Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

ML Based Finance Advisor and Budget Optimizer

Authors: Anurag Singh, Kiran Kumar Das, Pratik Mishra, Shahbaz Siddiki , Dr. Sharanabasava C Inamadar

DOI Link: https://doi.org/10.22214/ijraset.2024.65998

Certificate: View Certificate

Abstract

With the rapid change in the financial world, particularly today, the urgent demand for intelligent solutions to optimize the budget was therefore in great demand, individually as well as corporately. The paper proposes an advisory system for finance based on a cross-platform mobile application of Android and Flutter implementation of ml algorithm, which is designed to ana-lyze users\' financial data and come up with a personalized recommendation for budget optimization. The system can identify spending patterns, predict financial directions, and even propose cost-cutting initiatives by using ml algorithms that incorporate clustering and predictive analytics. It uses such core programming languages as Python in the design of the ml models and Dart through Flutter to give users a smooth, high-performance interface for Android and iOS. This makes it accessible and very easy to use to allow users to make real-time, data-driven financial decisions. The solution allows the users to maximize budgets in effective ways by reducing wastefulness and eventually leading towards financial stability. Demonstrated here is how ml-enhanced financial advisory applications have the potential to redesign personal and business finance management.

Introduction

I. INTRODUCTION

Financial stability is a very critical yet challenging objective in this current world. It has always been the desire of any user, whether an individual or a business, to develop helpful strategies for managing and optimizing budgets. Traditional techniques used in financial planning and advisory are usually cumbersome and, consequently not personalized, making it hard for the users to make well-informed real-time financial decisions. This has led to an increase in demand for intelligent accessible tools that can guide users toward smarter financial management.New avenues for financial advisory services have opened with the progress of ML technology. While data-driven algorithms are unlocking spending that lies hidden, predicting future expenditures, and providing suggestive individualized budgets to users based on this fact, ML-driven finance advisors might keep users empowered with actionable insights at their fingertips through ubiquity and convenience of mobile apps.

II. LITERATURE SURVEY

- Research Interest in Machine Learning (ML) Financial Advisory Services: The intersection of ml with financial advisory services has garnered special attention in the past few years mainly due to the latter's ability to increase efficiency in such financial management tools and individualize them according to necessity. This literature survey describes quite a number of studies and technological advancements regarding budget optimization, ML-driven financial advisory, and developing cross-platform financial applications with mobile development frameworks like Flutter.

- ML in Financial Advisory Systems: According to research, ml can find better spending behavior patterns, predict possible financial behaviors, and future trends for significant enhancement in financial advisory through supervised learning (including classification algorithms such as linear regressions) and unsupervised learning.

- Budget Optimization through ML Algorithm: For instance, Li et al. (2019) show how optimization methods triggered by the principles of ML, such as linear regression and optimization algorithms, might be implemented to suggest budget change recommendations. The algorithms may evolve with new expenditure data; therefore, they provide real-time budgeting recommendations. Adaptive approaches ensure that the user responds to changing financial needs and behaviors. That is why their budgeting plans are more resilient and flexible.

- Personal Finance Management Apps and User Behavior: Studies into mobile finance management apps indicate that the user interaction is heavily driven by whether the app is capable enough to provide an intuitive, seamless, and informative experience. According to Brown & Wu's 2022 research, a friendly interface was found, more users would be able to use finance management apps if the insights from ML were presented directly to them. This example emphasizes the use of UX design in app adoption and the need for budget optimization tools to be simple and powerful.

- Cross-Platform Development with Flutter for Financial Apps. As mobile technology develops, cross-platform applications development emerged to reach a large audience. Flutter is an open-source framework developed by Google that enables developers to write once and deploy across Android and iOS platforms. Tan et al. (2021) note that the applications developed using Flutter reach high performance near native with a constant user experience. Financial advisory applications must guarantee all these aspects in order to provide smooth interaction to the user, timely updates, and native device features in order to keep financial data safe and responsive.

- Data Privacy and Security in Financial Advisory Applications Data privacy and security are essential in financial applications since this system handles user information. Based on different research works, secure protocols, encryption, and privacy-preserving techniques of ML should be in place to protect the information of the users (Nguyen et al., 2020). Such best practices used within a finance advisory application guarantee the user trust together with compliance with the GDPR regulation.

- Case Studies and Industry Implementations: Already existing personal finance management solutions like Mint, YNAB (You Need a Budget), and PocketGuard have integrated the basic ability of ML to manage the budgets and account for spending activities. These applications are mainly more attuned to retrospective analysis rather than proactive and predictive advice (Smith et al., 2023). Recent case studies reflect a trend toward making intelligent, even predictive budgeting tools that not only make recommendations but will proactively indicate budgeting adjustments to make finance management dynamic and forward-looking. For example, these ML algorithms can identify your spending patterns and predict outflows of money to suggest specific budgets. Using Flutter would enable this all with maximum ease that is cross-platform, thus making such features reach a lot of users while keeping the execution costs to a minimum level. However, for an ML-based finance advisory system to be actually applied, it needs to do so while considering data privacy and security with UX sensitivity. Building on these conclusions, this research proposes an all-rounded finance advisory system with predictive power through ml accessed and used by a mobile application-a solution bridging current gaps in financial advisory solutions while offering a proactive approach towards budget optimization.

III. MATERIALS

This paper includes all the materials, tools, resources, and algorithms designed and developed for the mobile application during the creation of a finance advisory system based on ml, mainly about budget optimization.

A. Data Sources and Datasets

- Financial Transaction Datasets: Datasets, e.g., the Real-word Financial Diaries or BankSim datasets for simulating the expenditure and financial transaction of users

- User-Generated Financial Data (Simulated): It simulates income, expenditures, and budget allocation for hypothetical users in real-world testing.

B. Python Libraries for ML Algorithms:

- Scikit-learn: Regression and Classification model logistic regression, ridge regression, and decision tree.

- TensorFlow/Keras: Design, train, and deploy artificial neural networks (ANN)

- Database and Cloud Storage: User data storage with Firebase or Google Cloud Firestore for secure storing and real-time syncing feature into the mobile app.

C. Flutter Framework and Dart Language

- Flutter SDK: For developing mobile applications, ensuring a seamless, cross-platform experience on both Android and iOS.

- Dart Programming Language: For frontend and backend application logic within the Flutter framework.

IV. METHODOLOGY

It uses all kinds of ml algorithms like classification and regression, decision trees, ridge regression, logistic regression, and artificial neural networks to develop predictive and advisory models. The whole model shall be integrated into the Flutter application to provide real-time budgeting insights. The methodology includes data preparation, model development, integration into the mobile application, and iterative testing.

A. Data Preparation And Preprocessing

- Data Cleansing: Cleaning and preprocessing financial transaction data to remove any anomalies or missing values.

- Feature Scaling and Selection: Scaling data for improved accuracy and efficiency, particularly when the models are sensitive to the feature magnitude, especially logistic regression and ANN.

- Data Transformation: Arranging and categorizing income and expense data into similar types of income and expenses for easy analyses.

B. Training Classification and Regression Algorithms

1) Decision Tree

This is a classification-based model, such as predicting the spending category of a user using transaction history. This algorithm is interpretable and helps in segmenting spending patterns for budget recommendations.

Formula (Entropy in Decision Tree):

Entropy=-∑i=1cpi×log2(pi)

Formula (Gini Index):

GiniIndex=1-ΣPi2

2) Ridge Regression

The ridge regression is applied for predicting future expenses based on historical spending data, especially when there might be multicollinearity among predictors. This model reduces overfitting by adding a term for regularization.

Formulation:

Loss=Σyi-?i2+λΣβi2

where Σ is the regularization parameter and βi are the regression coefficients.

3) Logistic Regression

It is particularly used in binary classification, meaning that it can be applied to determine whether a user is likely to surpass the budget category given the current expenditure prevalent in the present situation.

Formula (Sigmoid Function):

P(Y=1|X) = 1 / (1 + e^(-β? + β?X? + β?X? + ... + β?X?))

P(Y=1|X): Probability that the output Y is 1 given the input features X.β?, β?, ..., β?: Model coefficients.

X?, X?, ..., X?: Input features.

4) Artificial Neural Network (ANN)

An ANN for complex budget prediction as well as user behavior modeling would enable the app to build much more in-depth insights based on multi-layered, non-linear relationships that apply for financial data. The ANN has layers like input layers, hidden layers, and output layers with activation functions that define more complex relationship hierarchies.

Activation Function (ReLU) for Hidden Layers:

f(x) = max (0, x)

Activation Function (Sigmoid) for Output Layer in Classification:

C. Mobile Application Development and Integration

- Flutter UI Design develops a clean and intuitive UI for displaying budgeting insights and recommendations. Key components are:

- Budget Dashboard shows the patterns of spending, predictive budget limits, as well as recommendations.

- Real-time notifications: Provide warnings and tips based on the predictions the ANN comes with, regarding potential over-spending.

D. Significance of ML in the Financial Sector

ML in the financial sector has monumental transformative potential and has huge efficiency benefits associated with it, along with personalization and better risk management capabilities. For the most part, the keyways through which ML is becoming an integral part of modern financial systems include:

E. Predictive Analytics for Decision-Making

This allows financial institutions to mine huge chunks of data and make precise predictions on the trend, market movements, and consumer behavior. It makes time-series and neural networks models a pathway to predict stock price movements, risks in the market, and change in the economy for better investment decisions. This makes the management of portfolios, investing strategies, and even personal finance advisory services to be at a smarter level.

F. Personalized Financial Services and Customer Experience

The ML models facilitate hyper-personalization in financial services by analyzing customer data to understand unique preferences, spending habits, and needs. This leads to personalized recommendations of investment advice, savings plans, and credit offers, thereby improving customers' satisfaction and loyalty. Another area where ml has played a very important role is robo-advisory services; algorithms help clients achieve personalized financial planning according to goals, risk tolerance, and other relevant factors.

G. Risk management and regulatory compliance

The ML algorithms can measure and predict risk more accurately with a mix of structured and unstructured data, such as market trends, borrower histories, and geopolitical events. This might enable the institutions to be more proactive in risk management and data-driven decision-making. With the continuous evolution of ML, the sector is bound to see faster and more accurate decision-making, synonymous with better customer experiences, stronger compliance, and enhanced risk management. All in all, ML is not just a technologically enhanced force but is also a strategic advantage in positioning financial institutions to thrive in an increasingly data-driven world.

V. RESULTS

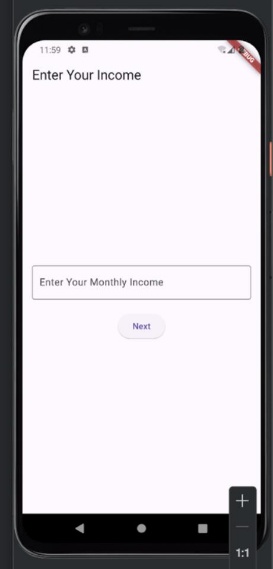

Fig 1 [a]: Mobile Application Interface-1 (Monthly Income)

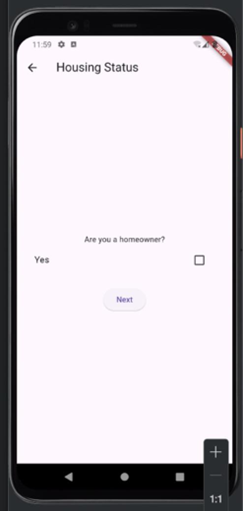

Fig 1 [b]: Mobile Application Interface-2 (Housing Status)

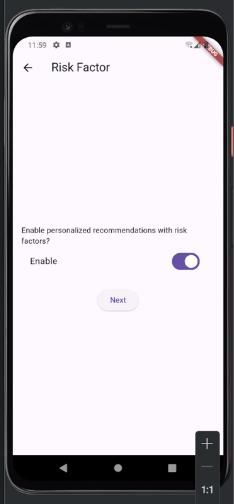

Fig 1 [c]: Mobile Application Interface-3 (Risk Factor- USP)

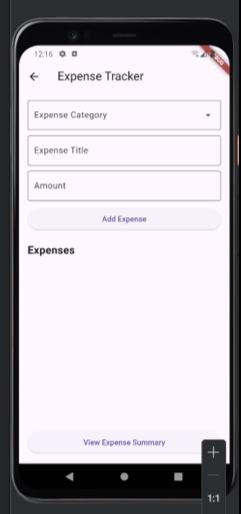

Fig 1 [d]: Mobile Application Interface-4 (Expense Category Selection)

Conclusion

ML in the finance industry has been the greatest leap forward to date and is going to revolutionize this world of predictive analytics, customer personalization, and risk management. It assists financial institutions process large datasets and yield much-required in-sights to improve decision-making and operational performance. However, these benefits of embracing ML are accompanied by significant challenges such as concerns over data privacy and regulatory compliance, model interpretability, and demands in infra-structure, all demanding careful analysis. Further debates arise in relation to bias in algorithms, ethical considerations, and interface in legacy systems.

References

[1] “Financial advisor: Job description.” [Online]. Available: https://www.thebalance.com/financial-advisor-career-information-526017 [2] A. Helfert, Techniques of financial analysis: A practical guide to managing and measuring business performance. Irwin, 1994, no. 658.15. [3] Quinlan, J.R. Induction of decision trees. Mach Learn 1, 81–106 (1986). https://doi.org/10.1007/BF0011625 [4] W. W. Cohen, “Fast effective rule induction,” in Machine Learning Proceedings 1995. Elsevier, 1995, . 115–123. https://doi.org/10.1016/B978-1-55860-377-6.50023-2 [5] Murphy, Kevin P. \"Naive bayes classifiers.\" University of British Columbia 18.60 (2006): 1-8. [6] Heckerman, D., Geiger, D., & Chickering, D. M. (1995). Learning Bayesian Networks: The Combination of Knowledge and Statistical Data. Machine Learning, 20(3), 197-243. https://doi.org/10.1023/A:1022623210503 [7] Rob Schumaker “A Discrete Stock Price Prediction Engine Based on Financial News” October 2010 Computer 43(1):51-56 [8] Nadeau and S. Sekine, “A Survey of Named Entity Recognition and Classification” August 2007 Lingvisticae Investigationes 30(1) [9] A. Gerlein, M. McGinnity, A. Belatreche, and S. Coleman, “Evaluating machine learning classification for financial trading: An empirical approach,” Expert Systems with Applications, vol. 54,. 193–207, 2016. https://doi.org/10.1016/j.eswa.2016.01.018 [10] Cleary and L. E. Trigg, “K*: An instance-based learner using an entropic distance measure,” in Machine Learning Proceedings 1995. Elsevier, 1995, . 108–114. [11] Landwehr, N., Hall, M. & Frank, E. Logistic Model Trees. Mach Learn 59, 161–205 (2005). https://doi.org/10.1007/s10994-005-0466-3 [12] R. R. Hocking, “A Biometrics Invited Paper. The Analysis and Selection of Variables in Linear Regression,” Biometrics, vol. 32, No. 1,. 8–9, 1976. [13] Y. Freund and R. E. Schapire, “A decision-theoretic generalization of on-line learning and an application to boosting,” Journal of computer and system sciences, vol. 55, no. 1, . 119–139, 1997. https://doi.org/10.1006/jcss.1997.1504 [14] Swingler, K. Financial prediction: Some pointers, pitfalls and common errors. Neural Comput & Applic 4, 192–197 (1996). https://doi.org/10.1007/BF01413817 [15] D. S. Wilks, “Cluster analysis,” in international geophysics. 100, . 603–616. [16] Forgy, E. (1965) Cluster Analysis of Multivariate Data: Efficiency versus Interpretability of Classifications. Biometrics, 21, 768-780. [17] Lance, G.N., & Williams, W.T. (1967). A General Theory of Classificatory Sorting Strategies: 1. Hierarchical Systems. Comput. J., 9, 373-380. [18] N. R. Draper and H. Smith, Applied regression analysis. 2014, vol. 326. [19] John Wiley & Sons, B. Szalkai, “An implementation of the relational k-means algorithm,” arXivpreprint arXiv:1304.6899, 2013.

Copyright

Copyright © 2024 Anurag Singh, Kiran Kumar Das, Pratik Mishra, Shahbaz Siddiki , Dr. Sharanabasava C Inamadar. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65998

Publish Date : 2024-12-18

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online