Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

CrowdInnovate: An Approach for Crowding using Block Chain

Authors: K. Prathyusha, Bandaru Kranthi Kumar Varma, B. Vishal Reddy, B. Varshitha

DOI Link: https://doi.org/10.22214/ijraset.2024.65568

Certificate: View Certificate

Abstract

Crowdfunding has emerged as a transformative method for raising capital, enabling individuals and organizations to fund projects through the collective contributions of a large number of people, typically via online platforms. This paper provides a comprehensive analysis of crowdfunding, focusing on its various models—donation-based, reward-based, equity-based, and debt-based—and their impact on the financing landscape. The study investigates key success factors, including campaign design, social influence, marketing strategies, and the role of digital platforms in facilitating engagement and trust. Through a combination of case studies, statistical analysis, and surveys, the research identifies the determinants of success and failure in crowdfunding campaigns, examining both the opportunities and challenges faced by entrepreneurs and backers. Furthermore, the paper explores the integration of emerging technologies such as block chain, analyzing how they enhance transparency, security, and accountability in crowdfunding processes. The findings indicate that successful crowdfunding campaigns are often characterized by clear communication, strong community support, and innovative reward structures, while challenges like fraud, platform fees, and regulatory concerns remain significant barriers. This research offers insights into the evolving dynamics of crowdfunding, providing valuable recommendations for practitioners, investors, and policymakers aiming to optimize the effectiveness and sustainability of crowdfunding platforms.

Introduction

I. INTRODUCTION

Crowdfunding, a practice in which individuals or organizations raise funds from a large group of people, has evolved significantly over the last two decades, largely due to the rise of digital platforms and social media. Initially emerging as a niche funding model for creative projects and personal causes, crowdfunding has now become a mainstream method for financing a wide range of ventures, from startups and social enterprises to humanitarian efforts and scientific research. Platforms such as Kickstarter, Indiegogo, GoFundMe, and Patreon have facilitated millions of projects, generating billions of dollars globally, and democratizing access to capital in ways previously unimaginable.

Traditionally, businesses and projects seeking funding were reliant on a few major sources: personal savings, bank loans, venture capital, or government grants. Crowdfunding disrupts this model by enabling individuals to solicit smaller amounts of money from a large, diverse pool of backers. This process not only provides a financial resource for project creators but also creates a sense of community and ownership among backers, who often receive early access to products, rewards, or a stake in the project’s success. Crowdfunding's ability to tap into global networks has made it especially attractive to entrepreneurs, artists, and social innovators who might otherwise struggle to secure traditional funding.

However, despite its rapid growth, crowdfunding is not without its challenges. Many campaigns fail to reach their funding goals, while others are hindered by issues related to transparency, fraud, and trust. Backers often face uncertainty about whether their contributions will result in tangible outcomes, and creators may struggle with managing the expectations of a large, diverse group of supporters. Additionally, the variety of crowdfunding models—donation-based, reward-based, equity-based, and debt-based—each come with their own set of complexities, impacting the strategies needed to ensure success. Furthermore, the lack of standard regulations and varying fee structures across platforms pose significant obstacles for both creators and investors.

This paper aims to explore the multifaceted landscape of crowdfunding, focusing on the different models and the factors that influence the success or failure of crowdfunding campaigns. By analyzing the dynamics of crowdfunding platforms, we examine how elements like campaign design, social media engagement, marketing strategies, and community involvement can impact funding outcomes. Additionally, the study will address the challenges that often impede crowdfunding success, such as issues of fraud, the lack of legal frameworks, and platform fees.

One of the key areas of focus in this research is the potential for emerging technologies, particularly block chain, to address some of these challenges. block chain offers the promise of increased transparency and security, which could improve trust among backers and creators and reduce risks associated with fraud. Through the decentralized nature of block chain, crowdfunding campaigns could benefit from tamper-proof records of financial transactions, ensuring that funds are used appropriately and reducing the chances of mismanagement or deceit. This paper will explore how block chain could reshape the future of crowdfunding, offering innovative solutions to some of the existing limitations.

Ultimately, this research seeks to provide a deeper understanding of crowdfunding's role in modern finance and its potential to drive innovation. By offering insights into the factors that make crowdfunding campaigns successful and identifying the challenges that hinder their effectiveness, this study will contribute valuable recommendations for both creators and backers, as well as policymakers and platform developers aiming to enhance the crowdfunding ecosystem.

The paper is organized as follows: Section 2 provides a review of the existing literature on crowdfunding, Section 3 outlines the methodology used in this research, Section 4 presents the findings, and Section 5 discusses the implications of these findings for crowdfunding practices, entrepreneurs, and policymakers.

II. LITERATURE REVIEW

Crowdfunding has garnered considerable attention in recent years, emerging as a significant tool for financing projects across various domains. The concept of crowdfunding, which involves pooling small contributions from a large number of people to support a specific project, is not new, but its rapid adoption in the digital age has created new opportunities and challenges for entrepreneurs, investors, and the general public. This literature review examines the existing body of research on crowdfunding, focusing on its different models, the factors influencing its success, and the emerging technologies, such as block chain, that are reshaping the crowdfunding landscape.

A. Crowdfunding Models

One of the most fundamental aspects of crowdfunding is the variety of models it encompasses. These models have been classified into four primary types: donation-based, reward-based, equity-based, and debt-based crowdfunding. Donation-based crowdfunding is typically used for charitable or social causes, where backers contribute without expecting financial returns . Reward-based crowdfunding, on the other hand, allows backers to receive non-financial rewards such as products, experiences, or acknowledgments in exchange for their contributions. Equity-based crowdfunding involves offering equity or shares in a company in exchange for capital, while debt-based crowdfunding, also known as peer-to-peer lending, enables backers to lend money to individuals or businesses in exchange for interest payments.

Research has shown that the success of crowdfunding campaigns varies significantly across these models. For instance, reward-based crowdfunding tends to attract creative and entrepreneurial projects, where backers are motivated by the desire to support new ideas or receive early access to products . Equity-based crowdfunding, however, has been more complex due to regulatory hurdles and concerns over the valuation of early-stage ventures . As crowdfunding continues to evolve, hybrid models that combine elements from multiple crowdfunding types are also emerging, reflecting the growing diversification of the crowdfunding landscape .

B. Challenges in Crowdfunding

While crowdfunding offers numerous advantages, it is not without its challenges. One major issue is the risk of fraud and mismanagement. Crowdfunding platforms are often criticized for lacking sufficient safeguards to prevent fraudulent campaigns, where creators fail to deliver on their promises or misappropriate funds. Backers may also encounter difficulties in holding project creators accountable, especially in cases where platforms do not provide clear guidelines or enforceable regulations. This problem is particularly prevalent in donation-based crowdfunding, where the absence of financial returns leaves backers with limited recourse if a project fails .

Another challenge is the lack of regulatory clarity surrounding crowdfunding, particularly for equity-based and debt-based models. The legal frameworks governing crowdfunding vary significantly across regions, creating confusion and uncertainty for both project creators and investors . In the United States, the JOBS Act of 2012 facilitated the growth of equity crowdfunding but also introduced complex legal requirements that many small businesses and startups struggle to navigate. In Europe, different countries have taken varied approaches to regulation, with some imposing strict rules while others have adopted more relaxed frameworks .

C. The Role of block chain in Crowdfunding

Emerging technologies such as block chain are increasingly being explored as solutions to some of the challenges in crowdfunding. block chain technology offers decentralized, tamper-proof records of transactions, which could address issues related to transparency, trust, and fraud. block chain-enabled crowdfunding platforms allow investors to track the flow of funds in real-time, providing a level of accountability that is often lacking in traditional crowdfunding models . Furthermore, the use of block chain can help reduce platform fees by eliminating intermediaries and facilitating peer-to-peer transactions

III. CROWD FUNDING MODELS

A. Donation-Based Crowdfunding

Donation-based crowdfunding involves individuals contributing money to a cause or project without expecting anything in return, except perhaps a sense of fulfillment from supporting a meaningful initiative. This model is commonly used for charitable causes, medical expenses, community projects, and social good campaigns. The contributors, also known as backers, donate funds to help individuals or organizations that need financial support.

Examples: GoFundMe: A platform used for medical, personal, or charitable causes where donors do not expect any financial reward.

B. Reward-Based Crowdfunding

Reward-based crowdfunding is the most popular form and often used for creative projects, product launches, or artistic endeavors. Backers pledge money in exchange for non-financial rewards, which could include products, services, or experiences. The rewards are typically tiered, meaning that backers who contribute larger amounts receive more valuable or exclusive rewards. This model is particularly popular for funding new product prototypes, films, music albums, or other creative projects.

Examples: Kickstarter: One of the most widely known platforms for creative projects. Entrepreneurs or creators seek funding for their ideas and offer rewards such as early product access, special edition items, or acknowledgment in the project.

C. Equity-Based Crowdfunding

Equity-based crowdfunding allows backers to invest in a company or project in exchange for equity (ownership) in that venture. This model is more akin to traditional investment but democratizes the process by making it accessible to the general public, not just accredited investors. Investors receive shares or a stake in the company, and their returns are tied to the company’s performance. This model is often used by startups or small businesses looking to raise capital for expansion or product development.

Examples: SeedInvest: A platform that connects startups with potential investors, offering equity in exchange for investment.

D. Debt-Based Crowdfunding (Peer-to-Peer Lending)

Debt-based crowdfunding, also known as peer-to-peer (P2P) lending, enables individuals to lend money to businesses or individuals in exchange for interest payments over time. This model differs from traditional lending as it removes financial institutions as intermediaries, connecting borrowers directly with lenders. It is commonly used for small businesses looking for loans or individuals seeking personal loans. The interest rates and loan terms are typically determined by the market dynamics and the risk profile of the borrower.

Examples: LendingClub: A popular platform that facilitates P2P lending for personal loans, business loans, and auto loans.

IV. FACTORS INFLUENCE THE SUCCESS OF CROWDFUNDING

A. Rules Of Crowdfunding

- Legal and Regulatory Factors: For equity-based and debt-based crowdfunding, navigating the legal landscape is crucial. Regulations vary across countries, and understanding the relevant rules about securities, investment thresholds, and investor protection can significantly affect the campaign's viability . Complying with these regulations ensures that the campaign avoids legal issues that might hinder its progress or cause trust issues among investors.

B. Social Influence and Network Size

- Network Effect: Campaigns with larger and more influential social networks tend to perform better. A creator's pre-existing network, such as followers on social media or connections with influencers, can significantly impact campaign success. Strong social influence often results in more pledges and shares, expanding the reach of the campaign.

- Influencer Involvement: Partnering with influencers or getting endorsements from trusted individuals can create social proof, which can substantially improve a campaign’s credibility and attractiveness. Backers are more likely to contribute when they see that influencers or experts support the project.

C. Blockchain in Crowdfunding

Blockchain technology is increasingly being integrated into crowdfunding platforms to address various challenges and enhance the overall process. Blockchain, a decentralized, distributed ledger technology, offers transparency, security, and efficiency, making it an attractive solution for crowdfunding projects. By eliminating the need for intermediaries, blockchain can reduce transaction costs, increase trust, and ensure that funds are used in accordance with campaign goals. Here’s how blockchain is transforming crowdfunding and the potential benefits it brings:

1) Transparency and Trust

One of the primary challenges of traditional crowdfunding models is trust between project creators and backers. In many cases, backers have no visibility into how their funds are being used, which can lead to concerns about fraud or mismanagement. Blockchain technology provides an immutable, transparent record of all transactions that can be publicly verified by anyone in real-time.

With blockchain, all contributions to a campaign are recorded on the blockchain ledger, and backers can track the flow of funds throughout the campaign. This level of transparency helps establish trust between creators and contributors, as backers can be assured that the funds are being allocated properly and not diverted for other purposes. For example, with Ethereum-based smart contracts, funds can be automatically released when certain project milestones are met, further ensuring that backers’ contributions are being used appropriately.

2) Global Reach and Inclusion

Crowdfunding has traditionally been limited by geographic boundaries and financial systems. Many international backers may not be able to participate in campaigns due to currency exchange issues, high transaction fees, or restrictions on cross-border payments. Blockchain technology, however, can enable crowdfunding campaigns to reach a truly global audience by utilizing cryptocurrencies that can be transferred across borders with minimal fees and without the need for traditional banks.

The ability to accept cryptocurrency contributions allows project creators to tap into a global pool of potential backers who may not have access to traditional banking systems. This makes crowdfunding more inclusive and accessible to individuals from regions where conventional financial services are limited or non-existent.

3) Decentralization and Ownership

Traditional crowdfunding platforms are often centralized, meaning they are controlled by a single entity (such as Kickstarter or GoFundMe). This centralized model introduces several risks, such as platform fees, censorship, and potential biases in selecting projects. Blockchain-based crowdfunding platforms, however, are typically decentralized, meaning they operate without a central authority, and the control is distributed among the participants.

4) Reduced Transaction Fees

Traditional crowdfunding platforms often charge significant fees (sometimes as high as 5%–10%) for processing payments and providing platform services. These fees can reduce the amount of money that ultimately reaches the project creators. Blockchain technology can significantly reduce or even eliminate these intermediary fees by allowing direct transactions between contributors and creators, particularly when using cryptocurrencies such as Bitcoin or Ethereum.

V. RESULT

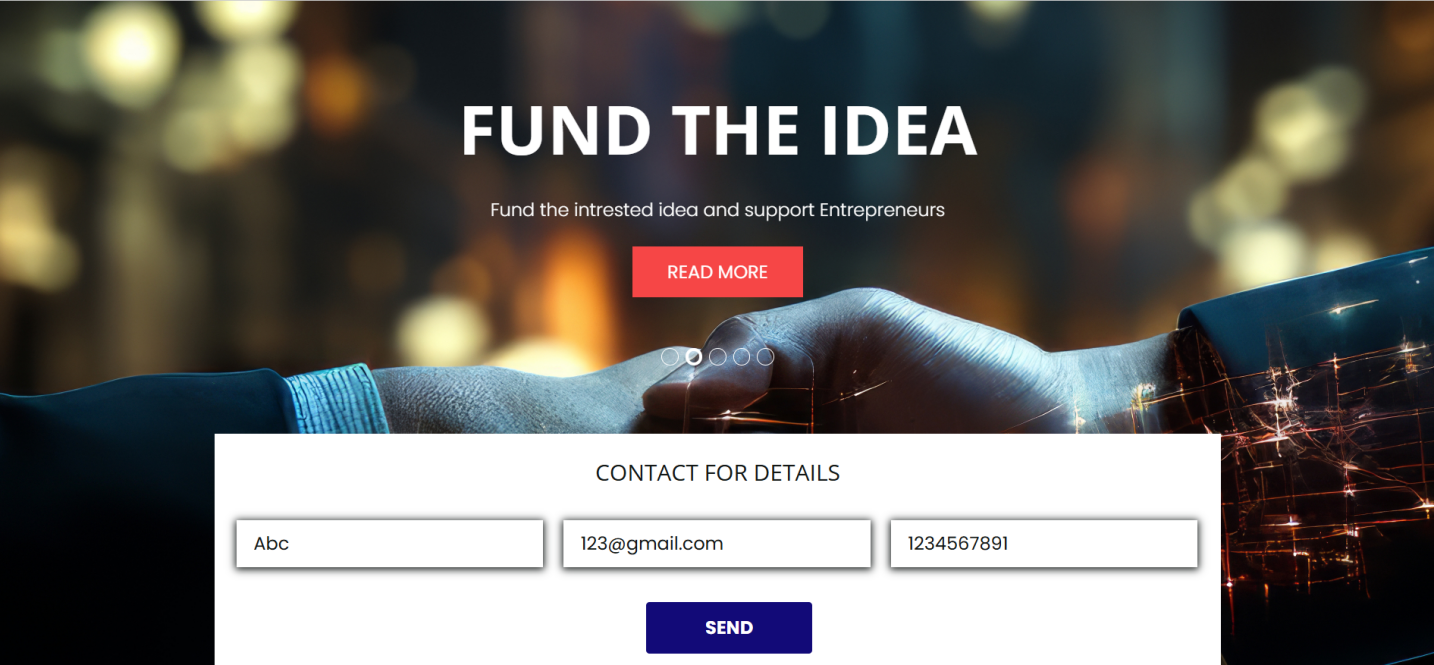

Fig: The initial page of the donation platform, displaying options for contributors to choose from. This interface guides users through the donation process with clear and intuitive prompts.

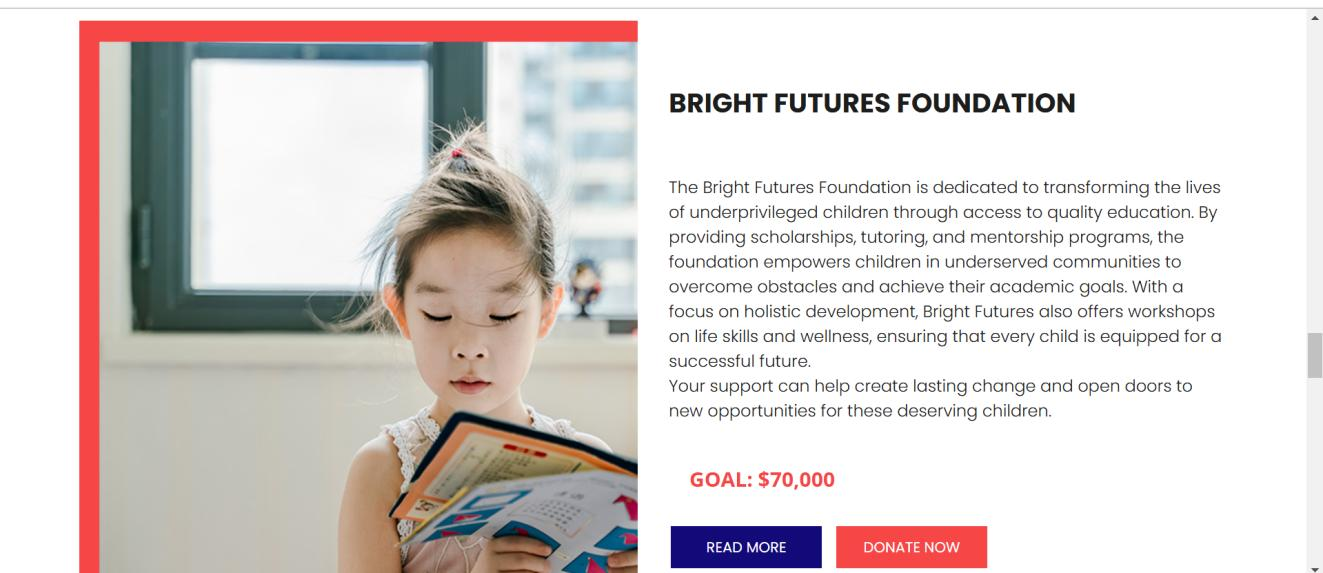

Fig: The Donations page, which outlines the projects and provides an option for users to make donations. This view offers a detailed overview of each project and its funding needs.

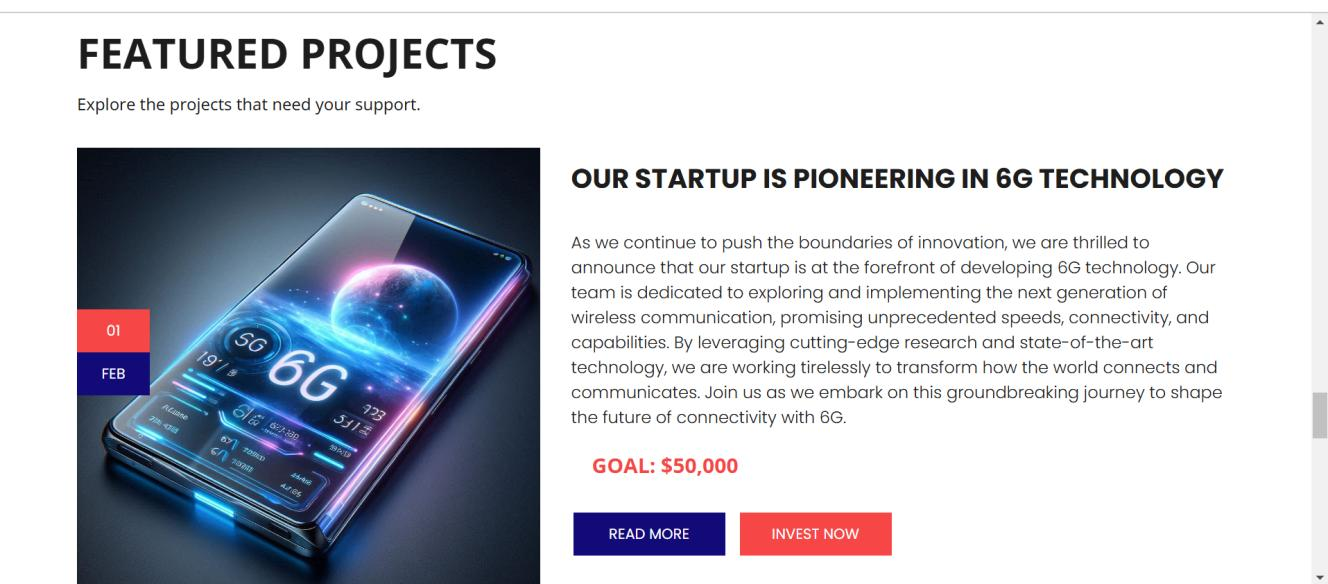

Fig: The Investment Page, where users can explore investment opportunities and make financial contributions. This page provides detailed information on each investment option and its potential returns.

Fig: Payment Page

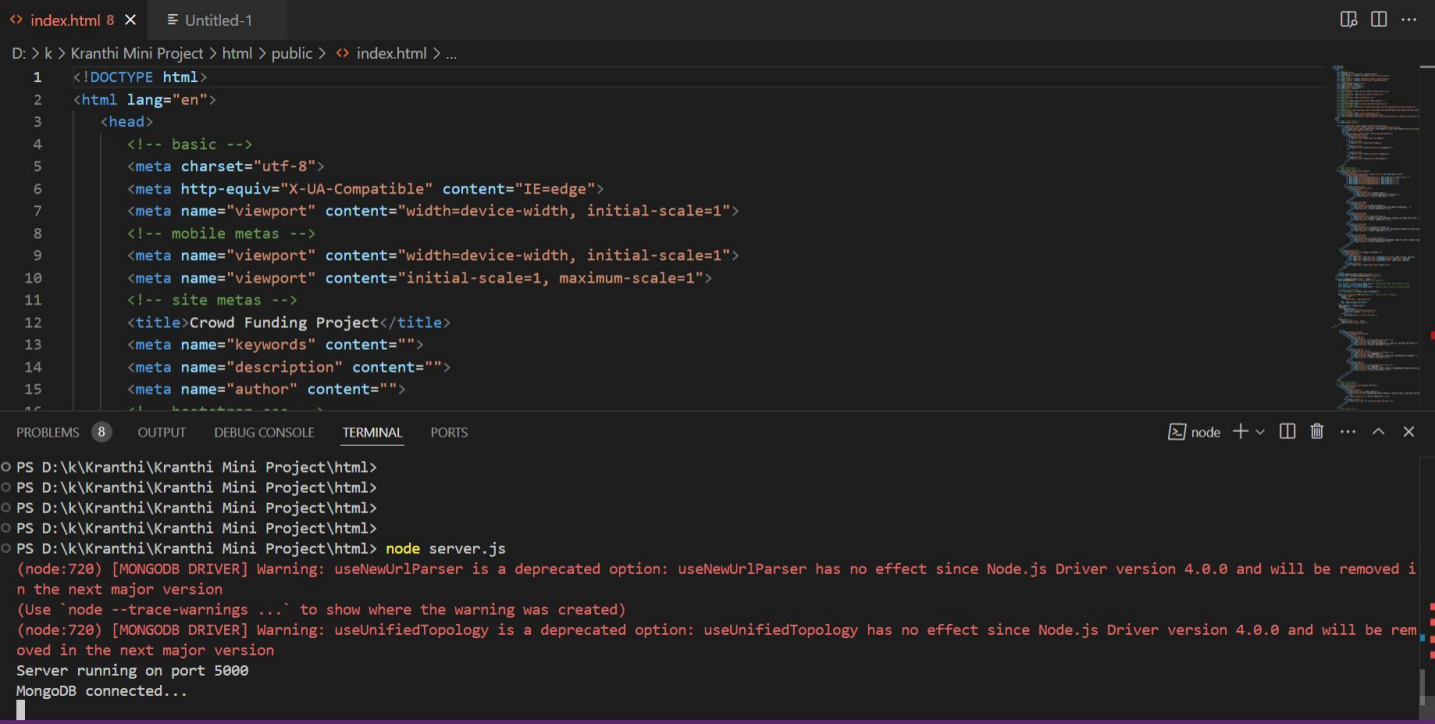

Fig: Running a Node.js server, where the server is initialized and listens for incoming requests. This process involves starting the server with node or nodemon and monitoring for requests on a specified port.

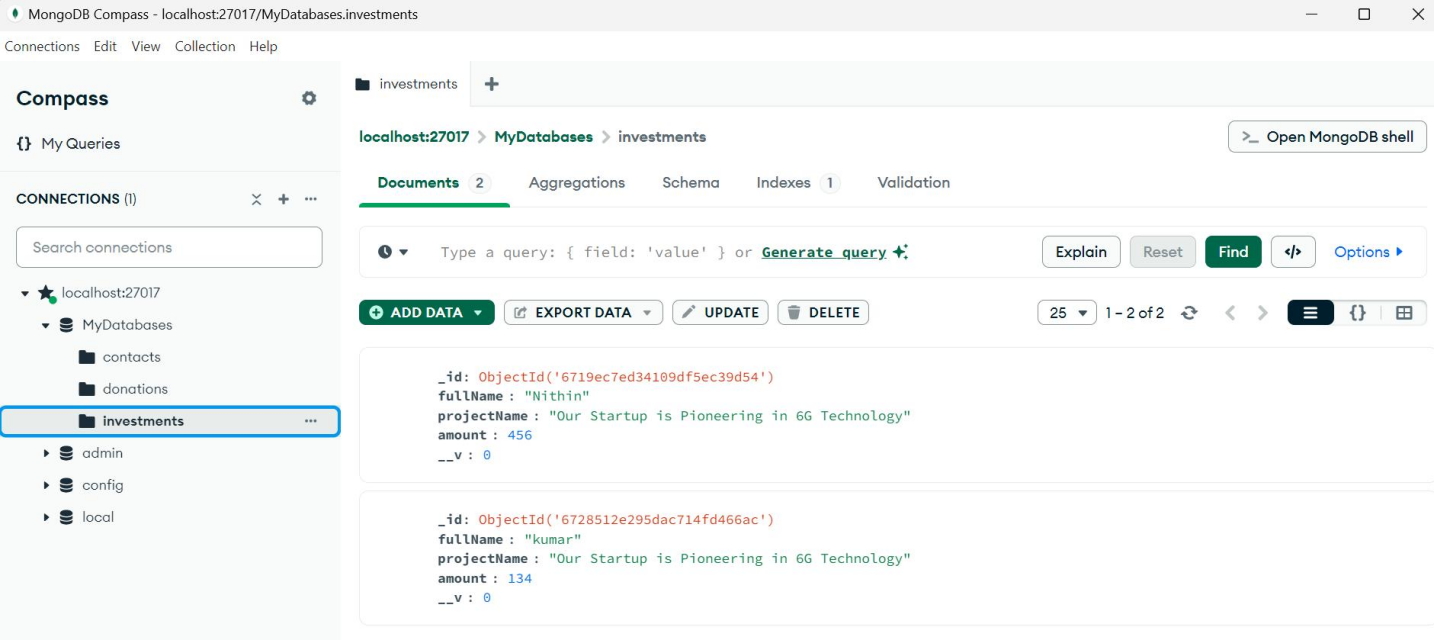

Fig : MongoDB(of Investments)

Fig : MongoDB(of Investments)

MongoDB database containing investment records. This collection stores details of each investment, including investor information, investment amounts, and project data, ensuring efficient tracking and management of contributions.

Conclusion

System testing is an essential phase in the development of a crowdfunding platform, ensuring that all components work together seamlessly and that the platform meets both technical specifications and user expectations. Through various types of testing, including unit testing, integration testing, functional testing, system testing, white box testing, and black box testing, developers can identify and resolve issues at different stages of the platform\'s development. The crowdfunding industry is highly competitive, and users expect platforms to offer a seamless, reliable, and secure experience. System testing plays a significant role in ensuring that the platform meets these expectations. In the context of crowdfunding, where transactions are frequent, large sums of money are exchanged, and user trust is critical, comprehensive testing is necessary • Ensure Reliability: Crowdfunding platforms must operate without interruption, and testing verifies that the system is stable under different conditions, including high traffic volumes, multiple donations, and simultaneous project submissions. • Guarantee Security: Payment information, user data, and financial transactions need to be securely handled. System testing helps uncover vulnerabilities and ensures data is encrypted, transactions are secure, and user privacy is protected. By thoroughly testing each individual module, validating interactions between components, and verifying the end-user experience, a crowdfunding platform can be made robust, secure, and scalable.

References

[1] Agrawal, A., Catalini, C., & Goldfarb, A. (2011). The geography of crowdfunding (NBER Working Paper No. 16820). http://www.nber.org/papers/w16820. [2] Agrawal, A., Catalini, C., & Goldfarb, A. (2013). Some simple economics of crowdfunding (NBER Working Paper No. 19133). Retrieved August 6, 2013, from https://www.nber.org/papers/w19133 [3] Ahlers, G., Cumming, D., Günther, C., & Schweizer, D. (2013). Equity crowdfunding (SSRN Working Paper No. 2362340). Retrieved May 15, 2014, from http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2362340 [4] Aitamurto, T. (2011). The impact of crowdfunding for journalism. Journalism Practice, 5(4), 429–445. https://doi.org/10.1080/17512786.2010.551018 [5] Allen, F., & Santomero, A. (1997). The theory of financial intermediation. Journal of Banking & Finance, 21(11–12), 1461–1485. https://doi.org/10.1016/S0378- 4266(97)00032-0 [6] Allison, T. H., Davis, B. C., Short, J. C., & Webb, J. W. (2014). Crowdfunding in a prosocial microlending environment: Examining the role of intrinsic versus extrinsic cues. Entrepreneurship Theory and Practice. https://doi.org/10.1111/etap.12108

Copyright

Copyright © 2024 K. Prathyusha, Bandaru Kranthi Kumar Varma, B. Vishal Reddy, B. Varshitha. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65568

Publish Date : 2024-11-26

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online