Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

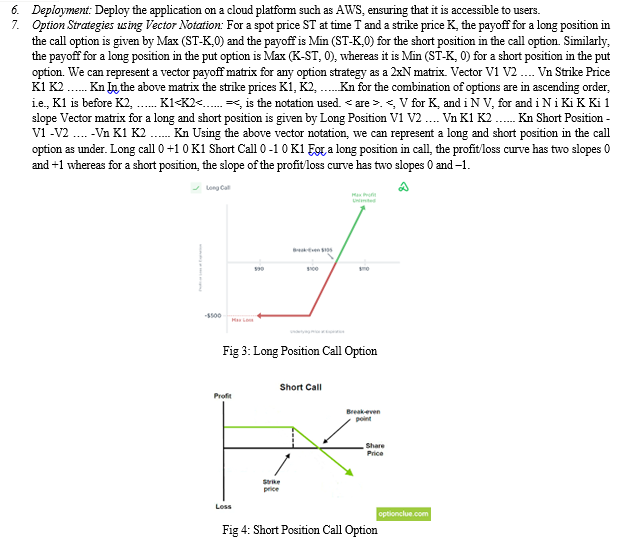

- Copyright

React Financial Analysis with Interactive Pay-Off Graph and Options Data

Authors: Amitha S K, Aayush Kumar Shah, Chitra C S, Dipika Kumari, Niveditha Sharma

DOI Link: https://doi.org/10.22214/ijraset.2024.59442

Certificate: View Certificate

Abstract

We propose a System which represents a web-based financial application designed for managing options trading strategies. Developed using React, it offers an intuitive user interface for strategy selection, parameter configuration, and visualization of profit and loss via payoff graphs. The application provides real-time market data, P&L grid views, and insights into option Greeks. It integrates with AWS services for backend processing, handles order placement and status monitoring, and efficiently manages external services and a database. This system architecture is structured for scalability and high-performance in options trading, serving as a comprehensive tool for traders and investors.

Introduction

I. INTRODUCTION

Stock?related information tends to be gradually reflected in stock prices. Generally, this information consists of pieces of unorganized raw fundamental data combined with noise. Stock analysts attempt to decode the fundamental data to predict the fair value of stock prices. Manela (2014), the efforts of data evaluation by analysts will gradually produce organized decisions that eliminate noisy information subsumed in stock prices. As such, the speed of data diffusion and the decoding of data are critical factors that impact stock price valuation (Fama, 1998). Institutional investors can decode the latest pieces of information to earn self?financial interest (Hendershott et al., 2015). In contrast, retail investors struggle to gain access to privileged financial information. Therefore, retail investors may observe information from multiple channels to produce their investment decisions. Gan et al. (2020) argue that social media are the dominant source of sentiments in information. Sources of information may come from channels, such as the stock market, the options market, sentiments from financial social media, and others. According to Pan and Poteshman (2006), retail investors can observe options trading volume as a signal in determining future stock price movements, since the options with deep leverage have significant predictive power on future stock returns. Prior research has documented the fact that retail traders trade badly, pay high spreads, and exercise their options sub-optimally.1 As to market quality, the impact of retail trading is yet to be fully understood. While uninformed retail trading may improve market quality by lowering (relative) adverse selection costs, herding and other behavioural biases may disrupt prices. In a particularly relevant recent paper, Eaton, Green, Roseman, and Wu (2022b) use disruptions in trading venues to explore the impact of retail trading on venue market quality. They conclude that the most inexperienced retail traders, who dominate the Robinhood platform and are more likely to herd, disrupt markets, while retail trading more generally leads to better quality. In particular, they show that disruptions in Robinhood trading, which lowers inexperienced trading, reduced volatility. We examine volatility induced by retail trading that arises not from their trading in the securities themselves, but from an increase in their trading of options on the securities. The COVID pandemic coincided with a dramatic rise in retail investor participation in options markets. In 2020 alone, retail investors accounted for more than $250 billion of total single-name option volume. The objective of this study is to provide timely, large-sample evidence on these considerations.

II. LITRETURE SURVEY

An In this paper it documents a rapid increase in retail trading in options in the United States. Facilitated by payment for order flow (PFOF) from wholesalers executing retail orders, retail trading recently reached over 60% of total market volume. Nearly 90% of PFOF comes from three wholesalers. Exploiting new flags in transaction-level data, we isolate wholesaler trades and build a novel measure of retail options trading. Our measure comoves with equity-based retail activity proxies and drops significantly during U.S. brokerage platform outages and trading restrictions. Retail investors prefer cheaper, weekly options with average bid-ask spread of 12.6%, and lose money on average [1].

Retail investors purchase options in a concentrated fashion before earnings announcements, particularly those with greater expected abnormal volatility. Comparing across asset markets, we also find retail investors disproportionately trade options over stocks as anticipated announcement volatility increases. In doing so, retail investors display a trio of wealth-depleting behaviours: they overpay for options relative to realized volatility, incur enormous bid-ask spreads, and sluggishly respond to announcements. These translate to retail losses of 5-to-9% on average, and 10-to-14% for high expected volatility announcements [3]. Using Robinhood’s introduction of options as a shock to retail trading, we confirm that option volume increased around this event and show that volatility similarly increased for: inter listed US securities, relative to their Canadian counterparts; optioned shares relative to optionless shares for firms with dual class shares; and more so for shares that would be become more attractive to retail traders as a result of the fee change (relatively high stock prices or low option prices). We provide further evidence suggesting the effect is permanent and that the underlying mechanism is related to market makers hedging their option exposure. Our results suggest that a shift in retail trading toward options drives [4]. First, we show that, for our focal firms, net trade options volume ratio from the options market is positively and significantly related to the bullish sentiment of posts on StockTwits. Second, we find that net trade options volume ratio and bullish posts are positively and significantly related to stock returns. Third, we show that higher agreement amongst the sentiment of posts on StockTwits and net trade options volume ratio for options that are deeply out?of?the?money (high leverage) both predict future stock returns for up to 20 days. This finding is consistent with the explanation that informed investors have an affinity to trade deeply levered options to maximize their returns at the lowest cost [5]. This study investigates as to how the Indian stock market is integrated with global markets of the US, the UK and Japan and major regional markets in Asia such as Singapore and Hong Kong.

The study uses the popular multivariate cointegration model to gauge the integration process. Empirical findings support that a single cointegration relation bounds these stock markets. Moreover, cointegration of the Indian stock market with the global and regional markets holds for stock prices measured in US dollar rather than local currency, attributable to the role of international portfolio investors and capital flows [6]. The existence of finance dial markets that trade instruments associated with the inputs or outputs of the underlying processes facilitates the use of these models. The energy industry has thus received a substantial amount of Attention within the real option and operations (management/research) communities. The extant work lacks a review of the operations literature on energy real options.

We present a synthesis of this literature considering review categories that pertain to the phenomena it studies and the tools it uses to conduct its analysis. Further, we outline potential research directions [7]. Leveraging different frequency prices as features and incorporating the Gate Recurrent Unit (GRU), its effectiveness in enhancing back testing performance and filtering trading strategies based on expected values. Empirical research employing Taiwan capitalization weighted Stock index (TAIEX) weekly options (TXOW) spanning January 2017 to December 2021 [8]. This driven to exceptionally tall sum development (,) in optin costs. Product Channel List (CCI) is one of the apparatuses of specialized investigation, which makes a difference in surveying energy and grant indicate almost future instability in costs. The display ponders points to follow noteworthy (at slightest twofold) rise in choice cost with least chance utilizing CCI. For this reason, verifiable information of NSE's Clever record was tried on stipulated rules of CCI demonstrating solid energy and appropriately making long position in comparing within The Cash choice contracts. The chance and return of utilizing this exchanging instrument, in Clever alternative was calculated utilizing Return, Most extreme Misfortune Zone, Normal Pick up to Normal Misfortune Proportion, Strike Rate (Victory rate) and its noteworthiness. [9]. Heavier trading in the options market also tends to make out-of-the-money call options more (less) expensive than the at-the-money counterparts over time (cross-sectionally). Because trading activities do not predict future equity returns, investor overconfidence, and not informed trading, seems to be a more plausible explanation for our finding [2].

III. AIM AND OBJECTIVES

The aim and Objectives of this paper are:

- To create engine for Financial Analysis with Interactive Pay-Off Graphs and Options Data.

- In spite of the fact that volume of choice exchanging, particularly in NSE'S Clever File contract, rise essentially over a period of time, it is considered as comparatively complicated due to the complexities include in alternative estimating.

- Instability in costs play exceptionally critical part in choice estimating. With offer assistance of energy markers of specialized examination, one can recognize point of the anticipated tall sum of instability in costs. This driven to exceptionally tall sum development in option costs. The hazard and return of utilizing this exchanging component in Clever alternative were calculated utilizing Return, Greatest Misfortune Zone,

IV. DESIGN AND IMPLEMENTATION

A. Proposed System

This paper proposes a web application made specifically for option trading strategy by the help of Pay-Off Graph and various strategy builder and even virtual strategy builder. This application will contain interfaces which will be user friendly and will contain strategy selection, parameter setup, and visualizing payoff graphs. With P&L grid view, real-time market data, and detailed option Greeks insights, it will provide high level experience to the users. With AWS backend services the management of order placement, monitoring of status update and database handling are done efficiently. Due to which it provides high performance with high scalability, which gains trust of trader and investors.

B. Modules

- Module 1: API Services

It Encapsulates API call functionalities using the Fetch API or Axios library. This module is responsible for managing endpoints and API key or token handling. API service also provides methods for interacting with backend services like checking order status, placing orders and fetching virtual orders.

2. Module 2: Virtual Trade

This module displays virtual trade data for users which fetches and display virtual orders, strategies, P&L, LTP, entry prices etc. virtual trade handles virtual order placement, status tracking and analysis. Virtual trade contains reusable UI components like button, tables, side navigation, loader, error widgets, etc which helps to maintain a consistent UI design across the application.

3. Module 3: Data Servies

Data Servies module help to manages data storage and retrieval using browser storage mechanisms like session Storage or local Storage. Data services stores and retrieves user preferences, virtual trade data, and other application-related data.

4. Module 4: Config

Things like API endpoints and server URLs, along with other necessary stuff like API keys, are all kept in this neat little spot for managing configurations that are used widely in the application. This centralized location is where you go to make sure all the configurations are in check, making everything work smoothly as a butter. It’s like the heart of the application, helping to keep everything on track and running smoothly.

5. Module 5: Proxy Config

The proxy configuration module is existed as a key component of the overall system architecture. Furthermore, proxy configuration gives a sturdy platform for easily managing backend API URLs. Without capability like this, different environments such as development; and production would confront major challenges. Grammatical inconsistencies also contribute to unique article as whole! You know, Proxy Configuration stores proxy configurations, but it also helps manage different environments like development; and production without changing your code. The role it plays in the system is still important to ensure API URLs function smoothly in different environments. Thus, keeping up to date the proxy configuration module is in some ways very important for system stability.

6. Module 6: Utility Function

It contains a bunch of helper functions and utilities that is used widely throughout the application, always ensuring smooth operations. Includes some functions for date/time formatting, data manipulation, encryption/decryption, etcetera. Despite some errors here and there, the utility function remains essential for streamlined application performance, most notably when dealing with crucial data handling tasks.

7. Module 7: Error Handling

Handles global error handling additionally to logging while simultaneously displaying user-friendly error messages for API failures or unexpected errors! The importance of effective error handling cannot be underestimated as it directly impacts the user experience and overall system performance. Remember to continuously monitor and address potential issues that arise to ensure a smooth user experience throughout the application usage. Furthermore, implementing a robust error handling strategy is crucial to prevent system breakdowns and maintain user satisfaction.

8. Module 8: Strategy Builder

- Component Integration: Integrates a variety of React components from libraries like react-bootstrap, react-icons, and customized components like Loader to build a user interface for strategy creation and management.

- State Management: Utilizes React hooks such as useState, useEffect, and custom hooks like using Local Storage to manage components state and storing important data in local storage for persistency across sessions.

- API Interaction: Interacts with the Api Services class to make API calls for tasks such as placing virtual orders, fetching option chain data, and managing trade-related info.

- Dynamic User Interface: Dynamically presents a table with interactive elements like checkboxes, dropdowns, and input fields for adjusting strategy parameters like expiration date, strike price, option type (CE/PE), and lot size.

- Virtual Trading Features: Implements features for virtual trading, including creating virtual orders, viewing virtual portfolios, and managing virtual trades, providing users with a risk-free environment for strategy testing.

- Error Handling and Navigation: Implements error alerts for scenarios like no liquidity price availability for selected dates and provides navigation options for seamless movement between different sections like virtual trading and order placement!

9. Module 9: Pay-Off Graph

- Component Imports: Imports React as well as essential slow hooks (useState, useEffect) from React. Also, imports various sublime components from external libraries such as ChartJS, react-chartjs-2, react-bootstrap, and some custom service files.

- Chart Setup: Sets up ChartJS configurations such as scales; elements; tooltips, etc., utilizing ChartJS. Register; Initiates. Configures data and options for rendering the Line chart using the react-chartjs-2 library.

- State Management: Uses React hooks (useState) to manage the component state variables like graphList, xg, yg, profit, grid Data, etc. Expertly handles the state of expiry date, market prices, and other relevant data for the graph and calculations.

- Data Processing and Calculation: Processes data received from props and transforms it into the required format for rendering the payoff graph. Expertly utilizes helper functions and external services (Common Services, Data Services) to calculate and update graph data, profits, and related information based on user interactions.

- Effect Hooks: Utilizes useEffect hooks superbly to perform side effects like data fetching, calculations, and state updates based on dependencies like graphList, expiry; etc. Handles cleanup and un suspicion logic for preventing memory leaks.

- Rendering: Renders a dynamic Line chart using react-chartjs-2 based on the processed data and available options. Also, includes tabs for displaying P&L Grid, Option Greeks, and other relevant data based on vibrant user selections and available data.

- Component Structure: Divides the component logic into logical sections such as data processing functions (fn_PaintGraph), state management, effect hooks; rendering components, and riveting UI elements.

V. METHODOLOGY

Methodology, is the study of research methods. However, the term can also refer to the methods themselves or to the philosophical discussion of associated background assumptions. Implement features for displaying market data, placing orders, and managing virtual orders. A method is a structured procedure for bringing about a certain goal. Implement features for displaying market data, placing orders, and managing virtual orders. It involves the development of a financial application using a frontend-backend architecture, with a focus on real-time data integration.

- Data Collection: Understand the requirements of the financial application, such as displaying real-time market data, placing orders, and managing virtual orders.

- Data Architecture: Choose a modular architecture that separates the frontend, API layer, backend services, and database. Use serverless technology, such as AWS Lambda, for backend services to enable scalability and cost-efficiency.

- Frontend Development: Create the user interface (UI) for the financial application, ensuring it provides an intuitive user experience. Implement features for displaying market data, placing orders, and managing virtual orders.

- API Layer Development: Develop the API layer, which serves as an intermediary between the frontend and backend services. Implement endpoints for various functionalities, including retrieving market data and placing orders. Implement security measures, such as authentication and authorization.

- Backend Services Development: Create AWS Lambda functions to handle backend processes. Develop functions for placing both real and virtual orders, retrieving real-time market data, and managing order statuses. Implement integration with external services to obtain live market data.

VI. ACKNOWLEDGMENT

The fulfillment and elation that go with the fruitful completion of any assignment would be inadequate without the mention of the people who made it conceivable and whose consistent support and direction delegated my Endeavor’s with victory.

We consider proud to be part of Impact College of Engineering and Applied Sciences family, the institution which stood by our way in Endeavor.

We wish to thank our guide Mrs. Amitha S K, Assistant Professor, Dept of Computer Science and Engineering of Impact College of Engineering and applied sciences for guiding and correcting various documents of us with attention and care. She has taken lot of effort to go through the document and make necessary corrections as and when needed.

We are grateful to Dr. Dhananjaya V, Professor and HOD, Department of Computer Science and Engineering of Impact College of Engineering and Applied Sciences who is source of inspiration and of invaluable help in channelizing our efforts in right direction.

We express our deep and sincere thanks to our Management and Principal, Dr. Jalumedi Babu for their continuous support.

We would like to thank the faculty members and supporting staff of the Dept of Computer Science and Engineering, ICEAS for providing all the support for completing the Project.

Finally, we are grateful to our parents and friends for their unconditional support and help during the course of our project.

Conclusion

This Framework offers a user-friendly front-end interface created in Respond, highlighting alternative methodology choices, parameter arrangements, and visualizations of benefit and misfortune through payoff charts. Clients can get real-time showcase information, see P&L subtle elements in a framework, and pick up bits of knowledge into alternative Greeks like Delta, Gamma, Theta, and Vega. The framework coordinates with AWS administrations for effective backend handling and executes security measures like session tokens. It empowers clients to put both genuine and virtual orders and screens arrange status while proficiently overseeing outside administrations. This design is planned for adaptability and tall execution within the setting of choice exchanging.

References

[1] Svetlana Bryzgalova, Anna, and Taisiya, Retail trading in options and the rise of the big three wholesalers, December 2023 [2] Han-Sheng Chen, , Sanjiv Sabherwal ,The Effects of Option Trading Behavior on Option Prices, 1Department of Accounting, Finance, and Economics, Lipscomb University, 1University Park Dr, Nashville, TN 37204, USA, 2Department of Real Estate, University of Texas at Arlington, 701 S. West Street, Arlington, TX 76019, USA, July 2023 [3] Tim de Silva, Eric C. So, Kevin Smith, Losing is Optional: Retail Option Trading and Expected Announcement Volatility, 1Massachusetts Institute of Technology Sloan School of Management, 2Massachusetts Institute of Technology Sloan School of Management, 3Stanford University Graduate School of Business, June 8, 2023 [4] Marc Lipson, Davide Tomio, and Jiang Zhang, A Real Cost of Free Trades: Retail Option Trading Increases the Volatility of Underlying Securities March 9, 2023 [5] ZinYau Heng1, Henry Leungb, The role of option-based information on StockTwits, options trading volume, and stock returns, of data mining in agriculture, 1Department of Economics, The University of Queensland, St Lucia, Queensland, Australia Business School, 2The University of Sydney, Darlington, New South Wales, Australia, 8 January 2023 [6] Janak Raj and Sarat Chandra Dhal, Integration of India\'s stock market with global and major regional markets, May 2022 [7] Selvaprabu Nadarajaha, Nicola Secomandi, A review of the operations literature on real options in energy, 2022 [8] Min-Kuan Chena , Dong-Yuh Yangb , Ming-Hua Hsiehc , Yen-Lin Chend and Mu-En Wu, Forecasting Stock Returns with LSTM for Options Trading Strategies, 2022 [9] Pinkal Shaha, Sumandeep Vidyapeeth, An Empirical Study on Options Trading Strategy for NSE’s Nifty Options in India, 1, 2 Professor, Department of Management, Vadodara, Gujarat.

Copyright

Copyright © 2024 Amitha S K, Aayush Kumar Shah, Chitra C S, Dipika Kumari, Niveditha Sharma. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET59442

Publish Date : 2024-03-26

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online