Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Maximizing Profit for Cloud Brokers in The Era of Cloud Computing

Authors: Venkata Ramana Kaneti

DOI Link: https://doi.org/10.22214/ijraset.2023.56264

Certificate: View Certificate

Abstract

Cloud computing has experienced significant growth in recent years, with an increasing number of applications migrating to the cloud, where they can centrally manage a wide range of resources, including hardware and software. These resources are delivered over the internet as services, catering to customer demands. One of the key features of cloud computing is the pay-as-you-go model. However, due to the one-hour billing cycle and the discount structure favoring long-term users, many customers end up paying more than their actual usage. To address this issue, cloud brokers rent reserved Virtual Machines (VMs) from cloud providers at a reduced cost and offer them to users on an on-demand basis at a more affordable rate than what the cloud providers offer. Moreover, cloud brokers operate on a shorter billing cycle compared to cloud providers. This study focuses on configuring a cloud broker and determining the optimal pricing for its VMs to maximize its profits. Most cloud providers offer two primary payment options for their instances: On-Demand and Reserved Instances. With On-Demand instances, users pay for compute capacity per hour, making them suitable for short-term workloads. Reserved Instances provide significant discounts but require users to commit to long rental periods, disadvantaging short-term customers. The introduction of the cloud broker serves as a novel intermediary between cloud providers and cloud users, addressing the issues of both one-hour billing cycles and the limitations on discounts for short-term users. This manuscript begins by introducing a multi-server queuing model, a revenue model, and a cost model, followed by a comprehensive analysis of the factors affecting them. It defines an optimization problem aiming to determine the optimal configuration for multi-server setups and VM pricing, all aimed at profit maximization. To address this optimization problem, a heuristic method is proposed, which combines partial derivatives and a bisection search. This method offers a practical approach to finding the optimal VM price and system scale, ultimately maximizing profit. This manuscript explores the critical role of cloud brokers in the cloud computing landscape and presents a comprehensive approach to optimizing their operations, ultimately benefitting both cloud providers and users.

Introduction

I. INTRODUCTION

Cloud computing offers convenient on-demand access to computer system resources, encompassing data storage and processing power, without the need for direct, active user management. However, this description often fails to capture the cost-effectiveness of data centers accessible to a broad range of users. Nowadays, large cloud networks are prevalent, distributing functions from central servers to various locations. When user proximity is a priority, the deployment of a foothold server becomes essential. Clouds can be private, corporate, or open to different communities, including the public sector. Cloud computing leverages resource sharing to enhance efficiency and achieve economies of scale.

The expansion of cloud hosting has been monumental. Service providers have embraced the data revolution, collectively offering a wide array of resources, from hardware to software, delivered over the Internet as service offerings. An increasing number of businesses are migrating their operations to the cloud.

The pay-as-you-use model is a fundamental feature of cloud-based solutions, with two implications. Firstly, physical data can be efficiently classified and allocated to customers through virtual machinery, based on application usage rates, and customers pay according to the resources they consume. Secondly, resources can be dynamically allocated and accessed at various levels, with customers paying based on the frequency of utility usage.

Providers offer two primary billing methods for their instances: on-demand and reserved. On-demand instances are billed on an hourly basis for processing power, regardless of the specific iterations they run. Reserved Instances offer a substantial discount compared to on-demand rates, but they require long-term commitments, disadvantaging short-term users. To address this, cloud brokers lease reserved VMs from cloud providers, regulate them, and offer them to clients at a discounted on-demand rate, making cloud services more accessible to a wider range of users.

Cloud brokers play a pivotal role in reducing costs through two distinct strategies. Firstly, they capitalize on the seasonal price variations between reserved and on-demand VMs, procuring them at a lower cost and offering them at a reduced rate compared to the regular on-demand pricing. Secondly, cloud brokers introduce a shorter billing cycle, significantly improving resource efficiency while meeting customer demands at a more affordable rate.

Service providers stand to gain a considerable cost advantage between reserved and on-demand instances while providing customers with more budget-friendly options. Profit maximization is a core goal for all industries. Therefore, the focus is on enhancing the profitability of cloud brokers while ensuring pricing that customers can rely on.

Additionally, the cost of a cloud broker is influenced by two factors: the cost of sales and the size of the service network. Service quality is determined by providers, and the service network can be viewed as a multi-server system with a plethora of resources available for lease. The network's size directly affects its service capability, with larger processing capacities serving more customers, generating greater revenue, albeit potentially incurring higher costs. Hence, the size of the network must be carefully evaluated to maximize contributions.

This manuscript provides a comprehensive analysis of the factors impacting profit in order to optimize the profitability of cloud brokers and formulate a value maximization task. The key inputs include:

- The implementation of a groundbreaking business model, acting as intermediaries between cloud providers and consumers to reduce cloud usage costs.

- Viewing brokers as M/M/n queuing models in a multi-server context, allowing the assessment of all factors affecting profitability.

- A thorough investigation of the relationship between machine selling prices and customer demand, informing the pricing of VM requests.

- A series of numerical studies demonstrating the potential to reduce costs for cloud customers while simultaneously generating substantial profits.

A. Problem Statement

In the context of both On-Demand and Reserved Instances, customers often find themselves paying more for short-term use than they would prefer. While lessors profit from a specific configuration, the crucial consideration revolves around the quantity of resources they intend to lease and the associated costs.

B. Objectives

Our primary goal is to empower cloud brokers to maximize their profits. These brokers procure long-term, reserved instances from providers and offer them to clients as on-demand resources at a more cost-effective rate. Our aim is to guide lessors in customizing their virtual networks for optimization and providing pricing strategies. The objective is to offer a near-optimal solution that can accommodate the fluid and dynamic nature of relationships in the configuration and pricing processes.

II. ANALYSIS ON OPTIMAL SOLUTION

A. Existing System

The system comprises various elements, including Cloud Brokers and Cloud Broker Companies, along with a multitude of private and public suppliers offering diverse services. Cloud Brokers traditionally functioned as schedulers, mediating between these suppliers and clients. However, users often face challenges in finding the best solutions that align with their specific application needs, whether for enhancement or execution. This system primarily addresses two key aspects: aiding clients in selecting the most suitable cloud service and assisting providers in making informed decisions regarding resource allocation. To achieve these objectives, effective scheduling mechanisms are essential. These mechanisms optimize the selection of cloud datacenters, aiming to reduce the cost of adopting Virtual Machines (VMs) and meet performance constraints, such as responsiveness and computational capacity.

The role of Cloud Brokers has evolved significantly in the context of advancing cloud computing. It has shifted from being a mere scheduler between cloud providers and customers to becoming a third-party provider of cloud services. Importantly, these cloud brokers may not necessarily own the underlying resources. Cloud Broker Companies have also undergone transformation. They now procure a variety of reserved instances for extended periods from various clients and offer these resources at more competitive rates compared to traditional suppliers.

One challenge faced by cloud brokers is the need to strike a balance between resource allocation and the risk of underutilization. To mitigate this risk, cloud brokers may choose to mortgage resources. However, this approach can result in resource wastage and potential financial losses if demand declines during the corresponding period.

The existing system has notable drawbacks, including the fact that short-term customers often end up paying more than they initially intend. The introduction of cloud leasers, acting as intermediaries between cloud providers and customers, is aimed at alleviating the cost implications associated with this service component.

B. Proposed System:

A cloud broker acquires reserved instances from cloud providers for extended durations and offers them as on-demand resources at a reduced price compared to what service providers charge for the same VMs. This approach not only lowers subscription costs but also offers more precise Billing Transfer Units (BTUs), resulting in significant cost savings for customers using public clouds. Major cloud companies, such as Amazon EC2 and Windows Azure, provide both on-demand and reserved instances.

Cloud brokers play a vital role in guiding clients on how to customize their virtual resource network and maximize their operations. They lease VMs from cloud providers to shape their private cloud networks and determine the platform's size, which signifies the number of products managed. However, in cases where no VMs are available, and incoming requests cannot be promptly accommodated within the private cloud, these requests may need to be rerouted to servers, potentially leading to a loss of customers. To address these challenges, optimal solutions are devised through a combination of partial derivative methods and bisection techniques. The ultimate goal is to optimize revenue through a comprehensive analysis of the factors influencing income and the formulation of a profit maximization question.

The proposed system offers several advantages, including the representation of a cloud broker as a multi-server system that considers all factors impacting profit. It also provides in-depth research on the relationship between product selling prices and customer demand, facilitating the determination of charge requests based on this analysis.

III. SURVEY ON CLOUD BROKERS

Cloud computing is a paradigm that offers on-demand access to computer system resources, primarily encompassing data storage and processing power, without direct user management. This concept typically refers to data centers accessible over the Internet, often referred to as "the cloud." Large-scale cloud infrastructures, which are prevalent today, distribute functions across multiple locations, with edge servers serving users in close proximity. Cloud services can be private or public, tailored to a single enterprise or accessible to a wide range of organizations, and they rely on resource sharing to achieve cost-efficient scalability [3].

Conventional cloud brokering approaches aim to address challenges related to matching service providers with the best technical and cost-effective solutions based on market demands [16] [7]. These approaches also focus on assisting customers in optimizing their applications through the dynamic allocation and deallocation of virtual machines based on usage and availability. In high-demand situations, cloud bursting techniques are employed to extend computational capacity transparently to users [17].

Software as a Service (SaaS) offerings have gained recognition among end-users and providers. Service providers benefit from streamlined deployment and centralized version control, while end-users enjoy anytime, anywhere access, seamless data exchange, and secure data storage within the infrastructure [2]. In cases where all Reserved Instances (RIs) are utilized, and an instance cannot continue until its expiration, virtual brokers may need to procure on-demand instances [9] [13]. However, the service discovery aspect is not explored as virtual brokers do not possess physical processing power; they operate indirectly through public cloud resources [13].

By leveraging technologies like virtual machines and cloud storage, a market-oriented resource allocation system has been developed. This system introduces market-based inventory management approaches that integrate customer-driven demand management and quantitative risk management to support Service Level Agreements (SLAs) related to resource allocation [15]. It also involves the creation of global cloud exchanges for dynamic trading. An empirical approach to optimization processes is designed, with analytical methods leading to recommended optimal solutions. Algorithms are employed to determine realistic solutions while considering constraints on server capacity and server intensity [6].

The system begins with an initial investment plan, followed by adaptations to create a more favorable portfolio of investments [9]. The data owner uses virtualization in Infrastructure-as-a-Service (IaaS) networks to partition hardware according to customer demands. Users are billed only for the resources they use, with cloud growth promoters facing complexity, particularly in pricing structures that may not align with actual usage patterns [5].

In a multi-tier setting, the rental cost is proportional to the number of servers on a multi-server system, and this cost influences profit optimization, considering both user fees and overhead costs. High-performance computing resources are employed to manage various services, including servers, storage, and applications, which are delivered to end-users as charge-per-use services through data centers located in diverse geographical locations [13]. Load transfer policies, including online migration among federated data centers, are executed when additional resources are required [15].

The urbanization process involves deploying web server instances with identical topologies to stopover providers and migrating applications from iconic virtual machines to evolving virtual machines at the destination [15]. Different user applications may require diverse layouts and specifications, making it challenging to measure the behavior of various resources for these applications [16].

The ecosystem involves various digital tools, and service providers offer services to users, outsourcing the required hardware resources for hosting services. Infrastructure Providers (IPs) provide infrastructure "as a service," offering flexibility and cost reduction through the movement of computing resources [11]. On-demand computing services are delivered at low cost through IaaS clouds, freeing users from the need for proactive infrastructural development to meet peak demands [21].

To achieve the dual goals of maximizing user satisfaction and profits, a heuristic classification reflects the behavioral characteristics of authorized services in terms of Quality of Service (QoS) [4] [12] [13]. The brokering service fee is constant for all forms of connections, whether requests are processed in-house or at the data center [12] [13].

In certain IaaS clouds, different monitoring collector editions are available, including on-demand and reserved observations. On-demand scenarios enable flat-rate booking without considering the duration of usage. Cloud resources are requested to expand demand estimates for a specific time frame based on arbitrary reservation actions. It's essential to account for the expected returns while determining how many instances to book at a given time [2] [21].

The proposed economic model focuses on efficient management of Reserved Instances (RIs) to meet customer demand while adhering to the accepted level of service quality. The system assumes accurate reservations have been made, optimizing the broker's profit by effectively managing RIs [10] [17]. Service requests that cannot be handled immediately enter a queue, awaiting available servers within the corresponding system [6]. Two approaches are implemented and compared, allocating workloads first to servers in the data center before extending usage to other data centers based on electricity prices [17].

Pricing policies and server-level agreements determine the revenue model, using a price compensation system to ensure service quality and customer satisfaction. Cloud systems benefit from round-robin algorithms, and these approaches have been evaluated and tested using simulation tools like Cloud Analyst [12]. The economic models vary across different cloud domains, with consumers generating reserves and defining pricing and usage terms. These models aim to uncover exclusive contracts that attract new customers to new facilities [4].

To efficiently accommodate inquiries, contenders must use virtual tools wisely. If they cannot satisfy all demands while adhering to Service Level Agreements (SLAs), on-demand VMs are procured to boost production, akin to hybrid cloud-bursting [17].

IV. THREE-TIER CLOUD ARCHITECTURE

The cloud structure, depicted in Figure 1, comprises three essential components: cloud service providers, cloud brokers, and clients. A cloud broker is an organization that acts as an intermediary between cloud service providers and consumers. It acquires reserved instances from providers for extended periods and rents them to clients at a reduced cost, offering more favorable Billing Transfer Units (BTUs) compared to the rates charged by the cloud for equivalent VMs. However, many clients often use these resources for short periods, leading to inefficient resource utilization and financial waste.

On the other hand, on-demand instances provide flexibility without the need for long-term commitments or direct upfront payments. Clients pay only for the actual hours of usage, making it a cost-effective option. The pricing of on-demand instances is based on the application's workload, ensuring clients pay only for the resources they consume. In contrast, reserved instances offer a discount compared to on-demand pricing, providing several options in terms of capacity, price, and performance metrics in the cloud market. This array of choices can be overwhelming for clients seeking the most efficient and cost-effective solution.

The cloud broker's multi-tier structure is a widely adopted model, subject to extensive research from various perspectives, all with the ultimate goal of maximizing the cloud broker's efficiency.

V. IMPLEMENTATION OF MODULES

A. Cloud Computing Structure

In the digital marketplace, a diverse range of services with distinct characteristics, including affordability, quality, and performance, is available. Individuals can access resources and opportunities from various providers. However, navigating the complex landscape of pricing and selecting the right options can be a challenging task for potential clients. As a result, some web service providers opt for a pricing strategy that uses a billing time unit, which can result in overspending for customers.

On the other hand, on-demand instances offer a flexible and cost-effective solution, without requiring long-term commitments or upfront payments. Clients only pay for the actual hours of usage, making it a reasonable choice. The pricing is based on the capacity needed, allowing clients to scale their computing resources up or down as required, and they are billed only for what they use. This approach offers a significant discount compared to on-demand pricing.

However, a drawback lies in the surcharge imposed on short-term customers with shifting usage patterns. It can result in clients having to reserve resources for an extended period to optimize their resource allocation while incurring additional charges. This approach can impact clients' choices and work orders negatively, affecting their overall cost-effectiveness.

B. Multi-Server Queue System

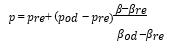

The broker provides a unified service platform under a single cloud provider and delivers similar services to its customers. These services come with a fixed set of features, including memory, bandwidth, and processor capacity. The submission of requests in the M/M/n/n queuing model is characterized by a queue length represented by λ. The generation times of these requests are statistically independent and follow incremental random variables with an average of 1/λ.

The authorization rate of the broker is determined by two main components: the overall customer demand, denoted as πmax, and the profit margin of the resources it offers. The broker caters to web users who configure their personal platforms and estimates the number of users it can accommodate, denoted as "n." When clients assess customer needs and decide whether requests should be handled in-house or outsourced, they manually process the orders for incoming access.

However, in cases where no machines are readily available and incoming requests cannot be promptly resolved within the private residence, the broker must address these requests. When clients receive service requests, they evaluate how to handle these requests, either internally or by outsourcing based on their capabilities and resources.

C. Cost Modeling

The budget of a payment processor serves various functions, including expense management, setup costs, and more. However, it primarily bears the implications of reformatting and operating the multi-server virtual platform. To efficiently manage its operations, the processor leases a significant number of instances for an extended period and bills its clients accordingly. While the average rental cost for a produced unit is denoted as βre, this relates to the module of the multi-server platform.???????

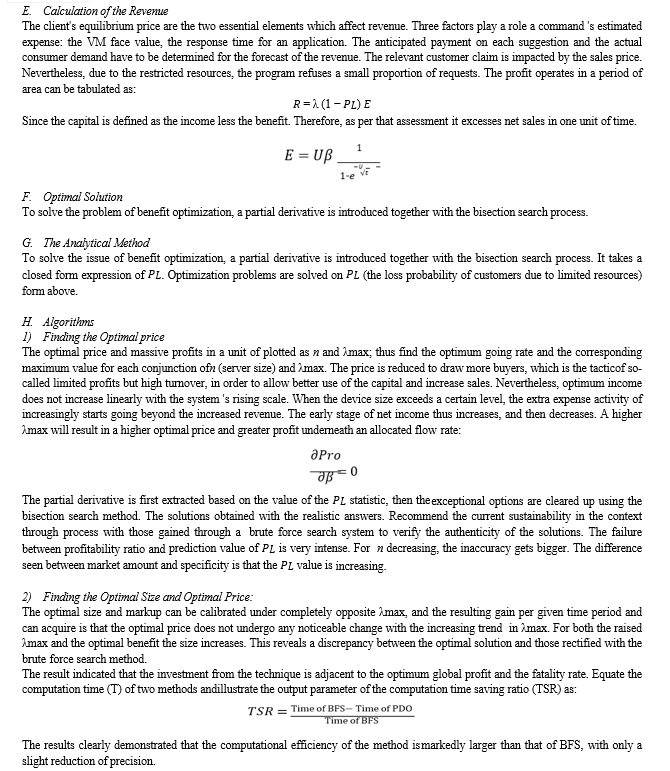

D. Revenue Modeling

Two significant parameters influence the revenue. The first determinant impacting revenue is customer demand, quantified as the arrival rate of requests denoted by λ. A higher request rate leads to increased revenue at a set fee. To generate substantial profits, the gross profit margin must surpass its fair market value, which means that the market rate at which the broker acquires licensed instances from providers. One viable strategy for increasing revenue is by raising customer expectations. Customer behavior adjusts in response to varying pricing structures, as clients tend to make choices based on similar pricing levels.

???????

???????

Conclusion

A cloud broker is an entity that acquires licensed instances over extended periods and then offers them to customers at lower prices with more flexibility in machine allocation. This can result in substantial cost savings for clients, albeit potentially at the expense of reduced customer satisfaction. Many prominent organizations are considering ways to establish a virtual asset portal and take advantage of such a service. The platform is designed based on M/M/n/n queue theory, incorporating challenges that stem from various factors affecting investments and their interconnections, all within the framework of queuing theory. The optimal solutions are derived using a combination of partial derivatives and the bisection method. This necessitates a series of analyses to assess the evolving trends in earnings and capital expenditures. Looking ahead, linear price-demand models will be employed to analyze the profitability of the broker\'s earnings, as it is a crucial factor in the actual market. Different cloud industries may exhibit unique price-demand relationships, leading to more complex value-demand curves in the future.

References

[1] Ahmad M. Manasrah, Tariq Smadi, and Ammar Almomani. A variable service broker routing policy for data center selection in cloud analyst. Journal of King Saud University - Computer and Information Sciences, 2016. [2] Armando Fox, Rean Grif?th, A Joseph, R Katz, AKonwinski, G Lee, D Patterson, A Rabkin, and I Stoica. Above the clouds: A berkeley view of cloud computing. Dept. Electrical Eng. and Comput. Sciences, University of California, Berkeley, Rep. UCB/EECS, 28:13, 2009. [3] Buyya Rajkumar, Broberg James, and Andrzej M Goscinski. Cloud computing: Principles and paradigms. 8(6-7):1– 41, 2011. [4] Daniele D?Agostino, Antonella Galizia, Andrea Clematis, Matteo Mangini, Ivan Porro, and Alfonso Quarati. A qosaware broker for hybrid clouds. Computing, 95(1):89–109, 2013. [5] Dhaval Limbani and Bhavesh Oza. A proposed service broker strategy in cloudanalyst for cost-effective data center selection. International Journal of Engineering Research and Applications, 2(1):793–797, 2014. [6] Jing Mei, Kenli Li, Aijia Ouyang, and Keqin Li. A profit maximization scheme with guaranteed quality of service in cloud computing. IEEE Transactions on Computers, 64(11):3064–3078, 2015. [7] J. Tordsson, R. S. Montero, R. Moreno-Vozmediano, I. M. Llorente, \"Cloud brokering mechanisms for optimized placement of virtual machines across multiple providers\", Future Gener. Comput. Syst., vol. 28, no. 2, pp. 358-367, 2012. [8] Junwei Cao, Kai Hwang, Keqin Li, and Albert Y. Zomaya. Optimal multiserver configuration for profit maximization in cloud computing. IEEE Trans. Parallel Distrib. Syst., 24(6):1087–1096, 2013. [9] Kenli Li, Jing Mei, and Keqin Li. A fund-constrained investment scheme for profit maximization in cloud computing. IEEE Transactions on Services Computing, PP(99):1– 1, 1939. [10] Keqin Li. Optimal configuration of a multicore server processor for managing the power and performance tradeoff. The Journal of Supercomputing, 61(1):189–214, 2012. [11] Luis M Vaquero, Luis Rodero-Merino, Juan Caceres, and Maik Lindner. A break in the clouds: towards a cloud definition. ACM SIGCOMM Computer Communication Review, 39(1):50–55, 2008. [12] Mohammed Radi. Efficient service broker policy for largescale cloud environments. Computer Science, 2015. [13] [13]N.Gohring Confirmed: Cloud infrastructure pricing is absurd. http://www.itworld.com/cloud-computing/387149/confirmed-cloud-iaas-pricing absurd. [14] Owen Rogers and Dave Cliff. A ?nancial brokerage model for cloud computing. Journal of Cloud Computing,1(1):1–12, 2012. [15] Rajkumar Buyya, Chee Shin Yeo, Srikumar Venugopal, James Broberg, and Ivona Brandic. Cloud computing and emerging it platforms: Vision, hype, and reality for delivering computing as the 5th utility. Future Generation computer systems, 25(6):599–616, 2009. [16] R. Buyya, R. Ranjan, R. N. Calheiros, \"Intercloud: Utility-oriented federation of cloud computing environments for scaling of application services\", Proc. Int. Conf. Algorithms Architectures Parallel Processing, pp. 13-31, 2010. [17] S Nesmachnow, S Iturriaga, and B Dorronsoro. Efficient heuristics for profit optimization of virtual cloud brokers. IEEE Computational Intelligence Magazine, 10(1):33–43, 2015. [18] Shuo Liu, Shaolei Ren, Gang Quan, Ming Zhao, and Shangping Ren. Pro?t aware load balancing for distributed cloud data centers. In IEEE International Symposiumon Parallel and Distributed Processing, pages 611–622, 2013. [19] Vahid Hajipour, Vahid Khodakarami, and Madjid Tavana. The redundancy queuing-location-allocation problem: A novel approach. IEEE Transactions on Engineering Management, 61(3):534–544, 2014. [20] W. Wang, D. Niu, B. Li, and B. Liang. Dynamic cloud resource reservation via cloud brokerage. In ICDCS, 2013. [21] Wei Wang, Di Niu, Baochun Li, and Ben Liang. Dynamic cloud resource reservation via cloud brokerage. In IEEE International Conference on Distributed Computing Systems, pages 400–409, 2013.

Copyright

Copyright © 2023 Venkata Ramana Kaneti. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET56264

Publish Date : 2023-10-23

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online