Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Graph Convolutional Networks in Stock Market Predictions: A Review of Enhanced Investment Strategies

Authors: Priya Kumari, Aditya Jaiswal, Er. Roop Lal, Saransh Khandelwal, Neeraj Shekhawat, Dhruv Sood

DOI Link: https://doi.org/10.22214/ijraset.2024.61002

Certificate: View Certificate

Abstract

Machine learning analyses large datasets, finds patterns, and forecasts market trends, transforming stock market recommendation systems. Using data-driven insights, this dynamic method gives investors the power to make well-informed decisions. In this thorough analysis, we examine how machine learning has revolutionised stock market recommendation systems. We explore how dynamic approaches are used to forecast market trends, find patterns in large datasets, and analyse them. We illustrate the crucial role of data-driven insights in directing investors towards profitable possibilities and efficient risk management by highlighting the practical application of AI in moulding investment decisions. In today\'s quickly changing financial scene, this analysis offers a comprehensive grasp of the implications of machine learning for stock market recommendations by critically examining how it is changing the recommendations given by the market.

Introduction

I. INTRODUCTION

A. Stocks

Stocks, sometimes referred to as shares or equities, represent a company's ownership. Investors purchase and sell them on stock exchanges where they are traded. Investors navigating financial markets need to have a basic understanding of equities. [1] This study looks into the mechanics of stock trading and investigates how recommendation systems can help investors make wise choices in the face of difficult market conditions.

B. Stock Market

Stocks, bonds, and derivatives are the main financial instruments that investors can purchase and sell on the stock market. Its main function is to enable businesses to raise finance for growth and expansion by enabling them to issue shares. Recognising the various market capitalization categories—small-, mid-, and large-cap companies—is essential to understanding the stock market. The market capitalization of small-cap firms usually falls between a few million and one billion dollars, that of mid-cap companies lies between one billion and ten billion dollars, and that of large-cap corporations is greater than ten billion dollars. [2]The purpose of this study is to investigate the dynamics and mechanics of the stock market with an emphasis on the ways in which recommendation systems can enable investors to make better decisions in a range of market capitalization classes.

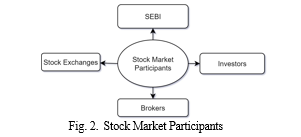

C. Market Participants

People who purchase and sell securities on the stock market include individuals as well as institutions like pension funds and investment businesses[3] hey use a range of investment strategies, including value investing, which concentrates on cheap stocks; growth investing, which focuses on businesses with strong growth potential; and technical analysis, which forecasts future price movements using historical market data. [4] With the growth of internet trading platforms, retail investors have gained more clout recently and are now contributing to market dynamics alongside institutional participants. Gaining an understanding of the various tactics and players is essential to understanding investment trends and market behaviour.

D. Trends and Volatility of Market

The stock market has historically shown cyclical periods of expansion and contraction that are impacted by a range of social, political, and economic variables. It is important to comprehend volatility, which is a measure of price variation, since it affects risk management and investment choices. [5] The market is dynamic, as seen by recent patterns like the rise in technology stocks brought on by innovation and the digital transformation, or the fallout from international events like pandemics and trade disputes. In order to make wise selections, investors navigate these patterns by evaluating their risk tolerance and the state of the market. In order to shed light on how the stock market is changing and what that means for investors, this paper will examine volatility dynamics, historical market trends, and current events.

E. Integration of Stock Market and Machine Learning

The stock market has historically shown cyclical periods of expansion and contraction that are impacted by a range of social, political, and economic variables. It is important to comprehend volatility, which is a measure of price variation, since it affects risk management and investment choices.[6] The market is dynamic, as seen by recent patterns like the rise in technology stocks brought on by innovation and the digital transformation, or the fallout from international events like pandemics and trade disputes. In order to make wise selections, investors navigate these patterns by evaluating their risk tolerance and the state of the market. In order to shed light on how the stock market is changing and what that means for investors, this paper will examine volatility dynamics, historical market trends, and current events.

In order to overcome obstacles and show how machine learning can be used practically and effectively to improve investment decision-making, this article will concentrate on creating and assessing a machine learning-based recommendation system for the stock market.

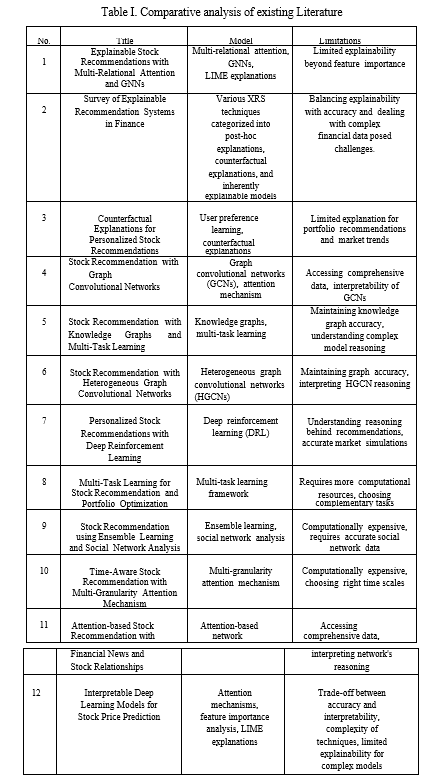

II. LITERATURE REVIEW

In their research work [7] the authors combine GNNs with multi-relational attention in an attempt to produce explainable stock recommendations. Their method uses attention techniques to learn user preferences and takes into account other elements such as news and basics.

Complex stock relationships inside the network are captured by GNNs. LIME explanations shed light on the recommendations made for particular equities. The accuracy of the system is competitive, especially for people with short histories. Explainability, however, primarily depends on feature importance visualisation, which allows for the investigation of more thorough counterfactual or interactive explanation techniques.

Explainable recommendation systems (XRS) in the financial industry are reviewed by the authors of research article [8],who stress the significance of XRS for user pleasure, confidence, and transparency. They divide XRS approaches into three primary categories: intrinsically explainable models, which are created with interpretability in mind; counterfactual explanations, which illustrate how altering inputs would impact recommendations; and post-hoc explanations, which interpret already-existing models.

The study examines several XRS techniques used in finance, such as feature importance-based, rule-based, and decision tree techniques.

It also talks about difficulties, like handling complicated financial data and striking a balance between explainability and accuracy. In their conclusion, the authors urge more study on user-centric XRS design, assess the usefulness of explainability, and integrate explainability into financial rules.

The research paper's writers [9] give counterfactual justifications in addition to stock recommendations, emphasising user comprehension. Individual preferences are learned by the system, which then creates "what-if" scenarios to illustrate how recommendations change in response to choices.

By enabling people to make knowledgeable investment decisions based on the criteria guiding the recommendations, this promotes confidence and transparency.

More research on elucidating market patterns and portfolio recommendations could provide even more transparency and user knowledge while maintaining competitive accuracy.

Using graph convolutional networks, the authors of research study [10] question established stock recommendation techniques (GCNs).

This method acknowledges the interconnectedness of the stock market and how other stocks might affect a stock's performance. Using stocks as nodes and the links between them as edges, their model creates a graph. After that, GCNs examine this graph to identify intricate connections and market patterns.

With a focus on the main factors influencing each stock's performance, an attention mechanism further emphasises the most pertinent links for each one. Better recommendation accuracy is achieved with this dual strategy, particularly for long-term forecasts. But there are still difficulties.

It is essential to have access to complete and correct data for the graph, and additional study is required to improve the interpretability of GCN models so that users can comprehend the rationale behind recommendations.

A unique stock recommendation system that goes beyond price history is proposed by the research [11]. They incorporate multi-task learning, in which the model simultaneously predicts several relevant financial indicators, and knowledge graphs, which capture rich information such as news and firm financials. Improved suggestion accuracy results from this more comprehensive data and learning strategy. But there are still issues with preserving the correctness of the knowledge graph and comprehending the logic of the intricate model.

Beyond straightforward price interactions, the authors of the study paper [12] present a unique stock recommendation method. They construct a heterogeneous network with stocks, firms, and industries all connected by a variety of interactions such as news mentions, affiliations, and transactions.

This intricate network is then analysed by heterogeneous graph convolutional networks (HGCNs), which enable the model to capture subtle market interdependencies beyond simple changes in price. This method yields far higher recommendation accuracy and gives a clearer picture of the several aspects that affect stock performance. But there are still issues with comprehending the HGCN's logic and keeping the complex graph accurate.

The problem of customised stock recommendations with little user data is addressed by the authors of the research study [13]. They suggest a cutting-edge strategy based on deep reinforcement learning (DRL), in which the machine picks up knowledge through simulated encounters. Since the system experiments with different investment methods in a simulated market and adjusts in response to user feedback, personalisation is possible even in the absence of clear user preferences.

Even with insufficient data, this DRL technique achieves competitive accuracy. Accurate market simulations and comprehending the rationale behind recommendations continue to be difficult tasks, nonetheless.

A unique strategy that tackles both stock recommendation and portfolio optimisation at once is proposed in the research paper [14]. A single model can learn from both tasks at the same time thanks to their multi-task learning framework, possibly enhancing performance in both. This model optimises portfolios by choosing a variety of high-return equities and projects future stock values for recommendations.

By taking into account a stock's place within a diversified portfolio, this combined method offers various advantages, including more accurate recommendations that may reduce overall risk and improve portfolio optimisation: The recommended stocks provide larger potential profits for portfolios. According to the study, this multitasking strategy works better than approaches that handle each activity independently. For best results, it necessitates the selection of truly complementary jobs and demands greater computational resources.

A novel technique to stock recommendation is proposed in the research paper [15] which combines social network analysis and ensemble learning. They combine the advantages of several machine learning models—each with a unique viewpoint—to provide a prediction that is more reliable and accurate overall.

This "wisdom of the crowd" method considers the bigger picture of the market in addition to specific models. The complex web of relationships between stocks is then understood through the application of social network analysis. Through the analysis of stock-to-stock relationships, the system uncovers hidden dependencies and intricate market dynamics that could be overlooked by more conventional approaches. Recommendations that are more informed and possibly more profitable result from this social awareness. When compared to traditional methods, the study shows that this combination approach enhances suggestion accuracy significantly. But the computational cost of training numerous models can be high, and the efficacy of this process depends on the accuracy of the social network data.

Using a multi-granularity attention mechanism, the research paper [16] proposes a time-aware approach to stock recommendations. This mechanism analyses data at many time scales at once, assisting the model in navigating the complex world of stock price swings. It is able to comprehend how prices change over time by taking into account both long-term patterns and short-term shocks. This "time travel" strategy has various advantages, Enhanced Accuracy: The model may be able to provide suggestions with greater accuracy by accurately capturing temporal dynamics, particularly when it comes to long-term projections. With dynamic attention, which adjusts to shifting market conditions and trends, the attention mechanism automatically concentrates on the most pertinent information at each time scale.

The results show that this strategy produces much better recommendation accuracy than approaches that don't take n time into account as well.

This implies that in order to make wise financial decisions, one must comprehend temporal information at various sizes. However, selecting the appropriate time scales for analysis necessitates considerable thought because the intricate attention mechanism might be computationally costly.

Beyond historical data, the authors of research study [17], suggest an attention-based network for stock recommendations. It includes stock linkages and financial news. By giving priority to the most pertinent data from these various sources, the network enhances accuracy and produces richer data.

When compared to techniques that solely used historical pricing, the study shows a considerable improvement in accuracy, indicating that a more comprehensive understanding of the market is essential for making wise investment decisions. Still, there are difficulties in obtaining complete data and deciphering the network's logic.

In their research work [18] the authors address the problem of opaque deep learning models for stock price forecasting. They make the case for interpretability, which enables people to comprehend the "why" behind suggestions and promotes confidence in such important choices. Their method makes use of a number of strategies, including Model-Agnostic Explanations (LIME), Attention Mechanisms, and Feature Importance Analysis. Benefits include better debugging, more trust, and educated decision-making. There are, however, certain drawbacks.

For example, increased interpretability may result in decreased accuracy, complexity, and explainability. Overall, the author highlights the significance of interpretability in stock prediction and provides helpful resources for fostering confidence and comprehension in these potent models.

A. Key Observations from Literature Review

Promising developments in stock recommendation algorithms have been made recently. Research examining Graph Convolutional Networks (GCNs)[10] and Heterogeneous Convolutional Networks (HGCNs)[12] show remarkable accuracy increases by capturing intricate linkages between stocks and market movements. Acquiring and retaining correct data for the underlying network topologies is a challenge for both approaches, though.

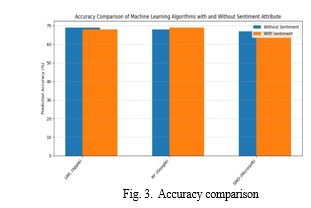

Research is also required to improve the interpretability of these models so that consumers can feel more confident and understood. This paper addresses the interpretability issue that deep learning models frequently have by suggesting explicable techniques for stock prediction.It does, however, recognise that there may be trade-offs between interpretability and accuracy, and that the intricacy of these methods calls for the creation of more straightforward and approachable explanations for non-technical users.

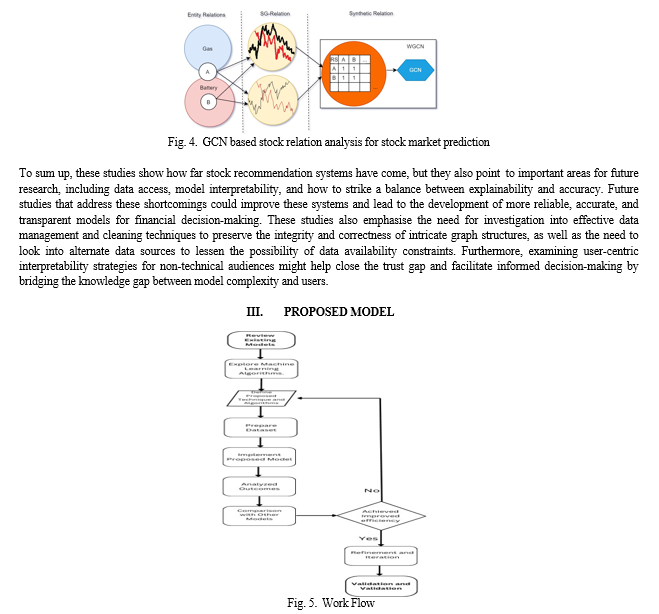

Several significant research gaps and prospects for future developments in stock recommendation systems were found by our assessment of the literature. These limitations mostly concern interpretability of the models, data accessibility, and striking a balance between explainability and accuracy. In this section, we will provide a proposed framework for stock market advice that aims to address the recognised gaps in research and improve the applicability of models.

- Algorithm Exploration: This phase entails a detailed analysis of several algorithms that are appropriate for the particular goals of the suggested stock recommendation model. We evaluate several algorithms according to their advantages, disadvantages, fit for our particular purpose, and capacity to integrate the data management and interpretability characteristics that were previously found. Selecting the optimal algorithm for constructing our model is crucial.

- Model Development: This step concentrates on the real model design and implementation, using the selected algorithm as the basis. It's analogous to building a house from the selected blueprint. In order to guarantee the integrity and correctness of the training data, we incorporate the recognised data management techniques here. We also include user-centric interpretability features, such as interactive visualisations or more straightforward explanations, to help users grasp the model despite its complexity. In this step, the model is basically constructed and outfitted with its essential features.

- Model Training: In this phase, a large and varied dataset are fed into the model. This dataset serves as the model's learning resource, enabling it to find trends and connections in the data that are pertinent to stock recommendations. The diversity makes it possible for the model to adjust and function well even in the presence of unknown data. At this point, the model has all the information and abilities needed to provide precise suggestions.

- Validation and Testing: This phase assesses the model's performance in real-world scenarios. We thoroughly evaluate the model's accuracy, generalizability, and resilience using a variety of validation and testing techniques, such as dividing the data into training and testing sets. This phase aids in detecting any flaws or potential areas for enhancement prior to depending on the model for practical implementations.

- Comparison with Existing Models: At this point, the effectiveness of our model is compared to other well-known stock recommendation systems. To determine our model's relative efficacy and potential benefits, we compare it to other methods using measures like accuracy, efficiency, and other pertinent data. This aids in our evaluation of our model's contribution and added value.

- Refinement & Iteration: This phase is essential for ongoing development. We iteratively improve the model based on the assessment findings from the validation and testing procedures. This could entail fine-tuning the interpretability features, enhancing data cleaning techniques, or modifying the algorithm settings. It resembles a pupil returning back to look over their errors and refine their comprehension in light of criticism. Our model will continuously learn and adapt thanks to this iterative process, which will eventually lead to optimal performance.

- Objective Achieved: Creating a reliable and accurate stock recommendation model with user-centric interpretability features is the ultimate goal of this entire procedure. By accomplishing this goal, we provide a fresh and intuitive instrument for wise financial decision-making, which advances stock recommendation systems. It's comparable to a student accomplishing their learning objectives and receiving a valuable degree.

Conclusion

To sum up, our study revealed significant deficiencies in the existing stock recommendation systems, namely with regard to data accessibility, comprehensibility, and striking a balance between explainability and accuracy. These voids present chances for progress. It is imperative to address data management by investigating alternate sources and implementing effective cleaning procedures. Furthermore, it\'s critical to promote user comprehension by using user-centric interpretability strategies. By combining GCN/HGCNs for capturing complicated relationships, using reliable data management, and adding user-centric interpretability features, our suggested model creation process fills up these gaps. The work will be done in an organised manner, with algorithm exploration coming first and model training, validation, and comparison with previous models coming last. The development of a reliable, accurate, and user-friendly stock recommendation system will require constant iteration based on evaluation outcomes. Subsequent investigations may go into other developments in interpretability strategies, like instantaneous clarifications or tailored suggestions. Furthermore, looking into the incorporation of sentiment analysis or other data sources could improve the model\'s functionality and offer insightful information for well-informed financial decision-making.

References

[1] Hong-Yu Zhou, Chixiang Lu, Chaoqi Chen, Sibei Yang, and Yizhou Yu, “PCRLv2: A Unified Visual Information Preservation Framework for Self-supervised Pre-training in Medical Image Analysis” , arXiv:2301.00772. [2] Runqiao Li and Ae Ja Yee, “Schmidt Type Partitions”, arXiv:2204.02535. [3] Roger H. Gordon & Young Lee, Do Taxes Affect Corporate Debt Policy? Evidence from US Corporate Tax Return Data National Bureau of Economic Research, w7433 [4] Enrique G. Mendoza ,”On the Instability of Variance Decompositions of the Real Exchange Rate across Exchange-Rate-Regimes: Evidence from Mexico and the United States” , National Bureau of Economic Research, w7768 [5] Bhowmik, Roni, and Shouyang Wang. \"Stock Market Volatility and Return Analysis: A Systematic Literature Review.\" Entropy, vol. 22, no. 5, 2020, p. 522, doi:10.3390/e22050522. [6] Mahinda Mailagaha Kumbure, Christoph Lohrmann, Pasi Luukka, and Jari Porras, \"Machine learning techniques and data for stock market forecasting: A literature review\", Archives of Computational Methods in Engineering, vol. 31, pp. 1-16, 2023. [7] Taher Hekmatfar, Saman Haratizadeh, Parsa Razban, Sama Goliaei, “Attention-Based Recommendation On Graphs” arxiv:2201/2201.05499 [8] Yongfeng Zhang, Xu Chen, \"Explainable Recommendation: A Survey and New Perspectives\", arXiv:1804.11192. [9] Juntao Tan, Shuyuan Xu, Yingqiang Ge, Yunqi Li, Xu Chen, and Yongfeng Zhang, “Counterfactual Explainable Recommendation” [10] ,arXiv:2108.10539. [11] Yi-Ling Hsu , Yu-Che Tsai , Cheng-Te Li,”FinGAT: Financial Graph Attention Networks for Recommending Top-K Profitable Stocks”, arXiv:2106.10159v1 [cs.LG] 18 June 2021 [12] Yikun Xian, Zuohui Fu, S. Muthukrishnan, Gerard de Melo, and Yongfeng Zhang, “Reinforcement Knowledge Graph Reasoning for Explainable Recommendation”, arXiv:1906.05237. [13] Rahul Ragesh, Sundararajan Sellamanickam, Arun Iyer, Ram Bairi, and Vijay Lingam, \"HeteGCN: Heterogeneous Graph Convolutional Networks for Text Classification\", arXiv:2008.12842. [14] Timo Schick, Jane Dwivedi-Yu, Zhengbao Jiang, Fabio Petroni, Patrick Lewis, Gautier Izacard, Qingfei You, Christoforos Nalmpantis, Edouard Grave, Sebastian Riedel, \"PEER: A Collaborative Language Model\" arXiv:2208.11663v1 [cs.CL] 24 Aug 2022 [15] Pu Hua, Yubei Chen , Huazhe Xu, \"Simple emergent action representations from multi-task policy training\", arXiv:2210.09566v2 [cs.AI] 6 Mar 2023 [16] Aadhitya A, Rajapriya R, Vineetha R S and Anurag M Bagde, \"Predicting Stock Market time-series data using CNN-LSTM Neural Network model\" arXiv:2305.14378v1 [q-fin.ST] 21 May 2023. [17] Richard Alvarez, Paras Bhatt, Xingmeng Zhao, and Anthony Rios, \"Turning Stocks into Memes: A Dataset for Understanding How Social Communities Can Drive Wall Street\" arXiv:2203.08694v1 [cs.CL] 16 Mar 2022 [18] Jiezhu Cheng, Kaizhu Huang and Zibin Zheng \"Can Perturbations Help Reduce Investment Risks? Risk-Aware Stock Recommendation via Split Variational Adversarial Training\" arXiv:2304.11043v2 [q-fin.RM] 26 Jan 2024 [19] Jaydip Sen and Sidra Mehtab \"Accurate Stock Price Forecasting Using Robust and Optimized Deep Learning Models\" arXiv:2103.15096.

Copyright

Copyright © 2024 Priya Kumari, Aditya Jaiswal, Er. Roop Lal, Saransh Khandelwal, Neeraj Shekhawat, Dhruv Sood. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET61002

Publish Date : 2024-04-25

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online