Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Introduction

- Copyright

From Delivery Boy to CEO: The Inspiring Story of CRED\'s (Kunal Shah)

Authors: Aman Singla, Mr. Rupesh Rajak

DOI Link: https://doi.org/10.22214/ijraset.2024.58913

Certificate: View Certificate

Abstract

Introduction

I. CRED

In an Introduction Cred is a TrustTech firm based in India that connects credit card holders to facilitate online payments using an application. The firm was started in 2018 by Indian businessman Kunal Shah. Its fundamental tenet is that in exchange for rewards in the form of coins, it advances credit card transactions to tax payment for individuals. Users can purchase a variety of goods on the platform with discounts and exclusive deals by using their reward coins. Within a few years of its founding, the startup's user base exploded, reaching over six. The company currently has over 4.1 billion reviews and over $700 million in total funding.

A. Its Key Composition Includes

- Ganesh Subramanian – Chief Architecture

- Lisa Boye – Executive Operations

- Sandeep Tandon – Advisor

- Priya Vadivel – TPM

- Sudarshan Tapuriah – Executive Operations

- Bharat Kumar – Consultant Tech Program Manager

- Chandra Maloo – Product Manager

- Deepak Narang – Campaign Manager

- Hriday Bradoo – Product Manager

- Preet Khalsa – Product Platform Manager

- Kanhaiya Agarwal – Engineer

- Tejas Balasubramanya – Product Analytics

- Trupthi Shetty – Product & Marketing.

With all these dignitaries in this field present Cred still has its drawbacks as it doesn't bring anything groundbreaking or simply new in its field. This can be deciphered because they exclusively do not hold any patents to themselves as they did not bring any new inventions to the table in the existing market. Although their founder Kunal Shah contains many patents to his name, none of its beneficiaries are CRED.

Cred a members-only startup paying credit card bills in India, has raised $4 million from US venture capital firm Sequoia. [1]

According to the Register of Filings (ROC), the company has issued 20,179 shares to the investor at INR 13,653.31 each. Following the recent investment Sequoia will own a 12.68% stake in Cred. Cred plans to use the new funds to support its growth and expansion. He also intends to use part of the proceeds for marketing and general corporate activities. The startup has already partnered with several brands, including BookMyShow, Urban Ladder, Airbnb, FreshMenu, and CureFit, among others. Several Indian banks such as

HDFC, ICICI, Kotak, and Axis Bank are associated with Cred. Cred is a TrustTech company that creates an online payment platform. It's a place where users can pay rent and many other bills use their credit cards, and earn rewards simultaneously.

Moreover, the site provides not just bonuses but also unique deals and spending tracking. Additionally, consumers are able to link credit cards from several Indian banks. On the platform, MasterCard and Visa Card can also be utilized. The company was formed by Kunal Shah in April 2018 and has a single headquarters. When this reliable firm first started, it was to inspire individuals to like paying taxes and earning incentives. After a few months, a million people were drawn to use their credit cards to pay their bills thanks to this novel concept. As a result, it attracted the interest of numerous investors there. The business swiftly grew and raised more capital, which is currently valued at over $4.1 billion. Cred functions by enabling customers to use its platform to pay their bills and receive exclusive benefits. If a user's credit score is 750 or above, they are immediately approved. Nevertheless, applicants whose credit score falls short of the cut-off will have to wait for their application to be accepted. They can utilize all of the app's functions after being approved. Cred Travel, Store, Pay, Rent, and Stash. First off, the hobby fee on the Cred Stash is lower than that of an ordinary credit scorecard as it is a direct credit score line that supplies customers. Clients using this function can borrow up to five million Rupees, or exactly 66,034.95 at the time of writing.

Thirdly, customers pay payments with their credit score playing cards and acquire rewards with the Cred pay function. At the pinnacle, the procedure permits people to view and tune their non-public economic facts at the app to pay the payments on time. Thirdly, the business enterprise additionally capabilities of Cred's RentPay monitoring habitual fees and rentals. Thus, it reminds the customers to finance their expenditures on time. Cred Travel is any other function supplying flight tickets and inn purchases, and bookings. As soon as the customers buy whatever through the app, they regularly get rewards such as Cred cash. Therefore, the praise cash may be utilized in shopping for plenty of merchandise in a Cred keep. Lastly, the Cred keep is the maximum appealing function the business enterprise provides. Besides, the customers can buy merchandise from over 2000 one-of-a-kind shops with unique charges. Business Application This Trust Tech organization gives an unfastened accessibility app for Android and IOS versions. The app builds in a handy interface permitting customers to be had after paying the credit score payments. Moreover, the customers can freely sign up for the app and join up to music and be careful about different monetary statistics on their own. Cred has partnered with heaps of companies to offer invoice bills thru the platform. Those companies are inclined to provide the platform's customers with several benefits. Furthermore, because the platform has tens of thousands and thousands of energetic customers, the companies which have partnerships with the organization can get clients in return. Thus, this commercial enterprise version is a win-win method for the organization. This commercial enterprise version is a beautiful concept that Kunal Shah used while organizing the organization. The idea is ready to be profitable for any customers inclined to pay their credit score payments via the app. Like no different online price platform, the customers pay credit score payments and get one-of-a-kind rewards. The organization delivered this new function in August 2021. This newly installed function permits a p2p (peer-to-peer) lending for creditworthy platform customers to borrow cash from different platform customers. The procedure allows customers to construct a more potent network in the platform. In addition, customers with not less than 750 credit score rankings or better are considered credit score-worth members. The p2p function best allows the customers with the noted credit score rankings to borrow cash. At the pinnacle, borrowing money is bendy borrowing; therefore, creditors have the proper to withdraw the funds returned whenever with hobbies of an accrued period. Cred is famous for supplying pleasant person reviews because the organization offers excellent values to the clients. The first issue is the utility has a helpful, smooth, and handy interface, making it clean for customers. They can use the app to finance credit score loans, payments, rentals, etc. Apart from this, the app statistics and offers all economic data and reminds the customers of the bill's plan. Therefore, the customers can devise and put together their finance better. Furthermore, the organization additionally affords a direct credit score mortgage with decreased hobby fees via a p2p lending system, making it handy for individuals who want immediate coins flow. Last, however, maximum importantly, this Trustworthy startup is predominantly exquisite thanks to the truth that it encourages its customers to pay payments on the platform in trade for cash. The customers can use the money to buy numerous merchandise with top gives at the Cred store.

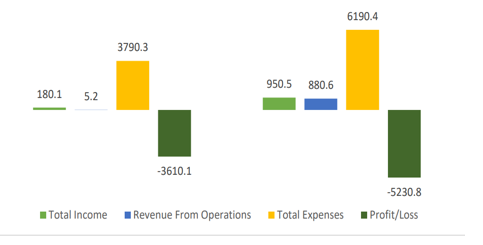

Initially, Cred prices list prices from companies listing their services and products on the app. However, because tens of thousands and thousands of customers use the platform and features to get admission to numerous services and products as displayed at the interface, companies are inclined to pay the list prices. Other than that, the companies are recommended to offer one-of-a-kind gives; therefore, they can appeal to the eyes of many clients to the platform. Regarding the list rate price, the organization prices the partnered companies best while the clients redeem Cred cash.

Furthermore, the organization additionally has some extra profits re-assets that generate truthful revenues, along with commercials, transaction prices, and loans. Online commercials permit the organization to earn partial sales by showing the app's commercial. In addition, a processing rate of one to 1.5% is likewise a part of the organization's sales. Lastly, the organization earns mortgage hobby prices from a p2p lending platform.

B. Kunal Shah, The Founder Of Cred Was Motivated By Several Factors To Become An Entrepreneur

- Problem-solving Mindset: Kunal Shah has always been fascinated by solving problems. Before founding CRED, he co-founded FreeCharge, an online recharge platform. His entrepreneurial journey is marked by identifying issues and developing innovative solutions for them.

- Entrepreneurial Spirit: Kunal Shah possesses a natural entrepreneurial spirit, driving him to create something new and impactful. He thrives on the challenges and opportunities that come with building and growing businesses.

- Passion for Technology: Shah has a deep passion for technology and its potential to transform industries. This passion likely fueled his desire to create tech-driven solutions to everyday problems.

- Desire for Impact: Kunal Shah is driven by a desire to make a significant impact on society. Through his ventures like CRED, he aims to improve people's lives by offering them better financial solutions and experiences.

- Opportunity Identification: Shah has a knack for identifying lucrative opportunities in the market He saw the potential in the fintech sector, particularly in addressing issues related to credit card management and rewards, which led to the inception of CRED.

- Personal Experiences: Like many entrepreneurs, Shah's personal experiences might have played a role in his decision to start CRED. He might have encountered frustrations or inefficiencies in managing credit cards himself, prompting him to create a platform that simplifies and enhances the experience for users.

- Visionary Mindset: Kunal Shah possesses a visionary mindset, constantly envisioning what the future could look like and working towards realizing that vision. This forward-thinking approach likely motivated him to embark on the entrepreneurial journey with CRED. Kunal Shah's motivation to become an entrepreneur stems from a combination of problem-solving skills, passion for technology desire for impact, opportunity identification, personal experiences, and a visionary mindset. These factors have driven him to create innovative solutions that address real-world challenges and improve people's lives.

C. In The Initial Stages Of Building CRED, Kunal Shah Encountered Various Challenges But he Also Employed Strategic Approaches To Overcome Them

- Funding

To secure funding, Kunal Shah leveraged his reputation and track record as a successful entrepreneur. He capitalized on his previous venture, FreeCharge, which had been acquired by Snapdeal, to attract investors' interest in CRED. Additionally, he demonstrated a clear vision for CRED's potential and its unique value proposition, which helped convince investors to fund the startup.

2. Talent Acquisition

Shah recognized the importance of assembling a talented team to drive CRED's growth. He actively recruited skilled professionals by offering them opportunities to work on innovative projects, providing competitive salaries, and creating a vibrant work culture. Shah's ability to articulate his vision and inspire others to join him played a crucial role in attracting top talent to CRED.

3. Market Validation

To validate the market demand for CRED, Shah adopted an iterative approach. He launched a beta version of the platform to gather feedback from early adopters and refine the product based on their input. By continuously iterating and improving the platform, Shah ensured that CRED addressed users' needs and preferences effectively, thereby gaining traction in the market.

4. Regulatory Compliance

Shah navigated the regulatory landscape by engaging legal experts and compliance professionals early on. He ensured that CRED adhered to all relevant regulations and obtained the necessary licenses and permits to operate legally. By prioritizing regulatory compliance from the outset, Shah mitigated the risk of encountering legal issues later and built trust with stakeholders.

5. Technology Development

Shah invested in building a robust and scalable technology infrastructure for CRED. He assembled a team of experienced engineers and developers to develop and maintain the platform. Additionally, Shah embraced agile development methodologies, allowing CRED to iterate quickly and adapt to changing market dynamics.

6. Building Partnerships

Shah forged strategic partnerships with credit card company’s banks and other financial institutions to enhance CRED's offerings and reach a broader audience. He leveraged his industry connections and negotiation skills to establish mutually beneficial partnerships that added value to CRED and its users.

7. Brand Building and Marketing

Shah focused on building CRED's brand identity and awareness through targeted marketing campaigns and partnerships. He leveraged social media, influencer marketing, and word-of-mouth referrals to attract users to the platform. Additionally, Shah emphasized delivering exceptional user experiences, which helped drive positive word-of-mouth and organic growth for CRED.

8. Managing Growth

As CRED experienced rapid growth, Shah focused on scaling the business while maintaining quality and customer satisfaction. He invested in expanding CRED's team, infrastructure, and customer support capabilities to handle increasing demand effectively. Additionally, Shah remained agile and adaptable, adjusting CRED's strategy and operations as needed to sustain growth momentum.

Diverse traits that successful businesspeople have help explain their accomplishments. Research shows that characteristics like high information asymmetries, inherent venture and campaign characteristics, signals sent by entrepreneurs to investors, and leadership, autonomy, risk-taking propensity, readiness for change, endurance, lack of emotionalism, low need for support, low conformity, persuasiveness, high self-efficacy, opportunity recognition, perseverance, social skills, dispositional optimism, self-confidence, initiative, dynamism, creativity, energy, receptivity, and entrepreneurial competencies play critical roles in entrepreneurial success.

Additionally, it has been determined that individual traits like as labor, human capital, and entrepreneur labor are critical to the performance and profitability of ventures. Personality attributes such as a proactive nature, an internal locus of control, a need for achievement, a stress tolerance, and a love of work are also linked to entrepreneurial success. Research has indicated the significance of traits like daring, drive for success, acceptance of uncertainty, inventiveness, self-assurance, tenacity, enthusiasm and positivity in fostering dynamic capacities and a forward-thinking approach in enterprises. Moreover, there are favorable correlations between an entrepreneur's demographic traits and their assessment of the variables influencing the performance of their business as a whole. A mix of character attributes, skill sets, and actions help successful business owners overcome obstacles, grasp opportunities, and spur company expansion. These characteristics collectively contribute to their ability to innovate, lead effectively, persevere through difficulties and build successful ventures

D. Kunal Shah’s Delta 4 Theory

The creator of CRED, Kunal Shah, has developed a theory known as Delta 4 that identifies the elements necessary for a firm to succeed. On a 10-point scale, any startup that receives an efficiency score of more than 4 is deserving of recognition. For instance, ordering an Uber to be delivered right to your home is significantly more effective than standing outside in the sweltering heat and waiting for rickshaws to arrive.

Three things, according to him, are included with a delta 4 good or service:

- Customer behavior is unchangeable; once you adopt a highly effective technique, you can never go back.

- Despite the product's shortcomings, you put up with it.

- You can't help but boast about it. He refers to it as the one-of-a-kind, boastful proposal.

E. Lessons to Learn from Kunal shah

- Observe people who can thrive in a crisis and learn from them.

- For people who hate wealthy people, or hate wealth, wealth will not come to them.

- Money is a medium to unlock choices in life and is not your identity. More money leads to more choices and more access. If you grow your skills, money will chase you.

- Upskill like crazy and money will hunt you down.

- The CRED Application: After paying their credit card bills, consumers can browse the offers offered using this elegantly designed and well-structured application. They can quickly sign up for the application and learn about all of the opportunities for earning.

- Businesses that Post Deals on the App: In addition, CRED users have access to a wide selection of offers from additional companies. CRED collaborates with the groups it has placed in order to achieve this. It is a mutually beneficial partnership for the businesses as well as helping CRED and its customers, who stand to gain from the offers made by the businesses. They greatly profit from their perceivability

- Credit card bill payers: CRED offers a smooth and fulfilling experience for those who make their credit payments. End users can pay their credit card payments and get other offers and incentives by using CRED, as opposed to banking or other services. Conversely, those who find the program enjoyable spread the word about CRED to their loved ones.

- On August 20, 2021, CRED launched CRED Mint, a shared loaning stage that let consumers lend their inactive funds to financially solid individuals. A uncomplicated connection just permits reputable Cred individuals with a modest financial assessment of 750 or higher to be the borrowers. Furthermore, the loan experts may withdraw their funds at any time utilizing the premium that has accrued over time.

II. SWOT ANALYSIS

A. Strengths

- Ability to understand the market well- he started visa and mastercard and other payment options after realising the demand for such a thing in the market.

- Good quality payment system.

- Leadership Qualities

- Consumer Analysis- He studies the feedback section extensively to understand the views of the viewers and delivers content accordingly.

- Good presentation and delivery.

- Ability to connect with the audience well.

- Creativity and unlimited payment system with bonus points.

B. Weakness

- Risk-taking Tendencies: XCWhile risk-taking can be a valuable trait for entrepreneurs, it can also lead to overly ambitious or risky decisions that may not always pay off. Kunal Shah may need to balance his risk appetite with a prudent approach to decision-making.

- Micromanagement: As a highly involved founder, Kunal Shah might have a tendency to micromanage aspects of his company's operations. This could potentially limit delegation and hinder the growth and development of his team members.

- Work-life Balance: The demanding nature of entrepreneurship can sometimes lead to neglecting personal well-being and work-life balance. Kunal Shah may need to ensure that he maintains a healthy balance between his professional and personal life to prevent burnout and maintain long-term productivity.

C. Threats

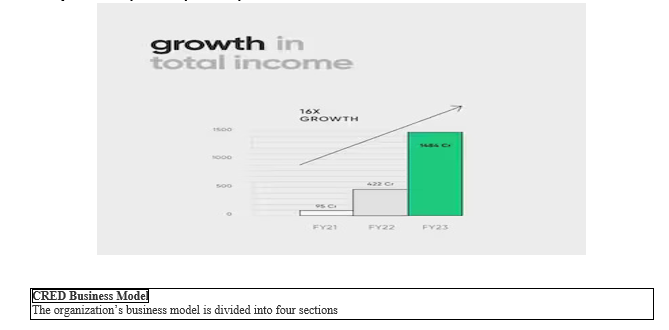

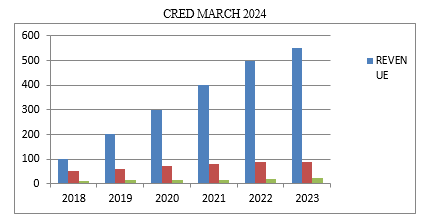

I don’t feel that this entrepreneur has any threat as of now. Not only he is well established but he is well established in different fields and is trying for many more, hence even if he fails in one, he has other things to do credit card installments in India," according to Kunal CRED has demonstrated consistent growth over time. As a startup launched in 2018, it essentially entered the unicorn club on April 6, 2023, when it closed its investment for $215 million. CRED continues to manage "22 percent of all Shah's explanation offered

III. CRED GROWTH

|

Total number of Credit Card Users in India |

75 Million |

|

Growth rate of Credit Cards |

22% per year |

|

Number of Cred Users |

9 million |

|

No of Transaction Cred processes |

25 million |

|

Cred’s UPI transactional worth |

INR 160 Bn+ |

|

Source- RBI, NPCI, Cred |

|

CRED's success story is a testament to Kunal Shah's entrepreneurial vision and strategic execution. CRED started with a simple yet ambitious goal: to revolutionize the credit card experience for users in India. Here's how CRED's journey unfolded:

- Identifying a Pain Point: Kunal Shah recognized that managing credit cards could be a cumbersome and frustrating experience for many users. From tracking expenses to making timely payments and maximizing rewards, there were numerous pain points associated with credit card usage in India.

- Innovative Solution: Leveraging his experience in the fintech industry, Shah conceptualized CRED as a platform that would simplify credit card management and reward users for responsible financial behavior. CRED's app offers features like bill payment reminders, expense tracking, and personalized credit card recommendations, making it easier for users to manage their credit cards effectively.

- Building a Strong Brand: One of CRED's key success factors is its focus on building a strong brand identity. Through clever marketing campaigns, engaging content, and strategic partnerships, CRED has positioned itself as a premium lifestyle brand synonymous with financial responsibility and rewards.

- User-Centric Design: CRED prioritizes user experience, offering a sleek and intuitive app interface that enhances usability and engagement. From seamless onboarding to personalized recommendations, every aspect of the CRED app is designed with the user in mind, ensuring a seamless and enjoyable experience.

- Incentivizing Responsible Behaviour: CRED incentivizes users to maintain good credit behaviour by offering rewards and benefits for timely bill payments and responsible financial habits. This gamification element not only encourages users to engage with the app but also fosters positive financial habits.

- Monetization Strategy: While initially offering its services for free, CRED has successfully implemented a monetization strategy by partnering with brands and financial institutions to offer targeted offers and promotions to its user base. This has enabled CRED to generate revenue while providing value to its users.

- Rapid Growth and Expansion: Since its launch, CRED has experienced rapid growth, attracting millions of users and securing significant funding from investors. The platform has expanded its offerings beyond credit card management to include additional financial products and services, further solidifying its position in the fintech space.

- Community Building: CRED has built a vibrant community of users who actively engage with the platform, share insights, and participate in exclusive events and offers. This sense of community not only fosters loyalty but also strengthens CRED's brand presence and user engagement

IV. FUTURE OF THE ENTREPRENEUR

Kunal Shah CRED's founder and CEO, was a well-known personality in the Indian startup sector for his entrepreneurial skills and unique business style. Potential paths for Kunal Shah's future may include Kunal Shah may continue to lead CRED through its growth phase, extending its services and user base both in India and perhaps globally. This might entail expanding its products beyond credit card payments to include other financial services or allied businesses.

Kunal Shah's experience and network in the startup ecosystem may lead him to get more involved in venture capital investments or company incubation. This might include starting his own venture capital fund or joining an existing one as a partner or advisor Industry Influence and Thought Leadership: Kunal Shah's experiences with CRED might help him become a thought leader or influencer in fintech, consumer behavior and entrepreneurship. Philanthropy and Social effect As his career grows, Kunal Shah may get increasingly active in charitable projects or initiatives to drive social effect. This might include contributing to education healthcare or other causes that accord with his principles.

Kunal Shah may opt to develop new enterprises or companies, either in the finance field or in completely unrelated industries, employing his knowledge and resources to address new challenges and possibilities.

Copyright

Copyright © 2024 Aman Singla, Mr. Rupesh Rajak. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET58913

Publish Date : 2024-03-10

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online