Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

BlockFund: A Blockchain-Based Platform for Secure and Transparent Investment Management

Authors: Ajeet Kumar, Gurman Singh Sambhi, Suyash Dixit, Harsh Verma

DOI Link: https://doi.org/10.22214/ijraset.2025.66308

Certificate: View Certificate

Abstract

BlockFund is a blockchain-based investment management platform designed to revolutionize how investments are managed and tracked. Traditional methods of investment often lead to inefficiencies, lack of transparency, and the possibility of mismanagement, causing frustration for both investors and project creators. BlockFund solves these problems by harnessing blockchain technology and smart contracts to create a transparent, secure, and milestone-driven investment ecosystem. With BlockFund, funds are released automatically upon achieving predefined project milestones, ensuring accountability and reducing the risk of fraud. The decentralized nature of the platform eliminates the need for intermediaries, significantly cutting costs and streamlining the funding process. Investors can track their contributions in real time through an immutable ledger, building trust and confidence in the system. BlockFund is versatile in catering to a wide range of projects-from start-ups to large-scale ventures-and democratizes access to investment opportunities for entrepreneurs and investors alike. BlockFund, by incorporating features like tokenization and a refund mechanism, ensures a safe and inclusive environment for the management of investments. In this innovative approach, BlockFund addresses the limitations that traditional funding systems have encountered and opens up avenues for an efficient and transparent financial future.

Introduction

I. INTRODUCTION

The investment scenario in the world has reached a critical juncture, as traditional financial systems are lagging behind the rapidly changing needs of the highly dynamic digital economy. Being fundamental, traditional models of investment are always found to have inefficiencies and shortcomings like high transaction cost, time lags for making funds available, dependency on intermediaries, and unclearness of transactions. These issues prevent investors, as well as innovation projects and startups dependent on timely funding, from prospering.

In the past few years, blockchain has emerged as a solution for these challenges. It offers an architecture that is decentralised and transparent. Therefore, it gives more security and efficiency to such traditional financial systems. This technology has been adopted by platforms like BlockFund in transforming investment management by providing features such as milestone-based fund releases, real-time transaction tracking, and tokenized investments. Such platforms reduce intermediaries and automating processes through smart contracts ensure that there is greater accountability and trust between investors and project creators.

BlockFund especially emerges as one of the more innovative platforms to address such significant pain points in the funding ecosystem. It pegs the disbursement of funds to predetermined project milestones so that the investments are used effectively and the threat of fraud and mismanagement is minimized. The decentralized nature of the platform also democratizes access to investment opportunities, making it possible for entrepreneurs to get funding without the constraints of traditional financial institutions. Other features such as refund mechanisms and tokenization add layers of security and engagement, making BlockFund a robust solution for modern investment challenges.

This review paper seeks to discuss the transformational potential of blockchain-based investment platforms like BlockFund. It talks about existing literature that has been published about blockchain technology and examines how smart contracts, decentralized ledgers, and tokenization are remoulding the financial world. This paper further informs the reader of the advantages it offers in the form of enhanced transparency, reduced cost, and increased investor confidence. At the same time, it has to overcome all the other challenges of scalability, security, and regulatory compliance, all of which are necessary if these platforms are going to reach mass adoption.

The aim of this paper is to explore the potential of blockchain-based investment systems in changing the future of financial management, by providing a holistic review of the current state of such systems. It therefore puts emphasis on the necessity to adapt to innovative technologies such as blockchain to create an all-inclusive, efficient, and transparent investment ecosystem.

II. LITERATURE REVIEW

Blockchain technology and its usage in smart contracts have been profoundly explored both academically and practically, which reflects its potential transformation across all domains. Insights from this literature are integrated directly into the BlockFund platform.

K. Saini et al. (2021) presented Blockchain 2.0 advancements in the form of smart contracts that can enhance blockchain performance by removing redundant processes and lowering transaction costs. The concept is important in BlockFund, which applies milestone-based fund releases to improve transaction efficiency. BlockFund avoids unnecessary computational overhead by only triggering transactions when predefined conditions are met, thus smoothing out the flow of funds.

T. M. Hewa et al. (2021) gave a comprehensive review of blockchain-based smart contracts, with major challenges in scalability and security limitations. The research underlined the need for scalable and secure mechanisms to support efficient DeFi operations. Inspired by these findings, BlockFund integrates smart contracts on Ethereum to create secure, immutable transactions. Moreover, resource management optimizations and scalability enhancements directly address the challenges outlined in their survey, ensuring robust performance.

A. Kumar et al. (2024) has reviewed security vulnerabilities in decentralized finance, including re-entrancy attacks and flawed contract logic.

This work emphasizes rigorous security audits and testing practices. BlockFund directly takes into account these findings through comprehensive testing and auditing of its Solidity-based smart contracts. This means the protection of investor funds by blocking risks related to vulnerabilities, thus providing a safe and secure decentralized investment.

C. Wu et al. (2022) discussed the recent advancement in smart contracts with their capability to automatically conduct transactions and ensure tamper-proof records. The study emphasized that the blockchain protocols should be continually refined to accommodate practical uses. BlockFund demonstrates this approach by tokenizing the issuance of digital tokens to represent investment stakes and harmonizing blockchain with traditional financial structures. This fits their goal of building systems that connect innovation with implementation.

Y. Zhu (2021) highlighted the transformative potential of blockchain in financial management, emphasizing transparency and enhanced asset control. Zhu’s findings align closely with BlockFund's objectives of decentralizing investment processes and providing a transparent and real-time tracking system. These features empower investors by enabling them to monitor milestone progress, enhancing confidence and fostering trust.

By synthesizing insights from such seminal works, BlockFund has been designed carefully to take on the challenges of the literature. The platform offers security, scalability, and transparency and brings about trust through tokenization and decentralized processes. All these contributions have shaped the architecture of BlockFund as a solution that stands ahead in terms of decentralized investment management.

Table 1 : Gap Analysis

|

S.N |

Author(s) |

Year |

Proposed System |

Identified Gap |

|

1) |

K. Saini et al. |

2021 |

Introduced Blockchain 2.0, focusing on better efficiency of smart contracts and cost reduction and removal of redundant processes. |

- Majorly theoretical discussions about optimizing performance without including case studies in real-life scenarios |

|

|

|

|

|

- Milestone-based application is not much focused on which will be a key factor in funding platforms such as BlockFund |

|

2) |

T. M. Hewa et al. |

2021 |

Surveyed blockchain-based smart contracts on technical issues like security and scalability in DeFi ecosystems. |

- Gave a broad perspective but could not specify implementation frameworks best suited for conditional fund management. |

|

|

|

|

|

-Less focus on designing scalable solutions for diverse user bases, including project developers and investors |

|

3) |

A. Kumar et al. |

2024 |

Highlighted security concerns within DeFi, including re-entrancy attacks, while recommending robust auditing and monitoring mechanisms.. |

- Focused largely on internal vulnerabilities but forgot the practical integration with oracles, which would improve the integrity of data. |

|

|

|

|

|

- No consideration to address new-age problems, such as hybrid vulnerabilities of smart contracts in the investor ecosystems. |

|

4) |

C. Wu et al. |

2022 |

Discussed advances in smart contracts that involve automation and non-tamperable transaction systems in blockchain networks |

-Did not focus on mechanisms for enabling adaptability of blockchain technology in real-time investment workflows. |

|

|

|

|

|

-Lacked focus on enhanced interactivity features, such as seamless interfaces for funding and tracking milestones. |

|

5) |

Y. Zhu |

2021 |

Explored blockchain's role in improving financial transparency and decentralized asset management |

-Did not consider tokenization as a method for enhancing investment participation |

|

|

|

|

|

- They did not have integration strategies between blockchain-based and traditional financial ecosystems. |

III. PROPOSED WORK

This project shall overcome the inefficiencies of the traditional investment management by making blockchain technology create a transparent, secure, and decentralized platform. The proposed work includes the following key elements and methodologies:

A. Platform Design and Architecture

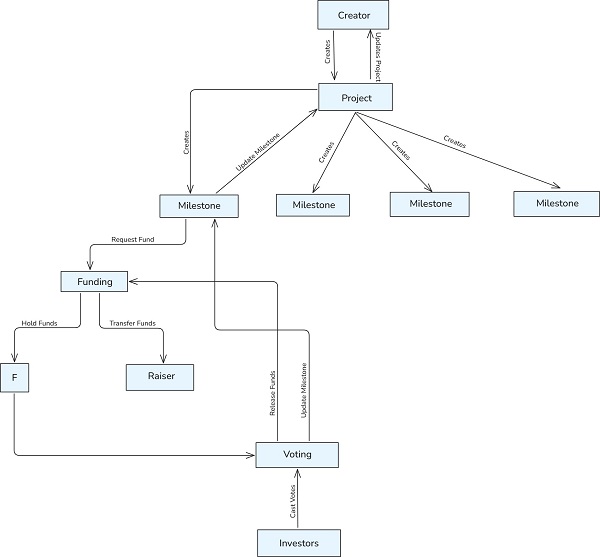

BlockFund is built on the blockchain technology; therefore, the decentralized architecture of this platform will host smart contracts on the Ethereum blockchain. Smart contracts will automate all processes, and transparency will also be displayed. The architecture consists of the modules:

User Module: This module comprises all investor and project creators who have the capability to get registered, authenticate, and manage their profiles.

Investment Module: carries contribution of funds, milestones tracking, and issuance of tokens Smart Contract Module: automate the distribution of funds for specified milestones in projects. Analytics Module: Perception of project progression and how funds are being spent in the projects

B. Smart Contract Development

Smart contract would lay the structural foundation for this platform: they would render safe and automated funding services. The smart contract can be defined using Solidity as above:

Milestones: Funds will be released according to pre-defined achieved milestones in projects. Refund Mechanism: In case the project goes wrong or milestones are not met, investors can always claim their refunds.

Tokenization: Digital tokens will also be issued to investors who will be given extra functions like voting rights and rewards.

C. Frontend and Backend Development

The platform will be built by using the MERN Stack, MongoDB, Express.js, React.js, and Node.js for a robust yet scalable solution:

Frontend: The frontend would be developed using React.js so that the investor as well as the project owner can easily interact with the system

Backend: A Node.js backend will manage API calls, database operations, and interaction with the blockchain.

D. Blockchain

Blockchain integration will be provided to ensure transparency as well as security:

Immutable Ledger: All transactions, and movements of funds shall be on the blockchain. All this creates an auditable trail for investors.

Wallet Integration: Cryptocurrency transactions will be managed securely using MetaMask or a similar wallet.

Web3.js/Ethers.js: This is what connects the front-end to the blockchain network.

E. Data Flow Steps

1) User Registration and Authentication:

When a user-investor or project creator-signs up or logs in, the frontend requests his credentials and sends it to the backend through an API request.

The backend validates the credentials, contacts the database to store or retrieve user information, and responds back to the frontend to indicate successful authentication.

2) Investment Process:

An investor chooses a project and has decided to invest.

The frontend sends the investment details in terms of amount and project ID to the backend by making an API call.

The backend processes the request, communicates with the blockchain (smart contract) in order to trigger the transaction, and updates the database with the investment details.

The blockchain captures the transaction, and the smart contract releases funds based on set milestones.

The frontend retrieves the status of the transaction and updates the user interface with the progress.

3) Monitoring Milestones and Fund Release

The backend continuously monitors the project’s milestones.

As a milestone is completed, the backend sends a request to the smart contract to release the funds.

The blockchain verifies the milestone completion and releases funds, which are then reflected in the investor's dashboard.

4) Token Issuance and Refunds:

After an investment, the smart contract issues tokens to the investor as proof of their stake in the project.

If the project failed to meet its milestones, the investor can request the refund.

The backend requests the refund, interacts with the smart contract to cancel the transaction, and up-dates the database.

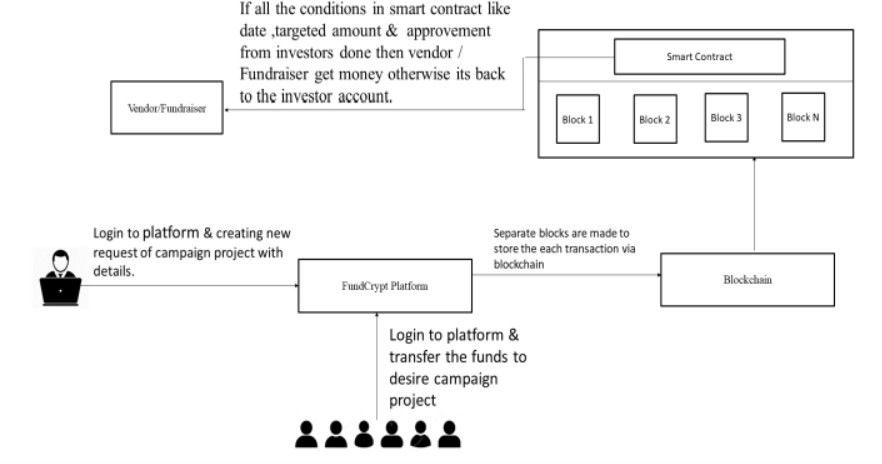

Figure 1: BlockFund System Architecture

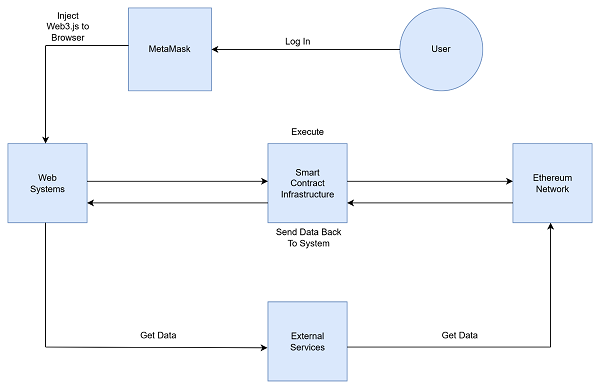

Figure 2: Data flow diagram for Communication between various services using Blockchain

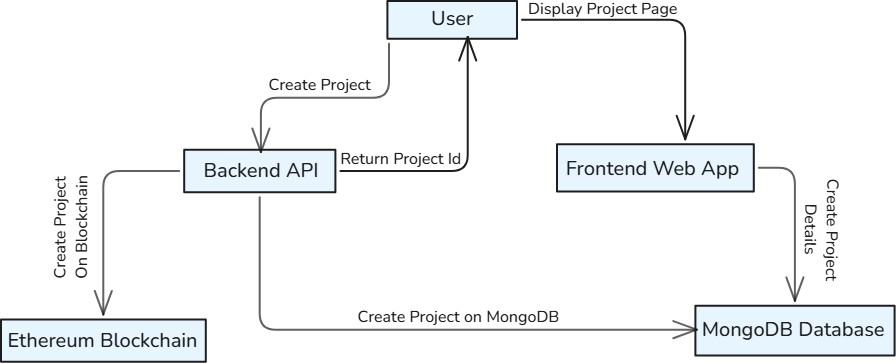

Figure 3: Data flow diagram for working of Solidity Contract methods in BlockFund using Blockchain

Conclusion

BlockFund offers a safe and modern investment management system, making use of blockchain technology and smart contracts to ensure that investments are accounted for and transparent. The platform removes inefficiencies in traditional systems such as high costs and mismanaged funds through the automation of transactions and milestone-based releases of funds. This means money will only be used once all conditions are met, so investors have more control over the process and more trust in it. BlockFund draws insights from existing research and incorporates the best practices that prioritize security, scalability, and trust. The features include rigorous testing and auditing, which protect the smart contracts from vulnerabilities like faulty code or attacks. Tokenization is also supported on the platform, which helps to have digital representations of investment stakes, aligning with emerging trends in decentralized finance. Combining decentralized technology with user-friendly functionality, BlockFund addresses problems such as a lack of transparency while providing a vision for the future of investment management. Its adaptive and scalable design ensures it can meet diverse funding needs, bridging the gap between innovation and practicality, while setting a benchmark for decentralized investment platforms.

References

[1] T. M. Hewa et al. (2021), \"Survey on Blockchain-Based Smart Contracts: Technical Aspects and Future Research\", IEEE Access, vol. 9, pp. 87643-87662 DOI: 10.1109/ACCESS.2021.3068178. Key focus: Presents the security and scalability aspect of blockchain-based smart contracts. [2] A. Kumar et al. (2024), \"Smart Contract Security in Blockchain Ecosystems\", Proceedings of the Blockchain Ecosystems Conference, 2024. Key focus: The authors describe the importance of smart contract security and the current vulnerabilities in decentralized finance ecosystems. [3] Y. Zhu (2021), \"Research on Digital Finance Based on Blockchain Technology\", International Conference on Computer, Blockchain and Financial Development (CBFD), Nanjing, China, 2021, pp. 410-414.DOI: 10.1109/CBFD52659.2021.00089. Key emphasis: This paper explores the ways blockchain technology is altering digital finance and asset management. [4] K. Saini, A. Roy, P. R. Chelliah, and T. Patel (2021), \"Blockchain 2.O: A Smart Contract\", 2021 International Conference on Computational Performance Evaluation (ComPE), Shillong, India, 2021, pp. 524-528.DOI: 10.1109/ComPE53109.2021.9752021. Key focus: Introduces Blockchain 2.O and evaluates its application for performance enhancement in blockchain systems. [5] T. M. Hewa, Y. Hu, M. Liyanage, S. S. Kanhare, and M. Ylianttila (2021), \"Survey on Blockchain-Based Smart Contracts: Technical Aspects and Future Research\", in IEEE Access, vol. 9, pp. 87643-87662.DOI: 10.1109/ACCESS.2021.3068178. Key focus: Provides a survey of smart contract technologies, looking at security concerns, scalability, and privacy issues

Copyright

Copyright © 2025 Ajeet Kumar, Gurman Singh Sambhi, Suyash Dixit, Harsh Verma. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET66308

Publish Date : 2025-01-07

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online