Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Study on Impact of Audit Committee on Organization Financial Performance

Authors: Rakshitha V

DOI Link: https://doi.org/10.22214/ijraset.2024.58909

Certificate: View Certificate

Abstract

As of late, the job of review panels inside associations has acquired expanding consideration because of their urgent job in guaranteeing straightforwardness, responsibility, and powerful administration. This study means to investigate and examine the effect of review advisory groups on hierarchical execution, zeroing in on their capabilities, synthesis, and viability.

Introduction

I. INTRODUCTION

Review boards have played a significant part in the administration of organizations since their beginning in the mid 1940s, and their perceivability and commitments have significantly expanded in the beyond couple of years. Review advisory groups have been depicted as associations' gatekeepers of monetary respectability. According to an administrative point of view, the administrative organization enabled to manage the issuance and exchanging of protections of public companies, the Protections and Trade Commission (SEC), has been engaged with the foundation and oversight of review advisory groups in open companies since their starting years. An audit committee is a sub-group of a company’s board of directors responsible for the oversight of the financial reporting and disclosure process. To be successful, the audit committee should be aware of the processes and internal controls in the organization. The committee must coordinate with the management team, independent auditor, and internal auditors to monitor the choice of accounting policies and principles and to ensure compliance with laws and regulations.

A. Research Objectives

- To analysis Composition and Effectiveness of audit committee

- To analysis the transparency of an accounting system with the presence of audit committee

- To examine the Organizations with internal audit committees demonstrate better financial performance compared to those with external audit committees.

- To understand the working of audit committee

B. Regulations

- The audit committee must consist of independent members.

- The audit committee is given the responsibility of selecting and overseeing the company’s independent auditor.

- Compensation is provided to any outside auditors or independent auditor engaged by the audit committee.

- The audit committee is given the authority to engage advisors.

- Processes must be in place for managing complaints related to the accounting practices.

The main review leader (CAE) ought to have immediate, unhindered admittance to the review advisory group and CEO as and when required.

The review advisory groups transmit will commonly incorporate the accompanying:

- Inner controls and chance administration frameworks

- The inside review process including arrangement and resourcing

- Budget summaries including administration articulations

- The external review process

- Consistence reports

- Administrative review reports

- Key execution information

- Whistleblowing

- Interchanges with investors in regards to its exercises

C. Roles of an Auditor in Organization

- Monitoring the accounting processes of an organisation An auditor periodically monitors and inspects a company's accounting books to verify that they are accurate and comprehensive

- Complying with auditing guidelines

- Preparing an audit report

- Verifying protocols for borrowings and lending

- Giving honest opinion of a process

- Reporting fraud and helping investigation

D. Importance of Audit Committee

- Financial Reporting and Oversite

The main role of a review panel is to give thorough oversight of the monetary detailing process. This includes guaranteeing that budget reports are precise, finished, and follow important regulations and guidelines. The advisory group audits huge bookkeeping and announcing issues, late expert and administrative declarations, and evaluates their possible effect on budget reports

2. Inside Controls and Hazard, The executives

Review councils are liable for assessing the organization's arrangement of interior controls. They guarantee that suitable strategies and cycles are set up to forestall and distinguish extortion, resource misappropriation, debasement, and fiscal summary misrepresentation.

By effectively observing gamble the executives rehearses, the council helps defend the association against monetary and functional risks.

3. Outer Examiner Oversight

The review panel chooses, redresses, and regulates crafted by the outside inspector. It guarantees the freedom of the examiner and surveys proposed review draws near. Significantly, CPAs report straightforwardly to the review board, not to the executives. The council likewise meets independently with outside examiners to talk about issues privately.

4. Morals and Consistence

The panel tends to charges or infringement of the organization's overarching set of principles speedily and reliably.

It safeguards people who report problematic way of behaving by representatives, advancing straightforwardness and accountability3.

5. Administrative Prerequisites

Compelling since April 2003, the Protections and Trade Commission (SEC) orders review advisory group necessities under the Sarbanes-Oxley Demonstration of 2002.

These prerequisites incorporate freedom of advisory group individuals, choice and oversight of autonomous bookkeepers, taking care of objections about bookkeeping practices, and position to draw in advisors1.

In outline, a viable review panel guarantees monetary uprightness, risk moderation, and moral direct, contributing essentially to an organization's general administration and financial backer trust.

6. Needed Audit Committee

Review boards are not needed in that frame of mind, as the requirement for a review council frequently relies upon different factors, for example, the organization's size, proprietorship structure, administrative prerequisites, and industry standards.

Public corporations, certain privately owned businesses, particularly bigger ones or those with complex tasks, may deliberately lay out review advisory groups as a feature of their administration design to upgrade straightforwardness, responsibility, and chance administration.

The choice to lay out a review board of trustees at last relies upon the organization's particular conditions, administrative climate, and administration targets.

7. Implementing of Audit Committee

a. Monetary Revealing Cycle: The review board of trustees guarantees the precision and respectability of budget reports. It audits critical bookkeeping and detailing issues, late expert and administrative proclamations, and evaluates their effect on budget reports.

b. Review Interaction: The board of trustees surveys the aftereffects of reviews led by outer inspectors. It examines matters expected to be imparted to the board under commonly acknowledged reviewing principles. Furthermore, it handles coordination with inner review staff.

c. Inward Controls: The review board of trustees administers the organization's arrangement of inner controls. This incorporates controls over monetary revealing, data innovation security, and functional issues.

d. Consistence with Regulations and Guidelines: Guaranteeing consistence with legitimate and administrative necessities is another basic obligation. The council guarantees that the organization complies with pertinent regulations and guidelines.

e. Reviewer Oversight: The review panel selects, redresses, and directs crafted by outer inspectors. It meets independently with reviewers to examine matters that require private conversation.

f. Spending plan Authority: The advisory group has authority over its own financial plan and the spending plan for outside inspectors. These assurances assemble financial backer confidence in the exactness of monetary reports.

E. Recent Trends

- Canter around Network safety: With the rising recurrence and refinement of digital dangers, review advisory groups have been focusing closer on network safety gambles. They are supposed to work intimately with IT and network protection specialists to evaluate and alleviate these dangers.

- Ecological, Social, and Administration (ESG) Worries: There has been a developing accentuation on ESG factors in corporate administration. Review boards of trustees are supposed to consider ESG dangers and exposures, guaranteeing that the organization’s exercises line up with maintainability objectives and administrative necessities.

- Expanded Oversight of Inside Controls: Review councils assume a pivotal part in regulating interior controls to forestall extortion, blunders, and misquotes in monetary revealing. Late patterns propose an uplifted spotlight on the viability of inner controls, particularly because of administrative examination and high-profile bookkeeping embarrassments.

- Upgraded Correspondence with Partners: Review panels are progressively expected to discuss straightforwardly with investors, controllers, and different partners. This incorporates giving clear clarifications of monetary execution, risk the board practices, and review processes.

- Innovation Reception and Information Investigation: As organizations embrace advanced change, review advisory groups are utilizing innovation and information examination apparatuses to improve review quality and effectiveness. This pattern includes putting resources into cutting edge examination, computerized reasoning, and computerization to further develop risk appraisal and evaluating techniques.

- Variety and Freedom: There’s a developing acknowledgment of the significance of variety and freedom inside review boards of trustees. Organizations are focusing on the arrangement of assorted individuals with shifted foundations and ability to upgrade administration viability and direction.

- Administrative Consistence and Oversight: Review panels are under expanded administrative examination, especially in areas with rigid consistence necessities like money, medical services, and energy. Consistence with guidelines like Sarbanes-Oxley Act (SOX) stays a key canter region for review boards.

- Transformation to Remote Workplace: The shift to remote work because of the Coronavirus pandemic has required changes in review board of trustees rehearses. Boards of trustees have needed to track down ways of leading gatherings, supervise reviews, and keep up with correspondence successfully in a virtual climate.

These patterns highlight the developing job and obligations of review boards of trustees in guaranteeing successful corporate administration, risk the executives, and monetary straightforwardness. Review advisory groups genuinely must keep up to date with these turns of events and adjust their practices appropriately to actually satisfy their oversight obligations.

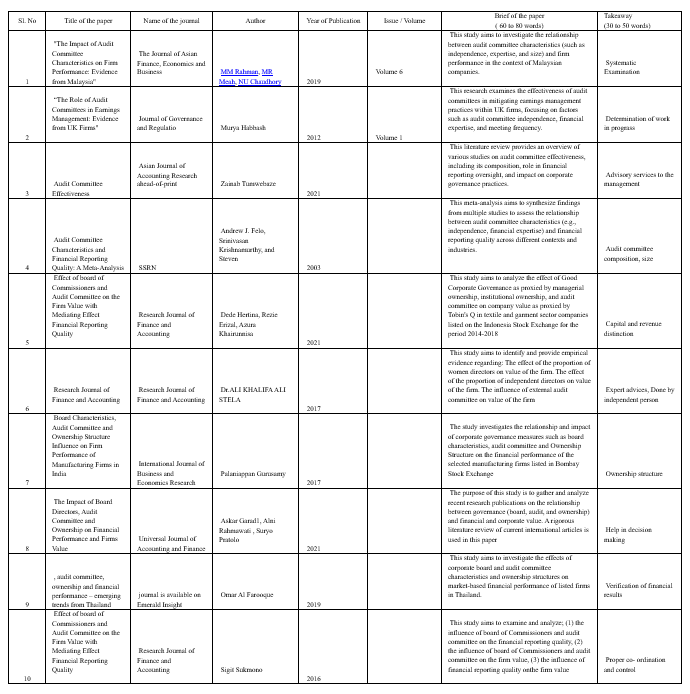

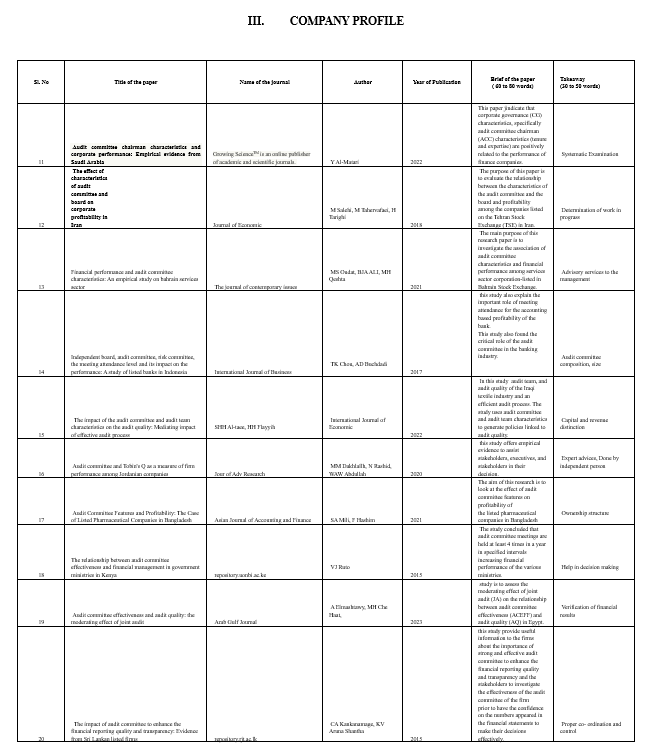

II. LITERATURE REVIEW

Firm name: Sirmanth and veeresh Charted Accountants Established

Year: 2020 Address: No.17 & 18, 4th Floor, Hanumathra Arcade 60 Feet Road, Pattegarapalya, Vijayanagar North, Bengaluru, Karnataka 560079

This firm is mainly called as “Audit Firm”, being an audit firm they have been servicing in various sector such as: Nidhi Company, NBFC, Information Technology, hotels and Restaurants, Hospitals, Education Institution, charitable Organisation.

Team structure

- Partners

- Employees

- Consultants

- Article assistants

- Other paid assistants

A. Services

- Accounting / Book keeping

- Internal and stock Audit

- Direct and Indirect Tax

- Statutory Registrations

- Assessments and Litigation

- Start –ups, Business

- Statutory Certification

- Virtual CFO

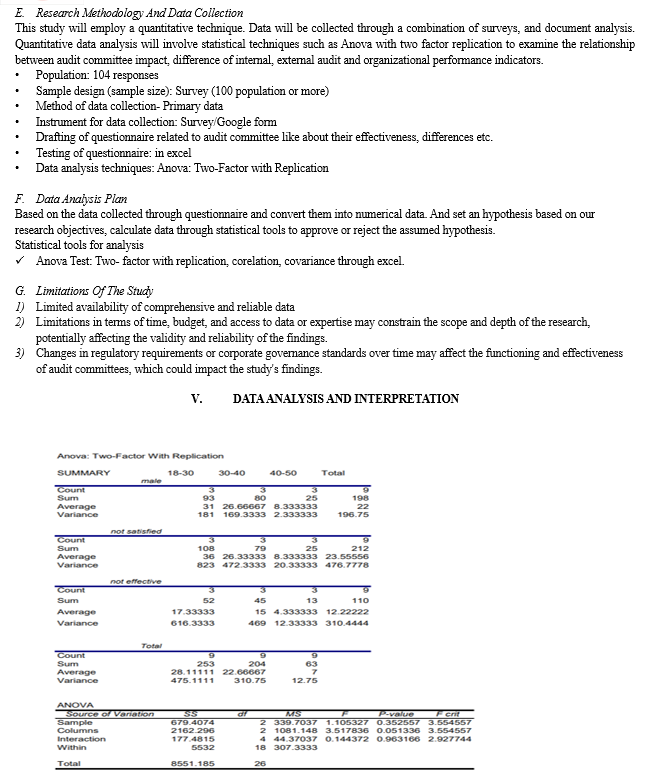

IV. RESEARCH DESIGN

A. Statement of the problem

The effectiveness of audit committees in contributing to organizational performance remains a subject of debate and investigation. Despite their widespread adoption, questions persist regarding the extent to which audit committees positively influence organizational outcomes such as financial performance, risk management, and compliance with regulations. Furthermore, variations in audit committee structures, practices, and regulatory environments across different industries and regions add complexity to assessing their impact.

B. Research Gap

- What specific actions will be taken to address any identified weaknesses or deficiencies in internal controls?

- Are there any potential conflicts of interest among members of the audit committee or with management?

- What is the process for evaluating and selecting external auditors?

- How does the audit committee ensure the independence and objectivity of the external auditors?

- What is the committee's approach to overseeing risk management practices within the company?

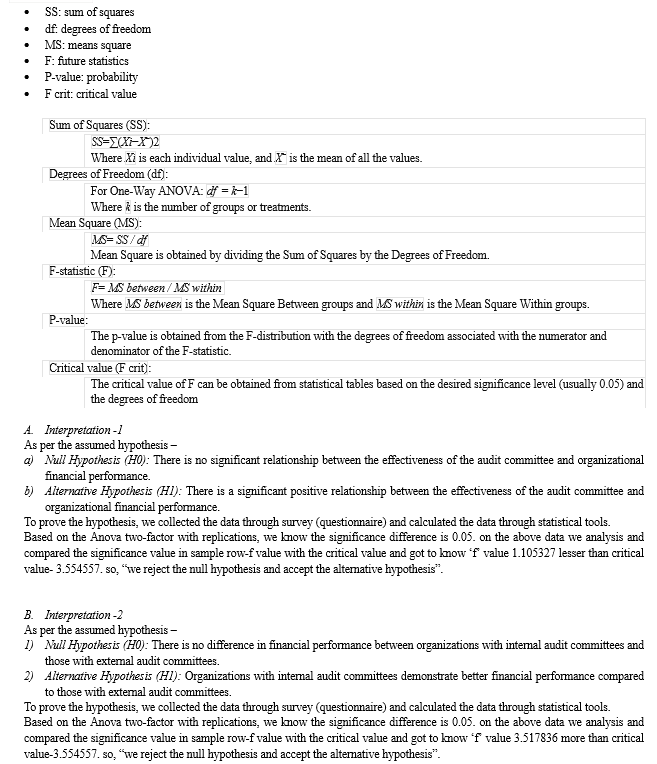

C. Research Hypothesis

- Null Hypothesis (H0): There is no significant relationship between the effectiveness of the audit committee and organizational financial performance.

- Alternative Hypothesis (H1): There is a significant positive relationship between the effectiveness of the audit committee and organizational financial performance.

- Null Hypothesis (H0): There is no difference in financial performance between organizations with internal audit committees and those with external audit committees.

- Alternative Hypothesis (H1): Organizations with internal audit committees demonstrate better financial performance compared to those with external audit committees.

D. Scope of the Study

Understanding the impact of audit committees on organizational performance is crucial for regulators, boards of directors, and practitioners seeking to enhance corporate governance practices. By identifying the factors that contribute to the effectiveness of audit committees, this study aims to provide actionable insights for organizations to optimize their governance structures and improve overall performance.

Conclusion

A. Suggestions 1) The review board of trustees assumes a pivotal part in the corporate administration structure, assisting with controlling and screen the executives inside an association. At the point when the review advisory group works autonomously, it can really administer monetary detailing, interior controls, and chance administration. 2) Offer opportunities for professional development, such as workshops, seminars, and certifications, to keep members abreast of developments in their areas of expertise. 3) Appoint a capable and experienced chairperson to lead the audit committee, facilitate discussions, promote collaboration, and ensure the committee operates efficiently and effectively. 4) Foster a culture of integrity, ethical behaviour, and accountability throughout the organization to uphold public trust and confidence. B. Conclusion This research seeks to contribute to the existing literature on corporate governance by providing empirical evidence on the impact of audit committees on organizational performance. In the above we get to know how the audit is impacting companies to grow. By addressing key research questions and objectives, this study aims to enhance understanding of the roles, functions, and effectiveness of audit committees, thereby informing policy, practice, and future research in this area.

References

[1] Mili, S. A., & Hashim, F. (2021). Audit Committee Features and Profitability: The Case of Listed Pharmaceutical Companies in Bangladesh. Asian Journal of Accounting and Finance, 3(2), 1-7. [2] 21). Audit Committee Features and Profitability: The Case of Listed Pharmaceutical Companies in Bangladesh. Asian Journal of Accounting and Finance, 3(2), 1-7. [3] Aryan, L. A. (2015). The relationship between audit committee characteristics, audit firm quality and companies’ profitability. Asian Journal of Finance & Accounting, 7(2), 215-226. [4] Ruto, V. J. (2015). The relationship between audit committee effectiveness and financial management in government ministries in Kenya. [5] Elmashtawy, A., Che Haat, M. H., Ismail, S., & Almaqtari, F. A. (2023). Audit committee effectiveness and audit quality: the moderating effect of joint audit. Arab Gulf Journal of Scientific Research. [6] Al-taee, S. H. H., & Flayyih, H. H. (2022). The impact of the audit committee and audit team characteristics on the audit quality: Mediating impact of effective audit process. International Journal of Economics and Finance Studies, 14(03), 249-263. [7] Chou, T. K., & Buchdadi, A. D. (2017). Independent board, audit committee, risk committee, the meeting attendance level and its impact on the performance: A study of listed banks in Indonesia. International Journal of Business Administration, 8(3), 24. [8] Salehi, M., Tahervafaei, M., & Tarighi, H. (2018). The effect of characteristics of audit committee and board on corporate profitability in Iran. Journal of Economic and Administrative Sciences, 34(1), 71-88. [9] Al-Matari, Y. (2022). Audit committee chairman characteristics and corporate performance: Empirical evidence from Saudi Arabia. Accounting, 8(1), 47-56. [10] Almaqoushi, W., & Powell, R. (2017). Audit committee indices, firm value, and accounting outcomes. Firm Value, and Accounting Outcomes (April 27, 2017). [11] Arianpoor, A. (2019). Impact of audit report lag, institutional ownership and board characteristics on financial performance. Iranian Journal of Accounting, Auditing and Finance, 3(2), 83-97. [12] Doloksaribu, E. A., & Hutapea, J. Y. (2022). The Effect of Managerial Ownership, Institutional Ownership, Independent Commissioners, Audit Committee on Company Value (IDX 30 2018-2020). JIIP-Jurnal Ilmiah Ilmu Pendidikan, 5(9), 3858-3862. [13] Saha, N. K., Moutushi, R. H., & Salauddin, M. (2018). Corporate governance and firm performance: the role of the board and audit committee. Asian Journal of Finance & Accounting, 10(1), 210-225. [14] Kholis, A. (2020). The effect of information asymmetry, financial performance, financial leverage, managerial ownership on earnings management with the audit committee as moderation variables. Jurnal Mantik, 4(3), 1734-1745. [15] Sukmono, S., & Yadiati, W. (2016). Effect of board of Commissionersand Audit Committee on the Firm Value with Mediating Effect Financial Reporting Quality. Research Journal of Finance and Accounting, 7(2), 131-148. [16] Hertina, D., Erizal, R., & Khairunnisa, A. (2021). Corporate value impact of managerial ownership, institutional ownership and audit committee. Journal Psychology and Education, 58(3), 14-22. [17] Stela, A. K. A., & Rhumah, A. M. A. (2017). Effect of board diversity, audit committee, managerial ownership, ownership of institutional, profitability and leverage on value of the firm. International Journal of Financial Management (IJFM), 8(1), 1-10. [18] Stela, A. K. A., & Rhumah, A. M. A. (2017). Effect of board diversity, audit committee, managerial ownership, ownership of institutional, profitability and leverage on value of the firm. International Journal of Financial Management (IJFM), 8(1), 1-10. [19] Stela, A. K. A., & Rhumah, A. M. A. (2017). Effect of board diversity, audit committee, managerial ownership, ownership of institutional, profitability and leverage on value of the firm. International Journal of Financial Management (IJFM), 8(1), 1-10. [20] Gurusamy, P. (2017). Board characteristics, audit committee and ownership structure influence on firm performance of manufacturing firms in India. International Journal of Business and Economics Research, 6(4), 73-87. [21] Setiany, E. (2023). The Effect Local Ownership, Audit Quality, Audit Committee, And Financial Performance on Company Value. Journal of Accounting and Finance Management, 4(1), 125-137. [22] Fuadah, L. L., Mukhtaruddin, M., Andriana, I., & Arisman, A. (2022). The ownership structure, and the environmental, social, and governance (ESG) disclosure, firm value and firm performance: The audit committee as moderating variable. Economies, 10(12), 314. [23] Al Farooque, O., Buachoom, W., & Sun, L. (2020). Board, audit committee, ownership and financial performance–emerging trends from Thailand. Pacific Accounting Review, 32(1), 54-81.

Copyright

Copyright © 2024 Rakshitha V. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET58909

Publish Date : 2024-03-10

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online