Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Credit Card Fraud Detection

Authors: Prof. R. B. Gurav, Mrs. Shraavani Mandar Badhe, Mrs. Sakshi Nagtilak, Mr. Sarthak Pandit Sonawane, Mr. Siddhant Agarwal

DOI Link: https://doi.org/10.22214/ijraset.2022.41594

Certificate: View Certificate

Abstract

Now a day’s online transactions have become an important and necessary part of our lives. It is vital that credit card companies are able to identify fraudulent credit card transactions so that customers are not charged for items that they did not purchase. As frequency of transactions is increasing, number of fraudulent transactions are also increasing rapidly. Such problems can be tackled with Machine Learning with its algorithms. This project intends to illustrate the modelling of a data set using machine learning with Credit Card Fraud Detection. The Credit Card Fraud Detection Problem includes modelling past credit card transactions with the data of the ones that turned out to be fraud. This model is then used to recognize whether a new transaction is fraudulent or not. Our objective here is to detect 100% of the fraudulent transactions while minimizing the incorrect fraud classifications. Credit Card Fraud Detection is a typical sample of classification. In this process, we have focused on analyzing and preprocessing data sets as well as the deployment of multiple anomaly detection algorithms such as Local Outlier Factor and Isolation Forest algorithm on the PCA transformed Credit Card Transaction data.

Introduction

I. INTRODUCTION

Credit Card Fraud can be defined as a case where a person uses someone else’s credit card for personal reasons while the owner and the card issuing authorities are unaware of the fact that the card is being used. Due to rise and acceleration of E- Commerce, there has been a tremendous use of credit cards for online shopping which led to High amount of frauds related to credit cards. In the era of digitalization, the need to identify credit card frauds is necessary. Fraud detection involves monitoring and analyzing the behavior of various users in order to estimate detect or avoid undesirable behavior. In order to identify credit card fraud detection effectively, we need to understand the various technologies, algorithms and types involved in detecting credit card frauds. Algorithm can differentiate transactions which are fraudulent or not. Find fraud, they need to passed dataset and knowledge of fraudulent transaction. They analyze the dataset and classify all transactions. Fraud detection involves monitoring the activities of populations of users in order to estimate, perceive or avoid objectionable behavior, which consist of fraud, intrusion, and defaulting. Machine learning algorithms are employed to analyses all the authorized transactions and report the suspicious ones. These reports are investigated by professionals who contact the cardholders to confirm if the transaction was genuine or fraudulent. The investigators provide a feedback to the automated system which is used to train and update the algorithm to eventually improve the fraud-detection performance over time.

II. LITERATURE SURVEY

As the information technology is developing the fraud is also increasing as a result financial loss due to fraud is also very large. A cost sensitive decision tree approach has been used for fraud detection. A cost called misclassification cost is used which is taken as varying as well as priorities of the fraud also differs according to individual records. So common performance metrics such as accuracy, True Positive Rate (TPR) or even area Under Curve cannot be used to evaluate the performance of the models because they accept each fraud as having the same priority regardless of the amount of that fraudulent transaction or the available usable limit of the card used in the transaction at that time. For avoiding this a new performance metric which prioritizes each fraudulent transaction in a meaningful way and it also checks the performance of the model in minimizing the total financial loss. The measure used is Saved Loss Rate (SLR) which is the saved percentage of the potential financial loss that is the sum of the available usable limits of the cards from which fraudulent transactions are committed. Different methods are used for cost sensitivity. They mainly include the machine learning approach, decision tree approach. In machine learning approach two techniques called over sampling and under sampling is performed, in which the latter obtained a good result. In decision tree approach, decision tree algorithms are used in which misclassification cost is considered in pruning step. A cost matrix is used to find the varying misclassification cost. After finding the misclassification cost the one with minimum value is used. By finding the misclassification cost not only the node value is obtained but also it predicts whether the transaction is fraudulent or not. This study using misclassification cost has made a significant improvement in fraud detection. Rimpal R. Popat with Jayesh Chaudhary: They made a survey on credit card fraud detection, considering the major areas of credit card fraud detection that are bank fraud, corporate fraud, Insurance fraud.

With these they have focused on the two ways of credit card transactions i) Virtually (card, not present) ii) With Card or physically present. They had focused on the techniques which are Regression, classification, Logistic regression, Support vector machine, Neural network, Artificial Immune system K-nearest Neighbor, Naïve Bayes, Genetic Algorithm, Data mining, Decision Tree, Fuzzy logic-based system, etc.Prajal Save et al. [18] have proposed a model based on a decision tree and a combination of Luhn's and Hunt's algorithms. Luhn's algorithm is used to determine whether an incoming transaction is fraudulent or not. It validates credit card numbers via the input, which is the credit card number. Address Mismatch and Degree of Outlierness are used to assess the deviation of each incoming transaction from the cardholder's normal profile.

III. PROPOSED METHODOLOGY

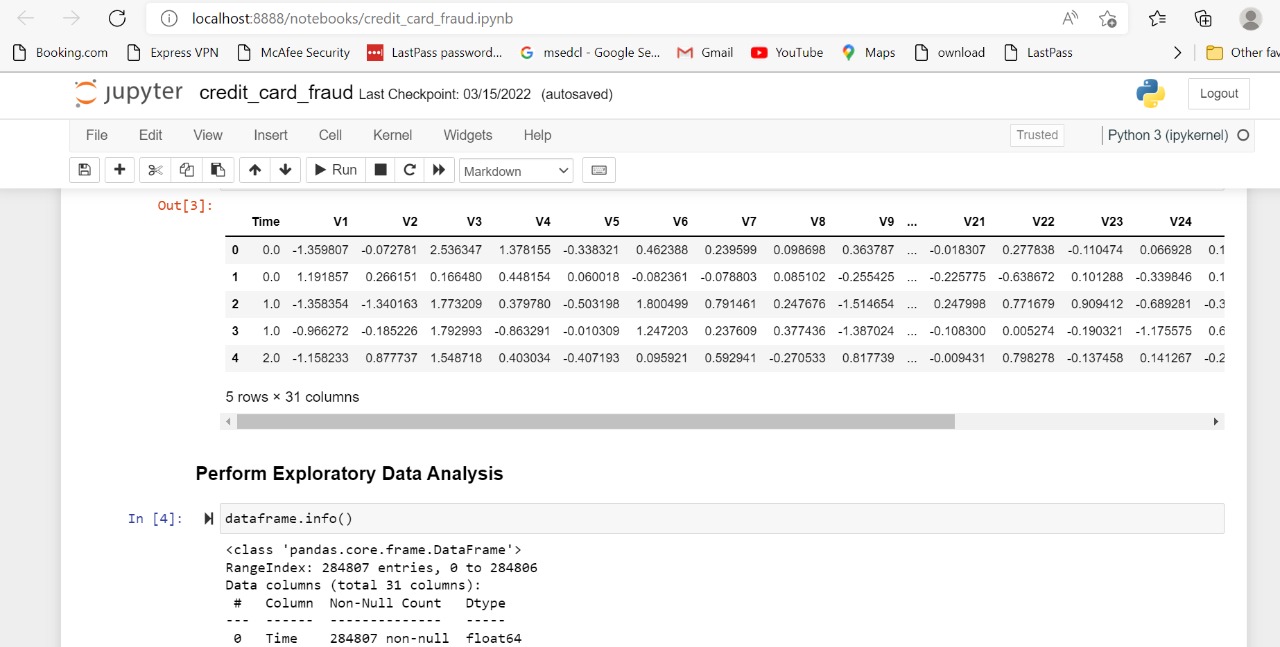

The approach that this paper proposes, uses the latest machine learning algorithms to detect anomalous activities, called outliers. The basic rough architecture diagram can be represented with the following figure: When looked at in detail on a larger scale along with real life elements, the full architecture diagram can be represented as follows: First of all, we obtained our dataset from Kaggle, a data analysis website which provides datasets. Inside this dataset, there are 31 columns out of which 28 are named as v1-v28 to protect sensitive data. The other columns represent Time, Amount and Class. Time shows the time gap between the first transaction and the following one. Amount is the amount of money transacted. Class 0 represents a valid transaction and 1 represents a fraudulent one. We plot different graphs to check for inconsistencies in the dataset and to visually comprehend it: This graph shows that the number of fraudulent transactions is much lower than the legitimate ones. This graph shows the times at which transactions were done within two days. It can be seen that the least number of transactions were made during night time and highest during the days. This graph represents the amount that was transacted. A majority of transactions are relatively small and only a handful of them come close to the maximum transacted amount. After checking this dataset, we plot a histogram for every column. This is done to get a graphical representation of the dataset which can be used to verify that there are no missing.

Credit Card Fraud Detection 10 Tamojit Das -tamo.das.97@gmail.com any values in the dataset. This is done to ensure that we don’t require any missing value imputation and the machine learning algorithms can process the dataset smoothly. After this analysis, we plot a heatmap to get a colored representation of the data and to study the correlation between out predicting variables and the class variable. This heatmap is shown below: The dataset is now formatted and processed. The time and amount column are standardized and the Class column is removed to ensure fairness of evaluation. The data is processed by a set of algorithms from modules. The following module diagram explains how these algorithms work together: This data is fit into a model and the following outlier detection modules are applied on it: • Local Outlier Factor • Isolation Forest Algorithm These algorithms are a part of sklearn. The ensemble module in the sklearn package includes ensemble-based methods and functions for the classification, regression and outlier detection. This free and open-source Python library is built using NumPy, SciPy and matplotlib modules which provides a lot of simple and efficient tools which can be used for data analysis and machine learning. It features various classification, clustering and regression algorithms and is designed to interoperate with the numerical and scientific libraries. Wave used Jupyter Notebook platform to make a program in Python to demonstrate the approach that this paper suggests. This program can also be executed on the cloud using Google Collab platform which supports all python notebook files. Detailed explanations about the modules with pseudocodes for their algorithms and output graphs are given as follows: 1. Local Outlier Factor It is an Unsupervised Outlier Detection algorithm. ‘Local Outlier Factor’ refers to the anomaly score of each sample. It measures the local deviation of the sample data with respect to its neighbors. Credit Card Fraud Detection 11 Tamojit Das -tamo.das.97@gmail.com More precisely, locality is given by k-nearest neighbors, whose distance is used to estimate the local data. The pseudocode for this algorithm is written as: On plotting the results of Local Outlier Factor algorithm, we get the following figure: By comparing the local values of a sample to that of its neighbors, one can identify samples that are substantially lower than their neighbors. These values are quite amanous and they are considered as outliers. As the dataset is very large, we used only a fraction of it in out tests to reduce processing times. The final result with the complete dataset processed is also determined and is given in the results section of this paper. 2. Isolation Forest Algorithm The Isolation Forest isolates observations by arbitrarily selecting a feature and then randomly selecting a split value between the maximum and minimum values of the designated feature. Recursive partitioning can be represented by a tree, the number of splits required to isolate a sample is equivalent to the path length root node to terminating node. The average of this path length gives a measure of normality and the decision function which we use. The pseudocode for this algorithm can be written as: On plotting the results of Isolation Forest algorithm, we get the following figure: Partitioning them randomly produces shorter paths for anomalies. When a forest of random trees mutually produces shorter path lengths for specific samples, they are extremely likely to be anomalies. Once the anomalies are detected, the system can be used to report them to the concerned authorities. For testing purposes, we are comparing the outputs of these algorithm to determine their accuracy and precision

IV. PROJECT PURPOSE

The objectives of the project is to implement machine learning algorithms to detect credit card fraud detection with respect to time and amount of transaction. The project has covered almost all the requirements. Further requirements and improvements can easily be done since the coding is mainly structured or modular in nature. Improvements can be appended by changing the existing modules or adding new modules. One important development that can be added to the project in future is file level backup, which is presently done for folder level.

In proposed system, we present a new system FDS Which does not require fraud signatures and yet is able to detect frauds by considering a cardholder’s spending habit. The details of items purchased in Individual transactions are usually not known to any Fraud Detection System (FDS) running at the bank that issues credit cards to the cardholders. Hence, we feel that FDS is an ideal choice for addressing this problem. Another important advantage is a drastic reduction in the number of False Positives transactions identified as malicious by an FDS although they are actually genuine.

V. RESULT

Identify fraudulent credit card transactions. Given the class imbalance ratio, we recommend measuring the accuracy using the Area Under the Precision-Recall Curve (AUPRC). Confusion matrix accuracy is not meaningful for unbalanced classification. The code prints out the number of false positives it detected and compares it with the actual values. This is used to calculate the accuracy score and precision of the algorithms. The fraction of data we used for faster testing is 10% of the entire dataset. The complete dataset is also used at the end and both the results are printed. These results along with classification report for each algorithm is given in the output as follows, where class 0 means the transaction was determined to be valid and 1 means it was determined as a fraud transaction.

VI. ACKNOWLEDGEMENT

I would like to express my deep gratitude to Professor Mrs. R.B.GURAV, our project guide, for their patient guidance, enthusiastic encouragement and useful critiques of this research work.

I would also like to thank Mrs. V.R. Palandurkar, for her advice and assistance in keeping my progress on schedule.

I would also like to extend my thanks to the technicians of the laboratory of the Information Technology department for their help in offering me the resources in running the program.

Finally, I wish to thank my parents for their support and encouragement throughout my study.

Conclusion

Fraud detection is a complex issue that requires a substantial amount of planning before throwing machine learning algorithms at it. Nonetheless, it is also an application of data science and machine learning for the good, which makes sure that the customer’s money is safe and not easily tampered with. Future work will include a comprehensive tuning of the Random Forest algorithm I talked about earlier. Having a data set with non-anonymized features would make this particularly interesting as outputting the feature importance would enable one to see what specific factors are most important for detecting fraudulent transactions. As always, if you have any questions or found mistakes, please do not hesitate to reach out to me. A link to the notebook with my code is provided at the beginning of this article.

References

[1] https://www.kaggle.com/datasets/mlg-ulb/creditcardfraud [2] https://www.analyticsvidhya.com/blog/2021/07/anomaly-detection-using-isolation-forest-a-complete-guide/#:~:text=In%20an%20Isolation%20Forest%2C%20randomly,more%20cuts%20to%20isolate%20them. [3] 1. Credit Card Fraud Detection Based on Transaction Behavior -by John Richard D. Kho, Larry A. Vea published by Proc. of the 2017 IEEE Region 10 Conference (TENCON), Malaysia, November 5-8, 2017 [4] 2. L.J.P. van der Maaten and G.E. Hinton, Visualizing High-Dimensional Data Using t-SNE (2014), Journal of Machine Learning Research [5] 3. Machine Learning Group — ULB, Credit Card Fraud Detection (2018), Kaggle [6] 4. Nathalie Japkowicz, Learning from Imbalanced Data Sets: A Comparison of Various Strategies (2000), AAAI Technical Report WS-00–05

Copyright

Copyright © 2022 Prof. R. B. Gurav, Mrs. Shraavani Mandar Badhe, Mrs. Sakshi Nagtilak, Mr. Sarthak Pandit Sonawane, Mr. Siddhant Agarwal. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET41594

Publish Date : 2022-04-19

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online