Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Exploring Cyber Insurance: A Strategic Shield against Modern Threats

Authors: Pari Patel

DOI Link: https://doi.org/10.22214/ijraset.2024.65906

Certificate: View Certificate

Abstract

In today’s digitally transformed global business ecosystem, organizations face unprecedented cybersecurity challenges that threaten their financial stability and reputation. As technological vulnerabilities grow increasingly complex and pervasive, cyber insurance has become a critical tool for risk mitigation. It provides comprehensive financial protection and robust support against the evolving landscape of digital threats. This research paper examines the multifaceted dimensions of cyber insurance by synthesizing theoretical insights and practical considerations. It explores the complex ecosystem of cyber insurance, focusing on its two primary coverage types: first-party protection, which addresses direct organizational losses, and third-party coverage, which manages external liabilities. Through a systematic analysis, the study delves into the fundamental components of cyber insurance, the intricate dynamics of the market, rigorous assessment methodologies, and its strategic importance within modern organizational risk management frameworks. The paper concludes by highlighting the potential of cyber insurance to do more than merely protect organizations. It argues that cyber insurance can actively support sustainable digital transformation, making it a crucial enabler of organizational resilience in an era of persistent and evolving technological challenges.

Introduction

I. INTRODUCTION

The escalating frequency and sophisticated methodologies of cyberattacks have fundamentally transformed the technological risk landscape, exposing organizations to unprecedented financial and reputational vulnerabilities. In response to these dynamic challenges, cyber insurance has crystallized as an essential defensive strategy, delivering targeted financial protection and critical recovery resources for enterprises navigating the treacherous digital terrain.

By synthesizing theoretical insights and practical considerations, this scholarly investigation comprehensively unpacks the concept of cyber insurance, meticulously analyzing its core components, inherent benefits, and potential implementation challenges. The research ultimately illuminates cyber insurance's pivotal role within a holistic and proactive cybersecurity strategy, offering stakeholders a nuanced understanding of this increasingly important risk management instrument.

A. Defining Cyber Insurance

Cyber insurance, alternatively known as cyber liability insurance or cybersecurity insurance, represents a sophisticated financial instrument designed to protect businesses from the potentially catastrophic financial consequences of cyber-related incidents. Unlike traditional insurance models, cyber insurance addresses the unique and evolving risks associated with digital infrastructure, data protection, and technological vulnerabilities.

B. Contextualizing Cyber Risk

The digital transformation of global business has exponentially increased organizational exposure to cyber risks. From small startups to multinational corporations, no entity is immune to potential cyber threats. The escalating complexity and frequency of cyber incidents necessitate a proactive and comprehensive approach to risk mitigation.

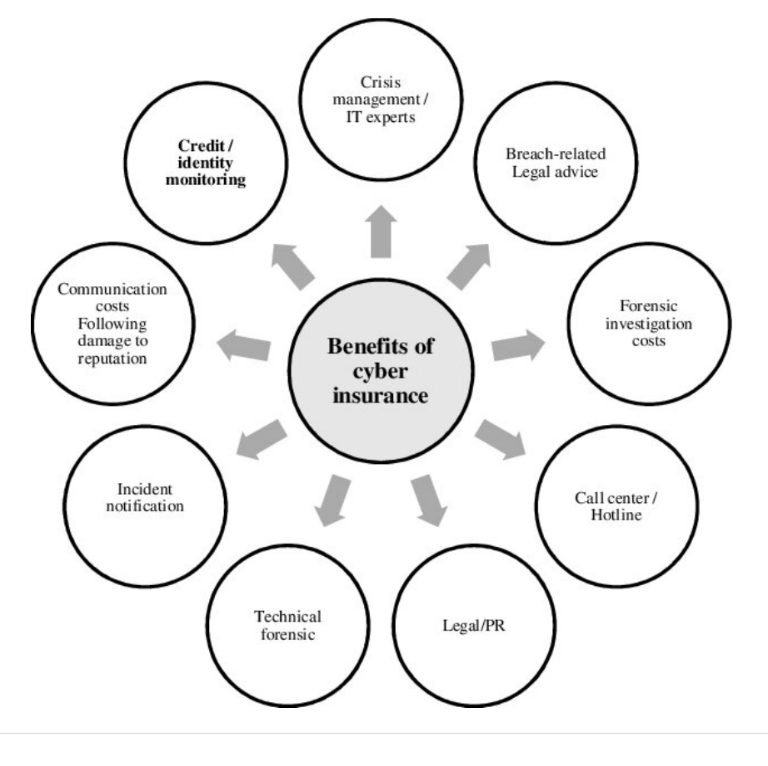

Benefits of cyber insurance for enterprises source:

Figure 1: Benefits of Cyber Insurance

II. LITERATURE SURVEY

The field of cyber insurance has emerged as a critical domain of research, drawing insights from diverse disciplines including economics, technology, risk management, and regulatory studies. Pioneering works by researchers like Gordon, Loeb, and Sohn (2003) laid the foundational economic principles for understanding how insurance can transfer the risks associated with cyber-attacks.[7] Their seminal research established the initial framework for conceptualizing cyber risks as transferable economic phenomena, providing a critical starting point for subsequent scholarly investigations.

As digital technologies evolved, researchers began exploring more nuanced aspects of cyber insurance. Böhme and Schwartz (2010) developed a unifying framework that delved into the economic incentives and challenges of cyber risk management.[3] Their work highlighted the complex interplay between technological vulnerabilities and financial risk, demonstrating that cyber insurance is far more than a simple financial product – it is a sophisticated risk mitigation strategy.

The technological dimension of cyber insurance has been particularly fascinating. Researchers like Chen, Mak, and Ramachandran (2019) have explored the transformative potential of machine learning in cyber risk quantification. [5] Their work demonstrates how artificial intelligence can dramatically improve underwriting processes, enabling more accurate risk assessments and personalized insurance policies. This technological approach is complemented by research from Yayla and Hu (2020), who systematically reviewed how organizations' security investments influence their risk profiles.

Regulatory and policy considerations form another crucial aspect of cyber insurance research.[10] Baker and Dellaert's (2018) examination of algorithmic risk assessment provides critical insights into how computational tools can enhance risk evaluation.[1] Simultaneously, Romanosky, Telang, and Acquisti (2017) investigated the impact of data breach disclosure laws, revealing the intricate relationship between legal frameworks and cyber insurance effectiveness.[8]

The practical challenges of cyber insurance have not been overlooked. Biener, Eling, and Wirfs (2015) critically examined whether some cyber risks are too large or unpredictable to insure, addressing fundamental questions about the insurability of digital threats.[2] This work is complemented by Shetty, Zhou, and Kamhoua's (2018) exploration of moral hazard, which highlights the behavioral risks where insured organizations might underinvest in security.[12]

Recent research has begun to look toward the future of cyber insurance. Liu, Chen, and Zhang (2021) have demonstrated how artificial intelligence is transforming the industry, enabling more sophisticated risk assessments and personalized policy designs.[13] Marotta et al.'s (2017) comprehensive survey provides a broad overview of policy structures, market trends, and emerging challenges.[11]

The practical implementation of these theoretical insights is grounded in frameworks like the NIST Cybersecurity Standard, which serves as a benchmark for organizations to evaluate their cybersecurity posture.[15] Sources like the Thynk.Network Cybersecurity Overview bridge the gap between academic research and real-world application, demonstrating how theoretical insights translate into practical risk management strategies.[14]

Collectively, these research papers represent a multidisciplinary approach to understanding cyber insurance. They reveal a field that is simultaneously complex and dynamic, requiring continuous adaptation to evolving technological landscapes, emerging threat vectors, and changing regulatory environments. The research underscores cyber insurance's critical role not just as a financial instrument, but as a comprehensive risk management strategy in an increasingly digital world.

III. COMPONENTS OF CYBER INSURANCE

Cyber insurance policies are structured to mitigate two primary types of risks:

A. First-Party Coverage

1) Coverage

- Crisis Management

- all hostile attacks on information and technology assets.

2) Insured Losses

- costs from specialized service provider to reinstate reputation.

- cost for notification of stakeholders and continuous monitoring (e.g., credit card usage).

3) Coverage: Business Interruption Data Asset Protection

- denial of service attack.

- hacking.

- information assets are changed, corrupted, or destroyed by a computer attack

- damage or destruction of other intangible assets (e.g., software applications).

4) Insured Losses

- costs resulting from reinstatement

- loss of profit

- cost resulting from reinstatement and replacement of data

- cost resulting from reinstatement and replacement of intellectual property (e.g., software).

5) Coverage: Cyber Extortion

- extortion to release or transfer information or technology assets such as sensitive data

- extortion to change, damage, or destroy information or technology assets

- extortion to disturb or disrupt services;

6) Insured Losses

- cost of extortion payment

- cost related to avoid extortion (investigative costs).

7) First-party coverage safeguards the insured organization directly and includes

- Data Breach Response: Expenses related to notifying affected individuals and providing credit monitoring services.

- Identity Restoration: Costs associated with recovering stolen identities.

- Ransomware Payments: Funds for resolving cyber extortion demands.

- System Recovery: Expenses for repairing or replacing compromised IT systems.

- Business Interruption: Compensation for revenue losses caused by operational downtime due to cyberattacks.

B. Third-Party Coverage

1) Coverage: Privacy Liability

- disclosure of confidential information collected or handled by the firm or under its care, custody, or control (e.g., due to negligence, intentional acts, loss, theft by employees).

2) Insured Losses

- legal liability (also defense and claims expenses (fines), regulatory defense costs)

- vicarious liability (when control of information is outsourced)

- crisis control (e.g., cost of notifying stakeholders, investigations, forensic and public relations expenses)

3) Coverage: Network Security Liability

- unintentional insertion of computer viruses causing damage to a third party

- damage to systems of a third party resulting from unauthorized access of the insured

- disturbance of authorized access by clients

- misappropriation of intellectual property.

4) Insured Losses

- cost resulting from reinstatement

- cost resulting from legal proceeding.

5) Coverage: Intellectual Property and Media Breaches

- breach of software, trademark and media exposures (libel, etc.)

6) Insured LossesS

- legal liability (also defense and claims expenses (fines), regulatory defense costs)

7) Third-party coverage manages liabilities to external parties, such as

- Privacy Breach Lawsuits: Legal expenses stemming from data breaches affecting customers.

- Network Security Failures: Claims related to damages caused by compromised systems.

- Media Liability: Coverage for defamation or copyright infringement claims arising from electronic communications.

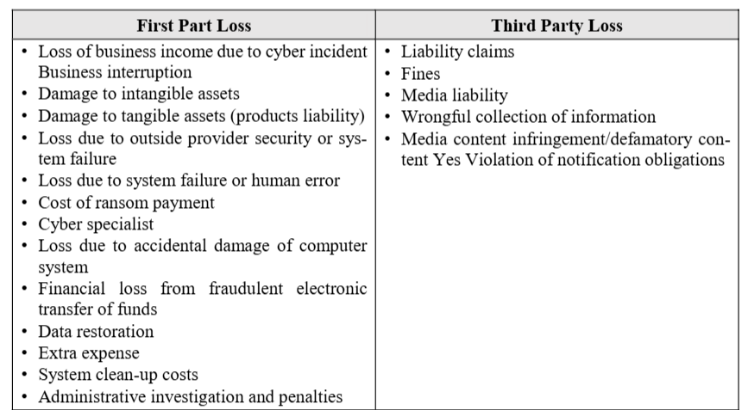

Table 1: cyber-insurance coverage

IV. CYBER RISK ASSESSMENT PROCESS

Cyber risk assessment is a systematic, strategic approach to identifying, analyzing, and evaluating potential cybersecurity vulnerabilities and threats within an organizational ecosystem. It serves as the critical foundation for developing robust cybersecurity strategies and informing cyber insurance policy decisions.

A. Foundational Components of Cyber Risk Assessment

Key Assessment Dimensions

- Technological Infrastructure Assessment

- Network architecture analysis

- Hardware and software inventory

- Cloud and on-premises infrastructure evaluation

- Legacy system vulnerability identification

- Data Sensitivity Mapping

- Classification of data types (personal, financial, proprietary)

- Data storage and transmission protocols

- Compliance with regulatory requirements (GDPR, CCPA, HIPAA)

- Data access and permission management

- Human Factor Evaluation

- Employee cybersecurity awareness

- Social engineering vulnerability

- Access control mechanisms

- Training and preparedness assessment

B. Comprehensive Risk Assessment Methodology

Preliminary Assessment Stage

1) Organizational Scoping

- Define assessment boundaries

- Identify critical assets and systems

- Establish assessment objectives

- Assemble cross-functional assessment team

2) Information Gathering

- Comprehensive asset inventory

- Network topology documentation

- Current security policy review

- Previous incident documentation

C. Threat Identification Process:

Threat Categorization

- External Threats

- Malware and ransomware

- Phishing attacks

- Advanced Persistent Threats (APTs)

- State-sponsored cyber attacks

- Internal Threats

- Insider negligence

- Unauthorized access

- Accidental data exposure

- Malicious insider activities

- Third-Party Risks

- Vendor security vulnerabilities

- Supply chain compromise

- API and integration risks

- Cloud service provider weaknesses

D. Vulnerability Analysis

1) Technical Vulnerability Assessment

- Penetration testing

- Vulnerability scanning

- Code security review

- Configuration management audit

2) Vulnerability Scoring

- Common Vulnerability Scoring System (CVSS)

- Risk prioritization matrix

- Potential impact assessment

- Likelihood of exploitation evaluation

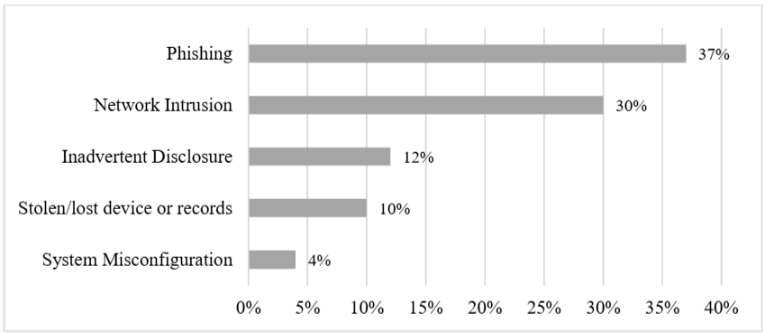

Figure 2: Most common cyber-attacks experienced by the US companies

V. STRATEGIC IMPORTANCE OF CYBER INSURANCE

A. Financial Protection

Cyber insurance serves as a critical financial buffer against potentially devastating cyber incidents, covering:

- System restoration costs

- Revenue loss mitigation

- Legal expense management

- Customer notification and support

B. Comprehensive Risk Management

Beyond financial compensation, cyber insurance represents a holistic risk management strategy that:

- Promotes proactive security measures

- Encourages continuous technological vigilance

- Provides structured incident response frameworks

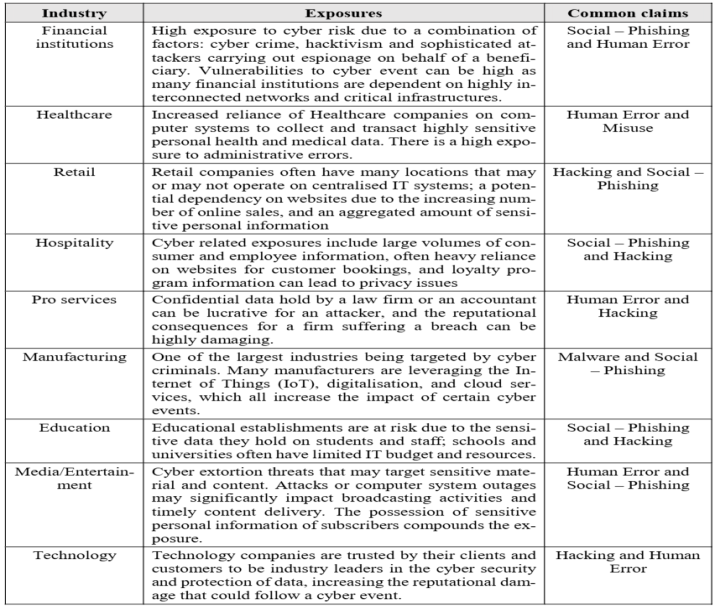

Table 2: Cybernetic risk exposure in specific industries

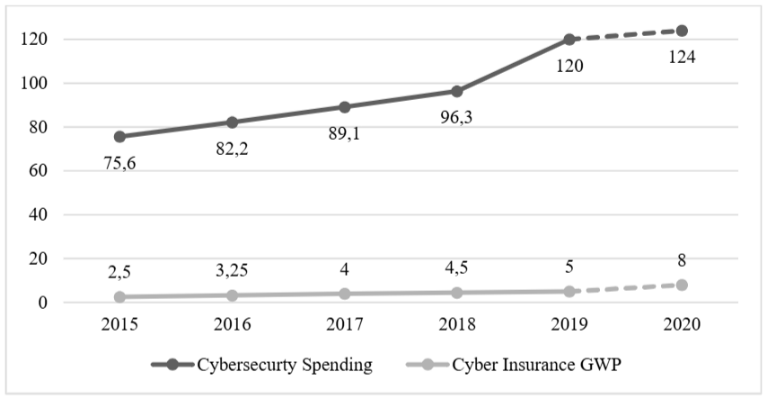

Figure 3: Annual cyber security spending

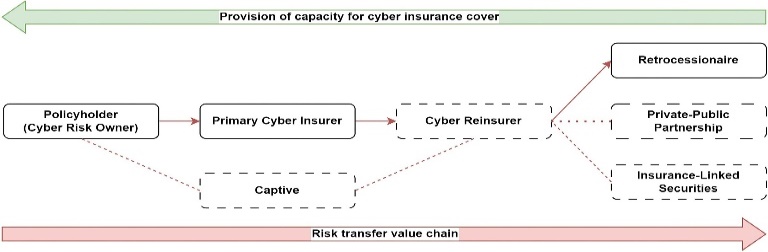

Figure 4: typical insurance policy transfer

VI. METHODS

A. Pre-breach

Insurers work to design appropriate cyber insurance policies for their customers. They work with them to better understand risks and prevent breaches based on appropriate risk management. Insurers offer also consulting services to train and assist organisations in best practices for responding to and limiting damages from a cyber-attack or incident.

B. Post-breach

Insurers provide services that evaluate the impact of an attack, help implement response and recovery plans, provide public relations and communications support, and identify appropriate mitigating actions. The addition of new services along the cyber risk value chain increases the attractiveness of cyber insurance for customers and potentially improves the profitability of insurers. Offering additional services also increases customer retention.

C. Organizational Profiling

- Detailed analysis of technological infrastructure

- Evaluation of existing cybersecurity measures

- Identification of critical digital assets

- Assessment of potential vulnerability points

D. Threat Landscape Mapping

- Categorization of threat types

- Analysis of industry-specific risk patterns

- Evaluation of historical incident data

- Assessment of emerging technological vulnerabilities

E. Incident Response Framework

- Immediate response protocols

- Damage assessment mechanisms

- Recovery support strategies

- Forensic investigation support

F. Claims Processing

- Rapid assessment protocols

- Forensic evidence evaluation

- Financial impact verification

- Transparent compensation mechanisms

G. Comprehensive regulatory alignment

- Data protection standards compliance

- Industry-specific regulatory requirements

- International cybersecurity standards

- Continuous regulatory landscape monitoring

H. Proactive Risk Reduction

- Preventative security recommendations

- Risk transfer mechanisms

- Security infrastructure enhancement guidance

- Continuous improvement frameworks

I. Quantitative Risk Analysis

- Probabilistic risk modeling

- Financial loss potential calculation

- Scenario-based impact assessment

- Machine learning-enhanced predictive analytics

J. Key Risk Quantification Parameters

- Potential financial losses

- Probability of cyber incidents

- Recovery cost estimations

- Business interruption potential

- Reputation damage calculations

Conclusion

In an increasingly digital world, cyber insurance has emerged as a critical strategic tool for organizations navigating the complex landscape of technological risks. This research has comprehensively explored the multifaceted nature of cyber insurance, revealing its significance far beyond a simple financial protection mechanism. As cyber threats continue to evolve in sophistication and frequency, the importance of a robust cyber insurance strategy has become paramount for organizational resilience. The analysis demonstrates that cyber insurance represents a holistic approach to risk management, integrating financial protection, strategic support, and proactive risk mitigation. Organizations face unprecedented challenges in protecting their digital assets, with potential cyber incidents threatening not just financial stability but also organizational reputation. Cyber insurance provides a critical buffer against these risks, offering comprehensive support that extends from immediate incident response to long-term recovery and strategic planning. However, the research also highlights significant challenges in the cyber insurance ecosystem. The dynamic nature of cyber threats, coupled with the complexity of risk quantification, presents ongoing obstacles for insurers and organizations alike. Limited historical data, rapidly changing technological landscapes, and the intricate nature of digital vulnerabilities make traditional risk assessment methodologies increasingly inadequate. This complexity underscores the need for continuous innovation in cyber insurance approaches. Looking forward, the potential for cyber insurance is profound. Emerging technologies such as artificial intelligence and advanced predictive modeling promise to revolutionize risk assessment methodologies. Organizations must view cyber insurance not as a passive financial product, but as an active, strategic investment in their digital resilience. This requires a fundamental shift in approach – from reactive protection to proactive risk management. The interdisciplinary nature of cyber insurance emerges as a critical insight. Effective cyber risk management demands collaboration across multiple domains, including cybersecurity experts, insurance professionals, data scientists, and organizational leadership. This holistic approach is essential for developing comprehensive strategies that can adapt to the rapidly changing digital threat landscape. As digital transformation continues to reshape business environments, cyber insurance will become increasingly vital. Organizations must develop robust, flexible approaches to digital risk management, with cyber insurance serving as a key strategic instrument. The future belongs to those who can effectively anticipate, understand, and mitigate digital risks through comprehensive, forward-thinking strategies. Ultimately, cyber insurance represents more than a financial safeguard – it is a critical enabler of sustainable digital transformation. In an era of unprecedented technological complexity and persistent cyber threats, it stands as a crucial mechanism for organizations seeking to navigate the intricate terrain of digital risk management. The journey of cyber insurance is just beginning, and its potential to protect, support, and empower organizations is only beginning to be understood.

References

[1] Baker, T., & Dellaert, B. G. (2018). Regulating algorithmic insurance risk assessment: A comparative approach. Journal of Risk and Insurance, 85(3), 593-620. [2] Biener, C., Eling, M., & Wirfs, J. H. (2015). Cyber risk: Too big to insure? Risk Management and Insurance Review, 18(1), 25-45. [3] Böhme, R., & Schwartz, G. (2010). Modeling cyber-insurance: Towards a unifying framework. Proceedings of the Workshop on the Economics of Information Security (WEIS), Harvard University. [4] Cavusoglu, H., Mishra, B., & Raghunathan, S. (2016). A model for evaluating IT security investments. Communications of the ACM, 59(2), 87-93. [5] Chen, L., Mak, B., & Ramachandran, S. (2019). Machine learning approaches to cyber risk quantification. IEEE Transactions on Information Forensics and Security, 14(7), 1755-1769. [6] Eling, M., & Lehmann, M. (2018). The impact of digitalization on the insurance value chain and the insurability of risks. The Geneva Papers on Risk and Insurance, 43(3), 359-396. [7] Gordon, L. A., Loeb, M. P., & Sohn, M. (2003). A framework for using insurance to transfer the economic risk of cyber-attacks. Communications of the ACM, 46(3), 81-85. [8] Romanosky, S., Telang, R., & Acquisti, A. (2017). Do data breach disclosure laws reduce identity theft? Journal of Policy Analysis and Management, 36(2), 256-286. [9] Woods, D. W. (2011). Design principles for cyber-insurance. International Journal of Critical Infrastructure Protection, 4(3-4), 133-149. [10] Yayla, A. A., & Hu, Q. (2020). The impact of information security investments on cyber risk: A systematic literature review. IEEE Transactions on Engineering Management, 67(4), 1010-1034. [11] Marotta, A., Martinelli, F., Nanni, S., & Yautsiukhin, A. (2017). \"Cyber-Insurance Survey.\" [12] Shetty, S., Zhou, D., & Kamhoua, C. (2018). \"Moral Hazard in Cyber Insurance.\" [13] Liu, Y., Chen, X., & Zhang, W. (2021). \"AI in Cyber Insurance: Transforming Risk Assessment.\" [14] Thynk.Network Cybersecurity Overview, www.cyberinsurance.com?46†source?. [15] National Institute of Standards and Technology (NIST) Cybersecurity Framework.

Copyright

Copyright © 2024 Pari Patel. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65906

Publish Date : 2024-12-13

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online