefits, and other administrative costs. This could be due to a number of factors, such as an increase in the number of employees or higher salaries and benefits.

- Administrative expenses: This category of expenditure has increased by over 50% from 2019-20 to 2021-22. This suggests that Vaniyambadi is spending more on general and administrative costs, such as office supplies, travel, and training. This could be due to a number of factors, such as an increase in the size and complexity of the organization or higher costs for goods and services.

- Operations and maintenance: This category of expenditure has increased by over 20% from 2019-20 to 2021-22. This suggests that Vaniyambadi is spending more on the upkeep and maintenance of its infrastructure and assets. This could be due to a number of factors, such as the aging of infrastructure or higher costs for maintenance and repairs.

Overall, the income statement and expenditure statement of Vaniyambadi for the past 3 years show a number of concerning trends. Revenue grants, contribution and subsidies are increasing, while income from investments and other income is declining. Establishment expenses, administrative expenses, and operations and maintenance are all increasing. These trends could lead to a budget deficit and make it difficult for Vaniyambadi to maintain its current level of services in the future.

VII. SUGGESTIONS TO OVERCOME THE ISSUES

Vaniyambadi should take steps to reduce its reliance on government grants and subsidies. This could be done by increasing its own revenue generation through fees and user charges, or by finding alternative sources of funding, such as private investment. Vaniyambadi should also take steps to reduce its expenditure. This could be done by reviewing its staffing levels and salaries, renegotiating contracts with vendors, or finding more efficient ways to operate. Vaniyambadi should develop a long-term financial plan that addresses the challenges it is facing. This plan should identify specific steps that Vaniyambadi will take to reduce its budget deficit and ensure its financial sustainability in the future.

Conclusion

Based on the analysis of the document, it can be concluded that the municipality of Vaniyambadi is facing several financial challenges. The income statement and expenditure statement for the past three years indicate concerning trends such as increasing reliance on government grants and subsidies, declining income from investments and other sources, and increasing expenses in establishment, administration, and operations and maintenance. These trends could lead to a budget deficit and make it difficult for the municipality to maintain its current level of services in the future. To overcome these issues, Vaniyambadi should reduce its reliance on government grants, increase revenue generation through fees and user charges, and find alternative sources of funding. The municipality should also take steps to reduce expenditure by reviewing staffing levels and salaries, renegotiating contracts, and finding more efficient ways to operate. Developing a long-term financial plan that addresses these challenges is crucial for ensuring the financial sustainability of Vaniyambadi in the future.

References

[1] Miyauchi, T., & Setoguchi, T. (2023). Does low urban density increase municipal expenditure? Population density as a performance target for compact city planning in Japan. Journal of Urban Management, 12(4), 375–384. https://doi.org/10.1016/j.jum.2023.08.003 [2] Hortas-Rico, M., & Solé?Ollé, A. (2010). Does Urban Sprawl Increase the Costs of Providing Local Public Services? Evidence from Spanish Municipalities. Urban Studies, 47(7), 1513–1540. https:// doi.org/ 10.1177/0042098009353620 [3] Vaniyambadi Municipality - https://www.tnurbantree.tn.gov.in/vaniyambadi/ [4] Ambur Municipality - https://www.tnurbantree.tn.gov.in/ambur/ [5] Administrative report 2022-2023 (Vaniyambadi & Ambur) [6] Income and expenditure statement 2019-2020 (Vaniyambadi & Ambur) [7] Income and expenditure statement 2020-2021 (Vaniyambadi & Ambur) [8] Income and expenditure statement 2021-2022 (Vaniyambadi & Ambur) [9] Demand collection balance sheets 2019-2020 (Vaniyambadi & Ambur) [10] Demand collection balance sheets 2019-2020 (Vaniyambadi & Ambur) [11] Demand collection balance sheets 2019-2020 (Vaniyambadi & Ambur) [12] Overall balance sheets 2022-2023 (Vaniyambadi & Ambur) [13] Schemes and Taxation report 2022- 2023 (Vaniyambadi & Ambur)

Copyright

Copyright © 2024 Abraham A, Vijay Vignesh P. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63512

Publish Date : 2024-06-29

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online