Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Moneymate: A Finance Application

Authors: Vaishali Rajput, Aditya Bhagat, Aditya Kulkarni, Nirwani Adhau, Aditri Sivakumar, Aditi Dharmadhikari, Varad Adhyapak

DOI Link: https://doi.org/10.22214/ijraset.2024.61151

Certificate: View Certificate

Abstract

Moneymate stands as a comprehensive finance application, simplifying personal finance management with ease and precision. It meticulously tracks daily expenditures, offering insightful visuals and categorizes expenses for effortless analysis of spending patterns. Serving as a centralized hub for financial information, it provides real-time updates on assets and currency values relative to the Indian Rupee, aiding informed decisions on investments and transactions. Beyond mere tracking, Moneymate empowers users with tools for goal setting, savings budgeting, and income optimization, fostering a proactive approach to financial planning. Personalized insights and actionable recommendations further enhance its utility in financial decision-making. With a user-friendly design and powerful functionalities, Moneymate transforms the landscape of personal finance management, simplifying tasks such as daily spending, asset management, currency conversion, and income tracking. Its holistic approach makes it an indispensable companion for individuals seeking control and empowerment over their financial health.

Introduction

I. INTRODUCTION

This research paper aims to explore Moneymate, an innovative finance application crafted to simplify personal financial management. In today's rapidly evolving economic landscape, individuals seek user-friendly tools to effectively navigate their financial affairs [5]. Moneymate emerges as a solution to this growing need, offering a comprehensive platform for managing monetary resources with ease and precision. As digitalization continues to reshape the financial industry, the demand for intuitive finance apps like Moneymate is on the rise, reflecting a shift towards more proactive and personalized approaches to money management [1]. By examining the features and functionalities of Moneymate, this paper seeks to provide insights into its role in empowering users to make informed financial decisions and achieve their long-term financial goals. Through this exploration, we aim to shed light on the potential impact of Moneymate in enhancing financial literacy and promoting financial well-being among its users [9]. Recent literature on personal finance highlights the growing demand for user-friendly finance applications that address diverse financial needs [3]. Studies emphasize the importance of features such as real-time expense tracking, visualization of spending habits, and goal-setting and budgeting tools. Moneymate aligns with these findings by offering a suite of features tailored to effectively meet users' dynamic requirements in managing their finances. The uniqueness of the Moneymate app lies in its multifaceted approach to personal finance management. Unlike conventional finance applications, Moneymate offers a diverse range of features that cater to various aspects of financial health. Its real-time display of assets and daily currency values relative to the Indian Rupee (INR) sets it apart, enabling users to track their financial portfolios globally. Additionally, Moneymate goes beyond basic tracking by providing tools for proactive financial planning, including goal setting, budgeting, and income optimization. This proactive approach, coupled with personalized insights and recommendations, empowers users to make informed decisions and take control of their financial futures effectively. In essence, Moneymate's seamless integration of innovative features and user-friendly design redefines personal finance management, offering users a comprehensive solution to navigate the complexities of their financial lives with ease and precision.

II. LITERATURE REVIEW

- Financial Management Concepts: A Review (researchgate.net)

Summary: This research investigates financial management in educational institutions, focusing on return assessment principles. Utilizing qualitative descriptive analysis of literature, it explores the importance of effective financial management.

2. EJBM-Vol.9 No.2 2017.docx (core.ac.uk)

Summary: Financial Management applies management principles to financial resources, involving planning, organizing, directing, and controlling activities. It ensures effective financial planning, investment policies, stability, and profitability.

3. Personal Finance Application- GROW MORE (ijraset.com)

Summary: Personal finance apps manage money, track spending, and plan budgets, aiding in borrowing, lending, and investing. Budgeting allocates income to expenses, savings, and debt repayment. Mobile apps simplify expense tracking, unlike paper or computer-based methods.

4. A Study on Financial Management in Promoting Sustainable Business Practices & Development (researchgate.net)

Summary: This study underscores the importance of financial management in sustainability, emphasizing disclosure of sustainability reports, integrating sustainability into capital budgeting, measuring and mitigating sustainability risks, and offering predictive distress identification models.

5. IJM_07_07_002.pdf (iaeme.com)

Summary: Financial management prioritizes maximizing shareholder wealth through profit distribution. It involves planning, organizing, and controlling monetary resources. Success hinges on efficient finance management. This study delves into various finance management techniques, enhancing understanding through quality information and analysis.

6. Personal finance apps and low?income households (researchgate.net)

Summary: Personal finance smartphone apps enhance financial knowledge, attitudes, and behaviors, particularly in low-income households. Users display increased self-confidence, financial literacy, and capability to manage finances effectively, aided by personalized features and user engagement strategies like push notifications and gamification.

7. Mobile Apps and Financial Decision Making* | Review of Finance | Oxford Academic (oup.com)

Summary: This paper examines the impact of a mobile financial app on consumer decision-making using transaction data from Iceland. The release of a mobile app led to increased user engagement.

8. What People Like in Mobile Finance Apps – An Analysis of User Reviews | Request PDF (researchgate.net)

Summary: This study analyses over 300,000 review sentences from 1,610 finance apps, employing machine learning to examine factors influencing app ratings. Apps were categorized into sub-categories for detailed insights on aspects like privacy, user interface, and notifications, shedding light on user expectations.

9. Frontiers | Financial Management Behavior Among Young Adults: The Role of Need for Cognitive Closure in a Three-Wave Moderated Mediation Model (frontiersin.org)

Summary: This study investigates the relationship between investment literacy and financial management behavior, mediated by investment advice use and moderated by the need for cognitive closure. Findings suggest that individuals utilizing investment advice and exhibiting high cognitive closure display improved financial behavior over time.

10. Financial Management of Large Projects: A Research Gap - ScienceDirect

Summary: This paper examines high-impact journal research on financial management in large projects, focusing on aspects analyzed, the application of financial theories, and areas for further research. Performance measurement emerges as a key focus.

III. METHODOLOGY

A. Features

- Real-time Expense Tracking

This feature allows users to record and monitor their expenses as they occur, providing a real-time overview of their spending habits. The purpose of real-time expense tracking is to help users stay informed about their financial transactions, enabling them to manage their budgets more effectively and make informed spending decisions. Users can input their expenses into the app as they happen, categorize them, and view a summary of their spending in real time.

The app may also offer features such as automatic categorization, receipt scanning, and expense reminders. Users interact with this feature by inputting their expenses manually or through automated means, reviewing categorized expenses, and analyzing spending trends over time through visual representations such as charts or graphs.

2. Visualization of Spending Patterns

This feature presents users with visual representations of their spending habits, allowing them to understand where their money is going and identify areas for potential savings or budget adjustments. The purpose of visualization of spending patterns is to provide users with insights into their financial behavior, enabling them to make more informed decisions about their spending and saving habits. Users can view various types of charts or graphs, such as line graphs, pie charts, or bar charts, displaying their spending across different categories, periods, or compared to budget goals. Users interact with this feature by selecting different visualization options, adjusting time frames or categories for analysis, and interpreting the displayed data to gain insights into their spending patterns.

???????3. Goal Setting

This feature allows users to set financial goals, such as saving for a vacation, paying off debt, or building an emergency fund, within the app.

The purpose of goal setting is to help users establish clear objectives for their finances, track their progress, and stay motivated to achieve their financial aspirations. Users can create and customize their financial goals, including setting target amounts, and deadlines, and tracking their progress towards achieving them. The app may also provide notifications or reminders to keep users on track with their goals. Users interact with this feature by creating new goals, editing existing ones, monitoring their progress, and receiving updates or prompts related to their goals within the app.

???????4. Asset Tracking

This feature enables users to track and manage their assets, such as bank accounts, investments, properties, or other valuable possessions, within the app. The purpose of asset tracking is to provide users with a comprehensive view of their financial portfolio, including both liquid and non-liquid assets, and facilitate informed decision-making about their financial future. Users can input information about their assets, including current values, acquisition dates, and relevant details, and view a consolidated summary of their assets within the app. The app may also offer tools for analyzing asset performance, tracking changes in value over time, and projecting future growth. Users interact with this feature by adding, editing, or removing assets from their portfolio, viewing asset details and performance metrics, and using asset management tools to optimize their financial strategy.

???????B. Technologies used are as follows.

Java serves as the backbone of the Moneymate app, providing essential functionalities for all its features. Real-time expense tracking relies on Java for processing and storing expense data, while visualization of spending patterns utilizes Java for analyzing data and generating visual representations. Similarly, goal setting features utilize Java for managing and tracking financial goals, and asset tracking functionalities rely on Java for managing and updating user assets within the app.

Android Studio plays a crucial role in the development of the Moneymate app, providing tools for designing, coding, and testing. Real-time expense tracking features are developed using Android Studio, enabling developers to design intuitive user interfaces for inputting expenses and viewing updates. Visualization of spending patterns utilizes Android Studio for designing screens to display charts and graphs representing spending trends. Similarly, goal setting and asset tracking features leverage Android Studio for UI design, allowing users to set financial goals and track assets effectively.

XML is utilized for defining user interface layouts and resource files in the Moneymate app, enhancing the visual presentation of its features. Real-time expense tracking features utilize XML for designing input forms and summary displays, ensuring a user-friendly experience for managing expenses. Visualization of spending patterns relies on XML for defining layouts for chart displays and data presentation elements. Goal-setting functionalities leverage XML for designing forms for setting goal parameters and progress-tracking indicators. Additionally, asset tracking features utilize XML for defining layouts for asset input forms and summary displays.

The Moneymate app utilizes several additional elements alongside Java, Android Studio, and XML to enhance its functionality and performance. The SQLite database is employed for storing and managing various data entities such as expense records, financial goals, and user assets, offering a structured and efficient storage solution.

The Android SDK provides essential tools, libraries, and APIs necessary for building Android apps, granting access to device features like sensors, location services, and network connectivity, enriching the app's capabilities, and enabling seamless integration with platform-specific functionalities. Additionally, the Gradle Build System automates the build process and manages project dependencies, ensuring smooth integration of third-party libraries, consistent app performance, and efficient resource management throughout the development workflow.

IV. TESTING

A meticulous evaluation of the Moneymate finance app ensures its functionality, usability, security, and performance meet the highest standards. Through a comprehensive testing regimen, the app undergoes rigorous scrutiny to validate its core features, assess its user experience, fortify its security measures, and optimize its performance. It is verified that all core features of the app, such as expense tracking, goal setting, and asset management, work as intended without errors or bugs. Users can perform key tasks seamlessly, such as adding expenses, setting financial goals, and viewing reports and insights. The accuracy of calculations and data processing within the app, including currency conversions, loan calculations, and expense categorization is validated. Testing has been done considering various financial cases. Users find the user interface easy to use and attractive. Feedback is gathered from 50 users related to the functioning of the application. Application security is checked. There is no leakage of any data. Data security is preserved.

V. RESULTS AND DISCUSSIONS

- Overall Satisfaction: Users expressed general satisfaction with the Moneymate app, highlighting its intuitive design and comprehensive features for managing finances.

- Ease of Use: Many users found the app easy to navigate and use, praising its simple and user-friendly interface.

- Feature Satisfaction: Users appreciated the variety of features offered by the app, including expense tracking, goal setting, and asset management. Positive feedback was received regarding the effectiveness of these features in helping users manage their finances.

- Performance: While most users reported smooth performance, some experienced occasional glitches or slow loading times, particularly when accessing certain features or syncing data. Improvements in app responsiveness and performance optimization were suggested by users.

- Suggestions for Improvement: Users provided valuable suggestions for enhancing the app, such as adding new features, improving data visualization options, and refining existing functionalities. These suggestions will be considered for future updates to the app.

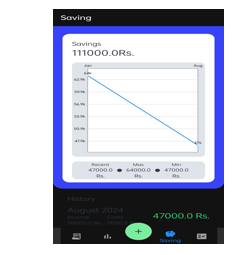

Above are Images 1,2, and 3 respectively. Image 1 is the main page of the app. It has all the information related to transactions made. Image 2 is the page of the app which shows the comparison between the income and expenses of the particular month selected. Image 3 is of the page of the app which shows a line graph of overall savings.

VI. FUTURE SCOPE

The future scope of the Moneymate finance application appears promising, with a range of potential enhancements and expansions poised to empower users to manage their personal finances more effectively. These avenues for future development include the integration of machine learning algorithms to offer personalized financial insights, advanced data analytics techniques to derive deeper insights from user data, and collaboration with financial institutions to provide real-time updates on account balances and transaction histories. Additionally, implementing features such as predictive budgeting, gamification elements, support for blockchain technology, and smart notifications can further enhance the app's utility and engagement for users. By embracing these future-oriented developments, Moneymate has the potential to evolve into a comprehensive and cutting-edge financial management platform, meeting the evolving needs of users in the dynamic landscape of personal finance.

VII. ACKNOWLEDGMENT

The completion of the Moneymate finance application project has been a collaborative effort and, I would like to express my sincere gratitude to those who have contributed to its realization. First and foremost, I extend my heartfelt thanks to [my team members], who provided the environment and resources necessary for the development of Moneymate. The support and encouragement from the entire team have been instrumental in overcoming challenges and achieving project milestones. I would like to express my appreciation to the development team for their dedication and hard work. Each member has brought unique skills and perspectives, contributing to the success of the project. The spirit of collaboration and commitment to excellence has been the driving force behind Moneymate's evolution. Special gratitude goes to [VAISHALI RAJPUT], whose guidance and expertise have been invaluable throughout the development process. Their insights, feedback, and mentorship have played a pivotal role in shaping the application and ensuring its alignment with industry standards. I am also thankful to the end users and beta testers who provided valuable feedback during the testing phases.

Their insights have been crucial in refining the user experience and functionality of Moneymate. Finally, I would like to express my gratitude to my family and friends for their unwavering support and understanding during the project's demanding phases. Their encouragement has been a source of motivation, and, I am grateful for their belief in the project's potential impact.

The completion of Moneymate marks the culmination of a collective effort, and I am grateful to everyone who has contributed to its success. This acknowledgment is a reflection of the collaborative spirit that defines the project's journey.

Conclusion

In conclusion, the development of Moneymate signifies a significant leap forward in the realm of personal finance applications, presenting users with a robust and user-friendly tool to take control of their financial well-being. From inception to execution, the journey has culminated in an application replete with features that excel in expense tracking, asset management, currency conversion, loan calculations, and proactive financial planning. Moneymate\'s strength lies in its user-centric design, offering an intuitive interface that allows users to seamlessly navigate various financial facets. The integration of real-time currency values, a robust loan calculator, and personalized financial insights positions the application as a versatile companion for individuals seeking to bolster their financial literacy and make informed decisions. Looking forward, the future scope of Moneymate appears promising. By incorporating machine learning, advanced analytics, and emerging technologies like blockchain, the application\'s capabilities can be elevated, furnishing users with even more sophisticated tools for financial management. The potential for gamification, wearables integration, and collaborative financial planning fosters continuous innovation and user engagement. As Moneymate continues to evolve, its commitment to data security, regulatory compliance, and a seamless user experience remains unwavering. Ongoing feedback from users will play a pivotal role in refining the application, addressing emerging needs, and staying attuned to the ever-changing landscape of personal finance. In the broader canvas of financial technology, Moneymate emerges not merely as an application, but as a trusted financial companion, empowering users to navigate the complexities of personal finance with confidence and clarity. With its foundation rooted in sound mathematical principles, user-centric design, and a dedication to continuous improvement, Moneymate is poised to leave a lasting impact on how individuals perceive, manage, and optimize their financial journeys.

References

[1] (PDF) Financial Management Concepts: A Review (researchgate.net) [2] Microsoft Word - EJBM-Vol.9 No.2 2017.docx (core.ac.uk) [3] Personal Finance Application- GROW MORE (ijraset.com) [4] (PDF) A Study on Financial Management in Promoting Sustainable Business Practices & Development (researchgate.net) [5] IJM_07_07_002.pdf (iaeme.com) [6] (PDF) Personal finance apps and low?income households (researchgate.net) [7] Mobile Apps and Financial Decision Making* | Review of Finance | Oxford Academic (oup.com) [8] What People Like in Mobile Finance Apps – An Analysis of User Reviews | Request PDF (researchgate.net) [9] Frontiers | Financial Management Behavior Among Young Adults: The Role of Need for Cognitive Closure in a Three-Wave Moderated Mediation Model (frontiersin.org) [10] Financial Management of Large Projects: A Research Gap - ScienceDirect

Copyright

Copyright © 2024 Vaishali Rajput, Aditya Bhagat, Aditya Kulkarni, Nirwani Adhau, Aditri Sivakumar, Aditi Dharmadhikari, Varad Adhyapak . This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET61151

Publish Date : 2024-04-28

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online