Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

A Study on Factors Influencing Behavioral Intention to Adopt and Use Neobanking

Authors: Pratyusha Potaraju, Reshma K. J., Ajitha S

DOI Link: https://doi.org/10.22214/ijraset.2025.66858

Certificate: View Certificate

Abstract

Financial inclusion has a significant impact on economic growth and development and improves the living standards of individuals in emerging economies. After the impact of demonetization, the tendency among people to incline towards digital payments and net banking increased. Digital payment apps, e-wallets, and online shopping are now going through a higher growth rate. Neobanking is a concept completely powered by Fintech wherein there exists no bank in its physical form and complete operation is in its virtual form. This has enabled the Neobanking system to be the financial institution in its complete sustainable potential. The research is carried out to study the Behavioral Intention to adopt and use Neobanks with a sample size of 131 respondents randomly. The research deals with the area of Financial Technology and Behavioural Finance. As a part of the research, a developed questionnaire was circulated. After collecting the data, Reliability tests such as Cronbach\'s alpha and validity tests such as Average Variance extracted were conducted to understand the reliability of the constructs used. Partial Least Squares (PLS) - Structural Equation Modelling (SEM) analysis and bootstrapping analysis are conducted to understand the impact of constructs on Behaviour Intention to adopt and use Neobanks. The results identified that among the Perceived Risks, Perceived Financial Risk (PFR) and Perceived Privacy Risk (PPR) have a strong, positive and significant impact on Behavioral Intention to Adopt (BIA) Neobanks. Among the key constructs of the UTAUT model only Hedonic Motivation (HM) has a significant impact on Behavioral Intention to use (BIU) Neobanks. Demographic factors further helped us to understand the Behavioral Intention to Adopt and Use Neobanks.

Introduction

I. INTRODUCTION

Banking in general has evolved and scaled up to be one of the greatest industries after the adoption and adaption of Information technology (Elroy Monis1, Ramesh Pai2). Neobanking is the next revolution in the banking industry and has created a buzz in the Fintech community. Neo banks is basically a kind of digital banks without any branches and no physical existence. The business of banking is changing rapidly and so the customer’s behaviours and expectations change demanding an easy and effective banking which is proved with the introduction of Neobanks. They provide all the services compared to traditional banks such as checking and savings account, payment and money transfer services, loans for individuals and businesses and other services including budgeting help. They also tend to have lower fees and offer higher interest rates on deposits compared to traditional banks, due to their reduced overhead costs from not maintaining physical branches. (Dhanraj Jaglan, 2021). In 2017, as digital and virtual activities grew, Neo banks gained popularity and momentum. The adoption of new technologies by the new generation of MSMEs and those with irregular income and revenue is one of the factors propelling the development of Neo banks [17]. Neo banking's main goal is to deliver cutting-edge financial services at a cheaper cost by using fintech and AI. (Elroy Monis, Ramesh Pai, 2023).

Neobanks are a new reality of banking that has emerged from customers changing preferences and needs. Neobanks surfaced in the early 2010s and are fully accessible by internet or mobile devices. Neobanks leverage their technology to create a customer experience that provides customers with services such as the ability to open their own accounts, convenient mobile payments, depositing money, savings and investment management tools, as well as different loan services.

The global market of neobanks is around USD and is expected to accelerate at a much more compounded growth rate of approximate 45.6% within next 5 to 6 years. Neobanks have been operating in US and Europe in quite for some time now and is popular in Australia too. In India “Neobank” is still an obscure term for many people but is likely to change soon as it is grabbing the attention of Fintech investors and some big entrepreneurs. India will soon be emerging as playground for Neo-banks because of its customer centric service approach and some players like NiYO and YONO have already entered the Indian market. Some of the prominent neo banks operating in India are RazorpayX, Instant Pay, Jupiter, Fi etc. (Dhanraj Jaglan, 2021).

This study is strongly motivated by minimal academic research on the risks and challenges associated with Neobanks as they start to enter the banking industry and market.

II. REVIEW OF LITERATURE AND HYPOTHESIS DEVELOPMENT

The literature on neobanks explores their rise as digital-first financial institutions revolutionizing the banking landscape. Neobanks operate without physical branches, offering technology-driven, customer-centric solutions such as AI-powered services, seamless payment platforms, and cost-effective operations. Their streamlined offerings appeal particularly to the younger, tech-savvy demographic, filling service gaps left by traditional banks. Studies, such as those by Temelkov (2020) and Barodawala (2022), highlight how neobanks prioritize customer convenience, process efficiency, and affordability, making them a strong competitor in the digital financial ecosystem.

Despite their advantages, neobanks face substantial challenges, particularly in regulatory compliance and cybersecurity. Sharma (2023) and Kapliar et al. (2024) emphasize that neobanks in India lack direct banking licenses, forcing them to rely on partnerships with licensed banks, which limits their autonomy. Moreover, their digital nature exposes them to risks such as data breaches, cyber fraud, and financial mismanagement. These challenges underscore the importance of robust regulatory frameworks and innovative risk management strategies.

Another key focus of the literature is the importance of trust and transparency. Studies by Agrawal and Yesugade (2020) note that the limited awareness of neobanking compared to mobile wallets and net banking could hinder their growth. However, their potential for advancing digital transactions and financial inclusion remains significant, particularly in emerging markets. Matraku (2024) further highlights how financial literacy and tailored services for specific demographic groups, such as international students, can enhance customer satisfaction and trust in neobanks.

The literature also underscores the transformative impact of fintech on traditional banking. Studies by Lindström and Nilsson (2023) suggest that neobanks represent a paradigm shift, challenging traditional banks through enhanced customer experiences, affordability, and speed. However, traditional banks continue to hold dominance due to their established regulatory compliance and larger customer base.

Research frameworks like UTAUT-3 (Unified Theory of Acceptance and Use of Technology) have been employed to study customer adoption of neobanking services. Bhatnagr and Rajesh (2023) highlight how behavioral factors such as habits, hedonic motivation, and perceived risks influence customer decisions. The findings stress the need for neobanks to address risk concerns while prioritizing simplicity, accessibility, and transparency to gain a competitive edge.

In conclusion, the literature identifies neobanks as a disruptive force with significant growth potential, particularly in India's digital ecosystem. While their innovative approach and customer-centric services position them as a viable alternative to traditional banks, addressing challenges such as regulatory compliance, cybersecurity, and trust-building remains crucial for their sustained growth and expansion. Further research is needed to explore customer behavior, preferences, and regulatory evolution in the context of neobanking.

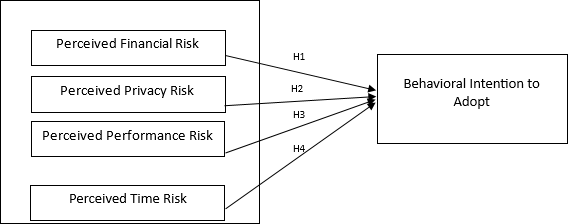

III. HYPOTHESIS

H1-PFR -> BIA PFR (Perceived Financial Risk) has a positive impact and is also significant on Behavioral Intention to Adopt Neobanking (BIA)

H2-PPR -> BIA PPR (Perceived Privacy Risk) has a positive impact and is also significant on BIA (Behavioral Intention to Adopt)

H3-PPER -> BIA PPER (Perceived Performance Risk) does not have a positive impact and is not significant on BIA (Behavioral Intention to Adopt)

H4-PTR -> BIA PTR (Perceived Time Risk) does not have a positive impact and is not significant to BIA (Behavioral Intention to Adopt)

Figure: 1 Conceptual Model

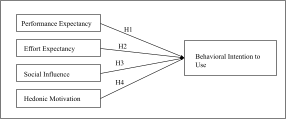

H1-PE -> BIU PE (Performance Expectancy) does not have a positive impact and is not significant on BIU (Behavioral Intention to Use)

H2-EE -> BIU EE (Effort Expectancy) does not have a positive impact and is not significant on BIU (Behavioral Intention to Use)

H3-SI -> BIU SI (Social Influence) does not have a positive impact and is not significant on BIU (Behavioral Intention to Use)

H4-HM -> BIU HM (Hedonic Motivation) has a positive impact and is also significant on BIU (Behavioral Intention to Use) and detailed analysis of the relationships within the data.

Figure: 2 Conceptual Model

IV. NEED FOR THE STUDY

Neobanks in India are encountering obstacles despite their increasing potential for adoption. Concerns of users regarding these digital-only platforms arise from perceived risks associated with finances, dependability, privacy, and efficiency. The lack of traditional bank locations increases these concerns, particularly for individuals who are not as experienced with online banking. Even though current models like UTAUT-3 and perceived risk theory offer valuable perspectives, further extensive research is required. In particular, research should examine the impact of perceived performance risk, financial risk, and time risk on neobank adoption in India. Comprehending these elements may unlock the solution to breaking down barriers to adoption and promoting expansion in this developing industry.

V. RESEARCH METHODOLOGY

A research approach was used to attain the project goal. To complete the project goal gathered information from the primary and secondary data. This study employs a quantitative research approach using a cross-sectional survey design. A structured questionnaire developed based on previous literature and adapted to the neobanking context. The questionnaire includes sections on:

- Demographic information

- Perceived risks related to neobanking adoption

- UTAUT model components

- Behavioral intention to adopt neobanking

- Behavioral intention to use neobanking

This research employs a causal research design, with data collected from a sample of 131 randomly selected individuals. The data collection tool used is a structured questionnaire, which was developed and distributed to gather insights from the respondents. The reliability of the questionnaire is measured using Cronbach’s Alpha, while the validity is assessed through Average Variance Extracted (AVE). To analyse the data, statistical methods such as Structural Equation Modelling (SEM) and bootstrapping techniques are utilized, ensuring robust

VI. RESULTS AND DISCUSSIONS

The study advanced our knowledge of the variables affecting consumers' behavioral intentions to adopt and utilize neo banking services. Developing more sophisticated features improves the adoption and user experience of neo banking, as younger, tech-savvy users are its main adopters. Educating those with lower adoption rates about the perceived benefits and offering them streamlined user services are important. Since security is a top priority, privacy concerns and data breaches should be viewed as an urgent threat that necessitates the use of advanced security features like encryption techniques. There is no denying that perceived risks like performance risk and time risk exist, and that time plays a crucial role in determining behavioral intentions. It is advised that ongoing performance evaluation and enhancement, as well as the deployment of effective customer service systems that promptly address any problems, can help reduce risks and increase user adoption. Neo banking adoption and usage will increase by emphasizing and enhancing its services, streamlining the on boarding procedure, and offering a user-friendly, secure interface

VII. COLLINEARITY STATISTICS (VIF)

Collinearity refers to the non-independence of predictor variables, usually in a regression-type analysis. It is a common feature of any descriptive ecological data set and can be a problem for parameter estimation because it inflates the variance of regression parameters and hence potentially leads to the wrong identification of relevant predictors in a statistical model. Collinearity is a severe problem when a model is trained on data from one region or time, and predicted to another with a different or unknown structure of collinearity. To demonstrate the reach of the problem of collinearity in ecology, we show how relationships among predictors differ between biomes, and change over spatial scales and through time. Dormann, C. F., Elith, J., Bacher, S., Buchmann, C., Carl, G., Carré, G., Marquéz, J. R. G., Gruber, B., Lafourcade, B., Leitão, P. J., Münkemüller, T., Mcclean, C., Osborne, P. E., Reineking, B., Schröder, B., Skidmore, A. K., Zurell, D., & Lautenbach, S. (2013).

Table-1 Collinearity Statistics

|

Table-2 Collinearity Statistics of key Components of UTAUT

|

|

The Variance Inflation Factor (VIF) values for the different variables indicate the level of multicollinearity among them. The VIF values range from 1.236 to 2.429, all well below the critical threshold of 3. This suggests that the independent variables in the model are not highly correlated, ensuring reliable and stable regression results The Variance Inflation Factor (VIF) values for the different variables indicate the level of multicollinearity among them. The VIF values range from 1.273 to 1.851, all well below the critical threshold of 3. This suggests that the independent variables in the model are not highly correlated, ensuring reliable and stable regression results.

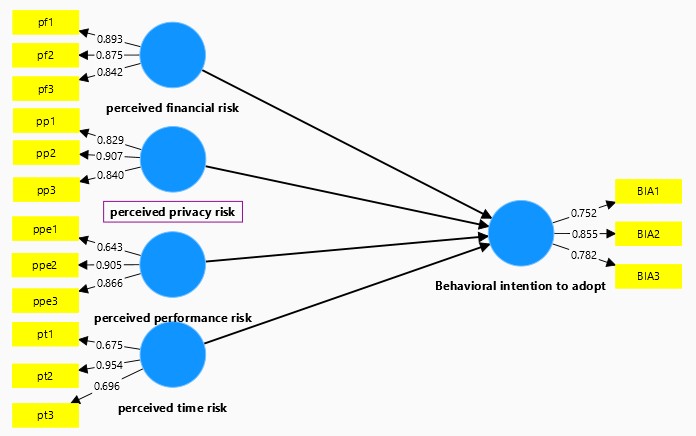

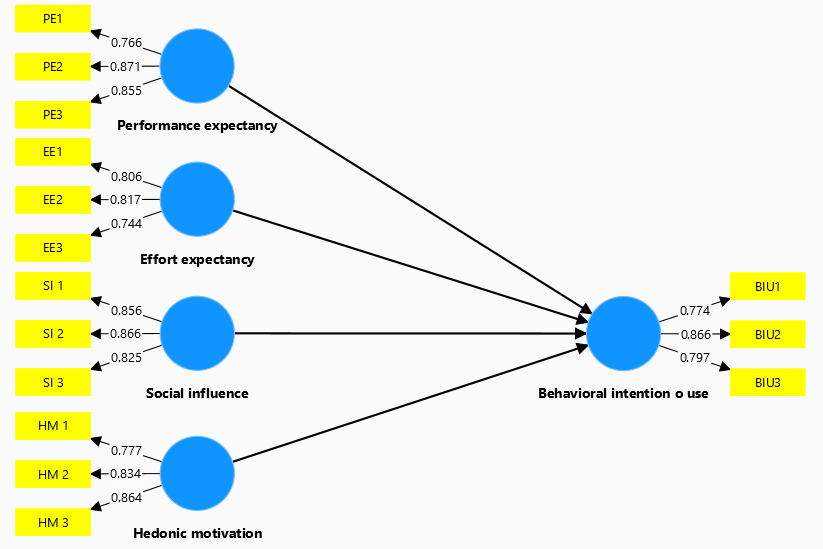

VIII. STRUCTURAL EQUATION MODEL FIT (SEM MODEL)

Structural equation model (SEM) fit has recently become a confusing and contentious area of evaluative methodology. Proponents of two kinds of approaches to model fit can be identified: those who adhere strictly to the result from a null hypothesis significance test, and those who ignore this and instead index model fit as an approximation function. Both have principled reasons for their respective course of action. Barrett, P. (2007).

Figure-2 Measurement Model of Perceived Risks

From the model constructed all the outer factor loadings of variables are >0.7, which indicates that there is a strong reflection of latent construct and ensuring that the constructs are being reliably and validly measured.

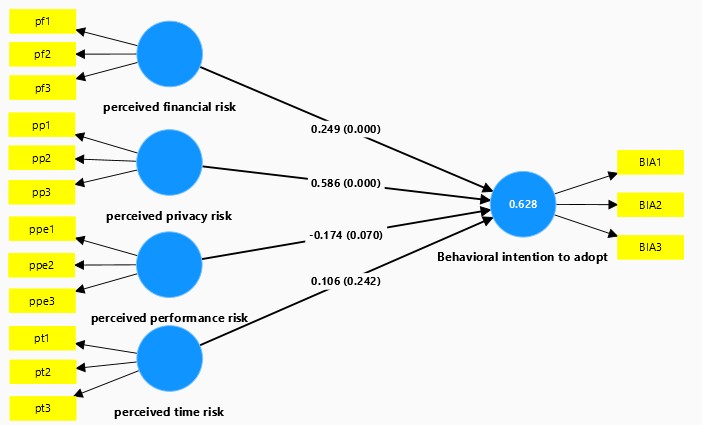

IX. BOOTSTRAPPING MODEL

The bootstrap is a well-established early computer-age inferential method (Efron, 1979; Efron and Hastie, 2016; Efron and Tibshirani, 1994). The bootstrap is based on the idea that using only the data at hand can sometimes give better results than making unwarranted assumptions about the populations we’re trying to estimate. The core mechanism of the bootstrap is sampling with replacement from the data, which is a form of data-driven simulation. Thus, learning about the bootstrap is not only learning about an alternative to the standard parametric methods of statistical inference but is also a way to learn about simulations and to question our choices of methods. As we will see, bootstrap doesn’t provide a single alternative approach to classic problems such as group comparisons, but a large family of new approaches. Having the bootstrap in your toolbox is like getting a powerful Swiss Army Knife, which offers great versatility—others have referred to the bootstrap as Meat Axe, Swan-Dive, Jack-Rabbit, and Shotgun (Efron, 1979). The bootstrap is a versatile technique that relies on data-driven simulations to make statistical inferences. When combined with robust estimators, the bootstrap can afford much more powerful and flexible inferences than is possible with standard approaches such as T-tests on means. Rousselet, G., Pernet, C. R., & Wilcox, R. R. (2023).

Figure-3 Bootstrapping Model of Perceived Risks

Table-3 Bootstrapping Results of Perceived Risks

|

Factors |

Path Coefficient |

P- Values |

|

Perceived Financial Risk-Behavioral Intention to Adopt |

0.249 |

0.00 |

|

Perceived Privacy Risk-Behavioral Intention to Adopt |

0.586 |

0.00 |

|

Perceived Performance Risk-Behavioral Intention to Adopt |

-0.174 |

0.07 |

|

Perceived Time Risk-Behavioral Intention to Adopt |

0.106 |

0.14 |

The significance of path coefficients is typically tested through bootstrapping. From the analysis it is found that the path coefficients of PFR (H1), PPR (H2) are closer to +1 which implies there is a strong relationship between PFR, PPR and BIA. It is also found that P-values of PFR (H1), PPR (H2) are less than 0.05, which indicates only PFR, PPR has a significant impact on Behavioral Intention to Adopt.

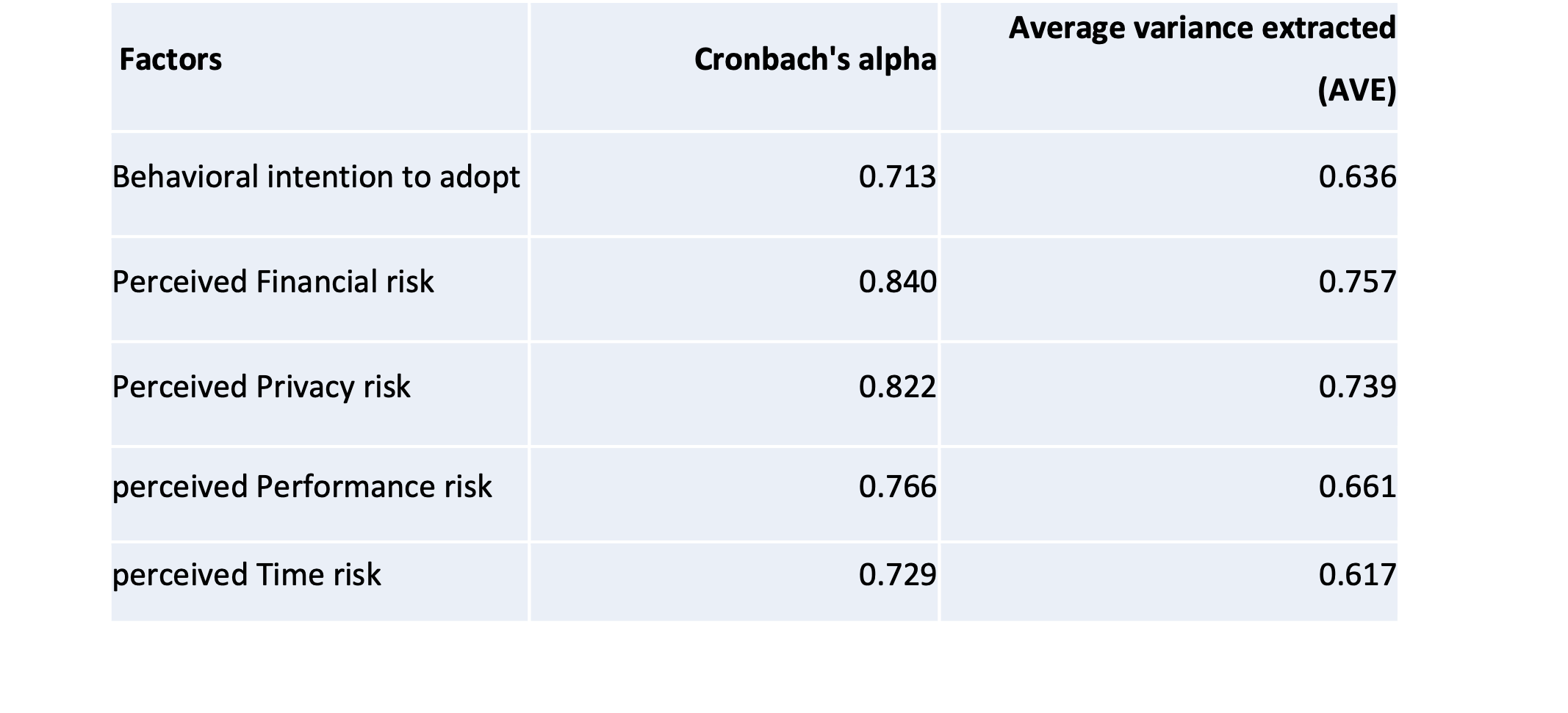

X. CONSTRUCT RELIABILITY AND VALIDITY

Construct validation is the process by which scientists generate evidence to support a claim that a score produced by an instrument holds a specific meaning (Cronbach & Meehl, 1955). If the numbers used in a study are not valid (e.g., the motivation scores do not reflect levels of motivation) then the conclusions of that study are also not valid.

Table -4 Construct reliability and validity

XI. CRONBACH’S ALPHA

All values are above 0.7, indicating good internal consistency and reliability

XII. AVERAGE VARIANCE EXTRACTED (AVE)

All AVE values are above 0.5, showing that the constructs explain sufficient variance in their observed variables, ensuring good convergent validity. From the model constructed all the outer factor loadings of variables are >0.7, which indicates that there is a strong reflection of latent construct and ensuring that the constructs are being reliably and validly measured.

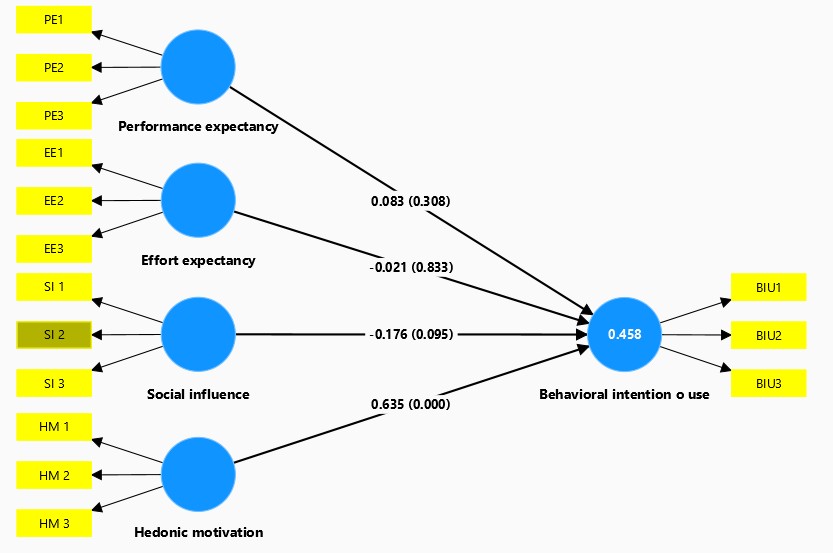

Figure-5 Bootstrapping model of UTAUT key components

The p-value indicates the significance of the impact of the independent variable on the dependent value. If the p-value is less than 0.05, then the impact of the independent variable on the dependent variable is considered statistically significant.

|

Table-6 Bootstrapping Results of UTAUT components

Table-5 Variance of BIA

|

Variables |

R-Square |

R-Square Adjusted |

|

Behavioral Intention to Adopt |

0.628 |

0.616 |

R-Square (R²) is a measure of the explained variance of the dependent variable. The R² for BIA is 0.628, it means that 62.8 % of the variance in BIA is explained by Perceived Risks.

Figure-4 Measurement model UTAUT key components

The significance of path coefficients is typically tested through bootstrapping.

From the analysis it is found that the path coefficient of HM (Hedonic Motivation) is closer to +1 which implies there is a strong relationship between HM and BIU.

It is also found that P-values of HM are less than 0.05, which indicates only HM has a significant impact on Behavioral Intention to Use.

Table-7 Variance of BIU

|

Variables |

R-Square |

R-Square Adjusted |

|

Behavioral Intention to Use |

0.458 |

0.441 |

R-Square (R²) is a measure of the explained variance of the dependent variable. The R² for BIU is 0.458, it means that 45.8 % of the variance in BIU is explained by Key Component of UTAUT.

My study provides robust evidence that PFR (Perceived Financial Risk), PPR (Perceived Privacy Risk), HM (Hedonic Motivation) significantly influence Behavioral Intention to Adopt and Use Neobanking.

XIII. FINDINGS

We can clearly see that Perceived Financial Risk and Perceived Privacy risk are showing significant impact on Behavioral Intention to Adopt because money and privacy concerns are particularly very important when adopting digital only services. Financial transactions and personal data are the foundation of any banking service. If users are being compromised on these, they are less likely to adopt the service. Users are naturally concerned about losing money. If they perceive that adopting neobanking could lead to financial losses they may hesitate to adopt it. Increasing online thefts and data breaches has also become a major concern and if these are perceived as threats to users to go completely digital, people are reluctant to adopt to neobanking. The desire to engage in activities that bring pleasure, enjoyment or emotional satisfaction is explained as hedonic motivation to adopt or use a service. In a completely transformed digital world, users want to experience seamless and enjoyable digital interactions. By offering user-friendly interface, personalized services and intuitive features like real-time notifications, convenience of performing transactions from anywhere contribute to the fun and enjoyment. Individuals feel that creating engaging experience with technologies that provide enjoyable experiences, alongside functional utility enhances the behavioral intention to use neobanking. The emotional satisfaction and enjoyment fostered by these services encourage users stay loyal to neobanking platforms

Conclusion

The study concludes that the behavioral intention to adopt and use neobanking services in India is significantly influenced by perceived risks and motivational factors. Perceived Financial Risk (PFR) and Perceived Privacy Risk (PPR) emerged as critical determinants, indicating that concerns about financial losses and data security heavily impact user adoption. Additionally, Hedonic Motivation (HM) plays a pivotal role, highlighting that users value enjoyable and seamless digital experiences when engaging with neobanks. Younger, tech-savvy individuals, particularly those aged 18-25, are more inclined to adopt neobanking due to their preference for innovative and user-friendly banking solutions. The findings underscore the importance of addressing security concerns, enhancing privacy measures, and offering personalized services to improve user trust and satisfaction. Moreover, the study reveals that while neobanks hold significant growth potential, their success relies on overcoming regulatory challenges and continuously evolving to meet consumer expectations in the competitive digital banking landscape. These insights provide a foundation for future strategies aimed at fostering adoption and sustaining growth in the neobanking sector.

References

[1] Barodawala, Y.A., 2022. Neo banking: An innovative window of banking arena. Global Journal of Interdisciplinary Studies, 3, pp.27-33. [2] Sardar, S. and Anjaria, K., 2023. The future of banking: how neo banks are changing the industry. International Journal of Management, Public Policy and Research, 2(2), pp.32-41. [3] Sharma, J., 2023. Neo-banking challenges and expansion in future. [4] Bhatnagr, P. and Rajesh, A., 2023. Neobanking adoption–An integrated UTAUT-3, perceived risk and recommendation model. South Asian Journal of Marketing. [5] Lindström, V. and Nilsson, O., 2023. The sudden rise of neobanks and the threat it poses upon the traditional banking system. [6] Larisa, G., Tetiana, N. and Viktoriia, V., 2019, October. Neobanks operations and security features. In 2019 IEEE International Scientific-Practical Conference Problems of Info communications, Science and Technology (PIC S&T) (pp. 839-842). IEEE. [7] Temelkov, Z., 2020. Differences between traditional bank model and fintech based digital bank and neobanks models. SocioBrains, International scientific refereed online journal with impact factor, (74), pp.8-15. [8] Agrawal, A. and Yesugade, A., A perception study of Neo banking as a Fintech Revolution. [9] Shabu, K. and Ramankutty, V., 2022, February. Neobanking in India: Opportunities and Challenges from Customer Perspective. In Proceedings of the International Conference on Innovative Computing & Communication (ICICC). [10] Monis, E. and Pai, R., 2023. Neo banks: A paradigm shift in banking. International Journal of Case Studies in Business, IT and Education (IJCSBE), 7(2), pp.318-332. [11] Meijer, K., Abhishta, A. and Joosten, R., 2022, August. Role of culture in customer acceptance of Neobanks. In International Workshop on Enterprise Applications, Markets and Services in the Finance Industry (pp. 97-116). Cham: Springer International Publishing. [12] Amon, A., Jagri?, T. and Oplotnik, Ž.J., 2024. The Neobank Revolution: An Assessment of Their Contribution to the Global Sustainability. [13] Kapliar, K.A.R.I.N.A., Maslova, N.A.T.A.L.I.A. and Hnoievyi, V.A.L.E.N.T.Y.N., 2024. Risks of the Neobanks’ Activities in the Conditions of the Economy Digitalization. WSEAS Trans. Inf. Sci. Appl, 21, pp.11-22. [14] Matraku, G., 2024. Neobank Adoption and Satisfaction: Insights from University Students. [15] Vuorinen, N., 2024. Are digital banking services a solution for good customer satisfaction? [16] Premalatha, J.R., 2021. An Investigation into the factors influencing the behavioral intention of private sector bank customers towards adoption of internet banking services in South India. PhD. Alagappa University. [17] Bhuvana, M., 2019. Effectiveness of Financial Inclusion on Banking Services through Information and Communication Technology. PhD. Vels University. Guided by S. Vasantha. Available at: INFLIBNET Centre.

Copyright

Copyright © 2025 Pratyusha Potaraju, Reshma K. J., Ajitha S. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65858

Publish Date : 2024-12-11

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online