Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Narratives Driven Bull Market: The Indian Stock Market 2020-2024

Authors: Veerendra Anchan, Shrihan Mohite, Shonit Magan, Sanjana Jangra

DOI Link: https://doi.org/10.22214/ijraset.2024.64882

Certificate: View Certificate

Abstract

Narratives play a key role in shaping the opinions of people. Advent of social media has accentuated the importance of narratives in economic and financial decisions. Narrative is a piece of information gone widespread due its acceptability and relevance to the masses. Frenzy during bull markets is usually associated with a flow of narratives building momentum. Objectives of this study is to examine the relationship between the bull market in the Indian Stocks during 2020-24 and the socio-economic narratives in circulation, effects of sustained favourable narratives during negative socio-economic event and quantification of the relationship. Only secondary data is used for this study. For collection of data, individual phrase, summarizing each narrative and relevant keywords for the phrase are used to make the search relevant and get precise textual count. Multiple regression model is used for this study to test the existence of relationship between Nifty 50 Index and narratives. The study indicates that the rise in Indian stocks during 2020-24 is explained by the independent variables - ‘Atmanirbhar Bharat’ and ‘India, Emerging Manufacturing Powerhouse’, individually and collectively.

Introduction

I. INTRODUCTION

The stock market is said to be in a bull market when stock prices have a sustained rise of 20% or more. Bull markets are normally underpinned by a positive flow of socio-economic news and augmented investor confidence. Sentiments play a crucial role in fuelling a bull market. In extreme cases the sentiments are downright irrational. This statement can be proven true by (Brown & Cliff, 2005), who have done research on how investor sentiments affect asset valuations. (Baker & Wurgler, 2006) have conducted a study on how investor sentiments has an impact on the cross-section of stock returns. The researchers predicted that investor sentiments has an effect on securities whose valuations are greatly subjective and difficult to arbitrage. Following this (Baker & Wurgler, 2007) have also proven that investor sentiment has a very evident and regular effect on individual firms and the stock market as a whole. During the dot-com bubble in 1996, the chairman of the then federal reserve board, Alan Greenspan in his famous speech given at the American Enterprise Institute used the phrase “Irrational Exuberance”. The impact of the speech was such that the Tokyo stock market which was live during the speech, closed 3% down and other world markets followed.

In India, we have witnessed many bull markets in stocks. Like, after the economic liberalization of 1991, from 2003 to 2007 driven by foreign funds flowing into our economy post Great Financial Crisis of 2008 when governments world over implemented Quantitative Easing and recently, from 2020 to 2024 post Covid the Nifty 50 Index has risen 244% from the trough due to government capital expenditure and programs like Atmanirbhar Bharat, and Production Linked Incentive (PLI) scheme etc.

During all bull markets, from ‘Tulipmania’ during the 1600s in Holland to AI frenzy in the US markets now, narratives spun off due to rumours, news or expert opinions have played a significant role. With the advent of social media, narratives have gained heightened interest of economists and psephologists lately. Narrative Economics is such a field that examines the role of narratives and storytelling in economic decision-making. Narrative Economics broadly focuses on the role that narratives play in various economic aspects. Narrative Economics hypothesizes that the stories, rumours, and discourses that investors use to make sense of what is happening around them, play a critical role in the way they make decisions and in shaping economic behaviour and outcomes (Osterrieder, 2023). This hypothesis holds true when you look at how market bubbles such as the internet bubble form. The Internet bubble started in 1995; the valuations of internet stocks boomed until the bubble burst in 2000. Robert Shiller has even claimed that the narratives played a significant role in the formation of the internet bubble and during the Global Financial Crisis of 2008. (Bhattacharya et al., 2009) explored whether Shiller’s claim about the media hyping the internet stocks was correct and played a hand in the drastic rise and fall of internet stocks during the Internet IPO bubble. The paper provided evidence in favour of Robert Shiller’s claim that the media had indeed hyped the Internet stocks during the Internet IPO bubble.

Robert Shiller, (2017) in his book “Narrative economics. How stories go viral & drive major economic events” describes narratives as something like a contagion. Narratives have a particular life cycle like a contagion. A narrative starts as a piece of information or “tidbit”, matures and diminishes. For example, an economist is doing analysis on current state of the economy and stumbles upon some information of concern. Further, the economist mentions this information in a live interview which is being viewed by many people. This small information, through the media outlet spreads to numerous like-minded people. This prompts people to do their own research which may or may not lead them to the same conclusion as the economist had at the beginning. The information cascades and the narrative starts.

As more and more people talk about the narrative, it spreads and enters a mature stage of its life cycle. This leads to a change in the perception of the masses. The change in perception prompts people to act as per their understanding of the situation. The action could be positive or negative in its nature.

But as time passes, the narrative runs its course and is hardly talked about. Due to this, effect of the narrative on people diminishes and the narrative eventually dies down.

Of course, when one narrative dies down, another one is born and goes through the same life cycle. Albeit the duration of life cycle of a new narrative may vary. Even though the narrative is no longer talked about, it has a residual effect that lingers until such time when history rhymes and a similar narrative reappears, and the cycle starts anew.

Narratives have been a topic of study for quite some time. Their effect in shaping the behaviour of people and outcome in the world vary from narrative to narrative. While fundamentals and other factors play a part in the investor’s decisions, most of the volatile activities in the stock market are caused due to investor sentiments that stem from the narratives being circulated. People’s reactions vary on the matter when they try to make sense of the narratives. For example, a news article comes up talking about a potential correction in the market and some plausible causes are stated as to why. Investors react differently to such news. Some who view this in a negative way, may get into panic selling and book whatever profits they have, while others who view this as an opportunity will start accumulating more stocks for their portfolio.

(Dyck et al., 2003) did a research paper where the researchers analysed the impact of media coverage of corporate earnings announcement on stock market reaction. From the findings, the study proved that the stock prices were more reactive to the nature of the earnings that were covered by the media. Further, the study found that this effect was stronger for those companies who had fewer analysts and the media outlet covering the announcements was more credible. The researchers also found that the media spin mostly followed the spin promoted by the company itself. Evidence gathered in the study showed that it was due to a “Quid Pro Quo” relation between the journalists and the company, where the journalist received private information in exchange for a positive spin in the news about the company. A similar research paper by (Solomon, 2012) found that Investor Relation (IR) firms “spin” the news of their clients to generate more media coverage which increases returns due to the positive press release, with the opposite effect occurring due to negative press releases. Another similar research paper done by (Fang et al., 2009) wherein the researchers found that stocks with no media coverage earn higher returns, than those with high media coverage. The said research suggests that range of information disseminated has an impact on the stock returns. (Birz & Lott, 2011) had also conducted similar research which shows the impact of real economic news on returns. The research mainly focused on the impact of news pertaining to GDP and unemployment had on the stock returns. (Mian et al., 2012) have also shown that stock price is highly sensitive to firm specific news. The research findings have demonstrated that stock price sensitivity to good earnings news are higher during times of high investor sentiment and low during times of low sentiment, whereas the stock price sensitivity to bad earnings news is higher during times of low sentiment than during times of high sentiment.

The Index is a cumulative value of the underlying stocks. The movement in the Index could be attributed to various factors that investors consider, consciously or subliminally. Socio-economic narrative is such subliminal factor that invokes greed and fear among investor. Narratives are catalytic in nature. A continuous flow of favourable narratives can encourage risk taking and exuberance.

The objective of this study is to understand the relationship between favourable socio-economic narratives and sustained bull market between Q2 2020 and Q1 2024 in Indian stocks, the effect of sustained favourable narratives on stock market during negative socio-economic event, and to quantify the relationship between narratives and bull market between Q2 2020 and Q1 2024 in Indian stocks.

Narratives covered under this study:

Liquidity Driven Stock Market: This narrative was based on the details about how new retail investors entered the Indian stock market. How these investors created a gush of liquidity though SIP route in mutual funds.

How domestic institutional investors (AMCs) received continuous supply of funds through SIP and helped the stock market to remain in a buoyant state throughout the bull market.

Earnings Visibility: This narrative was based on the details about how post Covid, the earnings visibility improved in many sectors where government of India initiated capex in defence, infrastructure and PSU Banks etc. How introduction of PLI schemes and government capital expenditure helped the Indian economy to reboot from the slowdown during Covid.

Risk-off Trade: This narrative was based on the details of how retail investors who entered the stock market during Covid lockdown had no experience of a severe downturn and buoyed by continued profits, how these investors accepted high risk.

Resurgent Indian Economy: This narrative was based on the resurgence of the Indian economy. (Business Today, 2024, February 12) How India and Indonesia once famously lumped together as part of Morgan Stanley’s “Fragile Five” became investor favourites. Also, the fact that India achieved 7.6% growth rate of GDP in 2023 and has $704 Billion in foreign reserves.

The India Stack: This narrative was discussed in many economic forums. How India stack consisting of layers of digital infrastructure built on digital identity and digital payment system unbounded the e-commerce and e-services.

Atmanirbhar Bharat: This narrative was largely promoted by the government to kick start the Indian economy after Covid slowdown. The narrative was based on Atmanirbhar Bharat Abhiyan started by the government on 13 May 2020. The Abhiyan helped Indian industry, manufacturing and defence sector to compete against global companies and develop supply chain resilience.

Retail Participation: This narrative was based on the rapid growth of retail participation in Indian stock markets and how most of them were first time participants with higher risk appetite.

India, Emerging Manufacturing Powerhouse: This narrative was based on ‘China plus one’ concept in the supply chain management and government’s push for manufacturing industry that catapulted India as an emerging manufacturing hub for the world. How Production Linked Incentive (PLI) schemes and reduced corporate tax for new manufacturing units could make India a favourable destination for global manufacturers.

PE Expansion in Indian Stocks: Optimism leads to expansion in Price to Earnings ratio during bull markets. This narrative was based on a major PE expansion seen in mid and small caps and PSU stocks during 2020-24.

The India Decade: The period from 2014 to 2024 marks a significant chapter in India's economic history, characterized by substantial growth and development across various sectors. This narrative was based on India's remarkable economic growth trajectory during the last decade and consistently surpassing global averages.

The fastest growing major economy: The narrative was based on various reports emphasising that the Indian economy grew at a healthy pace despite challenging global conditions e.g. (World Bank Group, 3 September 2024) The India Development Update (IDU) observed that India remained the fastest-growing major economy and grew at a rapid clip of 8.2 percent in FY23/24.

The India Bull Market: This narrative was based on how Nifty 50 index climbed 3.44 times from the trough of 7610.25 on 23 Mar 2020 to 26178.95 on 27 Sep 2024 giving 244% returns.

Every decade or so, the investors witness a bull market where investor confidence and optimism are seen heightened to the extent of being irrational. During the bull run, investors make and lose fortunes. It is imperative that the professionals in the field of investing and money management understand the relationship between narratives and bull markets as a significant market force.

Reasons for studying and understanding this relationship could be attributed to the following. The phenomena of narratives driven bull markets is recurring in nature. Social media has accentuated rapid dissemination of narratives and its significant impact on investments. “Chance favours the prepared mind” - Louis Pasteur. Investors or money managers could turn narratives in their favour. To avoid losses.

This study has covered the period between Q1 2020 and Q2 2024. For this study, 12 narratives (independent variables) as detailed earlier were shortlisted. These narratives were prominent and in circulation during the period of this study. The study covers individual and cumulative effect of narratives on Nifty 50 Index values (dependent variable).

The narratives covered herein could be divided into two categories.

Narratives related to Indian Economy:

Resurgent Indian Economy, The India Stack, Atmanirbhar Bharat, India - The Emerging Manufacturing Powerhouse, The India Decade, India - the fastest growing economy.

Narratives related to Indian Stock Market:

Liquidity in Stock Market, Earnings Visibility, Risk-off Trade, Retail Participation in Stock market, PE Expansion of Stocks, India Bull market.

This study covers a period from July 2020 to June 2024. Run up to the Lok Sabha Election, 2024 may have had an impact on our data.

The stepwise regression model may have included non-important narratives or excluded important narratives from the analysis. However, it has provided an objective screening procedure.

II. LITERATURE REVIEW

There have been many research papers studying and trying to understand narratives, media coverage, economic behaviour and its relationship with the assets and the stock market. These papers have highlighted the role of emotionally charge narratives in various aspects of the economy and stock markets. The research papers highlight the role played in shaping investor perceptions, economic behaviours and outcomes, particularly during times of financial crises. Following the work of Robert Shiller about narratives, (Taffler et al., 2021) emphasize that economic narratives can amplify investor emotions, especially during times of extreme market events, which then go on to influence market returns. According to the study, the emotional response to narratives during crises like the dot-com bubble crisis and the Global Financial Crisis show strong interaction between market returns and investor sentiment across different crises. (Taffler et al., 2024) added to the said research, the impact of investor emotions during the time of the COVID 19 pandemic. Continuing this vein of study, (Agarwal et al., 2024) measure how investor emotions affect their decisions during speculative market bubbles, using textual analysis of media narratives and domain-specific keywords to show how investor emotional dynamics help in explaining market behaviour. (Sharpe et al., 2020) also shed light on the power of narratives in economic forecasts by quantifying the degrees of optimism against pessimism in the forecast narratives, which is called the “Tonality” of the text, which is based on the counts of words that were classified as positive or negative. (Paugam & Stolowy, 2020) examined how activist short sellers use the narratives in convincing other investors that the target firms are overvalued. The research assesses the impact of the credibility-based, emotions-bases and logic-based rhetorical strategies used by the activist short sellers to influence other investors. Furthermore, (Chan, 2003) investigates how the price of stocks reacts to news and the pattern that follows post-news drifts, underreactions of investors and reversals in price movement. According to the researcher, stocks that experienced negative returns due to bad news tend to underperform compared to their peers, while stocks that have positive news experience less drift. Stocks that have extreme returns but no news pertaining to the said stocks have seen reversals months later. These findings highlight the importance of understanding the reactions of the markets beyond the immediate events covered in the news. Another study of a similar nature was conducted by (Fama et al., 1969) who examined the stock splits and the impact they had on market behaviour. The study found that the markets quickly account for the information regarding the stock splits or their dividend implications in particular. The researchers suggests that the reaction of the markets to the splits is mainly driven by the changes in the expected income rather than the splits themselves. This underscores the significance of dividend expectations in price adjustments. (Engelberg et al., 2011) further explored the influence of media coverage on investor behavior and have demonstrated that local media coverage has a significant impact on local trading behaviour. The research gives emphasis to the causal relationship between media presence and trading activity, suggesting that media narratives can drive market behaviour, particularly in markets with varying levels of media exposure. (Hanna et al., 2020) have used sentiment analysis of the Financial Times to explore how the tone of the news coverage affects trading volumes and returns. The research findings also support Robert Shiller’s hypothesis that the media acts a propagator of the speculative movements in the market, with investor’s sentiments driving market behaviour in bull markets. The said research also covers the nuanced role media sentiment play in different market conditions. (Bollen et al., 2011) have done a study on the role public opinion and social media, in the study’s case Twitter, in predicting the financial markets. The study showed that sentiment analysis from social media platforms can enhance one’s market predictions. The researchers also added mood dimensions to the study to demonstrate that narrative-driven insights can improve the accuracy of forecasts and have emphasized the importance of emotional and narrative aspects in market analysis. Another such research paper was published by (Chen et al., 2014) who investigate the extent to which investor’s opinions transmitted through popular social media platforms in the United States predict future returns in the stock market. The study considered the reader’s perspective as being inferred from the commentaries written in response to the articles. The findings suggest views expressed in both articles and commentaries predict future stock returns. (Baker et al., 2006) have taken this discussion further by showing that investor sentiment affects stock price reactions to their earnings announcements. (Shiller, 2019) reinforces the importance of narratives in economic theory and how narratives can predict economic behaviour and market returns. A study by (Dierks et al., 2021) shows just how powerful narratives, explaining why retail and institutional investors decided to trust the narratives circulated by the company in an attempt to reduce uncertainty, even though the fact of large-scale accounting inconsistencies was obvious.

Narratives being a mostly qualitative study, there are some who have attempted to quantify the impact of narratives on markets. Such as (Calomiris et al., 2019), who quantified the impact of narratives using key lists of words or its combinations to see how its presence affects market outcomes, (Alanyali et al., 2013) who used a large corpus of daily print issues of the Financial Times to quantify the relationship between the decisions taken in the financial markets and the developments in the news. A paper by (Nyman et al., 2021) applies algorithmic analysis to the financial market text-based data to assess how narratives and sentiment might drive the development of financial systems. Another attempt at quantifying narratives was by (Bhargava et al., 2023) wherein the study used an approach based on the media coverage of the financial markets to quantify narratives and develop methodologies for explaining the extent narratives drive financial markets and the returns on investment portfolios. (Macaulay & Song, 2023) studied the role of narratives for macroeconomic fluctuations. The research showed how exposure to different narratives can affect expectations in an otherwise standard macroeconomic model. Establishing a link between media narratives and social media data, the study shows that exposure to a narrative that is indicative of recessions is associated with a more pessimistic sentiment, while showing no such change in sentiment otherwise. (Glasserman & Mamaysky, 2019) examined the impact “unusual” news have on market volatility and tried to see if such news can forecast market stress. (Tetlock, 2007) also explored the connection between media narratives and market outcomes and found that media pessimism is correlated with market downturns and increases in trading volumes. Thus, challenging the traditional view that media reflects market conditions and suggests that narratives can drive market behaviour. (Hillert et al., 2014) add to this by examining how media coverage enhances investor biases, leading to stronger momentum and eventual reversals in the stock prices. (Dougal et al., 2012) continue this line of exploration by examining how individual journalist writing styles and biases at the Wall Street Journal affect market performance. The research findings suggests that journalists can enhance or weaken marker sentiment, particularly during periods of extreme market conditions. (Kräussl & Mirgorodskaya, 2017) investigated the impact of media pessimism on financial market returns, volatility in the long run and the lag effect of media pessimism on market performance. (Bask et al., 2024) have examined the impact negative media sentiments have on stock returns. The study found that negative media coverage is associated with low expected returns. Using a corpus of over 5.5 million news articles on the 20 large firms in the US from across a 10-year period from January 2001 to December 2010, (Ahmad et al., 2016) show how media-expressed negative tones impact returns at a firm-level in ways that vary across different firms and over time. (Harris et al., 2023) also shows the impact of bad news surrounding the accidents of the Boeing 737 MAX on the company. (Bathia & Bredin, 2016) examines the relationship between investor sentiment and G7 stock returns using a range of investor sentiment proxies, such as investor survey, equity fund flow, closed-end equity fund discount and equity put-call ratio to examine if the sentiments have a significant influence on value and growth stock returns along with aggregate market returns. (Froot et al., 2017) introduced the idea of a reinforcement effect between past returns and media-measured sentiments. According to the findings in the study, return reversal is more noticeable when the media sentiments match the formation period return, showing that independent responses to individual signals is overwhelmed by the responses to reinforced signals. The said research adds to the growing use of textual analysis to link media content with financial market behaviour, bringing emphasis to the role of media sentiment in asset pricing models. (Roos & Reccius, 2024) gives an overview on how studies so far use the term “narratives” in their research before proposing the concept of a collective economic narratives.

III. RESEARCH METHODOLOGY

Secondary data was used for this study. Each narrative was summarized into a phrase. Multiple keywords related to the summarized phrase were used together as a search criterion to get results. For example, Keywords ‘Earnings Visibility, Companies, India’ used together for “Earnings Visibility” phrase. A count was recorded for the occurrences of the phrase representing the narratives. Certain degree of freedom was accepted in the search result e.g., resurgent, resurging or resurgence of Indian economy, etc.

A total of 7987 textual counts were accounted for the 12 narratives.

Daily closing values of Nifty 50 Index were sourced from NSE website.

Data Smoothing: High variance in the closing values of Nifty 50 Index could result in biased results. To smoothen the data, the 100 Day Simple Moving Average (100 DMA) was used instead of the daily closing values.

The count for the occurrence of each narrative in various publications was summed up on a quarterly basis. The premise for clubbing the data was that the lifecycle of narratives run over a period and are rarely seen as a spike. Correspondingly, a 100 DMA value of Nifty 50 Index for the last working day of each quarter was used for data analysis.

Data Analysis: For the study, a parsimonious regression model was built for data analysis. It was necessary to eliminate redundant or irrelevant narratives and explain the data with a minimum number of important narratives.

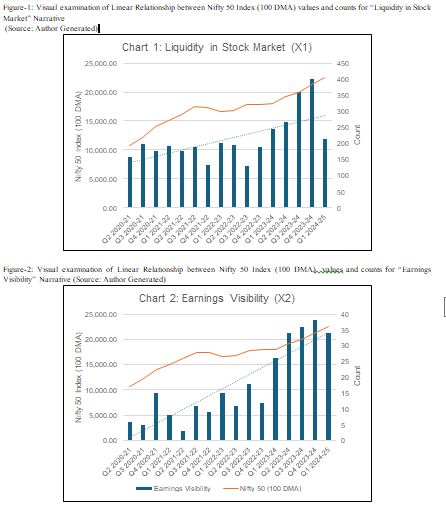

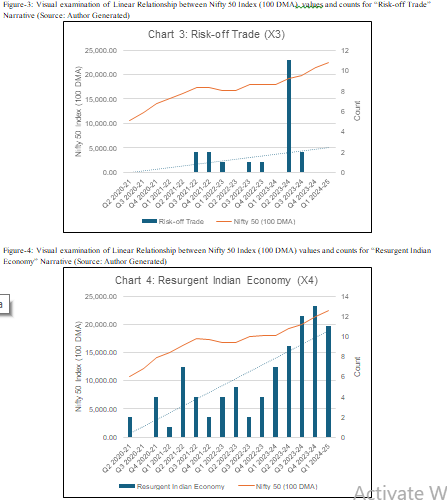

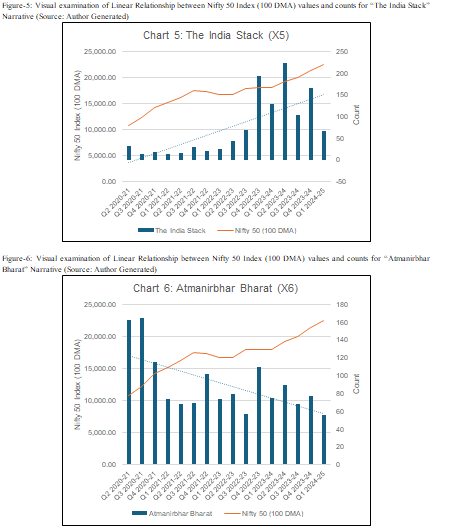

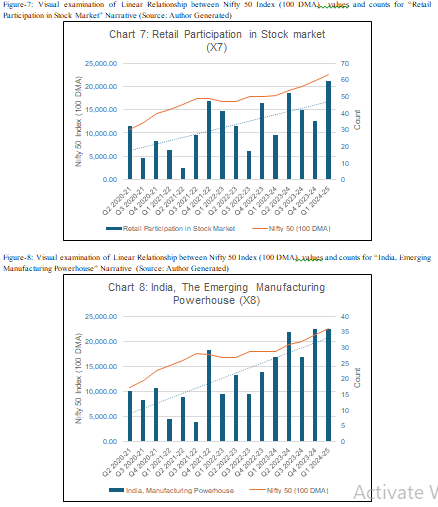

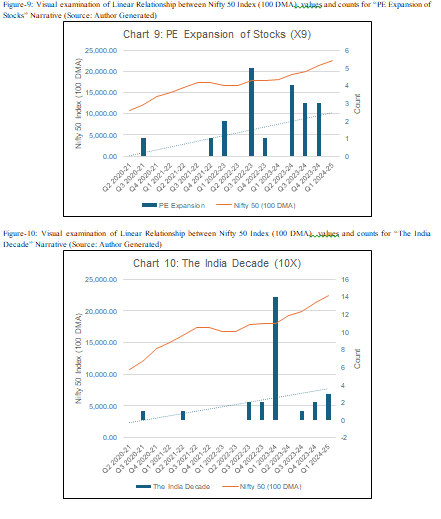

The relationship between Nifty 50 Index (100 DMA) values and the occurrences of each narrative was confirmed first with the help of Diagrams and Trend Lines.

A Parsimonious Regression Model was built to analyse the data statistically. The study uses a 5% (a = 0.05) level of significance to test F and t statistics.

The general multiple regression equation for this study is.

Y = β0+ β1X1+β2X2+β3X3+β4X4+β5X5+β6X6+β7X7+β8X8+β9X9+β10X10 +β11X11+β12X12…….(1)

The model was built based on the following method:

The model started with no element in the equation.

Y regressed on Xj – where Xj includes all narratives. Feature (independent variable + Dependent Variable) with highest absolute t-Value (| t |) and with p-Value of less than 0.05 was selected and added to the equation.

Y regressed on Xn1+Xj – Feature with highest absolute t-Value and with p-Value less than 0.05 was selected and added to the equation with Xn1.

Y regressed on Xn1+Xn2+Xj – Feature with highest absolute t-Value and with p-Value less than 0.05 was selected and added to the equation Xn1+Xn2.

The process was iterated till of all remaining coefficients of independent variables were not significant (α=0.05) and the model was finalized at that point.

Steps Followed to build our regression model:

The relationship between dependent variable (Y) and independent variables (Xj) were examined visually using individual diagrams and trendlines.

Single step multiple regression model was built first to understand existence of multicollinearity among independent variables.

Correlation analysis was conducted on independent variables to examine the relationship between them.

Redundant independent variables were eliminated from further analysis using Variance Inflation Factor (VIF) to minimize multicollinearity among independent variables.

A parsimonious multiple regression model was built using stepwise forward selection method as described earlier.

IV. RESULTS & DISCUSSION

Table-1: Independent Variable and Dependent Variable of the study

|

Independent Variable |

Dependent Variables |

|

Nifty 50 Index (100 DMA) Values |

Liquidity in Stock Market (X1) |

|

|

Earnings Visibility (X2) |

|

|

Risk-off Trade (X3) |

|

|

Resurgent Indian Economy (X4) |

|

|

The India Stack (X5) |

|

|

Atmanirbhar Bharat (X6) |

|

|

Retail Participation in Stock market (X7) |

|

|

India, The Emerging Manufacturing Powerhouse (X8) |

|

|

PE Expansion of Stocks (X9) |

|

|

The India Decade (X10) |

|

|

India, the fastest growing economy (X11) |

|

|

India Bull market (X12) |

Based on the diagrams, it can be interpreted that all narratives have some linear relationship with Nifty 50 Index. However, some of the narratives have low count of occurrences or occurrences in patches for limited period. Except for Atmanirbhar Bharat, all other narratives have a positive relationship with the index. This negative relationship is explained later.

Counts for Independent variables are observed for a period of 16 quarters. Narratives having a life span throughout that period can be considered important.

Table-2: Single Step Multiple Regression Model Output Summary (Source: Author’s Computation)

|

Regression Statistics |

|||||

|

Multiple R |

0.9780 |

|

|

|

|

|

R Square |

0.9565 |

|

|

|

|

|

Adjusted R Square |

0.7827 |

|

|

|

|

|

Standard Error |

1429.1289 |

|

|

|

|

|

Observations |

16 |

|

|

|

|

|

|

|

|

|

|

|

|

ANOVA |

|||||

|

|

df |

SS |

MS |

F-Statistic |

p- Value |

|

Regression |

12 |

134826633.8 |

11235552.8 |

5.50 |

0.093 |

|

Residual |

3 |

6127228.6 |

2042409.5 |

|

|

|

Total |

15 |

140953862.5 |

|

|

|

|

|

|

|

|

|

|

|

|

Coefficients |

Standard Error |

t-Statistic |

p-value |

|

|

Intercept |

17220.345 |

2774.874 |

6.206 |

0.008 |

|

|

X1 |

1.079 |

15.954 |

0.068 |

0.950 |

|

|

X2 |

-52.584 |

149.709 |

-0.351 |

0.749 |

|

|

X3 |

-42.384 |

235.151 |

-0.180 |

0.868 |

|

|

X4 |

111.827 |

356.263 |

0.314 |

0.774 |

|

|

X5 |

3.159 |

12.189 |

0.259 |

0.812 |

|

|

X6 |

-53.945 |

20.184 |

-2.673 |

0.076 |

|

|

X7 |

47.555 |

56.110 |

0.848 |

0.459 |

|

|

X8 |

76.284 |

99.572 |

0.766 |

0.499 |

|

|

X9 |

157.425 |

537.878 |

0.293 |

0.789 |

|

|

X10 |

-24.960 |

225.416 |

-0.111 |

0.919 |

|

|

X11 |

32.215 |

29.203 |

1.103 |

0.351 |

|

|

X12 |

-22.938 |

69.515 |

-0.330 |

0.763 |

|

Based on the results, it can be interpreted that the model explains 95.65% of the variation in Nifty 50 Index (100 DMA) values. But the model is not meaningful. Compared to F-Critical Value (3.49), F-Statistic is not large enough (5.50). p-Value of F test is not statistically significant (a = 0.05). Considering the statistics, it is apparent that a high level of multicollinearity exists between independent variables.

Further, correlation and multicollinearity tests are run on the independent variables and a parsimonious multiple regression model is built using stepwise forward selection method after removing redundant variables.

Table-3: Correlation Analysis (Source: Author’s Computation)

|

r |

X1 |

X2 |

X3 |

X4 |

X5 |

X6 |

X7 |

X8 |

X9 |

X10 |

X11 |

|

X1 |

1.00 |

|

|

|

|

|

|

|

|

|

|

|

X2 |

0.78 |

1.00 |

|

|

|

|

|

|

|

|

|

|

X3 |

0.18 |

0.37 |

1.00 |

|

|

|

|

|

|

|

|

|

X4 |

0.82 |

0.86 |

0.22 |

1.00 |

|

|

|

|

|

|

|

|

X5 |

0.56 |

0.67 |

0.56 |

0.56 |

1.00 |

|

|

|

|

|

|

|

X6 |

-0.24 |

-0.45 |

-0.07 |

-0.50 |

-0.15 |

1.00 |

|

|

|

|

|

|

X7 |

0.27 |

0.58 |

0.43 |

0.47 |

0.50 |

-0.15 |

1.00 |

|

|

|

|

|

X8 |

0.55 |

0.79 |

0.35 |

0.74 |

0.66 |

-0.18 |

0.72 |

1.00 |

|

|

|

|

X9 |

0.35 |

0.51 |

0.52 |

0.26 |

0.51 |

-0.24 |

0.18 |

0.32 |

1.00 |

|

|

|

X10 |

0.18 |

0.31 |

-0.19 |

0.22 |

0.30 |

-0.19 |

-0.04 |

0.28 |

-0.12 |

1.00 |

|

|

X11 |

0.59 |

0.74 |

0.01 |

0.66 |

0.52 |

-0.30 |

0.39 |

0.61 |

0.19 |

0.32 |

1.00 |

r = Correlation Coefficient

The correlation analysis indicates a high degree of correlation between independent variables, particularly, between X1, X2, X4, X8 and X11 independent variables and Variance Inflation Factor (VIF) analysis for multicollinearity is warranted.

Table-4: Multicollinearity Test (Source: Author’s Computation)

|

Narrative |

Variable |

VIF |

VIF |

VIF |

|

|

|

Round 1 |

Round 2 |

Round 3 |

|

Liquidity in the Stock Market |

X1 |

10.1 |

7.0 |

2.2 |

|

Earnings Visibility |

X2 |

23.8 |

|

|

|

Risk-off Trade |

X3 |

3.0 |

2.5 |

2.5 |

|

Resurgent Indian Economy |

X4 |

15.0 |

14.3 |

|

|

The India Stack |

X5 |

5.3 |

4.2 |

4.0 |

|

Atmanirbhar Bharat |

X6 |

3.3 |

3.2 |

1.3 |

|

Retail Participation in Stock Market |

X7 |

5.0 |

3.2 |

3.1 |

|

India, Manufacturing Powerhouse |

X8 |

6.9 |

6.9 |

4.3 |

|

PE Expansion |

X9 |

5.8 |

2.6 |

2.6 |

|

The India Decade |

X10 |

4.4 |

2.3 |

2.3 |

|

India, The Fastest Growing Economy |

X11 |

4.6 |

3.8 |

3.5 |

|

The India Bull Market |

X12 |

3.6 |

3.2 |

2.3 |

|

Terminate at VIF < 5 |

|

23.8 |

14.3 |

4.3 |

VIF = Variance Inflation Factor

Since Independent variables X2 and X4 had greater values than 5, they were eliminated from the multiple regression model.

Table-5: Parsimonious Multiple Regression Model built with Stepwise Forward Selection Method (Source: Author’s Computation)

|

Narrative |

Independent variable |

Y regressed on Xj |

Y regressed on X6+Xj |

Y regressed on X6+X8+Xj |

|||

|

|

|

| t-Stat | |

p-Value |

| t-Stat | |

p-Value |

| t-Stat | |

p-Value |

|

Liquidity in the Stock Market |

X1 |

2.449 |

0.028 |

2.594 |

0.022 |

1.024 |

0.326 |

|

Risk-off Trade |

X3 |

0.983 |

0.342 |

1.171 |

0.263 |

0.052 |

0.959 |

|

The India Stack |

X5 |

2.558 |

0.023 |

3.570 |

0.003 |

1.383 |

0.192 |

|

Atmanirbhar Bharat * |

X6 |

4.420 |

0.001 |

|

|

|

|

|

Retail Participation in Stock Market |

X7 |

2.665 |

0.018 |

3.854 |

0.002 |

1.148 |

0.273 |

|

India, Emerging Manufacturing Powerhouse ** |

X8 |

3.573 |

0.003 |

6.322 |

0.000 |

|

|

|

PE Expansion |

X9 |

1.572 |

0.138 |

1.249 |

0.234 |

0.545 |

0.596 |

|

The India Decade |

X10 |

0.917 |

0.375 |

0.523 |

0.610 |

-0.548 |

0.594 |

|

India, The Fastest Growing Economy |

X11 |

3.399 |

0.004 |

3.730 |

0.003 |

2.050 |

0.063 |

|

The India Bull Market |

X12 |

0.218 |

0.831 |

0.591 |

0.564 |

0.094 |

0.926 |

(Level of significance (α) = 0.05)

Parsimonious multiple regression model was built using remaining independent variables after multicollinearity test. At each round, an independent variable with highest absolute t-Stat and p-Value of less than 0.05 was added to the model. The process was terminated when none of the independent variable were statistically significant. The model was finalised with Atmanirbhar Bharat (X6) and India, Emerging Manufacturing Powerhouse (X8) independent variables. The equation for the model could be derived as

Y = ?0 + ?1X6 + ?2X8…………………………………….(2)

Should the study have added ‘India, The Fastest Growing Economy’ (X11) independent variable to the model:

In the third round of stepwise model building, Independent variable X11 – India, The Fastest Growing Economy had highest absolute t-Statistic of 2.050 among all independent variables and the p-Value of coefficient (0.06) that was close to the level of significance (a = 0.05).

Had the X11 variable been added in the model, the study would have had the following results compared to the finalised model without X11.

Table-6: Comparison between adding ‘India, The Fastest Growing Economy’ (X11) and not

adding ‘India, The Fastest Growing Economy’ (X11) (Source: Author’s Computation)

|

Parameter |

X6 + X8 |

X6 + X8 + X11 |

|

R2 |

0.8976 |

0.9241 |

|

F |

56.95 |

48.72 |

|

F-Statistic |

0.0000004 |

0.0000005 |

|

Coefficient of X6 |

-60.76 |

-56.93 |

|

Coefficient of X8 |

179.19 |

140.76 |

|

Coefficient of X11 |

|

24.13 |

By adding X11 independent variable, the model would have explained 92.41% of variation in Nifty 50 Index (100 DMA) values compared to 89.76% earlier. This would have enhanced the study’s predictability by 2.96%. However, the F-Statistic would have reduced to 48.72 from 56.95. Which wasn’t desirable (F = MSR/MSE). Also, coefficient of X11 (24.13) couldn’t be considered as a large proportion. Considering the p value and other statistics, it was concluded that adding X11 independent variable to the regression model wasn’t beneficial.

Table-7: Results of Multiple Regression Model (Source: Author’s Computation)

|

Regression Statistics |

|||||

|

Multiple R |

0.9473 |

||||

|

R Square |

0.8976 |

||||

|

Adjusted R Square |

0.8818 |

||||

|

Standard Error |

1053.907 |

||||

|

Observations |

16 |

||||

|

|

|||||

|

ANOVA |

|||||

|

|

df |

SS |

MS |

F-Statistic |

p-Value |

|

Regression |

2 |

126514492.5 |

63257246.2 |

56.95 |

0.0000004 |

|

Residual |

13 |

14439370.0 |

1110720.8 |

||

|

Total |

15 |

140953862.5 |

|

|

|

|

|

Coefficients |

Standard Error |

t-Statistic |

p-Value |

|

|

Intercept |

18754.7 |

1068.44 |

17.55 |

0.00000 |

|

|

X6 |

-60.8 |

8.32 |

-7.31 |

0.00001 |

|

|

X8 |

179.2 |

28.34 |

6.32 |

0.00003 |

|

Level of Significance (a) = 0.05

R2 measures proportion of total variation in dependent variable explained by independent variables i.e., R2 is a ratio of explained variation to total variation.

Considering the results above, R2 for our multiple regression model indicates that 89.76% of the total variation in Nifty 50 Index (100 DMA) is explained collectively by independent variables - Atmanirbhar Bharat and India, emerging manufacturing powerhouse. Since R2 is descriptive, the regression model will have to be validated using F-statistic.

Table-8: F-Statistic (Source: Author’s Computation)

|

Level of Significance |

Degrees of Freedom |

F Critical Value |

|

a = 0.05 |

(k = 2, N-k-1 = 13) |

19.42 |

F-Statistic (56.95) for the regression model is greater than the F-Critical value (19.42) calculated at 0.05 level of significance. We can say that the regression model is effective in its explanation of variability in Nifty 50 Index (100 DMA) and at least one coefficient of independent variable in the model is non-zero.

Considering the p-Value for F test (0.0000004), which is less than 0.05 level of significance, it can be inferred that the model is statistically significant and meaningful compared to the possible base model (Y = ?0). Base model would have 0 coefficient for both independent variables.

t-Statistic:

t-Test determines whether each independent variable influences the dependent variable significantly. Both independent variables – ‘Atmanirbhar Bharat’ and ‘India, emerging manufacturing powerhouse’ are statistically significant (a = 0.05) and are individually useful for explaining the variation in Nifty 50 Index (100 DMA) during Q2 2020 – Q1 2024 period.

Negative Coefficient of Determination for Atmanirbhar Bharat:

Atmanirbhar Bharat narrative has a negative coefficient of determination. Negative coefficient implies that Nifty 50 Index has inverse relationship with the narrative. Negative coefficient is not expected in the model. The premise for this study suggests that increase in the counts for narratives would result in a higher index value during the bull market.

However, after plotting counts on a diagram, it can be understood that the counts for narrative ‘Atmanirbhar Bharat’ were at its peak during Q2 and Q3 of 2020-21 and mostly tapered down thereafter. Atmanirbhar Bharat Abhiyan started on 13 May 2020. At the start of the Abhiyan, the media coverage was very strong due to the push by government to kickstart the economy slowed down by Covid lockdown. In fact, the bull market started in second quarter of 2020 and coincided with the burst in media coverage for Atmanirbhar Bharat Abhiyan. Seemingly contradictory relationship between index values and Atmanirbhar Bharat counts becomes logical when plotting the data regarding both narratives and Nifty 50 Index (100 DMA) together.

Conclusion

Narratives and bull markets have positive relationship. Narratives feed the market with positive flow of information and increasing stock prices augment that information. The bull market during 2020-24 in Indian stocks exhibits this relationship between narratives and bull markets clearly. For this study to understand the relationship between the bull market in Indian stocks during 2020-24 and narratives in circulation, the following conclusions were drawn. Bull Markets are driven by narratives. The regression model has indicated statistically significant presence of a relationship between the bull market in Indian stocks (2020-24) and narratives in circulation. As per the parsimonious regression model built, the rise in Nifty 50 Index during 2020-24 could be explained effectively using two variables i.e., Atmanirbhar Bharat and India – Emerging Manufacturing Powerhouse. Both the narratives incorporated post Covid economic story of India extensively. Supply chain shock was a setback as well as an opportunity for the Indian government. These two narratives well publicised the economic benefits and prospective gains for the stock market investors, pushing stock prices higher and creating a surging effect on Nifty 50 Index. The effect of narratives on bull markets is cumulative. The correlation analysis, variance inflation factor analysis and single step regression model indicated presence of multicollinearity among narratives under the study. Narratives have long and short lifecycles. Many of the narratives started, peaked and diminished in a short span. But some remained active during the period of study. Though, each narrative pushed the stock market up during the bull run. Sustained favourable narratives can overcome the impact of negative event. A flow of favourable narratives about India’s economic growth opportunities started a bull run in Indian stock market in 2020 that continued for 4 years despite economic worries due to Covid lockdown in the beginning.

References

[1] Baker, M., & Stein, J. C. (2004). Market liquidity as a sentiment indicator. Journal of financial Markets, 7(3), 271-299. [2] Fang, L., & Peress, J. (2009). Media coverage and the cross?section of stock returns. The journal of finance, 64(5), 2023-2052. [3] Baker, M., & Wurgler, J. (2006). Investor sentiment and the cross?section of stock returns. The journal of Finance, 61(4), 1645-1680. [4] Chan, W. S. (2003). Stock price reaction to news and no-news: drift and reversal after headlines. Journal of financial economics, 70(2), 223-260. [5] Taffler, R. J., Agarwal, Vineet, & Obring, Maximillian. (2021). Narrative Economics and Market Bubbles. European Financial Management, European Financial Management Association, 21(4). [6] Shiller, R. J. (2017). Narrative economics. American economic review, 107(4), 967-1004. [7] Baker, M., & Wurgler, J. (2007). Investor sentiment in the stock market. Journal of economic perspectives, 21(2), 129-151. [8] Fama, E. F., Fisher, L., Jensen, M. C., & Roll, R. (1969). The adjustment of stock prices to new information. International economic review, 10(1), 1-21. [9] Dyck, A., & Zingales, L. (2003). The media and asset prices. Working Paper, Harvard Business School. [10] Brown, G. W., & Cliff, M. T. (2005). Investor sentiment and asset valuation. The Journal of Business, 78(2), 405-440. [11] Bhattacharya, U., Galpin, N., Ray, R., & Yu, X. (2009). The role of the media in the internet IPO bubble. Journal of Financial and Quantitative Analysis, 44(3), 657-682. [12] Engelberg, J. E., & Parsons, C. A. (2011). The causal impact of media in financial markets. the Journal of Finance, 66(1), 67-97. [13] Birz, G., & Lott Jr, J. R. (2011). The effect of macroeconomic news on stock returns: New evidence from newspaper coverage. Journal of Banking & Finance, 35(11), 2791-2800. [14] Bathia, D., & Bredin, D. (2016). An examination of investor sentiment effect on G7 stock market returns. In Contemporary Issues in Financial Institutions and Markets (pp. 99-128). Routledge. [15] Alanyali, M., Moat, H. S., & Preis, T. (2013). Quantifying the relationship between financial news and the stock market. Scientific reports, 3(1), 3578. [16] Ahmad, K., Han, J., Hutson, E., Kearney, C., & Liu, S. (2016). Media-expressed negative tone and firm-level stock returns. Journal of Corporate Finance, 37, 152-172. [17] Froot, K., Lou, X., Ozik, G., Sadka, R., & Shen, S. (2017). Media reinforcement in international financial markets. Working paper. [18] Kräussl, R., & Mirgorodskaya, E. (2017). Media, sentiment and market performance in the long run. The European Journal of Finance, 23(11), 1059-1082. [19] Calomiris, C. W., & Mamaysky, H. (2019). How news and its context drive risk and returns around the world. Journal of Financial Economics, 133(2), 299-336. [20] Agarwal, S., Kumar, S., & Goel, U. (2019). Stock market response to information diffusion through internet sources: A literature review. International Journal of Information Management, 45, 118-131. [21] Hanna, A. J., Turner, J. D., & Walker, C. B. (2020). News media and investor sentiment during bull and bear markets. The European Journal of Finance, 26(14), 1377-1395. [22] Nyman, R., Kapadia, S., & Tuckett, D. (2021). News and narratives in financial systems: exploiting big data for systemic risk assessment. Journal of Economic Dynamics and Control, 127, 104119. [23] Harris, R. (2023). Narrative Finance-The use of narrative to inform investment judgement. How stories move markets-the system behind the Boeing 737 MAX shock news. [24] Agarwal, V., Taffler, R. J., & Wang, C. (2024). Investor emotions and market bubbles. Review of Quantitative Finance and Accounting, 1-31. [25] Roos, M., & Reccius, M. (2024). Narratives in economics. Journal of Economic Surveys, 38(2), 303-341. [26] Dierks, L. H., & Tiggelbeck, S. (2021). Emotional finance: The impact of emotions on investment decisions. Journal of New Finance, 2(2), 3. [27] Breaban, A., & Noussair, C. N. (2018). Emotional state and market behavior. Review of Finance, 22(1), 279-309. [28] Sharpe, S. A., Sinha, N. R., & Hollrah, C. A. (2020). The power of narratives in economic forecasts. [29] Taffler, R. J., Agarwal, V., & Obring, M. (2024). Narrative Emotions and Market Crises. Journal of Behavioral Finance, 1-21. [30] Mian, G. M., & Sankaraguruswamy, S. (2012). Investor sentiment and stock market response to earnings news. The Accounting Review, 87(4), 1357-1384. [31] Bhargava, R., Lou, X., Ozik, G., Sadka, R., & Whitmore, T. (2022). Quantifying narratives and their impact on financial markets. Journal of Portfolio Management, Forthcoming. [32] Macaulay, A., & Song, W. (2023). Narrative-driven fluctuations in sentiment: Evidence linking traditional and social media (No. 2023-23). Bank of Canada. [33] Bollen, J., Mao, H., & Zeng, X. (2011). Twitter mood predicts the stock market. Journal of computational science, 2(1), 1-8. [34] Bokhari, A. (2024, March). Exploring the Impact of Competing Narratives on Financial Markets I: An Opinionated Trader Agent-Based Model as a Practical Testbed. In ICAART (1) (pp. 127-137). [35] Paugam, L., Stolowy, H., & Gendron, Y. (2021). Deploying narrative economics to understand financial market dynamics: An analysis of activist short sellers\' rhetoric. Contemporary Accounting Research, 38(3), 1809-1848 [36] Bybee, L., Kelly, B., & Su, Y. (2023). Narrative asset pricing: Interpretable systematic risk factors from news text. The Review of Financial Studies, 36(12), 4759-4787. [37] Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. The Journal of finance, 62(3), 1139-1168. [38] Solomon, D. H. (2012). Selective publicity and stock prices. The Journal of Finance, 67(2), 599-638. [39] Bask, M., Forsberg, L., & Östling, A. (2024). Media sentiment and stock returns. The Quarterly Review of Economics and Finance, 94, 303-311. [40] Chen, H., De, P., Hu, Y., & Hwang, B. H. (2014). Wisdom of crowds: The value of stock opinions transmitted through social media. The review of financial studies, 27(5), 1367-1403. [41] Dougal, C., Engelberg, J., Garcia, D., & Parsons, C. A. (2012). Journalists and the stock market. The Review of Financial Studies, 25(3), 639-679. [42] Hillert, A., Jacobs, H., & Müller, S. (2014). Media makes momentum. The Review of Financial Studies, 27(12), 3467-3501. [43] Tetlock, P. C. (2014). Information transmission in finance. Annu. Rev. Financ. Econ., 6(1), 365-384. [44] Glasserman, P., & Mamaysky, H. (2019). Does unusual news forecast market stress?. Journal of Financial and Quantitative Analysis, 54(5), 1937-1974. [45] Szczygielski, J. J., Charteris, A., Bwanya, P. R., & Brzeszczy?ski, J. (2024). Google search trends and stock markets: sentiment, attention or uncertainty?. International Review of Financial Analysis, 91, 102549. [46] Todd, A., Bowden, J., & Moshfeghi, Y. (2024). Text?based sentiment analysis in finance: Synthesising the existing literature and exploring future directions. Intelligent Systems in Accounting, Finance and Management, 31(1), e1549. [47] Business Today. (2024, February 12). Morgan Stanley\'s fragile-five days long gone as money starts piling into India. [48] World Bank Group. (2024, September 3). India’s economy to remain strong despite subdued global growth [Press release] [49] Vallery-Radot, R. (1911). The life of Pasteur (Lady Claud Hamilton, Trans.). McClure, Phillips & Co. [50] Osterrieder, J. (2023). A Primer on Narrative Finance. [51] Shiller, R. J. (2019). Narrative economics: How stories go viral and drive major economic events. The Quarterly Journal of Austrian Economics, 22(4), 620-627.

Copyright

Copyright © 2024 Veerendra Anchan, Shrihan Mohite, Shonit Magan, Sanjana Jangra. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64882

Publish Date : 2024-10-28

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online