Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- References

- Copyright

Performance Evaluation of Select RRBs in Maharashtra State: A Comparative Study Using Capital Adequacy Ratio’s of Camel Model

Authors: Suneet Kopra

DOI Link: https://doi.org/10.22214/ijraset.2024.65106

Certificate: View Certificate

Abstract

The performance evaluation of Vidharbha Konkan Gramin Bank (VKGB) and Maharashtra Gramin Bank (MGB) operating in Maharashtra state is carried out. A comparative evaluation is also performed between them by using Capital Adequacy of CAMEL Model Hence, this chapter embodies different ratios under Capital Adequacy of CAMEL model. The banking sector is a critical component of the financial system and cornerstone of the global economic system. Banks are one of the oldest financial institutions in the financial system, which play a vital role in the mobilization of deposits and the disbursement of credit among the different sectors of the economy. A sound banking system acts as a fuel injection that stimulates economic productivity and industrial development by mobilizing savings and investing them in high return endeavors. Various research reports show that countries with a well-developed banking system have high GDP rate and higher economic growth. In the recent past, banking regulators and policy makers have proposed banking regulation by using the CAMEL (Capital adequacy, Asset quality, Management efficiency, Earnings and Liquidity) rating model to evaluate and assess the performance and financial soundness of the bank. CAMEL rating system is an important internal supervisory method to assess and distinguish financial institutions. The Federal Financial Institutions Oversight Board of USA was introduced CAMEL model for the first time in 1979. Regulations of the banking sector always monitors the performance of the banks to ensure efficient financial system based on CAMEL ratios.

Introduction

I. INTRODUCTION

The Narsimham Committee was set up by the Government of India to propose a range of reforms in the financial and banking sector that put more emphasis on improving the efficiency and profitability of banks. In India, the two supervisory frameworks were developed by the Padhmanabhan working group for evaluating bank performance in India. For India's commercial banks and foreign banks operating in India, the CAMELS (Capital Adequacy, Assets Quality, Management, Earnings, Liquidity, Systems and Controls) and CAES (Capital Adequacy, Assets Quality, Enforcement, System and Control) rating models are used. Even after accounting for a wide range of publicly available information on the status and performance of banks, the CAMEL technique is favourable. The CAMEL approach is also used as a loss predicting model by banks. The ranking will be based on both quantitative and qualitative information about the banks.

The CAMEL model is very common among the regulators due to its greater effectiveness. This model is highly consistent with the evaluation of the bank’s results. The role of banks is more predominant in developing countries, as financial markets are generally underdeveloped. Moreover, the banks are traditionally, the only major sources of finance and function as custodians of economic savings. The strength of CAMEL factors will decide the bank's overall strength. Besides, the internal strength of each component and how it can take care of itself against market risk reinforce the consistency of each component. The strong financial health of the bank also offers insurance to its creditors and the economy as a whole.

II. LITERATURE REVIEW

A number of studies have been conducted to see the functioning and performance of indigenous pastoral bank in the country. The literature available in the working and performance of RRBs in India is a little limited. The literature attained by investigators in the form of reports of colorful panels, commissions and working groups established by the Union Government, NABARD and Reserve Bank of India, the exploration studies, papers of experimenters, bank officers, economists and the commentary of profitable judges and news is compactly reviewed in this part. Some of the affiliated literatures of reviews are as follows.

NABARD( 1986) published a study on RRBs viability which was conducted by Agriculture Finance Corporation in 1986 on behalf of NABARD. The study revealed that viability of RRBs was basically dependent upon the fund operation strategy, periphery between coffers mobility and their deployment and on the control exercised on current and unborn costs with advances. The proportion of the establishment costs to total cost and expansion of branches were the critical factors, which affected their viability. The study further concluded that RRBs incurred losses due to blights in their systems as similar, there was need to amend these and make them feasible. The main suggestions of the study included enhancement in the structure installations and opening of branches by marketable banks in similar areas where RRBs were formerly in function.

Jasvir S. Sura( 2008) the study shows that the overall position of RRBs in India is n't relatively encouraging. The poor credit- deposit rate is still making dent on the improvable functioning of RRBs. Since the RRB is supposed to be a bank for poor people, its presence in all the countries of country especially in underdeveloped States can make effects more. The government should spread the branches of RRBs at lawn root position to give similar banking service to the indigent pastoral people. also, it's the responsibility of the bank operation and the patronized bank to take corrective measures to raise the credit- deposit rate of the bank that would make RRBs applicable in the pastoral India

In the year-1989 for the first time, the conceptualization of the entire structure of Regional Rural Banks was challenged by the Agricultural Credit Review Committee( Khusro Committee), which argued that these banks have no maintainable cause for continuance and recommended their combinations with guarantor banks. The Committee was of the view that “ the sins of RRBs are aboriginal to the system andnon-viability is erected into it, and the only option was to combine the RRBs with the guarantor banks. The ideal of serving the weaker sections effectively could be achieved only by tone- sustaining credit institutions. ”

Chauhan( 1991) studied the vacuity and acceptability of credit, its use by borrowers and impact on pastoral income and savings with specific reference to the operations of RRBs. Data were collected from four RRB branches aimlessly named in the Etawah quarter of Uttar Pradesh. Borrowers were divided into four orders small and borderline growers, landless labours and pastoral handworker and small dealers. Results for the time 1984/85 showed that the vacuity of credit per borrower was the loftiest for landless labour, still, it was set up that the demand for loans exceeded the force by about eight per cent for the other three orders of borrowers. Further, it was set up that 35 per cent of total loan were put to unproductive use to the critical consumption needs particularly in landless labour and a veritably little supernumerary income was within the sample ranging from 7 to 16 per cent for the average ménage. It was credit conditioning and schemes to encourage the rallying of saving among the pastoral poor.

The Committee on Financial Systems,( 1991)( Narasimham Committee) The study has shown stress on the poor fiscal health of the RRBs to the rejection of every other performance index. 172 of the 196 RRBs were recorded empty with an aggregate loan recovery performance of 40.8 percent.( June 1993). The low equity base of these banks( paid up capital of Rs. 25 lakhs) did n't cover for the loan losses of utmost RRBs. In the case of a many RRBs, there had also been an corrosion of public deposits, besides capital. In order to conduct viability to the operations of RRBs, the Narasimham Committee suggested that the RRBs should be permitted to engage in all types of banking business and should n't be forced to circumscribe their operations to the target groups, a offer which was readily accepted. This recommendation marked a major turning point in the functioning of RRBs.

Jai Prakash A. K.( 1996) conducted a study with the ideal of assaying the part of RRBs in Economic Development and revealed that RRBs have been playing a vital part in the field of pastoral development. also, RRBs were more effective in disbursal of loans to the pastoral borrowers as compared to the marketable banks. Support from the state Governments, original participation, and proper supervision of loans and opening civic branches were some way recommended to make RRBs further effective.

A. Objective Of The Study

To evaluate the Capital Adequacy ratio of 2 Regional Rural Banks in Maharashtra State using CAMEL Method on the below mentioned 5 parameters:

- CRAR

- Debt-Equity Ratio

- Total Advances to Total Assets

- Government Securities to Total Investment

- Asset Coverage Ratio

B. Hypothesis of the study

- Ho1- There is no significant difference in Capital Risk Adequacy Ratio between MGB and VKGB during the study period

- Ho2- There is no significant difference in banks in Debt Equity Ratio between MGB and VKGB during the study period.

- Ho3- There is no significant difference in banks in Debt Equity Ratio between MGB and VKGB during the study period.

- Ho4- There is no significant difference in banks in Government Securities to Total Investment Ratio between MGB and VKGB during the study period.

- Ho5- There is no significant difference in banks in asset coverage ratio between MGB and VKGB during the study period.

C. Problems Of The Study

- First and important problem of the research work is analysis of financial data.

- Data collection from respective regional rural bank, NABARD and RBI was problematic to be obtained.

D. Significance/ Importance Of The Study

- The research study is significant to evaluate the Capital Adequacy ratio of RRBs in Maharashtra State.

- The results/ findings of the present study are useful to the policy planners in their efforts to improve the working of the RRBs in Maharashtra , Sponsor Banks of these RRBs and NABARD.

E. Scope And Coverage Of The Study

- It covers only RRBs situated in Maharashtra State.

- The study covers a specific period of 2018-19 to 2022-23

- There is function evaluation of performance of 2 RRBs in Maharashtra State.

F. Area Of The Study

- Maharashtra State only.

G. Research Methodology

- CAMEL Method and Capital Adequacy ratio is to be studied.

- The study is based on secondary data collected from these 2 RRBs websites, their financial annual reports , reports published by Reserve Bank of India and the NABARD.

H. Scope And Coverage Of The Study

- The study covers the period of 5 years i.e. 2018-2019 to 2022-2023 of the 2 RRBs in Maharashtra state .

- CAMEL Method and Capital Adequacy ratio is to be studied to analyse the data.

III. DATA ANALYSIS

A. Camel Frame Work Of Performance Evaluation Of Rrbs Performance Evaluation Using Camel Model

Since the inception of CAMEL model, the researchers and policy makers have used it in different perspectives to measure the performance of banking sector in different time period in different countries.

The CAMEL ratios used to evaluate the performance of banks and financial institutions by scrutinizing its balance sheet as well as income statement on the basis of each component. CAMEL rating is a concise and indispensable tool to ensure banks healthy condition by analyzing various aspects such as financial statement, funding sources, macroeconomic data, information, budget and cash flow projection and business operations. The various components of the CAMEL rating model in the form of financial ratios are described as below:

1) Capital Adequacy

Capital adequacy is considered to be a primary indicator in evaluating the financial soundness of a bank. In order to survive, it is necessary to maintain the trust of the stakeholder and to avoid its bankruptcy. Capital is believed to be a shield that provides stakeholder security and improves the stability and productivity of the bank. Capital adequacy reflects the overall financial state of the bank. It represents whether the bank has adequate capital to absorb potential losses in the future. The capital adequacy of banks is measured by the following ratio:

Capital Risk Adequacy Ratio (CRAR)

This ratio is employed to gauge out bank’s ability to absorb fair amount of losses sustained during their operations and to recognize losses. The higher ratio shows that, banks are stronger and the investors are more secure. In India, banks are expected to maintain a CRAR of 9 %. C ratio (CRAR) is calculated by dividing tier assets.

Tier-1 capital includes shareholder equity perpetual non-cumalative preference shares, disclosed reserves and innovative capital instruments. Tier 2 capital includes undisclosed reserves, revaluation reserve of fixed assets and long-term holding of equity securities, general provisions/general loan loss reserves, hybrid debt capital instruments and subordinated debt.

CRAR = Capital / ????????????????????????????????????????????????????????????????? ???????????????????????? × 100

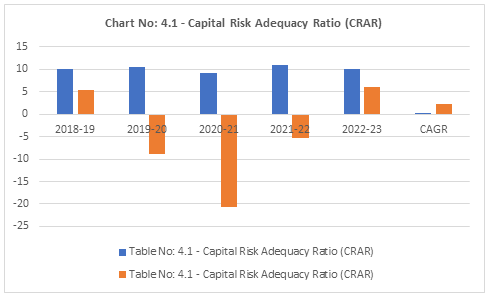

Table No: 4.1 - Capital Risk Adequacy Ratio (CRAR)

|

Table No: 4.1 - Capital Risk Adequacy Ratio (CRAR) |

||

|

Year |

MGB (%) |

VKGB (%) |

|

2018-19 |

10.14 |

5.37 |

|

2019-20 |

10.58 |

-8.81 |

|

2020-21 |

9.30 |

-20.80 |

|

2021-22 |

10.99 |

-5.24 |

|

2022-23 |

10.18 |

5.99 |

|

CAGR |

0.08 |

2.21 |

Table no 4.1 reveals the information regarding Capital Risk Adequacy Ratio of VKGB and MGB.

The CRAR of MGB was 10.14 % in 2018-19 which tends to decline in 2020-21 to 9.30 % and further increased to 10.99 % in 2021-22 and which tends to continuously increased in 2022-23 to 10.18 %.

Due to the growth of risk weighted assets and low growth of capital. The CRAR of VKGB was 5.27 % which declined to -20.80 % in 2020-21. It improved to 5.99 % in 2022-23 after constantly declining from 2019-20 to 2021-22 due to growth of risk weighted assets and low growth of capital. On the whole, one cannot fail to observe that the CRAR Ratio of VKGB regional rural bank is experiencing a decreasing trend during the study period.

|

Hypothesis |

Ho1- There is no significant difference in Capital Risk Adequacy Ratio between MGB and VKGB during the study period. |

|

Table No: 4.2 Average Level and Stability of CRAR of PKGB and KVGB |

||

|

Parameters |

MGB (%) |

VKGB (%) |

|

Sum |

51.19 |

-23.49 |

|

Average |

10.238 |

-4.698 |

|

variance |

0.315056 |

98.414936 |

|

SD |

0.561298495 |

9.920430233 |

|

SS |

1.58 |

492.07 |

|

CV |

6.13% |

-236.08% |

|

t-value |

0.0369 |

|

|

p-value |

0.9723 |

|

|

Result |

Accepted Your result is not statistically significant: there is not enough evidence to reject the null hypothesis. |

|

Table no 4.2 discloses the average and stability of CRAR of MGB and VKGB during the study period.

The average CRAR of MGB (10.23 %) is higher than the average ratio of VKGB (-4.69 %).

The CV of MGB is 6.13 % which is relatively more stable compared to the CV of VKGB (i.e. -236.08 %). Although, only MGB have maintained minimum level of 9 % and have performed above the bench mark level. Similarly, the outcome of hypothesis testing of CRAR reveals that there is no significant difference between MGB and VKGB as its significance value (i.e.0.97) is more than (0.05) at 5 level of significance. Hence, there is no refusal of null hypothesis.

2) Debt Equity Ratio

The debt-equity ratio reflects the bank's degree of leverage and the proportion of scope and equity in overall structure of the bank's fund. It is determined by dividing the bank's total borrowings with the shareholdersnet worth. The net worth includes equity capital and surplus capital. Lower debt equity ratio protects the depositors and creditors interest and vice versa.

???????????? = ???????????????????????????????????????? / ????????????????????????????? × 100

|

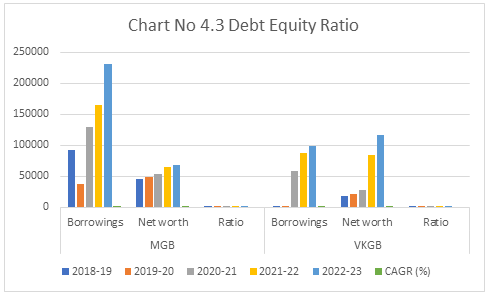

Table No: 4.3 Debt Equity Ratio (Rs. In Lakhs) |

||||||

|

Year |

MGB |

VKGB |

||||

|

Borrowings |

Net worth |

Ratio |

Borrowings |

Net worth |

Ratio |

|

|

2018-19 |

92021.62 |

45481.43 |

202.33 |

2422.63 |

18539.87 |

13.07 |

|

2019-20 |

37190.48 |

48200.65 |

77.16 |

855.69 |

22065.15 |

3.88 |

|

2020-21 |

129,857 |

53,564 |

242.43 |

58,017 |

27,298 |

212.54 |

|

2021-22 |

164,667 |

64,405 |

255.67 |

87,970 |

84,812 |

103.72 |

|

2022-23 |

231182.09 |

68211.18 |

338.92 |

99495.14 |

116202.8 |

85.62 |

|

CAGR (%) |

20.23 |

8.44 |

|

110.23 |

44.35 |

|

Table no 4.3provides the information pertaining to debt equity ratio of MGB and VKGB during the period 2018-19 to 2022-23.

The debt equity ratio of MGB in the initial period from 2018-19 to 2022-23 shows an increasing trend from 202.22 % to 338.92 % due to increase in borrowings and net worth.

The debt equity ratio of VKGB has shown persistent declining and increasing trend during the entire study period due to decline in borrowings, revealing some part of repayment of borrowings and increase in net worth. It clearly reveals that there is a fluctuating trend in average debt equity ratio of VKGB during the study period.

It is clear from the table that the MGB has experienced 20.23 % of compound annual growth rate in borrowings whereas VKGB has registered a high growth rate of 110.23 % in borrowings during the study period. Furthermore, MGB has recorded lower compound annual growth rate in net worth (i.e., 8.44 %) as compared to the VKGB (i.e. 44.35 %) during the period under consideration.

|

Hypothesis |

Ho2- There is no significant difference in banks in Debt Equity Ratio between MGB and VKGB during the study period. |

|

Table No: 4.4 Average Level and Stability of Debt Equity Ratio of PKGB and KVGB |

||||||

|

|

MGB |

VKGB |

||||

|

Parameters |

Borrowings |

Net worth |

Ratio |

Borrowings |

Net worth |

Ratio |

|

Average |

130983.48 |

55972.47 |

234.01 |

49752.14 |

53783.53 |

92.50 |

|

variance |

4298152661 |

79431483.76 |

1726844824 |

1561717143 |

||

|

SD |

73298.64137 |

9964.40 |

735.60 |

46460.26 |

44183.10 |

105.15 |

|

CV |

55.96 |

17.8 |

3.14 |

93.38 |

82.15 |

1.13 |

|

t-value |

2.1045 |

|||||

|

p-value |

0.17 |

|||||

|

Result |

Accepted |

This difference is considered to be not statistically significant. |

||||

The average debt-equity ratio of MGB is 234.01 % which is more than the average ratio of VKGB is 92.50 %. The CV of VKGB is 1.13 %, which is relatively more stable when compared to the CV of MGB is 3.14 %.

The inference is that, both the banks depend on debt capital compared to equity capital. But MGB is more reliant on debt capital compared to VKGB. Furthermore, the result of hypothesis testing of debt equity ratio discloses that there is no significant difference between MGB and VKGB as its significance value (i.e, 0.17) is greater than (0.05) at5% level of significance. Hence, the researcher fails to reject null hypothesis.

3) Total Advances to Total Assets Ratio

This ratio shows the relationship between gross advances and total assets and bank’s aggressiveness in lending. It eventually creates greater profitability. Usually, higher ratio is preferred.

???????????????????????????????????????????????????? ???????? ???????????????????????????????????????????????????????????????? = ???????????????????????????????????????????????????? / ???????????????????????????????????????????? × 100.

|

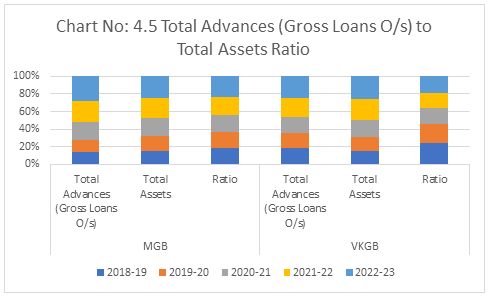

Table No: 4.5 Total Advances (Gross Loans O/s) to Total Assets Ratio (Rs in Lakhs) |

||||||

|

Year |

MGB |

VKGB |

||||

|

Total Advances (Gross Loans O/s) |

Total |

Ratio |

Total Advances (Gross Loans O/s) |

Total |

Ratio |

|

|

2018-19 |

465468.9 |

1154245.08 |

40.33 |

272346.62 |

441548.21 |

61.68 |

|

2019-20 |

505792.32 |

1250026.4 |

40.46 |

259979.03 |

476112.79 |

54.60 |

|

2020-21 |

698,342 |

1,575,808 |

44.32 |

282,327 |

581,922 |

48.52 |

|

2021-22 |

802,896 |

1731071.23 |

46.38 |

321,241 |

735,841 |

43.66 |

|

2022-23 |

970075.79 |

1891047.87 |

51.30 |

368605.96 |

773,386 |

47.66 |

|

CAGR (%) |

15.82 |

10.38 |

152.41 |

6.24 |

11.86 |

52.61 |

Table no 4.5 discloses the ratio of total advances to total assets of MBG and KVGB.

The ratio of VKGB has experienced gyrations. It may be because of mismatch between growth rate of total assets and growth rate of advances during the study period.

It is clear from the above table that this ratio pertaining to MGB has recorded continuous increase from year to year during the study period. This may probably due to higher growth rate in total advances than total assets during the study period.

It is evident from the table that higher growth rate of advances (i.e., 15.82 %) of MGB than the VKGB (i.e. 6.24 %) during the study period. Further the total assets of VKGB has experienced high compound annual g (i.e. 11.86 %) when compared with 10.38 % of MGB.

|

Hypothesis |

Ho3- There is no significant difference in banks in Debt Equity Ratio between MGB and VKGB during the study period. |

|

Table No: 4.6 |

||||||

|

MGB |

VKGB |

|||||

|

Parameters |

Borrowings |

Net worth |

Ratio |

Borrowings |

Net worth |

Ratio |

|

Average |

688514.98 |

1520439.71 |

45.28 |

300899.91 |

601762.12 |

50.00 |

|

SD |

209519.21 |

313050.93 |

66.92 |

44251.07 |

44183.10 |

100.15 |

|

CV |

|

|

10.25 |

|

|

13.73 |

|

t-value |

0.4588 |

|||||

|

p-value |

0.6914 |

|||||

|

Result |

Accepted |

This difference is considered to be not statistically significant. |

||||

Table no 4.6 portrays the average level and stability of MGB and VKGB during the study period.

The average ratio of VKGB is 50.00 % and is more than the average ratio of MGB i.e. 45.28 %. The CV of MGB is 10.25 % and the CV of VKGB is 13.72 %, which has greater volatility compared to MGB. The outcome of hypothesis testing for total advances to total assets ratio exposes that, there is no significant difference between MGB and VKGB as its ascertained significance value (i.e, 0.001) is less than 0.05 at 5% level of significance. Hence, there is refusal of null hypothesis.

4) Government Securities to Total Investment

It is determined by dividing the investment in government securities by the total investment of the banks. Government securities are considered to be the most safe and non-volatile debt instruments. It means higher the investment in government securities will result in lower risk and vice versa.

???????????????????????????????????????? ???????????????????????????????????????? ???????? ???????????????????? ???????????????????????????????????????? = Government Securities / ???????????????? ???????????????????????????????????????? × 100.

|

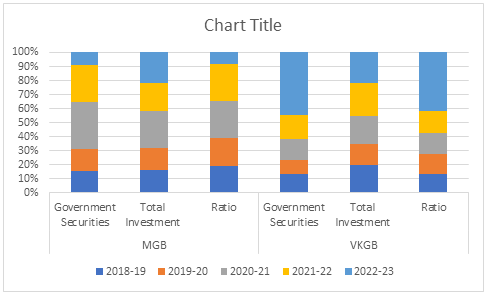

Table No: 4.7 - Government Securities to Total Investment (Rs in Lakhs) |

||||||

|

Year |

MGB |

VKGB |

||||

|

Government Securities |

Total Investment |

Ratio |

Government Securities |

Total Investment |

Ratio |

|

|

2018-19 |

250,169.62 |

394,278.36 |

63.45 |

113,241.41 |

126,639.91 |

89.42 |

|

2019-20 |

240,392.53 |

371,376.79 |

64.73 |

86,565.98 |

95,315.98 |

90.82 |

|

2020-21 |

540,887.43 |

632,141.78 |

85.56 |

131,955.86 |

131,990.26 |

99.97 |

|

2021-22 |

419,776.01 |

483,329.90 |

86.85 |

150,750.94 |

150,850.94 |

99.93 |

|

2022-23 |

140,472.60 |

516,039.20 |

27.22 |

388,165.32 |

141,072.60 |

275.15 |

|

CAGR (%) |

(10.90) |

5.53 |

-197.1066908 |

27.94 |

2.18 |

1281.65 |

It is evident from the table that government securities to total investment of MGB has experiencing oscillation trend throughout the study period due to variations in proportion of Government securities to total investment.

The VKGB has witnessed slight variability in the ratio of Government securities to Total Investment due to mismatch between SLR requirements to total investments.

On the whole, MGB has reported an negative annual growth of 10.90 % in Government securities and 5.53 % in total investment during the study under review. Whereas, VKGB has experienced an positive annual growth rate of 27.94 % in Government securities and 2.18 % in total investment during the study period.

|

Hypothesis |

Ho4- There is no significant difference in banks in Government Securities to Total Investment Ratio between MGB and VKGB during the study period. |

|

Table No: 4.8 |

||||||

|

|

MGB |

VKGB |

||||

|

Parameters |

Borrowings |

Net worth |

Ratio |

Borrowings |

Net worth |

Ratio |

|

Average |

318339.63 |

479433.20 |

66.39 |

174135.90 |

129173.93 |

134.80 |

|

SD |

159825.25 |

104406.21 |

153.08 |

121974.62 |

21048.66 |

579.48 |

|

CV |

50.2 |

21.77 |

2.30 |

70.04 |

16.29 |

4.29 |

|

t-value |

2.2126 |

|

|

|

|

|

|

p-value |

0.1574 |

|

|

|

|

|

|

Result |

Accepted |

This difference is considered to be not statistically significant. |

||||

Table no 4.8 displays the average level and stability of government securities to total investment ratio of MGB and VKGB.

The average government securities to total investment ratio of VKGB is 134.80 %, which is higher than the average ratio of MGB i.e. 66.39 %. The CV of MGB is 2.30 % and is more stable than the CV of VKGB i.e. 4.3 %.

It can be inferred that average ratio of VKGB is more, because of high proportion of investments made by the bank in government securities compared to MGB. Moreover, the result of hypothesis testing of Government securities to total investment ratio shows that, there is no significant difference between banks as its significance value(i.e. 0.15) is greater than 0.05 at5% level of significance. Therefore, there is acceptance of null hypothesis.

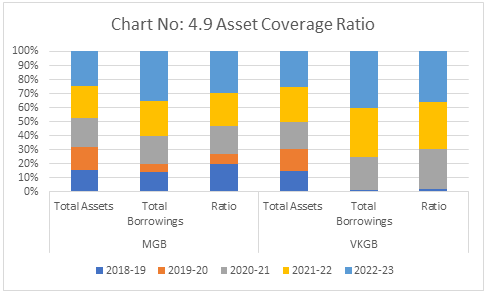

5) Asset Coverage Ratio

Asset Coverage Ratio measures a company's ability to cover its assets. The ratio shows how much of the company's assets will require to cover its outstanding debts. It provides a snapshot of a company's financial position by measuring its tangible and monetary assets against its financial obligations. This ratio allows the investors to reasonably predict the future earnings of the bank and to assess the risk of insolvency.

Asset Coverage Ratio = Total Borrowings / Total Assets.

|

Table No: 4.9 Asset Coverage Ratio (rs in Lakhs) |

||||||

|

Year |

MGB |

VKGB |

||||

|

Total Assets |

Total Borrowings |

Ratio |

Total Assets |

Total Borrowings |

Ratio |

|

|

2018-19 |

1,154,245.08 |

92,021.62 |

7.97 |

441,548.21 |

2,422.63 |

0.55 |

|

2019-20 |

1,250,026.40 |

37,190.48 |

2.98 |

476,112.79 |

855.69 |

0.18 |

|

2020-21 |

1,575,808.00 |

129,856.69 |

8.24 |

581,922.17 |

58,016.91 |

9.97 |

|

2021-22 |

1,731,071.23 |

164,666.54 |

9.51 |

735,840.94 |

87,970.34 |

11.96 |

|

2022-23 |

1,891,047.87 |

231,182.09 |

12.23 |

773,386.49 |

99,495.14 |

12.86 |

|

CAGR (%) |

10.38 |

20.23 |

|

11.86 |

10.76 |

|

The asset coverage ratio of both the Banks have been found fluctuating over the study period. The annual compounded growth of total assets of VKGB is more than MGB over the study period. The annual compounded growth of total borrowing of VKGB is more over MGB over the study period.

|

Hypothesis |

Ho5- There is no significant difference in banks in asset coverage ratio between MGB and VKGB during the study period. |

|

Table No: 4.10 - |

||||||

|

MGB |

VKGB |

|||||

|

Parameters |

Borrowings |

Net worth |

Ratio |

Borrowings |

Net worth |

Ratio |

|

Average |

1520439.71 |

130983.48 |

8.61 |

601762.12 |

49752.14 |

8.27 |

|

SD |

313050.93 |

73298.58 |

23.41 |

149400.40 |

46460.32 |

31.09 |

|

CV |

20.58 |

55.96 |

2.71 |

24.82 |

93.38 |

3.76 |

|

t-value |

1.1068 |

|||||

|

p-value |

0.3837 |

|||||

|

Result |

Accepted |

this difference is considered to be not statistically significant. |

||||

Table no 4.10 reveals the asset coverage ratio for the 2 RRBs in the study period.

The asset ratio has experienced the fluctuations during the study period in the growth of asset and borrowings. The performance of MGB is more stable than VKGB. It is clear from the table that CV ratio of MGB is better than VKGB. The average ratio of VKGB in regards to Borrowings and net worth is slightly better than MGB.

The outcome of hypothesis testing of asset coverage ratio reveals that there is no significant difference between MGB and VKGB as its significance value (i.e, 0.38) is greater than 0.05 at5% level of significance. Hence, there is an acceptance of null hypothesis.

IV. SUMMARY OF CAMEL RATIOS

On the basis of CRAR analysis of the CAMEL Model Rating system, the final and overall analysis has been made to evaluate the performance of the banks on the basis of of capital adequacy ratio.

Table No: 4.47 : Composite Capital Adequacy Ratio (CCAR).

|

SL No |

Criteria |

Ratio |

Inference |

||

|

MGB |

VKGB |

MGB |

VKGB |

||

|

1 |

Capital Risk Adequacy Ratio |

10.238 |

-4.698 |

Better Performance. |

|

|

2 |

Debt Equity Ratio |

234.01

|

92.50 |

|

Better Performance |

|

3 |

Total Advances to Total Assets Ratio |

45.28 |

50.00 |

|

Better Performance |

|

4 |

Government Securities to Total Investment Ratio |

66.39 |

134.80 |

|

Better performance |

|

5 |

Asset Coverage Ratio |

8.61 |

8.27 |

Better Performance. |

|

|

Overall performance of banks in CCAR |

On the basis of average ratio of composite capital adequacy, VKGB performing better due to its better performance in Debt Equity ratio, Total Advances to Total Assets ratio and Government Securities to total investment ratio compared to MGB. |

||||

V. SUMMARY OF FINDINGS

- Research Findings based on CAMEL Approach - Capital Adequacy

- It is found that MGB has maintained higher average ratio of Capital Risk Adequacy Ratio (i.e. 10.23 %) as compared to VKGB (i.e. -4.68 %). However, the MGB has maintained the stability in the ratio relatively as its CV is 6.13 % as compared to the CV of VKGB (i.e. -2.36 %). The ascertained p-value of t-test in relation to Capital Risk Adequacy Ratio of MGB and VKGB Banks during the study period has favoured the acceptance of null hypothesis. Only MGB was able to maintain minimum level of 9% during the study period and have performed above the bench mark level.

- It is found that the net worth of MGB have gone up from Rs. 45481.43 lakh to Rs. 68211.18 lakh with an annual growth rate of 8.44 % during the study period whereas its borrowings increased from Rs. 92021.62 lakh to Rs. 231182.09 lakh with an annual growth rate of 20.23 % during the same period. On the other hand, the net worth of VKGB have gone up from Rs. 18539.87 lakh to Rs. 116202.8 lakh with an annual growth rate of 44.35 % during the period where as its borrowings increased from Rs. 2422.63 lakh to Rs. 99495.14 lakh during the study period. This resulted to maintain the high ratio of leverage. It is also noticed that, the average debt-equity ratio of MGB is 234.01 % which is more than the average ratio of VKGB i.e. 92.50 % during the study period. Thus, it can be inferred that both the banks depend on debt funds compared to equity funds. But VKGB is more reliant on debt fund compared to MGB. It is also observed that the VKGB has consistency in the ratio as its CV is 113.67 %, which is relatively more stable when compared to the CV of MGB (i.e. 314.38 %). The results of t-test indicated that there is no significant difference between MGB and VKGB in relation to Debt-equity Ratio as its p-value is 0.17 which is more than 0.05

- It is observed that total amount of total advances of MGB increased from Rs. 465468.9 lakh to Rs. 970075.79 lakh with an annual growth rate of 15.82 %. On the other hand the amount of advances of VKGB increased from Rs. 272346.62 lakh to Rs. 368605.96 lakh at an annual growth rate of 6.24 % during the period of the study. It reveals that the growth rate of total advances of VKGB relatively less. Whereas its total assets decreased from Rs. 441548.21 lakh to Rs.773,386 lakh at an annual growth rate of 11.86 % during the study period. Besides, the total assets of MGB increased from 1154245.08 lakh to Rs. 1891047.87 lakh with an annual growth rate of 10.38 %. It indicates that the MGB has good asset base compared to VKGB during the study period. It is also observed from the present study that, the VKGB has higher average ratio (i.e., 50.00 %) of total advances to total assets ratio as compared to MGB (i.e. 45.28 %). It indicates that VKGB has utilized its assets in high yielding advances. VKGB has greater volatility in the ratio as its CV is 13.73 % which is more as compared to MGB (i.e. 10.25 %). The results of hypothesis testing reveals that there is a no significant difference between two banks under study in terms of total advances to total assets as its p-value (i.e, 0.69) is more than 0.05.

- It is noticed that the amount of Government securities of MGB have reduced from Rs. 250169.61 lakh to Rs.140,472.60 lakh thus registering negative annual growth of 10.90 %. Likewise, Government securities of VKGB increased from Rs. 113241.40 lakh to Rs. 388165.32 lakh during the study period thus registering annual growth of 27.94 %. Whereas, the total investment of MGB increased from Rs. 394278.36 lakh to Rs. 516039.2 lakh with an annual growth rate of 5.53 %. Moreover, the total investment of VKGB increased from Rs. 126639.91 lakh to Rs. 141072.6 % at an annual growth rate of 2.18 %. It indicates that VKGB has registered relatively minimum growth rate compared to the MGB in relation to Government securities and total investment. It is also evident from the present study that, VKGB has higher average ratio (i.e. 134.80 %) of Government securities to total investment as compared to MGB (i.e. 66.93 %). It shows VKGB has diverted its major portion of investments in to SLR securities as measure of safety and consistent return. It is also found that, VKGB has shown greater consistency in the ratio as its CV is 4.29 % which is less as compared to MGB (i.e. 2.30 %). The outcome of t-test adopted to verify the hypothesis styled as there is no significant difference between MGB and VKGB as far as their government securities are concerned as its p-value (0.15) is higher than 0.05 has favoured the acceptance of null hypothesis.

- It is observed that, the average asset coverage ratio of MGB (i.e. 8.61) is more as compared to the average ratio of VKGB (i.e. 8.27). It indicates that MGB is considered to be less risky and the bank can cover its debt. It is also noticed that, MGB has greater stability in the ratio as its CV is 2.71 % which less than the CV of VKGB (i.e. 3.76 %). The ascertained p-value of t-test (0.383) in relation to asset coverage ratio of MGB and VKGB reveals that there is no significant difference between banks in terms of Assets Coverage ratio.

References

[1] Government of India Report of the Committee on Rural Banks, (Chairman-M, Narasimhan), New Delhi, 1975. [2] Government of India. Parliament of India (Loksabha), (2004). Motion for consideration of ‘The Regional Rural Banks (Amendment) Bill, 2004. [3] Gupta, R.V. (1998). Report of the High-Level Committee on Agricultural Credit through Commercial Banks. ReserveBank of India, Mumbai. [4] IBA (Indian Banks’ Association), (1999). Performance Highlights of Banks, 1997-98, Indian Banks Association,Mumbai. [5] Karam Pal and Jasvir Singh. (2006). “Efficacy of Regional Rural Banks (RRBs) In India: A Conventional Analysis”,JIMS-8M, Indian Journals.com. [6] Khankhoje, Dilip and Dr. Milind Sathye, 2008. “Efficiency of Rural Banks: The Case of India”, International Business Research-CCSE, Vol-1, No.2. [7] Mester, L.J. (1996). “A Study of Bank Efficiency taking into account Risk Preferences”, Journal of Banking and Finance, Vol.20, No.6, 1025-45.

Copyright

Copyright © 2024 Suneet Kopra. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65106

Publish Date : 2024-11-09

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online