Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Mutual Fund in Kotak Mahindra Bank

Authors: Priti Raj , Dr. Pratiksha Jha

DOI Link: https://doi.org/10.22214/ijraset.2024.59939

Certificate: View Certificate

Abstract

The use of mutual funds as a safety net for one\'s finances is on the rise. The industrial sector\'s performance has boosted India\'s economic narrative, and mutual funds have lowered the barrier to entry for households looking to invest. More and more people are becoming aware of mutual funds and the advantages they offer. Most people don\'t invest in mutual funds because, for example, 90% of wage workers in India are unaware that they exist. One out of five individuals may decide to put their money into a mutual fund when they find out what possibilities are available to them. To effectively market mutual funds to someone who is unfamiliar with them, one must first identify the type of people who are inclined to purchase them and then provide reasons that they will see as substantial. Working on this piece was a terrific learning experience and gave me a lot of practice with analysis. Investors\' saving and investing habits, mutual fund preferences, and other market research topics are examined and recommended in this paper report.

Introduction

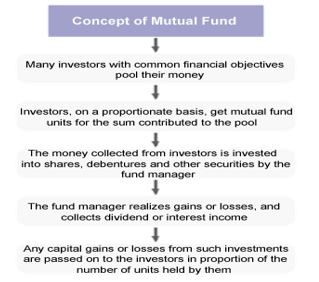

Most people's investment portfolios now include mutual funds because of their accessibility to the financial markets and the diversification benefits they provide. They make it easier for individuals and organisations to join the financial markets. Among the many financial institutions that offer mutual funds, Kotak Mutual Fund is a prominent player. Its extensive offerings, competent leadership, and customer-centric approach have earned it widespread renown. Learn the ins and outs of mutual funds and compare Kotak Mutual Fund to other investment choices in this article. Through a single mutual fund, several individuals have the opportunity to invest in a diverse range of assets, such as stocks, bonds, and other securities. Experts in the area oversee the administration of these monies. Those in charge of the fund's investments keep its goals and strategy in mind at all times.

A. Benefits of Putting Money into Mutual Funds

Mutual funds offer diversity, making them an excellent choice for those who are apprehensive about losing money investing in a single investment. Proficient Management: E Fund managers use extensive research and analysis to make prudent investment decisions. Compared to individual investors, they are better at this.

Many individuals, including those without the knowledge or resources to handle their own accounts, are able to invest thanks to mutual funds. The average person now has easier access than ever before to mutual funds. A measure of liquidity, the current net asset value (NAV) allows investors to buy or sell units in mutual funds on any given business day. Due to its prominent position in the mutual fund business, Kotak Mutual Fund is well-known to many. The innovative products, customer-centric approach, and exceptional performance of Kotak Mutual Fund have earned it a stellar reputation. Here are only a handful of the most critical things that demonstrate how crucial Kotak Mutual Fund is. An Symbol of Reliability and Credibility One of the many prestigious and long-standing financial services companies in the globe, the Kotak Mutual Fund is a part of it. Different Items: Kotak Mutual Fund accommodates investors with varied risk tolerances by offering a broad range of mutual fund programmes. These kinds of systems can take many forms, including themed funds, equity funds, debt funds, and hybrid funds.

Making the Most of Your Money: Skilled financial experts oversee the Kotak Mutual Fund and stick to a tried-and-true investing plan that has paid well in the past. Supporter of financial matters Assistance and Guidance Kotak Mutual Fund is an excellent tool for investors who want to make educated decisions..

II. ADVANTAGES OF MUTUAL FUND

- We spread our investments out.

- Skilled guidance

- Reducing and Distributing Risk Liquidity

- Flexibility and Simplicity

- Payment processing costs falling

- Making sure it's in a regulated environment

- Choose a scheme

- Effective Expression

III. DISADVANTAGE OF MUTUAL FUND

- There Is No Control over Expenses by Investors

- Insufficient personalised portfolios

- Being in Charge of a Portfolio of Funds

- Choosing the Appropriate Investment Plan Is Not Always Easy

IV. HISTORY OF THE INDIAN MUTUAL FUND INDUSTRY

The first mutual fund company in India, Unit Trust of India, was established in 1963 with backing from the Reserve Bank and the Government of India. Even though it had been expanding gradually up until 1987, the rate of expansion accelerated when competitors other than UTI joined the market.

In terms of both the number and quality of mutual funds, the Indian market has grown substantially throughout the past decade. Assets under management (AUM) for the market monopoly peaked at Rs67 billion. Following a record of 470 billion rupees in March 1993, the AUM reached 1540 billion rupees in April 2004, when the private sector was finally allowed to participate.

The phenomenally expanding mutual fund industry has clearly divided into four distinct epochs. A brief overview of each step is provided below.

V. LITERATURE OF REVIEW

Sandeep Bansal, Deepak Garg, and Sanjeev K. Saini (2012) examined several mutual fund schemes to find out how Treynor's Ratio and Sharpe Ratio impacted them. This article finds that a basic market index may represent the overall risk profile of the mutual fund universe by comparing the results of several mutual fund schemes using Sharpe and Treynor’s ratios. Comprehensive fund analysis, liquidity, systematic and unsystematic risk, and comparable monthly returns would all be provided by the index. Drs. K. Veeraiah and A. Kishore Kumar analysed the outcomes of several mutual fund initiatives in India in January 2014. This study primarily aims to examine the performance of Indian mutual funds. We looked at how these funds did and where they fit in the portfolio over a five-year NAV. The study's findings suggest that mutual funds outperform novice investors. Because of their potential for growth over the long term, mutual funds are popular among investors.

In his 2012 essay "Emerging Scenario of Mutual Funds in India," Dr. Yogesh Kumar Mehta reports that tax funds were examined. This research takes into account a variety of equity funds, including both public and private mutual funds. Institutional and corporate investors pour 2.87 million rupees (or 56.55 percent of all MF net assets) into the sector, yet they only make up 1.16 percent of all MF investors. The debt section also did not support MFs.

July 2012 saw an analysis of Birla Sunlife and Reliance mutual funds' debt programmes by scientists Drs. Surender Kumar Gupta and Sandeep Bansal. After determining the standard deviations and net asset values of two mutual funds, Reliance and Birla Sunlife, the study evaluates their debt plan performance using the Sharpe Index. With an average return of 6% and a benchmark return of 4.34 percent for the Crisil Composite Debt Fund Index over the last five years, debt plan returns are on par with risk-free returns.

In 2013, Professor V. Vanaja and Dr. R. Karrupasamy examined the performance of specific balanced category mutual fund schemes in India's private sector. This performance evaluation research may help both investors and AUMs. Investors might find out about the greatest schemes out there, while AUMs could utilise it to fix failed schemes and enhance their portfolios. The primary objective of the research is to evaluate different kinds of funds by utilising the risk-adjusted metrics put forward by Sharpe, Treynor, and Jensen. Furthermore, it will compare industry standards to determine which private sector balanced plans are the most profitable.

The 2011 NAVs of Indian mutual funds were examined by E. Priyadarshini and Dr. A. Chandra Babu using AriMA. In this case, we model a handful of Indian mutual funds using the ARIMA (Box-Jenkins autoregressive integrated moving average) method. We have used conventional statistical methods to forecast the mutual funds' future NAV values and have verified that our predictions are correct.

Drs. Ranjit, Anurag, and H. Ramananda Singh studied mutual funds in rural and suburban areas in August 2011. Mutual funds are becoming more popular among city dwellers as investment vehicles. As a result, there is presently an excess of supply in urban areas. In an attempt to broaden their investor base, mutual fund companies are adjusting their marketing to target people in less populated regions. Investors are more likely to put money into a product if it is popular, accessible, and affordable. It ought to fulfil their needs in other ways as well. Here you will find solutions to all of these problems. It determines the relative importance of criteria including accessibility, affordability, acceptability, and awareness in influencing investment choices in both urban and suburban areas.

To assess how well Indian company mutual fund schemes worked, professors Kalpesh P. Prajapati and Mahesh K. Patel performed a comparative study in July 2012. This dissertation draws on a variety of metrics—including risk-return analysis, Treynor's ratio, Sharp's ratio, Sharp's measure, Jensen's measure, and Fama's measure—to analyse and contrast the relative performance of Indian mutual funds. All NAVs shut daily. The information is sourced from a database that is kept online by the Association of Mutual Funds in India (AMFI). From 2007 to 2011, the research was conducted. Most mutual funds turned a profit between 2007 and 2011, according to the numbers.

An empirical analysis on the performance of certain equity growth mutual funds in India was carried out by C. Srinivas Yadav and Hemanth N. C. from June 1, 2010, to May 31, 2013, (Feb 2014). Using measures like as Treynor and Sharpe, this study compares and contrasts the top Indian growth equities funds. S&P CNX NIFTY is the index that serves as a benchmark. among the three-year period beginning June 1, 2010, and ending May 31, 2013, fifteen equity growth schemes (NAV) were chosen among the top ten asset management companies (AMCs) according to AUM.

In 2013, Rashmi Sharma and N. K. Pandya summed up the investment in mutual funds. This introductory study will teach you all you need to know about mutual funds, including how to determine their NAV and how to compare them to other investment alternatives. This study sought to analyse the differences in investor attitudes on mutual funds across different demographic categories. For accurate data analysis and measurement of many variables, pie charts have shown to be invaluable. Factors influencing mutual fund investments have also been investigated using this method.

The effectiveness of a growth mutual fund was evaluated in May 2013 by Rahul Singal, Anuradha Garg, and Dr. Sanjay Singla. In order to determine whether growth mutual fund methods have been effective, this article examines twenty-five separate approaches. From 2004 to 2008. The Treynor ratio, beta test, and sharpe ratio are utilised to achieve this. Discrepancies are typically not very great when compared to other approaches, and these outputs define rank.

VI. METHODOLOGY

Although secondary sources were also taken into account for this article, the focus was on primary sources because of how important they are in attitude research. Major uses of research approach include identifying the problem, collecting and evaluating relevant data, and developing alternative solutions.It also helps with data collection, which is crucial for senior management to make better decisions on a daily basis.

VII. DATA SOURCES

The study relies entirely on primary sources of information. Secondary data may only be used for reference reasons. The majority of the information utilised in this study came from conversations with various people. The secondary data was sourced from a variety of academic journals and internet databases.

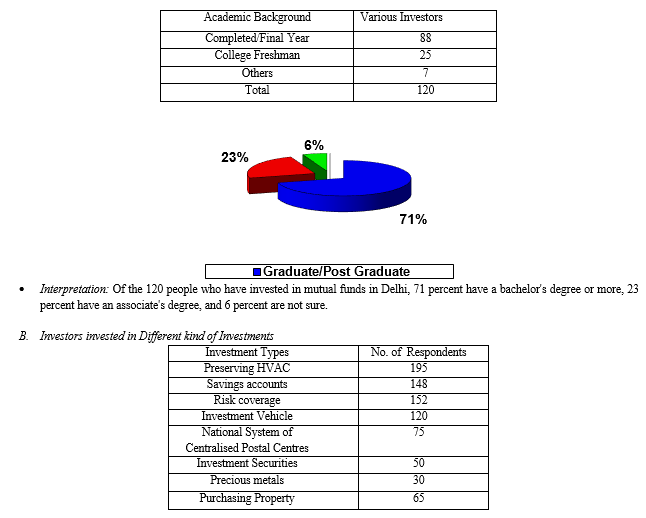

A. Educational Qualification of investors of Delhi

VIII. OBJECTIVES OF THE STUDY

- Determine which asset management company is most popular with investors.

- For the purpose of learning about the portfolio preferences.

- To understand the rationale behind investing in or not investing in KOTAK MUTUAL FUND Investment vehicle

- Determine which channel is most popular.

- In order to learn how to improve the mutual fund industry.

IX. SCOPE OF THE STUDY

The mutual fund sector has grown substantially throughout the last several decades. In recent years, a plethora of new firms have entered the market, all competing for a share of this exciting and constantly evolving sector.

The research was conducted at Saket. At two separate Birla Sun Life locations, I completed the necessary papers. In order to compile my research paper, which is titled "Study of investors preference about mutual fund," I conducted a survey among customers at Birla Sun Life's Saket branch. This research may help determine which company, investment strategy, portfolio, return choice, etc. are most well-liked by buyers. In upcoming strategy and planning sessions, company executives may find this paper report helpful..

X. FINDINGS

- Delhi has the biggest concentration of people between the ages of 36 and 40. Those under the age of 30 had the lowest concentration of investors, while those between the ages of 41 and 45 had the second-highest.

- While the bulk of Delhi's investors possessed master's or higher degrees, a tiny proportion had bachelor's degrees or less.

- Those working in the private sector invested the most, those in the public sector the second most, and those in the agricultural sector the least.

- Households with incomes between 20,000 and 30,000 rupees were most numerous, followed by those with incomes of 30,000 rupees and above; the lowest income band, below 10,000 rupees, had the fewest families.

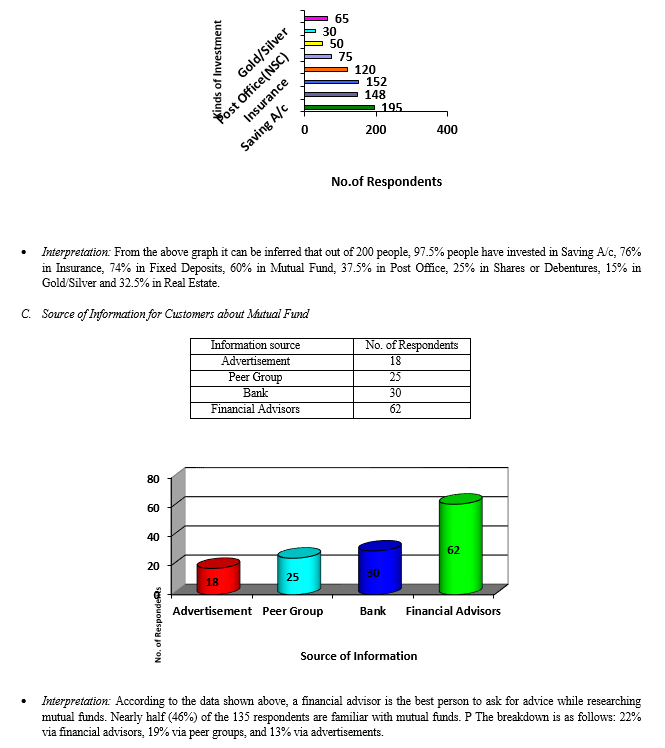

- Despite the prevalence of bank accounts among survey takers, just 60% of them put their money into mutual funds, while 76% put it into fixed deposits.

- Investors ranked high return, low risk, liquidity, and trust as their top four investing priorities.

Conclusion

To ensure that any mutual fund runs well, one must have an in-depth understanding of the Indian stock market as well as the mentality of individual investors. The study\'s overarching goal was to draw conclusions on the effects of brand (AMC), product (product), channel (etc.) and other investor decisions on mutual fund performance. Many people find the idea of mutual funds to be somewhat intimidating. They are concerned that putting their money into a mutual fund would not be secure. They should be well-versed in mutual funds and related terminology. Many people have the financial resources to invest, but they haven\'t taken advantage of mutual funds since they don\'t know about their advantages. Along with increasing disposable money and education, the number of people investing in mutual funds is soaring. \"Brand\" is crucial in the world of investing. People are more inclined to put their money into a firm they know and trust. There may be a lot of AMCs in Dehradoon, but only a handful have become them big because of their namesake brands. Even though their schemes are profitable, numerous AMCs are failing since their brands aren\'t well-known. When comparing industry heavyweights like Reliance, UTI, KOTAK Mutual Fund, ICICI Prudential, etc., to less well-known names like Principle and Sunderam, it becomes clear that the former two have superior track records and larger assets under management. Another important factor to consider while investing in mutual funds is the distribution networks. The vast majority of mutual fund investors work with professional financial counsellors. They can convince people to rethink their initial investing decisions. Direct investments through AMC are popular among investors because of the absence of an entry charge. Direct investment is only suitable for those who have a deep understanding of mutual funds and are willing to put in the effort to study how they function.

References

[1] Abhishek Kumar (2012), “Trend in Behavioral Finance and Asset Mobilization in Mutual Fund Industry of India”, International Journal of Scientific and Research Publications, Volume 2, Issue 10, October 2012, pp 1-15. [2] Ansari, “Mutual Funds in India: Emerging Trends”, The Chartered Accountant, Vol. 42(2), (August 1993), pp.88-93. [3] Bansal L K, “Challenges For Mutual Funds In India”, Chartered Secretary, Vol. 21(10), (October 1991), pp. 825-26. [4] Batra and Bhatia, “Indian Mutual Funds: A study of Public sector”, paper presented, UTI Institute of Capital Market, Mumbai, (1992). [5] Dr. Vikas Kumar (2011), “Performance Evaluation of Open Ended Schemes of Mutual Funds”, International Journal of Multidisciplinary Research, Vol.1 Issue 8, December 2011, pp 428-446. [6] Gupta Amitabh, “Investment Performance of Indian Mutual Funds: An Empirical Study”, Finance India, Vol. XIV (3), (September 2000), pp. 833-866. [7] Gupta Ramesh, “Mutual Funds”, The Management Accountant, Vol. 24(5), (May 1989), pp.320-322. [8] Gupta O. P. and Sehgal Sanjay, “Investment Performance of Mutual Funds: The Indian Experience”, paper presented in Second UTI-ICM Capital Markets Conference, December 23-24, (1998), Vasi, Bombay. [9] Irissappane, Aravazhi “Paradigm Shifts In the Performance of Indian Mutual Funds: An Analysis With Reference To Close-Ended Funds of Selected Institutions”, UTI Institute of Capital Markets, Mumbai (2000). [10] Jayadev M., “Mutual Fund Performance: An Analysis of Monthly Returns”, Finance India, Vol. X (1) (March 1996), pp. 73-84. [11] Kale and Uma, “A Study on the Evaluation of the Performance of Mutual Funds in India”, National Insurance Academy, Pune, India (1995). [12] Kumar V K, “In Search Of Turnaround Strategies for Mutual Fund Industry”, The Management Accountant, (May 1999) Vol. 34(5), pp. 337-343. [13] Muthappan P. K. & Damodharan E. , “Risk-Adjusted Performance Evaluation of Indian Mutual Funds Schemes”, Finance India, Vol. XX(3), (September 2006), pp.965-983. [14] Narasimhan M. S. and Vijayalakshmi S. “Performance Analysis of Mutual Funds in India”, Finance India, Vol. XV (1), (March 2001), pp.155-174. [15] Roshni Jayam, “Debt Be Not Proud, Equity’s Back”, Business Today, (April 2002) pp. 42- 45. [16] Sanjay Kant Khare 2007, “Mutual Funds: A Refuge for Small Investors”, Southern Economist, (January 15, 2007), pp.21-24. [17] Saha Asish and Rama Murthy Y Sree, “Managing Mutual Funds: Some Critical Issues”, Journal of Social and Management Science, Vol. XXII (1), (1993-94), pp.25-35. [18] Shome, “A Study of Performance of Indian Mutual Funds”, unpublished thesis, Jhansi University, (1994).

Copyright

Copyright © 2024 Priti Raj , Dr. Pratiksha Jha. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET59939

Publish Date : 2024-04-07

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online