Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Impact of AI on Investment Decision and Financial Inclusion of Rural India: A Study on Young Rural Women Near Ranchi District

Authors: Shikha Poddar, Dr. Amar Kumar Chaudhary

DOI Link: https://doi.org/10.22214/ijraset.2024.64883

Certificate: View Certificate

Abstract

The integration of Artificial Intelligence (AI) into the financial sector has revolutionized investment decision-making, offering a powerful tool to empower individuals in making informed choices about their financial future. This research paper explores the impact of AI on the investment decisions of rural consumers, shedding light on the transformative potential of AI in promoting financial inclusion in underserved regions. Rural consumers in emerging economies face unique challenges in accessing financial services and making sound investment decisions. The study aims to investigate how AI technologies, including machine learning algorithms and predictive analytics, can address these challenges by providing personalized investment advice, risk assessments, and portfolio optimization for rural consumers. It examines the key factors that influence the adoption and acceptance of AI-driven investment solutions among rural populations. Through a mixed-method research approach, including surveys, interviews, and data analysis, this paper analyses the application of AI in rural investment decision-making. It discusses the benefits of AI, such as improved risk management, increased financial literacy, and enhanced access to financial markets. Additionally, the research assesses potential concerns, including data privacy, ethical considerations, and the need for human oversight in AI-driven investment processes. The findings suggest that AI can bridge the financial literacy gap in rural areas and enhance the investment decision-making capabilities of rural consumers. However, this transformation requires a holistic approach, encompassing not only the development and deployment of AI technology but also regulatory frameworks and educational initiatives to ensure its responsible and equitable use. In conclusion, this research paper highlights the pivotal role of AI in democratizing access to financial opportunities for rural consumers, ultimately contributing to greater financial inclusion and economic growth in rural regions. It offers valuable insights for policymakers, financial institutions, and technology developers aiming to leverage AI to improve investment decisions and financial well-being for rural populations.

Introduction

I. INTRODUCTION

In recent years, Artificial Intelligence (AI) has emerged as a formidable force, transforming industries and redefining the way we live, work, and interact with the world. The realm of finance is no exception to this sweeping wave of technological innovation. AI's integration into the financial sector has not only streamlined processes but also expanded the horizons of investment possibilities for individuals. One segment of society that stands to benefit significantly from AI's potential in investment decision-making is rural consumers.

Rural areas, often characterized by their geographical remoteness and limited access to financial services, have long struggled with financial inclusion. Investment decisions, which are pivotal to securing one's financial future, tend to be challenging for rural consumers due to a lack of access to relevant information, financial expertise, and personalized guidance. AI has the potential to address these issues, offering tailored investment solutions and a pathway to financial empowerment for rural populations.

This research paper delves into the dynamic synergy between AI and investment decisions in rural contexts. It explores how AI technologies, encompassing machine learning algorithms, data analytics, and predictive modelling, can become catalysts for financial inclusion in underserved regions.

Our study aims to provide a comprehensive understanding of the transformative potential of AI in reshaping the investment landscape for rural consumers.

Rural consumers in emerging economies face a unique set of challenges. Limited financial literacy, restricted access to traditional banking services, and uncertainty about investment risks often result in missed opportunities for wealth creation and economic stability. As such, the central question guiding this research is: How can AI empower rural consumers in making informed and effective investment decisions, breaking down the barriers that have historically hindered their financial progress?

Through a combination of quantitative and qualitative research methods, including surveys, interviews, and data analysis, we intend to unravel the implications of AI-driven investment solutions for rural consumers. Our investigation will consider the advantages that AI can offer, such as personalized financial guidance, risk mitigation, and increased financial market access. At the same time, we will critically assess the concerns, including data security, ethical considerations, and the role of human oversight in ensuring responsible AI use in financial decision-making.

In essence, this research seeks to shed light on how AI can empower rural consumers by enhancing their investment decision-making capabilities. By bridging the gap in financial literacy and providing equitable access to financial markets, AI has the potential to foster greater financial inclusion and promote economic development in rural regions. It is within this framework that we embark on a journey to unravel the transformative possibilities of AI for investment decisions in rural areas, and to provide insights that can guide policymakers, financial institutions, and technology developers in their pursuit of a more inclusive and equitable financial landscape.

ABBREVIATION – AI (Artificial Intelligence)

II. BENEFITS OF AI IN INVESTMENT DECISION MAKING AND FINANCIAL INCLUSION

Artificial intelligence (AI) offers significant benefits in both investment decision-making and financial inclusion.

A. Investment Decision-Making

- Enhanced Data Analysis: AI can process vast amounts of financial data quickly and accurately. Machine learning algorithms can identify patterns and trends that may be missed by human analysts, providing deeper insights into market conditions.

- Predictive Analytics: AI models can predict market trends and asset performance based on historical data, current market conditions, and other variables. This helps investors make more informed decisions and anticipate market movements.

- Algorithmic Trading: AI-driven algorithms can execute trades at high speeds and with precision. This can lead to more efficient trading strategies and the ability to capitalize on short-term market opportunities that human traders might miss.

- Risk Management: AI can assess and manage risks by analyzing data related to market volatility, economic indicators, and other factors. This helps investors understand potential risks and adjust their portfolios accordingly.

- Personalization: AI can tailor investment recommendations based on individual investor preferences, risk tolerance, and financial goals. This customization improves the alignment of investment strategies with personal objectives.

- Fraud Detection: AI systems can identify unusual trading patterns and potential fraud more effectively than traditional methods. This enhances security and trust in investment processes.

B. Financial Inclusion

- Accessibility: AI-powered financial services can reach underserved and remote populations who may not have access to traditional banking services. Mobile apps and online platforms using AI can offer banking, credit, and investment services to a broader audience.

- Credit Scoring: AI can use alternative data (such as social media activity, transaction history, and other non-traditional sources) to assess creditworthiness. This provides financial opportunities to individuals who may lack a traditional credit history.

- Cost Reduction: AI can reduce operational costs for financial institutions by automating routine tasks, which can lead to lower fees and more affordable services for customers.

- Personalized Financial Advice: AI-driven chatbots and virtual advisors can provide personalized financial guidance and planning, making financial education and advice more accessible to people who might not afford a human advisor.

- Fraud Prevention: AI can help prevent financial fraud by analyzing transactions in real-time for signs of suspicious activity. This enhances the security of financial services for all users, particularly those who are less familiar with digital platforms.

- Efficiency and Speed: AI can streamline processes such as loan approvals, account openings, and customer service inquiries, making financial services faster and more efficient.

III. ISSUES INVOLVED

The topic of "AI and Investment Decision of Indian Rural Consumers" is a complex one that involves several significant issues and challenges. some key issues related to this topic needs to be highlighted. Digital Divide is the major issue in this regard . Rural areas in India often lack access to high-speed internet and technology infrastructure. The digital divide poses a significant hurdle for rural consumers looking to access AI-driven investment tools and information. Financial Literacy is major challenge faced by rural customers specially in India where rural population has high drop out rates. Rural consumers may have limited financial literacy and may struggle to understand complex investment concepts and AI-based recommendations, making it challenging for them to make informed decisions.

Data Privacy and Security is growing concern now as cyber fraud is immensely increasing and small places like Jamtara becoming hub for such cases. As rural consumers begin to use AI-based financial services, their personal and financial data becomes vulnerable to breaches and misuse. Ensuring data privacy and security is a critical concern. Trust in AI is also a issue as no one has such financial trust on machines till now. Rural consumers may have reservations about trusting AI algorithms with their financial decisions. They may be skeptical of AI's ability to understand their unique needs and preferences. Regulatory Framework need to be strengthen as till now India do not have proper cyber laws and any cryptocurrency related protection and increasing use of AI is so dangerous that it need mitigation as well as curative protection. There is lack of clear and comprehensive regulations governing AI in the financial sector, which can lead to uncertainty and potential misuse of AI technologies.

Bias and Fairness is sometime a issue as it is ultimately a creation of human being. AI algorithms can inherit biases present in the data they are trained on, which may disproportionately affect marginalized groups in rural areas. Ensuring fairness in AI recommendations is a growing concern. Rural consumers may be hesitant to use AI-driven investment tools if they cannot understand how recommendations are generated. The lack of transparency and explainability can be a barrier to adoption. Education and Training is also one of challenge as non academic people need to be trained. Adequate training and education are required to help rural consumers understand how to use AI for investment decisions effectively. Access to such training may be limited in rural areas.

Customization and Localization is high need of current society as it goes with the trend and they cater to have different needs. AI solutions need to be customized to suit the specific needs of rural consumers and be localized to account for regional variations and preferences. AI recommendations should consider the unique risk tolerance and financial goals of rural consumers, which may differ significantly from urban populations. Ethical Concerns is major in todays business worlds whether it be B to B or B to C. The use of AI in investment decisions raises ethical questions regarding the responsibility of financial institutions and AI developers to ensure the well-being of rural consumers. The impact of AI on investment decisions in rural areas may have broader economic implications for these regions, potentially influencing employment, local businesses, and wealth distribution.

Addressing these issues requires a multidisciplinary approach involving policymakers, financial institutions, AI developers, and educational organizations. It's essential to balance the benefits of AI with the ethical and social considerations to ensure that rural consumers can make informed and equitable investment decisions with the help of AI.

Case study of Rural young women near Rural areas of Ranchi District

The study constituted 100 women of age between 18 -25 who are actively taking their financial decisions and part of financial inclusion in India .The income of these rural people at individual level is Rs 1,00,000 per annum for 84% and 14 % having income between Rs1,00,000 to Rs3,00,000 per annum.

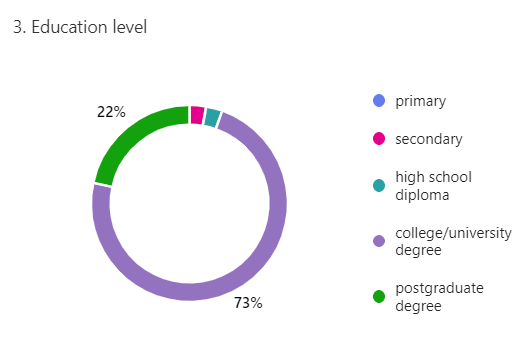

Figure1Education level of sample collected

As per study the education level of these are university level in majority 73% of sample taken have university degree and 22% have high school diploma , and they are well capable of taking decisions but they faces many issues about concept of AI and different cyber and digital threats are issue for them .After talking to them and collecting primary data researcher found that they know about AI as73% of them know about artificial intelligence and 27% have no idea regarding them and also they have some basic idea of different application of AI but financial illiteracy and AI as financial tool is something that they lack knowledge about ,not

only knowledge the lack of trust in digital medium and lack of awareness about different security measures and well informed decision making is lagging them behind the world .

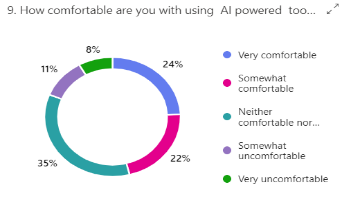

Figure 2Ease of rural women with AI tools

The responses show us that the lack of financial awakening And no formal financial education is the key issue fo

r women .The practical knowledge is missing among their desire for achievement.

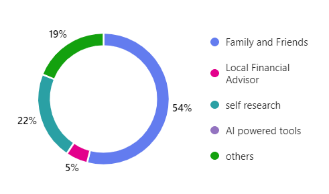

Figure 3sources of information by consumers

The concerned shown by them in using any AI medium for financial decision is also the matter of study most of women take decision from informal sources like family and friends. 49%of sample are very concerned regarding safety and using tools for financial decisions 32 % are concerned over the capacity of regulation and financial frauds. From the collected samples and analysis of data consumers find it more easy to take manual advices rather AI or any other tools .

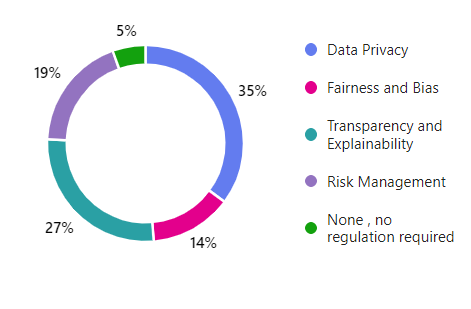

Figure 4 issues in using AI for taking financial decision.

The given figure 4 shows the concern and main issues for rural young women in using AI and taking financial decision. With all these the patriarchal mindset of society and the thought to protecting women are also involved deeply .

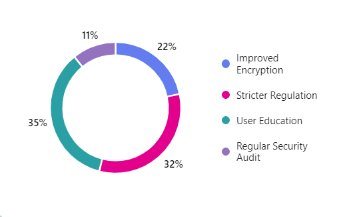

After all such discussion and analysis researcher tried to find out solution from them only as the sufferer knows the medicine better. Following are some solution suggested and agreed by these rural young women near Ranchi district rural areas. As figure 5 stated it. Thus we can conclude from our study of very small size sample that people are interested to use these advance technologies but key stakeholders have to make foundation for them .

Figure 5 some solution for issues related to decision making using AI

IV. SOLUTION

Addressing the issues related to "AI and Investment Decision of Indian Rural Consumers" requires a combination of technological, regulatory, and educational solutions. Researcher have suggested some potential solution here. Digital Infrastructure Development should be developed specially keeping women in view. Expanding and improving digital infrastructure in rural areas to ensure that high-speed internet access is readily available to all. Encourage the deployment of affordable and reliable internet services in rural regions. Develop and implement financial literacy programs specifically tailored to the needs of rural consumers and vulnerable society like women. These programs can be conducted in local languages and focus on basic financial concepts and AI-driven investment tools. Data Privacy and Security Measures need to be adopted by implementing robust data privacy and security measures, including data encryption, secure storage, and user consent, to protect the financial and personal data of rural consumers.

Regulatory Framework need to be strengthen to buy trust of people as goodwill in against of AI. Establish clear and comprehensive regulatory frameworks for AI in the financial sector. These regulations should ensure transparency, fairness, and ethical use of AI. Bias Mitigation will be a major task need to be completed by developing and implementing AI algorithms that are designed to minimize biases. Regular audits of algorithms can help identify and rectify any unfair biases.

Transparency and Explainability will also be required to Ensure that AI systems provide explanations for their recommendations in a manner that is understandable to rural consumers. This could involve user-friendly interfaces that show how decisions are made. Education and Training is most important part to bridge the educational gap and to Promote AI and financial literacy through educational institutions, community centres, and online courses. Make these resources easily accessible to rural populations.

Human-AI Collaboration is also one of solution for bridging trust gap and for understanding the technology properly. Encouraging a model of human-AI collaboration in which AI assists rural consumers in making decisions rather than making decisions on their behalf. This will allow for human oversight and input. For Customization and Localization the Customization of AI solutions to the specific needs and cultural preferences of rural consumers is important. This may involve adapting AI interfaces, content, and services to be more locally relevant.

Ethical Considerations can be taken by Promoting ethical AI practices in the financial sector and by establishing guidelines and codes of conduct. It will Encourage financial institutions and AI developers to prioritize consumer welfare. Economic Impact Assessment will lead to studies to assess the economic impact of AI-driven investment decisions on rural areas and will use the findings to inform policies that can promote economic growth and wealth distribution. Financial Inclusion Initiatives is also way to Collaborate with financial institutions and governmental bodies to develop and offer affordable financial products and services tailored to the needs of rural consumers. Research and Innovation is the final solution for every problem now and coming to invest in research and innovation to create AI solutions that are better suited to rural contexts. This includes developing AI models that can adapt to variable and resource-constrained environments. Community Engagement will Involve local communities and leaders in decision-making processes related to AI adoption. Their insights can help shape AI solutions that are more in tune with local needs.

These solutions should be implemented in conjunction with each other, as they are interconnected and can complement one another. Policymakers, financial institutions, technology developers, and educational organizations should work together to ensure that AI benefits rural consumers and contributes to their financial well-being and inclusion in the digital economy.

Conclusion

The integration of Artificial Intelligence (AI) into the investment decisions of Indian rural consumers specially women represents a promising avenue for financial inclusion and empowerment. This topic underscores both the opportunities and challenges that accompany the adoption of advanced technology in rural finance. AI has the potential to bridge the gap in financial literacy, providing personalized investment guidance and improving access to financial markets for rural consumers. It can mitigate risks and enhance financial decision-making, thereby contributing to economic growth and inclusion and wealth creation in underserved regions. However, several challenges must be addressed to realize this potential fully. These challenges include the digital divide, data privacy concerns, the need for robust regulatory frameworks, and the imperative to ensure fairness and transparency in AI algorithms. Moreover, trust-building and educational efforts are essential to make rural consumers comfortable with AI-powered financial solutions. It is crucial that all stakeholders, including the government, financial institutions, technology developers, and local communities, work in tandem to develop and implement solutions that safeguard the interests of rural consumers. This includes the provision of digital infrastructure, financial literacy programs, and security measures. It also necessitates the creation of a supportive regulatory environment and the localization of AI services to cater to the unique needs and preferences of rural populations. In the journey toward empowering Indian rural consumers and women with AI, lessons learned from the hypothetical incident highlight the importance of vigilance in data security and the responsive adaptation of technology to address the concerns and needs of rural users. By doing so, we can build a financial landscape that leverages AI to promote financial inclusion, gender equality , economic prosperity, and a brighter future for rural India. Overall, AI has the potential to democratize access to financial services, making investment opportunities and financial resources more available and tailored to individual needs.

References

[1] Dwivedi, Y. K., Kshetri, N., Hughes, L., et al. (2023). So what if ChatGPT wrote it? Multidisciplinary perspectives on opportunities, challenges and implications of generative conversational AI for research, practice and policy. International Journal of Information Management, 71, 102642. [2] Mariani, M. M., & Nambisan, S. (2021). Innovation Analytics and Digital Innovation Experimentation: The Rise of Research-driven Online Review Platforms. Technological Forecasting and Social Change, 172, 121009. https://doi.org/10.1016/j.techfore.2021.121009 [3] Abbeel, P., Quigley, M., Ng, A.Y., 2006. Using inaccurate models in reinforcement learning, in: Proceedings of the 23rd International Conference on Machine Learning, ICML ’06. Association for Computing Machinery, New York, NY, USA, pp. 1–8. https://doi.org/10.1145/1143844.1143845 [4] Adadi, A., Berrada, M., 2018. Peeking Inside the Black-Box: A Survey on Explainable Artificial Intelligence (XAI). IEEE Access 6, 52138–52160. https://doi.org/10.1109/ACCESS.2018.2870052 [5] Ashta, A. and Herrmann, H., 2021. Artificial intelligence and fintech: An overview of opportunities and risks for banking, investments, and microfinance, Strategic Change, Volume 30, Issue 3, pp. 211-222. [6] Biallas, M., O’Neill, F., 2020. Artificial Intelligence Innovation in Financial Services. https://doi.org/10.1596/34305

Copyright

Copyright © 2024 Shikha Poddar, Dr. Amar Kumar Chaudhary. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64883

Publish Date : 2024-10-28

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online