Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Financial Technology FINTEC Innovation and Disruption

Authors: Saurabh Sinha, Dr. Ashutosh Kumar Jha

DOI Link: https://doi.org/10.22214/ijraset.2024.61243

Certificate: View Certificate

Abstract

The advent of financial technology (fintech) advances has caused a rapid transformation of the financial industry, causing major disruptions to the traditional banking and finance sectors. In an effort to shed light on how the financial industry is changing, this thesis examines the patterns and ramifications of fintech innovation and disruption. The first section of the paper is a thorough examination of the literature that describes the development of fintech as well as the theoretical underpinnings of disruption and innovation. Through case studies of profitable fintech businesses, it investigates current developments in fintech innovation, such as robo-advisors, blockchain technology, and digital payments. The thesis also examines the disruptive effects of fintech on the financial sector, emphasizing the ways in which fintech is changing the landscape of traditional banking and finance. Additionally, it addresses the regulatory issues raised by fintech. The thesis makes predictions about the direction of fintech based on the data and suggests possible areas for more study. With a summary of the most important findings and their ramifications for researchers, financial institutions, and legislators, it ends by highlighting the necessity of proactive tactics for adjusting to the shifting fintech environment. By adding to the body of knowledge already available on fintech innovation and disruption, this thesis helps academics, business professionals, and policymakers navigate the changing financial world. Through innovation and disruption, financial technology, or fintech, has become a disruptive force in the financial industry, altering traditional banking and finance. This thesis examines how fintech has developed and how it has affected the financial industry, emphasizing trends, obstacles, and stakeholder consequences. This study examines the several ways that fintech is changing the financial services sector, including banking, insurance, and investment management, through an extensive assessment of the literature. With an emphasis on regulatory sandboxes and open banking initiatives, it investigates how regulatory frameworks either support or impede fintech innovation and disruption. This thesis also explores the tactics used by prosperous fintech startups to overthrow established players and increase market share. It also takes into account the dangers and difficulties that come with fintech innovation, like issues with cybersecurity, data protection, and regulatory compliance.

Introduction

I. INTRODUCTION

Through innovation and disruption, financial technology, or fintech, has become a disruptive force in the financial services sector, altering traditional banking and finance. The term "fintech" refers to a wide range of technology advancements intended to enhance and automate the provision of financial services. These advances improve efficiency, accessibility, and transparency in the financial sector by utilizing cutting-edge technologies like blockchain, artificial intelligence, and big data analytics.

With the introduction of digital payment methods and internet banking in the early 2000s, fintech began to take shape. But since it revealed the flaws and shortcomings of established banking systems, the global financial crisis of 2008 acted as a trigger for the explosive rise of fintech. Fintech companies started to appear in the wake of the financial crisis, providing substitutes for conventional banking services like robo-advisors, mobile payment apps, and peer-to-peer lending platforms.

The evolving expectations and behavior of consumers is one of the main forces behind fintech innovation. Because they grew up in the digital era, millennials and Gen Z are looking for financial services that are easy to obtain, personalized, and convenient—things that traditional banks find difficult to offer. By providing solutions that are mobile-first and easy to use, fintech companies have benefited from this trend and are targeting the digital native population.

In addition, technological developments like the widespread use of smartphones and the internet of things (IoT) have opened up new avenues for fintech innovation. For instance, mobile payment apps have completely changed how individuals conduct business by enabling them to pay with only a tap of their smartphone for goods and services. Fintech has many advantages, but it also presents difficulties and interruptions to the established banking sector. Compared to traditional banks, fintech companies are frequently more inventive and nimble, which enables them to quickly adjust to shifting consumer demands and market conditions.

Fintech companies have gained a competitive advantage over traditional banks due to their agility, especially in areas like customer experience and product innovation.

Here are some more things to think about when you're writing the opening to your thesis on fintech disruption and innovation:

- Impact Worldwide: With businesses and innovations appearing in numerous nations, fintech is not restricted to just one area but rather has an impact on the entire world. Fintech's global reach emphasizes how important it is as a force for change in the global financial industry.

- Ecology Dynamics: The ecology in which fintech companies operate is just as important to innovation as the companies themselves. This involves working together with technology companies and government agencies, as well as alliances between fintech startups and conventional financial institutions. Comprehending these processes is crucial in order to fully appreciate the magnitude of fintech's influence.

- Regulatory Obstacles and Solutions: Fintech innovation is advancing at a rate that frequently outpaces legal frameworks, creating problems for industries including financial stability, consumer protection, and data privacy. In order to promote innovation while reducing risks, regulators are increasingly addressing these issues with creative solutions like regulatory sandboxes and agile regulation.

- Financial Inclusion: By giving underprivileged groups, like those living in rural or isolated places, access to financial services, fintech has the potential to increase financial inclusion. This fintech feature, which gives people and communities access to financial tools and services, has the potential to have significant social and economic effects.

- Effect on Conventional Banking structures: By providing more effective, customer-focused solutions, fintech is upending conventional banking structures. Due to fintech disruption, the competitive landscape has changed, putting pressure on traditional banks to innovate and adjust to the new market dynamics.

- Emerging Technologies: Fintech innovation is intimately related to developments in blockchain, AI, and machine learning, among other emerging technologies. New fintech solutions are being made possible by these technologies, which are also fostering industry synergies that will spur additional innovation and disruption.

FinTech is beginning to affect how we live our daily lives, from making it easier to pay for goods and services to provide the infrastructure needed for financial institutions to run. In addition to streamlining financial services, it provides consumers with efficient and convenient access to these services via smartphones. FinTech, as a term, generally refers to the methods and ideas used to provide financial services via internet connectivity and the widespread use of smart mobile technology around the world in the financial sector to assist businesses in managing the financial parts of their operations.

The paper's objective is to present FinTech business models while methodically going over the concept, traits, and uses of the industry from current literature. We then conducted a comparison analysis of FinTech firms, comparing local startup enterprises with global FinTech organizations, based on current studies. The study is anticipated to help business sectors see how FinTech is being adopted, particularly in the context of local markets and market segmentation.

II. LITERATURE REVIEW

In the financial services sector, financial technology, or fintech, has become a disruptive force that is upending established banking practices and changing how financial services are provided and used. Using a variety of scholarly and commercial sources, this literature review analyzes the main themes, forces behind fintech innovation and disruption, and their ramifications.

A. Fintech's Evolution

The inception of online banking and digital payment systems in the early 2000s marked the beginning of the fintech movement. But since it revealed the flaws and shortcomings of established banking systems, the global financial crisis of 2008 acted as a trigger for the explosive rise of fintech. Since then, changes in consumer behavior, technological developments, and legislative changes have all contributed to the rapid evolution of fintech.

B. The Fintech Innovation Drivers

Fintech innovation has been propelled by several important factors. A major motivator is the shift in customer behavior, especially from younger generations who are accustomed to digital technologies and have higher expectations for personalized, easy, and seamless financial services. Technological innovations that improve efficiency, security, and transparency in the financial sector, such blockchain, artificial intelligence (AI), and big data analytics, have also been essential in propelling fintech innovation.

C. Fintech's Disruptive Effect

Fintech has challenged established banking structures and opened up new avenues for innovation, causing a disruptive effect on the financial services sector. Fintech companies have launched peer-to-peer payment platforms, digital wallets, and mobile payment apps that offer faster, more affordable, and more convenient payment choices than traditional methods. Payments is one of the major areas of disruption in this space. With the emergence of peer-to-peer lending networks and online lending markets that provide people and small businesses with alternate sources of funding, fintech has also upended the lending industry.

D. Regulatory Obstacles and Solutions

Fintech innovation is advancing at a rate that frequently outpaces legal frameworks, creating problems for industries including financial stability, consumer protection, and data privacy. In order to promote innovation while reducing risks, regulators and legislators are increasingly addressing these issue with creative solutions.

E. Prospects for the Future

Future fintech developments are probably going to be marked by ongoing innovation and upheaval. The emergence of decentralized finance (DeFi), the incorporation of fintech into routine services, and the possibility of fintech to tackle global issues like sustainable development and climate change are important developments to keep an eye on.

It is well known that the financial sector makes extensive use of ICT. In actuality, the financial sector is leading the way in leveraging ICT to offer top-notch services to their clientele. However, the recent advancement in the fusion of ICT and finance, along with the widespread availability of high-speed internet connections that are simple to access through smartphones, has sparked the creation of cutting-edge financial technology that offers consumers a wide range of financial products that cater to their needs.

Since many of these financial goods are provided by non-financial institutions, the rivalry in the financial industry is altered. When financial technology was first coined, it referred to ICT-based technologies used by financial institutions on both the front and back ends. Perhaps one of the most cutting-edge developments in today's FinTech began when Barclays Bank began using automatic tellers, or ATMs, in 1967. Since the end of the first decade of the twenty-first century, the word has come to refer to any technical advancement in the financial industry, including advancements in retail banking, investment, financial literacy and education, and even cryptocurrency like bitcoin.

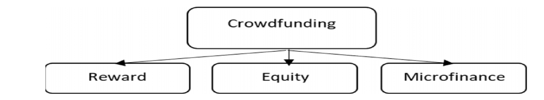

Crowdfunding is among the best examples of FinTech in the investment space. Crowdfunding offers several investment options to persons looking to launch a business and receive money from investors who pool their resources to support initiatives together. Generally speaking, crowdsourcing schemes provide more alluring returns than what individuals may obtain by saving money or making deposits through banks. According to Freedman and Nutting crowdfunding platforms are now competing with traditional banking products in the finance and investment sectors. Three categories of crowdfunding exist: microfinance, reward-based, and equity-based. Participant rewards in reward-based crowdfunding can be material or intangible.

Through the use of equity-based crowdfunding, project initiators can specify a deadline and an intended funding target. Next, the target sums are split into equal stock shares at a predetermined cost. It is possible for anyone to earn from the investing phase. Microfinance, on the other hand, focuses on those with low incomes who have restricted access to financial services and banking. Crowd money is obtained by means of an intermediary from a multitude of individuals.

III. OBJECTIVE

This thesis aims to do a thorough examination of the developments, forces behind, and effects of financial technology (fintech) innovation and disruption on the conventional financial services sector. The study will look at how fintech has developed, pinpoint the major technology developments that are spurring innovation, and assess how fintech is changing the financial industries, including banking, insurance, investment management, and others.

Furthermore, the study will examine the tactics and business plans employed by prosperous fintech enterprises, appraise the regulatory framework pertaining to fintech, and appraise the obstacles and prospects brought about by the disruption of fintech. The ultimate objective is to offer insights that will help scholars, industry practitioners, and policymakers navigate the shifting financial services industry and understand the ramifications of fintech innovation and disruption.

Examining how fintech is influencing the competitive environment, market share, and profitability of established banks and financial enterprises is one way to assess how fintech is affecting traditional financial institutions.

Examining how regulatory frameworks, such as regulatory sandboxes and open banking efforts, are impacting the creation and uptake of fintech solutions is one way to determine how regulation is promoting or impeding fintech innovation.

To look at the dangers and difficulties that come with fintech innovation: This goal can include recognizing and evaluating problems including cybersecurity hazards, data privacy concerns, regulatory compliance, and the possibility of employment displacement.

To investigate how fintech affects financial inclusion: Examining how fintech is increasing access to financial services could be one way to achieve this goal.

Analyzing how fintech innovation may affect society could entail looking into how it is affecting consumer behavior, financial literacy, and the state of the economy as a whole.

To offer suggestions to researchers, industry professionals, and legislators: This goal can entail combining the research results to provide stakeholders with useful advice on how to navigate the changing fintech landscape, take advantage of its advantages, and minimize its hazards.

These goals can direct your investigation and offer a structure for your thesis, which will examine the main facets of fintech innovation and disruption.

To Examine the Growth and Evolution of Fintech: This goal entails tracking the evolution of fintech from its inception to the present.

Utilizing and innovating digital technologies expands financial inclusion and enhances economic opportunities. The financial services sector now has an efficient and cost-effective view thanks to a wave of technology. Still, the financial industry continues to reject and underutilize a great deal of advancements.

The financial services sector now has an efficient and cost-effective view thanks to a wave of technology. Still, the financial industry continues to reject and underutilize a great deal of advancements. In addition, a lot of the financial services industry still struggles to incorporate these developments into its primary business offering, despite all the achievements in the field.

institutions are better able to support themselves and assist the less fortunate when financial innovation is used. Consequently, there is a direct relationship between the growth of the IT industry and the financial markets. More precisely, they have a positive connection in common.

The recent history of the financial sector can be divided into two major periods. The first, which lasted from the 1940s until the 1970s, was marked by stability, interventionism, and strict control. The second phase was characterized by deregulation and rising volatility and lasted from the 1970s until the onset of the subprime mortgage crisis in 2007. This liberalization combined with a wholly insufficient regulatory framework is what led to the increased instability in the second period, as was seen during the crises in the US and Japan.

During the second period, risk management techniques, automated credit scoring, internet and phone banking, ATMs, and derivatives and securitization were introduced.

The following section discusses several categories of financial innovations:

Process Innovations: Cutting-edge financial business procedures improve customer service and increase operational efficiency. Among other things, these innovations include innovative business practices that increase output and open up new markets. The online banking service is the most basic example.

Financial Institutional Innovations: Innovation is essential to the development of the financial system, which is a precondition for economic expansion. The founding of a new company offering cutting-edge procedures or services is one example. But it's difficult to design a regulatory framework that balances social and private interests fairly while fostering innovation, globalization, and the expansion of the financial industry.

Product Innovations: It presents novel financial instruments or products, like family wealth accounts and weather derivatives. Product innovations are introduced to improve efficiency or better meet shifting consumer demands.

IV. RESEARCH METHODOLOGY

Research Design: A mixed-methods strategy will be used in this study to combine qualitative and quantitative research techniques. Case studies of profitable fintech startups and an extensive assessment of the literature will be part of the qualitative component. Data analysis of regulatory frameworks and financial indicators will be part of the quantitative component.

A. Gathering of Data

- Qualitative Information Academic journals, industry studies, government publications, and the websites of fintech companies will be the sources of the qualitative data. Data for the case study will be gathered by analyzing corporate records and conducting interviews with industry specialists.

- Quantitative Data: Fintech businesses' financial data, government sources' regulatory data, and industry reports' market data will all be included in the quantitative data.

- The present study will employ thematic analysis to discern significant themes and patterns within the qualitative data. The identification of successful fintech companies' business models and strategies will be the main focus of the investigation.

Quantitative Analysis: To find trends and patterns, financial and market data will be statistically evaluated. To determine how rules affect financial innovation, regulatory data will be examined. - Case Studies: In order to comprehend the innovative and disruptive techniques employed by successful fintech organizations, a number of case studies will be undertaken. Companies from several fintech industries, including payments, loans, and wealth management, will be included in the case studies.

- Regulatory Analysis: The regulatory analysis will concentrate on looking at the laws and rules that control fintech businesses. Analyzing how rules affect fintech innovation and disruption will be part of this, as will the function of open banking programs and regulatory sandboxes.

- Ethical Aspects: Throughout the research process, ethical aspects will be taken into account. These aspects include protecting participant anonymity and abiding by ethical standards for data collection and analysis.

- Limitations: The study's limitations, such as the data's accessibility and the research's scope, will be noted. The primary area of interest for this research will be fintech innovation and disruption in developed economies.

- Research Philosophy: In order to comprehend the varying experiences and interpretations that people and organizations in the financial services sector assign to fintech innovation and disruption, the study will employ an interpretivist research philosophy.

Research approaches: To give a thorough examination of the research issue, the study will employ a mixed-approaches research technique that combines qualitative and quantitative methods. - Quantitative Data: A larger sample of people working in the financial services sector will be given surveys to complete in order to gather quantitative data. In addition to asking about their opinions on the effect of fintech on the sector, the survey will also ask about their awareness, adoption, and impressions of fintech advances.

B. Method of Sampling:

- Qualitative Sampling: To ensure that a wide range of viewpoints is represented, participants for the interviews will be chosen through the use of purposeful sampling.

- Quantitative Sampling: The survey will be given out to conveniently available financial services industry participants by convenience sampling.

C. Analyzing Data:

- Qualitative Analysis: Thematic analysis will be utilized to examine the interviewees' qualitative material.

- Quantitative Analysis: The quantitative information from the surveys will be examined using descriptive statistics, such as frequencies and percentages. This will give a summary of the replies and enable comparisons between various responder groups.

- Triangulation: To improve the validity and reliability of the results, the study will employ triangulation. Utilizing a variety of techniques (qualitative and quantitative) and data sources, or triangulation, helps to validate the findings and offer a deeper comprehension of the subject matter of the study.

- Ethical Considerations: The study will abide by the moral standards that apply to research involving human subjects, which include getting informed consent, protecting participant privacy and identity, and limiting any possible risk to the subject.

V. FINDINGS

- Impact of Fintech on Financial Services: Fintech has increased accessibility and inclusivity while democratizing access to financial services. People's financial management has changed as a result of online lending platforms, digital payments, and mobile banking.

- Disruption of Traditional Banking: Fintech startups are becoming a bigger competitor for traditional banks, which means they need to get creative and adapt. To remain competitive, banks are integrating fintech technology into their business processes

- Opportunities for Growth: Despite challenges, fintech presents significant opportunities for growth and development. Collaboration with traditional financial institutions and leveraging emerging technologies can drive further innovation in the industry

- Future Outlook: The future of fintech looks promising, with emerging technologies like blockchain and artificial intelligence expected to play a significant role in driving innovation. Fintech companies that address challenges and embrace collaboration can drive positive change in financial services globally. These findings provide a comprehensive understanding of the impact, challenges, and opportunities of fintech innovation and disruption in the financial services .

- Customer-Centric Solutions: Fintech companies are known for their customer-centric approach, offering personalized and user-friendly financial services. This focus on customer experience has reshaped consumer expectations and forced traditional banks to improve their services.

- Efficiency and Cost Savings: Fintech has led to significant efficiency gains and cost savings in the financial industry. Automation and digitalization have streamlined processes, reducing operational costs for both fintech companies and traditional financial institutions.

- Financial Inclusion: Fintech has played a crucial role in promoting financial inclusion by providing services to underserved populations. Mobile banking and digital payments have enabled people in remote areas to access banking services for the first time.

- Enhanced Convenience and Efficiency: Fintech solutions streamline operations by automating repetitive tasks and processes, which speeds up transactions, reduces operating expenses, and gives users a more convenient experience overall Robo-advisors and mobile banking apps are two excellent examples.

VI. LIMITATIONS

Financial Technology is referred to as FinTech. It is gradually and progressively changing how many industries conduct business. The efficiency and ease of performing business activities has increased exponentially. The core of fintech is the application of technology innovations to streamline financial processes. This is a field that is always changing and developing new ways to solve issues as they come up. FinTech's frontiers are continuously being explored. There are a couple restrictions on this idea, though. Large offices in desirable locations and multi-layered management structures result in significant operational expenditures. Their high overhead expenses make it difficult for them to compete with adaptable technology firms that concentrate on specialized markets and reduce operating costs.

The fintech sector has to have a deeper comprehension of the elements that put users under financial strain. They can collaborate with groups that can assist them in taking a comprehensive approach to resolving those situations. Prescription policies are necessary when policies fail. Financial technology is unable to raise the minimum wage or retrain workers for alternative careers. It is unable to reduce healthcare expenses.

Based on this, the study sample for this paper consists of listed businesses from 2012 to 2022, and it empirically assesses the main FinTech channels and techniques in relation to corporate funding limitations. Research indicates that the financing constraints of publicly traded companies are lessened when financial technology advances. This is because higher financial technology also helps to address the information asymmetry issue that publicly traded companies face, which lessens financing constraints. The limitations of listed firms' finance and financial technologies are negatively mediated by the quality of public disclosure.

Every technical advancement will result in some losses. The nature of these losses with Fintech, is probably going to be rather varied, but mechanization is crucial in this situation. Of course, industrialization raises concerns around the globe in every aspect of life. It is becoming more and more likely that the need for human labor will decline sharply as machine learning and robotics grow. It's possible that this is not interesting.

Getting back to the more specialized area of financial technology, there is a tendency towards the necessity for fewer personnel to execute financial services. The rate at which fintech is developing also creates the possibility that certain people will completely disappear afterwards.

Conclusion

Fintech, or financial technology, has become a significant force in the financial services sector, propelling innovation and disruption. Fintech has transformed the way consumers access and manage their finances over the last ten years by providing a wide range of cutting-edge solutions that are altering the sector. A. Important Trends and Innovations Financial services are now more easily accessible, effective, and easy for both individuals and businesses because to fintech breakthroughs including peer-to-peer lending, robo-advisors, blockchain technology, and mobile payments. These developments have also spurred a surge of investment and entrepreneurship in the fintech space, which has resulted in the industry\'s explosive growth. B. Possibilities and Difficulties Fintech innovation has not, however, been without difficulties. Some of the major obstacles that fintech startups must overcome are regulatory difficulties, cybersecurity dangers, and rivalry from established financial institutions. Additionally, fintech companies constantly have hurdles in staying ahead of the curve due to the quick speed of technology change and shifting consumer expectations. C. Prospects for the Future Future fintech developments are probably going to be marked by ongoing innovation and upheaval. New goods and services that were previously unthinkable will be made possible by emerging technologies like artificial intelligence, machine learning, and big data analytics. These technologies will be crucial in propelling fintech innovation. Furthermore, it is anticipated that regulatory frameworks would change to support fintech innovation while maintaining financial stability and consumer safety. In summary, fintech innovation and disruption are creating new prospects for growth and development within the financial services sector. Fintech companies may promote positive change and improve the way financial services are supplied and consumed globally by embracing innovation, collaboration, and regulatory compliance.

References

[1] In 2016, Anshari, M., Smith, M., Alas, Y., Hardaker, G., Jaidin, J. H., and Ahad, A. D. Personalization, gender, and generational differences in Brunei\'s smartphone habits and behaviors. 64, 719–727; Computers in Human Behavior. [2] The doi is 10.1016/j.chb.2016.07.063 [3] Arner, D. A., Bukley, R. P., and Barberis, J. (2016). Fintech development: A new paradigm for the post-crisis era? Extracted from \"Arner-Barberisand-Buckley.PDF\" at https://www.law.georgetown.edu/academics/law-journals/gjil/recent/upload. [4] Barberis, J., Buckley, R. P., and Arner, D. W. (2015). Fintech\'s development: A fresh paradigm in the wake of the crisis. Int\'l L. Geo. J., 47, 1271. The doi is 10.2139/ssrn.2676553. (2017) Augustine, A. Fintech for Baby Boomers: Go with the flow. GEN, 4, 4. [5] M. Blake (2016). Five things regarding fintech that you should know. Global Economic Forum. taken from the website weforum.org M. Brando (2016). Cloud-based finance. Cloud-Based Film and Video Production: Ideas, Processes, [6] T. F. Dapp (2014). Fintech refers to the financial industry\'s digital (r)evolution, which focuses on reducing transaction costs and making effective use of information. 2(4) Current Issues, 16–17. [7] F. Desai (2015). The Evolution of Fintech. taken from the 2015/12/13 publication at https://www.forbes.com/sites/falgunidesai /#454f8b0e3dd0, the-evolution-of-fintech/2 [8] Stein, R. M., and V. Dhar (2017). FinTech tactics and platforms. ACM Communications, 60(10), 32–35. [9] Schmitt, M., Hornuf, L., Dorfleitner, G., and Weber, M. (2017). An explanation of the FinTech sector and what FinTech is. Springer. 10.1007/978-3-319-54666-7_2 is the doi. doi:10.1145/3132726 [10] Facebook (2014). Global monthly active Facebook user count as of the first quarter of 2015. From https://www.statista.com/statistics/264810/number-of-monthly-active-facebook-users-worldwide, retrieved May 5, 2015. [11] Nutting, M. R., and D. M. Freedman (2015). Equity crowdfunding for investors: a guide to risks, returns, regulations, funding portals, due diligence, and deal terms. Wiley & Sons, Inc. doi:10.1002/9781118864876

Copyright

Copyright © 2024 Saurabh Sinha, Dr. Ashutosh Kumar Jha. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET61243

Publish Date : 2024-04-29

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online