Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Analysis of Behavioral Intention on Start-up Business of Mobile Application

Authors: Amrit Ranjan Kumar, Siyaram Yadav, Dr. Suresh Wati, Ms. Tajendra Riya

DOI Link: https://doi.org/10.22214/ijraset.2025.66152

Certificate: View Certificate

Abstract

Using machine learning (ML) techniques, this study examines the behavioral intents of entrepreneurs in the mobile application startup industry. The study uses classification algorithms to forecast entrepreneurial ambitions by examining survey data on attitudes, incentives, and perceived barriers. The results point to important factors and advance our knowledge of how machine learning might improve entrepreneurship research.

Introduction

I. INTRODUCTION

A critical field of research is explored in the paper "How to Build Behavioral Intention on Start-Up Business of Mobile Application": determining the elements that influence user behaviour and intentions toward mobile business applications, especially in Indonesia. Due to its enormous population and rising internet penetration, Indonesia offers a unique potential and challenge as a developing Internet of Things (IoT) market.

Despite these benefits, there is a notable disconnect between internet usage and e-commerce activity in the region, as only 3.63% of worldwide internet users conduct business there. This disparity emphasizes how important it is to examine user preferences and behaviour in order to promote the uptake and use of mobile applications in this developing industry. The study adopts a quantitative research approach, using surveys to collect data from 248 respondents. Its primary objective is to evaluate the influence of product quality on users' behavioral intentions toward mobile applications.

II. RELATED WORK

The research aims to identify the primary determinant of users' behavioral want to adopt the Travy mobile application, which serves as a personalized travel planner. Understanding these factors is crucial before the app's full market launch, especially since it has not yet been promoted due to existing bugs.

- Technology Acceptance Models: The research utilizes the Extended Unified Theory of Acceptance and Use Technology (UTAUT2) model, which has been widely applied in understanding user acceptance of new technologies. Previous studies have shown that this model effectively identifies key factors influencing behavioral intention, such as performance expectancy, effort expectancy, social influence, and facilitating conditions.

- Challenges in Adoption: Despite the potential benefits, several challenges hinder the uses of mobile apps. Issues such as technical bugs, lack of awareness, and inadequate marketing strategies can negatively impact user intention. The literature emphasizes the need for thorough testing and user feedback before launching applications to ensure a smooth user experience and to build trust among potential users.

- Importance of User Feedback: Engaging with users through surveys and feedback mechanisms is crucial for understanding their needs and improving application features. The literature suggests that continuous improvement based on user input can lead to higher satisfaction and increased likelihood of adoption

A. Theoretical Background

- Theory of Planned Behaviour (TPB): A foundation for understanding entrepreneurial intentions, emphasizing attitudes, subjective norms, and perceived control.

- Technology Acceptance Model (TAM): Emphasizes perceived utility and ease of use and perceived usefulness as predictors of technology adoption.

B. Scope of the Study

As information technology and technical innovation have been incorporated throughout the years, trading apps have radically changed the stock brokerage platform as a whole. Eventually, this led to an increase in the proportion of stock market investors. In order to improve performance and efficiency, this study aims to investigate how people generally perceive the trading apps. In order to increase the number of potential clients from all professions, the trading software should be properly promoted using a variety of digital media, including Facebook ads, blog posts, email marketing, and others. People from all professions should be able to use the app, and it should be created to meet the requirements. The applications should make sure to offer enough features that improve their functionality while guaranteeing user-friendliness. Additionally, it should offer adequate information and real-time customer support, demonstrating the transparency of the app and company. The customer's desire to use the trade will be increased if the app's risk is kept below optimal levels by appropriate monitoring, updating, and maintenance.

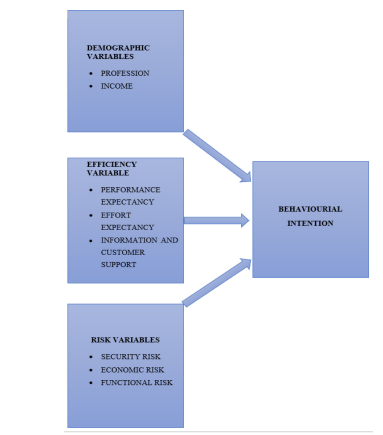

Fig: business analysis on starts up mobile application

- Market Saturation - With millions of apps available, standing out in a crowded marketplace poses a significant challenge. Startups must identify unique selling propositions (USPs) to differentiate their offerings.

- User Retention- Acquiring users is only part of the equation; retaining them is critical for long-term success. Startups need strategies to encourage repeat usage, such as:

- Regular Updates: The software is being continuously improved based on user input keeps it relevant.

- Engagement Strategies: Implementing push notifications and personalized content can enhance user engagement.

III. LITERATURE REVIEW

Hawaldar and Rahiman (2019) claim that the stock market has improved significantly over time, and investors now view it as a better platform for investing, even though they still risk losing their money. The innovators' investing strategy determines whether they receive a higher risk or a higher return. Analysing the several elements that would affect the choice of investment and category was the main goal of the study. Furthermore, consideration was also given to the sources of awareness. Returns had a greater impact on main investors' safety, capital appreciation, maturity time, tax benefits, and risk than did returns. In a similar vein, stock investments were preferred over mutual funds and derivatives.

Investors decide on their own instead of relying on other sources.

According to the research conducted by Madan and Yadav (2016), the adoption of mobile wallets for the purchase of goods and services is significantly affected by expectancy of effort, performance, social influence, facilitating conditions, perceived risk, perceived value, perceived regulatory support, and promotional benefits.

Shanmugham and Ramya's (2012) study found that while the internet has no effect on trading, social connections and media do. The primary determinant of attitude toward trading is social interaction, which is a social component that is followed by media. Attitude, perceived behavioral control, and intention to trade are positively correlated, whereas subjective norms are negatively correlated.

Yang et al. (2021) have researched working adults' intentions to invest in the stock market; adding more information on working-class adults will increase the number of stock market investors. Regarding the goal, risk tolerance and overconfidence bias are regarded as independent variables. Subjective norms have a weakly favourable impact on investing intention. According to Akhtar and Das (2019), attitude acts as a mediator between financial knowledge and investment intention.

Additionally, the association between personality traits and investing intention is influenced by financial self-efficacy in two ways. According to Vijay and Rao (2018), globalization has led to a lot of investment opportunities in the financial sector, which has increased the number of participants and complicated the decision-making process. Investor perception include return on investment, market volatility-related investment risk, short-term profitability, share price, dividend policy, historical financial performance, company and board reputation, current earnings, and expert opinion. Boda and Sunitha (2018) contend that the perception and response of investors are more important than any other aspect influencing the financial market. Making better and more efficient decisions in the financial market requires an understanding of investor psychology. Additionally, the risk could be reduced or eliminated. Retail investors boosted their stock market investments during the pandemic, especially on mobile trading apps, claims Malhotra (2020). This is the situation due to the main characteristics of these mobile trading apps. The purpose of this study report is to demonstrate the significance of these characteristics from the viewpoint of the consumers by conducting an empirical investigation into these key components of the mobile trading apps of certain well-known stock broking companies. Based on factor analysis, the study came to the conclusion that the most important aspect of the app is its ease of use.

Security and privacy issues were in second and third place, respectively, as significant variables influencing consumer choice and preference for a mobile trading app, aside from investment analysis data. Important managerial suggestions are included in the research article. Rastogi (2010) A new chapter in the history of the fixed income derivatives market began with the country's introduction of interest rate futures trading. Over time, the product's initial design flaws and departures from global standards would disappear, and it would become a game-changer that paved the way for other new derivatives endeavours. The Indian Securities Market's integration with the rest of the world has reached another significant milestone with the introduction of interest rate futures trading. Interest rate derivatives make up more than 70% of all derivatives transactions in all economies worldwide, making them the market's darlings. Since it is anticipated to open the door for future developments in other derivatives, it can be considered a groundbreaking effort in India. Market participants have unanimously praised the initiative, however there seem to be some concerns regarding the design of the product and its possible impact on interest rate volatility. The purpose of this study is to address those issues. Vohra and Kaur (2016) As the social structure of a society changes, people must manage their finances and resources so that the many family and personal objectives that form over the course of their lives are fulfilled. This calls for a range of investment options that are customized to each person's requirements and preferences. Because women have different investing preferences than males, financial organizations must target women as a distinct market niche. Furthermore, despite the fact that women's participation in a variety of fields has increased in recent decades, they still make up a very small portion of the stock market. As more women join the workforce and as their financial situation improves, it is perhaps even more important to look at their investing choices behavior changes dramatically. Therefore, the current study intends to examine Punjabi women's investing choices, including those of stock and non-stock investors. The study used a well-structured, pre-tested questionnaire to collect data from primary sources. The collected data was evaluated using descriptive statistics. According to the study's findings, Punjabi women choose fixed deposits above other investing options. While women who are stock investors show less interest in the stock market, those who are not wish to invest in the stock market in the near future. According to the research, women who have already made stock market investments are unhappy and wish to take their money out. According to the article, there should be camps for women's education and awareness. Enhanced Women who are more knowledgeable about the stock market will be more satisfied and trusting, which will boost their involvement in the market. To continue investing in the stock market, women who are risk averse need to have faith in it.

Theoretical framework. (Source: Primary data)

IV. RESEARCH METHODOLOGY

This study is descriptive and draws on both primary and secondary sources of information. Primary data was gathered through questionnaires distributed to Keralan investors, while secondary data was mostly gathered from journals, research papers, websites, magazines, and other sources. Since the study's sample includes both current investors and potential app users from Kerala, a purposeful sampling technique was employed.

Conclusion

Investors over the years have embraced the significant change that the stock market has undergone. With all of the new hazards that were emerging, the advent of digital media and the development of apps had greatly increased investors\' desire to use the trading platform. Eventually, a significant shift in the inventors\' plan to use the app also emerged. Investors from a variety of professions are aware of trading applications. Furthermore, the profession\'s demographic variable has a big impact on investors\' behavioral intention toward trading applications, whereas income has little bearing on investors\' behavioral intention toward usage. Furthermore, the study demonstrated a sufficient link between the behavioral intention to utilize the app and the efficiency and risk characteristics.

References

[1] Rahiman, H., and I. T. Hawaladar (2019). Perception of investors R. Thakur (2013). An empirical study employing a modified technology acceptance model examined how professionals in two Indian cities adopted mobile payment systems. Research and Business Perspectives, 1(2), 17–30. [2] Ammendola, C., Fleisch, E., Huebner, J., Frey, R. M., & Ilic, A. (2018). (pp. 293e304). November. An examination of user reviews reveals what users prefer in mobile banking apps. The 17th International Conference on Mobile and Pervasive Multimedia Proceedings. [3] Yadav, R., and K. Madan (2016). Behavioral intention to use a mobile wallet: An analysis from underdeveloped nations. Indian Business (2020) Malhotra, S. Analysis of mobile trading app features: A benefit of the pandemic. 12(1), 75–80, Journal of Global Information & Business Strategy (JGIBS). [4] Panggabean, R. R., and Nur, T. (2021). The extended UTAUT approach is one of the factors affecting generation Z\'s adoption of mobile payment methods (pp. 14e28). [5] S. Rastogi (2010). Interest rate futures in India include spot market volatility and future trading. Dynamics of Management, 10(2), 65–78. [6] In 2013, Thakur, R. An empirical study employing a modified technology acceptance model examined how professionals in two Indian cities adopted mobile payment systems. Research and Business Perspectives, 1(2), 17–30. [7] Morris, M. G., Davis, G. B., Venkatesh, V., & Davis, F. D. (2003). Information technology user acceptance: Moving toward a common perspective. Quarterly for MIS, 425–478. [8] Venkatesh, V., Thong, J. Y., & Xu, X. (2016). Unified theory of acceptance and use of technology: A synthesis and the road ahead. Journal of the Association for Information Systems, 17(5), 328e376. [9] Rao, B. C., and Vijay, S. (2018). An investigation into how investors view the Sharekhan Ltd. share market. Trend in Scientific Research and Development: An International Journal (ijtsrd). ISSN: Volume Issue2456-6470. [10] Huang, Y. H., Chang, Y. C., Wei, M. F., and Luh, Y. H. (2021). Analysis of the adoption behavior of mobile payments by the younger generation using an expanded UTAUT model. 16(4), 618e637, Journal of Theoretical and Applied Electronic Commerce Research.

Copyright

Copyright © 2025 Amrit Ranjan Kumar, Siyaram Yadav, Dr. Suresh Wati, Ms. Tajendra Riya. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET66152

Publish Date : 2024-12-27

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online