Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Review: Detect and Overcomes the Problem in Project Finance

Authors: Aniket Doijod, Prof. S. S. Chavan, Prof B. V. Birajdar

DOI Link: https://doi.org/10.22214/ijraset.2024.60639

Certificate: View Certificate

Abstract

Despite the increasing investment in constructional development over the past decade, a systematic review of construction project financing is lacking. The objectives of this paper are to conduct a systematic review to examine the policies, practices, and research efforts in the area of project finance in construction projects and to explore the potential opportunities for future research. To achieve these goals, this paper first reviewed the reasons for financial crises in the construction industry and sustainable construction project financing practices implemented by the critical analysis method for Kolhapur district. Project finance refers to the funding of long-term projects, such as public infrastructure or services, industrial projects, and others, through a specific financial structure. Finances can consist of a mix of debt and equity. The cash flows from the project enable servicing of the debt and repayment of debt and equity. This paper contributes to the body of knowledge by reviewing existing policies, practices, and research efforts in the area of construction project financing. Meanwhile, the findings from this paper benefit the industry as well, because they are able to provide practitioners with a holistic view of risk and uncertainty, thereby enhancing their knowledge and skills in this regard

Introduction

I. INTRODUCTION

Construction is one of the largest sectors of the economic activity. The level and amount of the capital construction largely determine the further development of other sectors of the economy and ensure continued growth of economic potential and national income of the country. At the same time a large proportion of the investment activity belongs to the construction sector, which determines the growing role of construction in the economy development as a whole. In today's difficult economic situation, it is especially important to encourage the development of the construction industry and attract new investments. Therefore, the adoption of a balanced and informed decision-making about expediency of investment in capital projects has got the greatest importance, which is possible only in case of systemic and integrated approach. The successful implementation of the investment project is possible only in case of the competent organization of the project financing. Financing of the project is a supply of a project with the investment resources, which include cash and other investments, expressed in monetary terms (fixed and current assets, property rights and intangible assets, credits, loans and liens, land-use rights) and necessary for the implementation of the project with the subsequent return of the investments and the interest for their use. The process of supply of a project with the financial resources must be arranged so that each step of the implementation of the project required costs covered with cash resources i.e. it is important to ensure the implementation of the project up to the scheduled date. When arranging the financing, it is needed to find the optimal balance between owned and borrowed funds to reduce the risks.

A. Project Finance

Project finance is an approach to funding major projects through a group of investment partners, who are repaid based on the cash flow generated by the project. The investors in a project finance arrangement are known as sponsors, and often include financial institutions with a high tolerance for risk. Sponsors may also include organizations in the same industry, a contractor interested in the project, and government or other public entities.

Project finance is most often used to fund large-scale industrial or infrastructure projects that involve a construction phase, such as building a transportation system addition or a power generation facility. Projects like these require significant upfront capital, and they do not generate a return until the construction phase is complete. They are also relatively high risk, as unforeseen problems during the construction phase can lead to project failure. Project finance is a good fit for initiatives like these because it provides access to a significant amount of cash to cover initial expenses.

B. The Structure Of Project Finance

Project financing directs funds to an entity called a special project vehicle, or SPV, that oversees the project until it is completed. This structure gives project financing two characteristics off-balance sheet recording of liabilities and non-recourse financing that differentiates it from other financing methods. An SPV differs from a joint venture, which doesn’t always involve establishing a new legal entity and, consequently, these two advantages.

- Off-balance Sheet Liabilities

Debts and obligations associated with project finance arrangements are not recorded directly on the balance sheets of the businesses that sponsor the project. Instead, they are held by the subsidiary SPV. The debts may be mentioned in balance sheet notes or discussed by business executives, but they do not impact standard balance sheet calculations, such as a business’s total assets or liabilities. The ability to keep debts off formal balance sheets is an attractive benefit of project finance. It means that organizations can undertake major projects without directly overloading themselves with debt. Neither do they run the risk that a sudden increase in balance sheet liabilities will harm their credit ratings or ability to obtain loans.

2. Non-recourse Financing

Project finance is classified as a non-recourse type of financial structure. This means that in the event of default on the loans secured to fund the project, sponsors generally have recourse only to assets held by the SPV, rather than the parent company. The interest rates for non-recourse financing are typically higher to reflect the greater risk assumed by lenders. Project financing means providing a target loan which implies the mobilization of funds from various sources (owned and borrowed). The main feature of project finance is that the loan return is affected by cash income generated by the project itself. Project financing process consists of several stages: A preliminary study - Market analysis and evaluation of the effectiveness of the project are held; a decision on the feasibility of investments is made. The recipient of the funding is usually a specially created project organization. Additionally, external consultants may be used for legal or tax problems, etc. x

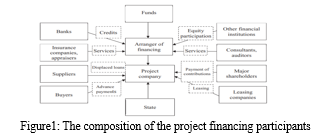

Coordination and signing of documents on the deal - If the decision on expediency of investments is made, the parties chose a scheme of financing of the investment-construction project and the parties begin to develop and coordinate the protocol of intent. It contains information on the composition of the project participants, target use and the procedure for granting the loan, interest rate, timing and refund order, rights and obligations of the parties, guarantees, insurance and hedging; list of collateral provided by the borrower to meet the obligations of the Bank. Signing of the protocol of intent is the basis for further elaboration on the transaction: credit agreement; agreements on opening bank accounts; pledge agreements, assignment of rights; agreement with the investor and among creditors. The granting of a credit and the implementation of the project - The provision of the credit facilities with the ability is to monitor the implementation of the project. The risks are high, so the Bank can request regular financial expenditure reports. This requirement is enshrined in the documents on the deal. The project finance scheme involves quite a wide range of participants. The main one among them is the Bank. It is the very enterprise that organizes and controls the process of attracting investment to the project. The Bank, after making a decision on whether to participate or not, determines the financial instruments and forms of funding. A characteristic feature of the project financing is the establishment of the project company that attracts resources (not only money), implements the project, and pays back to the investors and creditors. The establishment of the project company implies the separation of the investment project from other activities of the initiators to prevent risks associated with the previous operations of the company. The newly created organization has no financial history; therefore, reputation and credit history of the borrower in this case are not investigated. All risks are distributed among the project participants and are regulated with the agreements and contracts. Major participants are also the sponsors of the project, as a rule, these are the organizers of the project company. They act as the initiators of the project and participate in its capitalization. The initiators of the project are those who send to the project loan application to the Bank. The composition of the investment project participants is shown in Figure1

II. LITERATURE REVIEW

- Satheesh K. Sundararajan and Chung-Li Tseng, (2017) author studied the infrastructure project financing and public-private partnerships (PPPs) are underpinned by risk allocation between the public and private sectors. Project performance risks are often passed to the private sector as a contractual risk transfer that is often deterministic and inflexible. In complex projects where there are uncertainties in the scope of work and capital costs, performance risks may need more flexibility with active management on the evolution of project uncertainties over the life of the project’s development. Conventional fixed capital structures and project performance measurements cannot capture the evolution of project performance risks and their dynamics. This paper develops a dynamic capital structure approach that explicitly considers the performance risks of complex projects under uncertainty and allows the capital structure to be adjusted proactively to counter their impact on the project value. Unlike most models that focus on the operational phase when revenues are generated, this paper specifically considers the impact of project performance risks that occur during the development phase. This approach identifies the potential threat of default attributable to project performance risks and allows the private-sector-sponsored project company and lenders to make proactive management decisions using a real-options approach. Numerical results show that such a model can add significant value to a PPP project under uncertainty. Furthermore, numerical tests also show that with the flexibility in adjusting the capital structure, the probability of potential default can also be reduced.

- Ming Shan, Bon-Gang Hwang and Lei Zhu, (2017) The objectives of this manuscript are to conduct a systematic review to examine the policies, practices, and research efforts in the area of sustainable construction project financing, and to explore the potential opportunities for the future research. Despite the increasing investment in sustainable development over the past decade, a systematic review of sustainable construction project financing is lacking. To achieve these goals, this paper first reviewed the sustainable construction project financing practices implemented by four representative developed economies including the United Kingdom, the United States, Singapore, and Australia. Then, this paper reviewed the efforts and initiatives launched by three international organizations including the United Nations, the Organization for Economic Co-operation and Development, and International Finance Corporation. After that, this paper reviewed the research efforts of sustainable construction project financing published in peer-review journals and books. This paper identified four major research themes within this area, which are the review of financial stakeholders and market of sustainable construction, benefits and barriers to sustainable construction project financing, financial vehicles for sustainable construction projects, innovative models and mechanisms for sustainable construction project financing. Additionally, this paper revealed five directions for the future research of sustainable construction project financing, which are the identification of financial issues in sustainable construction projects, the investigation of financial vehicles for sustainable construction projects in terms of their strengths, limitations, and performances, the examination of critical drivers for implementing sustainable construction project financing, the development of a knowledge-based decision support system for implementing sustainable construction financing, and the development of best practices for implementing sustainable construction project financing. This paper contributes to the body of knowledge by reviewing existing policies, practices, and research efforts in the area of sustainable construction project financing. Meanwhile, the findings from this paper benefit the industry as well, because they are able to provide the practitioners with a holistic view of sustainable construction project financing, thereby enhancing their knowledge and skills in this regard

- Roman Gorshkov, Viktor Epifanov, (2016) This article presents the results of the research project of the mechanism of the project financing for investment projects in underground construction Taking into account the advantages and disadvantages of the project, there were studied the basic stages and components of the process of project financing, its main participants and sponsors.

- Aayushi Gupta, Mahesh Chandra Gupta, Ranjan Agrawal, (2013) The study aims to identify and rank the critical success factors (CSFs) for BOT projects in India. The study was conducted based on an extensive literature review and focus group discussions. Through structured questionnaire, a survey was conducted with executives from leading construction, consultancy and government organizations. A total of 150 questionnaires were sent out of which 60 responses were received. Analytical hierarchy process method was used to analyze the data. Concession agreement, short-construction period, selection procedure of concessionaire, sufficient long-term demand and sufficient net cash inflow emerged as the top five factors critical for the success of the BOT projects in India. The identified CSFs should influence the policy development towards BOT projects and are expected to enhance the success rate of these projects. The study has made much-needed contribution to the extant literature on BOT projects. The findings would be valuable in assisting government (owner) and private participants to have a better understanding of the critical factors leading to success of these projects. The results from the current study are crucial as not many studies have been conducted in India as compared to China and West

- Rozalia Pala and Annalisa Ferrando, (February 2010) This paper investigates the financing conditions of non-financial corporations in the euro area. We develop a new firm classification based on micro-data by distinguishing between three groups of firms: unconstrained, relatively and absolutely constrained firms. We also provide further evidence on the sources of the correlation between corporate cash flow and cash savings by conducting the analysis in a dynamic framework. Our results suggest that the propensity to save cash out of cash flows is significantly positive regardless of firms financing conditions. This implies that even for firms with favourable external financing conditions, the internal cash flow is used in a systematic pattern for inter-temporal allocation of capital. The results also indicate that the cash flow sensitivity of cash holdings cannot be used for testing financing constraints of euro area firms.

- Boeing Singh Laishram And Satyanaranaya N. Kalidindi, (2009) Public–private partnership (PPP) road projects are highly leveraged capital-intensive projects. Lenders, which provide the major portion of financing in the form of debt instruments, undertake loan approval processes to examine the various aspects of the projects that could influence the debt servicing capability while making credit decisions. In view of this, project sponsors could also assess beforehand how desirable is the project from the debt financing perspective in order to facilitate timely arrangement of debt financing and avoid funding problems. The Desirability Rating Analytical Tool (DRAT) has been developed in order to enable the project sponsor to assess how desirable the project is from a debt financing perspective. DRAT uses the aggregation operator Choquet fuzzy integral to aggregate the information relating to the various aspects of PPP road projects that lenders take into account while making credit decisions. The application of DRAT is illustrated with an example of a PPP road project from a National Highways Development Programme undertaken by the National Highway Authority of India, Government of India. DRAT expressed the result of the information aggregation in the form of a desirability rating profile indicating the degrees of membership to different levels of desirability. The desirability rating profiles of the project provide valuable information for decision making and can help in formulating strategies on improving the performance of the project where it is not performing satisfactorily.

- Andra–Maria vasilescu, Alina Mihaela DIMA, Simona Vasilache, (2009) This paper aims to illustrate a revolutionary approach to bank financing of extensive investment projects developed by major corporations. The new approach pertains to corporate banking and is applied to corporate projects developed by special purpose vehicles. The theoretical framework highlights general aspects of project finance and of construction projects management in general, with special focus on residential constructions. The second part adds to the theoretical structure the example of a project finance policy implemented by a Romanian subsidiary of a foreign bank and places the emphasis on the credit analysis in case of residential construction projects. The final objective of the paper is to bridge the corporate banking field with project finance, regarded as a banking field of its own, in line with the vision of the bank subject to this article

- Dong-Eun Lee, (2005) this manuscript explains introduces software, Stochastic Project Scheduling Simulation (SPSS), developed to measure the probability to complete a project in a certain time specified by the user. To deliver a project by a completion date committed to in a contract, a number of activities need to be carried out. The time that an entire project takes to complete and the activities that determine total project duration are always questionable because of the randomness and stochastic nature of the activities’ durations. Predicting a project completion probability is valuable, particularly at the time of bidding. The SPSS finds the longest path in a network and runs the network a number of times specified by the user and calculates the stochastic probability to complete the project in the specified time. The SPSS can be used by a contractor: (1) to predict the probability to deliver the project in a given time frame and (2) to assess its capabilities to meet the contractual requirement before bidding. The SPSS can also be used by a construction owner to quantify and analyze the risks involved in the schedule. The benefits of the tool to researchers are: (1) to solve program evaluation and review technique problems; (2) to complement Monte Carlo simulation by applying the concept of project network modeling and scheduling with probabilistic and stochastic activities via a web based Java Simulation which is operate able over the Internet, and (3) to open a way to compare a project network having different distribution functions.

- J E Okema, Author explainer in this manuscript is developing Countries are, because they are yet to develop the stock of their infrastructure. To develop the stock of infrastructure, the construction industries are pivotal and are the conduits. The challenges of sustainable development of developing countries are the challenges of development of stock of infrastructure. Subsequently, the challenges of development of stock of infrastructure are the challenges facing the Construction Industries. The effective development of infrastructure through constructions, are issues of growing concern, satisfaction and study. One of the challenges to optimum construction is risk and uncertainty that project faces, due to evolving and emerging conditions through the project lifecycles, organizations and environment.

To avoid construction projects from running out of control, optimize the deliveries of projects and to strengthen business positions, there is need for an effective and deliberate approach to risks and uncertainties management. The paper introduces and discusses the concept of risk and uncertainty and their effect on construction projects management as one of the challenges facing Construction Industry in Developing countries. It concludes by advocating for systematic approach to risks and uncertainties management as the optimal prerequisite for Construction Industries to overcome the associated challenges.

III. THEORY

A. Construction Financial Management

A few constructions financial management tips that will help the tensed businessmen in sorting their financial issues-

- Save Time: It is a human tendency to procrastinate in stressful conditions. They waste their energy and time thinking about the problem and panicking. Instead, they should focus on possible solutions to resolve the issue. Delaying and over thinking can worsen the condition.

- Rule out the Underlying Cause: The first step to resolve any problem is to identify the primary underlying cause. Financial issues are usually intense and require long-term solutions. Identifying the root cause helps in finding permanent problem-solving. A few sources that lead to the financial problem in a construction company can be an unexpected pandemic, accident, and poor decision making.

- Prevent Excess Expenditure: One should analyze the unnecessary expenses being made. The owner should focus on where and how costs can be deducted. Selling of rarely used equipment or cutting fuel costs can be one of the ways. An automated accounting system can replace manual accounting. The company holder should be careful while purchasing any tool. The crisis can always be resolved with a little patience. The executive should not suspend its employees or should not leave the base location unless it is required.

- Re-formulate Budget: No consultant can guess the future problems accurately. There are times when things don’t go as planned. The new budget needs to be drafted according to the present needs and wants of the company. Expenses should be prioritized following the current scenario. A financial plan should be made in a way that helps businesses with profit. The budget guides in areas where unnecessary expenses are occurring and where money can be saved.

- Change Marketing Strategy: Strategies formulated according to the budget of the organization and its goals. Since the goals and budget changed due to the crisis, therefore, business strategy and plan also needs to be revised. Old plans need to be modified based on the current priority of the organization. Business expansion plans, if any, needs to be postponed.

- Maintain Old Customers: It is a crucial point to take into consideration. Customers have a huge contribution to help a business grow. Money related problems can lead to loss of contracts. Therefore, it is necessary to maintain the trust of the customer in the organization. The quality of the service should now compromise.

- Prioritize Revenue: Cash flow should be personally analyzed regularly. This method helps the owner to understand the income and expenses of the company. Making financial priorities is crucial to overcome the financial crisis. A track of debts should be made. Service should be efficient. Truck Transportation should be low-cost, and the service of equipment shall be delayed, if not urgent. Salaries of the employees and the payment of bills shouldn’t hinder.

B. Cash flow in the construction industry

The construction industry typically involves large scale projects that require expensive equipment and materials. For construction businesses, having the finance to be able to cover such costs is the challenge, especially when you throw in other overheads such as equipment rentals and wages. Generally speaking, cash flow issues account for more than 80% of business failures. In construction, cash flow is considered one of the main reasons why businesses go under. This makes it vital for construction companies to use cash flow projections to monitor the money they have on hand to stay in business.

C. Reasons for Cash Flow Problems in the Construction Industry

- Inaccurate Quoting and Tendering

When quoting or bidding for projects, the price you come to needs to be realistic. It can be tempting to offer a competitive quote in order to secure work, but if that price is too low then you’ll earn less than the job is actually worth.

This is a fine balance, and the nature of competitive bidding almost works against your business interests. It may be worth including a buffer in any quotes for unexpected expenses, in order to have something of a safety net during a project.

2. Unforeseen Change Orders

Change orders are adjustments to the original scope of a project. They often end up creating more work, and more money, for a contractor or business, but they also can put pressure on short term cash flow.

3. Long Payment Periods

Cash flow for construction projects that go on for months, or even years, can be complicated. Invoices are often payable within 30-60 days, during which time there can be a lot of overheads to pay. On top of that, invoicing in the middle of ongoing projects can create difficulties, and clients can retain payment until work is completed to a satisfactory standard. All of this leads to long periods of time where businesses need to cover operating expenses out of their own pocket before being paid.

Conclusion

This paper has developed a new classification scheme that can be used to detect the presence of financial constraints. Based on this new classification, we find that financially constrained firms that are unable to obtain external financing or face higher costs of borrowing invest at a lower rate and grow more slowly. They also hold relatively higher cash positions that grow substantially also under depressed economic conditions, confirming the precautionary cost hypotheses of holding cash. The cash savings of unconstrained firms are positively affected by an increase in long-term debt. The significant debt sensitivity of unconstrained firms indicates that cash savings are used for inter-temporal allocation of both internal and external sources of fund. Firms can decide to allocate the obtained long-term credit over time. In addition, an increase in leverage of the firm could result in an increase of liquidity in order to fulfill the higher interest obligations and credit repayment in the future.

References

[1] Aayushi Gupta, Mahesh Chandra Gupta, Ranjan Agrawal, “Identification and ranking of critical success factors for BOT projects in India”, Management Research Review Vol. 36 No. 11, 2013 [2] Andra–Maria vasilescu, Alina Mihaela DIMA, Simona Vasilache, “Credit Analysis Policies In Construction Project Finance”, Management & Marketing, Vol. 4, No. 2, pp. 79-94, 2009 [3] Boeing Singh Laishram And Satyanaranaya N. Kalidindi, “Desirability rating analysis for debt financing of public–private partnership road projects”, Construction Management and Economics Vol.27, Pp. 823–837, 2009 [4] Dong-Eun Lee, “Probability of Project Completion Using Stochastic Project Scheduling Simulation”, J. Constr. Eng. Manage. Vol. 131, Pp. 310-318, 2005 [5] J E Okema, “Risk and Uncertainty Management of Projects: Challenges of Construction Industry”. [6] Ming Shan, Bon-Gang Hwang and Lei Zhu, “A Global Review of Sustainable Construction Project Financing: Policies, Practices, and Research Efforts”, Sustainability, Vol. 9, 2017 [7] Roman Gorshkov, Viktor Epifanov, “The mechanism of the project financing in the construction of underground structures”, Procedia Engineering, Vol. 165, PP. 1211 – 1215, 2016 [8] Rozalia Pala and Annalisa Ferrando, “Financing constraints and firms’ cash policy in the euro area”, The European Journal of Finance Vol. 16, No. 2, Pp. 153–171, February 2010 [9] Satheesh K. Sundararajan and Chung-Li Tseng, “Managing Project Performance Risks under Uncertainty: Using a Dynamic Capital Structure Approach in Infrastructure Project Financing”, J. Constr. Eng. Manage, Vol. 143(8), 2017

Copyright

Copyright © 2024 Aniket Doijod, Prof. S. S. Chavan, Prof B. V. Birajdar. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET60639

Publish Date : 2024-04-19

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online