Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Prediction of Stock Price Using XG Boost: A Machine Learning Technique

Authors: Vismayaa Yadav BKV, Shailaja K. P.

DOI Link: https://doi.org/10.22214/ijraset.2024.63695

Certificate: View Certificate

Abstract

Forecasting stock prices is a very difficult task due to the sudden and volatile nature of financial markets. This paper reviews recent developments in the use of the XGBoost algorithm for stock price forecasting. XGBoost, a robust and efficient gradient enhancement implementation, has demonstrated excellent performance in a variety of predictive modeling environments. The analysis uses various experimental methods, including data generation, feature engineering, model training, and validation procedures. It also compares the performance of XGBoost with other machine learning algorithms. The findings show that XGBoost is able to capture complex non-linear relationships in stock market data, resulting in improved forecasting accuracy. However, challenges such as excessive packaging and reliance on quality remain. The paper presents possible future research directions, including the integration of mixed models, the use of new data sources, and the enhancement of model interpretation and real-time predictive capabilities.

Introduction

I. INTRODUCTION

Stock price forecasting has always been at the core of financial research because of the importance of its implications to investors, financial organizations, and overall economic health. The primary difficulty when it comes to stock price prediction is the stochastic and non-linear nature of financial markets, which are influenced by a vast array of factors, ranging from economic indicators to market sentiment and geopolitical events, as well as investors’ behavior.

The linear regression and autoregressive integrated moving average (ARIMA) models used in the conventional approaches for predicting the stock prices fail to capture the non-linear structure and the complex relationships present in the financial time series data. The traditional statistical models that were used in the past to solve such problems do not have the capability of handling such complexities, but the new machine learning approaches can. Of these techniques, the ensemble learning methods especially gradient boosting have become popular due to high accuracy and less overfitting.

XGBoost is an advanced gradient boosting algorithm that has received much attention and appreciation from the machine learning community due to its effectiveness. XGBoost is a more advanced version of the Gradient Boosting algorithm which was developed by Tianqi Chen and Carlos Guestrin; the advancements include regularization, parallel processing, and tree pruning which enhance both computational speed and model performance. These features make the XGBoost particularly suitable for high-dimensional and large-scale data sets, typical for the analysis of the stock market.

This paper aims to provide an overview of the literature on stock price prediction using XGBoost, combining methodologies, findings, and discussions from the current literature. Here, we will discuss the application of XGBoost in predicting the stock prices and identify the advantages, shortcomings, and future directions of this approach. The proposed review covers data pre-processing, feature engineering, model training, and model evaluation in the context of the XGBoost algorithm.

II. RELATED WORK

In the realm of stock price prediction using machine learning (ML) techniques, recent literature reflects a broad spectrum of methodologies and innovations aimed at improving forecasting accuracy and reliability. Researchers from various institutions globally have contributed to this field:

Sumeet Sarode, Harsha G. Tolani, Prateek Kak, and Lifna C S from Vivekanand Education Society’s Institute of Technology, Mumbai, India, explore the application of ML algorithms for stock price prediction, focusing on regression and classification methods. Their work emphasizes leveraging historical data patterns to forecast future price movements.

Gourav Bathla, at the University of Petroleum & Energy Studies, Dehradun, India, investigates LSTM (Long Short-Term Memory) and SVR (Support Vector Regression) models for predicting stock prices. Bathla’s research highlights LSTM’s capability to capture long-term dependencies and SVR’s robustness in handling noisy data, aiming to enhance prediction accuracy.

YaoHu Lin, Shancun Liu, Haijun Yang, and Harris Wu from Beihang University, China, propose combining candlestick charting with ensemble ML techniques. Their approach includes innovative feature engineering to improve the predictive power of models, integrating technical indicators with machine learning methodologies.

Sondo Kim, Seungmo Ku, Woojin Chang, and Jae Wook Song from Seoul National University, South Korea, utilize transfer entropy alongside ML techniques to forecast the direction of US stock prices. Their study focuses on identifying causal relationships and dependencies within stock market data, enhancing predictive capabilities.

Audeliano Wolian Li and Guilherme Sousa Bastos, affiliated with the Federal University of Itajubá, Brazil, conduct a systematic review on deep learning and technical analysis integration for stock market forecasting. Their review highlights deep learning’s ability to extract intricate patterns from financial data, complementing traditional technical analysis methods.

Donghwan Song, Adrian Matias Chung Baek, and Namhun Kim from Ulsan National Institute of Science and Technology, South Korea, propose a novel approach using padding-based Fourier transform denoising and deep learning models. Their method focuses on improving data quality before applying deep learning techniques to forecast stock market indices.

Empirical studies by Vaibhav Gaur, Shubham Sood, Lisha Uppal, and Manpreet Kaur from Manav Rachna University, Haryana, India, and Sahil Vazirani, Abhishek Sharma, and Pavika Sharma from Amity University Uttar Pradesh, India, demonstrate practical applications of ML algorithms in stock market prediction. Their research spans from comparative studies of ML models to the development of hybrid approaches, aiming to optimize prediction accuracy and adaptability to market dynamics.

Additionally, Huei Wen Teng, Yu-Hsien Li, and Shang-Wen Chang from National Chiao Tung University, Taiwan, and Kartika Maulida Hindrayani, Prismahardi Aji R., Tresna Maulana Fahrudin, and Eristya Maya Safitri from UPN “Veteran” Jawa Timur, Indonesia, contribute insights into various ML algorithms and their application in empirical asset pricing and during the COVID-19 era, respectively.

Collectively, these studies underscore ongoing advancements in ML techniques, feature engineering, and data preprocessing strategies to enhance the efficacy of stock price prediction systems. Future research directions may focus on further integrating AI advancements, enhancing model interpretability, and addressing real-time prediction challenges in dynamic financial markets.

III. TECHNIQUES FOR STOCK MARKET PREDICTION

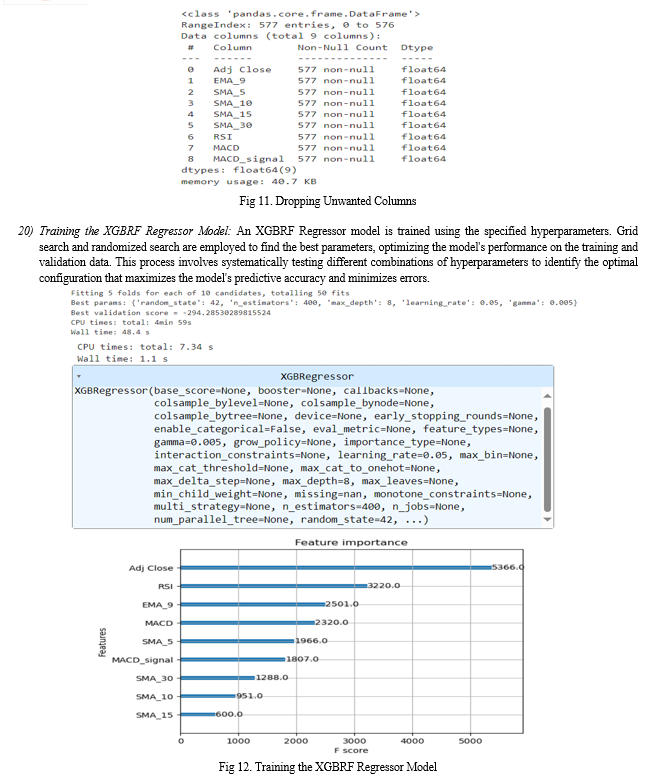

- Importing Libraries: To begin the stock market prediction task, essential libraries are imported. NumPy and Pandas are utilized for numerical operations and data manipulation, enabling efficient handling of large datasets and providing functionalities for data cleaning and preprocessing. Matplotlib is used to create basic static visualizations, allowing for exploratory data analysis and preliminary visual inspection of trends. XGBoost, a robust and efficient implementation of gradient boosting algorithms, is employed for predictive modeling, known for its high performance in regression tasks and handling of missing data. Scikit-learn offers various utilities for data preprocessing, model evaluation, and hyperparameter tuning through grid search, facilitating the development of robust and accurate predictive models.

- Chart Drawing with Plotly: Plotly libraries are imported to create interactive and visually appealing charts. Plotly offers a variety of interactive visualization tools, allowing for dynamic data exploration and presentation. Integrating Plotly with Jupyter notebooks enables seamless embedding of interactive plots, which enhances data analysis interpretability and presentation. Plotly's flexibility in customizing plots ensures that complex data relationships can be clearly communicated, making it a powerful tool for both analysis and reporting in research.

- Suppressing Warnings: To maintain a clean and readable output, warnings related to future and deprecation issues from the Scikit-learn library are suppressed. This ensures that the output remains focused on relevant results and analysis, free from non-critical warning messages. By suppressing these warnings, we can avoid distractions and maintain the flow of analysis, which is particularly important when presenting findings in a professional or academic setting.

- Initializing Plotly Notebook Mode: Plotly's notebook mode is initialized to ensure that charts are correctly displayed within Jupyter notebooks. This enhances the user experience by allowing interactive visualizations to be rendered directly in the notebook environment. By enabling this mode, researchers can interact with the data visualizations, zooming in on specific areas of interest, and gaining deeper insights from the presented data

- Customizing Plotly Layout: The default background color for all Plotly visualizations is customized, setting a transparent paper background and a lightly shaded plot background to improve visual appeal. A custom template is created to ensure consistent styling across all visualizations, contributing to a cohesive and professional presentation. This step is crucial for creating high-quality, publication-ready figures that adhere to the aesthetic standards of academic and professional publications.

- Installing yfinance: The

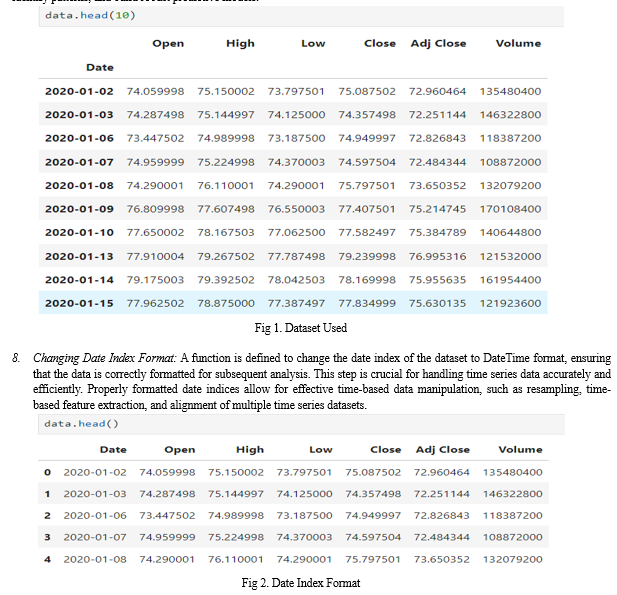

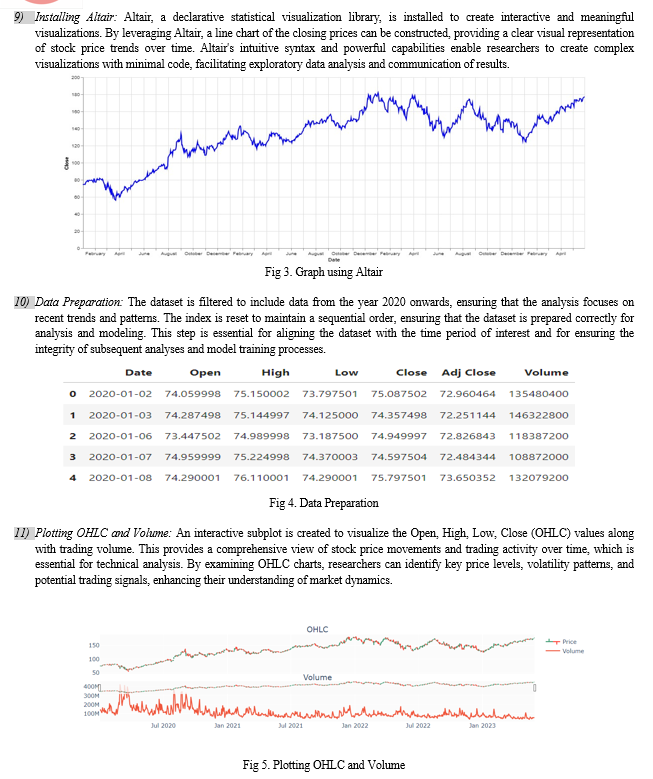

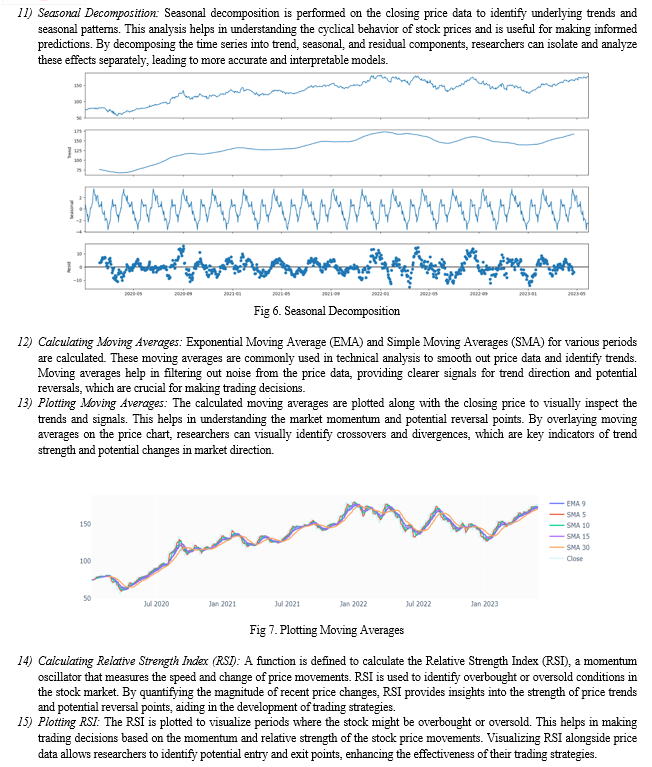

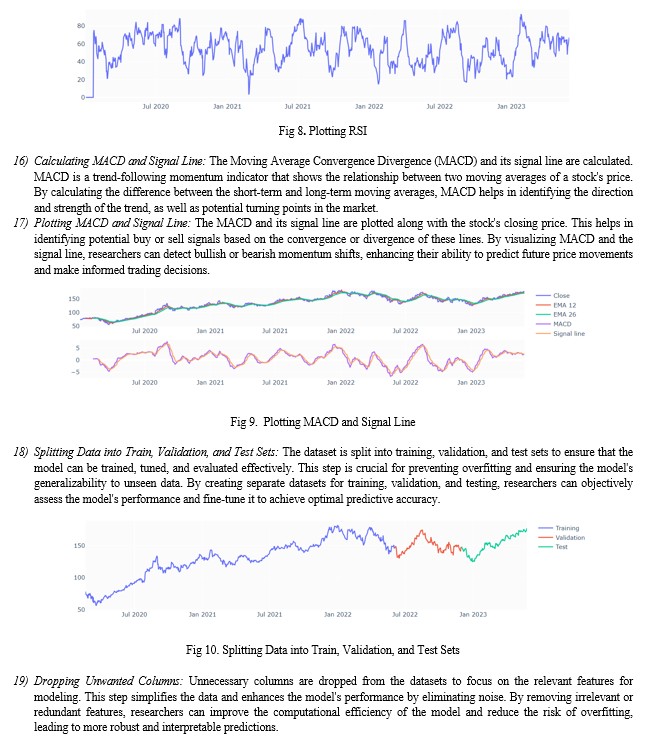

yfinancelibrary is installed to facilitate the fetching of historical stock data from Yahoo Finance. This library provides a user-friendly interface for accessing stock data, which is crucial for building and testing predictive models in financial analysis. By leveragingyfinance, researchers can easily obtain up-to-date and comprehensive financial data, ensuring the accuracy and relevance of their predictive models. - Fetching Stock Data: Historical stock data for Apple Inc. (AAPL) is retrieved from Yahoo Finance for a specified date range. This data includes attributes such as open, high, low, close prices, and volume, which are essential for comprehensive stock market analysis and prediction. Access to accurate and detailed historical data allows researchers to perform thorough analyses, identify patterns, and build robust predictive models.

IV. COMPARISON WITH OTHER MODELS

When compared to traditional statistical models such as ARIMA or simple linear regression, the XGBoost model offers several advantages:

- Handling Non-Linearity: Unlike linear models, XGBoost can capture non-linear relationships within the data, making it more suitable for the inherently volatile and complex nature of stock prices.

- Feature Importance: XGBoost provides insights into feature importance, helping in understanding which indicators most significantly impact the stock price predictions.

- Speed and Performance: XGBoost is optimized for speed and performance, especially with large datasets, making it an efficient choice for real-time stock market prediction.

- Regularization: XGBoost includes built-in regularization techniques that prevent overfitting, enhancing the model's generalizability to unseen data.

However, it is essential to note that while XGBoost performs exceptionally well in many scenarios, it also requires careful tuning of hyperparameters, which can be computationally intensive. Other machine learning models like LSTM (Long Short-Term Memory) networks could potentially offer better performance for sequential data due to their capability to retain long-term dependencies, which is a significant factor in time series analysis.

Conclusion

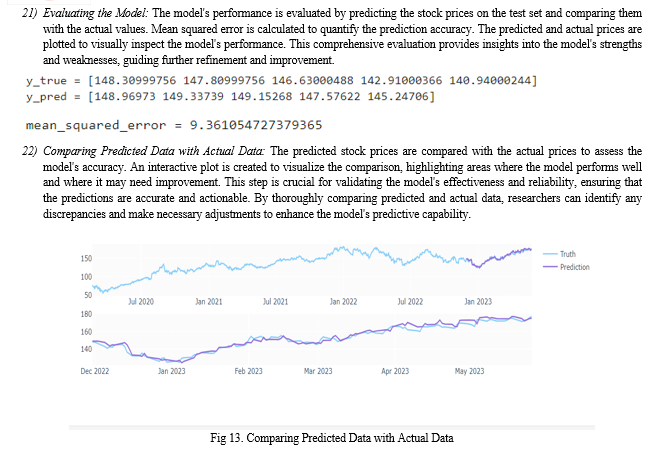

The stock market prediction model developed in this research leverages advanced machine learning techniques, particularly the XGBoost regressor, to predict future stock prices. XGBoost has been chosen for its robustness, efficiency, and superior performance in handling complex datasets with multiple features and time dependencies. The model incorporates various technical indicators such as moving averages, RSI, and MACD, providing a comprehensive analysis of stock price movements. In conclusion, the use of XGBoost for stock market prediction demonstrates significant potential due to its advanced capabilities in handling complex and non-linear relationships in the data. While this model shows promising results, continuous refinement and comparison with other sophisticated models like LSTM or hybrid approaches can further enhance predictive accuracy and reliability. The choice of model should always be aligned with the specific requirements and constraints of the prediction task at hand.

References

[1] Gourav Bathla, Stock Price prediction using LSTM and SVR, January 2021, DOI: 10.1109/PDGC50313.2020.9315800. [2] Srinath Ravikumar, Prediction of Stock Prices using Machine Learning (Regression, Classification) Algorithms, June 2020. [3] Yaohu lin, Stock Trend Prediction Using Candlestick Charting and Ensemble Machine Learning Techniques With a Novelty Feature Engineering Scheme, May 2021, DOI: 10.1109/ACCESS.2021.3096825 [4] Sondo Kim, Predicting the Direction of US Stock Prices Using Effective Transfer Entropy and Machine Learning Techniques, June 2020, DOI: 10.1109/ACCESS.2020.3002174 [5] Stock Market Forecasting Using Deep Learning and Technical Analysis: A Systematic Review, AUDELIANO WOLIAN LI, October 2020, DOI: 10.1109/ACCESS.2020.3030226 [6] DONGHWAN SONG1, Forecasting Stock Market Indices Using Padding-Based Fourier Transform Denoising and Time Series Deep Learning Models, June 2021, DOI: 10.1109/ACCESS.2021.3086537 [7] Parag P. Kadu, Comparative Study of Stock Price Prediction using Machine Learning, April 2020, DOI: 10.1109/EICT48899.2019.9068850 [8] Shoban Dinesh, Prediction of Trends in Stock Market using Moving Averages and Machine Learning, April 2021, DOI: 10.1109/I2CT51068.2021.9418097 [9] S. Nithya Tanvi Nishitha, Stock Price Prognosticator using Machine Learning Techniques, December 2020, DOI: 10.1109/ICECA49313.2020.929764 [10] Vaibhav Gaur, Revitalizing Stock Predictions with Machine Learning Algorithms – An Empirical Study, February 2021, DOI: 10.1109/INDICON49873.2020.9342571 [11] Huei Wen Teng, Machine Learning in Empirical Asset Pricing Models, December 2020, DOI: 10.1109/ICPAI51961.2020.00030 [12] Kartika Maulida Hindrayani, Indonesian Stock Price Prediction including Covid19 Era Using Decision Tree Regression, January 2021, DOI: 10.1109/ISRITI51436.2020.9315484 [13] Sahil Vazirani, Analysis of various machine learning algorithm and hybrid model for stock market prediction using Python, December 2020, DOI: 10.1109/ICSTCEE49637.2020.9276859

Copyright

Copyright © 2024 Vismayaa Yadav BKV, Shailaja K. P.. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63695

Publish Date : 2024-07-20

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online