Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Big Data Analytics: Analyzing the Significance of it in Light to Indian Banking Sector

Authors: Ananya Basy Roy Chowdhury

DOI Link: https://doi.org/10.22214/ijraset.2024.61369

Certificate: View Certificate

Abstract

Banks are the engines that drive the financial sector, monetary markets, and economic expansion. Since the introduction of information technology (IT) in the 1980s, 1990s, and 2000s, the Indian banking sector has experienced a number of changes in terms of how IT is applied to various banking operations from different perspectives, such as cutting expenses, earning revenue, detection of fraud, security concerns, etc. These changes are still ongoing with the emergence of new trends like business intelligence and big data analytics. Banks are utilizing big data to their advantage. To obtain a general competitive edge, they push for innovations in data and analytics through the use of big data and data science. Due to the vast amount of data about transactions that banks collect, big data has the ability to completely change business operations and procedures. Big Data analytics is the answer to the current banking environment\'s challenges of growing competitiveness, fraud, and cyber security risks. When banks are able to effectively prevent fraud by utilizing analytics and cutting-edge technology, their losses from fraud will decrease. Data is much more than just an IT asset; in the modern banking business, data plays a critical role in its digital evolution. This study canters on the ideas of analytics within the Indian banking industry. This paper\'s analysis shows how big data as both service and application has emerged as a potent and cutting-edge tool to support the Indian banking industry. The acceptance as well as effective application of data analytics are also covered in this study, along with certain case studies, difficulties encountered, and patterns within the Indian banking industry.

Introduction

I. INTRODUCTION

The "five Vs"—are the underlying characteristics used for describing big data.

- Volume: A vast amount of data is generated each minute in the linked world of today, including financial transactions, films, and images in addition to tweets. Over the course of time, financial institutions have handled large volumes of data and have consistently had the largest datasets.

- Variety: Both data that is organized and unorganized are possible. Big Data technology enables users to look at increasingly complicated unorganized data that becomes more important in addition to the organized data found in financial services, leading to the discovery of new insights and implications.

- Veracity: Describes how reliable the information in big data is, particularly if it comes from open sources that are not affiliated with the company. The burden of veracity might increase rapidly as the quantities of data expand.

- Velocity: It refers to the pace at which data is received from many locations; this data is constantly updated, easily evaluated, and potentially subject to analysis in real time.

- Value: Banks and financial institutions can provide clients with fresh products and services by forecasting emerging patterns using data analysis.

The banking sector in India is expanding rapidly, and a survey by Klynveld Peat Marwick Goerdeler and Confederation of Indian Industry (KPMG-CII) suggests that it could emerge as the third largest by 2025. However, in order for the prediction to come to pass, Indian banks would need to gain global competitiveness, and in order to do so, all Indian banks will need to adopt the data method. Large-scale data in the world of banking, is the application of technology and software together with sophisticated algorithms and techniques to obtain additional information, make well-informed judgments, or forecast earnings and risk. The first focus of efforts is on obtaining fresh perspectives from the data that already exists, followed by newly accessible sources of data with the highest priority given to customer-driven goals. Banks may safeguard and preserve the truthfulness and reliability of payments by utilizing multiple-point security, but they should also frequently update the systems they use. The way branches of banks operate has changed as a result of clients using mobile applications, having continuous web access to their user accounts, and being able to perform any job from their cell phones.

In the modern world, people are increasingly willing to divulge personal information. They set up accounts on social media, leave reviews, and share their whereabouts. A large number of details has emerged through various routes as a result of this risk tolerance and interest in sharing personal information. This explains in detail how big data is becoming more and more important in the banking sector. An Everest Group report indicates that analytics is becoming a major factor in the banking industry's adoption of cloud services. Banks were able to limit exposure risk, minimize fraud, and cope with market volatility with the aid of datamining and advanced analytics tools.

There are some Big Data tools which are used in Banking sector which are –

a. YARN: Through the ability to work with and analyse data stored in HDFS (Hadoop Distributed File System), it significantly increases the effectiveness of the system as a whole. These data processing engines include graph, collaborative, stream, and batch processing algorithms.

b. HIVE: The technology in question is a data warehouse for the analysis of organized information. The structure is built using Hadoop. It was founded by Facebook itself. Massive datasets stored in distributed storage can be read, written, and managed with Hive. Indexing is used to speed up searches.

c. KAFKA: Given its ability to handle massive volumes of data while maintaining responsiveness, Kafka is the database of choice when dealing with substantial to vast volumes of data. It is scalable to a big number of users fast and is sturdy, reliable, constant and adaptable.

II. LITERATURE REVIEW

- Shilpa (2013) in her study stated that the emergence of Big Data can be attributed to our society's heavy reliance on data technologies. The administration of such vast amounts of data presents a number of issues due to its abundance. Among the many difficulties include data that is not structured, real-time analytics, fault tolerance, data handling, and storage. The processing of the data and the ability to store it are the two primary issues with big data. This study focuses on the different methods and tools available for analysing, transforming, and displaying large amounts of data.

- The technical issues need to be resolved for big data to be processed quickly and efficiently, according to Harshawardhan's(2014) study. The obstacles encompass a range of issues, such as diversity, absence of organization, handling mistakes, confidentiality, promptness, origin, and display throughout the process. The processing of massive data sets in an environment of distributed computing is supported by the Hadoop programming framework. The MapReduce software framework from Google created Hadoop, which is a program that is divided into different sections.

- In Tanvi Ahlawat's (2016) study, a number of business-related tasks were completed using Big Data in conjunction with powered analytics, including real-time Root Cause Analysis for corresponding shortcomings, errors, and difficulties, POS-based generated coupons based on consumer behaviour, and many other decisions that need to be made in a business environment. Minute-by-minute calculations and recalculations of the risk portfolio are possible. prior to an organization being affected, conducting identification of fraud and using fraud analytics

- Big Data's ultimate objective, according to Fosso et al. (2015), is to produce economic value and provide an advantage over competitors.

- According to Schultz (2013), the most striking aspects of big data for managers in large companies are the possibilities and advantages that it offers as well as the infrastructure it needs.

III. OBJECTIVES OF THE STUDY

- To comprehend the idea and outline of big data analytics with regard to the banking industry.

- To look into the factors which are influencing for the adaption of Big data Analytics in Banking sector.

- To comprehend the significance of big data analytics in financial risk management and fraud detection of banks.

- To look into a case of the Indian banks employing big data analytics.

- To analyse issues encountered in the implementation of Big Data analytics in Indian banking.

IV. RESEARCH METHODOLOGY

The study's focus is on concepts and descriptions. It is based only on secondary data that has been gathered from a variety of sources such as online databases, publications on analytics in banking produced by a range of organizations throughout a range of time frames, and various literature reviews. A framework for Big Data Analytics in Banking has been established based on the analysis and observation of literature.

V. ANALYSIS AND INTERPRETATION:

A. Conceptual Framework Of Big Data Analytics

Human civilization began to arrange, decipher, and compile information in order to determine values. In a similar vein, information has been gathered and utilized to analyse findings in order to improve making choices across a range of positions. During the early 1900s, Gosset, a statistician, used his statistical expertise to choose the highest yielding barley types by applying it to features of farming and brewing. That was the beginning of statistical modelling; eventually, a number of software tools, including SAS and Excel, as well as programming languages, such R and Python, were developed to serve practitioners in other domains. Multidimensional analysis was initially done using OLAP (Online Analytical Processing) in the 1997s. In the 2000s, business intelligence analysis was carried out for data-driven decision-making and monitoring tools. The field of analytics began with the application of SAS in 2010 and progressed to statistical and mathematical analysis. Currently, several of these programs are being carried out under the banner of big data analytics, with the help of a variety of programming languages and applications that have been developed and organized to work with the current data sets.

Big data refers to the massive volume of data that runs through numerous electronic devices like desktops and cell phones and is expressed in terabytes. With the correct solutions, any company or organization might use all that data to boost its business value. Big data analytic techniques and technology available today have the power to completely transform any type of business, but they are especially powerful in financial service areas like banking. One of the main reasons why risk management in a sector like banking is so difficult is the absence of data. The banking industry's needs, as well as those of financial services like risk and management of capital, financial planning, and relationships with consumers, can be met by incorporating big data and analytical capabilities into future architecture, which Oracle Corporation spearheaded in 2015. This will also help to improve identifying fraudulent activity. Through the efficient use of big data systems, organizations can gain a deeper understanding of their data, which facilitates the ability to make wise decisions. Three factors—Regulatory Compliance & Recession Recovery, Customer Profiling & Segmentation, and Prioritizing & Competitive Advantage—have been identified by Cloudera as establishing Big Data in the banking sector.

B. Factors Impacting the Big Data Analytics and usage of Big Data Analytics in Banking Sector

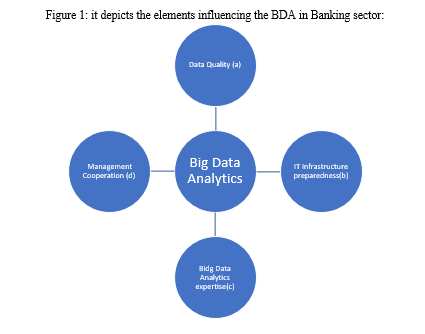

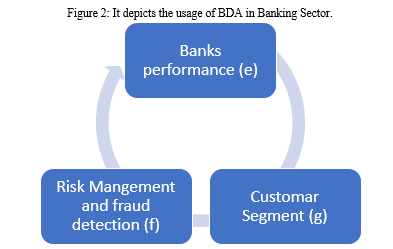

From figure 1 we can see that Main elements influencing BDA utilization in banks are data quality(a), IT infrastructure preparedness(b), BDA expertise(c) and management cooperation(d). Moreover, this model's use of BDA alludes to the capacity to generate dynamic capacities like those that are inventive, flexible and absorbent. In light of this, from figure 2 we can see that banks can enhance banking performance(e) in two distinct ways by using BDA.

Firstly, BDA can help in improving the bank performance by improving the risk management and fraud detection(f). Utilizing data extracted from multiple sources, including social media platforms and commercial records, big data analytics assists banks in creating numerous prognostic indicators. Banks can better visualize client behaviour with the aid of this predictive indicator. In order to lower risk factors and develop a more detailed relationship with their clients, banks have taken great strides to integrate processes by extracting customer data using big data analytical tools. Big data analytics tools and approaches provide the business value for the company by combining, analysing, examining, and associating the large amount of data. Without using more human resources, analytics enables banks to comprehend and assess the many risk characteristics considerably more quickly. It is seen to be crucial for banks to integrate data from diverse systems in order to perceive potential danger. Consequently, the banks must estimate risks by keeping a unified platform that links the analytical tools and the associated dangers. According to IBM, banks may use these technologies to monitor transaction patterns, identify fraud, and put a stop to it while it does substantial harm. Financial organizations, such as banks, have begun to invest in state-of-the-art data analytics techniques and technology in order to promptly identify instances of fraud. Because these data analytics generate vast volumes and various types of data from multiple sources, including social media websites, they assist banks in enhancing the accuracy and trust of their fraud prevention efforts. The use of data sources to assess indicators of fraud and determine the type of fraudulent behaviour, location of fraud, and other details is made easier for banks by big data analytics technologies. For the purpose of identifying fraud in financial organizations such as the banking industry, big data analytics is essential. The precise location of fraud incidents without interfering with client services will be identified through the use of big data tools that analyse data from a wide range and velocity.

Secondly, BDA can help in improving the bank performance by improving the customer segment (g). In order to improve the organization's consumer-centric performance, banks tailor their offerings to each individual consumer with the aid of information from within as well as outside the organization. Based on client segmentation, this kind of strategic planning aids the company in providing financial assistance. Big data analytical tools help the banking sector segment its customer base in a number of ways, including by creating marketing campaigns for specific audiences, creating loyalty programs to encourage card usage, optimizing pricing techniques, and cultivating enduring relationships with devoted clients. For the purpose of identifying customer groups and implementing customized marketing, data analytics provides the capacity to employ classification and clustering techniques. Through a combination of k-Means clustering and other levels of analysis, such as the recency, frequency range, and monetary value (RFM) model, banks discovered that they could create a customer segmentation model that was effective in increasing targeted marketing. They were also able to achieve the common customer relationship management (CRM) goals through successful profiling of customers carried out using strategies like search and progressive learning, predictive approaches like sorting, logical pattern learning, etc., and qualitative methods like clustering, associative rule research, etc.

Through the application of predictive modelling approaches, they were able to forecast and decrease client attrition while increasing cross-selling and up-selling. These techniques included decision trees, neural networks, CHAID, CART, Quest, and C5.0. Consequently, big data implementation trials often became standard practice for the majority institutions.

C. Implementations of Big Data Analytics in Banking Sector

The four phases that are covered can be used to integrate big data analytics in banking. To create an effective system, banks must comprehend a variety of technological and banking-related issues while applying data analytics.

- Set the Target Areas in order of Significance

Banks ought to pinpoint the domains (such as consumer, risk, financing, administration, or fraud) in which data and analytics may provide the most significant effects and secure early leadership involvement.

2. Simplifying Data

To do this, high-quality data from several product and business line silos must be integrated with one another. A unified perspective of the consumer, including his operations, tastes and likes, total risk taken on by product, and so forth.

3. Incorporation of the Decision System for Management

Analytics is a tool for making intelligent decisions in current circumstances. Therefore, it's imperative that decision systems for management be properly integrated. Using decision tree-based models for classification and regression like C5.0 and CART, Support Vector Machine (SVM), and logistic regression, artificial intelligence (AI) enables banks to come to smart decisions.

4. Search for Talent

The efficacy of the activity is ensured by matching the necessary people (statistical modelling experts, big data analysts, etc.) with the appropriate methodology. Banks ought to have a talent strategy that expands on both current inside and outside talent sources.

D. Big Data Analytics In Bank Financial Risk Management And Fraud Detection

The banking industry is changing toward digital transformation, and big data will play a critical role in helping the Indian banking sector uncover fraudulent activity, reduce risks, provide valuable offers to customers, and develop successful business models. Although there are many uses for big data services and apps, the banking industry is the one that is highlighted in this section for significance. One of the most important accounting factors that bank clients take into consideration is the degree of risk connected with a particular transfer of cash. Risks to the banking industry can be identified and predicted with the use of big data. Given the increase in cyberattacks, big data analysis may help identify patterns that point to a potential risk to the financial sector's cyber security. The use of data in risk management is a relatively new concept that hasn't been thoroughly studied in the scientific community before. By leveraging Big Data services and programs, the banking sector may gain a true understanding of their risks and utilize that understanding to inform their risk-management approach. The following lists a number of big data risk management applications:

- Vendor Risk Management (VRM): VRM helps you select vendors, assess the seriousness of threats, put internal risk-reduction measures in place (such as web proxy servers or multifaceted authentication), and then monitor the vendors' continuous operations.

- Prevention of Money Laundering: Predictive analyses offer an accurate and thorough way to identify and reduce misconduct or theft. In a time when traffickers' methods of money laundering have advanced, this is crucial.

- Credit Management: By examining data on past and present spending as well as redemption trends, risk for credit can be minimized.

E. The new Big Data Strategies to Banking fraud

Figure 3: Number of Bank fraud cases across India during the last five financial years from 2019-2023-

|

F.Y 2019 |

6,800 |

|

F.Y 2020 |

8,703 |

|

F.Y 2021 |

7,359 |

|

F.Y 2022 |

9,103 |

|

F.Y 2023 |

13,530 |

From figure 3 we can see that the frauds in banking sector from the last five financial years is increasing on a alarming rate, hence this requires the need of Big data Analytics. The techniques of big data analytics that can be used in mitigating frauds are:

- Financial Statement Fraud and Insurance Fraud: Financial statement fraud is the wilful manipulation of the financial standing of an organization achieved by purposeful or unintentional understatement of amounts or disclosures in financial reports. Losses from financial statement theft are typically significant and can even be disastrous for organizations. As a result, auditors, shareholders, and regulators are now very concerned about financial statement fraud. Many big data algorithms have been designed to mitigate this issue. Feature selection from heterogeneous data and classification for fraud prediction are common work flows. After utilizing a variety of algorithms using big data for selecting and categorizing features to identify fraud, it emerged that optimization techniques worked most effectively in fraud conglomerates and Bayesian belief networks (BBN) for non-fraudulent companies.

- Anti-bribery and Corruption (ABC): The diversion of public monies from building nations activities is implied by the misuse of official authority for personal gain. It erodes people's trust in government policies and procedures as well as popular confidence in governmental authority and institutions. Because to developments in information technology, automated learning techniques can now be used to both prevent and identify misconduct. Microsoft declared the introduction of its own anti-corruption technology and solutions (ACTS) in 2020. In years to come, cloud computing, AI, and machine learning will be used by Microsoft to detect and avoid corruption.

- Identity Theft: Identity theft is when crooks take advantage of another person's uniqueness and other essential information without permission. It usually causes instantaneous money loss, and victims may also experience numerous credit problems and other problems. This type of online criminal activity is known as "phishing." Phishing websites can be identified by employing a random forest classifier that uses heuristic features that are taken from URLs, software code, and third-party offerings. Identification of phishing sites can also be aided by the use of fuzzy sets in conjunction with classification to identify fuzzy parameters, such as the URL parameter's length.

- Anti-money Laundering: Money laundering refers to the technique of hiding the source of funds acquired through illicit means. The most popular method for AML employed by banks is rule-based categorization. Price returns in conjunction with bid/ask orders may provide a novel and effective way to identify irregularities in Bitcoin systems. Nevertheless, scammers can easily elude these rule-driven algorithms, they are highly dependent on domain specialists, and they are unable to investigate novel money laundering practices. Due to its ability to interpolate well on new circumstances without being constrained by rules, machine learning algorithms are also used to detect money laundering operations.

Banks could forecast fraud instances by utilizing descriptive models like k-Means clustering, where the only objective is to identify patterns, or data mining techniques for unsupervised purposes.

F. Utilization Of Big Data Analytics In Indian Banking Scenario

|

Banks |

Usage of Data Analytics |

|

SBI BANK |

Over 100 TB of data are stored in SBI's warehouse of data, and massive amounts of banking data are added there every day. To try and lower the proportion of loans that default, they are employing data analysis tools to develop their data models for student loans, car loans, mortgages, and small business loans. For example, in the case of a student loan, they integrate information from fiscal offices, credit bureaus, and their problematic loans to find qualified applicants, after which they remind them. In order to decide how much money should be kept in ATM branches as well as where to put them, they also employ analytics. |

|

ICICI BANK |

ICICI banks have used big data analytics for debt recovery. As per the incident lCICI Bank aimed to use debt collection as a tactic for customer retention instead of its primary function. Selecting the best approach method for a client who has defaulted was a crucial phase in the procedure for collecting debts, and ICICI Bank developed a "centralized debtors allocation model" to help with this. From among the various channels it employed, the model assigned the correct defaulter bucket to the most suitable one. These channels included non-intrusive ones like SMS, emails, IVR, dunning letters, and call centre reminder messages for early indebtedness as well as personal visits or the filing of lawsuits for serious offenders. In short, after accounting for a number of variables, including exposure, risk behaviour, customer outline, collector efficacy, and risk behaviour, the recovery model developed for each bucket across products estimated the likelihood of future payments according to historical data employing the logistic regression technique and CHAID decision tree, this allowed for different treatment. This in-house BI system comprised Data Clean, Blaze Advisor, TRIAD, SAS, Sybase, and Posidex components. By the end of the 2014 fiscal year, ICICI Bank had successfully implemented a standardized framework and gained the capacity to comprehend the national allocation logic, along with the added benefit of customizing its core model to reflect regional differences. |

|

FEDERAL BANK |

Federal Bank, which reduced expenses by using analytics to plan new ATMs in an efficient manner. “As ATMs are getting consolidated, banks don’t know who is going to use their ATM With analytics, banks can determine where they should open new ATMs and which are the ones need to shut down” said by Shalini Warrier, ED & COO, Federal Bank. |

|

INDUSLND BANK |

Data analytics is the foundation of IndusInd Bank's plan to become a digital bank. Data is used by the bank for risk, fraud, and consumer analytics. The deployment of the enterprise B stack and data repository is a crucial component of this approach. “To achieve this aim, an Enterprise Data Warehouse was built on Azure cloud which manages and integrates more than 50 banking systems, generates business dashboards and reports in a matter of a few hours while dealing data in the volumes of terabyte. At the same time, the infrastructure is maintained to be used in ‘on-demand’ mode, thereby regulating the costs,” said by CIO, INDUSLND BANK. |

|

AXIS BANK |

An internal analytics team of Axis Bank focuses on tailored to needs analysis, client segmentation, and extreme personalization of products and services. Additionally, the business has used models for prediction, which enable it to forecast which products would work best for a certain consumer and estimate the likelihood that a customer will fail on a credit card or loan. |

|

HDFC BANK |

In India, HDFC Bank was one of the first to successfully implement banking data analytics. Having established a retail bank data warehouse since the early 2000s, HDFC Bank was among the first banks across the nation to put money in and implement the necessary technology to manage the vast amounts of unorganized information it generated from various sources, including voice call records, emails, real-time market updates, and other data recorded by its IT systems. HDFC was able to monitor the differential that would be offered to customers on the basis of the value of their association with the bank in 2004 due to the establishment of its company data warehouse. As the HouseholdID project developed, it also had the ability to connect with current customers' families by utilizing non-numeric information like address, name, and zip code, and providing them with goods and services that satisfied their needs. The bank's efforts were acknowledged when it was honoured with the Businessworld Digital Leadership and CIO Awards 2017's Best Analytics Implementation Award. |

|

IDBI BANK |

The bank partnered with Oracle Financial Services to enhance its performance evaluation and provide a solution based on analytics for evaluating income and liquidity risk. |

G. Challenges Banks Faces When Utilizing Big Data Analytics

The financial resources of banks might not be enough to cover the extensive preparation required for analytics adoption. The gap in time between acceptance and achievement has been one of the main barriers to implementation of big data analytics for Indian banks, aside from cost. In general, it took a long time for all the work to pay off in terms of ROI. Additionally, this took longer than usual because the majority of banks jumped into the crisis before reviewing their data, which was in desperate need of a massive cleaning exercise. Unfortunately, Indian banks typically invested in technological advances before investing in data quality because the financial data gathered in the nation's banking sector was generally believed to be mostly accurate, dependable, and of good quality, making it readily suited to data analysis as well as mining. Accurate data was necessary to derive any useful information using advanced software and algorithm design. Another drawback is Benchmarking data, while benchmarks as well as effectiveness indicators are very helpful in assessing internal efficiency, the absence of historical data in analytics makes it challenging to create realistic goals.

Conclusion

These days, banks are starting to use technology and big data analytical tools to boost the bank\'s economic value and to open up new business chances by providing financial products and services to its devoted clientele. The banking industry is adopting a more customer-focused strategy with the help of big data technologies, realizing that customer retention is crucial to overall corporate success. This study examines the prospective for the big data industry in India, particularly in the banking sector, alongside the associated hazards and solutions. Analysts in the banking sector state that big data is the tool that allows an organization to gather, process, and manage extraordinarily large data volumes in a given length of time. Big data technologies help banks in many ways, such as by giving them the ability to precisely deliver the resources needed at any given moment and to constantly track a customer\'s behaviour in real-time utilizing data from transactions. This real-time assessment increases the banking sector\'s total profitability and efficiency, driving it further into a boom cycle. This study seeks to illustrate the effective use of big data Analytics in the banking industry. The integration of big data analytics has assisted banks in raising the bar for service quality and added to the value of the organization. Banks may reduce risk and reduce fraudulent activity in their operations by using Big Data tools to take more accurately strategic decision-making. The study shows the many ways that big data can be applied in banks. The study included cases from Indian banks where Big Data Analytics have been applied. Functional domains like risk management, fraud, identifying crimes, sales and marketing, and customer relations all employ business relationship analytics (BDA). This implies that banks and other suppliers of big data solutions have a lot of potential to develop BDA in order to enhance other areas. The study\'s influencing variables will assist banks in assessing Big Data initiatives undertakings in a thorough manner. Data analytics has permeated practically every aspect of banking, including obtaining customers, KYC and the onboarding process, management of brands, deposits and loans, and risk management, as demonstrated by the numerous case studies showcasing the leading companies in the Indian banking sector. Banks typically use metrics like increased revenue productivity, decreased non-performing assets (NPA) index, or the number of fraud-prevention successes to gauge the value of analytics; nevertheless, only a small percentage of top banks, such as Axis Bank, have shown favourable results. In 2014, Axis Bank introduced data analytics and saw a five-fold improvement in sales personnel productivity. Whenever more top banks share these kinds of revenue achievement stories and big data becomes into a critical component of their business strategy.

References

[1] Dumbill, E. (2013). Making sense of big data. Big Data, 1(1), 1–2. [2] Kwon, O., Lee, N., & Shin, B. (2014). Data quality management, data usage experience and acquisition intention of big data analytics. International Journal of Information Manage¬ment, 34(3), 387–394. [3] Lai, Y., Sun, H., & Ren, J. (2018). Understanding the determinants of big data analytics (BDA) adoption in logistics and supply chain management: An empirical investigation. International Journal of Logistics Management, 29(2), 676–703. [4] Verma, S., & Chaurasia, S. (2019). Understanding the Determinants of Big Data Ana¬lytics Adoption. Information Resources Management Journal, 32(3), 1–26. [5] Harshawardhan, S., Devendra, P. (2014). A Review Paper on Big Data and Hadoop. International Journal of Scientific and Research Publications, 4(10). [6] Ahlawat,T., Krishna,R. (2016). Literature Review on Big Data. International Journal of Advanced in Engineering Technology Management & Applied Science. [7] ManjitKaur,S. (2013). BIG Data and Methodology-A review. International Journal of Advanced Research in Computer Science and Software Engineering. 3(10). [8] Srivastava, U., & Gopalkrishnan, S. (2015). Impact of big data analytics on banking sec¬tor: Learning for Indian Banks. Procedia Computer Science, 50, 643–652. [9] Shakya, S., & Smys, S. (2021). Big Data Analytics for Improved Risk Management and Cus¬tomer Segregation in Banking Applications. Journal of ISMAC, 3(3), 235–249. [10] Nobanee, H., Dilshad, M. N., Al Dhanhani, M., Al Neyadi, M., Al Qubaisi, S., & Al Shamsi, S. (2021). Big Data Applications the Banking Sector: A Bibliometric Analysis Approach. SAGE Open, 11(4), 215824402110672 [11] Maroufkhani, P., Wan Ismail, W. K., & Ghobakhloo, M. (2020). Big data analytics adoption model for small and medium enterprises. Journal of Science and Technology Policy Manage¬ment, 11(4), 483–513. [12] Giebe, C., Hammerström, L., & Zwerenz, D. (2019). Big Data and Analytics as a sustainable Customer Loyalty Instrument in Banking and Finance. Financial Markets, Institutions and Risks, 3(4), 74–88. [13] Ali, Q., Salman, A., Yaacob, H., Zaini, Z., & Abdullah, R. (2020). Does Big Data Analytics Enhance Sustainability and Financial Performance? The Case of ASEAN Banks. Journal of Asian Finance, Economics and Business, 7(7), 1–13. [14] Ramanathan, R., Philpott, E., Duan, Y., & Cao, G. (2017). Adoption of business analytics and impact on performance: a qualitative study in retail. Production Planning and Control, 28(11–12), 985–998. [15] Sun, N., Morris, J. G., Xu, J., Zhu, X., & Xie, M. (2014). ICARE: A framework for big da¬ta-based banking customer analytics. IBM Journal of Research and Development, 58(5–6), 1–9. [16] Zhou, Z. H., Chawla, N. V, Jin, Y., & Williams, G. J. (2014). Big data opportunities and challenges: Discussions from data analytics perspectives [discussion forum]. IEEE Compu¬tational Intelligence Magazine, 9(4), 62–74. [17] Sivarajah, U., Kamal, M. M., Irani, Z., & Weerakkody, V. (2017). Critical analysis of Big Data challenges and analytical methods. Journal of Business Research, 70, 263–286. https:// doi.org/10.1016/j.jbusres.2016.08.001 [18] Grossman, R. L., & Siegel, K. P. (2014). Organizational Models for Big Data and Analytics. Journal of Organization Design, 3(1), 20.

Copyright

Copyright © 2024 Ananya Basy Roy Chowdhury. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET61369

Publish Date : 2024-04-30

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online