Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Network Based Feature Extraction Method for Fraud Detection Using Label Propagation

Authors: Ravula Muralidhar Reddy, N. Naveen Kumar

DOI Link: https://doi.org/10.22214/ijraset.2024.63525

Certificate: View Certificate

Abstract

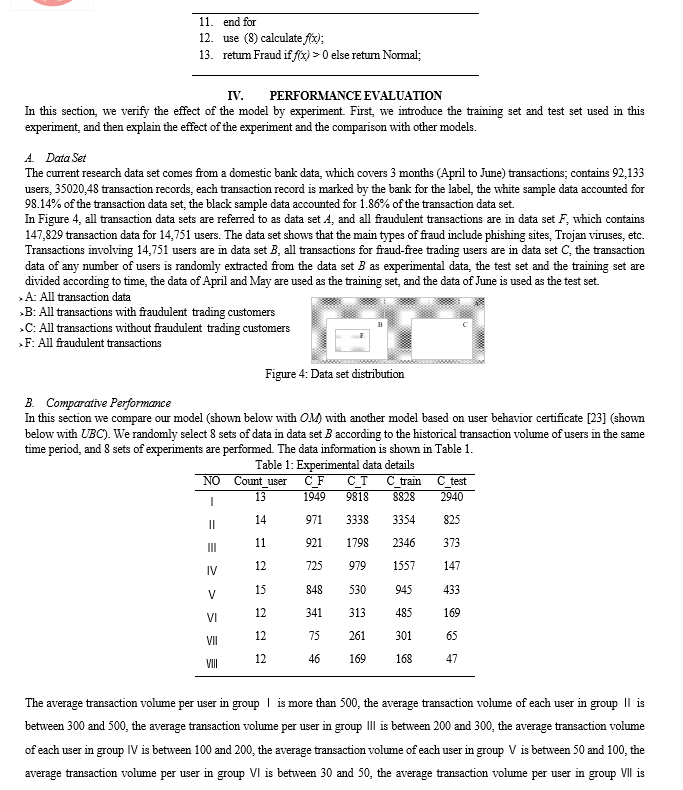

Nowadays, judging the current transaction based on user history transactions is an important detection method. However, different users have different transaction behaviors, when all users use the same limit to judge whether the transaction is abnormal, it will result in higher misjudgment for some users. Aiming at the above problems, this paper proposes an individual behavior transaction detection method based on hypersphere model. In this model, considering multiple dimensions of normal historical transaction records, the characteristics of user’s transaction behavior is generated with the trend of transaction. Then, the user optimal risk threshold algorithm is proposed to determine the optimal risk threshold for each user. Finally combining the transaction behavior and the optimal risk threshold, the user behavior benchmark is formed, which is used to construct the multidimensional hypersphere model. On this basis, a mapping method for transforming transaction detection into midpoint in multidimensional space is proposed. The experiment proves that the proposed method is superior to other models, and it is found that the characterization effect of user behavior is related to the frequency of users’ transactions. Applied computing ? Secure online transactions; Digital cash; Computing methodologies ? Instance-based learning; Rule learning.

Introduction

I. INTRODUCTION

The fraud detection in online lending establishes whether the user is a fraudster—someone who is unwilling to repay the loan. Fraud has become a major concern for consumer finance organizations worldwide due to quick development of consumer finance and the rise of fraudulent occurrences. Finding the unusual traits of fraudsters is the basic concept behind fraud detection, which has evolved from old techniques like blacklists and rules-based models to machine learning based on big data. Therefore, the crucial issue that ultimately determines the effectiveness of fraud detection is how to extract the traits from the available data that most accurately represent the fraudster. Currently, the most common approach to feature engineering is to extract certain intrinsic attributes from applicants as features. Examples of this include determining whether the applicant's credit information contains any past-due records and using the RFM technique to take details from the applicant's most recent transaction records, such as the quantity of consumption in the previous month or the number of transactions in the previous week. Moreover. Finding out if the registration name matches a specific pattern, the IP block being used at the time of application, whether it's a temporary IP is required. A person's likelihood of being a fraudster increases if they related to the other fraudsters.

With the rapid development of e-commerce, online payment has become more and more popular. The data shows that in 2017, the B2C market transaction volume accounted for 60.0% of the online shopping market in China, and the transaction scale reached 3.6 trillion yuan[6], and in the 2018 Double 11 Shopping Carnival, the final transaction volume of 24 hours reached an astonishing 213.5 billion yuan[18], however, the booming electronic trading market also provides opportunities for fraudsters, causing huge economic losses to users and institutions, disrupting the normal financial order and restricting the long-term healthy development of electronic transactions. According to the investigation and analysis of payment fraud cases by the payment control department, the main means of fraud crimes include hacking, stolen cards, credit card cashing, phishing websites, Trojan horses, etc. [14] How to effectively prevent the risk of online transaction fraud has become a problem to be solved.

Banks generally adopt a rule-based expert system as a method of fraud detection. Through anti-fraud experts analyze the behavior patterns of fraudsters in the case, find out the effective features, and write expert rules to identify fraudulent behaviors [17]. However, the recognition effect of this method is highly dependent on the artificial rules written by anti-fraud experts, at the same time, due to the excessive number of rules, there will be a certain degree of rule redundancy.

Most scholars generally use data mining methods to compensate for the lack of rule systems, such as neural networks, Markov Chains, Bayesian Networks, Decision Trees, Support Vector Machines, and Logistic Regression [5][2][15][16][13][1] and unsupervised methods such as Clustering algorithm and Self- organizing Mapping[12]. Some scholars start from the perspective of individual users, obtaining the transaction pattern of the user according to the historical data of a single user, and then matching the current record with the user transaction mode, thereby performing fraud detection, such as literature [4][11][23][24][9]. Despite the current efforts to resolve the transaction fraud problem, it still faces many difficulties:

- Using machine learning and other related models, the training data needs to be marked. However, in reality, there is a case where the sample is extremely unbalanced, and it is difficult for the model to fully learn the characteristics of fraudulent transactions[7].

- Occasionally, there may be an abnormal amount of money or an abnormal time in the normal transaction of the user, and the model can easily intercept such transactions, resulting in a higher false positive rate[23].

- How to extract user behavior characteristics to construct user behavior benchmark, user transaction abnormality judgment standards still face many challenges.

- The same limit is applied to all users to detect transactions, and the differences between users are not considered, resulting in higher misjudgment for some users.

Aiming at the above problems, this paper proposes a new transaction detection model based on individual behavior. Compared with other models, the proposed model can alleviate the above problems and has the following advantages:

- This paper from the perspective of individual users, using the user’s normal transactions to establish behavior benchmark, can well avoid the problem of sample imbalance.

- In the establishment stage of the user behavior benchmark, this paper considers the user’s various dimension information and considers the trend of user transactions, which can better describe the user behavior.

- This paper considers the difference between users, and proposes the optimal risk threshold division algorithm for users, and determines the optimal risk threshold for each user according to the transaction behavior of users.

- This paper builds a behavioral benchmark for each user, and proposes a hypersphere model based on behavioral benchmarks, transforming transaction detection into a mapping of points in multidimensional space.

As mentioned above, the main contributions of this paper are as follows. First, a more accurate individual behavior model is proposed, which considers user transaction behavior from multiple dimensions such as transaction amount, transaction time, transaction frequency, transaction IP and amount change trend. Secondly, considering the difference between different users, the user optimal risk threshold algorithm is proposed based on the user transaction behavior, and the user transaction behavior and the optimal risk threshold are combined into a user behavior benchmark. Based on the user behavior benchmark, a multidimensional hypersphere model is proposed. Third, it is found through experiments that the characterization of user behavior is related to the frequency of user transactions.

The rest of the paper is organized as follows, the second section details the related work, the third section discusses the model approach presented in this paper, the fourth section introduces the data source and the experimental results of this paper, and the fifth section summarizes the research results of the paper and the planning of future research work.

II. RELATED WORK

Fraud detection is a classification problem, so based on group users, using machine learning and other technologies to achieve fraud detection by learning pre-marked transaction data has been widely studied in recent years. Kolalikhormuji et al. [10] propose cascade artificial neural networks based on existing neural networks. AC Bahnsen et al.[3] propose a cost-sensitive method based on Bayesian minimum risk. Zareapoor et al.[20] use integrated learning techniques to build classifiers based on existing machine learning, and introduce decision-making mechanisms for classifier integration evaluation. Xuan et al.[19] use random forests to train the characteristics of normal and abnormal behaviors and perform well in credit fraud detection. Zhang Z et al.[21] can use the convolutional neural network to derive the characteristics of the feature, by inputting the original features and adding the feature arrangement layer to combine the inputs, the transaction is detected and a good result is obtained. J.Cui et al.[22] propose an agile sensing method, which includes an agile perception model of system anomaly and a Petri net model for repeated behavior detection, this method can effectively perceive impending system anomalies and locate them before they occur. However, in reality, high-frequency users have a large number of transactions, which makes it difficult for the model to learn the transaction characteristics of other users. Therefore, the misjudgment of some users is more serious.

In recent years, based on a single user, anomaly detection based on user history data has gradually gained attention. User behavior is more mature in the user portrait field, including intelligent marketing and personalized recommendation. By analyzing the basic information, social characteristics and transaction characteristics of the group users, the user is tagged and classified according to the tags to which the user belongs, and to achieve advertising recommendations, precision marketing, etc.[8] But the user portrait is actually a "typical" user obtained by refining the attribute characteristics, a virtual representation of the user’s real data, a collection of common features of a user group with similar behaviors, and a conceptual model of a user group with some distinctive features. However, the financial fraud detection based on individual users pay more attention to the users themselves. From the perspective of users, the user behavior model is constructed by analyzing the user’s transaction behavior patterns, and then the model is used to detect the transactions of the users. Ji Bingshuai et al.[4] propose a method for e-commerce user abnormal behavior detection research, collecting user historical behavior data, using data mining algorithm to establish the user’s normal behavior pattern, and judging whether the user’s transaction behavior is abnormal. Yigit Kultur et al.[11] propose a new cardholder behavior model for credit card fraud detection, focusing on the cardholder’s transaction behavior and detecting abnormal transactions through user’s historical transaction behavior. Zheng et al.[23] propose a new behavior certificate-based credit card fraud detection system that use user behavior certificates to identify user transactions. J.Zhong et al.[24] propose a method based on browsing behavior authentication, which constructs a user browsing behavior model from the Web usage log, the model identifies the true identity of the user in the visited web page. C.Jiang et al.[9] propose a new method using aggregation strategy and feedback mechanism. Firstly, all cardholders are divided into different groups through aggregation strategy, and a series of specific behavior patterns are extracted for each group of cardholders. Finally, a classifier set is used to detect fraud online.

In the above work, the literature[11] only starts from the perspective of the user transaction amount, if the amount is very different from usual, it will be regarded as an abnormality, but the user behavior cannot be fully characterized only by the amount. Although the literature [4] and [23] portray user behavior from multiple angles, it does not consider the independence between users when judging the normal transaction and abnormal transaction of the user, so the misjudgment of some users is more serious. Although the literature [24] establishes a browsing behavior model for each user, it pays more attention to the distinction between users rather than the judgment of user behavior. Although the literature [9] pays attention to the judgment of the transaction, it is to group similar users and establish a model for each group of users to judge, and does not fully consider each user. At the same time, due to the lack of real transaction data, some of the work is carried out on the simulated data, which is deviated from the actual situation, and the applicability needs to be evaluated.

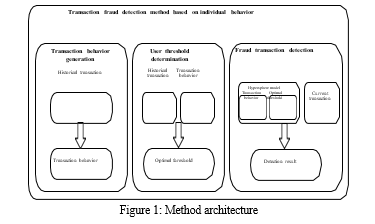

III. MODEL METHOD

This section introduces a new model for transaction detection based on individual behavior. As shown in Figure 1, the first part is the user transaction behavior generation, the second part is the determination of the user’s optimal risk threshold, and the third part is the transaction detection. The user transaction behavior generating part generates a transaction behavior for the user from multiple dimensions according to each user normal transaction. The optimal risk threshold determination section determines an optimal risk threshold for the user based on the transaction behavior and the transaction record of the user. The fraud detection part constructs a multidimensional hypersphere model based on the user behavior benchmark, and according to the model, a detection algorithm is proposed to judge the user’s transaction record.

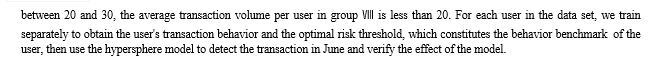

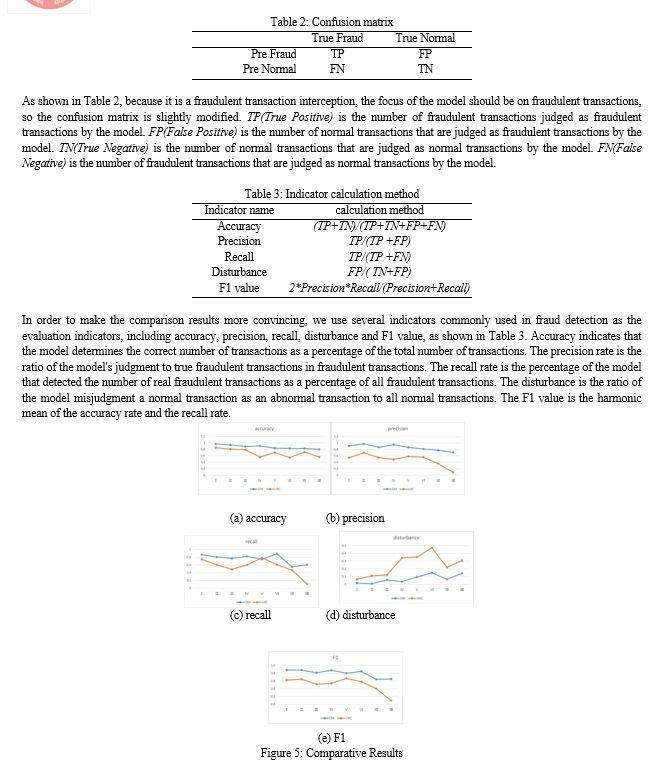

The comparison results are shown in Figure 5, the results can be seen under the same data set, the indicators of OM are higher than UBC. The accuracy rate, which is shown in Figure 5(a), is on average 10% higher than UBC, indicating that OM can more accurately determine the user's normal transactions and fraudulent transactions. The precision rate, which is shown in Figure 5(b), is on average 10% higher than UBC, indicating that OM is better than UBC in intercepting fraudulent transactions. The recall rate and disturbance rate, which are shown in Figure 5(c) and Figure 5(d), although there are fluctuations, the OM recall rate is still about 15% higher than UBC, and the disturbance rate is much lower than UBC, indicating that the model OM is accurately intercepting fraud, at the same time, the misjudgment of normal transactions is very rare. The F1 value, which is shown in Figure 5(e), which represents the overall performance of the model, it can be seen from the figure that OM is more than 20% higher than UBC under all data sets, and the overall performance of the model OM is better than UBC.

At the same time, it can be seen from the 8 sets of experiments that the overall performance of the model fluctuates with the gradual decrease of the user's historical transaction volume in the same time period, but the model OM can maintain better performance than UBC. When the user data volume is between 200 and 300, the overall performance of the model UBC shows a downward trend, the accuracy and precision rate shows a sharp decline, and the disturbance rate also increases rapidly, however, the model OM performs even better. When the number of user historical transaction records is above 100, the overall performance of model OM is excellent, and the accuracy and precision are above 90%. The recall rate and F1 value are also higher than other data sets, and the disturbance rate is less than 5%. When the user history transaction records between 30 and 100, the indicators are relatively good, and the accuracy, precision, recall and F1 values are all above 80%. When the number of user history transactions is less than 30, the performance of the model OM shows a downward trend, and all indicators have declined. At the same time, it can be found that the characterization effect of the user behavior is related to the frequency of the user's transaction. The more the user's transaction volume in the same time period, the better the model effect, that is, the better the characterization effect of the user behavior.

Through the analysis of the experimental results, it can be seen that OM has better overall performance than UBC, the main reasons are as follows. First, the data set used in this paper is real data, and the data set used by UBC is simulation data, and the data simulation is idealized, which is not completely consistent with the actual situation. Second, the characteristics derived from the establishment of the user behavior benchmark are more comprehensive, including transaction time, transaction frequency, amount, amount change, transaction location, whether it is a working day and the last transaction status, which more fully represent a person's transaction behavior. The third is to use the box plot method when dealing with transaction frequency and amounts, considering the case of outliers, it is more able to describe the data distribution characteristics. The fourth is to propose a user's optimal risk threshold algorithm based on the difference among users, and construct a hypersphere model based on user transaction behavior and user optimal risk threshold. Therefore OM has better overall performance than UBC.

Conclusion

In this paper, a fraud detection model for online transaction based on individual is proposed. Compared with other works, this paper considers the amount, time, location of transaction, as well as more detailed information, such as transaction frequency, transaction trend, states of previous transaction, and whether the transaction occurs during the workday, which can describe a user\'s transaction behavior more comprehensively. Furthermore, for considering the difference between user\'s transaction, we design a user optimal risk threshold algorithm that avoids misjudgment on users. Combined with above methods, user\'s behavior benchmark is modeled as a hypersphere model, which transforms fraud detection action into the mapping relationship of points in multidimensional space. Experiments have shown that our method is more accurate than other models and maintains a very low interference rate. In the future, we will focus on the relationship between the accuracy of user behavior and the area of transaction data (transaction frequency and transaction dimension). When we find this relationship, we will pay more attention to the behavior of low- frequency users.

References

[1] SamanehSorournejad , Zahra Zojaji, Reza Ebrahimi Atani, and Amir Hassan Monadjemi. 2016. A Survey of Credit Card Fraud Detection Techniques: Data and Technique Oriented Perspective. (11 2016). [2] Rong Chang Chen, Shu Ting Luo, Liang Xun, and V. C. S. Lee. 2005. Personalized Approach Based on SVM and ANN for Detecting Credit Card Fraud. In 2005 International Conference on Neural Networks and Brain, Vol. 2. 810–815. [3] A. C. Bahnsen, A. Stojanovic, D. Aouada, and B. Ottersten. 2013. Cost Sensitive Credit Card Fraud Detection Using Bayes Minimum Risk. In 2013 12th International Conference on Machine Learning and Applications, Vol. 1. 333– 338. [4] J. I. Bing-Shuai, L. I. Hu, Wei Hong Han, and Yan Jia. 2014. Research on E- commerce-oriented User Abnormal Behaviour Detection. Netinfo Security (2014). [5] R. Brause, T. Langsdorf, and M. Hepp. 1999. Neural data mining for credit card fraud detection. In Proceedings 11th International Conference on Tools with Artificial Intelligence. 103–106. [6] Chyxx 2018. Forecast of the market size of China’s online shopping industry in 2018. Chyxx. http://www.chyxx.com/industry/201803/614936.html. [7] Andrea Dal Pozzolo, Olivier Caelen, Yann Aël Le Borgne, Serge Waterschoot, and Gianluca Bontempi. 2014. Learned lessons in credit card fraud detection from a practitioner perspective. Expert Systems with Applications 41 (08 2014), 4915–4928. [8] Liu Haiou. 2018. Literature Review of Persona at Home and Abroad. Information Studies:Theory Application (2018). [9] C. Jiang, J. Song, G. Liu, L. Zheng, and W. Luan. 2018. Credit Card Fraud Detection: A Novel Approach Using Aggregation Strategy and Feedback Mechanism. IEEE Internet of Things Journal 5, 5 (Oct 2018), 3637–3647. [10] Morteza KolaliKhormuji, Mehrnoosh Bazrafkan, Maryam Sharifian, Seyed Mirabedini, and Ali Harounabadi. 2014. Credit Card Fraud Detection with a Cascade Artificial Neural Network and Imperialist Competitive Algorithm. International Journal of Computer Applications 96 (06 2014), 1–9. [11] Yigit Kultur and Mehmet Ufuk Caglayan. 2015. A novel cardholder behavior model for detecting credit card fraud. In 2015 9th International Conference on Application of Information and Communication Technologies (AICT). 148–152. [12] Dominik Olszewski. 2014. Fraud detection using self-organizing map visualizing the user profiles. Knowledge-Based Systems 70 (11 2014), 324–334. [13] A. Shen, R. Tong, and Y. Deng. 2007. Application of Classification Models on Credit Card Fraud Detection. In 2007 International Conference on Service Systems and Service Management. 1–4. [14] Souhu 2018. Research report on the trend of Network Fraud in 2017. Souhu. https://www.sohu.com/a/222391501_100017648. [15] Dheepa V and Dhanapal R. 2012. Behavior based credit card fraud detection using support vector machines. ICTACT Journal on Soft Computing 02 (07 2012), 391–397. [16] S. Wang. 2010. A Comprehensive Survey of Data Mining-Based Accounting Fraud Detection Research. In 2010 International Conference on Intelligent Computation Technology and Automation, Vol. 1. 50–53. [17] C. Whitrow, D. J. Hand, P. Juszczak, D. Weston, and N. M. Adams. 2009. Transaction aggregation as a strategy for credit card fraud detection. Data Mining and Knowledge Discovery 18, 1 (01 Feb 2009), 30–55. [18] Ws 2018. big data observation report on double 11 in 2018. Ws. http://www.100ec. cn/detail--6481169.html. [19] S. Xuan, G. Liu, Z. Li, L. Zheng, S. Wang, and C. Jiang. 2018. Random forest for credit card fraud detection. In 2018 IEEE 15th International Conference on Networking, Sensing and Control (ICNSC). 1–6. [20] Masoumeh Zareapoor and Pourya Shamsolmoali. 2015. Application of Credit Card Fraud Detection: Based on Bagging Ensemble Classifier. Procedia Computer Science 48 (12 2015), 679–686. [21] Zhaohui Zhang, Xinxin Zhou, Xiaobo Zhang, Lizhi Wang, and Pengwei Wang. 2018. A Model Based on Convolutional Neural Network for Online Transaction Fraud Detection. Security and Communication Networks 2018 (08 2018), 1–9. [22] Z.-H Zhang and J Cui. 2017. An Agile Perception Method for Behavior Abnormality in Large-Scale Network Service Systems. Jisuanji Xuebao/Chinese Journal of Computers 40 (02 2017), 505–519. [23] L. Zheng, G. Liu, W. Luan, Z. Li, Y. Zhang, C. Yan, and C. Jiang. 2018. A new credit card fraud detecting method based on behavior certificate. In 2018 IEEE 15th International Conference on Networking, Sensing and Control (ICNSC). 1– 6. [24] J. Zhong, C. Yan, W. Yu, P. Zhao, and M. Wang. 2014. A Kind of Identity Au- thentication Method Based on Browsing Behaviors. In 2014 Seventh International Symposium on Computational Intelligence and Design, Vol. 2. 279–284.

Copyright

Copyright © 2024 Ravula Muralidhar Reddy, N. Naveen Kumar. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63525

Publish Date : 2024-07-01

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online