Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Long-Term Impact of Mergers and Acquisitions on Firm Performance: A Panel Data Study

Authors: Veerendra Anchan, Shashwat Jhawar, Darshan Khanted, Surbhi Jani, Vanshita Vora

DOI Link: https://doi.org/10.22214/ijraset.2024.64665

Certificate: View Certificate

Abstract

Purpose - This study aims to examine the long-term impact of mergers and acquisitions (M&As) on firm performance, particularly within the pharmaceutical industry. Using a panel data regression model, the study assesses how key financial ratios such as Net Profit Margin, Return on Capital Employed (ROCE), Debt to Equity Ratio, and Enterprise Value influence post-merger firm performance over time. Design/methodology/approach - A panel data approach has been conducted using data from 10 pharmaceutical companies from their post-merger period, focusing on the effects of M&As on firm performance as measured by Net Profit Margin. Financial ratios related to profitability, liquidity, and valuation were used as independent variables. Findings - The study finds that M&As have a positive long-term impact on firm performance, particularly in companies with strong Earnings per Share (EPS), efficient capital management, and good liquidity. ROCE, Debt to Equity Ratio, and Current Ratio were significant predictors of improved Net Profit Margin, highlighting the importance of financial efficiency and debt management in the post-merger phase. Research limitations/implications - The focus on the pharmaceutical industry limits the generalizability of the findings to other sectors. Future studies should examine a broader range of industries to better understand the effects of M&As across different contexts.

Introduction

I. INTRODUCTION

Mergers and acquisitions (M&As) are pivotal strategies for corporate restructuring and growth, frequently employed by companies across industries to gain a competitive edge in an increasingly globalized market. As tools of strategic realignment, M&As enable firms to expand their market share, diversify product offerings, and achieve synergies that drive operational efficiency and profitability (Hitt et al., 2001; Weston et al., 2004). In particular, the pharmaceutical industry, with its complex regulatory landscape, high research and development (R&D) costs, and a continuous drive for innovation, has been at the forefront of M&A activity (Danzon et al., 2007; Higgins & Rodriguez, 2006). By consolidating resources and expertise, pharmaceutical companies can access new markets, enhance their research capabilities, and reduce the risks associated with drug development. However, the success of M&As is far from guaranteed, and their long-term impact on firm performance remains a subject of significant debate within both academia and industry (King et al., 2004; Cartwright & Schoenberg, 2006). The rationale behind mergers and acquisitions is often driven by the pursuit of economies of scale and scope. By merging with or acquiring another firm, companies can eliminate redundancies, reduce costs, and gain access to new technologies, patents, and intellectual property (Ravenscraft & Scherer, 1987; Andrade et al., 2001). In the pharmaceutical sector, these benefits are particularly attractive, given the substantial investments required in R&D and the lengthy process of bringing new drugs to market. M&As can enable pharmaceutical firms to streamline their R&D pipelines, pool resources, and accelerate time-to-market for new therapies (Grabowski & Vernon, 1994). Moreover, M&As offer opportunities for geographical expansion, allowing companies to penetrate new markets, comply with regional regulatory requirements, and increase their global presence (Danzon et al., 2007). Despite these potential benefits, the long-term success of M&As is not always realized. The integration process following a merger or acquisition presents numerous challenges, including the need to align corporate cultures, harmonize organizational structures, and achieve operational synergies. In many cases, cultural integration can be a stumbling block, as differences in management styles, employee expectations, and corporate values can lead to conflicts and inefficiencies (Schoenberg, 2006; Datta, 1991).

These challenges are particularly pronounced in the pharmaceutical industry, where the integration of R&D teams, clinical trials, and manufacturing processes requires careful coordination and collaboration. Failure to address these integration issues can undermine the potential synergies of the merger, leading to a decline in productivity and profitability (King et al., 2004). Strategic alignment is another critical factor in determining the success of M&As. For an acquisition to deliver long-term value, the acquiring firm must ensure that the target company’s strengths align with its own strategic objectives. This involves conducting thorough due diligence to assess the compatibility of the target’s product portfolio, market position, and growth prospects with the acquiring firm’s long-term goals (Seth, 1990; Moeller et al., 2004). In the pharmaceutical industry, this alignment is often centered around the complementary nature of drug pipelines, therapeutic areas, and market positioning. For example, a company specializing in oncology treatments may seek to acquire a firm with expertise in immunotherapy, thereby strengthening its position in a high-growth market segment. However, if the strategic alignment is not well defined, the merger may fail to generate the anticipated synergies, resulting in diminished returns and a weakened competitive position. In addition to cultural integration and strategic alignment, the broader economic environment plays a significant role in shaping the long-term outcomes of M&As. Economic conditions, such as interest rates, regulatory changes, and market volatility, can influence the success of a merger or acquisition (Sharma & Ho, 2002). In the pharmaceutical industry, regulatory approvals, patent expirations, and pricing pressures are critical external factors that can affect the financial performance of merged entities. For instance, changes in healthcare policies, particularly regarding drug pricing and reimbursement, can have a profound impact on the profitability of pharmaceutical companies. As such, firms must carefully navigate the regulatory landscape to ensure that their post-merger operations remain compliant and competitive in an evolving market environment (Higgins & Rodriguez, 2006). In the ever-evolving corporate realm, mergers and acquisitions (M&As) have become a strategic tool for growth, consolidation, and transformation. However, the long-term implications of these complex transactions remain shrouded in uncertainty, with much of the existing research focusing solely on their immediate financial outcomes, such as stock price reactions and short-term profitability. This narrow focus has left a significant gap in our understanding of the lasting impact of M&As on firm performance, particularly within the dynamic pharmaceutical industry. The pharmaceutical sector, with its reliance on innovation, stringent regulatory requirements, and the high cost of drug development, presents a unique and compelling context for exploring the long-term effects of corporate restructuring. Unlike other industries, the full benefits of a merger or acquisition in this sector may not be realized for several years, as the lengthy drug approval process and the need to navigate complex regulatory frameworks can significantly delay the realization of synergies and operational efficiencies. To address this gap, this study will employ a panel data approach to delve into the long-term performance of pharmaceutical firms that have undergone M&A transactions. By analyzing a range of financial metrics, including return on assets (ROA), return on equity (ROE), net profit margin, and enterprise value, the research aims to uncover the critical factors that contribute to the sustained success of merged entities. The focus on these comprehensive financial indicators provides a more holistic understanding of the operational efficiency and overall financial health of the merged firms, offering valuable insights that go beyond the immediate financial outcomes. This approach will enable the research to explore how factors such as firm size, economic conditions, and strategic alignment influence the long-term performance of pharmaceutical companies engaged in M&A activities. Furthermore, the study will examine the role of financial ratios related to profitability, liquidity, and debt management in predicting the long-term success of these corporate restructuring initiatives. These metrics serve as crucial signposts, highlighting the underlying financial dynamics that shape the trajectory of merged entities in the pharmaceutical industry. By delving into the complexities of this sector, the research will provide valuable insights into the specific factors that drive the success or failure of M&As in this critical industry. The findings will not only contribute to the growing body of literature on corporate restructuring but also offer practical recommendations for pharmaceutical companies navigating the intricate landscape of mergers and acquisitions. Moreover, the lessons learned from this study may have broader implications for other industries where M&As are employed as a strategy for growth and consolidation. The insights gleaned from the pharmaceutical sector can serve as a guide for enhancing the long-term success of corporate mergers and acquisitions across various industries, ultimately contributing to the overall understanding of this complex and multifaceted corporate strategy.

II. LITERATURE REVIEW

In the ever-evolving landscape of corporate strategy, mergers and acquisitions (M&As) have emerged as a powerful tool for growth, transformation, and value creation. However, the long-term implications of these complex transactions remain a topic of intense scrutiny and debate among scholars and practitioners alike. The existing body of research has shed light on the various factors that can influence the success or failure of M&As over an extended period.

Strategic alignment, cultural compatibility, and macroeconomic conditions have been identified as critical determinants in shaping the long-term outcomes of these corporate restructuring initiatives (Andrade, Mitchell, and Stafford, 2001). When companies engage in M&As with a clear strategic vision and a shared sense of purpose, the chances of achieving lasting synergies and sustained value creation are significantly higher. Successful M&As can enhance a company's market position, drive innovation, and create efficiencies that lead to cost savings and improved financial performance (Conyon et al., 2002). However, misaligned strategic goals can result in strategic drift, where the combined entity struggles to focus on its core objectives, leading to a decline in performance over time. The integration of diverse corporate cultures is another crucial factor in determining the long-term success of M&As. The ability to seamlessly blend different organizational cultures can have a profound impact on employee morale, productivity, and retention (Moeller and Schlingemann, 2005). When cultural integration is well-executed, it can foster a unified corporate identity and facilitate smoother operational integration. Conversely, cultural mismatches can give rise to conflicts, reduced productivity, and the departure of key personnel, jeopardizing the long-term viability of the merger.

The influence of macroeconomic conditions on the long-term outcomes of M&As cannot be overstated. Factors such as interest rates, economic stability, and market volatility can shape the timing, financial viability, and integration process of these transactions (Erel, Liao, & Weisbach, 2012). High interest rates, for instance, can increase the cost of financing M&A deals, reducing their potential profitability. Economic instability and market volatility, on the other hand, can make it more challenging to achieve the anticipated benefits of the merger, as the integration process may be disrupted by external shocks. Cross-border M&As introduce an additional layer of complexity, as companies must navigate divergent legal, regulatory, and cultural landscapes. While these transactions offer opportunities for market expansion and diversification, they also require meticulous planning and execution to ensure compliance with local frameworks and the effective integration of diverse corporate cultures (Rossi and Volpin, 2004). The long-term success of cross-border M&As often depends on the ability to manage these differences effectively, leveraging the complementary strengths of the merging entities. Furthermore, the literature highlights the long-term impact of M&As on innovation and technological advancement. When the integration process is well-managed, the pooling of resources and expertise can drive innovation and maintain a competitive edge. However, if the integration process disrupts R&D efforts or stifles creativity, it can lead to a decline in innovation, ultimately affecting the company's long-term growth prospects. In conclusion, this research paper aims to provide a comprehensive analysis of the long-term effects of mergers and acquisitions, exploring the intricate interplay of strategic, cultural, and macroeconomic factors that shape the success or failure of these corporate restructuring initiatives. By delving into the nuances of this complex landscape, the study seeks to offer valuable insights that can inform the decision-making process and enhance the long-term viability of M&A strategies across various industries.

III. RESEARCH METHODOLOGY

A. Objective

To assess the long-term effects of M&As on firm performance using financial ratios and other data as mentioned below as the key performance indicators.

B. Panel Data Approach Regression

1) Model Type

A panel data regression model has been employed by arranging the data in a cross-sectional format over time, allowing us to evaluate firm performance across different time periods. While this approach emphasizes cross-sectional variations (across firms), it also incorporates a time dimension by assessing performance before and after M&A events over multiple years. Though a simple pooled regression does not fully capture time-series effects such as autocorrelation, it still enables a broader understanding of how M&A events influence net profit margin trends over time. This model helps to assess long-term performance changes while controlling for firm-specific differences.

This research employs Net Profit Margin (NPM) as the dependent variable, a key measure of firm profitability. NPM reflects the percentage of revenue that a company retains as profit after accounting for all expenses, taxes, and costs. By focusing on NPM, this study aims to assess how mergers and acquisitions (M&A) influence the long-term profitability of firms, offering a clear indicator of the financial health and operational efficiency post-acquisition. The analysis incorporates a comprehensive set of independent variables that impact firm performance, including Return on Equity (ROE), Return on Capital Employed (ROCE), Return on Assets (ROA), Debt-to-Equity ratio (DE), Current Ratio (CR), Quick Ratio (QR), Earnings Per Share (EPS), Enterprise Value (EV), and Earnings Yield (EY). These variables are chosen to represent various financial dimensions—profitability, liquidity, capital structure, and market valuation—providing a robust framework to understand the factors influencing NPM in the context of M&A activities.

|

Variable Name |

Variable Description |

Source |

|

Net Profit Margin |

Dependent Variable |

Agbata, AE., Osingor, AS., Ezeala, G. (2021), Nabi, AA. (2014), Razak, M., Ribo, A., Zainal, FR. (2022), Nalurita, F. (2016). |

|

Basic EPS |

Independent Variable |

Nabi, AA. (2014)., Chalise, DR., Adhikari, NR. (2022)., Nalurita, F. (2016)., Hussein, A. (2020). |

|

Return on Assets (ROA) |

Independent Variable |

Nelson, J., Peter, EA. (2019)., Razak, M., Ribo, A., Zainal, FR. (2022)., Ogunmakin, AA., Adebayo, AI. (2022)., Senan, NAM., Ahmad, A., Anagreh, S., Tabash, MI. (2021). |

|

Net Profit/Share |

Independent Variable |

A Husna, I Satria (2019)., WP Har, MAA Ghafar (2015), AT Atidhira, AI Yustina (2017)., I El?Sayed Ebaid (2009). |

|

Return on Networth/Equity (ROE) |

Independent Variable |

Khadka, KK. (2022)., Pal, S. (2022)., Nalurita, F. (2016)., Hussein, A. (2020). |

|

Return on Capital Employed (ROCE) |

Independent Variable |

A Husna, I Satria (2019)., T Javed, W Younas, M Imran (2014)., W Khan, A Naz, M Khan, WKQ Khan (2013), HT Nguyen, AH Nguyen (2020). |

|

Return on Assets (%) |

Independent Variable |

Z Ahmad, NMH Abdullah, S Roslan (2012)., LD Brown, ML Caylor (2009)., SO Kajola (2008)., G Gong, H Louis, AX Sun (2008). |

|

Total Debt/Equity |

Independent Variable |

PG Liargovas, KS Skandalis (2010)., DMA Rouf (2015)., H Muhammad, B Shah (2014)., A Chowdhury, SP Chowdhury (2010). |

|

Current Ratio |

Independent Variable |

D Martani, R Khairurizka (2009)., VT Quy, LTM Nguyen (2020)., RA Novison, CT Setyorini (2022)., L Fangohoi, S Yuniarti, H Respati (2023). |

|

Quick Ratio |

Independent Variable |

B Namalathasan (2010)., WB Utami (2017)., K Taani (2011)., RA Novison, CT Setyorini (2022). |

|

Enterprise Value |

Independent Variable |

M Anwaar (2016)., A Gill, N Biger, HS Mand, N Mathur (2013). |

|

Earnings Yield |

Independent Variable |

M Anwaar (2016)., R Bauer, N Guenster, R Otten (2004)., TR Khan, MR Islam, TT Choudhury, AM Adnan (2014), OW Ibhagui, FO Olokoyo (2018). |

Table I: Variables List

C. Data Collected

The dataset used in this research comprises a variety of financial metrics that provide a comprehensive view of firm performance across multiple dimensions. First, per-share ratios are included to assess the company's earnings on a per-share basis, with Basic Earnings Per Share (EPS) serving as a key metric. This ratio reflects the portion of a company's profit allocated to each outstanding share, offering insight into shareholder value. Additionally, profitability ratios play a crucial role in measuring the efficiency with which a firm generates profits from its operations. Among these, the Net Profit Margin expresses the percentage of revenue that remains as profit after all expenses have been deducted, providing a direct measure of operational success. The dataset also captures the Return on Net Worth (ROE) and Return on Capital Employed (ROCE), which evaluate a firm's ability to generate profits from its equity and overall capital, respectively. Furthermore, Return on Assets (ROA) is included to gauge how effectively a company utilizes its assets to generate earnings. In addition to profitability, liquidity ratios are included to assess the firm's ability to meet short-term obligations. The Current Ratio measures the company's ability to cover its short-term liabilities with its short-term assets, while the Quick Ratio excludes inventory from the calculation, offering a more conservative view of liquidity.

These ratios are critical in evaluating the firm's financial health and operational flexibility, particularly in times of economic stress. Lastly, the dataset incorporates valuation ratios, which provide insights into the company's market value relative to key financial indicators. The Enterprise Value (EV), expressed in crores (Cr.), reflects the total value of the firm, considering both its market capitalization and debt levels, thus offering a holistic view of the firm's valuation. Additionally, Earnings Yield is included to measure the return on investment for shareholders, expressed as a percentage of earnings per share relative to the share price. Together, these financial metrics form the foundation for analyzing the impact of mergers and acquisitions (M&A) on firm performance in this study, capturing profitability, liquidity, and valuation dimensions that are crucial for a comprehensive assessment of post-merger financial outcomes.

D. Data Structure

The dataset consists of time-series data across multiple firms that have undergone M&A events, categorized by merger size (small, medium, and large). The panel structure allows for the analysis of how firm performance metrics evolve over time due to M&A activities. The dataset includes financial metrics collected from the firm's post-merger to ensure the analysis captures the long-term effects of M&A transactions. The data spans multiple years following the mergers, allowing for a detailed examination of the sustained impact on firm performance. This time frame enables the study to assess both immediate and delayed changes in profitability, offering insights into how mergers influence key financial indicators over time. The cross-sectional aspect of this study captures variations between firms of different sizes, providing insights into how small, medium, and large firms respond to M&A events. The longitudinal dimension examines changes within each firm over time, comparing firm performance in the pre and post-M&A periods. This combined approach offers a comprehensive understanding of both firm-specific changes and industry-wide differences in the impact of M&A on financial performance. A panel data approach regression will be used to investigate the long-term effects of mergers and acquisitions (M&As) on firm performance, specifically focusing on Net Profit Margin (NPM) as the dependent variable. This approach allows us to analyze both cross-sectional and time-series data, examining how firms of different sizes (small, medium, and large) perform across multiple years post-merger. The analysis will help identify trends and relationships between M&A events and financial performance over time.

E. Software

The regression analysis is been conducted using Microsoft Excel, applying a panel data approach to estimate relationships between M&A events and financial performance metrics, such as Earnings Per Share (EPS), Net Profit Margin (NPM), and Return on Assets (ROA). While Excel is not traditionally used for advanced panel data analysis, its functionality is sufficient for applying this approach to meet the study's objectives and provide meaningful insights.

F. Expected Outcome

The results of the panel data approach regression are anticipated to yield significant insights into the impact of mergers and acquisitions (M&As) on firm financial performance across various sizes of firms. This analysis primarily aims to evaluate whether M&A events exert a statistically significant influence on Net Profit Margin (NPM), while also considering other key financial performance metrics. By examining the magnitude and direction of these effects in relation to firm size, the analysis will offer a nuanced understanding of how different firms experience M&A-driven changes in financial outcomes. Furthermore, the regression will help identify which financial ratios, such as Return on Equity (ROE), Return on Assets (ROA), and Current Ratio (CR), are most sensitive to the occurrence of M&A activities, shedding light on the specific financial dimensions that are most affected by such corporate restructuring events. The panel data approach enhances the analysis by facilitating the assessment of financial performance over a multi-year period, thus providing a more comprehensive evaluation of both immediate and long-term post-merger effects. This temporal aspect is critical for understanding whether the benefits or challenges brought on by M&As are persistent, gradual, or subject to dissipation over time. Through this in-depth approach, the study aims to contribute meaningfully to the broader discourse on the long-term implications of M&As on firm performance, with a particular focus on how these transactions reshape financial metrics over time.

G. Mathematical Model

This study investigates the long-term impact of mergers and acquisitions (M&As) on firm performance within the pharmaceutical industry, using Net Profit Margin (NPM) as the primary measure of post-merger financial performance.

To assess the relationship between NPM and key financial indicators, it employs a Multiple Linear Regression model, which is well-suited for analyzing the effects of multiple independent variables on a single dependent variable.

The regression model can be expressed as follows:

NPMi?=β0?+β1?⋅EPSi?+β2?⋅ROAi?+β3?⋅Net Profiti? +β4?⋅ROEi?+β5?⋅ROCEi?+β6?⋅Debt/Equityi?+β7?⋅Current Ratioi?+β8?⋅Quick Ratioi ?+β9? ⋅Enterprise Valuei?+β10?⋅Earnings Yieldi?+?

Where:

- NPMi is the Net Profit Margin for company i.

- β0 ? is the intercept (the predicted value of NPM when all independent variables are zero).

In this equation, Net Profit Margin (NPM) represents the dependent variable, reflecting the percentage of revenue that a company retains as profit after accounting for all operating expenses. The independent variables include a series of key financial ratios and metrics that are hypothesized to influence firm profitability after an M&A event. Basic Earnings Per Share (EPS): EPS measures the portion of a company's profit allocated to each outstanding share of common stock. It is a crucial indicator of profitability from a shareholder's perspective.

Return on Assets (ROA): measures how efficiently a company uses its assets to make profit. It is calculated as net income divided by total assets, providing insights into how well a firm converts its investments into earnings. Net Profit: The overall profit after all expenses have been deducted from revenue, which serves as a direct measure of financial performance. Return on Equity (ROE): ROE assesses the profitability of a firm relative to shareholders' equity. It reflects how effectively management is using a company’s equity to generate profits.

Return on Capital Employed (ROCE): ROCE measures the return that a company is generating from its capital. It is a critical metric for evaluating the efficiency of capital utilization post-merger. Debt to Equity Ratio: This ratio provides a measure of a company’s financial leverage, showing the proportion of debt relative to shareholders' equity. It offers insights into a firm’s risk exposure in terms of financing. Current Ratio: A liquidity ratio that measures a company’s ability to pay short-term obligations, providing an indication of short-term financial health. Quick Ratio: Another liquidity ratio, the quick ratio assesses a company’s ability to meet short-term liabilities with its most liquid assets, excluding inventory. Enterprise Value (EV): EV is a comprehensive measure of a company's total value, including market capitalization, debt, and cash. It reflects the market's view of a firm's valuation. Earnings Yield: This ratio is the inverse of the price-to-earnings ratio and indicates the return on investment for shareholders, expressed as a percentage of earnings. Each independent variable in the model is assigned a corresponding coefficient βn? that quantifies its impact on the dependent variable, NPM. The coefficients β1,…,β10 represent the expected change in NPM for a one-unit change in the respective independent variable, holding all other factors constant. The intercept β0? captures the predicted value of NPM when all independent variables are zero, while the error term ?i accounts for unobserved factors or random fluctuations that may influence NPM but are not included in the model.

H. Interpretation of the Regression Coefficients

The magnitude and sign of each coefficient βn? provide valuable insights into the relationship between the independent variables and the Net Profit Margin. A positive coefficient indicates that as the independent variable increases, NPM is expected to increase, signaling a positive influence on firm profitability. Conversely, a negative coefficient suggests that an increase in the independent variable leads to a decrease in NPM, pointing to a negative impact on profitability. By estimating these coefficients through regression analysis, it can determine which financial metrics most strongly predict changes in NPM following an M&A. This approach allows us to identify key drivers of long-term profitability within the pharmaceutical industry post-merger.

I. Model Validation

After performing the regression analysis, several statistical measures will be used to validate the model. The R-squared value will indicate the proportion of variance in NPM that is explained by the independent variables collectively. Additionally, the p-values of the coefficients will be examined to determine the statistical significance of each predictor. Variables with a p-value less than 0.05 will be considered significant contributors to the variation in NPM. Lastly, multicollinearity will be checked using the Variance Inflation Factor (VIF) to ensure that the independent variables are not highly correlated with one another, which could distort the regression results.

|

Statistic |

Value |

|

Multiple R |

0.855447 |

|

R Square |

0.731789 |

|

Adjusted R Square |

0.717796 |

|

Standard Error |

8.742028 |

|

Observations |

122 |

Table II: Summary Statistics for the Regression Model

|

Source of Variation |

df |

SS |

MS |

F |

Significance F |

|

Regression |

6 |

23979.08 |

3996.513 |

52.2946 |

1.29E-30 |

|

Residual |

115 |

8788.651 |

76.42305 |

|

|

|

Total |

121 |

32767.73 |

|

|

|

Table III: ANOVA Table

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

|

Intercept |

3.41467 |

2.36892 |

1.441446 |

0.152176 |

|

ROE |

0.130442 |

0.060794 |

2.145634 |

0.034005 |

|

ROCE |

-0.67323 |

0.172537 |

-3.90196 |

0.000161 |

|

ROA |

2.371341 |

0.218759 |

10.83996 |

2.73E-19 |

|

DE |

-1.34143 |

0.469215 |

-2.85889 |

0.005049 |

|

CR |

-8.91477 |

3.285212 |

-2.71361 |

0.00768 |

|

QR |

8.928431 |

3.650308 |

2.445939 |

0.015962 |

Table IV: Coefficients and Standard Error

The results from the panel data approach regression reveal several key insights into the impact of mergers and acquisitions (M&A) on firm performance. The model's R-squared value of 73.18% indicates that a substantial portion of the variation in Net Profit Margin (NPM) is explained by the independent variables, suggesting that the selected financial ratios are effective in capturing the drivers of profitability across firms. The ANOVA results, with an F-statistic of 52.29 and a significance level of 1.29E-30, confirm that the regression model is statistically significant, meaning that the independent variables, when taken together, have strong predictive power for NPM. In terms of specific variables, several independent variables demonstrate statistically significant relationships with NPM. Return on Equity (ROE) has a positive and significant effect, where a 1% increase in ROE leads to a 0.13 unit increase in NPM. This indicates that firms with higher profitability relative to shareholder equity tend to see improved profit margins post-M&A. On the other hand, Return on Capital Employed (ROCE) shows a negative relationship with NPM, where a 1% increase in ROCE decreases NPM by 0.67 units. This counterintuitive finding suggests that firms may experience inefficiencies in capital management post-merger, or that higher capital costs outweigh the potential benefits. Meanwhile, Return on Assets (ROA) has a strong positive effect, with a 1% increase leading to a 2.37 unit increase in NPM, implying that firms that effectively utilize their assets post-merger experience significant improvements in profitability.

The Debt to Equity (DE) ratio has a negative impact on NPM, where a 1-unit increase in DE reduces NPM by 1.34 units. This suggests that firms with higher leverage post-merger struggle with profitability, likely due to increased financial risk and higher interest obligations. Similarly, the Current Ratio (CR) has a surprising negative effect on NPM, where an increase in liquidity, as measured by CR, results in a significant reduction in profitability.

This could indicate inefficiencies in holding excess liquidity post-merger, which might hinder a firm's ability to generate profits. In contrast, the Quick Ratio (QR) has a positive and significant impact, with a 1-unit increase leading to an 8.93-unit increase in NPM. This implies that firms with higher liquidity, excluding inventory, tend to perform much better post-M&A, likely because they maintain an optimal balance of liquid assets. In terms of non-significant variables, the intercept has a p-value of 0.152176, suggesting that without the influence of the independent variables, there is no significant baseline change in NPM. Overall, the findings of the regression highlight several important conclusions regarding the impact of M&A on firm performance. Firms that efficiently generate profits from their equity and assets, as reflected by ROE and ROA, tend to have higher post-merger profitability. However, firms with higher leverage, as measured by DE, face challenges in maintaining profitability due to increased financial obligations.

Additionally, the negative coefficient for ROCE suggests that firms may struggle to efficiently use their capital post-merger, especially if their capital costs are too high. Finally, the contrasting effects of CR and QR on profitability indicate that while holding too much liquidity can reduce NPM, maintaining efficient short-term assets, as shown by QR, leads to better post-merger performance.

Firms that can effectively manage their assets, liquidity, and debt levels are more likely to experience improved long-term financial performance after mergers.

J. Result of Regression Applied on Panel Data Approach

The panel data regression analysis conducted in Excel provides several key insights into the long-term impact of mergers and acquisitions (M&As) on the profitability of pharmaceutical firms. The results highlight the positive influence of efficiency metrics such as Return on Equity (ROE) and Return on Assets (ROA) on Net Profit Margin (NPM) post-merger. This indicates that firms with better asset utilization and higher profitability tend to experience improved financial performance after M&A activities, making efficiency crucial for successful mergers in the pharmaceutical sector. On the other hand, firms with higher Debt to Equity (DE) ratios showed a significant decline in NPM, suggesting that excessive leverage can undermine profitability. This may be attributed to the increased financial risk and interest obligations associated with higher debt levels, which can strain a firm's post-merger financial health.

Additionally, the analysis points to the importance of capital efficiency, as evidenced by the negative relationship between Return on Capital Employed (ROCE) and NPM. This suggests that firms struggling to allocate their capital efficiently may see a decline in profitability, highlighting the need for effective capital utilization to achieve sustainable growth post-merger. Liquidity management also plays a crucial role, with the findings showing that while high Current Ratios (CR) do not necessarily translate into higher profitability, maintaining a healthy Quick Ratio (QR) is essential. A higher QR, which reflects efficient management of short-term assets, is positively associated with improved profitability. These results underscore the importance of balancing leverage, capital efficiency, and liquidity management to ensure long-term financial success following M&A transactions in the pharmaceutical industry.

K. Model Validation and Correlation Analysis

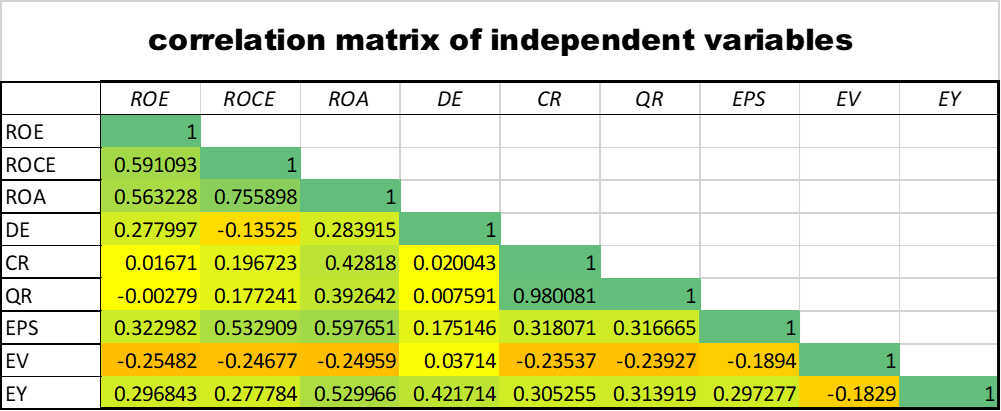

To validate the multicollinearity between the independent variables in the research model examining the long-term effects of mergers and acquisitions, a correlation matrix was constructed using data from key financial ratios.

The primary purpose of this correlation matrix is to identify the strength and direction of the linear relationships between the variables.

The correlation coefficients range from -1 to 1, where values close to 1 indicate a strong positive relationship, values close to -1 indicate a strong negative relationship, and values around 0 suggest no linear relationship. To ensure the robustness of the model, it is essential to evaluate whether any independent variables exhibit strong correlations (above 0.8 or below -0.8), which could signal multicollinearity issues.

Fig. 1: Correlation Matrix

L. Mathematical Formula for Correlation Coefficient

The mathematical formula used to calculate the Pearson correlation coefficient r between two variables X and Y is:

rXY=∑xi-xyi-y∑xi-x2Σyj-y2

Where:

- Xi and Yi? are the individual data points for the variables X and Y.

- x? and ? are the means of the variables X and Y

- The numerator represents the covariance of X and Y, and the denominator normalizes the covariance by the standard deviations of X and Y.

This formula measures the linear relationship between two variables, providing a value between -1 and 1.

M. Results and Interpretation of Correlation Matrix

ROCE and ROA show a strong positive correlation of 0.76, indicating that these two profitability ratios tend to move together. This is expected since both variables reflect company profitability, with ROA focusing on asset returns and ROCE on capital employed. CR and QR display a near-perfect correlation of 0.98, suggesting that these two liquidity ratios measure very similar aspects of the firm's liquidity profile. Since both ratios are close to each other in definition (with the primary difference being the exclusion of inventories in QR), this high correlation is justified. ROE and ROCE have a moderately strong positive correlation of 0.59, indicating that while these two ratios measure different aspects of profitability (equity and capital employed, respectively), they often align in their trends. DE (Debt to Equity) does not exhibit strong correlations with any of the other variables, indicating that leverage in firms tends to behave independently from the liquidity and profitability ratios in this dataset. EV (Enterprise Value) shows weak correlations with most variables, the highest being its negative relationship with ROE (-0.25), implying that higher enterprise values may coincide with lower equity returns in the firms studied. The highest negative correlation in the matrix is observed between EV and ROA (-0.25), suggesting that as enterprise value grows, the returns on assets tend to decrease slightly, potentially due to increasing firm size reducing the efficiency of asset utilization. None of the correlations exceed 0.8 (except for CR and QR), suggesting that multicollinearity is not a significant issue in this dataset, aside from the near redundancy between CR and QR, which may necessitate further consideration in model design.

N. Model Validation and VIF Analysis

To ensure the robustness of the regression model used to analyze the long-term effects of mergers and acquisitions, the issue of multicollinearity between the independent variables was tested using the Variance Inflation Factor (VIF). Multicollinearity occurs when independent variables are highly correlated, which can distort the coefficients in a regression model and lead to unreliable results. The VIF measures the degree of correlation between each independent variable and the other variables in the model. Higher VIF values suggest a higher level of multicollinearity. A rule of thumb is that a VIF exceeding 10 indicates serious multicollinearity problems that may require corrective action, such as removing variables or combining them.

|

Variables |

R Square |

Variance Inflation Factor |

|

ROE |

54% |

2.151 |

|

ROCE |

82% |

5.487 |

|

ROA |

91% |

10.653 |

|

Debt/Equity |

72% |

3.617 |

|

Current Ratio |

97% |

30.115 |

|

Quick Ratio |

97% |

29.04 |

|

EPS |

43% |

1.741 |

|

Enterprise Value |

15% |

1.173 |

|

Earnings Yield |

40% |

1.668 |

Table V: Variance Inflation Factor (VIF)

O. Mathematical Formula for VIF Calculation

The mathematical formula for the Variance Inflation Factor (VIF) is derived from the R-squared value of an independent variable regressed against all other independent variables:

VIF=1(1-R2)

Where:

R2 is the R-squared value obtained from regressing a particular independent variable against the remaining independent variables in the model.

This formula essentially measures how much the variance of an estimated regression coefficient increases due to multicollinearity.

P. Variance Inflation Factor (VIF) Results

ROA (Return on Assets) has the highest VIF value of 10.653, indicating significant multicollinearity with other variables. This suggests that ROA is highly correlated with other variables in the model, potentially affecting the accuracy of its coefficient estimation.

Current Ratio and Quick Ratio exhibit extremely high VIF values of 30.115 and 29.04, respectively. These liquidity ratios are nearly redundant, as their correlation with each other and other variables in the model is very strong. This level of multicollinearity suggests that one of these ratios should be excluded from the model to avoid redundancy and instability in the regression analysis. ROCE (Return on Capital Employed) shows a VIF of 5.487, which is below the threshold of 10 but still moderately high, suggesting some degree of multicollinearity.

Careful consideration should be given to whether it remains in the model or needs adjustment. Other variables, such as Enterprise Value (1.173), Earnings Yield (1.668), and EPS (1.741), exhibit very low VIF values, indicating little to no multicollinearity and suggesting that they can remain in the model without causing instability. Debt/Equity also has a moderate VIF of 3.617, suggesting that its collinearity is manageable, but it may still need to be monitored. Based on these results, the variables ROA, Current Ratio, and Quick Ratio present significant multicollinearity, which could distort the model's results. Appropriate adjustments should be considered, such as removing or combining highly correlated variables.

Q. Model Validation and Breusch-Pagan Test for Heteroscedasticity

In this section, we focus on diagnosing heteroscedasticity in the regression model used to evaluate the long-term effects of mergers and acquisitions (M&A). Heteroscedasticity occurs when the variance of the residuals (errors) in a regression model is not constant, violating one of the key assumptions of the ordinary least squares (OLS) method. The presence of heteroscedasticity can lead to inefficient estimates, inflated standard errors, and unreliable hypothesis testing results. To test for heteroscedasticity, the Breusch-Pagan (BP) test was performed, as it is a widely accepted method for detecting heteroscedasticity in regression models. The BP test involves regressing the squared residuals from the original model on the independent variables and evaluating whether the variance of the residuals changes systematically with the predictors. The regression model was estimated using the independent variables to predict the dependent variable. The residuals were extracted from this regression. Obtain Residuals: The residuals were squared to capture their variance, which is the key variable in the auxiliary regression. An auxiliary regression was performed, where the squared residuals from the original model were regressed on the same independent variables.

The R-squared value from this auxiliary regression was then used to calculate the Lagrange Multiplier (LM) statistic. The Breusch-Pagan test statistic (LM) is calculated using the following formula:

LM=n×R2

Where

-

- n is the number of observations,

- R² is the R-squared value from the auxiliary regression.

|

Statistic |

Value |

|

Multiple R |

0.491451 |

|

R Square |

0.241524 |

|

Adjusted R Square |

0.180575 |

|

Standard Error |

191.4667 |

|

Observations |

122 |

Table VI: Auxiliary Regression

|

Source of Variation |

df |

SS |

MS |

F |

Significance F |

|

Regression |

9 |

1307441.571 |

145271.3 |

3.962721 |

0.000207 |

|

Residual |

112 |

4105861.893 |

36659.48 |

|

|

|

Total |

121 |

5413303.463 |

|

|

|

Table VII: ANOVA Table

|

|

Coefficients |

Standard Error |

t Stat |

P-value |

|

Intercept |

76.486 |

57.728

|

-1.324

|

0.187 |

|

ROE |

-3.298 |

1.367 |

-2.411 |

0.017 |

|

ROCE |

18.075 |

3.9067 |

4.626 |

1.00373E-05 |

|

ROA |

-21.836 |

4.984 |

-4.380 |

2.67661E-05 |

|

DE |

36.828 |

10.997 |

3.348 |

0.0011 |

|

CR |

32.798 |

73.073 |

0.448 |

0.654 |

|

QR |

11.487 |

82.160 |

0.1398 |

0.889 |

|

EPS |

-0.214 |

0.556 |

-0.386 |

0.699 |

|

EV |

0.0011 |

0.0005 |

2.221 |

0.0283 |

|

EY |

142.731 |

267.764 |

0.533 |

0.595 |

Table VIII: Coefficients and Standard Error

The result is then compared to a chi-square distribution with degrees of freedom equal to the number of independent variables. If the test statistic is statistically significant, it suggests the presence of heteroscedasticity.

R. Breusch-Pagan Test Results

The results of the auxiliary regression are presented below:

- R-squared from the auxiliary regression: 0.2415

- Number of observations (n): 122

The Lagrange Multiplier statistic (LM) is calculated as follows

LM = 122*0.2415 = 29.4659

Next, we compare the LM statistic to the critical value from the chi-square distribution to determine the statistical significance of the result. Using the chi-square distribution with appropriate degrees of freedom (in this case, the number of independent variables), we calculate the p-value as:

p-value = CHISQ.DIST. RT(29.4659, df)

The p-value obtained from the chi-square distribution is 0.00054, which is well below the conventional significance level of 0.05.

Mathematical Formula for the Breusch-Pagan Test

The mathematical formula for the Breusch-Pagan test is given by:

LM=n×R2

Where:

- n is the number of observations (in this case, n=122)

- R2 is the R-squared value from the auxiliary regression (in this case, R2 = 0.2415)

S. Interpretation Heteroscedasticity Test Result

The Breusch-Pagan test statistic yielded a p-value of 0.00054, which is significantly less than the threshold of 0.05. Therefore, we reject the null hypothesis that the variance of the residuals is constant (homoscedasticity). The result suggests strong evidence of heteroscedasticity in the model, meaning that the variance of the residuals is not constant across observations. This violation of the OLS assumption implies that the standard errors of the estimated coefficients may be biased, potentially leading to incorrect inferences in hypothesis testing. As a result, remedial measures such as using robust standard errors or transforming the data may be necessary to correct for heteroscedasticity and ensure the reliability of the regression results.

IV. FINAL RESULTS AND IMPLICATIONS

In this research paper, we examine the long-term impacts of mergers and acquisitions (M&As) within the pharmaceutical industry, utilizing a variety of financial metrics and statistical tests. Our analysis focuses on three key areas: panel data regression results, correlation matrix outcomes, and diagnostic tests for multicollinearity (VIF) and heteroscedasticity (Breusch-Pagan test). Each section plays a critical role in understanding how post-merger performance is influenced by different financial factors. The panel data regression indicated significant relationships between key variables and post-merger profitability, particularly focusing on Net Profit Margin (NPM) as the primary measure of success. Both Return on Assets (ROA) and Return on Equity (ROE) emerged as strong drivers of post-merger profitability. Higher ROA and ROE values correlate with greater efficiency in utilizing resources, reflecting the ability of firms to integrate assets effectively and capitalize on synergies. These metrics suggest that firms that focus on operational efficiency post-merger are better positioned to realize financial gains. However, the debt-to-equity (D/E) ratio showed a negative impact on post-merger profitability, indicating that excessive reliance on debt financing can erode long-term financial health. The findings imply that pharmaceutical companies that leverage M&As as part of their growth strategy must strike a balance between financing options, as higher levels of debt could impose financial strain and limit profitability in the long run. Moving to liquidity management, the study finds significant distinctions between the Current Ratio (CR) and the Quick Ratio (QR). While both ratios assess liquidity, the QR emerged as a stronger predictor of long-term profitability. This suggests that pharmaceutical firms benefit more from effective management of short-term assets that are quickly convertible into cash, such as receivables, rather than maintaining high levels of inventory.

The correlation matrix revealed significant positive correlations between efficiency metrics like ROA and NPM, further supporting the notion that better resource management drives profitability. However, the matrix also highlighted strong correlations between liquidity ratios, such as the Current and Quick Ratios, indicating potential redundancy. This necessitated the use of the Variance Inflation Factor (VIF) to diagnose multicollinearity. The VIF analysis revealed substantial multicollinearity among several variables. ROA, with a VIF value of 10.653, indicates significant correlation with other variables, potentially inflating standard errors and reducing the reliability of coefficient estimates.

Both Current Ratio and Quick Ratio exhibited extremely high VIF values of 30.115 and 29.04, respectively, confirming the need to exclude one of them to reduce redundancy. Other variables like ROCE had moderately high VIF values, suggesting potential collinearity that may need careful consideration during interpretation. In contrast, variables like Enterprise Value, Earnings Yield, and EPS had low VIF values, indicating no significant multicollinearity and confirming their suitability for the model. Finally, the Breusch-Pagan test for heteroscedasticity indicated the presence of heteroscedasticity in the model. With a p-value of 0.00054, the null hypothesis of constant variance was rejected, suggesting that variance across residuals was not uniform. This finding implies that the standard errors of the model may be biased, necessitating the use of heteroscedasticity-robust standard errors to ensure the reliability of results.

V. DISCUSSION

The findings of this study offer crucial insights into the long-term implications of mergers and acquisitions (M&As) within the pharmaceutical sector. At the core of these insights lies the pivotal role of efficient asset utilization and prudent financial management in driving sustained profitability in the post-merger landscape. The strong relationship between profitability, as measured by net profit margin (NPM), and both return on assets (ROA) and return on equity (ROE) underscores the significance of resource efficiency in the post-merger integration process. Firms that are adept at effectively managing their assets and equity are better positioned to capitalize on the synergies created by the merger, leading to enhanced operational performance and financial outcomes. However, the study also highlights a cautionary note – the negative impact of high debt levels, as indicated by the debt-to-equity (D/E) ratio. While debt financing can be a crucial tool for funding M&As, excessive leverage can strain a firm's financial resources and limit its ability to realize long-term gains. This is particularly pertinent for pharmaceutical companies, where research and development investments and regulatory hurdles can be capital-intensive. Firms must therefore strike a careful balance in their capital structure, considering the long-term implications of debt on profitability.

The study further emphasizes the importance of liquidity management in the context of M&As. The Quick Ratio, which measures a firm's ability to meet short-term obligations without relying on inventory, emerged as a critical predictor of long-term profitability. This finding highlights the need for firms to maintain flexibility in their liquidity management post-merger. While adequate liquidity is essential for ensuring that firms can navigate unexpected challenges, excessive liquidity that is not efficiently deployed may not contribute to profitability. Pharmaceutical firms should therefore focus on optimizing their working capital, striking a balance between maintaining sufficient liquidity to meet obligations and investing in growth opportunities. The analysis also revealed significant multicollinearity between certain variables, particularly ROA and liquidity ratios. This finding suggests that some financial metrics may be redundant in the context of predicting long-term profitability. For instance, the high correlation between the Current and Quick Ratios indicates that one of these variables should be excluded from the regression model to avoid multicollinearity and improve the accuracy of the estimates. Additionally, the high VIF values associated with ROA suggest that this variable may be capturing information already explained by other variables in the model, necessitating adjustments or alternative specifications in future studies. Lastly, the presence of heteroscedasticity in the model, as revealed by the Breusch-Pagan test, emphasizes the need for carefully interpreting the results.

V. DISCUSSION

The findings of this study offer crucial insights into the long-term implications of mergers and acquisitions (M&As) within the pharmaceutical sector. At the core of these insights lies the pivotal role of efficient asset utilization and prudent financial management in driving sustained profitability in the post-merger landscape. The strong relationship between profitability, as measured by net profit margin (NPM), and both return on assets (ROA) and return on equity (ROE) underscores the significance of resource efficiency in the post-merger integration process. Firms that are adept at effectively managing their assets and equity are better positioned to capitalize on the synergies created by the merger, leading to enhanced operational performance and financial outcomes. However, the study also highlights a cautionary note – the negative impact of high debt levels, as indicated by the debt-to-equity (D/E) ratio. While debt financing can be a crucial tool for funding M&As, excessive leverage can strain a firm's financial resources and limit its ability to realize long-term gains. This is particularly pertinent for pharmaceutical companies, where research and development investments and regulatory hurdles can be capital-intensive. Firms must therefore strike a careful balance in their capital structure, considering the long-term implications of debt on profitability.

The study further emphasizes the importance of liquidity management in the context of M&As. The Quick Ratio, which measures a firm's ability to meet short-term obligations without relying on inventory, emerged as a critical predictor of long-term profitability. This finding highlights the need for firms to maintain flexibility in their liquidity management post-merger. While adequate liquidity is essential for ensuring that firms can navigate unexpected challenges, excessive liquidity that is not efficiently deployed may not contribute to profitability. Pharmaceutical firms should therefore focus on optimizing their working capital, striking a balance between maintaining sufficient liquidity to meet obligations and investing in growth opportunities. The analysis also revealed significant multicollinearity between certain variables, particularly ROA and liquidity ratios. This finding suggests that some financial metrics may be redundant in the context of predicting long-term profitability. For instance, the high correlation between the Current and Quick Ratios indicates that one of these variables should be excluded from the regression model to avoid multicollinearity and improve the accuracy of the estimates. Additionally, the high VIF values associated with ROA suggest that this variable may be capturing information already explained by other variables in the model, necessitating adjustments or alternative specifications in future studies. Lastly, the presence of heteroscedasticity in the model, as revealed by the Breusch-Pagan test, emphasizes the need for carefully interpreting the results.

Conclusion

This comprehensive analysis of the long-term effects of mergers and acquisitions (M&As) within the pharmaceutical industry offers invaluable empirical insights, shedding light on the critical financial drivers that determine the success of these strategic initiatives. By delving deep into the intricate web of profitability, asset efficiency, liquidity management, and capital structure, the findings of this research provide a robust framework for corporate leaders and policymakers alike to navigate the complexities of M&A transactions with a heightened sense of strategic acumen. At the heart of the study\'s conclusions lies the unequivocal importance of operational synergies and efficient asset utilization in the post-merger landscape. The strong positive correlation between profitability, as measured by net profit margin (NPM), and the key financial metrics of return on equity (ROE) and return on assets (ROA) underscores the pivotal role of resource optimization in driving sustained success. Firms that demonstrate the ability to seamlessly integrate newly acquired resources and leverage their existing capabilities are poised to reap the rewards of enhanced operational performance and financial outcomes. This insight serves as a clarion call for corporate leaders to prioritize the strategic alignment of assets and the meticulous execution of post-merger integration plans, ensuring that the full potential of M&As is unlocked and translated into tangible gains. However, the study also sounds a note of caution, highlighting the perils of excessive debt financing, as evidenced by the negative impact of a high debt-to-equity (D/E) ratio on profitability. For pharmaceutical companies, where capital-intensive research and development (R&D) investments and stringent regulatory hurdles are the norm, striking the right balance in the capital structure is paramount. Firms must exercise financial discipline and prudent risk management, carefully weighing the trade-offs between the benefits of debt financing and the potential long-term constraints it may impose on their ability to invest in innovation and growth. This finding aligns with the broader consensus that M&A strategies should be underpinned by a thoughtful consideration of the optimal capital structure, one that enables firms to capitalize on synergies while maintaining financial flexibility and resilience. Complementing the insights on asset efficiency and capital structure, the research also sheds light on the pivotal role of liquidity management in the context of M&As. The study\'s revelation that the Quick Ratio (QR), a more rigorous measure of short-term liquidity, emerges as a stronger predictor of long-term profitability than the traditional Current Ratio (CR) highlights the importance of agile and well-orchestrated working capital management. Pharmaceutical firms navigating the post-merger landscape must maintain a delicate balance, ensuring that they hold sufficient liquidity to weather unexpected challenges and seize growth opportunities, while avoiding the potential pitfalls of excessive liquidity that may not contribute directly to profitability. This finding underscores the need for corporate leaders to develop a nuanced understanding of their firms\' unique liquidity requirements, tailoring their working capital strategies to the specific demands of the post-merger environment. By optimizing liquidity management, these firms can fortify their financial foundations and enhance their ability to capitalize on the synergies unlocked by M&As. The analysis of multicollinearity using Variance Inflation Factors (VIF) further reinforces the importance of thoughtful model specification, revealing potential redundancies in the use of certain financial metrics. The high VIF values associated with ROA, Current Ratio, and Quick Ratio suggest that future research should carefully consider the interplay between these variables, potentially excluding or combining them to improve the reliability of coefficient estimates and enhance the overall predictive power of the model. This methodological insight not only strengthens the rigor of the current study but also serves as a guidepost for future scholars exploring the complexities of M&A performance evaluation. Finally, the presence of heteroscedasticity, as identified by the Breusch-Pagan test, underscores the need for cautious interpretation of the results and the application of robust statistical techniques. By employing remedial measures, such as the use of robust standard errors, future researchers can ensure that their findings remain valid and reliable, even in the face of non-constant variance. The profound implications of this research extend far beyond the confines of academic discourse, serving as a practical roadmap for corporate leaders and policymakers navigating the turbulent waters of mergers and acquisitions. For corporate leaders, the insights gleaned from this study offer a compelling blueprint for strategic decision-making, empowering them to align their M&A strategies with the financial drivers of long-term success. By prioritizing efficient asset utilization, prudent capital structure management, and effective liquidity control, these firms can position themselves for sustained growth and profitability in the post-merger era. This knowledge equips them to make informed choices, striking a delicate balance between the pursuit of synergies and the mitigation of financial risks – a balance that is particularly crucial in the capital-intensive pharmaceutical industry. Moreover, the findings underscore the need for a holistic approach to M&A planning, one that seamlessly integrates operational, financial, and cultural considerations to maximize the benefits of these strategic initiatives. For policymakers, this research provides a deeper understanding of the systemic impacts of M&As on the pharmaceutical industry, offering valuable guidance for the development of regulatory frameworks that foster competition, encourage responsible financial practices, and safeguard the long-term viability of the sector. By striking the right balance between enabling corporate dynamism and ensuring financial stability, policymakers can create an environment that supports sustainable growth and innovation, ultimately benefiting both the industry and the broader economy. Building on these robust empirical findings, future research can further explore the multifaceted implications of M&As, delving into the broader impacts on non-financial metrics, such as innovation, market share, and organizational culture. By adopting a more holistic approach, scholars can paint a richer and more comprehensive picture of post-merger success, highlighting the intricate interplay between financial and non-financial drivers of performance. This expanded scope of inquiry can yield valuable insights that inform the development of more sophisticated, context-specific models for evaluating the long-term viability of M&A strategies. In conclusion, this groundbreaking research stands as a testament to the power of empirical analysis in unraveling the complex realities of mergers and acquisitions. By providing a deep dive into the financial underpinnings of post-merger success, the study equips both corporate leaders and policymakers with the knowledge and tools necessary to navigate the dynamic landscape of the pharmaceutical industry. As the global economy continues to be shaped by the ebb and flow of M&A activity, this research serves as a guiding light, illuminating the pathways to sustainable growth, financial stability, and competitive advantage. Through the lens of this comprehensive analysis, the pharmaceutical sector can chart a course towards a future where strategic alliances and transformative acquisitions are not merely financial transactions, but catalysts for lasting prosperity and innovation.

References

[1] Agundu, P.C. and Karibo, N.O. (1999), “Risk analysis in corporate mergers decisions in developing economies”, Journal of Financial Management and Analysis, Vol. 12 No. 2, pp. 13?17. [2] Birkinshaw, J., Bresman, H. and Hakanson, L. (2000), “Managing the post?acquisition integration process: how the human integration and task integration processes interact to foster value creation”, Journal of Management Studies, Vol. 37 No. 3, pp. 395?425. [3] Buono, A.F. (2003), “Seam?less post?merger integration strategies: a cause for concern”, Journal of Organizational Change Management, Vol. 16 No. 1, pp. 90?8. [4] Pawaskar, V. (2001), “Effects of mergers on corporate performance in India”, Vikalpa, Vol. 26 No. 1, pp. 19?32. [5] Vaara, E. (2002), “On the discursive construction of success/failure in narratives of post?merger integration”, Organisational Studies, Vol. 23 No. 2, pp. 211?48. [6] Vasilaki, A. and O\'Regan, N. (2008), “Enhancing post?acquisition organisational performance: the role of the top management team”, Team Performance Management, Vol. 14 Nos 3/4, pp. 134?45. [7] Vermeulen, F. and Bakerma, H. (2001), “Learning though acquisitions”, Academy of Management Journal, Vol. 44 No. 3, pp. 457?76. [8] Weston, J.F., Chung, K.S. and Hoag, S.E. (2000), Merger Restructuring and Corporate Control, 5th ed. reprint, Prentice Hall of India P. Ltd, New Delhi. [9] Gulati, P.A. and Garg, S. (2024), \"Impact of merger on stock returns and economic value added (EVA) of the acquiring firms: a study from Indian corporate sector\" [10] Alhenawi Y., Stilwell M. (2017). Value creation and the probability of success in merger and acquisition transactions. Review of Quantitative Finance and Accounting, 49(4), 1041–1085. [11] Andre P., Kooli M., L’Her J. F. (2004). The long-run performance of mergers and acquisitions: Evidence from the Canadian stock market. Financial Management, 33(4), 27–43. [12] Caiazza R., Volpe T. (2015). M&A process: A literature review and research agenda. Business Process Management Journal, 21(1), 205–220. [13] Fraser D. R., Zhang H. (2009). Mergers and long-term corporate performance: Evidence from cross-border bank acquisitions. Journal of Money Credit and Banking, 41(7), 1503–1513. [14] Kumar S., Bansal L. K. (2008). The impact of mergers and acquisitions on corporate performance in India. Management Decision, 46(10), 1531–1543. [15] Mantravadi P., Reddy A. V. (2008). Post-merger performance of acquiring firms from different industries in India. International Research Journal of Finance and Economics, 22, 193–204. [16] Singh F., Mogla M. (2008). Impact of mergers on profitability of acquiring companies. The ICFAI University Journal of Mergers& Acquisitions, V(2), 60–76. [17] Sinha N., Kaushik K. P., Chaudhary T. (2010). Measuring post-merger and acquisition performance: An investigation of select financial sector organizations in India. International Journal of Economics and Finance, 2(4), 190–200. [18] Trivedi J. C. (2013). A study on pre & post-performance evaluation of merger and acquisition of selected Indian banks. The Journal of Institute of Public Enterprise, 36(3–4), 97–111. [19] Walsh J. P. (1988). Top management turnover following mergers and acquisitions. Strategic Management Journal, 9(2), 173–183. [20] Kumar, R. (2009), \"Post?merger corporate performance: an Indian perspective\" [21] Agarwal, M. (2002). Analyses of mergers in India, M. Phil Dissertation, Delhi: University of Delhi. [22] Agrawal, A., Jaffe, J.F., & Mandelker, G.N. (1992). The post-merger performance of acquiring firms: A re-examination of an anomaly. Journal of Finance, 47(4), 1605-1621. [23] Anand, M., & Singh, J. (2008), Impact of merger announcements on shareholders wealth: Evidence from Indian private sector banks, Vikalpa: Journal for Decision Makers, 33(1), 35-54. [24] Fuad, M., Thakur, V. and Sinha, A.K. (2021), \"Family firms and their participation in cross-border acquisition waves: evidence from India\", Cross Cultural & Strategic Management, Vol. 28 No. 4, pp. 791-814. [25] Rani, N., Yadav, S.S. and Jain, P.K. (2015), \"Financial performance analysis of mergers and acquisitions: evidence from India\", International Journal of Commerce and Management, Vol. 25 No. 4, pp. 402-423. [26] Poddar, N. (2019) A Study on Mergers and Acquisition in India and Its Impact on Operating Efficiency of Indian Acquiring Company. Theoretical Economics Letters, 9, 1040-1052. [27] Tripathi, V. and Lamba, A. (2015), \"What drives cross-border mergers and acquisitions? A study of Indian multinational enterprises\", Journal of Strategy and Management, Vol. 8 No. 4, pp. 384-414 [28] Agnihotri, A. (2013), \"Determinants of acquisitions: an Indian perspective\", Management Research Review, Vol. 36 No. 9, pp. 882-898. [29] Demirbag, M., Ng, C. and Tatoglu, E. (2007), \"Performance of Mergers and Acquisitions in the Pharmaceutical Industry: A Comparative Perspective\", Multinational Business Review, Vol. 15 No. 2, pp. 41-62. [30] Sahu, S.K. and Agarwal, N. (2017), \"Inter-firm differences in mergers and acquisitions: a study of the pharmaceutical sector in India\", Journal of Economic Studies, Vol. 44 No. 5, pp. 861-878 [31] Agrawal, A., & Jaffe, J. F. (2003). Do takeover targets underperform? Evidence from operating and stock returns. Journal of Financial and Quantitative Analysis, 38(4), 721–746. [32] Bauer, F., Dao, M. A., Matzler, K., & Tarba, S. Y. (2017). How industry lifecycle sets boundary conditions for M&A integration. Long Range Planning, 50(4), 20–517

Copyright

Copyright © 2024 Veerendra Anchan, Shashwat Jhawar, Darshan Khanted, Surbhi Jani, Vanshita Vora. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64665

Publish Date : 2024-10-18

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online