Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Copyright

Evolution of Derivatives Market in India

Authors: Dr. Mandeep Singh

DOI Link: https://doi.org/10.22214/ijraset.2022.39657

Certificate: View Certificate

Abstract

Universally, it is a well acknowledged fact that the free-market regime can grow concomitant with the development of the financial markets, especially derivatives. The integration of global economies has led to free flow of goods, services, capital and human resources. This phenomenon while ensuring optimal utilization of the world’s scarce resources, refuses volatility and risk in all the dimensions of the business. Management of this risk volatility becomes a daunting challenge as it requires novel products and processes – derivatives products. Across the globe, derivatives are regarded as risk management tools, the hedging mechanism.

Introduction

I. DERIVATIVES MARKET

Universally, it is a well acknowledged fact that the free-market regime can grow concomitant with the development of the financial markets, especially derivatives. The integration of global economies has led to free flow of goods, services, capital and human resources. This phenomenon while ensuring optimal utilization of the world’s scarce resources, refuses volatility and risk in all the dimensions of the business. Management of this risk volatility becomes a daunting challenge as it requires novel products and processes – derivatives products. Across the globe, derivatives are regarded as risk management tools, the hedging mechanism.

Financial derivatives represent some of the basic tools necessary in the mechanics of efficient markets. They serve vitally important economic functions of price discovery and risk management. The transparency that emerges from exchange traded derivatives through a wide participation base promotes sound price discovery in the underlying market. Further, they serve as risk sharing tools as they facilitate the transfer of risks among the market participants. Derivatives have become an integral part of the financial system in the world’s leading economies. The array of derivative products that has been developed in recent years has enhanced economic efficiency. The economic function of these contracts is to allow risks that formerly had been combined to be unbundled and transferred to those most willing to assume and manage each risk component (Greenspan, 1998). Derivatives in mathematics, means a variable derived from another variable. Similarly, in financial terms, a derivative is a financial product which has been derived from a market from another product. Without the underlying product, derivatives do not have any independent existence in the market. The parties managing risks in the market are known as hedgers. Some organizations are in the business of taking risks to earn profits. Such entities represent the speculators. The third player in the market, known as the arbitragers take advantage of the market mistakes.

As per the definition provided by the Securities Contracts (Regulations) Act, 1999; derivatives include: (a) a security derived from a debt instrument, share, loan whether secured or unsecured, risk instrument or contract for differences or any other form of security, and (b) a contract which derives its value from the prices, or index of prices, or underlying securities.

II. EVOLUTION OF DERIVATIVES

Although the formal setup of derivative markets is relatively new (since then 1970s), the general concept has existed account the world for years. Traders in Asian economies have observed and used the derivative instruments (forward, future and options) for their benefits and development processes. During the Renaissance, Venetion Spice traders waited for cargo on the high seas for which they entered into future contracts agreeing to a price for future deliveries. Also for hundreds of years, the Japanese rice farmers have used the futures markets to secure the future value of their production. This was true in India with various commodities. Looking at the not distant history, options of various kinds (Called Teji and Mandi and Fatak) in unorganized markets were traded as early in Mumbai (Aggarwal, 2001). Though, off the exchange, commodity-based derivatives have been in existence across the globe for ages, the way they are being structured and traded now is significantly different.

A. Global Derivatives Markets

In less than three decades of their coming into trading, derivatives markets have become the most important markets in the world. Financial derivatives came into spotlight with the fall of Bretton Woods System of fixed exchange rates and gold convertibility system in 1970s. This generated enormous discomfort owing to currency fluctuations. To mitigate this risk, foreign currency derivatives were introduced on an over-the- counter (OTC). Growth in this area has come from the two directions namely innovations in technology and financial economics. The first derivative on financial instruments was traded in 1972 on currencies (currency future) in the International Money Market (IMM) of the Chicago Mercantile Exchange (CME). Since then, the growth in the derivatives market has been phenomenal. Starting with currency futures in 1972, to stock options in 1973, to interest rate futures in 1975, the market has come a long way.

Swaps, which started in 1981-81 just 25 years ago – account for a trillion dollar business opportunity today, at the international level. Today, in the world markets, derivatives are being traded on anything and everything, including both tangibles and intangibles. The introduction of derivatives instruments like catastrophic bonds (CAT bonds) is an amazing invention. Securitization of any kind of receivables including inventory (Champagne Bonds) to album royalties (Bonnie bonds) is a remarkable accomplishment of the industry. Tremendous account of creativity and imagination is at work, in these markets.

B. Indian Derivatives Market

Starting from a controlled economy, India has moved towards a world where price fluctuates every day. The introduction of risk management instruments in India gained momentum in the last few years due to liberalization process and efforts of the Reserve Bank of India (RBI) in creating currency forward market. Derivatives are an integral part of liberalization process to manage risk. The National Stock Exchange (NSE) gauged the market requirements and initiated the process of setting up derivative markets in India. In 1996, the NSE submitted a proposal to the Securities Exchange Board of India (SEBI) for the introduction of derivatives. The SEBI constituted the L.C. Gupta Committee for policy formulation in the area of Stock Index Futures. In 1998, the committee submitted its report approved by the SEBI. Following which in 1999 derivatives operations began in Interest Rate Swaps and Forward Rate Agreements. The chronological development of derivatives market in India is given in Table 1.1

Table 1.1

Chronological Development of Derivatives Market in India

|

1875 |

Cotton Trade Association started futures trading. |

|

1900 |

Derivatives trading started in oilseeds in Mumbai. |

|

1912 |

Derivatives trading started in raw jute and jute goods in Kolkata. |

|

1913 |

Derivatives trading started in wheat in Hapur. |

|

1920 |

Derivatives trading started in bullion in Mumbai. |

|

1952 |

Commodity options trading and cash settlement of commodity futures were banned on fear of speculation. |

|

1960s |

Forward trading banned in many primary/essential commodities. |

|

Dec. 95 |

Permission sought by the Exchanges from SEBI to start trading in derivatives. |

|

Nov. 96 |

Setting up of L.C. Gupta Committee to design of policy framework for derivatives trading in India. |

|

July 99 |

RBI permitted OTC forward rate agreements (FRAs) and interest rate swaps. |

|

May 00 |

S&P CNX Nifty was chosen by SIMEX for trading futures and options. |

|

May 00 |

SEBI permitted the Exchanges (NSE and BSE) to start trading in derivatives. |

|

9 June 00 |

BSE commenced trading of Index futures based on Sensex 30 Index. |

|

12 June 00 |

NSE commenced trading of Index futures based on S&P CNX Nifty Index. |

|

25 Sept. 00 |

S&P CNX Nifty futures commenced trading at SGX. |

|

June 01 |

Index Options introduced on NSE based on S&P CNX Nifty Index. |

|

July 01 |

Stock Options introduced on NSE on 31 securities only. The list has been broadened to include 119 securities. |

|

Nov. 01 |

Stock futures introduced on NSE on 31 securities. The list now has been broadened to include 119 securities. |

|

2002 |

Future trading in commodities re-introduced. |

Source: Pan (2006).

The most notable development concerning the Indian capital market was the introduction of derivatives trading in June 2000. The SEBI approved derivatives trading based on future contracts at both BSE and NSE in accordance with the rules/ byelaws and regulations of the stock exchanges while derivatives trading based on sensitive index (SENSEX) commenced at BSE on June 9, 2000, derivative trading based on S & P CNX Nifty commenced at the NSE on June 12, 2000.

C. Economic Functions

Derivatives provide three important economic functions:

- Risk Management

- Price discovery

- Transactional efficiency

The primary purpose of risk management is to protect the existing profits, not to create new profits. Risk management involves the structuring of financial contracts to produce gains (or losses) that counter balance the losses (or gains) arising from movements in financial prices. Thus, by virtue of derivatives application, risks are reduced and profit is increased over a wide sphere of financial enterprise and various ways – from businesses whose efficiency is enhanced, to banks where depositors and borrowers are benefited; from investment managers who increase their performance for clients, to farmers who protect their crops; from commercial users of energy, to retail users of mortgages.

Price discovery represents the ability to achieve and disseminate price information. Without price information, investors, consumers and producers cannot take informed decisions. They are then inhibited and deterred from directing their capital to efficient uses. Derivatives are exceptionally well suited for the role of providing price information. They are the tools that assist everyone in the market place to determine value. The wider the use of derivatives, the wider the distribution of price information.

Transactional efficiency is the product of liquidity. Inadequate results in high transaction costs. This impedes investments and deters the accumulation of capital. Derivatives facilitate the opposite result. They significantly increase market liquidity. As a result, transactional costs are lowered, the efficiency in doing business is increased, the cost of raising capital is lowered and the amount of capital available for productive investment is expanded.

III. KINDS OF DERIVATIVE PRODUCTS

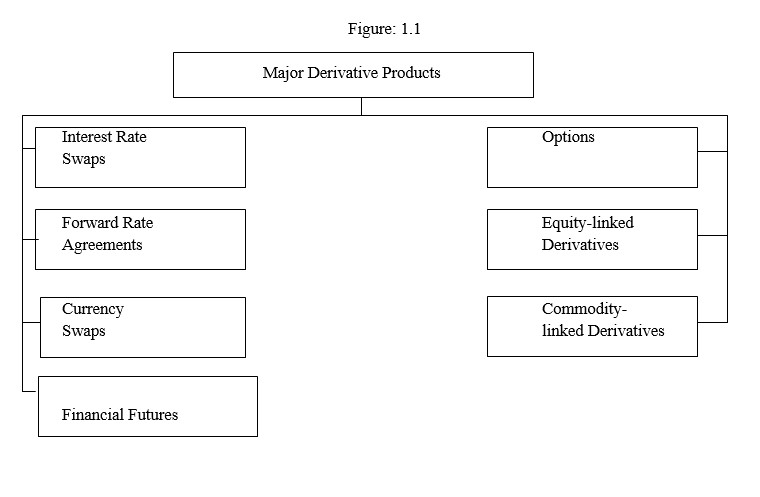

The modern derivatives market provides a wide range of products linked to the key factors affecting financial and commercial performance (Ross, 1999). Whether it is a small domestic importer or a transnational manufacturing giant or a security trader, external risk exists for all these parties. These factors include interest rates, foreign exchange, equity values and commodity prices. The power of derivative instruments lies in managing and finding an opportunity in risks. The major derivative products depicted in figure 1.1. have been discussed as follows:

- Interest Rate Swaps: Interest rate swaps help to exchange interest related payments in the same currency from fixed into floating rate and vice versa or from one type of floating rate to another.

- Forward Rate Agreements: A forward rate agreement is a legally binding agreement between two parties to determine the rate of interest that will be applied to a notional loan or deposit, of an agreed amount to be drawn or placed on an agreed date for a specified term.

- Currency Swaps: A currency swap is an agreement between two or more parties to exchange interest obligations/receipts, for an agreed period between two different currencies, and at the end of the period to re-exchange the corresponding principal amounts at an exchange rate agreed at the beginning of the transaction. The rationale for a currency swap is that one of the parties has a comparative advantage in borrowing one currency while another has an advantage in the other currency.

- Financial Futures: A financial futures contract is a legally binding agreement to make or take delivery, of a standard quantity of a specific financial instrument, at a future date and at a price agreed between the parties through open outcry on the floor of an organized exchange or through e-trading.

- Options: An option gives the buyer the right but not the obligation to buy or sell a specific amount currency or fix the rate of interest for an agreed amount for an agreed period on a specific future date. Thus, an option gives the investor or the borrower to limit the loss from an adverse movement while permitting him to gain from a favourable movement. The cost of the option contract is known as premium.

- Equity-linked Derivatives: The late 1980s saw the growth in modern derivatives applied to equity markets. Just as the growth of interest rate derivatives spurned the innovation of foreign exchange derivatives, the emergence of equity derivatives was almost inevitable in order for the risk/reward profile of equity investments to remain competitive with fixed income affected by debt instruments such as bonds. Equity derivative instruments allow investors to structure requirements in terms of market timing and risk reward profile. Importantly, the use of derivatives has changed the nature of equity portfolio management. Traditional techniques such as fundamental and technical analysis, diversification strategies and assets allocations strategies none rank along side the derivative risk management as means of achieving investment objectives.

- Commodity-linked Derivatives: Commodity derivatives are designed to satisfy the needs of producers, refiners and consumers of the world’s materials. The original derivatives market, commodity derivatives satisfy the needs of participants to manage price risk. Commodity price risk often forms the case business of users of such derivatives. Liquidity, solvency and possibly even survival, demand the use of derivatives. Today active users include oil producers, airline companies, electricity generation companies and mining companies to mention a few. Commodity derivatives are also being used by traders and investors to ensure the returns and carrying capacity of new projects. The derivative products are either traded in listed exchanges or in over-the-counter exchanges (OTC). The listed and OTC derivatives differ in their uses and credit risk characteristics.

IV. RISKS INVOLVED IN DERIVATIVES BUSINESS

Derivatives are used to separate risks from traditional instruments and transfer these risks to parties willing to bear these risks. The fundamental risks involved in derivatives business (Figure 1.2) have been discussed as follows:

- Credit Risk: This is the risk of failure of a counter party to perform its obligation as per the contract. It is also known as default or counter party risk and differs with different instruments.

- Market Risk: Market risk is a risk of financial loss as a result of adverse movements of prices of the underlying assets/instruments.

- Liquidity Risk: The inability of a firm to arrange a transaction at prevailing market prices is termed as liquidity risk. A firm faces two types of liquidity risks:

- Related to liquidity of separate products.

- Related to the funding of activities of the firm including derivatives.

- Legal Risk: Derivatives cut across judicial boundaries, therefore the legal aspects associated with the deal should be looked into carefully. An action by a court or regulatory body could invalidate a financial contract.

- Operations Risk: The operations risk associated with derivatives trading includes inadequate controls, deficient procedures, human error, system failure or frauds.

V. EXCHANGE-TRADED CONTRACTS VS OVER-THE-COUNTER (OTC) MARKETS

The OTC market for derivative contracts has existed in some form or other since many years (Andrew, 2006). It is a negotiated and client specific market. The features of this market are as below:

- The management of counter party (credit) risk is decentralized and located within individual institutions;

- There are no formal centralized limits on individual positions, leverage, or margining;

- There are no formal rules for risk and burden sharing;

- There are no formal rules or mechanisms for ensuring market stability and integrity, and for safeguarding the collective interests of market participants; and

- OTC contracts are generally not regulated by a regulatory authority although they are affected indirectly by national legal systems and banking surveillance.

Some of the features of OTC derivatives markets can give rise to financial instability affecting not only institutions but also the overall domestic financial markets.

Thus, it poses to be a threat to the stability of the entire international financial system. Few of them are: (i) the dynamic nature of gross credit exposures; (ii) information asymmetries; (iii) its effects on available aggregate credit; (iv) the high concentration of OTC derivative activities in major institutions; and (v) its central role in the global financial system. Sharp movements in underlying asset prices and counter party defaults give rise to instability, which apart from significantly altering the perceptions of current period, also alter potential future credit exposures.

If the asset prices change rapidly, the size and configuration of counter party exposures may become unsustainably large and provoke a rapid unwinding of positions.

There has been some progress in addressing these risks and perceptions. However, the progress has been limited in implementing reforms in risk management, including counter party, liquidity and operational risks as they are outside the regulatory purview. In view of the inherent risks associated with OTC derivatives, Indian law considers them illegal except for specific contracts under Forward Rate Agreements (FRAs)/ Interest Rate Agreement (IRA) on domestic currency as allowed by RBI.

VI. GLOBAL DERIVATIVES MARKETS

As per the FIA Annual Volume Survey (IBRD, 2006) the global overall futures and options trading volume recorded a rise of 30.5 per cent in the year 2005 as compared to 2004. Table 1.2 depicts year-wise trends of derivatives trading on the US Exchanges and Non-US Exchanges. In 1992, derivatives were more popular in the US but at the end of 2006 non-US exchanges became hub of derivatives trading.

Table 1.2

Year-wise Trend of Derivatives Trading (in terms of contracts)

(in million US $)

|

Year |

US Exchanges |

Non-US Exchanges |

Global |

|

1992 1993 1994 1995 1996 1997 1998 1999 2000 2002 2004 2006 |

550.39 523.36 807.87 776.64 793.63 905.16 1,033.20 1,100.86 1,313.65 1,578.62 1,844.90 2,172.52 |

387.83 538.36 779.83 905.99 975.34 1,025.07 1,142.65 1,301.98 1,675.80 2768.70 4,372.38 5,940.22 |

938.22 1,061.72 1,587.70 1,682.63 1,768.97 1,930.23 2,175.81 2,405.84 2,989.45 4,347.32 6,217.28 8,112.74 |

Source: Andrew (2007).

The trading in equity derivatives has grown by 42 per cent in the year 2005 as compared to 2004, followed by interest rates registering growth of 27 per cent. Table 1.3 is shows the trading of derivatives category-wise. It is quite evident that equity derivatives showed more movements followed by energy products.

Table 1.3

Category-wise Volume of Derivatives

(in millions)

Global |

2005 |

2004 |

Change (in percent) |

|

Equity Indices Interest Rate Individual Equities Energy Products Agrl. Commodities Non-Precious Metals Foreign Currency Index Based Precious Metals |

3,960.87 1,881.27 1,558.52 261.15 217.56 90.39 77.85 64.46 0.66 |

2,791.18 1,478.44 1,354.70 199.39 209.37 71.57 60.56 51.26 0.80 |

41.91 27.25 15.05 30.97 3.91 26.30 28.55 25.75 17.50 |

Source: Andrew (2006)

Table 1.4 presents the top twenty contracts for the year 2005. The Kospi 200 Options of Korea Stock Exchange (KSE) led the market with more than 2,837.72 million contracts followed by Euro Bond Futures of Eurex.

Table 1.4

Top 20 Contracts for the Year 2005(in million US $)

|

S. No. |

Contract |

Exchange |

2005 |

2004 |

Volume Change |

Change (in per cent) |

|

1. |

Kospi 200 Options |

KSE |

2,837.72 |

1,889.82 |

947.90 |

50.16 |

|

2. |

Euro-Bond Futures |

Eurex |

244.41 |

191.26 |

53.15 |

27.79 |

|

3. |

3 Month Eurodollar Futures |

CME |

208.77 |

202.08 |

6.69 |

3.31 |

|

4. |

TIIE 28 Futures |

MexDer |

162.08 |

80.60 |

81.48 |

101.09 |

|

5. |

E-Mini S&P 500 Index Futures |

CME |

161.18 |

115.74 |

45.44 |

39.26 |

|

6. |

Euro-Bobl Futures |

Eurex |

150.09 |

114.68 |

35.41 |

30.88 |

|

7. |

10 Year T-Note Futures |

CBOT |

146.75 |

95.79 |

50.96 |

53.20 |

|

8. |

3 Month Euribor Futures |

Euronext |

137.69 |

105.76 |

31.93 |

30.19 |

|

9. |

Euro-Schatz Futures |

Eurex |

117.37 |

108.76 |

8.61 |

7.92 |

|

10. |

DJ Euro Stoxx 50 Futures |

Eurex |

116.04 |

86.35 |

29.69 |

34.38 |

|

11. |

3-Month Eurodollar Options |

CME |

100.82 |

105.58 |

-4.76 |

-4.51 |

|

12. |

5 Year T-Note Futures |

CBOT |

73.75 |

50.51 |

23.24 |

46.01 |

|

13. |

CAC 40 Index Options |

Euronext |

73.67 |

50.51 |

23.24 |

46.01 |

|

14. |

E-Mini Nasdaq 100 Futures |

CME |

67.89 |

54.39 |

13.40 |

24.59 |

|

15. |

30 Year T-Bond Futures |

CBOT |

63.52 |

56.08 |

7.44 |

13.27 |

|

16. |

Kospi 200 Futures |

KSE |

62.20 |

42.87 |

19.33 |

45.09 |

|

17. |

DJ Euro Stoxx 50 Options |

Eurex |

61.79 |

39.48 |

22.31 |

56.51 |

|

18. |

No. I Soya bean Futures |

DCE |

60.00 |

12.69 |

47.31 |

372.81 |

|

19. |

3 Month Euribor Options |

Euronext |

57.73 |

33.48 |

24.25 |

72.43 |

|

20. |

Interest Rate Futures |

BM & F |

57.64 |

48.57 |

9.07 |

18.67 |

Source: Philip (2006)

VII. MARKET OUTCOME: INDIAN EXPERIENCES

As mentioned earlier, the derivatives are traded only on two exchanges, the NSE and BSE. The total exchange traded derivatives volume witnessed a sharp rise to Rs. 21,422,690 million during 2005-06 as against Rs. 4,423,333 million during the preceding year. It can be observed from Table 1.5 that the NSE is a market leader in the Indian market by accounting for about 99.5 per cent of total turnover.

During 2005-06, the Futures and Options (F & O) segment of NSE reported a total turnover for Rs. 21,306,492 million as against Rs. 4,398,548 million during the preceding year. The number of contracts traded in 2005-06 amounted to 56.9 million as against 16.8 million in the previous year. The segment witnessed a record turnover of Rs. 219.213 million on January 28, 2006. The monthly turnover increased from Rs. 500,196 million in April 2005 to Rs. 2,604,813 million in March 2006.

Table 1.5

Trends in Derivatives at NSE and BSE

|

Month/ Year |

NSE |

BSE |

Total |

|||

|

No. of Contracts Traded |

Turnover (Rs. In Mn.) |

No. of Contracts Traded |

Turnover (Rs. In Mn.) |

No. of Contracts Traded |

Turnover (Rs. in Mn.) |

|

|

April 05 |

2,205,470 |

500,196 |

5,280 |

873 |

2,210,750 |

501,069 |

|

May 05 |

2,252,050 |

534,233 |

1,155 |

229 |

2,253,205 |

534,462 |

|

June 05 |

2,750,294 |

730,173 |

423 |

92 |

2,750,717 |

730,265 |

|

July 05 |

3,720,563 |

1,098,495 |

4,718 |

10,131 |

3,725,281 |

1,099,526 |

|

Aug. 05 |

4,314,098 |

1,403,625 |

23,634 |

5,090 |

4,337,732 |

1,408,715 |

|

Sept. 05 |

5,481,939 |

1,851,509 |

34,274 |

8,509 |

5,516,213 |

1,860,018 |

|

Oct. 05 |

5,989,205 |

2,303,645 |

30,668 |

8,574 |

4,019,873 |

2,312,219 |

|

Nov. 05 |

4,769,938 |

1,921,714 |

31,337 |

9,287 |

4,801,275 |

1,931,001 |

|

Dec. 05 |

5,724,035 |

2,389,067 |

107,545 |

36,840 |

5,831,580 |

2,425,907 |

|

Jan. 06 |

6,976,023 |

3,240,630 |

103,573 |

37,869 |

7,079,596 |

3,278,499 |

|

Feb. 06 |

5,696,541 |

2,728,392 |

22,212 |

7,299 |

5,718,753 |

2,735,691 |

|

March 06 |

7,006,620 |

2,604,813 |

17,439 |

505 |

7,024,059 |

2,605,318 |

|

2005-06 |

56,886,776 |

21,306,492 |

382,258 |

116,198 |

57,269,034 |

21,422,690 |

* For NSE, data pertains to Index Futures, Stock Futures, Index Options and Futures on Interest Rates.

Source: NSE and SEBI Bulletin, March 2006.

The average daily turnover increased to Rs. 256,010 million in March 2006 from Rs. 118,401 million in April 2005. The business growth of F & O segment is presented in Figure 1.3 and Table 1.6. It is evident that the futures are more popular than options; contracts on securities are more popular than those on indices; and call options are more popular than put options.

The city wise distribution of turnover of F & O segment of NSE shows that during the year 2005-06, Mumbai contributed nearly 47.81 per cent of total turnover. The contributions from Delhi and Kolkata were 25.45 per cent and 11.32 per cent respectively. Similar trends continued for the year 2006-07.

Table 1.6

City-wise Turnover Distribution of F & O Segment of NSE

|

S No. |

Location |

Share in Turnover (%) |

||

|

|

|

2004-05 |

2005-06 |

2006-07 |

|

1. |

Mumbai |

41.20 |

47.81 |

44.22 |

|

2. |

Delhi/Ghaziabad |

20.31 |

25.45 |

26.31 |

|

3. |

Kolkata/Howrah |

15.16 |

11.32 |

12.30 |

|

4. |

Ahmedabad |

2.11 |

2.79 |

2.61 |

|

5. |

Hyderabad/Secunderabad/Kukatpally |

0.97 |

2.07 |

2.12 |

|

6. |

Chandigarh/Mohali/Panchkula |

2.00 |

2.06 |

2.03 |

|

7. |

Chennai |

2.24 |

1.85 |

1.92 |

|

8. |

Cochin/Ernakulam/Parur/Kalamserry/ Alwaye |

0.63 |

1.07 |

1.12 |

|

9. |

Bangalore |

1.19 |

0.72 |

0.76 |

|

10. |

Ludhiana |

0.99 |

0.61 |

0.65 |

|

11. |

Indore |

0.38 |

0.57 |

0.54 |

|

12. |

Jaipur |

1.89 |

0.51 |

0.56 |

|

13. |

Baroda |

0.71 |

0.49 |

0.45 |

|

14. |

Rajkot |

0.36 |

0.45 |

0.48 |

|

15. |

Pune |

0.31 |

0.34 |

0.37 |

|

16. |

Agra |

0.53 |

0.20 |

0.18 |

|

17. |

Coimbatore |

0.44 |

0.16 |

0.14 |

|

18. |

Lucknow |

0.21 |

0.14 |

0.17 |

|

19. |

Trivandrum |

0.13 |

0.13 |

0.16 |

|

20. |

Surat |

0.47 |

0.12 |

0.11 |

|

21. |

Tenali |

0.09 |

0.09 |

0.21 |

|

22. |

Others |

7.69 |

1.05 |

2.59 |

|

|

TOTAL |

100.00 |

100.00 |

100.00 |

Source: Economic Survey 2006-07

VIII. SEBI’S ROLE

As the regulator for the securities market the SEBI has been focusing on the following areas, so to deliver better values in terms of liquidity and risk protection. In order to deepen overall awareness as well as to assist in policy-making, the SEBI has been promoting high quality research in the Indian capital market. In order to improve market efficiency further and to set international benchmarks in the securities industry, the NSE administers a scheme called the NSE Research Initiative. The objective of this initiative is to foster research to better design market microstructure. The NSE Research Initiative has so far come out with many working papers.

- Testing and Certification

With a view to improve the quality of intermediation, a system of testing and certification has been used in some of the developed and developing markets. This ensures that a person dealing with financial products has some basic knowledge about the markets and regulations. As a result, not only the intermediaries benefit due to the improvement in the quality of their services, but also the career prospects of the certified professionals get impetus. Thus, the overall confidence of investors in the market increases.

The NSE has evolved a testing and certification mechanism known as the National Stock Exchange’s Certification in Financial System. The entire process in National Certification in Financial Markets (NCFM) from generation of question paper, invigilation, testing, assessing, scores reporting and certifying is fully automated.

It tests practical knowledge and skills, that are required to operate in financial markets. A certificate is awarded to those persons who qualify the tests, which indicates that they have a proper understanding of the market and skills to service different constituents of the market. It offers nine securities market related modules.

As such, the reforms in the securities market are far from complete. At the same time, the reforms undertaken so far have aimed at improving the operational and informational efficiency in the market by enabling the participants to carry out transactions in a cost-effective manner and providing them with full, relevant and accurate information in time. A number of checks and balances have been set up to protect investors, enhance their confidence and avoid systemic failure of the market. As a result of these reforms, the market design has changed drastically. Today, the Indian securities market bears a look which is absolutely different from what they were ten years ago.

Copyright

Copyright © 2022 Dr. Mandeep Singh. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET39657

Publish Date : 2021-12-27

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online