Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Cryptographic Money Value Expectation Utilizing ARIMA Model

Authors: Gandhari Manasa, Dr. G . Venkata Ramireddy

DOI Link: https://doi.org/10.22214/ijraset.2023.55521

Certificate: View Certificate

Abstract

In the beyond couple of years, the cryptocurrency market has developed at a rate that has never been seen. Cryptocurrency works like standard cash, however virtual installments for labor and products are made without the assistance of a national bank or government. Digital money utilizes cryptography to ensure that all exchanges are legitimate and remarkable, however this business is simply beginning, and serious worries have been made about its utilization. To get a full image of individuals\' opinion on digital money, it is vital to take a gander at how they feel about it. Along these lines, this study utilizes an assortment of tweets about cryptographic money, which are frequently used to foresee the cost of digital currency available, to do both temperament examination and feeling acknowledgment. A deep learning outfit model called LSTM-GRU is prescribed to deal with the accuracy of the assessment. It integrates two reasons for recurrent neural network: long short-term memory (LSTM) and gated recurrent unit (GRU). LSTM and GRU are collected with the end goal that the GRU gains from the features that LSTM finds. Using term repeat in reverse report repeat, word2vec, and bag-of words (BoW) incorporates, a couple of ML and profound learning methods and a suggested group model are considered. Furthermore, TextBlob and Text2Emotion are looked at to see how they can be used to analyze sentiments. Similarly, more individuals feel blissful when they use cryptographic money. Dread and shock are the following most normal sentiments. The outcomes show that when BoW qualities are utilized, ML models perform better compared to when they don\'t. The accuracy of the recommended LSTM-GRU gathering for breaking down state of mind and anticipating feelings is 0.99 and 0.92, separately. This is superior to both ML and cutting edge models.

Introduction

I. INTRODUCTION

In the beyond couple of years, the cryptocurrency market has developed at a rate that has never been seen. Cryptocurrency works like standard cash, however virtual installments for labor and products are made without the assistance of a national bank or government. Digital money utilizes cryptography to ensure that all exchanges are legitimate and remarkable, however this business is simply beginning, and serious worries have been made about its utilization. To get a full image of individuals' opinion on digital money, it is vital to take a gander at how they feel about it. Along these lines, this study utilizes an assortment of tweets about cryptographic money, which are frequently used to foresee the cost of digital currency available, to do both temperament examination and feeling acknowledgment. A deep learning outfit model called LSTM-GRU is prescribed to deal with the accuracy of the assessment. It integrates two reasons for recurrent neural network: long short-term memory (LSTM) and gated recurrent unit (GRU). LSTM and GRU are collected with the end goal that the GRU gains from the features that LSTM finds. Using term repeat in reverse report repeat, word2vec, and bag-of words (BoW) incorporates, a couple of ML and profound learning methods and a suggested group model are considered. Furthermore, TextBlob and Text2Emotion are looked at to see how they can be used to analyze sentiments. Similarly, more individuals feel blissful when they use cryptographic money. Dread and shock are the following most normal sentiments. The outcomes show that when BoW qualities are utilized, ML models perform better compared to when they don't. The accuracy of the recommenSince its beginning, the digital currency market has developed at an exceptionally quick rate. Cryptographic money is a computerized cash that can be utilized to pay for things on the web, yet it isn't constrained by a solitary association. To pay for labor and products on the web, "tokens," which are framework record notes, are utilized. As cryptography techniques, individuals use things like circular bend encryption and sets of public and confidential keys. Hashing capabilities are likewise used to safeguard online assets and ensure that every exchange is legitimate and exceptional. Bitcoin was the principal digital money based on a blockchain. It turned out in 2009 and is as yet significant and the market chief today. Notwithstanding Bitcoin, a ton of other digital currencies have been made over the long run. Every one has own arrangement of elements and capabilities make it special. A portion of these cryptographic forms of money are simply duplicates of Bitcoin, while others are totally new monetary standards with additional highlights. Due to the high points and low points of the crypto market, purchasers intend to bring in cash and lose cash.

For this, there are many apparatuses that can anticipate the crypto market, and a few purchasers make speculations in light of these expectations. The ascent and fall of cryptographic money request can likewise be brought about by prominent sentiment or government approaches. Along these lines, individuals' sentiments and feelings can assist with making sense of why the worth of cryptographic forms of money goes all over. As a matter of fact, feeling examination is a famous method for purchasing in digital currencies nowadays. Financial backers first gander at how individuals feel about a specific cash and afterward cause wagers in view of how individuals to feel. Along these lines, sorting out how individuals feel about bitcoin markets has turned into a vital work. Concentrates on show that tweets with positive messages hugely affect the interest for digital currencies and that the equivalent is valid for tweets with negative messages.ded LSTM-GRU gathering for breaking down state of mind and anticipating feelings is 0.99 and 0.92, separately. This is superior to both ML and cutting edge models.

Cryptocurrencies are advanced coins that can undoubtedly supplant customary cash from here on out. They are turning out to be so well known so rapidly in light of the fact that they are not difficult to get to. These coins can be claimed by nearly anybody, and they can be utilized to pay for things very much like standard cash. The majority of these coins are based on blockchain innovation, and their decentralized frameworks can be utilized in a lot more ways in the future to make work settings more secure and safer. In principle, it can change how economies and organizations work and totally dispose of waste and errors made by individuals.

II. LITERATURE REVIEW

- Cryptocurrency Price Prediction Using Tweet Volumes And Sentiment Analysis

In this review, we tell the best way to utilize information from Twitter and Google Patterns to foresee changes in the costs of Bitcoin and Ethereum. Bitcoin and Ethereum are the two most important cryptographic forms of money as far as market cost. Together, they are worth more than $160 billion. In any case, both Bitcoin and Ethereum have seen their costs change a ton, both day to day and over an extensive stretch of time. Twitter is being involved increasingly more as a news source, which influences individuals' purchasing choices by informing them regarding the money and how famous it is getting. In this way, a cryptographic money client or dealer can get an edge while trading on the off chance that they rapidly comprehend what tweets mean for the course of costs. By taking a gander at tweets, we observed that the quantity of tweets is a preferable gauge of cost bearing over the general tone of tweets, which is consistently sure, regardless of what direction the cost heads. We had the option to accurately figure the bearing of cost changes by utilizing a direct model that takes tweets and Google Patterns information as data sources. By utilizing this model, an individual can settle on better conclusions about the choice about whether to trade Bitcoin or Ethereum.

2. Algorithmic Trading Of Cryptocurrency Based On Twitter Sentiment Analysis

Research done in the past has demonstrated the way that constant Twitter information can be utilized to foresee how stocks and other monetary items will continue available [1]. The objective of this paper is to demonstrate the way that Twitter information about digital currencies can be utilized to make great exchange arrangements for crypto coins. Fully intent on sorting out how the bitcoin market is moving, our group will depict a couple of ML processes that utilization directed ML. This paper takes a gander at Bitcoin (BTC), which is the most notable elective money. By tidying up the information and utilizing directed learning strategies like logistic regression, Naive Bayes, and support vector machines, we can make forecasts that are more precise than 90% from one hour to another and everyday. To obtain this outcome, a severe blunder examination is utilized to ensure that right information sources are utilized at each step of the model. Overall, this study makes the response 25% more exact.

3. Predicting Cryptocurrency Value Using Sentiment Analysis

This paper checks the cases that a couple of creators have made about what virtual entertainment means for the costs of digital currencies. From the start, the attention is on Bitcoin. Later on, different coins can utilize a comparative methodology. To foresee costs, the opinion scores of tweets and news channels are considered, as well as the costs of the past and the number. The aftereffects of analyses show that assessment scores mean very little except if they are one-sided towards some class.

4. Advanced Social Media Sentiment Analysis For Short-Term Cryptocurrency Price Prediction

In the beyond couple of years, bitcoin and other digital forms of money have been certainly standing out enough to be noticed as legitimate and controlled pieces of banking frameworks. Bitcoin is one of the greatest cryptographic forms of money as far as market capitalization at the present time. Thus, this study recommends that state of mind examination can be utilized as a PC device to foresee the costs of bitcoin and other digital currencies for various time spans. A most significant aspect concerning the bitcoin market is that the costs of monetary forms change in view of how individuals see and feel about them, not on how foundations manage cash. To foresee the cost of a coin, it's critical to take a gander at how online entertainment and web look through cooperate. This study predicts the momentary costs of the main digital currency by taking a gander at Twitter and Google Patterns, which are utilized to influence purchasing decisions. The review uses and joins a remarkable multimodel strategy to take a gander at what web-based entertainment means for the costs of digital currencies. Our outcomes show that individuals' contemplations and activities immensely affect the exceptionally dangerous costs of cryptographic forms of money.

5. Cryptocurrency Price Prediction Using News And Social Media Sentiment

Bitcoin was first displayed to the world in a paper that was delivered covertly and endorsed with the name Satoshi Nakamoto. Because of its enormous achievement, a ton of new cryptographic forms of money were made in the years that followed. This ascent is for the most part because of how unstable the market is, which got a many individuals energized and involved, generally to bring in cash. Individuals who are keen on digital forms of money will generally share news and perspectives via web-based entertainment destinations like Twitter, which is one of the most well known. In this paper, we see how well Twitter temperament examination can be utilized to anticipate how the costs of cryptographic forms of money will change. To begin with, we gathered tweets and cost information for seven of the most renowned digital currencies. Then, at that point, we involved the Valence Aware Dictionary for Sentiment Reasoning (VADER) to dissect the tweets' opinions. Augmented Dicky Fuller (ADF) Kwiatkowski Phillips Schmidt Shin (KPSS) tests and Granger Causality tests were utilized to sort out whether or not the time series was fixed. In light of a bullishness proportion, it appears to be that Bitcoin, Cardano, XRP, and Doge are impacted by cost changes, while Ethereum and Polkadot are more steady. At last, Vector Autoregression (VAR) is utilized to see how well value changes can be anticipated. For two of the seven coins, extremely right expectations were made. Specifically, cost expectations for Ethereum and Polkadot were 99.67% exact and 99.17% precise, individually.

III. METHODOLOGY

In the beyond couple of years, the digital money market has developed at a rate that has never been seen. Cryptocurrency works like customary cash, however virtual installments for labor and products are made without the assistance of a national bank or government. Cryptocurrency utilizes cryptography to ensure that all exchanges are lawful and interesting, however this business is simply beginning, and serious worries have been made about its utilization. To get a full image of individuals' opinion on digital currency, it is critical to take a gander at how they feel about it.

A. Drawbacks

- The exploration doesn't function admirably.

- This business is simply beginning, and its utilization has caused a ton of stress.

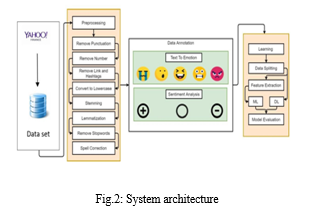

Along these lines, this study utilizes the yashoo finance connected dataset to digital money, which is frequently used to foresee the costs of digital money available, to do both temperament examination and feeling acknowledgment. An ARIMA model is recommended to fit the informational collection to make the examination more exact. The informational collection ought to be steady to foresee the element cryptographic cash esteem finishing cost in light of how the past information was gathered.

A cryptographic money is a computerized or virtual money that is safeguarded by cryptography. This makes it extremely difficult to counterfeit or spend two times. Most digital currencies run on decentralized networks that utilization blockchain innovation. Blockchain is a spread record that is monitored by an organization of PCs.

B. Benefits:

- The exploration doesn't function admirably.

- This business is simply getting everything rolling, and genuine stresses have been made over how it will be utilized.

C. Modules

The accompanying modules were made to complete the task expressed previously.

- Data examination: Using this module, we'll stack data into the structure.

- Dealing with: Using this module, we'll examine data for taking care of.

- Separating data into train and test: Using this module, data will be separated into train and test.

- Model age: Building the model with Bi-LSTM, Ri-RNN, Bi-GRU, GRU, RNN, LSTM, CNN, and LSTM + GRU with CNN. Computations not entirely settled;

- client data trade and login: using this module will get enrollment and login;

- client input: using this module will give input for assumption;

- estimate: end estimate is shown.

IV. IMPLEMENTATION

ARIMA: ARIMA, that wealth "Auto Regressive Integrated Moving Average," is surely a class of models that "form sense of" a likely occasion order on account of allure own premature kinds, or not completely, allure own slacks and the loosen forecast botches, so condition maybe appropriated to predict future statuses.

Bi-LSTM: A bidirectional LSTM (BiLSTM) layer learns long term links that go two together various habits between opportunity steps in a chain or opportunity succession. At the point when you assert that the institution bear gain from the complete opportunity succession at each opportunity step, these networks can help.

Bi-RNN: Bidirectional recurrent neural networks (BRNN) connect two secret layers that go in various ways to a similar result. With this kind of unique profound learning, the result layer can get information from both the past (expresses that go "in reverse") and what's to come (expresses that go "advances"). Schuster and Paliwal thought of BRNNs in 1997 with the goal that the organization could get additional data from an external perspective. For instance, the info information for multilayer perceptrons (MLPs) and time delay neural networks (TDNNs) should be set. Standard recurrent neural networks (RNNs) likewise have restrictions on the grounds that the present status can't be utilized to get data about what will be input from here on out. BRNNs, then again, needn't bother with their feedback information to be set. Additionally, they can get to their future info data from where they are presently.

Bi-GRU: A model for attractive care of successions named a Bidirectional GRU, or BiGRU, is amounted to of two GRUs. One steers the dossier in a forward course, and various steers it in a backward significance. It is a two-habit recurrent neural network with just the information and neglect entryways.

GRU: Gated recurrent units (GRUs) are a sort of entryway in recurrent neural networks. Kyunghyun Cho and others. founded GRUs in 2014. The GRU features a LSTM accompanying a neglect entrance to room, still it is smooth than a LSTM on account of it doesn't have a result stoop.

RNN: Recurrent neural networks (RNNs) are ultimate grown blueprint for following news. Both Siri and discourse search on Google use RNNs. It is the basic forecast accompanying an inside thought that understands entirety it was pronounced commotion. This create it amazing for ML issues accompanying ensuing facts.

LSTM: Long short-term memory (LSTM) is a believe deep learning that depends on a recurrent neural network (RNN). LSTMs can assist accompanying halting issues accompanying models and opportunity succession. Since skilled maybe obscure measures momentary between meaningful occasions inside order, LSTM networks are an productive procedure for distinctive, phase, and form gauges taking everything in mind occasion order news. LSTMs were fashioned to tackle the issue of vanishing slopes, that can take place while fitting standard RNNs.

CNN: A CNN is a somewhat arranging anticipate deep learning judgments. It is appropriated for controls like alarm pictures and taking care of pel realities. There are different kinds of neural networks in deep learning, still CNNs are excellent one for judgment and ready possessions.

Conclusion

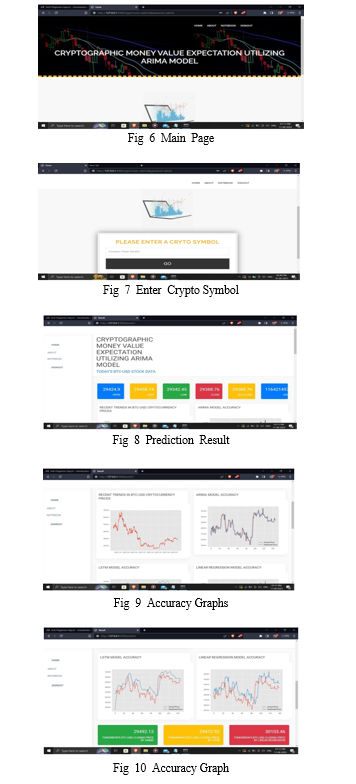

This study utilizes a Yahoo Money dataset to search for feelings and investigate how individuals feel about them. Opinion examination of digital forms of money could be significant on the grounds that it is frequently used to foresee the cost of digital currencies available, which requires an elevated degree of exactness in grouping feelings. Tests use information from Hurray Money, which is set apart with sentiments and mind-sets utilizing TextBlob and Text2Emotion, individually. As well as utilizing a few ML and deep learning models for characterization, this review utilizes the ARIMA Model to make a gathering of models that cooperate to further develop grouping execution. The ML models likewise utilize the BoW, TFIDF, and Word2Vec highlights as ways of recognizing highlights. The outcomes show that BoW highlights work preferred with ML models over TF-IDF and Word2Vec. With a score of 0.99 for accuracy, 0.99 for precision, and 0.98 for both recall and precision, the proposed model does the best occupation of dissecting state of mind. Similarly, ARIMA Model shows improvement over any remaining models with regards to making precise expectations for the following seven days. Utilizing arbitrary undersampling to adjust the informational collection shows that ARIMA\'s exhibition is lower since it has less preparation information. This study takes a gander at how to figure the cost of digital currency for the following 7 days. We intend to utilize the outcomes to foresee the cost of cryptographic money available later on.

References

[1] J. Abraham, D. Higdon, J. Nelson, and J. Ibarra, ‘‘Cryptocurrency price prediction using tweet volumes and sentiment analysis,’’ SMU Data Sci. Rev., vol. 1, no. 3, p. 1, 2018. [2] S. Colianni, S. Rosales, and M. Signorotti, ‘‘Algorithmic trading of cryptocurrency based on Twitter sentiment analysis,’’ CS229 Project, Stanford Univ., Stanford, CA, USA, Tech. Rep., 2015, pp. 1–5. [3] A. Inamdar, A. Bhagtani, S. Bhatt, and P. M. Shetty, ‘‘Predicting cryptocurrency value using sentiment analysis,’’ in Proc. Int. Conf. Intell. Comput. Control Syst. (ICCS), May 2019, pp. 932–934. [4] D. L. K. Chuen, L. Guo, and Y. Wang, ‘‘Cryptocurrency: A new investment opportunity?’’ J. Alternative Investments, vol. 20, no. 3, pp. 16–40, 2017. [5] K. Wo?k, ‘‘Advanced social media sentiment analysis for short-term cryptocurrency price prediction,’’ Expert Syst., vol. 37, no. 2, p. e12493, Apr. 2020. [6] C. Lamon, E. Nielsen, and E. Redondo, ‘‘Cryptocurrency price prediction using news and social media sentiment,’’ SMU Data Sci. Rev, vol. 1, no. 3, pp. 1–22, 2017. [7] M. Hasan, E. Rundensteiner, and E. Agu, ‘‘Automatic emotion detection in text streams by analyzing Twitter data,’’ Int. J. Data Sci. Anal., vol. 7, no. 1, pp. 35–51, Feb. 2019. [8] S. Sharifirad, B. Jafarpour, and S. Matwin, ‘‘How is your mood when writing sexist tweets? Detecting the emotion type and intensity of emotion using natural language processing techniques,’’ 2019, arXiv:1902.03089. [9] F. Calefato, F. Lanubile, and N. Novielli, ‘‘EmoTxt: A toolkit for emotion recognition from text,’’ in Proc. 7th Int. Conf. Affect. Comput. Intell. Interact. Workshops Demos (ACIIW), Oct. 2017, pp. 79–80. [10] S. A. Salam and R. Gupta, ‘‘Emotion detection and recognition from text using machine learning,’’ Int. J. Comput. Sci. Eng., vol. 6, no. 6, pp. 341–345, Jun. 2018.

Copyright

Copyright © 2023 Gandhari Manasa, Dr. G . Venkata Ramireddy. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET55521

Publish Date : 2023-08-26

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online