Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

A Study on Investors Perception on Indian Mutual Funds System with Reference to Private and Public Players

Authors: Ms. Daisy Bosco. T. , Dr. John Paul M

DOI Link: https://doi.org/10.22214/ijraset.2022.41869

Certificate: View Certificate

Abstract

The goal of this research is to find out more about investors\' preferences and perceptions of the Indian mutual fund system, with a focus on private and public players. The two most common investor classes in the Indian mutual fund market, public and private players, were used to select mutual fund businesses. A mutual fund is a way of pooling money by distributing units to investors and investing the proceeds in securities in accordance with the offer document\'s goals. As a result, for the typical person, a mutual fund is the greatest investment since it allows them to invest in a diversified, professionally managed basket of securities at a low cost. In recent years, the number of investors and investment sources has exploded.

Introduction

I. INTRODUCTION

This research focuses on consumer preferences and perceptions of the Indian mutual fund system, as well as whether investors prefer the private or public sectors. A mutual fund is a sort of investment that mostly invests in stocks. In order to give investors with steady and high returns, mutual funds are managed by a financial expert or organisation. People who invest in mutual funds are known as unitholders. It's a professionally managed open-end investment fund that pools money from multiple investors to purchase securities. Investors are given units based on the amount of money they have placed in mutual funds. As a result, a mutual fund is the greatest investment for the typical individual because it enables them to invest in a diversified, professionally managed basket of securities at a low cost.

Knowing how investors think about mutual funds and act becomes increasingly significant as it aids financial advisers in performing their duties more effectively and efficiently. Investor feedback is crucial to the long-term survival and acceleration of growth rates in mutual fund investments. Mutual fund returns have a low risk when compared to stock market returns. Consumers who want to minimise their risks while maximising their gains should invest in mutual funds. Mutual funds invest in a wide range of assets, including stocks and other equity instruments. It's also invested in debt securities, which are thought to be much safer.

A. Industry Profile

In 1964, UTI created its first mutual fund, with a few options geared at small investors. A strong financial market with extensive participation is required in a developed economy. This programme was developed by the Government of India and the Reserve Bank of India to encourage saving and investment, as well as participation in the Corporation's revenue, profits, and gains through the acquisition, holding, management, and disposal of securities. The first mutual fund company in India was the Unit Trust of India. It was founded in 1963 as a joint venture between the Indian government and the Reserve Bank of India. The purpose of the UTI was to make it easier for small and inexperienced investors to buy shares and other financial instruments in larger companies. The UTI had a monopoly at the time. One of the company's long-running mutual fund programmes was the Unit Scheme 1964.

Consumers do not spend their entire budget on various goods and services. He plans to set aside a certain amount of money and invest a portion of it in mutual funds. At this moment, consumers are likely to find mutual funds to be a preferable option. They are financial intermediaries entrusted with channelling the extra income of individuals. Consumers have a variety of investment options, but mutual funds stand out for their risk, return, liquidity, profitability, transparency, and other characteristics. In recent years, mutual funds have grown in popularity.

As the name implies, public mutual funds are open to the whole public. It operates with lower risk levels whenever possible in the goal of achieving long-term growth. Government-owned enterprises contribute to these funds.

Professional fund managers make active investments in a wide range of securities in order to achieve the mutual funds' stated objectives, which may include capital growth or income. A public mutual fund can be an index fund, a stock fund, a bond fund, or a money market fund.

Shares in a public mutual fund can be purchased directly from the investment company or through one of its brokers. Mutual fund shares cannot be purchased or sold on secondary markets such as the New York Stock Exchange. Public mutual funds spread investment risk by pooling assets from a variety of investors and diversifying with a diverse range of investments.

Private mutual funds are an investment option provided only to a select set of people. Private mutual funds may operate similarly, but some may be willing to take more risks in the future in the goal of a higher return. These funds are supported by private sector companies.

The minimum investment in a private mutual fund is much higher than in a public mutual fund. Depending on the number of investors in a private mutual fund, there is minimal or no government regulation. For example, hedge funds and private mutual funds are leveraged more than public mutual funds.

Private mutual funds typically use financial derivatives, repurchase agreements, and other borrowing strategies. For private mutual funds, each country has its unique set of advantages. Investors who are wary of regulation will appreciate the fact that there is no need for an administrator or annual audits.

B. Problem Statement

Every person has their own set of issues, such as expenses, services, regulations, profitability, participation, financial instability, and so on, which have been causing investors significant concern. The increased awareness of such issues is having a negative impact on investors' confidence in India's mutual fund business.

Investors Perception on Indian MUTUAL FUNDS System: Investors prefer Private Sector or Public Sector.

C. Need For The Study

The primary purpose of this study is to have a better understanding of mutual funds and how they work. This allows us to gain a better understanding of the mutual fund industry's beginnings, growth, and future prospects. It also helps to understand how investors think about Indian mutual funds. Because my study is based on investors' impressions of public and private players in the Indian mutual fund system, as well as their schemes like equity, income, and balance, and the results associated with them. The study's goal is to find out what mutual fund preferences and interests public and private players have. Finally, this will help investors understand the benefits of mutual funds.

D. Scope And Significance Of Study

My suggestion is limited to public and private mutual fund participants. There is a great demand for enhanced awareness in the mutual fund business. Private mutual funds have outperformed public mutual funds by a significant margin, owing to enhanced fund distribution, management, and portfolio manager performance, as well as their high-quality assets. An investor can invest in one or more Mutual Fund schemes and become a unit holder in those schemes. The money put in a Mutual Fund's specific plan is then invested in a variety of approved stocks, shares, bonds, and money market instruments by the fund manager.

E. Objectives Of The Study

- To understand how investors, think about the Indian Mutual Funds System.

- To determine mutual fund risk and return.

- To evaluate the awareness towards Mutual Funds.

- To identify the behaviour of Mutual Funds investors.

- To know the preference of the Public and Private players.

- To identify the problem faced by the Mutual Funds investors.

- To identify the loyal investors in Mutual Funds.

F. Limitations Of The Study

Because the number of possible mutual fund investors in the chosen geographic area is limited, sample data for analysis is constrained. For such purposes, people are not interested to provide their personal investment details.

II. REVIEW OF LITERATURE

Rajesh Trivedi, Prafulla Kumar Swain and Manoranjan Dash, 2017, The topic of this essay is An Indian Perspective on Investor Perceptions of Mutual Fund Decisions. The Indian financial sector is becoming more competitive, and the supply of diverse financial products must match investor demand expectations. Aiming for the best potential return with the least amount of risk is the goal of any investment, and mutual funds provide that opportunity to investors. As a result, the government is aiming to incorporate financial subjects into high school curriculum. Adults who have previously invested in mutual funds should continue to do so as their knowledge grows.

V. Rathnamani, 2013, Investor preferences in the Trichy mutual fund business are the subject of this essay. A mutual fund is the best investing instrument in today's complex and sophisticated financial landscape. In comparison to other financial products, mutual fund investment has grown in importance in India. Mutual fund investments are less risky and yield higher portfolio returns. The majority of investors in this survey are willing to pursue moderate and low-risk investments, with a moderate strategy being preferred by the majority. To entice more people to engage in mutual funds, mutual fund firms must implement an education programme on the benefits of doing so, as well as the safety and security given by mutual fund companies in this volatile stock market environment.

Ratheesh. K. Nair, 2016, This article discusses the issues and prospects of mutual fund investments, with a focus on Keralites. The study's goal was to examine the state's potential for mutual fund investment by examining investor behaviour and attitudes. By applying rigorous statistical techniques to the responses of 200 mutual fund investors and 200 non-mutual fund investors, the study was able to offer a wealth of information about the development and evolution of the mutual fund business in Kerala. Enhancing mutual fund services should be a top priority.

III. RESEARCH METHODOLOGY

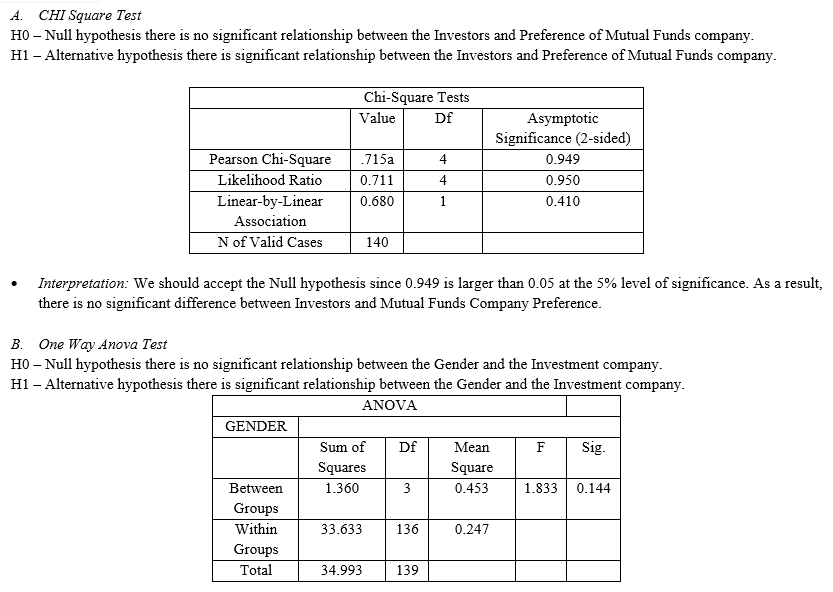

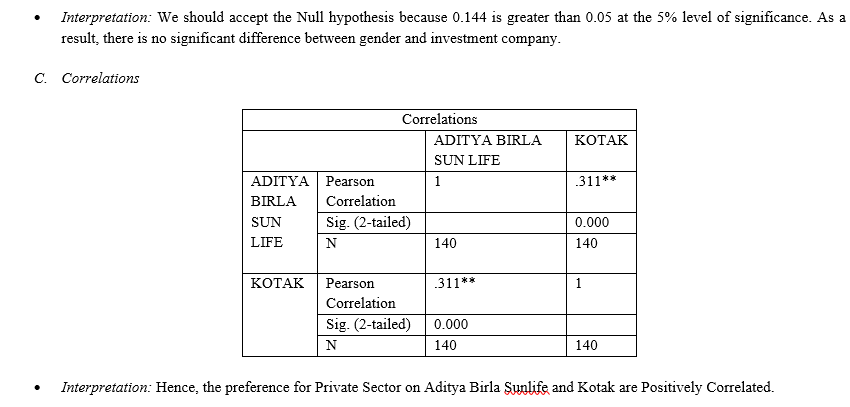

The goal of this descriptive study is to find out how investors feel about the Indian mutual fund system, with a focus on private and public players. The 140 samples were chosen using a stratified random sampling approach. The techniques used were correlations, one-way anova, and the Chi-square test. Secondary data includes a wide range of papers, journals, and digital content. The research took done in the Thoraipakkam neighbourhood of Chennai.

IV. DATA ANALYSIS

TABLE – 1 Rate Your Preference About Mutual Fund

|

Preference on Mutual Funds |

Frequency |

Percentage |

|

1 |

6 |

4.3% |

|

2 |

6 |

4.3% |

|

3 |

61 |

43.6% |

|

4 |

42 |

30% |

|

5 |

25 |

17.9% |

|

Total |

140 |

100% |

V. FINDINGS

Indian investors, according to my study, prefer private sector mutual funds. Private investors (58.6%) outperform public investors in the Mutual Fund system (41.4 %). Mutual fund investors are mostly between the ages of 21 and 25. Balanced funds are popular among new investors, who learned about them from friends and marketing. Investors in mutual funds who have a clear vision and grasp of risk and return are willing to advocate investing in a variety of funds.

VI. SUGGESTIONS

Despite the reality that we currently see many Mutual Fund advertising on television, some people still have no idea what a mutual fund is. My advice is to promote it not only through advertising, but also through campaigns, word-of-mouth, banks, and other methods. The most conspicuous investor profiles in the Indian Mutual Fund business, Public Players and Private Players, were used to select Mutual Fund houses. The firm will be able to push dangerous products onto the market as more consumers are ready to tolerate a moderate risk. Initially, they should strive to persuade municipal consultants to invest in mutual funds by selling the product and services. In both the public and private sectors of Mutual Funds, there is substantial evidence of a link between the pattern of fund mobilisation and redemption. In terms of mobilisation, if the current Mutual Funds trend continues, private and public players may become more tightly intertwined.

Conclusion

This study investigates customer preferences and opinions of India\'s mutual fund structure, as well as whether investors prefer private or public players. Understanding how investors feel about mutual funds and how they act is becoming increasingly important because it allows financial advisors to do their jobs more effectively and efficiently. Investor input is crucial to mutual fund growth\'s long-term sustainability and acceleration. When compared to the stock market, mutual fund returns are low risk. Mutual funds are the greatest option for those with minimal experience in stock investing because they are managed by financial professionals. Mutual funds are safe and risky because they are part of a well-regulated investing environment in which investors\' interests are protected by the regulator. According to my study, Indian investors prefer mutual funds in the private sector. Private investors outweigh public participants in the Indian Mutual Fund system because the return is better and the risk is lower in the private sector.

References

[1] International Journal of Economic ResearchISSN: 0972-9380available at http: www.serialsjournal.com© Serials Publications Pt. Ltd. Volume 14 • Number 9 • 2017 [2] IOSR Journal of Business and Management (IOSR-JBM) ISSN: 2278-487X. Volume 6, Issue 6 (Jan. Feb. 2013), PP 48-55 www.iosrjournals.org [3] JOURNAL OF CRITICAL REVIEWS ISSN- 2394-5125 VOL 7, ISSUE 17, 2020 [4] International Journal of Innovative Technology and Exploring Engineering (IJITEE) ISSN: 2278-3075, Volume-8 Issue-6S, April 2019 [5] www.researchgate.net/publication/319109300_A_Study_of_Investor\'s_Perception_Towards_Mutual_Fund_Decision_An_Indian_Perspectivelume 13 issue 1 July 2020 [6] Singaporean Journal of Business economics, and management Studies (SJBem) VOL. 5, NO. 6, 2017 [7] International Journal of Engineering and Management Research e-ISSN: 2250-0758 | p-ISSN: 2394-6962 Volume- 9, Issue- 1, www.ijemr.net https://doi.org/10.31033/ijemr.9.1.07 [8] Journal of Management Research and Analysis, January – March 2015;2(1):1-23 [9] June 2, 2017; Paper sent back for Revision: July 18, 2017; Paper Acceptance Date: October 24, 2017. [10] A Study on Investor’s Perception Towards Mutual Fund DOI:10.17010/IJF/2014/V8I10/71846Corpus ID: 155199893 file:///C:/Users/Lenovo/Downloads/Investors_perception_on_mutual_funds_with_referen.pdf http://shodh.inflibnet.ac.in:8080/jspui/bitstream/123456789/4011/3/03_litrature%20review.pdf https://www.semanticscholar.org Corpus ID: 62828595 https://www.semanticscholar.org Corpus ID: 21715227 https://www.sebi.gov.in/sebi_data/faqfiles/may-2017/1494501305219.pdf https://www.slideshare.net/praveensingh247/perception-of-customer-towards-mutual-funds https://www.slideshare.net/PriyankaBachkaniwala/mutual-fund-ppt-31393039 https://www.slideshare.net/SaraCooper161/mutual-funds-mutual-fund-basics-types-of-mutual-funds-mutual-fund-investments https://www.etmoney.com/mutual-funds/equity/sectoral-banking/39 https://www.fundsupermart.co.in/main/fundinfo/worst_Funds.svdo https://cleartax.in/s/best-mutual-funds-india

Copyright

Copyright © 2022 Ms. Daisy Bosco. T. , Dr. John Paul M. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET41869

Publish Date : 2022-04-26

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online