Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Blockchain-Based Banking System

Authors: Abrar Sayyed , Radhe Kulkarni , Srusti Kakade , Sumit Barmecha, Dr. Shraddha Khonde

DOI Link: https://doi.org/10.22214/ijraset.2024.62648

Certificate: View Certificate

Abstract

The emergence of blockchain technology has revolutionized the traditional banking system by providing a decentralized, secure, and transparent platform for financial transactions. This research paper explores the feasibility and benefits of implementing a blockchain-based banking system. By examining current challenges within the traditional banking sector, such as lengthy transaction times, high fees, and lack of transparency, this paper argues that blockchain technology can offer a viable solution. The paper also evaluates the potential risks and regulatory concerns associated with blockchain-based banking systems, and proposes strategies to mitigate these challenges. This research paper aims to highlight the transformative potential of blockchain technology in revolutionizing the banking sector and improving financial services for both consumers and institutions.

Introduction

I. INTRODUCTION

In the rapidly evolving realm of financial technology, the emergence of blockchain technology stands as a catalyst for profound transformations in traditional banking structures. This paper endeavors to embark on a meticulous and comprehensive exploration of the revolutionary landscape presented by blockchain-based banking systems. As the financial sector undergoes a paradigm shift towards decentralization, transparency, and heightened efficiency, the integration of blockchain technology becomes a linchpin in redefining the fundamental principles of banking services. Our inquiry delves deep into the core components that constitute the bedrock of these innovative systems, unraveling the intricate tapestry of consensus mechanisms that underpin blockchain networks. Whether through the robust security measures of Proof of Work or the energy-efficient alternatives like Proof of Stake, the chosen consensus mechanism shapes the system's resilience against adversarial attacks. Simultaneously, the examination of smart contract security unveils the critical need for secure coding practices and regular audits to fortify the reliability and safety of these self-executing contracts. The paper does not merely scrutinize the technical intricacies but extends its gaze to the critical realm of data security. We navigate through the nuances of encrypting sensitive data and safeguarding the privacy and confidentiality of user information both during storage and transmission. Furthermore, the exploration encompasses identity management systems and multi-factor authentication protocols, which form the bulwark against unauthorized access and protect the sanctity of user accounts. In addition to these technical aspects, the paper explores the regulatory landscape, addressing the imperative of compliance with financial and data protection regulations. The incorporation of Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures becomes essential to meet regulatory requirements, ensuring that these innovative systems operate within the bounds of legal frameworks. Network security assumes paramount importance in this landscape.

The paper scrutinizes the implementation of firewalls, intrusion detection systems, and other measures to fortify the network infrastructure against external threats, particularly Distributed Denial of Service (DDoS) attacks that could disrupt services. Moving beyond technical considerations, the exploration extends into user-centric elements. The paper emphasizes the importance of secure wallet solutions, advocating for the adoption of hardware wallets to provide users with a fortified environment for storing their digital assets. An incident response plan is discussed as a critical component, addressing the swift and strategic management of security breaches to minimize potential damages and restore confidence in the system. Furthermore, the paper underscores the significance of user education, as informed users contribute significantly to the overall security framework. By raising awareness about potential risks associated with blockchain technology and promoting secure practices, we aim to empower users to navigate this dynamic financial landscape with vigilance and understanding.

This paper aspires to provide a holistic and nuanced understanding of the challenges and opportunities embedded in the development and implementation of blockchain-based banking systems. By navigating through the technical, regulatory, and user-centric dimensions, we seek to equip architects and stakeholders with the insights needed to build resilient, secure, and user-centric financial ecosystems in the age of blockchain innovation.

II. TRADITIONAL BANKING VS BLOCKCHAIN

The contemporary financial sector is undergoing a profound transformation, primarily due to Blockchain technology. In contrast to the conventional structures of traditional banking, Blockchain introduces a decentralized framework promising high security, transparency, and efficiency. In this comprehensive analysis, we go into the distinct characteristics of traditional and Blockchain-based banking systems, explaining the transformative potential of Blockchain across various dimensions.

A. Security and Transparency

Traditional banks have always faced security challenges because they rely on centralized databases. Blockchain, as a technology built on cryptographic techniques and decentralized ledgers, strengthens its security architecture. The decentralized nature of the Blockchain ensures that transactions are securely recorded in a tamper-proof manner across a distributed network. This not only enhances security but also introduces a level of transparency rarely seen in traditional banking. Blockchain's cryptographic and decentralized features fundamentally redefine the concept of trust within financial transactions. Unlike traditional banking, where security is dependent on centralized entities, Blockchain disperses trust across the entire network. This approach mitigates the risk of unauthorized access and fraudulent activities, creating a new era of secure and transparent financial transactions.

Furthermore, the utilization of Blockchain in banking can address the challenges highlighted in research [3], which emphasizes the need for standards integration. Blockchain inherently brings a standardized approach to data recording and sharing, contributing to a cohesive and secure international banking ecosystem. Reference: [1] - Blockchain Technology, an Alternative to the Traditional Banking System

B. Decentralization and Elimination of Intermediaries

A basis of traditional banking lies in its dependence on multiple intermediaries, contributing to delays and increased costs in transactions. Blockchain disrupts this conventional model by facilitating direct peer-to-peer transactions through smart contracts. These contracts, executed automatically based on predefined conditions, eliminate the need for intermediaries, streamlining the entire process. The decentralized nature of Blockchain not only accelerates transaction settlements but also significantly reduces associated fees, making financial transactions more cost-effective. The elimination of intermediaries is not merely a procedural change; it is a fundamental shift that transforms the dynamics of banking. Blockchain's decentralized approach empowers users, promoting inclusivity and efficiency within the financial ecosystem. This revolutionary change challenges the traditional banking structure, paving the way for a more streamlined, user-centric, and cost-effective experience.

Additionally, the research [4] introduces the concept of "RBaaS" or Robust Blockchain as a Service, emphasizing the importance of decentralized blockchain nodes. This model ensures a high level of availability, addressing concerns related to network connections and data center reliability, further highlighting the advantages of decentralization. Reference: [2] - Blockchain Application in Banking System, [4] - RBaaS: A Robust Blockchain as a Service Paradigm in Cloud-Edge Collaborative Environment.

C. Efficiency in Transactions

Efficiency in transactions is a key differentiator between traditional and Blockchain-based banking systems. The absence of intermediaries in Blockchain leads to faster transaction processing times, enabling near-instantaneous settlements. Smart contracts, integral to the Blockchain framework, automate and execute predefined conditions, minimizing the need for manual intervention. This not only enhances the speed of individual transactions but also contributes to the overall fluidity and efficiency of the banking ecosystem. Blockchain's efficiency gains have far-reaching implications for the global financial landscape. Blockchain's power to make fast and secure transactions challenges the slow and less responsive nature of traditional banking. The efficiency of Blockchain isn't just a tech perk; it's a game-changer in how fast financial transactions can happen.

Furthermore, the research [7] emphasizes the role of Blockchain in addressing challenges related to Anti Money Laundering (AML) activities. The immutability and transparency of Blockchain can enhance the traceability of transactions, making it a valuable tool in the fight against financial crimes. Reference: [2] - Blockchain Application in Banking System, [7] - Blockchain Technology in The Banking Sector.

D. Innovation and Flexibility

Innovation and flexibility are intrinsic features of Blockchain technology, setting it apart from the often rigid structures of traditional banking systems. Traditional banks encounter challenges when adapting to new technologies, hampered by their established frameworks.

In contrast, Blockchain's decentralized and adaptable infrastructure provides fertile ground for innovation. Blockchain's flexibility is evident in its ability to seamlessly integrate new features and services, fostering continuous improvement in financial products. It acts as a catalyst for innovation, responding dynamically to the evolving needs of the financial sector. The adaptability of Blockchain positions it as a driving force for positive change, challenging traditional banking to keep pace with the rapidly changing landscape. Blockchain's impact on innovation goes beyond merely improving existing processes; it extends to reimagining financial products and services. The technology is fostering a culture of continuous improvement and dynamism, propelling the financial sector into uncharted territories. The research [5] on the application of Blockchain for central banks introduces the concept of Central Bank Issued Digital Currency (CBDC) as a potential use case. The study highlights that CBDC, among other use cases, is a research-intensive area, indicating the potential for innovation in the core functions of central banks. Reference: [7] - Blockchain Technology in The Banking Sector, [5] - Blockchain Application for Central Banks: A Systematic Mapping Study. The regulatory landscape and scalability are critical aspects that differentiate traditional and Blockchain-based banking systems. The lack of regulation, as highlighted in [7], poses a significant challenge for Blockchain adoption in the banking sector. Regulators need to gain a deeper understanding of Blockchain's features and characteristics to create a conducive environment for its implementation. The scalability challenge, discussed in the same research [7], focuses on the limitations of permissionless solutions in competing with existing systems in terms of speed and transaction volume. However, permission solutions offer a balance between scalability and technical architecture. In summary, while Blockchain offers unparalleled innovation and flexibility, addressing regulatory concerns and ensuring scalability is pivotal for its widespread adoption in the banking sector.

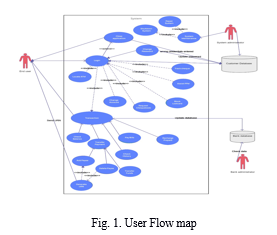

III. UI AND SYSTEM WE ARE LOOKING FORWARD TOO

The rapid growth of cryptocurrencies has brought about concerns, particularly regarding the scalability issue inherent in blockchain-based cryptocurrencies. The limitations in transaction processing speed, even for leading cryptocurrencies, hinder their practical applications. [4] Decentralized Identity Integration Module (DIIM), enhances privacy-preserving properties, surpassing user-centric identity management systems used in mainstream platforms like Facebook or Google. Provides a more secure and novel approach to identity integration within the OB ecosystem. Offers a decentralized solution for self-sovereign identities, ensuring user control over personal information.[1]

Cryptocurrencies, exemplified by Bitcoin and Ethereum, offer secure transactions through blockchains but face scalability challenges due to the need for network-wide consensus. Current transaction throughput is significantly lower than traditional systems like Visa, hindering widespread adoption. To address scalability issues, payment channels enable micropayments off-chain. However, utilizing multiple channels incurs overheads such as time costs and charges. The need for a more efficient solution prompts the proposal of a novel off-chain system called a "channel hub."[2]Serves as an interoperable backend for collaboration between national regulatory authorities (RAs) and banks. Facilitates decision-making processes and authenticates participants in the OB ecosystem. Enables effective data co-governance and monitoring of Third-Party Service Providers (TSPs) access behaviour.[1]

The performance and security of blockchains are crucial, with consensus algorithms playing a key role. Proof of work (PoW) is explained as an energy-intensive but secure algorithm used in permissionless blockchains. The environmental impact of PoW is acknowledged, and the potential issue of wealth concentration in proof of stake is mentioned. Permissioned blockchains, relying on consensus algorithms like proof of authority (PoA), practical Byzantine fault tolerance (PBFT), Istanbul BFT (IBFT), and Raft, are presented as more energy-efficient alternatives.[3]

The differences in fault tolerance and computational complexity among these consensus algorithms are discussed. While PBFT and IBFT offer higher fault tolerance with increased complexity, Raft and PoA provide lower complexity but with some trade-offs. The importance of data integrity assurance in platforms like Raft is noted. Overall, the need for balancing security, efficiency, and environmental impact in blockchain technologies is highlighted.[3] The limitations in transaction processing speed, even for leading cryptocurrencies, hinder their practical applications. To address this challenge, the paper introduces a promising solution called the payment channel network (PCN). PCN enables off-chain settlement of transactions, reducing reliance on resource-intensive blockchain operations. However, potential transaction failures due to external attacks or uncooperative users pose challenges.[4]

The channel hub acts as a shortcut device within the payment network, allowing direct coin transfers between channels. Unlike existing payment hubs connecting participant nodes, the channel hub efficiently leverages channels already established in the payment network.[2]a hybrid blockchain system tailored for Central Bank Digital Currency (CBDC) is proposed, acknowledging the need for controllable decentralization and enhanced supervision in comparison to existing cryptocurrencies. The focus is on designing a network architecture that conserves computing resources, a technical scheme aligned with economic ecology, and efficient consensus algorithms.[5]

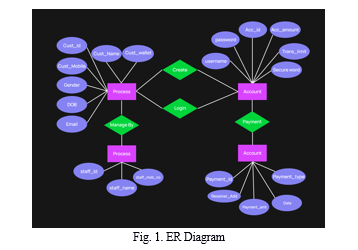

The proposed system is validated through three simulation experiments focusing on the scheme, network, and consensus. The results demonstrate the comprehensive improvement in transaction processing and consensus speed, highlighting the potential effectiveness of this hybrid blockchain system for CBDC. In terms of user interface, the emphasis is on presenting a modular, efficient, and supervised blockchain solution tailored to the specific requirements of a national digital currency.[5] In terms of user interface (UI), the model emphasizes a seamless and secure banking experience for users. The use of blockchain technology ensures transparency and security, and the incorporation of a consortium approach enhances the scalability and efficiency of the banking system. The UI should reflect the user-friendly aspects of the model, highlighting the secure registration process, transparent transactions, and the overall robustness of the proposed blockchain-based banking system.[6]

The proposed theoretical model for the banking sector aims to address various issues in the traditional banking system, such as data storage, privacy, scalability, and transparency, by leveraging blockchain technology. The model emphasizes the adoption of consortium blockchain, combining on-chain and off-chain transactions, and utilizing a Peer-to-Peer (P2P) protocol for enhanced data privacy.[6]

The analysis revealed categorizations for target user groups, data collection approaches, and data visualization methods across 14 blockchain-based and 10 non-blockchain-based agri-food traceability applications. However, the paper identified a lack of detailed discussions on user interfaces and design decisions, hindering thorough usability assessments. Furthermore, it highlighted a notable discrepancy in user involvement for evaluation between blockchain and non-blockchain-based research.[7]The potential consequence of overlooking user interface considerations is emphasized, as usability problems may arise, leading to the underutilization of blockchain technology. The paper concludes by discussing research gaps and proposing future directions to enhance user interface design in blockchain-based agri-food supply chain applications, emphasizing the importance of addressing these issues for broader blockchain adoption.[7]

IV. PRIVACY AND SECURITY

Creating a blockchain-based banking system necessitates a comprehensive approach to security and privacy to ensure the integrity of the financial infrastructure. Firstly, the consensus mechanism employed, whether Proof of Work or Proof of Stake, must be resilient against attacks, with a particular emphasis on preventing 51% of attacks. Smart contracts, the backbone of many blockchain applications, require secure coding practices and routine audits to identify and rectify potential vulnerabilities that could be exploited.

The protection of sensitive information is paramount. Employing strong encryption algorithms guarantees the confidentiality of user data both in storage and during transmission. Implementing end-to-end encryption across communication channels adds an extra layer of security. Identity management systems must be robust, ensuring that users are reliably authenticated, and the integration of multi-factor authentication enhances the overall security posture.

Privacy considerations extend to the transaction level. Features like confidential transactions and zero-knowledge proofs enable users to engage in financial transactions without revealing specific details, striking a balance between transparency and confidentiality. Network security measures, including firewalls and intrusion detection systems, guard against external threats, particularly Distributed Denial of Service (DDoS) attacks that could disrupt services.

Compliance with regulatory standards is imperative. This includes adherence to financial and data protection regulations specific to the blockchain-based banking system's jurisdictions. Implementing Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures ensures compliance with legal requirements and enhances the security of the financial ecosystem.

Access control mechanisms play a pivotal role in mitigating insider threats. Strict user access controls based on roles and responsibilities, regularly reviewed and updated, limit the risk of unauthorized access. The implementation of auditability mechanisms ensures that all transactions can be traced, contributing to compliance efforts and facilitating the identification of any suspicious activities. Secure wallet solutions are crucial components of the system, providing users with a safe environment to store their digital assets. Hardware wallets, in particular, offer an added layer of security. An incident response plan must be in place to handle security breaches promptly, minimising potential damages and restoring trust in the system. Regular security audits and vulnerability assessments are essential to a proactive security strategy.

User education is integral to the overall security framework. Informing users about potential risks associated with blockchain technology, promoting secure wallet practices, and raising awareness about phishing attacks and social engineering threats contribute to building a community of informed and vigilant users. In summary, addressing these multifaceted security and privacy concerns is essential for establishing a robust, trustworthy, and compliant blockchain-based banking system.

V. CASE STUDIES

Blockchain technology is a core, underlying technology with promising application prospects in the banking industry. With the increasing need for modernization in our day-to-day lives, people are open to accepting new technologies. From using a remote for controlling devices to using voice notes for giving commands, modern technology has made space in our regular lives [3]. The research reveals that blockchain can enhance the efficiency of various segments within the banking industry. Notably, it demonstrates positive impacts on cross-border fund transfers, financial reporting, compliance procedures, trade finance, and capital markets. Additionally, blockchain streamlines the Know Your Customer (KYC) process. Despite these advantages, regulatory and technological obstacles pose significant challenges that must be addressed for the effective implementation of blockchain in the financial system.[4]

The key purpose of the proposed program is the creation of a new technology to provide more security for banking transactions. The Blockchain, a platform for the exchange of leader schemes, can be used in a wide number of programmes[1]. The 21st century is all about technology with the increasing need for modernization in our day-to-day lives, people are open to accepting new technologies. From using a remote for controlling devices[2]. Confidence is improved when performing banking transactions between parties using Blockchain as it decreases the risk of fraud and creates records of operations automatically. This provides an automatic context tracking of all device users.[1]

Nowadays, we can see that banks have started implementing Blockchain technologies through forming consortiums such as the R3 consortium which is one of the most leading and significant in the world (Guo & Liang, 2016)[1]. A study was conducted to identify the transparency of currency without third-party entering. It is the study of the blockchain technology framework and banking Industry. The major role is played in the banking sector and main challenges are included. Blockchain technology is reshaping the future of Banking[3]. Banks are currently using permission-based BCT solutions for very defined (small) ecosystems because of data security reasons. It is like but not exactly the ‘WhatsApp group system wherein an administrator decides on membership of the group. However, for each bank, the considerations will differ for the ecosystem required to deploy the BCT solution. The study covers only leading banks and FinTech companies in the country and smaller players in the banking sector. In India financial institutions are at various stages of BCT adoption. They have already seen the benefits of BCT in some processes where BCT is put into use[2]. There has also been widespread optimism regarding the application of blockchain in the banking industry. In May 2016, McKinsey surveyed global banking executives, finding that approximately half of executives believe that blockchain will have a substantial impact within 3 years, with some even considering that this will happen within 18 months[1] but In recent years, it has been observed that many data breaches are happening in the banking system. Hackers are stealing vast amounts of money from banks because of the security issue of the banking system. Also, the banking system is improving very slowly. Even in the 21st century, it takes a lot of time, sometimes days, to make transactions[2] also The decentralized nature of blockchain poses a unique dilemma for regulators who grapple with the complexities of managing a system that lacks a centralized authority. Despite widespread discussions among regulators on the mechanisms for regulating blockchain, achieving effective regulation remains nearly impossible due to its inherently decentralized structure. This decentralization implies a lack of centralized control over financial institutions utilizing blockchain technology [4]

Conclusion

Blockchain-based banking systems offer several advantages, including greater security, faster transactions, lower costs, and increased transparency. Additionally, these systems can provide financial services to unbanked populations who may not have access to traditional banking services. Overall, the concept of blockchain-based banking systems seeks to revolutionize the traditional banking industry by providing a more efficient, secure, and inclusive financial system.

References

[1] Baiod, Wajde; Light, Janet; and Mahanti, Aniket (2021) \"Blockchain Technology and its Applications Across Multiple Domains: A Survey,\" Journal of International Technology and Information Management: Vol. 29: Iss. 4, Article 4. [2] Shiwangi Tiwari , Tulika Gairola , Shivam Goyal , Sarthak Singh , Tanu Saxena (2023) “Bank record storage using blockchain” INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY,Volume 10 Issue 1. [3] BLOCKCHAIN TECHNOLOGY, AN ALTERNATIVE TO THE TRADITIONAL BANKING SYSTEM, Bianca-Ioana NICOLAE, Bulletin of ”Carol I” National Defence University [4] Minhaj Uddin Chowdhury, Khairunnahar Suchana, Syed Md Eftekhar Alam, Mohammad Monirujjaman Khan “Blockchain Application in Banking System”, Journal of Software Engineering and Applications, 2021, 14, 298-311 [5] P. D. Dozier and T. A. Montgomery, \"Banking on Blockchain: An Evaluation of Innovation Decision Making,\" in IEEE Transactions on Engineering Management, vol. 67, no. 4, pp. 1129-1141, Nov. 2020, doi: 10.1109/TEM.2019.2948142 [6] S. Farrell, \"Blockchain Standards in International Banking: Understanding Standards Deviation,\" in Journal of ICT Standardization, vol. 7, no. 3, pp. 209-224, 2019 [7] Z. Cai et al., \"RBaaS: A Robust Blockchain as a Service Paradigm in Cloud-Edge Collaborative Environment,\" in IEEE Access, vol. 10, pp. 35437-35444, 2022 [8] N. Dashkevich, S. Counsell and G. Destefanis, \"Blockchain Application for Central Banks: A Systematic Mapping Study,\" in IEEE Access, vol. 8, pp. 139918-139952, 2020 [9] I. Eyal, \"Blockchain Technology: Transforming Libertarian Cryptocurrency Dreams to Finance and Banking Realities,\" in Computer, vol. 50, no. 9, pp. 38-49, 2017 [10] Cédric Dilé, Michael Toubal\"Blockchain Technology in The Banking Sector Applications and Challenges\" in Uppsala University Department of Informatics and Media Bachelor’s Degree Project Spring Semester of 2021 [11] Guo, Y., Liang, C. Blockchain application and outlook in the banking industry. Financ Innov 2, 24 (2016). [12] Chia-Hung Liao, Xue-Qin Guan, Jen-Hao Cheng, Shyan-Ming Yuan, “Blockchain-based identity management and access control framework for open banking ecosystem” , Future Generation Computer Systems, Volume 135, 2022, Pages 450-466, ISSN 0167-739X. [13] J. Zhang, Y. Ye, W. Wu and X. Luo, \"Boros: Secure and Efficient Off-Blockchain Transactions via Payment Channel Hub,\" in IEEE Transactions on Dependable and Secure Computing, vol. 20, no. 1, pp. 407-421, 1 Jan.-Feb. 2023 [14] M. M. Islam, M. K. Islam, M. Shahjalal, M. Z. Chowdhury and Y. M. Jang, \"A Low-Cost Cross-Border Payment System Based on Auditable Cryptocurrency With Consortium Blockchain: Joint Digital Currency,\" in IEEE Transactions on Services Computing, vol. 16, no. 3, pp. 1616-1629, 1 May-June 2023 [15] Y. Zhang and D. Yang, \"RobustPay+: Robust Payment Routing With Approximation Guarantee in Blockchain-Based Payment Channel Networks,\" in IEEE/ACM Transactions on Networking, vol. 29, no. 4, pp. 1676-1686, Aug. 2021 [16] J. Zhang et al., \"A Hybrid Model for Central Bank Digital Currency Based on Blockchain,\" in IEEE Access, vol. 9, pp. 53589-53601, 2021, doi: 10.1109/ACCESS.2021.3071033 [17] Z. Cai et al., \"RBaaS: A Robust Blockchain as a Service Paradigm in Cloud-Edge Collaborative Environment,\" in IEEE Access, vol. 10, pp. 35437-35444, 2022 [18] Muhammad Khalid Khan, Kashif Nisar, Yumna Farooq et al. An Improved Banking Application Model Using Blockchain, 20 July 2021, PREPRINT (Version 1) available at Research Square [https://doi.org/10.21203/rs.3.rs-582543/v1] [19] P. Jain et al., “Blockchain-enabled smart surveillance system with artificial intelligence,” Wireless Communications and Mobile Computing, vol. 2022, pp. 1–9, 2022 [20] S. Fugkeaw, \"Enabling Trust and Privacy-Preserving e-KYC System Using Blockchain,\" in IEEE Access, vol. 10, pp. 49028-49039, 2022 [21] Y. Song, C. Sun, L. Li, F. Wei, Y. Liu and B. Sun, \"Research on Blockchain-Based FinTech Trust Evaluation Mechanism,\" in IEEE Access, vol. 11 [22] M. M. Islam and H. P. IN, \"A Privacy-Preserving Transparent Central Bank Digital Currency System Based on Consortium Blockchain and Unspent Transaction Outputs,\" in IEEE Transactions on Services Computing, vol. 16, no. 4, pp. 2372-2386, 1 July-Aug. 2023 [23] Swathi H.C, Dr. H.P Mohan Kumar, “SECURE BANK TRANSACTION USING BLOCKCHAIN”, International Research Journal of Engineering and Technology (IRJET) Volume: 07 Issue: 08 | Aug 2020 [24] Hao Wang, Shenglan Ma, Hong-Ning Dai, Muhammad Imran, Tongsen Wang,”Blockchain-based data privacy management with Nudge theory in open banking, Future Generation Computer Systems” Volume 110, 2020, Pages 812-823, ISSN 0167-739X. [25] Mohd Javaid, Abid Haleem, Ravi Pratap Singh, Rajiv Suman, Shahbaz Khan”A review of Blockchain Technology applications for financial services, BenchCouncil Transactions on Benchmarks, Standards and Evaluations, Volume 2, Issue 3, 2022” [26] Aarti Patki, Vinod Sople, “Indian banking sector: blockchain implementation, challenges and way forward” May 2020 Journal of Banking and Financial Technology [27] C.Mallesha, S.Haripriya “A STUDY ON BLOCKCHAIN TECHNOLOGY IN BANKING SECTOR”, International Journal of Advanced Research in Commerce, Management & Social Science (IJARCMSS), Volume 02, No. 03, July - September, 2019.

Copyright

Copyright © 2024 Abrar Sayyed , Radhe Kulkarni , Srusti Kakade , Sumit Barmecha, Dr. Shraddha Khonde . This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET62648

Publish Date : 2024-05-24

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online