Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Product Design and Development Process in the Automotive Industry in North America and Europe

Authors: Emad Tanbour, M. C. Greenfield, Hawra Alzuad

DOI Link: https://doi.org/10.22214/ijraset.2025.48723

Certificate: View Certificate

Abstract

This paper focuses on North American and European automotive industry practices and tools for the phases comprising the product design and development processes. It outlines how organizational programs are put together, what role financial factors play in the development process, and how technology and digitization are changing the landscape. Lastly, a summary is provided on game-changing trends and how they are impacting the manufacturing and engineering aspects of the automotive industry.

Introduction

I. INTRODUCTION

The automotive industry has been drastically evolving over the last two decades to meet the needs of emerging markets, technology acceleration, green environment initiatives and regulations, and ever-changing consumer preferences towards sustainability, mobility, and ownership. Digitizing, as manifested in automation, simulated design modeling, and data-driven services within cars will continue to transform the industry significantly. This transformation will drive more disruptions and competitiveness across the full automotive value chain. Ride-sharing, autonomous cars, and electric cars, to name a few, are no longer trends but shape-setters for an industry that is ripe for more disruption and innovation. The technological and commercial landscape for the 132-year old automotive industry has evolved drastically over the last two decades and will continue to change beyond recognition. There are three trend-settings that have caused major disruptions: autonomous driving, ride-sharing, and electro mobility. Powertrain technology changes will also cause a paradigm shift. This paper will shed focus on product design processes and tools utilized throughout the production chain, with emphasis on digitization and its role in transforming the industry.

II. DESIGN AND DEVELOPMENT PROCESS

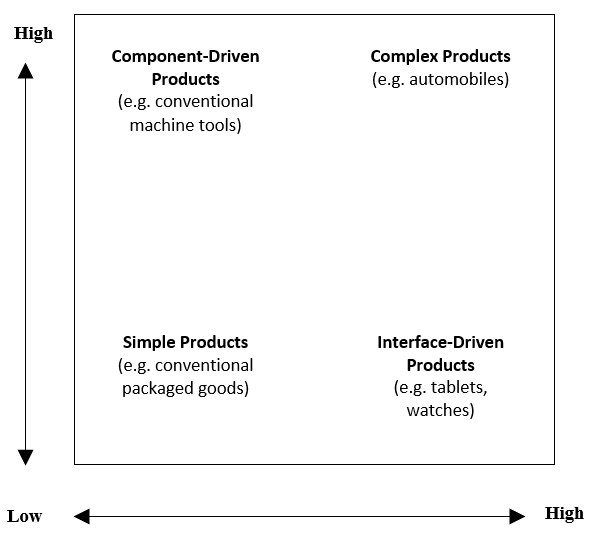

There are multiple intertwined steps in the assembling, testing, and production of automobiles. Hence, “design for manufacturability” is a critical part of the design and development process. [1]. Automobiles today, a car, a truck, an SUV, or a sport utility, may comprise north of 20,000 parts and components These components could have few hundred million interactions, adding to the level of complexity for the organization overseeing the end-to-end product [2]. Using Clark and Fujimoto (1991) [19] theory on product complexity (see Figure 1), a two-dimensional depiction along an internal and external complexity axis, automobile development clearly ranks high.

Figure 1 – Product Complexity

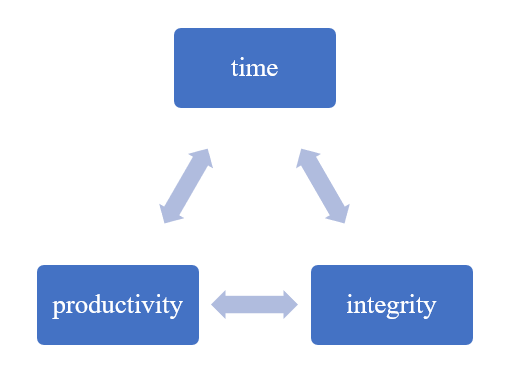

According to Wheelright and Clark (1992), any automobile development process, at a high-level, has three imperatives: short development lifecycle (time), efficient use of resources (productivity), and meet/exceed customer expectations (integrity) (see Figure 2). These imperatives are clearly impact the “timing and size of the resulting cash flow” [2]

Figure 2 – Development Process Imperatives

The automobile development process comprises several systems and functions that interconnect. For example, a body system is further divided into a closure system, a glass system, etc. Similarly, a chassis system consists of suspension system, a braking system etc. A “systems engineering” (SE) approach is critical to coordinate both technical aspects and management needs “from the early conceptual stage of a product (or a system) to the end of the life cycle of the product” [18]. Without SE, the resulting product will likely miss the desired outcome (customer satisfaction, development timeline or costs). [18].

The process is also multidisciplinary in that it requires input from different disciplines to assess design and operational issues, consider trade-offs, and rationalizes the resulting product.

III. PHASES OF THE AUTOMOBILE DEVELOPMENT PROCESS

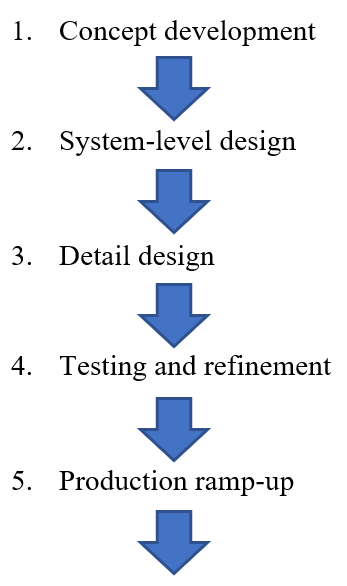

The automobile development process can be viewed as a linear sequence of decision making (even though some literature lists more varies steps). Ulrich and Eppinger (2015) define a five-step process:

Figure 3 – Phases of Development Process

A. Concept Development

As with any product, customers are key to an automobile product. A central part prior to the start of automobile development is a concept study. A concept is often a result of a careful study of customer needs and wants. This is done through secondary and primary research, with focus groups, surveys, implicit data gathering from analytics and consumer purchasing habits, and other demographical data. It results in a “description of the form, function, and features of [the automobile] product” [13] that not only meets customer needs, but also comply with government regulations and align with the company’s business goals. [18]

The resulting concept is further refined and improved upon through ongoing feedback loops and market research input.

Car manufacturers often present close to fully-functional models at major shows well in advance of planned release dates. These models not only help gauge consumer interest and reception, but also demonstrate design creativity and forward-thinking vision. Moreover, it is a powerful tool for solidifying a brand’s identity and presence.

Concept studies have differentiated manufacturers over the years. For example, Renault has often touted futuristic concepts while Volkswagen has focused on more realistic models that align with its anticipated consumer demand and future desired market-share acquisition. [3] [4]

It is important to note that most concepts are not developed from scratch; the design process is, therefore, often called “product development process” (although “development” and “design” are often used interchangeably). [18]

B. System-level Design

The design phase comprises two phases, starting with system-level. In this phase, a geometric layout of the automobile is developed, with the defining criteria and specifications of all sub-systems and components get identified. [2].

With a design concept completed, manufacturing engineers lay out an assembly process, including the customization of existing tools to meet the desired specifications and outcomes. The assembly process starts with a flow and identification of individual assembly units, following a logical order of execution.

C. Detailed Design

In this second design phase, a more complete detailed definition of systems, sub-systems, and their specifications is developed so that all parts comprising the product can be developed. Verification tests are also conducted to “ensure that all attribute requirements are met”. [18]

Specifically, in this phase, the following steps are involved [18]:

- Approval of design for both interior and exterior aspects.

- Computer-aided models are developed with full-scale prototypes, either in clay or 3D-printed.

- Aerodynamics testing.

- Buck building for reviews from both management and consumers.

- Additional sub-system and component level detailed design (emissions, powertrain etc.).

D. Testing and Refinement

In this phase, early constructed prototypes are used to test and validate the product meets the design criteria and requirements. This validation is conducted at the most granular level of components to the vehicle as a whole. This process entails “making a number of observations and/or measurements on selected samples of each entity” [18]. These measurements could be field, bench, or laboratory tests, depending on the stage of the development lifecycle [18]. Data is gathered, synthesized, analyzed, and reviewed by subject-matter experts. The results are then compared to the acceptance criteria defined as part of the initial specifications.

E. Production Ramp-up

In this final phase, and prior to mass-production and product launch, final tests are conducted on early produced automobiles to ensure all requirements are met. Also, assembly line tools are calibrated and monitored for quality and adjusted as needed to meet external demands. This phase concludes the development process.

Notes on the Development Process

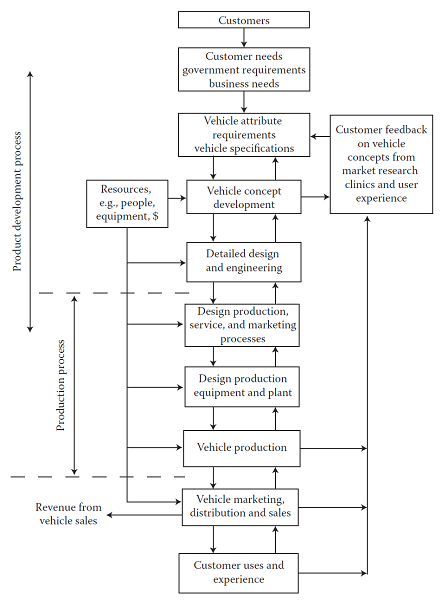

First, although Figure 3 shows a linear sequence, these phases could overlap. Second, these phases are interdependent with more than one bi-directional loops between phases. Third, information is critical throughout these phases; these could be in the form of early customer feedback, post-production discovery of feedback, response to market influencers, availability of resources, budgeting constraints etc. [2][18] Lastly, each phase, as explained, requires input from multiple disciplines and sources. These observations are depicted in Figure 4.

Figure 4 – Detailed View of Automobile Development Process

IV. BUSINESS PLANS, ORGANIZATIONAL STRUCTURE, AND FINANCIAL FACTORS

A. Business Plans

An automobile development program is a significant undertaking that requires commitment of time, resources, and management. As such, the program requires a careful study of marketing factors, capital requirements, allocation of resources, and a closely-managed execution plan. Such large investments are only approved after a business plan is presented.

A business plan is, therefore, a “roadmap for [business] success” [18] that is presented internally, with forward-looking timeline, usually 2-3 years into the future.

Once a plan is approved, a formal program is created with a well-defined organizational structure, often matrixed across the organization to leverage resources from different disciplines.

B. Organization Structure and Operations

Organizational structures are “instruments for enterprise objective fulfillment… [through] formal groups of people with shared goals” [21]. Operations are the actions undertaking by these groups throughout a given program or a project.

A program management is responsible for all aspect of execution, starting with activity and resource planning. It often comprises seasoned individuals with prior “adequate design of task structures and job assignments” [21]. This ensures that corporations achieve economies of scale in both the development process and production.

While most tasks are repeatable, “less repetitive jobs…require more flexible team organization principles, engaging in self-organization, and autonomous groups of skilled people.” [21]

It is important to note a difference between projects and programs. New automobile initiatives require a program, an on-going effort that would likely span many years to come. Projects, on the other hand, such as a minor enhancement, will likely be organizationally, short-lived.

C. Financial Factors

When assessing an automobile undertaking, manufacturers weigh heavily the capital investments required over the length of the program against rates of return. These financial factors include R&D, customer acquisition costs, marketing programs, asset depreciation, supply chain costs, interest rates, among others.

A business plan also details a list of parts that will need to be sourced by suppliers, either due to “lack of capital required for [the] internal production” or due to the “availability of reliable and low-cost suppliers”. [18]

V. COMPETITIVE ADVANTAGE OF A DEVELOPMENT PROCESS

A major objective for corporations is to create customer delight, and therefore create a sustainable growing market share of loyal customers.

For customers, price, reliability, safety, utility satisfaction, and brand are among the most important buying decision factors. [2] As such, a competitive advantage for a manufacturer can be described as “consistently produc[ing] products with attributes which correspond to the key buying criteria for the majority of customers” [14] That advantage can be achieved by optimizing resources and capabilities [16]. Resources are defined as “assets the firm owns or has access to” [15] while capabilities are defined as “a set of business processes strategically understood” [17]. Resources can, therefore, be considered the foundation for capabilities. Pandza et al (2003) notes that both have “characteristics that make them difficult to trade or imitate; hence performance differences between firms are to be expected, as they are a natural outcome of idiosyncratic and path dependent histories in which resources and capabilities have evolved”.

???????A. Technologies and Digital Transformation

The automotive industry faces fierce competition with an ever-changing set of challenges from changing demographics, to government regulations and environmentally-conscious consumers. In addition, automobiles are becoming an essential part of the new connected generation. With that, technology adoption and innovation are an important differentiator for manufacturers.

Technology innovation is also impacting automobile design, manufacturing, and testing processes with the desire to cut costs, increase reliability, and curtail time-to-market. For example, virtualization is used to accelerate inception and conceptualization phases; digital twins are used to simulate vehicle operational safety.

With the introduction of any new technology, a technology implementation plan is required that details the feature-set, how the technology will be integrated, challenges of implementation, and how these challenges will be met. [18]

1) Technology Considerations

Technology should only be adopted if there is an established demand for it, an opportunity to create a demand that has not existed before, or a resulting performance/capability enhancement. [18][20] As James McQuivey says in Digital Disruption: “..this means rapidly identifying a list of the next things your customers want and quickly giving them the few that are easiest for you to deliver. In this model, we do not predict the future of our product. We start with the next possible thing our customer needs and let the future find us.” [20]

These considerations can be summarized as:

- What level of improvement will this technology bring about?

- How willing are customers willing to adopt the technology (provided it is customer-facing)?

- What effect will the technology have on other systems in the automobile?

- Are resources available with the know-how?

- Is there space within the vehicle system to accommodate the technology and its supporting sub-systems?

- What effect will it have on the overall time to deliver and cost of product?

- Whether the manufacturer is better-off buying vs. building the technology?

Another important consideration is the risks involved with the implementation of new technologies. These can be technical risks (inability to develop, integrate, or support), schedule risks (delaying delivery of automobile to support implementation), or cost overruns (due to cost of development, sourcing, or integration). [18]

2) New Technologies – A Case in Focus

One of the technologies being employed in the development process is the use of 3D printing and advanced collaboration and modeling tools. For example, Aston Martin, an iconic British automobile manufacturer has transformed its design process using Autodesk Alias.[22]

Aston Martin’s team of 50, comprising different disciplines, collaborate very closely throughout the entire design process: sculpting and digital teams design 3D models, building on each other’s skills and expertise.

Using the same tool, Autodesk Alias, creative and production teams have real-time access to these models, giving them early insights into design direction and an opportunity to provide feedback earlier in the process. This streamlined flow has increased efficiencies through the end-to-end design process.

Once a visual is finalized, including design details, advanced 3D printing technologies are then used to provide physical depictions of parts and components. In essence, “the design..can go from ‘art’ one day to ‘part’ the very next.” [22] To summarize the power of these innovative technologies, the team has summarized the value as: “Through photorealistic visualisations and animations, the latest automotive models or concept designs can be fully experienced before they reach production.” [22]

VI. FUTURE AND GAME-CHANGING TRENDS

A. Ride-Sharing / Ride-Hailing

Ride-sharing, driven by a desire for higher efficiencies, economies of scale, and more cost-effective and convenient ways of transportation, has been a game-changer for the industry. Consumers will likely shift more from vehicle ownership to viewing cars as a commodity or a service. This transformation shift will force manufactures to re-tool their assembly and production lines to fewer models, with less focus on vehicle owner accessories, and more towards ride-sharing consumers’ preferences. According to IHS Markit, the app-based mobility market, which was not around a decade ago, will become a one trillion-dollar market by 2040.

This massive opportunity along with the technological and social changes it brings will leave car manufacturers with hard decisions of having to pivot towards different focus areas within the value chain. For example, a ride-sharing car will likely average, according to IHS Markit, 50,000 miles a year. This high utilization will drive towards more powertrain resiliency, fuel economy, and optimization [7].

B. Electrical Vehicles

The electric vehicle (EV) market has been grown at a strident pace, fueled primarily by consumer demand for more sustainable and environment-friendly mobility options. Government subsidies and tax incentives have helped both consumers and manufacturers alike in the adoption of EVs at an ever-increasing scale.

With climate change remaining front and center at the political debate, manufacturers will likely continue their investments in light-vehicle production. For example, Uber has announced that all their cars will be EVs by 2025 in the city of London, as part of its “clean air” sustainability plan. The firm said in a statement, "For example, a driver using the app for an average of 40 hours per week could expect around GBP3,000 of support towards an EV in two years' time and GBP4,500 in three years."

With its fleet of 45,000 drivers, this corporate effort presents ripe opportunities for European car manufacturers to streamline production of light electric vehicles. [8]

C. Autonomous Driving

Europe, had a difficult year in 2018 for the passenger car market, primarily impacted by the introduction of Worldwide Harmonized Light Vehicle Test Procedure (WLTP) testing certification. Nonetheless, some European markets continued to grow. In Spain, for example, the passenger car market space has seen a 7% year over year increase in 2018 alone, according to the Spanish Association of Passenger Car and Truck Manufacturers (Asociación Española de Fabricantes de Automóviles Turismos y Camiones: ANFAC). In addition, with Madrid, Spain announcing a ban on pre-2000 gasoline and pre-2006 diesels cars from the city, the automotive market expects to see a boost in adoption of the latest trends in the industry. [9]

Not only are these external factors (i.e. government regulations) substantially impacting design and production processes, technological advances, digital transformations, disruptions in the industry, and new entrants to the market continue to challenge manufacturers to quickly adapt.

D. Connectedness

The digital transformation, demographic and cultural changes will lead to more “connected” cars: the networking of the car with the outside world. This connectedness would manifest itself in two aspects: the networking of the car with its surrounding infrastructure, such as other cars or traffic lights; the second is the networking of the occupants with online services.

This expectation would require substantial changes to the product design and manufacturing processes of cars. Not only will the time-to-market curtail to meet demand and compete with up and coming players, manufacturers will need to keep up with consumer services that have become indispensable for a day-to-day life.

E. Annual Updates

Similar to how software and online services continue to receive regular updates and enhancements, a one-time purchase of a vehicle will become a thing of the past. In the future, consumers will expect annual, if not more often, updates to hardware and software. This will require shorter innovation cycles and different approach to manufacturing processes where up to 30% of labor could be spent on retrofitting existing models rather than net-new vehicles. This is evident by the landmark study by PwC, “Five trends transforming the Automotive Industry”, and McKinsey’s 2030 outlook on the automotive industry. [10][11].

VII. THE AUTOMOTIVE INDUSTRY IN EUROPE

The European automotive industry is considered a global leader, with a major contributor to European countries’ GDP; it employs 13.3 M jobs, the number one manufacturer employer, generating 7% of total income tax for the EU (2015, 415 EUR) [23 – see Exhibit 1].

The industry, aside from the global recession of 2007, has been growing since 1980, which is attributed to “the development and implementation of technical innovations such as fuel-efficient vehicles and alternative powertrains (e.g., hybrid).” [23]

VIII. CHALLENGES

The future trends outlined in this paper are the some of challenges that face the automotive industry in North America and Europe. In addition, recent scandals, such as Volkswagen’s diesel emissions, with more than $4.3bil in penalties and fines, have shaken consumers’ trust. Moreover, “revenue pools are shifting strongly towards Asia”, while more players continue to enter the market. [23]

When measured by automotive production output, McKinsey’s RACE 2050 points to a “shift of economic center of gravity” towards the east. For example, from 1970 to 2018, the “Chinese automotive market has grown from an annual production of 87,000 vehicles to 28 million” [23] (See Exhibit 2).

Another challenge that faces the industry is the flow of private venture capitalists. Since 2010, “more than EUR 100 billion have been invested in mobility start-ups, of which 94$ originated from..outside the automotive industry”. [23]

With a shift towards more enhanced user interfaces, software is now the most complicated component of a vehicle (See Exhibit 3)

With the level of sophistication and changing trends, the development process is facing disruption along the end-to-end supply chain. In addition, changing government policies, with a global shift towards more protectionism, could lead to higher tariffs and the need to shift to more local sourcing options. [23]

Conclusion

The automotive industry is transforming at a rapid rate. The design and development process will have to adapt with agility, innovation, collaboration, and in some cases, coopetition, for auto manufacturers to survive. With the shift in production output further east, both European and North American players will have to be customer-centric, focusing on empowering end-users with flexibility, efficient, and affordable mobility. A “zero-net impact emission” should be another important objective to employ right from the concept phase of a car. Sustainability-aware consumers, with more affordable options, are now demanding planet-friendly mobility solutions. [23] In summary, the organizations, processes, tools, and programs have to shift from “customer orientation” to “customer centricity”, from “environmental awareness” to “sustainable mobility”, and from “[pure] profitability” to “economic value creation”. [23]

References

[1] (2014) The Core of Automotive – Manufacturing Engineering. Retrieved 3/16/2019 https://www.automotiveengineeringhq.com/automotive-manufacturing-engineering/ [2] (2006) Optimizing the Automotive Development Process. In: The Automotive Development Process. DUV [3] Karjalainen TM. (2006) Strategic Concepts in the Automotive Industry. In: Keinonen T., Takala R. (eds) Product Concept Design. Springer, London [4] Moller, Simon (2004): Back to the Future. Design Report, 10/04. 62-65. [5] (2014) The Core of Automotive – Manufacturing Engineering. Retrieved 3/16/2019 https://www.automotiveengineeringhq.com/automotive-manufacturing-engineering/ [6] (2016) Automotive Manufacturing Process Overview. Retrieved 3/18/2019 https://www.slideshare.net/TalVagman/automotive-manufacturing-process-overview [7] (2018) Driving change: shaping the future of the automotive business. Retrieved 2/22/2019. https://ihsmarkit.com/research-analysis/driving-change-shaping-future-of-automotive-business.html [8] (2018) Uber plans to convert its fleet to fully electric in London by 2025. Retrieved 2/24/2019. https://ihsmarkit.com/research-analysis/uber-plans-to-convert-its-fleet-to-fully-electric-in-london-by.html. [9] (2019) Spanish passenger car market grows during 2018 . Retrieved 3/10/2019. https://ihsmarkit.com/research-analysis/spanish-passenger-car-market-grows-during-2018.html. [10] (2016) Disruptive trends that will transform the auto industry. Retrieved 3/5/2019. https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/disruptive-trends-that-will-transform-the-auto-industry. [11] (2018) Five Trends Transforming the Automotive Industry. Retrieved 2/26/2019. [12] https://www.pwc.at/de/publikationen/branchen-und-wirtschaftsstudien/eascy-five-trends-transforming-the-automotive-industry_2018.pdf. [13] Ulrich, K. T. and S. D. Eppinger. 2015. Product Design and Development . 6th Edition. [14] New York, NY: Irwin McGraw-Hill. [15] (1993) Hall, R. \"A framework linking intangible resources and capabilities to sustainable competitive advantage,\" Strategic Management Journal, Vol. 14, pp 607-618 [16] (1998) Chandy, R. K. and Tellis, G. J., \"Organizing for radical product innovation: the overlooked role of the willingness to cannibalize,\" Journal of Marketing Research, November, pp. 474-487. [17] (2003) Pandza, K., Horsburgh, S., Gorton, K., and Plajnar, A., \"A real options approach to managing resources and capabilities,\" International Journal of Operaitons & Production Management, Vol. 23, No. 9, pp. 1010-1031. [18] (1992) Stalk, G., Philip, E. and Shulman, L. E., \"Competing on capabilities: the new rules of corporate strategy,\" Harvard Business Review, March-April, pp. 57-68. [19] (2017) Bhise, V, “Automotive Product Development: A Systems Engineering Implementation,” CRC Press. [20] (1991) Clark, K. B. and Fujimoto, T., \"Product development performance - strategy, organization, and management in the world auto industry,\" Harvard Business School Press, Boston, MA. [21] (2013) McQUivey, J., “Digital Disruption: Unleashing the Next Wave of Innovation”, Amazon Publishing. [22] (2009) Grote, K, Antonsson, E., “Springer Handbook of Mechanical Engineering”, Springer, Berlin, Germany. [23] (2013) Accelerating the automotive design process. Retrieved 4/1/2019. https://damassets.autodesk.net/content/dam/autodesk/files/aston_martin_-_layout_-_proof.pdf [24] (2019) RACE 2050 – A Vision for the European Automotive Industry. Retrieved 4/1/2019. https://www.mckinsey.com/~/media/mckinsey/industries/automotive%20and%20assembly/our%20insights/a%20long%20term%20vision%20for%20the%20european%20automotive%20industry/race-2050-a-vision-for-the-european-automotive-industry.ashx

Copyright

Copyright © 2025 Emad Tanbour, M. C. Greenfield, Hawra Alzuad. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET48723

Publish Date : 2023-01-19

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online