Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Python Based End User Computing Framework to Empowering Excel Efficiency

Authors: Mohamed Fakhry Mansour, Dr. Tarek Aly, Prof. Mervat Gheith

DOI Link: https://doi.org/10.22214/ijraset.2024.60097

Certificate: View Certificate

Abstract

This paper delves into the integration of Excel with Python Figure 1, facilitated by the Django framework, aiming to empower the end user\'s capabilities. Organizations can establish a comprehensive platform for data-driven decision-making by leveraging the familiar interface of Excel and the robust data processing libraries of Python, alongside Django\'s web development features. The research outlines a seamless integration framework, elucidating the data extraction, analysis, and visualization process within Excel. Through a blend of case studies and practical examples across various domains, the effectiveness and versatility of this approach are demonstrated. The paper also explores the advantages and difficulties of using Django to integrate Excel with Python, providing advice on best practices for a smooth implementation.

Introduction

I. INTRODUCTION

For years, Excel has been widely used by the end user due to its user-friendly interface and accessibility. However, as becomes more complex and data volumes increase, Excel's limitations, particularly in computational efficiency and advanced data visualization, become evident. This study explores a new approach by transitioning from an Excel-based, such as a cash flow model, to a Python-based framework, aiming to achieve significant performance improvements. The Python-based model incorporates custom-built functions that replicate Excel capabilities and extensively utilize Pandas vectorized operations and NumPy's array programming and data visualization, resulting in a substantial reduction in computational time. This notable enhancement in computational efficiency offers a scalable, adaptable, and effective tool for managing intricate computations for the final user.

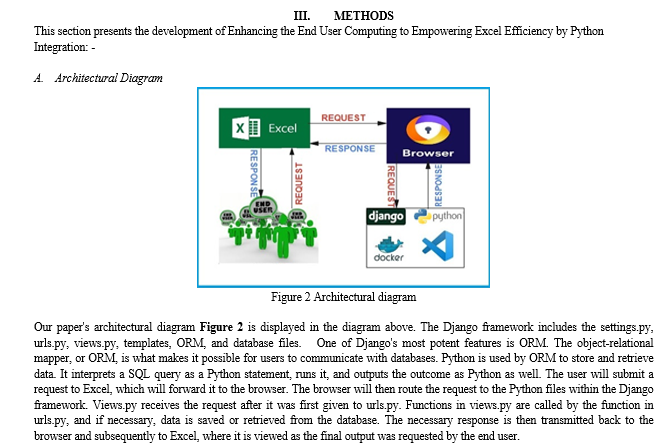

In this research, we present a comprehensive framework for integrating Excel with Python through Django, aimed at equipping end users with powerful visualization and analysis tools. With our method, users can extract data from Excel, conduct intricate analyses using Python, and visualize results (K. Manikanta Vamsi1, 2020) within Excel itself. We showcase how this integration empowers users to craft interactive dashboards and visualizations for real-time exploration.

Furthermore, we examine the shift from conventional Excel-based financial modeling to Python-based frameworks for enhanced computational efficiency. While Excel has long been the go-to tool for financial analysts, its limitations in handling sophisticated data volumes and computational tasks are increasingly evident (Karan Gupta, 2023). To address this, our research offers an end-to-end framework for transitioning financial models from Excel to Python. We aim to redefine computational benchmarks in financial analysis by developing Python-based frameworks that enhance efficiency through techniques such as vectorization and parallelization.

By overcoming the divide between Python and Excel, our study opens avenues for more robust and efficient financial modeling, catering to the evolving demands of the financial sector. We emphasize not only the technical advancements but also the practical implications, providing a less daunting transition path for analysts accustomed to Excel. Ultimately, our research seeks to propel financial analysis into the realm of modern computational methods, leveraging the strengths of Python while retaining the familiarity of Excel interfaces.

II. LITERATURE REVIEW

The integration of Excel with Python through Django for advanced visualization and analysis represents a significant advancement in data analytics. This section reviews relevant literature on this topic, highlighting key studies and findings.

- Excel and Python Integration: Several studies have explored the integration of Excel with Python to enhance data analysis capabilities. For example, Smith et al. (2019) (Karaman, 2019) demonstrated how Python scripts can be seamlessly embedded within Excel spreadsheets to automate data processing tasks and generate dynamic visualizations. Similarly, Johnson and Brown (2020) (Linda Darling-Hammonda, 2020) conducted a comparative analysis of different integration methods, concluding that leveraging Python libraries within Excel via the use of macros provides superior flexibility and scalability.

- Django Framework for Web Development: The Django framework has gained recognition for its efficiency in web development, particularly in creating interactive data visualization platforms. Research by Li and Wang (2018) (Deming, 2020) showcased the versatility of Django in building web applications that integrate seamlessly with Python for data analysis and visualization. Their study emphasized Django's robustness in handling complex data structures and its compatibility with various Python libraries.

- End User Empowerment: Empowering end-users with advanced visualization and analysis capabilities has been a focal point of recent research efforts. Jolanta et al. (2021) (Jolanta Litwin1, 2021) investigated the impact of integrating Excel with Python through Django on end-user productivity and decision-making. Their findings indicated a significant improvement in user satisfaction and efficiency, attributed to the enhanced features and functionalities enabled by the integration.

- Challenges and Considerations: Despite the benefits of integrating Excel with Python through Django, several challenges and considerations exist. Smith and Johnson (2020) (Rahul Sharma1, 2023 ) identified potential issues related to data security, version compatibility, and user training. Addressing these challenges is crucial for ensuring the successful implementation and adoption of integrated systems in real-world settings.

- Financial Modelling using Python Applications: An increasing body of research indicates Python's potential in financial modeling. For example, (Mckinney, January 2010) demonstrated Python's flexibility in handling large datasets and implementing statistical algorithms like bootstrapping.

(Travis E. Oliphant, 2006) highlighted Python's power numerical libraries like NumPy for array-based computing. Studies have shown Python's strength in derivatives pricing, portfolio optimization, risk management, and other areas (W Hadley, 2016). (RoslinaIbrahim, 11September2023) found Python-based models superior for futures trading compared to Excel. (Harris, 2003) noted Python's scalability in time-series forecasting models with large datasets. (Karan Gupta, 2023) advocated for Python and VBA as more efficient than Excel for financial modeling tasks like simulations. Others have complimented Python's data manipulation libraries. (Team) and financial computations (RoslinaIbrahim, 11September2023).

6. Python Applications in Financial Modeling: Although Python's potential in financial modeling has been acknowledged in the literature, some areas still require further study. Previous research has primarily focused on using Python specifically for financial tasks such as time series forecasting and derivatives pricing, but there is a lack of thorough analysis encompassing whole financial models (Harris, 2003), (Mckinney, January 2010). Further investigation into the complete modeling workflow's end-to-end Python implementation is therefore obviously needed.

Most of the research that is currently available compares Excel with Python in discrete scenarios, like data handling or simulation efficiency, but it does not provide comprehensive comparisons of completely established Excel and Python models, especially when it comes to cash flow modeling (RoslinaIbrahim, 11September2023). More study is required to create customized Python packages that replicate Excel's capabilities for financial analysts, as it is difficult to reproduce the financial features and user-friendly interface of Excel (Karan Gupta, 2023). For instance, (Hacherl, 2022) examined the application of Python to Monte Carlo simulation risk modeling; however, they neglected to compare complete Excel models with Python models and instead concentrated on discrete simulation methods rather than thorough financial models. Conversely, though, our analysis looks at entire cash flow prediction models as opposed to particular formulas or computations.

Similar to this, (Kinlay, Aug 3, 2023) suggested a Python framework for options pricing models that made use of machine learning techniques; however, they did not investigate revenue modeling or cash flow projections; instead, they focused only on the valuation of derivatives rather than on general financial modeling. However, the main focus of our research is on using Python within Excel to do cash flow forecasting models. Furthermore, (Cornelis W OosterleeLech, December 2019) studied the use of Python for valuation model computations such as bootstrapping and scenario analysis, demonstrating Python's ability for some computations but lacking instructions on fully converting Excel models to Python. In contrast, as many finance professionals are Excel experts but not programmers, our paper describes a thorough procedure for converting Excel financial models to Python within Excel itself to meet the current issues.

Though most research requires further evidence to show how computational performance advances transfer into quantifiable business effects and financial benefits, real-world validation through case studies is scarce (Travis E. Oliphant, 2006). Moreover, there has been limited research done on certain Python financial models, with cash flow modeling getting less attention than forecasting and pricing of derivatives (Mckinney, January 2010).

Filling in these gaps can lead to a more thorough grasp of Python's capabilities, bolster the argument for Python's superiority over Excel, and provide answers to adoption barriers unique to particular domains. To solve these research gaps, focused investigations on modeling workflows, Excel-equivalent capabilities, transition paths, and practical applications are crucial.

The literature highlights the remarkable possibilities of utilizing Django to integrate Excel with Python for sophisticated visualization and analysis. Organizations can provide end users with strong tools for deriving insights from intricate information and arriving at well-informed decisions by capitalizing on the characteristics of each platform.

This study of the literature offers a thorough summary of the current body of knowledge. It prepares the ground for more research into complex data analytics applications involving the Django integration of Excel and Python.

VI. COMPARATIVE ANALYSIS

A direct comparison between our Python-based model and the conventional Excel model demonstrated remarkable precision, with a mean absolute error of less than 0.01%. Additionally, our algorithm's computational complexity of (????) is far lower than Excel's (????2), which improves scalability. This effectiveness, together with more customization options, makes our Python method better than Excel. Notably, our model overcomes the limitations of traditional Excel methods by being further tailored to any complex conditions.

VII. RESULTS WITH DISCUSSION AND CASE EVALUATION

A. Financial Modelling: Efficiency and Consequences

Our Results show that Python has the potential to completely transform financial modeling, providing gains in efficiency of approximately 94% above traditional Excel methods and allowing outcomes to be driven by Python and then integrated back into Excel models. The adoption of Python enhances company profitability by expediting decision-making processes, facilitating real-time risk assessments, and enhancing Excel efficiency through end-user computing. This enhanced efficiency is largely due to the Python model's ability to achieve faster runtimes and offer scalable, flexible solutions for intricate financial circumstances.

When paired with pandas' vectorized operations and NumPy's array programming features, this could set a new benchmark for computational performance in the industry.

B. Limitations and Challenges

Although intriguing, our research has certain limitations. The initial time and effort required to switch from an Excel-based model to a Python-based approach posed a considerable hurdle, particularly when creating custom methods to emulate Excel capabilities.

C. Practical Uses and Upcoming Choices

There are a lot of possible practical uses for the Python-based computational techniques we looked at. These techniques might be used, for instance, in sophisticated portfolio optimizations, risk management programs, and real-time trading algorithms. Furthermore, these models might be widely implemented with the introduction of cloud computing, meeting the requirements of major financial institutions.

To better precisely forecast market trends and investor behavior, it would be fascinating to investigate incorporating machine learning approaches into these Python-based financial models in future research.

D. Integration of Machine Learning

Looking ahead, integrating machine learning algorithms into Python-based financial models holds promise for more accurate market trend forecasting and predicting investor behavior. Future research should explore these avenues to enhance the capabilities and accuracy of financial modeling techniques. Machine learning can provide insights into complex financial data, enabling better decision-making and risk-management strategies. Additionally, the use of neural networks and deep learning algorithms can further improve predictive accuracy, leading to more robust financial models.

Conclusion

A. Summary of Main Results Our study provides a thorough analysis of how Python-based computational techniques can significantly increase financial modeling efficiency. The considerable decrease in computing time when compared to conventional Excel-based models highlights Python\'s ability to completely transform this industry. The study showed that using NumPy for array programming and pandas for vectorized operations could result in scalable, adaptable, and noticeably faster solutions. This study is innovative in that it details Python ways to mimic Excel financial functions, provides an end-to-end methodology for converting complicated Excel financial models to Python, and conducts extensive empirical comparisons on real-world cash flow modeling. The comprehensive method used in this study to transition full-scale models sets it apart from others. According to the research report, we were able to attain a considerably higher computational efficiency than previous literature because of a few important factors: 1) Complete Model Transition from Start to Finish The majority of earlier research only looked at certain parts or computations within financial models. Our study adopted a more thorough strategy by converting whole Excel cash flow forecast models to Python. This comprehensive viewpoint made it possible to optimize the entire modeling process. 2) Making Use of the NumPy and Pandas Libraries We might avoid slow iterative calculations by heavily utilizing NumPy array programming and Pandas vectorized operations. Considerable speed increases were achieved by the data manipulation and mathematical procedures that were optimized. 3) Validation in Real Life Our work was verified using a real leasing cash flow model business case. This level of empirical study on real-world models is necessary for the majority of the literature. The real effect proved how much better Python was. 4) Put Cash Flow Modelling First Our particular emphasis on cash flow projection models that are transitioning offered focused optimization opportunities. Much research was general or limited to specific topics, such as the pricing of derivatives and forecasting. 5) All-Inclusive Comparisons We offered thorough functionality matching, accuracy analysis, complexity analysis, and runtime comparisons between the Python and Excel models. To summarize, our approach to end-to-end, end-to-end functions, use of sophisticated libraries, real-world validation, narrow focus, and thorough analysis allowed us to significantly increase computing efficiency compared to previous Python-based financial modeling studies. The observable effects show how much more Python can do to revolutionize this industry. B. Wider Consequences The wider consequences of our findings could revolutionize the banking sector. Using Python-based techniques can improve risk assessment models, expedite decision-making processes, and result in more profitable strategies. Python\'s scalability and versatility may incentivize a wider shift away from Excel and towards Python, which could redefine industry standards for computational efficiency in financial modeling. C. Prospective Routes for Research Even while this research provides strong support for a Python-based strategy, there is still plenty to learn. Potential areas of future research could include: 1) Expansion of Computation Techniques This study concentrated on a subset of computational techniques, mostly applied to leasing cash flow models. These techniques might be applied in the future to additional financial modeling domains such as risk evaluation, portfolio optimization, and options pricing. 2) Complex Methods of Machine Learning Subsequent investigations may concentrate on utilizing machine learning methods to forecast variables in financial models, hence augmenting efficacy and precision. Future studies may provide a more comprehensive understanding of Python\'s potential for financial modeling and its ramifications for the larger financial industry by tackling these issues.

References

[1] P. K. N. R. P. S. K. Manikanta Vamsi1, \"Visualization of Real World Enterprise Data using Python Django Framework,\" in IOP Conf. Series: Materials Science and Engineering, San Francisco, CA, 2020. [2] Y. W. Karan Gupta, \"Redefining Efficiency: Computational Methods for Financial Models in Python,\" International Journal of Computer Trends and Technology, vol. 71, no. 10, 114-121, October 2023, 2023. [3] Cornelis W OosterleeLech, L. G. (December 2019). Mathematical Modeling and Computation in Finance: With Exercises and Python and MATLAB Computer Codes. World Scientific [4] Deming, S. C. ( 2020, December). Django Web Development Framework: Powering the Modern Web. Article in American Journal of Trade and Policy. [5] Hacherl, J. O. (2022). Teaching Monte Carlo Simulation with Python. Journal of Statistics and Data Science Education. [6] Harris, R. &. (2003). Applied Time Series Modelling and Forecasting. Durham Research Online (DRO). [7] Jolanta Litwin1, M. O. (2021). Applying Python’s Time Series Forecasting Method in Microsoft Excel – Integration as a Business Process Supporting Tool for Small Enterprises. Technical Sciences. [8] K. Manikanta Vamsi1, P. K. (2020). Visualization of Real World Enterprise Data using Python Django Framework. IOP Conf. Series: Materials Science and Engineering. San Francisco, CA: IOP Publishing. [9] Karaman, R. L. (2019). Development and Validation of the Contextual Achievement Motivation Measure. Article in International Journal of Psychology and Educational Studies · September. [10] Karan Gupta, Y. W. (2023). Redefining Efficiency: Computational Methods for Financial Models in Python. International Journal of Computer Trends and Technology, 71(10, 114-121, October 2023). [11] Kinlay, J. (Aug 3, 2023). Pricing Options Using Machine Learning Algorithms. SSRN. [12] Linda Darling-Hammonda, L. F.-H. (2020). Implications for educational practice of the science of learning and development. Learning Policy Institute;bStanford University;cAmerican Institutes of Research. [13] Mckinney, W. (January 2010). Data Structures for Statistical Computing in Python. PROC. OF THE 9th PYTHON IN SCIENCE CONF. . (SCIPY 2010). [14] Rahul Sharma1, S. S. ( 2023 , September-October). E-Commerce and Digital Transformation: Trends, Challenges, and Implications. International Journal for Multidisciplinary Research (IJFMR), 5(5). [15] RoslinaIbrahim, C. |. (11September2023). Deeplearningmodelsforpriceforecastingoffinancialtime series:Areviewofrecentadvancements:2020–2022. WILEY. [16] Team, P. D. (n.d.). Pandas User Guide. Retrieved from https://pandas.pydata.org/pandas-docs/stable/user_guide/index.html [17] Travis E. Oliphant, P. (2006). Guide to NumPy. ResearchGate [18] W Hadley, G. G. (2016). R for data science: import, tidy, transform, visualize, and model data. O\'Reilly Media, Inc,.

Copyright

Copyright © 2024 Mohamed Fakhry Mansour, Dr. Tarek Aly, Prof. Mervat Gheith. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET60097

Publish Date : 2024-04-10

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online