Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Evaluation of Dimensions Impacting the Housing Property Retail Price in Noida: An Empirical Study

Authors: Shresth Bisaria, Dr. Samarth Sharma

DOI Link: https://doi.org/10.22214/ijraset.2024.59776

Certificate: View Certificate

Abstract

This study looks into the various aspects that affect how housing properties are priced at retail. Understanding the complex interactions between various factors is essential for stakeholders in the modern real estate market, from developers and investors to legislators. The research uses a thorough methodology, examining structural, locational, economic, and demographic aspects that affect housing property values. The research aims to provide a nuanced understanding of the complex web of influences shaping retail prices in the housing market by synthesising existing literature and utilising cutting-edge analytical tools. The study\'s insights may help real estate market players navigate the complexity and uncertainty involved in housing property pricing, which could influence strategic decision-making in the industry. Ultimately, this study adds to the larger conversation about affordable housing, stable markets, and urban development that is sustainable.

Introduction

I. INTRODUCTION

Real estate is the land plus any improvements, whether natural or man-made, that are permanently affixed to the land, such as homes. Real property includes real estate. Contrary to real estate, personal property includes items like cars, boats, jewellery, furniture, and farm equipment that are not permanently affixed to the ground.

A. Understanding Real Estate

Although the terms land, real estate, and real property are frequently used synonymously, they have different meanings.

The term "land" refers to the entire surface of the earth, including the water, minerals, and trees, as well as the space above it and the earth's centre. The physical attributes of land are its uniqueness, indestructibility, and immobility due to the geographical differences between each piece of land.

Real estate includes both the original land and any long-term human constructions, like homes and other structures. An improvement is any land addition or modification that raises the value of the property.

After land is improved, the entire amount of money and labour required to construct the improvement constitutes a substantial fixed investment. Improvements like drainage, electricity, water, and sewer systems are typically permanent, even though a building can be demolished.

Real property consists of the original land, any improvements made to it, as well as the rights derived from ownership and use.

B. Types of Real Estate

- Residential/ Commercial Real Estate: Any property used solely for commercial purposes, including parking lots, restaurants, shopping centres, theatres, hotels, hospitals, petrol stations, grocery stores and apartment buildings, is referred to as commercial real estate.

- Industrial Real Estate: Any property used for production, distribution, manufacturing, warehousing, research and development, or storage is considered industrial real estate.

- Land: This refers to undeveloped land, open space, and agricultural land, including ranches, farms, orchards, and timberlands.

- Special purpose: Real estate that is utilised by the general public, including parks, libraries, government structures, cemeteries, and schools.

The location of real estate has a significant impact on its value, and other variables that may also have an impact include employment rates, the local economy, crime rates, transportation options, school quality, municipal services, and property taxes.

C. Advantages of Housing Property

- Building Equity

The ability to create equity is one of the most compelling reasons to invest in a home. In contrast to renting, where monthly payments simply provide temporary shelter, homeownership allows the owner to build equity over time. Buyer steadily raise his ownership stake in the property as he makes mortgage payments. Building equity can be a significant asset, especially during times of financial necessity, and it also has the potential to accumulate wealth.

2. Long-term Investment

A house is more than just a place to live; it is also a long-term investment. Real estate usually appreciates in value over time, and by owning a property, the owner stand to benefit from this potential growth. Real estate has historically exhibited consistent growth, making it a generally safe investment option.

3. Stability and Control

Owning a house provides a sense of stability and control over the living space. The homeowner have the freedom to modify and personalise his living space according to his preferences and needs. Homeownership provides a secure living environment.

4. Tax Benefits

Purchasing a home can provide major tax advantages. Mortgage interest and property taxes are generally tax deductible, which lowers the overall tax burden. These deductions can improve financial status by raising the discretionary income.

5. Retirement Planning

Purchasing a home can be a critical component of retirement planning. Indirectly the person is effectively contributing to his future financial security by making regular mortgage payments. Once the mortgage is paid off, he will have a valuable asset as well as a place to live, which will reduce his living expenditures during retirement.

D. Residential Real Estate in India: Market Analysis

The size of the residential real estate market in India is projected to be USD 227.26 billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 24.77% to reach USD 687.27 billion by 2029.

The country's rapid urbanisation is driving up demand for affordable housing in many areas. Aside from that, the need for better lifestyles has led to a notable increase in the demand for large, luxurious homes.

- Real estate is one of India's most robust economic pillars. This pillar is evolving due to a number of factors, including the pandemic's effects, rapid urbanisation, shifting consumer behaviour, and regulatory changes. Following the pandemic, the real estate sector has started to rebound. A turning point was reached in India's residential real estate market in 2021. In 2022–2023, the housing market is predicted to maintain its strong momentum, with sales probably approaching pre–pandemic levels.

- The market is driven forward by the implementation of initiatives that create demand and motivate individuals to purchase real estate. In the residential category, buyers have shown a strong demand for apartments that are ready to move into. But in these situations, it's crucial to manage expectations and provide better customer education. The patterns that have been noted are groundbreaking. India is seeing a technological revolution in the real estate sector. There are a number of innovative tactics and solutions being used in the sector. These recent advancements have accelerated the market's growth trajectory.

- One of the most well-known advancements in home automation is a prime example of how well real estate and technology work together. These locations have a great deal of potential to draw in a wide variety of investment opportunities and progressive people. Properties that are still under construction gradually lose their appeal due to lengthy wait times and a rise in project failures. Ready-to-move-in homes are becoming more and more popular as a result. Many builders have embraced the business model of building first and selling later in order to support this idea. This well-liked American and European house design makes inroads into the Indian real estate market.

- These properties are now a more attractive investment option than traditional ones because Real Estate Investment Trusts (REITs) are required to have 80% of their underlying assets operational and income-generating. It is a low-risk way to spread out your financial holdings. Despite the pandemic's impact on rental cash flow, a robust and rising long-term outlook is predicted. The act of owning property is growing in popularity.

The support of the banking industry and government initially sparked the positive consumer sentiment towards residential real estate, even though this has contributed to it. Metrics related to supply and demand were improved by the convergence of these two factors. Many homeowners are realising the benefits of larger homes after working indoors for extended periods of time.

E. Residential Real Estate of India: Market Trends

This section covers the major market trends shaping the India Residential Real Estate Market according to our research experts:

- Increasing Demand for Big Residential Spaces Driving the Market

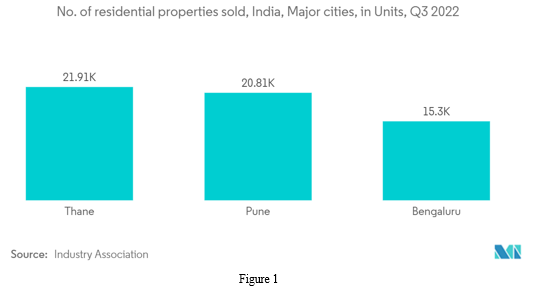

- After COVID-19 lockdowns, the real estate market has gradually recovered despite sharp inflation and rising interest rates. In comparison to the same period in 2021, sales of residential properties in India's top cities increased by 24% in the July–September quarter of 2022, according to a recent report by industry experts. The report states that overall sales increased from 87,747 units in the same quarter of 2021 to 1,08,817 units in the third quarter of 2022. Bengaluru, Chennai, Hyderabad, Kolkata, Thane, Mumbai, Navi Mumbai, Pune, and Delhi-NCR are listed as Tier-1 cities in this report.

- The main factors driving sales growth have been low-interest rates, relatively cheap prices, the pandemic's renewed need for home ownership, and buyers' need for a lifestyle upgrade. The demand momentum and shift in sentiment prompted developers to strategically launch 160,806 units in H1 2022—56% more than in the corresponding period of 2021. Of the top eight markets, Mumbai's 44,200 home unit sales volume accounted for 28% of total sales. In terms of annual percentage growth, NCR home sales rose to 29,101 units, a 154% annual increase. Among the top eight real estate markets in the nation, NCR had the second-highest share of sales.

- A waning pandemic with less chance of future disruptions, low interest rates, the best affordability levels, robust wage growth, and other factors have created a favourable environment for homebuyers who have rediscovered the need for new and better housing. Although financial strain is still a major concern for developers in all markets, robust and healthy homebuyer demand should open the door for gradual price increases, enabling them to withstand rises in vital input costs like steel and cement.

2. Central and State Government Pushing Towards Affordable Housing Driving the Market

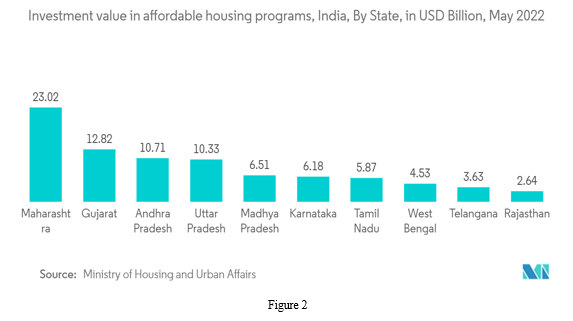

- By 2030, the Indian real estate market is predicted to grow to be worth $1 trillion, with affordable housing being a major contributor to this expansion. At a time when the average annual population growth rate is 2.1%, and many of our citizens have low purchasing power, providing the 40 million urban housing units that are needed once seemed unattainable. But in recent years, the government has made a number of significant announcements (some examples) to support affordable housing, so things have changed. It has become one of the real estate market's most dynamic sectors in India.

- Under the Pradhan Mantri Awas Yojana-Urban (PMAY-U), which was implemented to address urban housing shortages, including slum dwellers, by guaranteeing a pucca house to eligible urban households, particularly the Light House projects in six States as part of the Global Housing Technology Challenge - India (GHTC -India) initiative, innovative technology was used to build houses more quickly. The Made in India campaign gained momentum as a result of the initiative, which brought in a new era in Indian construction technology. LHPs will open up a new ecosystem wherein globally validated technologies will be applied for faster, more affordable, and environmentally responsible construction. These LHPs have many advantages, the main ones being affordability, resilience to climate change, and durability.

- In spite of this, there is still a severe lack of supply in this market, with more buyers choosing to purchase in cities where high-value real estate has been prioritised. A few years ago, few financiers would have considered financing customers seeking affordable housing; however, in order to make affordable housing a profitable business model, the majority of the major players in the industry are now involved in the market. To address the current imbalance in supply and demand in the market, they are venturing into the affordable housing sector. In Tier II and III cities, a large number of these projects have surfaced, spurring growth in those towns and cities.

F. Residential Real Estate in India: Industry Overview

With a large number of local and regional players and a small number of international players, the Indian residential real estate market is extremely fragmented. Godrej Properties, Prestige Estate, DLF, Phoenix Mills, L&T Realty Ltd., Omaxe Ltd., and numerous other significant players are among them. Due to a strong pipeline of new residential project launches, it is anticipated that the top listed developers' share of the Indian residential market would increase from 25% in FY21 to 29% in FY24. Big companies have the advantage of financial resources, but small businesses can compete successfully by developing local market expertise.

G. Residential Real Estate Market Leaders

- Godrej Properties

- Prestige Estate

- DLF

- Phoenix Mills

- L&T Realty Ltd.

H. Determinants of Housing Property Prices

Numerous factors influence the complex and dynamic real estate market, which in turn affects property prices. Policymakers, investors, and individual homeowners are just a few of the many stakeholders who must comprehend these determinants. This study attempts to disentangle the complexities that affect the values of residential and commercial properties by conducting a thorough investigation of the complex field of real estate price determinants.

- Fundamentals of Real Estate Dynamics: The fundamental ideas of supply and demand in economics form the basis of real estate valuation. Since location is a basic factor, it has a big influence on property values. A location's allure to prospective tenants or buyers is influenced by its general desirability, accessibility to amenities, and proximity to economic hubs. Furthermore, it is important to consider how supply and demand interact; a scarcity of housing in response to growing demand typically causes prices to rise, whereas an excess of supply may have the opposite effect.

- Governmental Policies and Regulations: Government rules and policies have a significant impact on the real estate industry. Property values are shaped by land-use regulations, zoning laws, and tax incentives and disincentives. Government actions, like stimulus plans or changes to regulations, can impact real estate markets significantly and quickly.

- Demographic Influences: A region's demographic makeup has a significant influence on real estate prices. The desire for residential and commercial real estate is influenced by factors such as migration patterns, age distribution, and population growth. Gaining an understanding of these demographic trends can help you anticipate future market dynamics.

- Technological Advancements in Real Estate: Real estate valuation now includes new factors as a result of technological advancements. Artificial intelligence, big data analytics, and virtual reality property tours are revolutionising the marketing, appraisal, and valuation of real estate. These developments in technology not only improve productivity but also affect how properties are perceived and desired.

- Environmental and Sustainability Considerations: Sustainability has become more important in real estate due to rising environmental awareness. High-end properties that meet green building standards or have energy-efficient features are frequently in high demand. The integration of ecological factors in real estate appraisal signifies a wider trend in society towards sustainable lifestyles.

- Socio-Cultural Trends in Real Estate: Real estate values are greatly influenced by cultural trends and societal preferences. The market demand for particular types of properties is shaped by shifts in lifestyle preferences, such as the preference for urban living over suburban sprawl or the growing demand for smart homes.

- Temporal Dynamics and Trends: Understanding that determinants may change over time, the purpose of this study is to pinpoint temporal patterns in real estate markets. Historical analysis gives us insights into the possible future trajectories of these determinants as well as how particular factors have gained or lost influence.

- Economic Indicators and Market Behaviour: Investigating the direct effects of economic indicators like GDP growth, inflation, and interest rates on real estate market behaviour is essential for delving deeper into the macroeconomic environment. Property prices typically rise during times of strong economic growth due to an increase in demand for residential and commercial real estate. On the other hand, economic downturns might result in less demand, which would lower property values.

- Financing and Interest Rates: The affordability and ease of financing are major factors in determining the value of real estate. Interest rates have a direct bearing on how affordable mortgages are, which affects how prospective buyers make decisions. Since borrowing becomes more accessible due to low interest rates, demand is frequently stimulated, increasing competition for real estate and driving up prices.

- Property-Specific Factors: The inherent qualities of a property, independent of outside factors, greatly add to its value. The attractiveness of a property to prospective buyers can be affected by various factors, including its size, condition, and amenities. A building's age and architectural style can also affect how much the market values it at.

- Psychological and Behavioural Aspects: Gaining an understanding of the psychological and behavioural aspects of market participants is essential to understanding the factors that influence real estate prices. Property prices are affected by irrational exuberance or fear that is driven by market sentiment, investor confidence, and the fear of missing out (FOMO).

- Globalization and Real Estate Markets: The real estate markets are not immune to global economic trends in this era of increased globalisation. International economic conditions, foreign buyers, and cross-border investments can all have a domino effect on local real estate values. Comprehending the interdependence of worldwide markets is imperative in order to predict prospective changes in the regional real estate scene.

- Regulatory Environment and Legal Framework: Property values are directly affected by the legal and regulatory framework and environment in which real estate transactions take place. Real estate markets can change due to modifications to property laws, tax laws, or zoning laws, which may present opportunities or difficulties for market players.

- Market Liquidity and Accessibility: Pricing dynamics are affected by the real estate market's liquidity, which is defined as how simple it is to buy or sell properties. While illiquid markets may react more strongly and slowly to changes in supply or demand, highly liquid markets frequently see smoother price adjustments.

- Market Sentiments and Perception: Market sentiment can be shaped by how the public, media, and dominant narratives perceive the real estate market. Either positive or negative feelings have the potential to trigger speculative activity, which in turn affects demand and, ultimately, real estate prices.

II. LITERATURE REVIEW

A complex and diverse field, the housing market is impacted by a number of social, economic, and environmental variables. Policymakers, investors, and other stakeholders must comprehend the nuances of these factors in order to navigate the housing market effectively. In order to offer a thorough grasp of the underlying forces, valuation dynamics, and effects of various variables on housing prices and property values, this literature review summarises recent research.

A thorough examination of the non-linear relationship between house size and price was carried out by Asabere and Huffman (2013). Their research showed that there are complex interactions rather than a clear-cut relationship between these two variables. Larger homes might not always fetch higher prices because market demand, location, and amenities all have a big impact on how much a property is worth.

Bailey, Haurin, and McGreal (2019) investigated the complex connection between mortgage leverage selection and home price beliefs. Their study brought to light the psychological and financial factors that impact people’s opinions of housing market trends and their choices when it comes to taking out mortgages. Policymakers and investors can better anticipate market dynamics and reduce risks by understanding how these beliefs shape market behaviours.

Sirmans et al. (2020) carried out a thorough meta-analysis on the importance of housing attributes. Their research revealed the cumulative effect of various property features on property valuation by synthesising results from multiple empirical studies. A property’s overall perceived value is influenced by a number of factors, including its age, architectural style, square footage, and the number of bedrooms and bathrooms it has.

Can (2018) investigated how neighbourhood characteristics affected price risk and valuation certainty. Their findings demonstrated the significance of contextual elements in influencing buyers’ assessments of value and risk, including crime rates, the calibre of the local schools, accessibility to amenities, and neighbourhood aesthetics. Both buyers and sellers must have a thorough understanding of these neighbourhood-level dynamics in order to make wise decisions.

The socio-psychological aspects of neighbourhood property values were examined by Anonymous (2018). They shed light on the social forces influencing housing market trends by analysing the effects of regression, progression, and conformity on market dynamics. Property values can be greatly impacted by elements like social standing, neighbourhood reputation, and community cohesion, underscoring the interaction between social dynamics and market results.

Glaeser, Kahn, and Rappaport (2020) in their analysis examined the function of public transport in urban housing markets. They highlighted the significance of transport infrastructure in influencing housing preferences and market dynamics by conducting research that illuminated the spatial patterns of housing demand and accessibility. Property values can be impacted by public transportation accessibility, especially in urban areas where residents prioritise convenience and mobility.

Bae, Kim, and Lee (2019) evaluated the effect of housing features on property valuations by conducting a comparative study across various property types. Through an analysis of multiple property characteristics, including size, location, amenities, and architectural style, their study offered significant understanding of buyers’ diverse preferences and the relative significance of various features in establishing property values.

De la Rosa and Olmos (2020) looked into how different market segments’ transaction prices were affected by different property features. Their research made clear how important market segmentation effects are in determining valuation dynamics because different buyer demographics and market circumstances can make some property features more important than others.

Wang and Huang (2020) looked at how amenities affect both housing costs and urban structure. Empirical evidence was presented by their research regarding the ways in which urban amenities like parks, recreational centres, and cultural attractions influence property values.

Desirable amenities have the power to increase a neighbourhood’s appeal and property values, underscoring the significance of quality-of-life-focused urban planning and development strategies.

Li, Zhang, and Wang (2019) in their investigation emphasised the spatial clustering and interdependence of housing market dynamics while examining spatial dependence in real estate prices. Their study showed how neighbourhood features, market trends, and the physical proximity to facilities are examples of localised factors that can affect property values within a given area. Comprehending spatial dependencies is essential for precise market analysis and property valuation.

In their analysis of the financial impacts of green office buildings, Eichholtz, Kok, and Quigley (2019) proposed possible connections between the real estate industry’s financial performance and environmental sustainability. Their findings demonstrated the growing significance of sustainability factors in real estate investment choices as buyers come to understand the long-term benefits of ecologically friendly construction.

The economic impact of green spaces in planned and unplanned communities was examined by Kim and Peiser (2018). Their research demonstrated how environmental amenities influence real estate prices and urban growth, emphasising how green infrastructure can improve neighbourhood liveability and appeal.

In addition, Geng (2018) looked at the basic causes of home prices in developed nations, offering perceptions into the macroeconomic elements affecting patterns in the housing market. Through the examination of variables like interest rates, income brackets, job growth, and population patterns, his study enhanced our comprehension of the wider economic factors influencing the dynamics of the housing market.

International research on the variables influencing housing prices was collated by IDEAS/RePEc (2018), providing a thorough understanding of the dynamics of the housing market around the world. Their study consolidated results from numerous investigations conducted in several nations, emphasising regional variations and common patterns in the behaviour of the housing market. Wilhelmsson and Long’s (2020) investigation into the effects of malls on flat prices provides specific examples of how localised commercial developments affect the value of residential real estate. Their research shed light on the relationship between residential and commercial real estate markets as well as the spatial dynamics of urban development by analysing the impact of shopping mall proximity on property values in urban areas.

III. RESEARCH METHODOLOGY

This research utilises a comprehensive and definitive approach to adequately address the complexities of the topic. This entails using a descriptive research design, which goes into great detail into the characteristics of the specific phenomenon under study.

The research design selected for the descriptive methodology is a cross-sectional analysis. Using this method, data can be collected at a single point in time, providing an overview of the relationships between variables over a given time frame. Researchers are able to draw significant conclusions about the current state of affairs because the study employs the cross-section method, which captures breadth rather than depth on the subject matter.

Secondary data is analysed in order to facilitate this investigation. Knowledge acquired by other organisations, such as governmental bodies, universities, or academic journals, is referred to as secondary data. The study can effectively access large amounts of information without having to gather primary data by making use of existing datasets, which optimises resources and saves time.

IV. RESULT & DATA ANALYSIS

Table 1: Summary Coefficients

|

Unstandardized coefficients |

Standardized Coefficients |

SE |

T Value |

P Value |

2.50% |

97.50% |

|

|

Garden size |

-19.307 |

-0.08 |

67.689 |

0.285 |

0.776 |

-153.744 |

115.13 |

|

Lot Length |

-30.61 |

-0.01 |

210.769 |

0.145 |

0.885 |

-449.215 |

387.995 |

|

House Area |

-393.836 |

-0.209 |

106.716 |

3.691 |

0 |

-605.784 |

-181.889 |

|

Tax Value |

1.491 |

1.385 |

0.144 |

10.378 |

0 |

1.206 |

1.777 |

|

Lot Width |

144.914 |

0.006 |

750.451 |

0.193 |

0.847 |

-1345.547 |

1635.375 |

|

Lot Area |

-39.369 |

-0.164 |

70.903 |

0.555 |

0.58 |

-180.187 |

101.45 |

|

Balcony |

3836.267 |

0.026 |

2027.226 |

1.892 |

0.062 |

189.98 |

7862.513 |

|

Intercept |

44639.474 |

0 |

12759.89 |

3.498 |

0.001 |

19297.229 |

69981.72 |

- Garden size: The coefficient is negative which means that as garden size goes up, dependent variable goes down albeit to a small extent and without statistical significance (P > 0.05).

- Lot Length: Similarly, there is a negative coefficient suggesting that in the case of lot length increasing, dependent variable decreases again this effect being non-significant.

- House Area: Notice an important negative coefficient; hence when house area increases, dependent variable decreases. It’s statistically significant (P < 0.05).

- Tax Value: It has a positive and highly significant coefficient meaning that as tax value goes up, so does the dependent variable.

- Lot Width: As well as lot width increases upwards, the dependent variable also increases just like it happens with this variable but its statistically insignificant though.

- Lot Area: Another way of summarizing this finding would be through stating that Lot Area has a negative coefficient implying that the larger a lot area, the smaller is the dependent variable albeit insignificantly.

- Balcony: There is a positive coefficient signifying that if there are more balconies found here then the corresponding changes in DV will increase slightly for example by nearly 6.2% probability (P = 0.062).

- Intercept: The intercept is the estimated value of the dependent variable when all predictors are at zero. In this case, it is quite high, indicating the basic value of the dependent variable when there are no predictors.

|

Sum Square |

DF |

Mean Square |

F |

P Value |

|

|

Total |

545523171717.17 |

98 |

0 |

0 |

0 |

|

Error |

9166803565.5190 |

91 |

100734105.116 |

0 |

0 |

|

Regression |

536356368151.65 |

7 |

76622338307.379 |

760.639 |

0 |

Table 2: Summary Anova

- Total Sum of Squares: A significant amount of variability in the data is indicated by the dependent variable's extraordinarily high total variability.

- Error Sum of Squares: This shows how much of the variability in the dependent variable the regression model is unable to account for. Since it's lower in this instance than the Total SS, a sizable amount of the dependent variable's variability can be accounted for by the model's predictors.

- Regression Sum of Squares: This shows how much of the variance in the dependent variable the regression model can account for. It represents a sizeable chunk of the Total SS and suggests that the model's predictors together have a big effect on the dependent variable.

- F and P values: The regression model is highly significant because the F-value is extraordinarily high and the p-value is extremely low (both practically zero). This shows that the model fits the data well and that the predictors in the model together have a considerable impact on the dependent variable.

Table 3: Standardized Coefficients

|

Retail Value |

|

|

Garden size |

-0.08 |

|

Lot Length |

-0.01 |

|

House Area |

-0.209 |

|

Tax Value |

1.385 |

|

Lot Width |

0.006 |

|

Lot Area |

-0.164 |

|

Balcony |

0.026 |

|

Intercept |

0 |

- With a positive coefficient of 1.385, tax value appears to have the greatest influence on the dependent variable among the listed predictors. This implies that, in comparison to other predictors, changes in tax value have a comparatively big impact on the dependent variable.

- The dependent variable appears to be significantly impacted negatively by house area as well, as evidenced by its coefficient of -0.209.

- Based on their coefficients, other predictors such as balcony presence, lot width, lot length, lot area, and garden size have comparatively smaller effects on the dependent variable.

Table 4: R-Square

|

Retail Value |

|

|

R-Square |

0.983 |

|

R-Square Adjusted |

0.982 |

|

Durbin-Watson test |

1.242 |

- The regression model fits the data very well and accounts for a significant amount of the variance in the dependent variable, as evidenced by the high R-Square and adjusted R-Square values.

- The marginally low Durbin-Watson statistic raises the possibility of a residual autocorrelation problem, which could compromise the accuracy of the model's estimates. Corrective actions or additional research may be required to resolve this problem.

- R-Square and adjusted R-Square show that the model's overall fit is still very strong, despite the possible autocorrelation concern.

Table 5: Path Coefficients – Mean, STDEV, T values, P values

|

Original Sample (0) |

Sample Mean (M) |

STDEV |

T Stats (I0/STDEV) |

P Value |

|

|

Balcony > Retail value |

0.026 |

0.026 |

0.015 |

1.721 |

0.085 |

|

Garden size > Retail value |

-0.08 |

-0.084 |

0.29 |

0.276 |

0.782 |

|

House area > Retail value |

-0.209 |

-0.216 |

0.069 |

3.017 |

0.003 |

|

Lot area > Retail value |

-0.164 |

-0.166 |

0.311 |

0.526 |

0.599 |

|

Lot length > Retail value |

-0.01 |

-0.014 |

0.058 |

0.174 |

0.862 |

|

Lot width > Retail value |

0.006 |

0.004 |

0.023 |

0.238 |

0.812 |

|

Tax value > Retail value |

1.385 |

1.398 |

0.155 |

8.923 |

0 |

- Balcony > Retail Value: The path coefficient between the two variables is 0.026, suggesting a weakly positive correlation between the two. But the coefficient (p = 0.085) is not statistically significant, indicating that the relationship might not be trustworthy.

- Garden Size > Retail Value: The path coefficient between garden size and retail value is -0.08, suggesting a slight inverse relationship. Nevertheless, the statistical significance of this relationship is not established (p = 0.782), implying that garden size may not be a significant predictor of retail value.

- House Area > Retail Value: There is a moderately negative relationship between house area and retail value, as indicated by the path coefficient of -0.209. The statistical significance of this relationship (p = 0.003) indicates that house area is a significant predictor of retail value.

- Lot Area > Retail Value: There is a slight negative correlation between lot area and retail value, as indicated by the path coefficient of -0.164. The lack of statistical significance in this relationship (p = 0.599) raises the possibility that lot area is not a reliable indicator of retail value.

- Lot Length > Retail Value: There is a very slight negative correlation between lot length and retail value, as indicated by the path coefficient of -0.01. Lot length may not be a significant predictor of retail value, as this relationship is not statistically significant (p = 0.862).

- Lot Width > Retail Value: There is a very weak positive correlation (path coefficient = 0.006) between lot width and retail value. Nevertheless, the statistical significance of this relationship is not established (p = 0.812), implying that lot width might not be a significant predictor of retail value.

- Tax Value > Retail Value: A strong positive correlation between tax value and retail value is indicated by the path coefficient of 1.385. The statistical significance of this relationship indicates that tax value is a significant predictor of retail value (p < 0.001).

Given their comparatively large coefficients and statistical significance, tax value and house area appear to be the most important predictors of retail value overall based on these path coefficients. Based on the available data, other predictors, like balcony and garden size, lot area, lot length, and lot width, do not seem to be significant predictors of retail value.

V. FUTURE RESEARCH

- Non-significant factors: Despite analysis, some factors failed to demonstrate statistically significant correlations with retail value. Among them are:

- Balcony

- The lot's width

- Length

- Area of the lot

- Size of the garden

2. Impact specific to context: The following factors may have an impact on retail value, according to the non-significant results for some of them:

- Reliant on certain circumstances that the study did not take into account.

- Affected by additional factors that have not yet been examined.

3. Residual autocorrelation: This is a possibility that could have an impact on the following aspects of the model:

- Accuracy

- Dependability of estimates

4. Reducing restrictions: More investigation is required to determine additional significant variables and examine the effects of non-significant factors in diverse settings.

VI. LIST OF TABLES

- Summary Coefficient

|

Unstandardized coefficients |

Standardized Coefficients |

SE |

T Value |

P Value |

2.50% |

97.50% |

|

|

Garden size |

-19.307 |

-0.08 |

67.689 |

0.285 |

0.776 |

-153.744 |

115.13 |

|

Lot Length |

-30.61 |

-0.01 |

210.769 |

0.145 |

0.885 |

-449.215 |

387.995 |

|

House Area |

-393.836 |

-0.209 |

106.716 |

3.691 |

0 |

-605.784 |

-181.889 |

|

Tax Value |

1.491 |

1.385 |

0.144 |

10.378 |

0 |

1.206 |

1.777 |

|

Lot Width |

144.914 |

0.006 |

750.451 |

0.193 |

0.847 |

-1345.547 |

1635.375 |

|

Lot Area |

-39.369 |

-0.164 |

70.903 |

0.555 |

0.58 |

-180.187 |

101.45 |

|

Balcony |

3836.267 |

0.026 |

2027.226 |

1.892 |

0.062 |

189.98 |

7862.513 |

|

Intercept |

44639.474 |

0 |

12759.89 |

3.498 |

0.001 |

19297.229 |

69981.72 |

2. Summary ANOVA

|

Sum Square |

DF |

Mean Square |

F |

P Value |

|

|

Total |

545523171717.17 |

98 |

0 |

0 |

0 |

|

Error |

9166803565.5190 |

91 |

100734105.116 |

0 |

0 |

|

Regression |

536356368151.65 |

7 |

76622338307.379 |

760.639 |

0 |

3. Standardized Coefficients

|

Retail Value |

|

|

Garden size |

-0.08 |

|

Lot Length |

-0.01 |

|

House Area |

-0.209 |

|

Tax Value |

1.385 |

|

Lot Width |

0.006 |

|

Lot Area |

-0.164 |

|

Balcony |

0.026 |

|

Intercept |

0 |

4. R-Square

|

Retail Value |

|

|

R-Square |

0.983 |

|

R-Square Adjusted |

0.982 |

|

Durbin-Watson test |

1.242 |

5. Path Coefficients – Mean, STDEV, T Value, P Value

|

Original Sample (0) |

Sample Mean (M) |

STDEV |

T Stats (I0/STDEV) |

P Value |

|

|

Balcony > Retail value |

0.026 |

0.026 |

0.015 |

1.721 |

0.085 |

|

Garden size > Retail value |

-0.08 |

-0.084 |

0.29 |

0.276 |

0.782 |

|

House area > Retail value |

-0.209 |

-0.216 |

0.069 |

3.017 |

0.003 |

|

Lot area > Retail value |

-0.164 |

-0.166 |

0.311 |

0.526 |

0.599 |

|

Lot length > Retail value |

-0.01 |

-0.014 |

0.058 |

0.174 |

0.862 |

|

Lot width > Retail value |

0.006 |

0.004 |

0.023 |

0.238 |

0.812 |

|

Tax value > Retail value |

1.385 |

1.398 |

0.155 |

8.923 |

0 |

VII. LIST OF FIGURES

VIII. ACKNOWLEDGEMENT

Starting this academic journey has been a demanding and rewarding experience, and I am truly grateful to those who have helped and encouraged me along the way, as their support and encouragement have made this dissertation possible.

To my esteemed advisor, Dr Samarth Sharma, your unwavering dedication, insightful guidance, and intellectual generosity have been the cornerstone of this endeavour. Your mentorship has not only shaped my research but has also inspired personal and scholarly growth. I am profoundly grateful for your patience, encouragement, and belief in my capabilities.

Heartfelt appreciation is extended to my family, whose boundless love, encouragement, and sacrifices have sustained me through the highs and lows of this journey. To my parents, Shilpa Bisaria and Sarvesh Bisaria, your unwavering support and belief in my dreams have been a constant source of strength. I am deeply grateful for your sacrifices and unwavering encouragement.

I am indebted to my friends and colleagues for their camaraderie, encouragement, and unwavering support throughout this academic pursuit. Your friendship, intellectual discussions, and shared experiences have made this journey more fulfilling and memorable.

Special appreciation goes to Amity Business School, Amity University, Noida for providing a conducive academic environment, resources, and opportunities essential for the completion of this dissertation. The institutional support has been invaluable in facilitating my research endeavours.

I extend my deepest gratitude to all the participants and individuals who generously contributed their time, insights, and expertise to this research endeavour. Your willingness to share your knowledge and experiences has enriched the quality and depth of this work.

Lastly, I acknowledge the countless individuals, mentors, and role models whose contributions, whether direct or indirect, have left an indelible mark on my academic and personal development. Your influence and inspiration have shaped my intellectual curiosity and passion for scholarship.

To all those mentioned above and to countless others who have supported me along this journey, your contributions have been invaluable. While words may fall short in expressing my gratitude, please know that your impact extends far beyond these pages and will be forever cherished.

Conclusion

This research investigated the complex dynamics of property valuation, concentrating on the factors that influence retail value by closely examining regression models and path coefficients. The results revealed a number of important insights that advance our knowledge of the intricate interactions between numerous predictors and retail value. The main takeaway from this is that tax value has a big influence on retail value. The strong positive relationship between retail value and tax value emphasises how important tax laws are in determining how much real estate is worth. This research emphasises how important it is for decision-makers in the real estate industry, including legislators, to carefully analyse the tax ramifications of property values and investment choices. The investigation also showed a complex correlation between house area and retail value. The negative correlation found between house area and retail value points to a more complex relationship than the common belief that larger properties fetch higher prices. Larger properties may have more space and amenities, but they may also require more upkeep or be situated in less desirable neighbourhoods, which would reduce their retail value. This result emphasises how crucial it is to take location, condition, and other aspects into account in addition to property size when estimating retail value. It is imperative to recognise the constraints of this research, though. Some predictors, including the presence of a balcony, the width, length, and area of the lot, and the size of the garden, did not show statistically significant relationships with retail value despite the thorough analysis that was done. Although their inclusion in the analysis offers insightful information, the lack of noteworthy results raises the possibility that their impact on retail value is context-specific or dependent on other factors that have not yet been investigated. Further investigations into these variables and other factors affecting property valuation may be undertaken in the future in order to offer a more thorough understanding of real estate dynamics. Moreover, residual autocorrelation may exist, which could jeopardise the precision and dependability of the model\'s estimates given the marginally low Durbin-Watson statistic. To solve this problem, more diagnostic testing or the addition of new variables to enhance the model\'s predictive capability may be needed.

References

[1] Asabere, P. K., & Huffman, F. E. (2013). Non-linear relationships between house size and price. ResearchGate [2] Bailey, M., Haurin, D. R., & McGreal, S. (2019). House Price Beliefs And Mortgage Leverage Choice. Review of Economic Studies [3] Sirmans, G. S., MacDonald, L., Macpherson, D. A., & Zietz, E. N. (2020). The Value of Housing Characteristics: A Meta Analysis. Springer [4] Can, A. (2018). Neighborhood Attributes and Analysis: Valuation Certainty and Price Risk. Collateral Analytics [5] Anonymous. (2018). How Conformity, Progression, and Regression Affect Neighborhood Property Values [6] Glaeser, E. L., Kahn, M. E., & Rappaport, J. (2020). Why Do the Poor Live in Cities? The Role of Public Transportation. Journal of Urban Economics, 115, 1–24 [7] Bae, J., Kim, Y., & Lee, S. (2019). Impact of Housing Features on Property Valuations: A Comparative Study Across Different Property Types. Journal of Real Estate Research, 41(3), 345–368 [8] De la Rosa, M., & Olmos, L. (2020). Influence of Property Features on Transaction Prices in Diverse Market Segments. Property Economics Journal, 28(2), 112–129 [9] Wang, Y., & Huang, J. (2020). Urban Structure, Housing Prices and the Double Role of Amenity: A Study of Nanjing, China. Applied Spatial Analysis and Policy, 17, 27–53 [10] Li, Y., Zhang, Y., & Wang, Y. (2019). Spatial Dependence in Real Estate Prices: Evidence from a Metropolitan Housing Market. Journal of Housing Markets and Analysis, 2(1), 1–18. [11] Eichholtz, P., Kok, N., & Quigley, J. M. (2019). Doing Well by Doing Good? Green Office Buildings. American Economic Review, 100, 2492–2509 [12] Kim, S. K., & Peiser, R. B. (2018). The Economic Effects of Green Spaces in Planned and Unplanned Communities. Journal of Urban Economics, 25(1), 1–18 [13] Geng, N. (2018). Fundamental drivers of house prices in advanced economies. IMF Working Paper. Retrieved from source [14] IDEAS/RePEc. (2018). Factors affecting housing prices: International evidence. Retrieved from source [15] Wilhelmsson, M., & Long, R. (2020). Impacts of shopping malls on apartment prices: The case of Stockholm. Journal of Urban Economics [16] Residential Real estate Market in India Size & Share Analysis - Growth Trends & Forecasts (2024 - 2029) Source: https://www.mordorintelligence.com/industry-reports/residential-real-estate-market-in-India. (n.d.). [17] Benefits of investing in house rather than paying rent. (n.d.). https://www.godrejproperties.com/blog/benefits-of-investing-in-house-rather-than-paying-rent.

Copyright

Copyright © 2024 Shresth Bisaria, Dr. Samarth Sharma. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET59776

Publish Date : 2024-04-03

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online