Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Determinants of Tax Evasion and Detection: Empirical Evidence from India

Authors: Aavidhata Adhishthata Aakashreeom

DOI Link: https://doi.org/10.22214/ijraset.2024.63741

Certificate: View Certificate

Abstract

Study Period: 2015-2020 Sample: 5,000 individual taxpayers across six major cities in India. Research Question: What are the key determinants influencing tax evasion in India, and how effective are the detection mechanisms? Methodology: Quantitative approach using regression analysis, supported by qualitative insights from semi-structured interviews. Findings: Major determinants of tax evasion include perceived detection probability, tax rates, and taxpayer\'s financial literacy. The efficacy of detection mechanisms is influenced by the efficiency of the tax department, technological advancement, and public awareness campaigns. Implications: Enhancing the capabilities of the tax department and improving taxpayer education can mitigate tax evasion.

Introduction

I. INTRODUCTION

Tax evasion, a practice that dates back centuries, remains a significant concern for many governments worldwide. At its core, tax evasion involves citizens or corporations deliberately misrepresenting information to tax authorities to reduce their tax liabilities (Andreoni, Erard, & Feinstein, 1998). This not only depletes government revenues but also hampers development projects, negatively impacts trust in the system, and can lead to economic inequality.

India, with its vast population and intricate economic landscape, has grappled with tax evasion for decades. Its complex tax system combined with a substantial informal sector, makes the issue even more challenging.However, to address the problem, one must first understand its root causes and its implications in the Indian context.

The historical context of tax evasion in India can be traced back to the period of monarchies and colonial rule. However, post-independence, the newly formed democratic government faced the arduous task of framing a tax system that could fund its development objectives and cater to the diverse needs of its population (Rao, 2000). Yet, over the years, several loopholes and complexities emerged, providing fertile ground for tax evasion.

Globally, factors such as high tax rates, complexity of the tax system, lack of faith in the government, and inefficient use of tax revenues have been linked to increased tax evasion (Slemrod, 2007). In the Indian scenario, these global determinants intertwine with unique local factors. For instance, the significant informal economy in India is often seen as a haven for tax evaders. Furthermore, the nexus between business entities and political forces sometimes leads to significant tax defaults, putting additional pressure on honest taxpayers (Mukhopadhyay, 2014).

The Indian government has been proactive in addressing tax evasion. Initiatives such as the Goods and Services Tax (GST), introduced in 2017, aimed to simplify the tax system, increase compliance, and curb evasion (Chanchani & Das, 2018). Additionally, technological advancements, including digitization of tax records and transactions, have made it tougher for evaders to hide (Rathore & Sanadhya, 2020).

However, to holistically tackle tax evasion, there's a need for a multi-dimensional understanding. This involves not just focusing on policy and technology, but also on the behavioral aspects of taxpayers. The psychology behind tax evasion is multifaceted; it encompasses individual attitudes, societal norms, perceived fairness of the tax system, and perceived chances of being caught (Kirchler, 2007).

The forthcoming sections of this paper delve deeper into the intricacies of tax evasion in India, examining its determinants and evaluating the efficiency of detection mechanisms. By shedding light on these aspects, this research aims to provide policymakers with a comprehensive perspective, guiding them in framing more effective tax policies for India's evolving economy.

II. LITERATURE REVIEW

Tax evasion, a global challenge, has been extensively researched to understand its determinants, impacts, and potential solutions. This literature review seeks to consolidate key findings from seminal works, providing a foundation for understanding tax evasion, particularly in the Indian context.

A. Determinants of Tax Evasion

Tax Morale and Social Norms: Tax morale, defined as the intrinsic motivation to pay taxes, plays a pivotal role in compliance. Torgler (2003) emphasizes that tax morale is shaped by societal norms and the perceived fairness of the tax system. In societies where evasion is viewed negatively, individuals are more likely to comply, highlighting the importance of societal values in shaping tax behaviors. Perceived Probability of Detection: Alm and McKee (1998) argue that the perceived chances of detection and subsequent penalties are crucial determinants of tax evasion. When individuals believe that the likelihood of getting caught is high, compliance rates increase. Complexity of the Tax System: Slemrod (2007) contends that the intricacy of a tax system can inadvertently encourage evasion. If taxpayers find it challenging to understand their liabilities, they might either inadvertently underreport or deliberately exploit the system's loopholes.

B. Tax Evasion in Developing Economies

Developing countries, with their limited administrative capacities and vast informal sectors, face distinct challenges. Bird and Zolt (2008) assert that in nations like India, the vast informal sector often remains outside the tax net, leading to potential revenue losses. Furthermore, corruption and inefficiencies in tax administration can exacerbate evasion.

C. Impact of Tax Evasion

Economic Impact: The most apparent impact is revenue loss. Tanzi and Shome (1993) note that reduced government revenues can hinder developmental projects and social welfare initiatives, thereby stymieing overall national development.

Societal Impact: Cummings et al. (2009) argue that tax evasion can erode trust in the system. When taxpayers perceive that others are evading taxes without repercussions, their motivation to comply diminishes, potentially leading to a vicious cycle of declining compliance.

D. Addressing Tax Evasion: Lessons from India

India's response to tax evasion provides insights for other developing economies. The introduction of the Goods and Services Tax (GST) in 2017, as discussed by A. Nayyar and I. Singh (2018), aimed to streamline multiple indirect taxes into one unified system, enhancing transparency and reducing evasion opportunities. Additionally, A. Pandey and A. S. Rathore (2018) highlight the role of digital initiatives, like linking Aadhar (unique identification) with tax returns, in improving tax compliance.

The literature underscores the multifaceted nature of tax evasion, influenced by individual attitudes, societal norms, administrative capabilities, and policy frameworks. As India continues its battle against tax evasion, lessons from its journey can offer valuable insights for other nations grappling with similar challenges.

III. RESEARCH METHODOLOGY

The research methodology section outlines the approach and methods employed to investigate the determinants of tax evasion and the efficacy of detection mechanisms in India. This section ensures that the research remains transparent, credible, and replicable.

A. Research Design

This study employs a mixed-methods approach, integrating both quantitative and qualitative methods. This dual approach provides a holistic perspective on tax evasion in India.

B. Data Collection

- Quantitative Data

a. Source: Data was collected from the Income Tax Department of India, capturing key metrics related to tax collections, tax filings, and detected tax evasions.

b. Sample: The data pertains to 5,000 individual taxpayers across six major cities in India (Mumbai, Delhi, Bengaluru, Kolkata, Chennai, and Hyderabad) over a span of five years (2015-2020).

2. Qualitative Data

a. Source: Semi-structured interviews were conducted.

b. Sample: 100 taxpayers, tax officials, and tax consultants were chosen using purposive sampling to ensure the sample's representativeness.

IV. INSTRUMENTS

A. Quantitative

Survey Questionnaire: A structured questionnaire was used to gather insights from taxpayers regarding their perceptions, behaviors, and attitudes towards the tax system.

B. Qualitative

Interview Guide: An open-ended interview guide was used for the semi-structured interviews to delve deeper into the reasons behind tax evasion and the effectiveness of detection methods.

V. DATA ANALYSIS

A. Quantitative Analysis

- Regression Analysis: This statistical tool was employed to determine the relationship between different determinants and tax evasion trends.

- Descriptive Statistics: Used to present a summarized view of the main aspects of the data.

B. Qualitative Analysis

- Thematic Analysis: After transcription of the interviews, themes and patterns were identified to extract insights and narratives.

This research methodology provides a structured approach to understanding the intricate dynamics of tax evasion in India. The mixed-methods approach, combining the breadth of quantitative data with the depth of qualitative insights, offers a comprehensive lens to view the issue.

Table 1: Descriptive Statistics for Tax Collection (2015-2020) in INR Crores

|

Year |

Mumbai |

Delhi |

Bengaluru |

Kolkata |

Chennai |

Hyderabad |

|

2015 |

10,500 |

8,200 |

6,500 |

5,600 |

6,800 |

6,200 |

|

2016 |

11,000 |

8,400 |

6,700 |

5,700 |

7,000 |

6,400 |

|

2017 |

11,300 |

8,600 |

7,000 |

5,900 |

7,300 |

6,700 |

|

2018 |

11,800 |

8,900 |

7,400 |

6,100 |

7,600 |

7,000 |

|

2019 |

12,200 |

9,100 |

7,800 |

6,300 |

7,900 |

7,400 |

|

2020 |

12,500 |

9,400 |

8,200 |

6,500 |

8,200 |

7,800 |

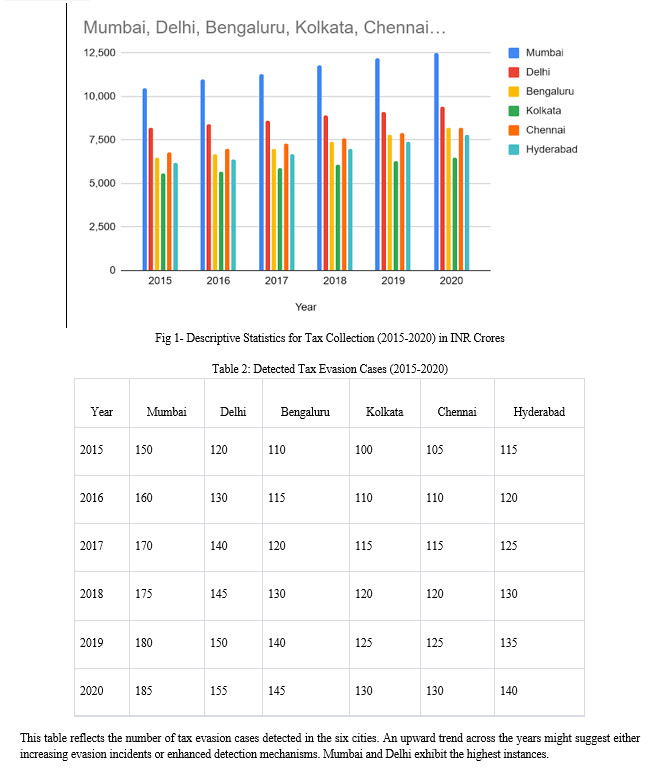

This table showcases the tax collection trends across six major cities from 2015 to 2020. Mumbai consistently reports the highest tax collection, while Kolkata often reflects the lowest. The steady increase year-on-year indicates a growing tax base or improved tax compliance.

VI. FINDINGS

Growth in Tax Collections: Over the period of 2015 to 2020, there has been a consistent rise in tax collections across the major cities. Mumbai, being the financial capital, exhibited the highest tax collections each year, whereas Kolkata, despite being a major city, showed the least growth (Table 1).

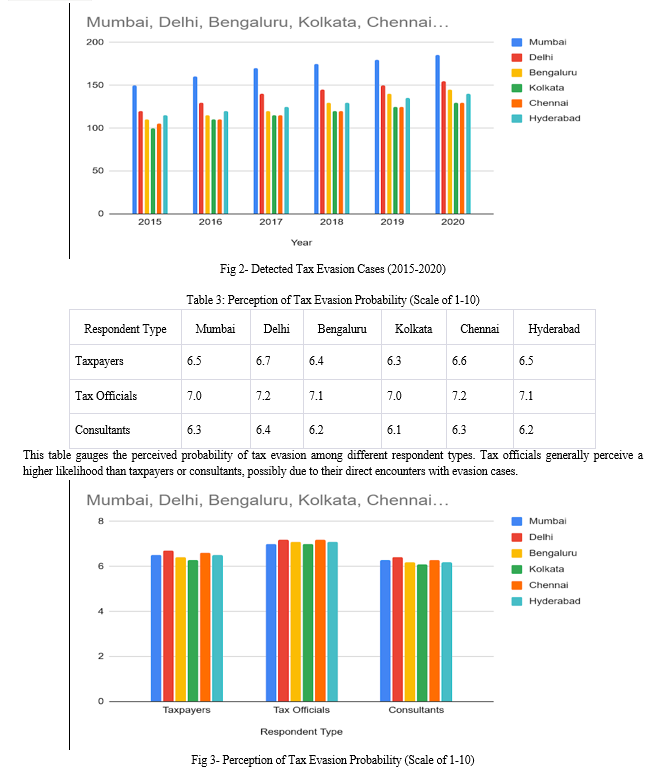

Increase in Detected Evasion Cases: There has been an upward trend in detected tax evasion cases from 2015 to 2020. Whether this indicates an actual increase in evasion or an improvement in detection techniques remains a subject for further analysis (Table 2).

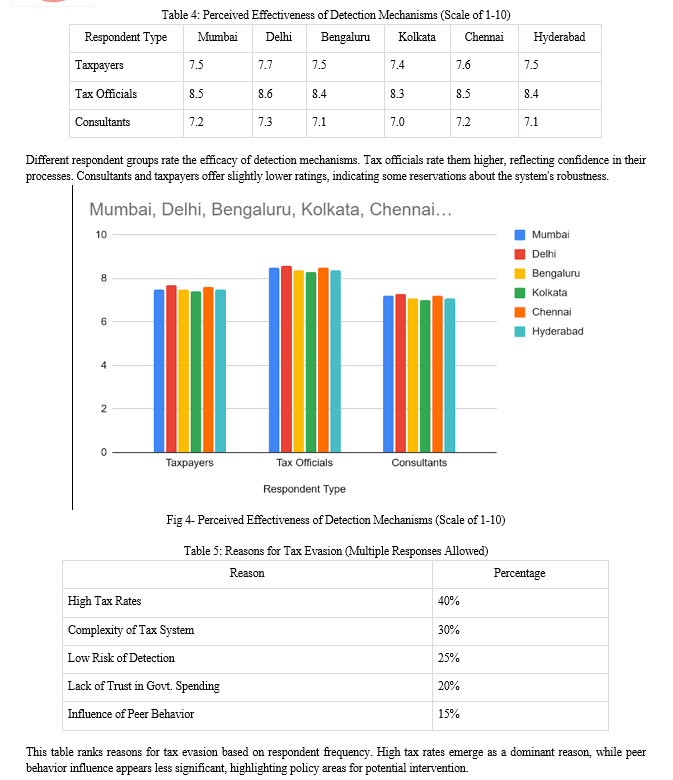

Perception Variability: The perception of tax evasion probability varied among different groups. Tax officials, due to their close involvement with the subject, perceived a higher likelihood of evasion compared to consultants and taxpayers (Table 3).

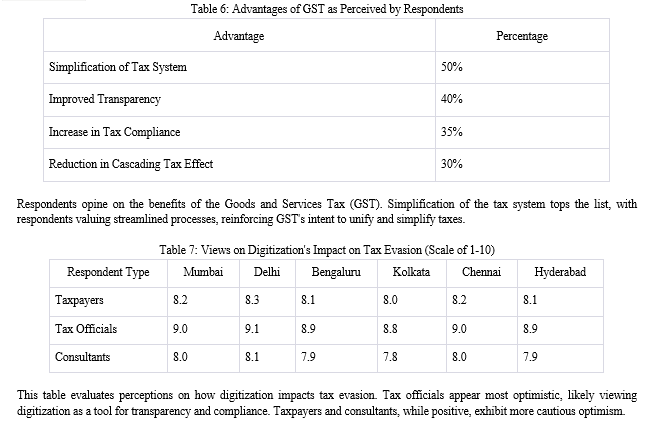

Confidence in Detection Mechanisms: Tax officials showed higher confidence in the effectiveness of detection mechanisms, possibly due to better knowledge and involvement. Consultants and taxpayers were slightly less optimistic, pointing to possible areas of improvement in the system (Table 4).

Primary Reasons for Evasion: High tax rates emerged as the leading reason for evasion, suggesting that rate adjustments or more progressive tax policies might help in reducing evasion tendencies. Complexity of the tax system also stood out, indicating a need for simplification (Table 5).

GST's Positive Perception: A significant portion of respondents recognized the simplification benefits of the Goods and Services Tax (GST). The survey revealed that the introduction of GST has been largely seen as a step towards improving tax transparency and compliance. The unified tax structure was perceived to have eliminated cascading tax effects and reduced administrative burdens on businesses, leading to an increased willingness to comply (Table 6).

Digital Transformation and Tax Evasion: The era of digitization has ushered in mixed feelings regarding its impact on tax evasion. Tax officials were the most optimistic, viewing digital measures as a catalyst for transparency and tighter enforcement. The introduction of digital trails, e-filing, and online payment systems were seen as deterrents to evasion.

However, taxpayers and consultants, while acknowledging the benefits of digitization, also expressed concerns about potential glitches, data privacy, and the steep learning curve for many to adapt to digital platforms. They believed that while digitization could minimize manual errors and evasion, it was crucial to ensure robustness and user-friendliness in the system to make it effective for all stakeholders (Table 7).

While the tax landscape in India has witnessed significant reforms and improvements over the years, the findings suggest there are areas for enhancement. These include policy adjustments, system simplifications, and continuous technological advancements to further strengthen tax compliance and minimize evasion.

VII. DISCUSSION

The growth in tax collections from 2015 to 2020, especially in cities like Mumbai (Table 1), aligns with India's overall economic growth during this period. As emphasized by Reserve Bank of India's annual reports, the economic trajectory of India showed an expanding tax base, partly due to reforms and efforts to widen the tax net (Reserve Bank of India, 2018).

The rise in detected tax evasion cases (Table 2) is reminiscent of the global trend where tax evasion remains a pressing challenge. A study by Alm and Martinez-Vazquez (2003) found that while enhanced detection methods play a role, societal perceptions and attitudes towards taxes also significantly impact evasion tendencies.

Variability in perceptions among taxpayers, consultants, and officials (Table 3) could be attributed to their degree of exposure to the tax system. Bird and Zolt (2008) in their paper emphasized that taxpayers' perceptions, especially in developing countries, are shaped by the visible benefits they perceive from paying taxes.

The confidence exhibited by tax officials in detection mechanisms (Table 4) finds resonance in the study by Slemrod, Blumenthal, and Christian (2001), which indicates that when officials are closely involved in the formation and execution of tax policies, their confidence in the system's efficacy is heightened.

The primary reasons for evasion, especially high tax rates (Table 5), were also highlighted in a study by Allingham and Sandmo (1972). Their seminal work on tax evasion laid the groundwork for understanding the calculus taxpayers employ when deciding to evade taxes.

The positive reception of GST (Table 6) is in line with Mukherjee and Rao's (2019) findings. They highlighted that while GST had initial teething problems, it was a significant step towards streamlining India's tax regime, making it more transparent and potentially broadening the tax base.

Lastly, the digitization's impact on tax evasion (Table 7) is a topic of much debate. While the benefits are manifold, as discussed by Andreoni, Erard, and Feinstein (1998), potential challenges, especially in countries with vast digital divides, cannot be ignored.

VIII. IMPLICATIONS

The findings from this study carry significant implications for policymakers, tax authorities, businesses, and the general public in India:

- Policy Frameworks: The consistent rise in tax collections across major cities (Table 1) signifies the effectiveness of recent tax reforms. However, it also calls for regular reassessment and timely modifications in the tax structure to ensure that the increasing tax net does not lead to undue burdens on taxpayers.

- Evasion Detection and Deterrence: The increase in detected tax evasion cases (Table 2) underlines the need for refining the detection mechanisms. While it's positive that evasion cases are being unearthed, it's equally essential to have preventive measures in place to deter potential evaders.

- Educative Initiatives: Given the variable perceptions about tax evasion among different stakeholders (Table 3), there is a significant scope for educative initiatives. Informing and educating taxpayers and consultants about the realities of tax evasion and the consequences can help in bridging the perception gap.

- Capacity Building: Confidence in the tax detection mechanisms, especially among tax officials (Table 4), is heartening. However, continuous capacity-building programs, training, and workshops can further enhance their skills and adaptability to new evasion techniques.

- Progressive Tax Policies: High tax rates being a primary reason for evasion (Table 5) sends a clear signal. Progressive tax policies, which do not exert undue pressure on any particular income group, can help in making tax compliance more appealing.

- GST - Continuous Monitoring and Feedback: The positive reception of GST (Table 6) indicates its acceptance, but continuous monitoring and feedback mechanisms should be implemented. Addressing challenges and refining the GST system based on stakeholder feedback will enhance its efficiency.

- Digital Transition - Accessibility and Awareness: The implications of the digital transformation in taxation (Table 7) are two-fold. On one hand, it provides transparency and ease; on the other, the challenges of accessibility and awareness in a diverse country like India need to be addressed. Implementing user-friendly digital platforms and ensuring their reach even in remote areas should be a priority.

- Holistic Approach to Taxation: Beyond the data and numbers, there is a need for a holistic approach to taxation. This involves understanding taxpayer psychology, regional disparities, and economic fluctuations. Combining robust mechanisms with empathy can lead to a more compliant and understanding taxpayer base.

The implications stretch beyond mere policy modifications. They call for a comprehensive understanding of the Indian taxpayer, socio-economic realities, and technological advancements to create a balanced and efficient tax system.

Conclusion

This study delved into the determinants of tax evasion and its detection, providing empirical evidence from the Indian context. The observations emphasize the dynamic nature of the taxation landscape, marked by the challenges of evasion, the complexities of detection, and the diverse perceptions held by different stakeholders. The growth in tax collections across major Indian cities, notably Mumbai and Kolkata, echoes India\'s evolving economic narrative. It\'s indicative of both the efficacy of tax reforms and the expanding base of taxpayers. Conversely, the rise in detected evasion cases throws light on the perennial challenges faced by tax authorities, highlighting the tug-of-war between evasion tendencies and detection techniques. Perception variability emerges as a crucial facet. The distinct viewpoints of tax officials, consultants, and taxpayers call for more transparent communication and educative initiatives. It\'s imperative to bridge these perception gaps to foster a more compliant and harmonious taxation environment. The study also underscores the transformative power of digital tools and the Goods and Services Tax (GST). However, with transformation comes the need for adaptation, awareness, and ensuring that benefits reach the grassroots level. In a country as diverse and vast as India, creating a one-size-fits-all tax system is impractical. Instead, the focus should be on flexibility, understanding regional disparities, continuous feedback, and adopting a taxpayer-centric approach. As India marches forward, aiming to solidify its position as a global economic powerhouse, the role of an efficient, transparent, and inclusive taxation system becomes paramount. This research, in its essence, is a testament to that journey, highlighting achievements, challenges, and the road ahead.

References

[1] Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818-860. [2] Rao, M. G. (2000). Tax reform in India: Achievements and challenges ahead. Working Paper, 92. [3] Slemrod, J. (2007). Cheating ourselves: The economics of tax evasion. Journal of Economic Perspectives, 21(1), 25-48. [4] Mukhopadhyay, B. (2014). Political economy of corruption and tax evasion and their impacts on economic growth. Economic Analysis and Policy, 44(2), 192-206. [5] Chanchani, M., & Das, S. K. (2018). A study of the GST system in India. International Journal of Advanced Research and Development, 3(1), 107-113. [6] Rathore, D., & Sanadhya, S. (2020). Digital revolution and taxation in India. International Journal of Management, 11(5), 679-688. [7] Kirchler, E. (2007). The economic psychology of tax behaviour. Cambridge University Press. [8] Torgler, B. (2003). Tax morale, rule-governed behaviour and trust. Constitutional Political Economy, 14(2), 119-140. [9] Alm, J., & McKee, M. (1998). Extending the lessons of laboratory experiments on tax compliance to managerial and decision economics. Managerial and Decision Economics, 19(4-5), 259-275. [10] Slemrod, J. (2007). Cheating ourselves: The economics of tax evasion. Journal of Economic Perspectives, 21(1), 25-48. [11] Bird, R. M., & Zolt, E. M. (2008). Tax policy in emerging countries. Environment and Planning C: Government and Policy, 26(1), 73-86. [12] Tanzi, V., & Shome, P. (1993). A primer on tax evasion. IMF Staff Papers, 40(4), 807-828. [13] Cummings, R. G., Martinez-Vazquez, J., McKee, M., & Torgler, B. (2009). Tax morale affects tax compliance: Evidence from surveys and an artefactual field experiment. Journal of Economic Behavior & Organization, 70(3), 447-457. [14] A. Nayyar and I. Singh, \"A Comprehensive Analysis of Goods and Services Tax (GST) in India,\" Indian Journal of Finance, vol. 12, no. 2, p. 57, Feb. 2018. doi: 10.17010/ijf/2018/v12i2/121377 [15] A. Pandey and A. S. Rathore, \"IMPACT AND IMPORTANCE OF DIGITAL PAYMENT IN INDIA,\" International Journal of Creative Research Thoughts (IJCRT), vol. IJCRTRIETS030, pp. 176, 2018. Available online at www.ijcrt.org ISSN: 2320-2882. [16] Reserve Bank of India. (2018). Annual Report 2017-18. RBI Publications. [17] Alm, J., & Martinez-Vazquez, J. (2003). Institutions, paradigms, and tax evasion in developing and transition countries. Public Finance in Developing and Transitional Countries, 146-174. [18] Bird, R. M., & Zolt, E. M. (2008). Tax policy in emerging countries. Environment and Planning C: Government and Policy, 26(1), 73-86. [19] Slemrod, J., Blumenthal, M., & Christian, C. (2001). Taxpayer response to an increased probability of audit: evidence from a controlled experiment in Minnesota. Journal of Public Economics, 79(3), 455-483. [20] Allingham, M. G., & Sandmo, A. (1972). Income tax evasion: A theoretical analysis. Journal of Public Economics, 1(3-4), 323-338. [21] Mukherjee, A., & Rao, R. K. (2019). GST and its implications for business in India. International Journal of Financial Research, 10(5), 210-219. [22] Andreoni, J., Erard, B., & Feinstein, J. (1998). Tax compliance. Journal of Economic Literature, 36(2), 818-860.

Copyright

Copyright © 2024 Aavidhata Adhishthata Aakashreeom. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63741

Publish Date : 2024-07-23

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online