Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Blockchain-Based Carbon Credit Ecosystem

Authors: Amol S. Netke, Yogesh M. Zade, Yuvrajsing G. Solanke, Harsh S. Satwani

DOI Link: https://doi.org/10.22214/ijraset.2025.66232

Certificate: View Certificate

Abstract

Climate change and global warming demand immediate action, and a global carbon trading system can help by reducing greenhouse gas emissions. Carbon credits allow companies to emit a defined amount of carbon dioxide, with each credit typically equaling one ton. Although these credits incentivize emissions reduction, current systems lack transparency, face high transaction costs, and benefit intermediaries. Our project proposes a blockchain-based Carbon Credit Ecosystem that uses blockchain and smart contracts to create a more transparent, accessible, and efficient carbon market. This system will tokenize carbon credits, establish protocols for credit creation and retirement, and transparently manage trading. Engaging stakeholders like the energy sector, project verifiers, NGOs, citizens, and governments, our model provides broad benefits and is adaptable to other credit and trading systems. Keywords: Blockchain, Carbon Credit, Smart Contracts, Carbon Trading, Transparency

Introduction

I. INTRODUCTION

With rising carbon emissions globally, there is an urgent need for a secure, transparent, and efficient carbon credit system. Traditional carbon credit mechanisms face significant challenges, including lack of transparency, risks of double-counting, high transaction costs, and fragmentation across regulatory environments. Our project aims to address these challenges by creating a Blockchain-Based Carbon Credit Ecosystem, leveraging blockchain technology to ensure the integrity and authenticity of carbon credits through immutable records and decentralized verification. This decentralized system uses smart contracts to automate the issuance, trading, and retirement of carbon credits, effectively reducing fraud and mismanagement risks.

The proposed platform provides transparency at each step of the carbon credit lifecycle—from issuance through trading and etirement while enhancing accessibility and lowering transaction costs by reducing reliance on intermediaries. Our objectives include establishing standardized protocols for tokenizing, minting, and burning carbon credits, and implementing a decentralized market with an automated market maker (AMM) to promote liquidity and price stability. This accessible, user-friendly system encourages diverse participation from stakeholders, including businesses, NGOs, and individuals, fostering global engagement in carbon markets. By aligning with international sustainability goals, this platform supports a broader effort toward reducing global greenhouse gas emissions and combating climate change.

II. RELATED WORK

Numerous studies have explored blockchain’s potential to improve transparency, efficiency, and scalability in carbon credit ecosystems, a critical need in the global effort to reduce greenhouse gas emissions. Dr. Soheil Saraji and Dr. Mike Borowczak addressed this by proposing a blockchain-based ecosystem that digitizes carbon credits and employs smart contracts to reduce transaction costs, prevent issues like over-crediting, and streamline carbon credit trading, though their model faces challenges in achieving global scalability and integrating with established carbon markets and diverse stakeholders. Similarly, Dr. Surekha Deshmukh’s research investigated the use of blockchain in the energy transition, particularly in decarbonization initiatives. Her study emphasized blockchain’s role in peer-to-peer trading, smart contracts, and grid optimization, which can enhance transparency and accountability within the energy sector’s decarbonization process. While her findings were promising, Deshmukh recommended improving data governance and stakeholder integration to maximize blockchain’s impact, along with the development of advanced AI models to optimize both market and operational efficiencies. Additionally, a study by Infosys Limited addressed the fragmented nature of carbon credit markets, advocating for a blockchain-powered, unified, and transparent platform that could facilitate the issuance, trading, and lifecycle tracking of carbon credits. By reducing dependence on intermediaries, this approach could standardize carbon credit pricing, improve transparency, and decrease transaction costs; however, the study also pointed to the need for further integration with IoT and AI to enhance data accuracy and simplify complex audit processes. Finally, Seong-Kyu Kim and Jun-Ho Huh’s work focused on a blockchain application designed to track and verify carbon credits in alignment with the UN Sustainable Development Goals (SDGs), suggesting the use of AI and big data for anomaly detection and transaction verification to reduce fraud and increase transparency. Despite the benefits of a blockchain-based verification system, they noted the need for more research into blockchain security and scalability to enable broader global adoption.

Together, these studies underscore blockchain’s potential to revolutionize carbon credit systems by fostering transparency, reducing fraud, and enabling efficient, secure transactions across various regulatory and market environments.

III. PROBLEM STATEMENT

A. Problem Statement

To develop a decentralized blockchain-based carbon credit system that ensures transparent, secure, and efficient tracking and trading of carbon credits, reducing fraud and costs while promoting trust and sustainability through automated processes.

B. Description

The current carbon credit systems are plagued by several critical issues that hinder their effectiveness in combating climate change. These systems suffer from fragmentation, with various regions and platforms adopting inconsistent standards and practices, which complicates the verification and comparison of carbon credits. This lack of uniformity reduces trust in the system and obstructs global efforts to standardize carbon trading. Furthermore, the absence of transparency in the issuance and trading processes leads to problems such as over-crediting and double spending, further undermining the credibility of these systems. Without clear and transparent processes, stakeholders find it difficult to audit or verify the authenticity of carbon credits, which fosters skepticism and diminishes participation. Additionally, high transaction costs are a major barrier, as the involvement of multiple intermediaries drives up expenses, reducing the financial incentives for individuals and companies to engage in carbon credit trading. These costs often benefit intermediaries rather than advancing environmental sustainability. To tackle these challenges, the proposed Blockchain-Based Carbon Credit Ecosystem leverages blockchain technology to create a standardized, transparent, and efficient platform. By utilizing smart contracts and decentralized ledgers, this ecosystem ensures the integrity and authenticity of carbon credits through immutable records and decentralized verification processes. The system will automate the issuance, trading, and retirement of carbon credits, minimizing the risks of fraud, double-counting, and mismanagement. This approach will reduce transaction costs, improve accessibility, and encourage wider participation, ultimately making carbon markets more effective in achieving global greenhouse gas reduction goals.

IV. PROPOSED SYSTEM

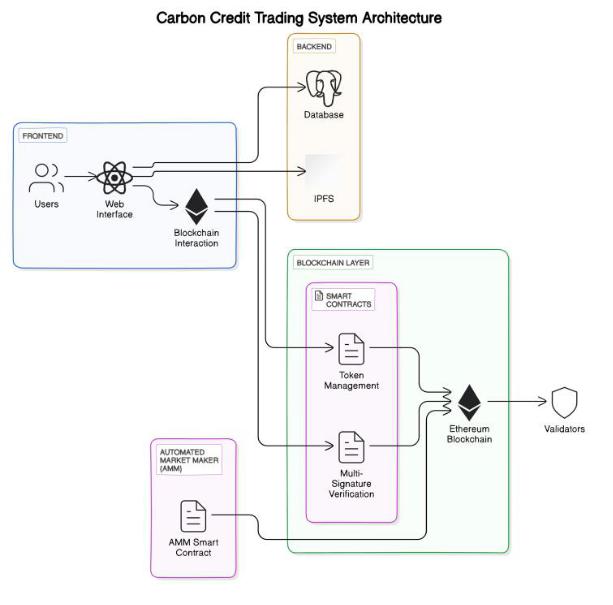

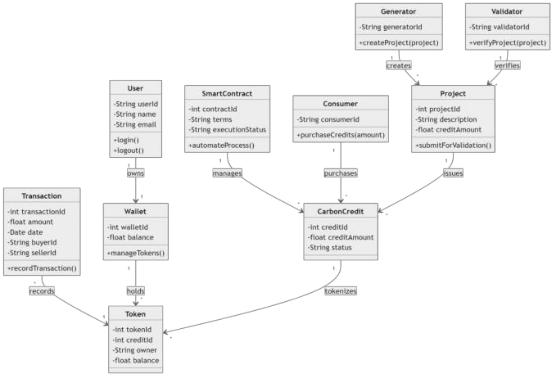

The proposed system aims to create a decentralized Blockchain-based Carbon Credit Ecosystem to enhance liquidity, transparency, accessibility, and standardization in carbon markets. It integrates stakeholders, including generators, consumers, and validators, into a unified platform. Key features include a Tokenization Mechanism for minting and burning carbon tokens, Transparent Distribution to ensure fair allocation of tokens, and an Automated Market Maker (AMM) for decentralized trading based on supply and demand. The system involves Generators (such as wind farms and reforestation projects), Consumers (industries offsetting emissions), and Validators (experts ensuring the legitimacy of credits). The workflow includes Tokenization (digitizing carbon credits into blockchain tokens), Trading Platform (a decentralized exchange for trading tokens), and Burning Mechanism (retiring tokens via a "buy and burn" model, with rewards in the form of non-fungible tokens, or NFTs).

Technology Stack

- Frontend Framework – React.js

- Web3 integration – Web3.js or Ethers.js

- Styling – Bootstrap and Material UI

A. Smart Contracts

The system utilizes four key smart contracts, each designed to automate specific processes and interact with stakeholders.

Smart Contract 1: Registry System records essential information about stakeholders, such as verifiers, credit-holders, and customers, ensuring that carbon credits are properly registered and tracked within the ecosystem. Smart Contract 2: Token Management manages the approval and minting of carbon tokens, ensuring that only verified carbon credits are converted into tokens, while also facilitating their transfer and burning. NFTs are issued as certificates for successfully retired carbon tokens. Smart Contract 3: Multi-Signature Verification oversees the minting and burning process, requiring approval from at least 70% of verifiers before execution to maintain the integrity and legitimacy of transactions. Smart Contract 4: Automated Market Maker (AMM) automates the trading of carbon tokens against digital currencies, such as stablecoins or potential future central bank digital currencies (CBDCs). It incentivizes liquidity providers by sharing transaction fees (e.g., 0.3%) and dynamically adjusts the price of carbon tokens based on market activity.

B. Frontend

The frontend of the Blockchain-based Carbon Credit Ecosystem offers a user-friendly interface for all stakeholders to engage with the system. It features a User Dashboard, providing a centralized view of user activities, including carbon credits, tokens, and transactions, along with notifications for important updates. Carbon Credit Management interfaces allow carbon credit generators to submit projects and enable buyers and sellers to participate in token trading, while tools for tracking market trends and transaction history are also available. Verification and Validation dashboards allow validators to review and approve carbon credits, ensuring transparency in the verification process, with an audit trail to track verification activities. The system integrates with the Marketplace Interaction feature for trading carbon tokens and viewing liquidity pools, facilitated by the AMM. Security Features ensure the protection of user information through secure login protocols, multi-factor authentication (MFA), and data encryption.

V. HIGH LEVEL DESIGN

The high-level design of the Blockchain-based Carbon Credit Ecosystem focuses on creating a decentralized, transparent, and efficient platform for carbon credit trading. The system integrates stakeholders such as carbon credit generators, consumers, and validators into a unified platform. Key components include tokenization for digital representation of carbon credits, automated market mechanisms for dynamic trading, and smart contracts for automating processes like credit approval, token minting, and verification. The user-friendly frontend allows stakeholders to manage carbon credits, track transactions, and engage in trading, while secure features ensure data protection. This design ensures enhanced liquidity, fairness, and scalability in carbon credit markets.

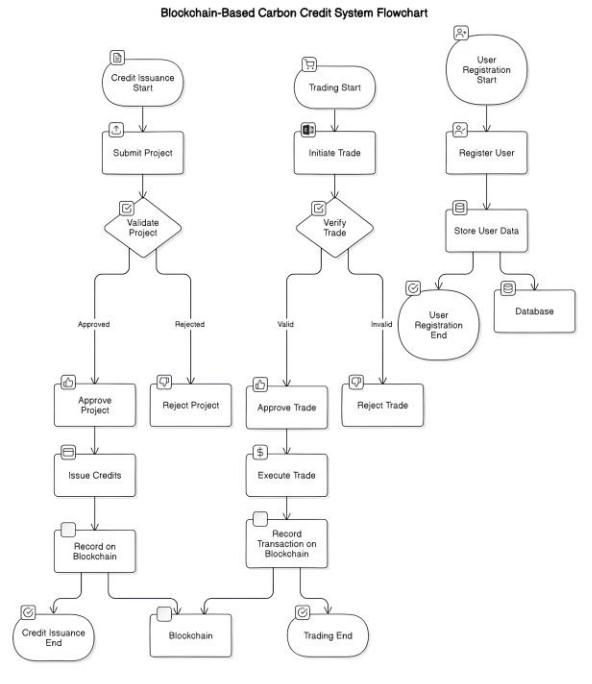

VI. UML DIAGRAM AND SYSTEM WORKFLOW

The UML diagram below illustrates the overall architecture and workflow of the Blockchain-based Carbon Credit Ecosystem. It visualizes the interactions between key components such as stakeholders, smart contracts, and the trading platform. The diagram highlights the flow of carbon credit tokens from generation and verification through to trading and retirement, ensuring transparency, accountability, and efficiency. It serves as a comprehensive representation of how the system operates, showcasing the seamless integration of tokenization, automated market mechanisms, and verification processes within the ecosystem.

VII. SYSTEM IMPLEMENTATION

The implementation of the Blockchain-Based Carbon Credit Ecosystem addresses key challenges in the current carbon credit market by utilizing blockchain technology, smart contracts, and user-friendly applications to enhance the integrity, transparency, and efficiency of carbon credit transactions, thereby supporting global sustainability efforts. The process begins by setting up the blockchain environment, including the installation of the Ethereum development framework (e.g., Truffle or Hardhat) and deploying smart contracts to the Ethereum test network. The web interface is developed using React.js, while React Native is used to build mobile applications for both Android and iOS. Integration of smart contracts is achieved through web3.js, enabling interaction with the deployed contracts for functions like issuing, trading, and retiring carbon credits. Comprehensive testing is carried out, including unit testing of smart contracts using tools like Mocha and Chai, as well as end-to-end testing for both web and mobile applications. Finally, the web application is deployed on cloud platforms like AWS or Heroku, and the mobile application is published on major app stores such as Google Play Store and Apple App Store.

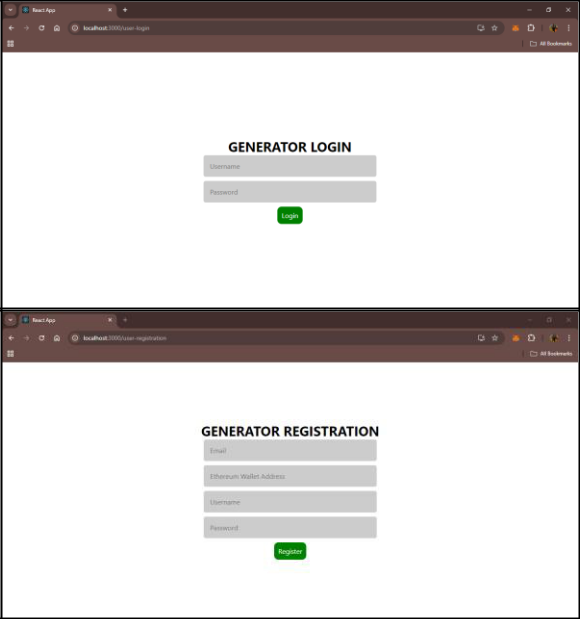

User Selection page from where we can select the user type to get login with.

The output images showcase the user interface (UI) for selecting the user type—Generator, Consumer, or Validator—ensuring a seamless flow for different stakeholders in the Blockchain-Based Carbon Credit Ecosystem. Upon selecting the "Generator" user type, the next images display the login and registration UI, designed to allow carbon credit generators to securely register and log in to the platform, enabling them to submit their emission reduction projects. These UI screens are intuitive and tailored to facilitate easy access for generators to engage with the carbon credit ecosystem.

VII. FUTURE SCOPE

The future scope of the Blockchain-Based Carbon Credit Ecosystem holds significant potential for further enhancing the effectiveness and scalability of global carbon markets. As blockchain technology continues to evolve, integrating advanced solutions such as artificial intelligence (AI) for improved carbon credit verification and machine learning (ML) for dynamic pricing and risk analysis could provide more accurate and efficient decision-making. Additionally, expanding the ecosystem to include more diverse carbon offset projects, such as those targeting biodiversity and water conservation, would further diversify carbon credit offerings. Collaborations with governmental bodies and international organizations could also promote standardization and global adoption, making the system a cornerstone in the fight against climate change.

Conclusion

The Blockchain-Based Carbon Credit Ecosystem represents a significant advancement in the way carbon credits are managed and traded. By leveraging blockchain technology, the project aims to create a more transparent, efficient, and trustworthy system for carbon offsetting. The ecosystem addresses key challenges in the current market, such as the lack of transparency, inefficiencies in verification processes, and the potential for fraud. Through this project, stakeholders will benefit from a decentralized and secure platform that automates the lifecycle of carbon credits, from issuance to retirement. The integration of IoT devices and data oracles ensures real-time and accurate monitoring of environmental impact, enhancing the credibility of carbon credits. Moreover, the decentralized marketplace will foster greater market liquidity and allow for peer-to-peer trading, reducing transaction costs and barriers to entry.

References

[1] Andoni, M., Robu, V., Flynn, D., Abram, S., Geach, D., Jenkins, D., & Peacock, A. (2019). Blockchain technology in the energy sector: A systematic review of challenges and opportunities. Renewable and Sustainable Energy Reviews, 100, 143-174. [2] Kim, S., & Huh, J. (2020). Blockchain of Carbon Trading for UN Sustainable Development Goals. Sustainability, 12(10), 4021. [3] Luo, F., & Gai, K. (2020). A Distributed Electricity Trading System in Active Distribution Networks Based on Multi-Agent Coalition and Blockchain. IEEE Transactions on Industrial Informatics, 16(8), 5046-5054.. [4] Wang, S., & Yu, J. (2021). Energy Crowdsourcing and Peer-to-Peer Energy Trading in Blockchain-Enabled Smart Grids. IEEE Transactions on Industrial Informatics, 17(6), 3564-3572.. [5] Zubair, S., & Khan, F. (2020). Exploring the potential of blockchain technology for carbon emissions reduction: A review. Journal of Cleaner Production, 263, 121365. [6] Zhang, Y., & Li, J. (2022). Blockchain-based carbon trading platform: A new approach for sustainable energy transition. Energies, 15(4), 1312. [7] Pahl, S., & Grefen, P. (2020). Blockchain technology for sustainable carbon markets: A review of challenges and opportunities. Sustainability, 12(11), 4622. [8] Sutherland, A., & Zhou, Z. (2021). The role of blockchain in enhancing the transparency of carbon credit markets. Environmental Science & Policy, 121, 64-73. [9] Rojas, J., & Jha, P. (2023). The impact of blockchain on carbon credit trading systems: An analysis of market efficiency. Energy Economics, 112, 105894. [10] Yadav, A., & Yadav, R. (2020). Leveraging blockchain technology for carbon credits: Opportunities and challenges. Journal of Environmental Management, 267, 110624. [11] Rejeb, A., & Rejeb, K. (2022). Blockchain technology for carbon footprint tracking: A systematic review. Journal of Cleaner Production, 333, 130107. [12] Dimitrov, S. (2022). Blockchain for carbon management: A decentralized approach to carbon trading. Computers & Chemical Engineering, 156, 107401. [13] Farahani, R. Z., & Khosravi, A. (2021). A blockchain-enabled framework for carbon trading: Challenges and prospects. Sustainable Cities and Society, 74, 103201. [14] Bhatia, M., & Malik, V. (2022). Blockchain as a tool for achieving sustainability in carbon credit trading: An analytical framework. Environmental Science and Pollution Research, 29(6), 8438-8454.

Copyright

Copyright © 2025 Amol S. Netke, Yogesh M. Zade, Yuvrajsing G. Solanke, Harsh S. Satwani . This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET66232

Publish Date : 2025-01-02

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online