Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Forecasting Bitcoin Price Using Deep Learning Algorithm

Authors: Sanjana T, Mahalakshmi V, M. Preethi Darshini, Hemanth. N, Sameena H S

DOI Link: https://doi.org/10.22214/ijraset.2022.43958

Certificate: View Certificate

Abstract

Cryptocurrencies are now deeply rooted and widely used as a form of money. Almost all financial instruments are affected, but Bitcoin trading is seen as one of the most recognizable potentials. Since this ever-growing short-term financial market is characterized by high volatility and significant fluctuations in value in a short period of time, the promotion of more accurate and reliable valuation models is seen as an important improvement feature in any firm. Wallet. This study describes a correlated deep learning model that can digitally predict the value and evolution of money. Use of CNN, CNN-LSTM and ARIMA algorithms. Almost any precise feature can be predicted.

Introduction

I. INTRODUCTION

In contemporary econo-physics literature, there is an increasing interest in studying Bitcoin [1]. A cryptocurrency is a digital money that is an encoded bits that signifies a digital currency which is monitored and organised by a technology called Unlike fiat currencies, the blockchain also acts as a secure record of transactions.[2]. and by utilising a deep learning-based scheme, it was proposed to foresee the change in the Bitcoin cost and exchanges in view of client feelings and opinions inferred by online discussions. However, generating accurate predictions is a complex and challenging one.

The cryptocurrency platform became an investing and trading platform [10]. Numerous specialists are attempting to figure precise costs. in this particle, we are proposing a deep learning-based framework to conjecsturimate the co-value and present value of bitcoins and with ongoing testing. and furthermore, contrasted and genuine determining costs.

II. DEFINITIONS

A. Cryptocurrency

A trendy currency is Bitcoins normally called as Cryptocurrency, a type of currency which does not have any physical form but it is valuable and legal and has higher value in the virtual level, these cryptocurrencies or the Bitcoins are stolen or misuse of those coins in any manner Every coin has their individual owner or membership , the user and the owner of those coins can decide whether to buy more coins or to sell them or keep them based on the trending of those coins and the value they possess in the market .This decision is purely on an individual basis. It's done by their gut feeling with the knowledge on the financial rules, situations and the trading knowledge. cryptocurrencies use validators to keep up with the digital money. In a proof-of-stake model, users set up their tokens as guarantee.

These currencies are not handled by any government sector, it's handled by Decentralised by the Central Bank Digital Currency (CDBC). Every coin mined will be mentioned in the ledger as centralised

Consequently, they get authority over the token in relation to the sum they stake. these symbolic stakes get extra possession in the token over the long run through network charges, brand new tokens. Every transaction made will be recorded in the online ledger and which will be transparent with the blockchain technology.

B. Bitcoin

Bitcoins are used for virtual or the digital financial transaction, bitcoins are not owned by any country and its open for everyone for the trading and investment purposes, there are various applications for the user to search and select the bit coins for transactions and for the purchasing of those bitcoins, during the transaction there will be no mention of the user but only the wallet id will be visible. largest Bitcoin exchange is done by the application Mt.Gox Bitcoins will be stored in wallet format and it will be organised and maintained by the Blockchain

C. Prediction

The value Bitcoin is possessed is different and it does not get affected by the business events or the government decisions as its not related to any of the central authority, it need a different version of prediction to understand the market and to predict the outcomes which is the price of those bitcoins.

III. LITERATURE SURVEY

- We use a peer-to-peer [3] network to propose solutions to the double payment problem. As long as uncoordinated nodes control the majority of CPU power used to attack the network, they generate the longest chains and outperform attackers. Nodes are allowed to quit and rejoin the network, and the longest proof of work chain is accepted as proof of what happened when the message disappeared.

- Eight normal Bitcoin misconceptions will be tended to. Bitcoin is a genuine cash. Satoshi Nakamoto is the individual who developed Bitcoin. Bitcoin is unreliable in light of the fact that it is principally utilized for unlawful purposes. Mining is wasteful. Bitcoin is enroute to turning into a significant monetary power, yet it is as of now extremely unstable to find success. Bitcoin is essentially an alternate sort of money. [4] Additional Resources Beyond "Bitcoin Myths and Facts" Additional Data "The Truth About Bitcoin" "Crypto Finance" is a report/slide show that digs further into digital currency mechanics.

- This study proposes a model for user adoption and use of virtual currencies [5] (such as Bitcoin) and focuses on the dynamics of acceptance when currency discrepancies arise. The impact of market factors on the exchange rate between fiat and bitcoin can be studied using a theoretical model.

- We discuss the valuation of Bitcoin and other blockchain currencies in Decentralized Financial Networks [6], a new sort of manufacturing economy (DN). Users of the DN service receive the same unit of resources as trusted DN participants (miners), which is typical of these resources. As a result, all bitcoin mining (hash rate) and the price are linked. It covers the demand for Bitcoin and the supply of hash rates, as well as how to solve fixed point problems and examine their determinants to find equilibrium values. Supply and demand shocks are exacerbated by rising prices.

- Bitcoin is a digital cryptocurrency that's of interest to the general public, profit campaigners, threat takers, scholars and, last but not least, economists. Despite its freshness, Bitcoin has been around since 2009 and this grounded on technology, which dates back more lately. This was the first cryptocurrency traded in 2010. Since 2015, Bitcoin's valuation and trading volume have made Bitcoin indeed more seductive. The Bitcoin system maintains a encyclopaedically distributed cryptocurrency or blockchain sale tally using a agreement medium that works on all bias around the world. The purpose of this composition is to explain the characteristics of cryptocurrencies and blockchains, how they actually work, and the status of Bitcoin blockchains in different countries. This composition also includes a literature review of Bitcoin Engineering, Bitcoin as a Currency and the Cryptocurrency System, affiliated work on queuing proposition, and work on competition and monopoly. Regarding the unborn eventuality of Bitcoin, this composition considers three scripts( 7).

- In this article [8], the Dow Jones Industrial Average is used to assess two of the most basic and often utilised trading rules: the moving average and out-of-range trading. Traditional statistical analysis is extended using the bootstrap method. Overall, our findings back up the technology initiative. Random Walk, AR, GARCH-M, and GARCH Exponential, the four most popular null patterns, do not generate the same results as these approaches. Real-time scenarios. The results show that the proposed model predicts the price of Bitcoin with greater accuracy than the existing model

- We continue to research and interpret the interesting books by Brock, Lakonishok, and LeBaron (1992)[9]. Discovering that simple forms of technical analysis have significant predictive power for US stock indices. Relationship. We document that predictability is partially, but not exclusively, related to returns. Measurement errors that occur during asynchronous transactions. We have no proof of technical predictions Power is incompatible with market efficiency. The cost of a one-way break-even transaction is calculated as follows: For the entire sample, as of 1975, they were 0.39% and 0.22%, lower than the most recent estimate. transaction costs. In addition, we test, but do not reject, the key constraints imposed by most equilibrium models. Ability to predict returns: Technical rules are not required to reliably identify periods of negative market risk.

IV. SCOPE OF THE PROJECT

Today in one of the most trending technologies, one of the by-products of such technology is Cryptocurrency which is developed by Using Blockchain, this project offers the user to analyse the market and do necessary trading and buying or sales of the bitcoins they choose. By this project a user will be able to select the Cryptocurrencies which are in trending and has good market value so that they will be able to carry out the informed decisions

The framework of our proposed approach as shown in above system architecture. The ?rst is the prediction algorithm module, which contains data collection, Splitting and classification. The data is composed of a variety of bitcoin price values. The system

Algorithms;

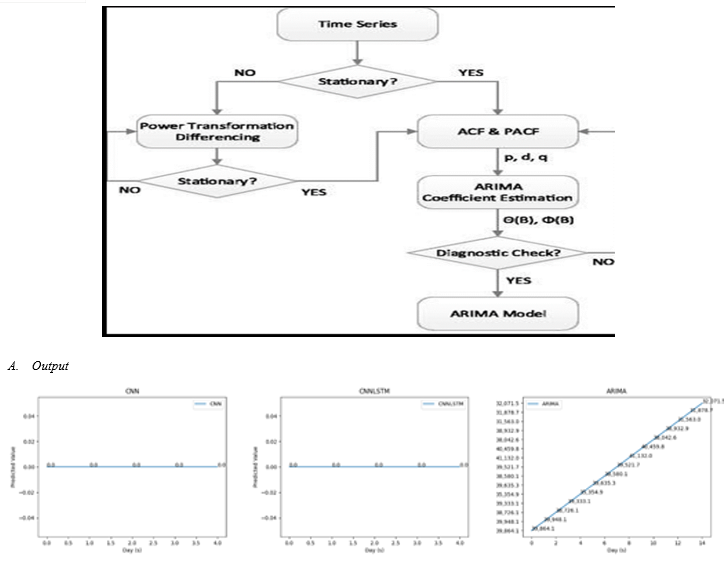

- We are utilizing ARIMA estimating calculation to carry out this undertaking

- An ARIMA model for time series examination and expectation is a class of measurable models.

- ARIMA is a further expansion of the Autoregressive Move Average and incorporates the idea of mix.

- AR: Auto relapse. One perception is associated with a few following perceptions through a reliant connection in this worldview.

- Incorporated. The utilization of crude information recognizing (for instance, the deleting of a reality from an earlier timeframe) for a steady time frame series.

- Normal moving. Utilizing the moving typical model's leftover blunder reliance between a perception and the time delay.

- Auto Regression (AR) Model Auto relapse is a period series model that utilizes past stage information to foresee the future worth. It is a decently

- fundamental idea that might prompt precise forecasts of a progression of issues:

- Yhat = B0 + b1 * XI

- B0 and b1 are model coefficients when prepared on preparing information, while X is a contribution for the expectation. This strategy might be utilized to time

- series when slack factors (input factors) are utilized in past perceptions. It is feasible to appraise the worth of the accompanying advance (t+1)

- in view of the aftereffects of the past two stages (t-1 and t-2). It is by all accounts a relapse model:

- X (t+1) = b0 + b1 * X (t-1) * b2 + X (t-2)

- Auto relapses are relapse models in which a similar info variable is utilized again over the span of the examination (Self relapse).

The result shows the forecasted values of bitcoin in from of graphs by using three models, which is CNN, CNN-LSTN, and ARIMA models. By using these models, it will predict the value more accurately

Conclusion

We have developed a desktop application using tkinter to predict the Bitcoin price prediction and showing the prediction results of CNN, CNN-LSTM, ARIMA in the graph format. The proposed model will give the accurate forecasting value to the user. By using this CNN, CNN-LSTM, ARIMA models we can compare the accurate values from one other. The user can select the num days as they want to predict the values of bitcoin.

References

[1] J. Melitz, ‘‘Monetary discipline, Germany, and the European monetary system,’’ vol. 178, pp. 1–38, Apr. 1987. [2] A. Bulí?, ‘‘Income inequality: Does inflation matter,’’ IMF Staff papers, vol. 48, no. 1, pp. 139–159, 2001 [3] S. Nakamoto. (2008). Bitcoin: A Peer-to-Peer Electronic Cash System. [Online]. Available: https://git.dhimmel.com/bitcoin-whitepaper/ [4] Harvey, Campbell R., Bitcoin Myths and Facts (August 18, 2014). Available at SSRN: https://ssrn.com/abstract=2479670 or http://dx.doi.org/10.2139/ssrn.2479670 [5] Carleton Athey, Susan and Parashkevov, Ivo and Sarukkai, Vishnu and Xia, Jing, Bitcoin Pricing, Adoption, and Usage: Theory and Evidence (August 1, 2016). Stanford University Graduate School of Business Research Paper No. 16-42, Available at SSRN: https://ssrn.com/abstract=2826674 [6] An Equilibrium Valuation of Bitcoin and Decentralized Networks Assets at SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3142022 [7] Bitcoin: Future Transaction Currency at SSRN https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3247428 [8] Simple Technical Trading Rules and the Stochastic Properties of stock return at SSRC https://onlinelibrary.wiley.com/doi/abs/10.1111/j.1540-6261.1992.tb04681.x#:~:text=Simple%20Technical%20Trading%20Rules%20and%20the%20Stochastic%20Properties%20of%20Stock%20Returns [9] https://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.569.5891&rep=rep1&type=pdf [10] G. Wood. Ethereum: A secure Decentralised Generalised Transaction Ledger. Accessed: 2016. [Online]. Available: https://scholar.google.com/scholar?hl=en&as_sdt=0%2C5&q=ETHEREUM%A+A+S%ECURE+DECENTRALISED+GENERALISED+ TRANSACTION+LEDGER&btnG= [11] Financial Platform and News Website. Accessed: 2008. [Online]. Available: https://www.investing.com/

Copyright

Copyright © 2022 Sanjana T, Mahalakshmi V, M. Preethi Darshini, Hemanth. N, Sameena H S. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET43958

Publish Date : 2022-06-08

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online