Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Reshaping FinTech with Blockchain Technologies

Authors: Jaydeep Tase

DOI Link: https://doi.org/10.22214/ijraset.2024.63843

Certificate: View Certificate

Abstract

This comprehensive article explores the transformative potential of blockchain technology in the FinTech sector, addressing current challenges and opportunities. It examines the evolving landscape of FinTech, discusses supply chain inefficiencies, administrative overheads, and error-prone systems, and presents blockchain as a solution to these issues. The article delves into the benefits of permissioned blockchains, the importance of scalability and interoperability, and the role of blockchain in building trust-based models. It also covers ROI predictions, implementation strategies, regulatory considerations, and future trends. Through case studies and best practices, the article provides insights into successful blockchain adoption in FinTech, offering a roadmap for industry stakeholders to leverage this technology for enhanced efficiency, security, and innovation in financial services.

Introduction

I. INTRODUCTION

Blockchain technology has emerged as a transformative force in the financial technology (FinTech) sector, offering unprecedented security, transparency, and efficiency. Blockchain is a distributed ledger technology that enables secure, transparent, and immutable record-keeping. It is particularly well-suited for financial applications where trust, accuracy, and security are paramount [1]. The potential of blockchain in FinTech extends far beyond its initial application in cryptocurrencies, with the capacity to revolutionize various aspects of the financial services industry, from streamlining cross-border payments to transforming identity verification processes. Despite the significant advancements made in the FinTech sector in recent years, numerous challenges still impede its full potential. These include data security, transaction speed, cost efficiency, and regulatory compliance issues. Blockchain technology offers innovative solutions to many challenges, presenting opportunities to reshape the industry [2].

This article will explore how blockchain can address current FinTech challenges and drive the next wave of innovation in financial services. We will examine the current state of FinTech, identify key pain points, and discuss how blockchain-based solutions can overcome these obstacles. By leveraging the inherent characteristics of blockchain technology, such as decentralization, immutability, and transparency, the FinTech industry can unlock new levels of efficiency, security, and trust in financial transactions.

As blockchain technology evolves and matures, industry leaders, stakeholders, and regulators must understand its implications and potential applications. This understanding will be essential in navigating the complex landscape of blockchain implementation in FinTech and harnessing its full potential to create more inclusive, efficient, and secure financial systems for the future.

II. CURRENT FINTECH LANDSCAPE: CHALLENGES AND OPPORTUNITIES

The FinTech market has experienced remarkable growth in recent years, with the global market size valued at USD 112.5 billion in 2021 and projected to grow at a compound annual growth rate (CAGR) of 19.8% from 2022 to 2030 [3]. This rapid expansion is driven by the increasing adoption of digital payments, rising investment in technology-based solutions, and growing demand for alternative lending platforms. The FinTech landscape encompasses various innovative solutions, including digital payments and mobile wallets, peer-to-peer lending platforms, robo-advisors and algorithmic trading, insurtech, regtech (regulatory technology), and blockchain and cryptocurrency applications.

While these solutions have significantly improved various aspects of financial services, the FinTech industry still faces several significant challenges. Data security and privacy concerns remain paramount as the industry handles sensitive financial information. Regulatory compliance and uncertainty pose ongoing challenges, particularly as regulations struggle to keep pace with technological advancements. Integration with legacy financial systems presents technical hurdles, while scalability issues can impede growth. Additionally, building customer trust and adoption and ensuring interoperability between different FinTech platforms are crucial for long-term success [4].

Addressing these pain points is essential for the continued growth and maturation of the FinTech sector. Blockchain technology offers potential solutions to many of these challenges, presenting opportunities to enhance security, transparency, and efficiency across various FinTech applications. By leveraging blockchain's inherent characteristics, such as decentralization and immutability, FinTech companies can mitigate data security risks, streamline regulatory compliance processes, and improve platform interoperability.

As the FinTech industry continues to evolve, stakeholders must stay abreast of emerging trends and technologies. Blockchain, in particular, holds promise for addressing many of the current challenges faced by FinTech companies. In subsequent sections, we will explore how blockchain technology can be applied to various aspects of FinTech, potentially revolutionizing how financial services are delivered and consumed in the digital age.

|

Year |

Market Size (USD Billion) |

Key Challenges |

|

2021 |

112.5 |

Data Security and Privacy |

|

2022 |

134.8 |

Regulatory Compliance and Uncertainty |

|

2023 |

161.5 |

Integration with Legacy Systems |

|

2024 |

193.5 |

Scalability Issues |

|

2025 |

231.8 |

Building Customer Trust and Adoption |

|

2026 |

277.7 |

Interoperability Between Platforms |

|

2027 |

332.7 |

Data Security and Privacy |

|

2028 |

398.6 |

Regulatory Compliance and Uncertainty |

|

2029 |

477.5 |

Integration with Legacy Systems |

|

2030 |

572.0 |

Scalability Issues |

Table 1: FinTech Market Growth and Challenges [3, 4]

III. SUPPLY CHAIN ISSUES IN FINTECH

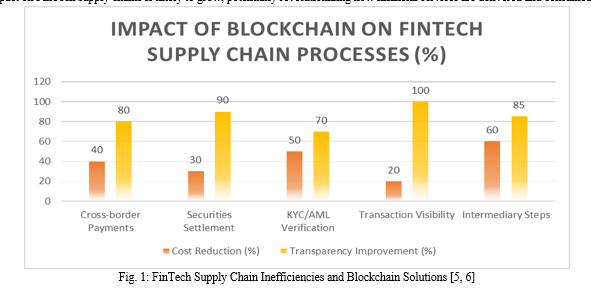

The financial services supply chain, encompassing the flow of funds, information, and services from providers to end-users, is often plagued by inefficiencies that result in higher costs, increased risk, and reduced service quality. These inefficiencies include multiple intermediaries adding time and cost to transactions, lack of transparency in cross-border payments, slow settlement times for securities transactions, and inefficient Know Your Customer (KYC) and Anti-Money Laundering (AML) processes [5].

These supply chain issues directly impact service delivery and customer experience in FinTech. Delayed transactions and settlements, higher fees due to multiple intermediaries, lack of real-time visibility into transaction status, increased risk of errors and fraud, and poor customer experience due to lengthy verification processes are common challenges. These factors can lead to customer dissatisfaction and limit the adoption of FinTech solutions, particularly in areas where traditional financial services are deeply entrenched.

Blockchain technology offers several potential solutions to address these supply chain inefficiencies in FinTech. By enabling peer-to-peer transactions, blockchain can reduce or eliminate the need for intermediaries, lowering costs and speeding up transactions. Blockchain ledgers' immutable and transparent nature can provide real-time visibility into transaction status and history, enhancing transparency throughout the supply chain. Smart contracts, automated and self-executing, can streamline processes such as settlements and compliance checks.

Additionally, blockchain-based identity solutions can enhance the efficiency and effectiveness of KYC and AML processes [6].

Implementing blockchain technology in FinTech supply chains has the potential to create more efficient, transparent, and cost-effective systems. For example, blockchain can reduce settlement times in cross-border payments from days to minutes, significantly lowering costs and improving transparency. In securities trading, blockchain-based systems can enable near-instantaneous settlement, reducing counterparty risk and freeing up capital. For KYC and AML processes, blockchain can provide a secure, shared repository of verified customer information, streamlining onboarding processes and reducing redundant checks.

Blockchain technology can help FinTech companies improve service delivery and enhance customer experience by addressing these supply chain inefficiencies. This, in turn, can drive greater adoption of FinTech solutions and foster innovation in the financial services sector. As the technology continues to mature and overcome challenges such as scalability and regulatory compliance, its impact on FinTech supply chains is likely to grow, potentially revolutionizing how financial services are delivered and consumed.

IV. ADMINISTRATIVE OVERHEAD AND PAPERWORK

The financial services industry, including the FinTech sector, has long been burdened by extensive administrative processes and paperwork. These processes typically involve manual data entry and verification, multiple layers of approval and sign-offs, physical document storage and retrieval, repetitive compliance checks, and data reconciliation across different systems. These processes are time-consuming and prone to errors and inefficiencies, leading to significant operational challenges [7].

The administrative burden in FinTech translates to substantial costs across various dimensions. Labor costs are significant, with a substantial portion of workforce time dedicated to administrative tasks. Infrastructure costs for physical storage and document management systems require ongoing investment. There are also considerable opportunity costs, as time spent on paperwork could be redirected to more value-adding activities. Compliance costs are particularly notable, with financial institutions spending up to 4% of their total revenue on compliance-related activities alone, according to a report by KPMG.

Traditional FinTech operations often inherit inefficiencies from the broader financial services sector. These include duplication of efforts across departments, slow response times to customer queries due to information silos, increased risk of human error in data entry and processing, difficulty in maintaining data consistency across systems, and limited ability to adapt to regulatory changes quickly. These inefficiencies not only increase operational costs but also hinder the ability of FinTech companies to deliver innovative, customer-centric solutions [8].

The impact of these administrative inefficiencies extends beyond direct costs. They can lead to slower time-to-market for new products and services, reduced agility in responding to market changes, and increased regulatory risks due to potential compliance errors. Moreover, these inefficiencies can negatively impact customer experience, potentially leading to lower customer satisfaction and retention rates.

To address these challenges, many FinTech companies are turning to technological solutions such as robotic process automation (RPA), artificial intelligence (AI), and blockchain. These technologies have the potential to automate many administrative tasks, reduce errors, improve data consistency, and enhance compliance processes. For example, blockchain technology can create immutable, transparent records that can streamline audit processes and reduce the need for manual reconciliation.

As the FinTech industry continues to evolve, addressing these administrative inefficiencies will be crucial for companies looking to maintain a competitive edge. By leveraging innovative technologies and rethinking traditional processes, FinTech firms can reduce costs, improve operational efficiency, and free up resources to focus on core business activities and customer-centric innovation.

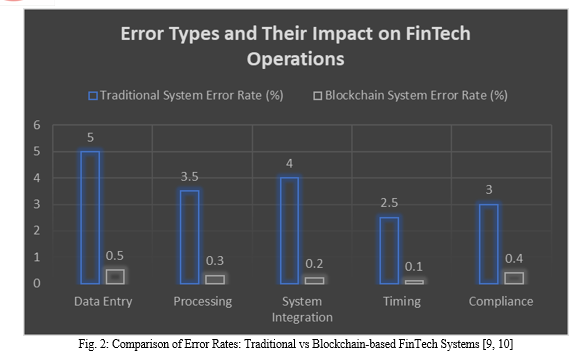

V. ERROR PRONENESS IN CURRENT SYSTEMS

Current FinTech systems are susceptible to errors that can occur at different stages of financial operations, from customer onboarding to transaction processing and reporting. These errors include data entry mistakes due to manual input, processing errors resulting from complex calculations or data transformations, system integration errors arising from inconsistencies in data transfer between different systems, timing errors caused by delays in updating information, and compliance errors stemming from misinterpretation or oversight of regulatory requirements [9]. The impact of these errors in FinTech operations extends far beyond immediate financial losses. Direct financial costs can include monetary losses, fines, and penalties. Operational costs are incurred through time and resources spent on error detection and correction. Reputational damage can erode customer trust and harm brand reputation. Frequent errors may attract increased regulatory scrutiny and potential sanctions. Additionally, there are opportunity costs as resources allocated to error management could be used for innovation and growth. The significance of these costs is underscored by an IBM study, which estimated that poor data quality costs the US economy around $3.1 trillion annually, with the financial services sector being one of the most affected industries. The prevalence and cost of errors in current FinTech systems highlight the urgent need for more robust, error-resistant solutions. Key requirements for such systems include automated data validation and verification, real-time error detection and correction mechanisms, end-to-end process visibility and traceability, standardized data formats and protocols, and intelligent anomaly detection using machine learning algorithms [10].

With its inherent immutability and transparency, blockchain technology presents a promising solution to many of these requirements. The decentralized nature of blockchain can help reduce single points of failure, while its immutable ledger can provide a reliable audit trail, making it easier to detect and trace errors. Smart contracts can automate many processes, reducing the risk of human error. Moreover, the transparency of blockchain systems can enhance regulatory compliance and reporting accuracy.

Implementing blockchain and other advanced technologies in FinTech can significantly reduce error rates and associated costs. For example, automated data validation can catch and prevent data entry errors before they propagate through the system. Real-time error detection and correction mechanisms can minimize the impact of any errors that do occur. Standardized data formats and protocols can reduce integration errors and improve system interoperability.

As FinTech companies strive to build more reliable and efficient systems, the focus on error reduction and prevention will likely intensify. By leveraging technologies like blockchain, artificial intelligence, and machine learning, the industry can move towards more robust, error-resistant systems that reduce costs and risks and enhance customer trust and satisfaction. This shift towards more reliable systems will be crucial for the continued growth and maturation of the FinTech sector in an increasingly competitive and regulated environment.

VI. THE CASE FOR PERMISSIONED BLOCKCHAIN IN FINTECH

Permissioned blockchain technology has emerged as a promising solution for FinTech applications, balancing the benefits of distributed ledger technology and the control required in regulated financial environments. Unlike public blockchains such as Bitcoin, permissioned blockchains are closed systems where only verified participants can access and interact with the network. This controlled access model provides several key features, including faster transaction processing through optimized consensus mechanisms, greater privacy as transaction details can be kept confidential between relevant parties, and improved compliance capabilities through more straightforward implementation of regulatory controls and auditing processes [11].

For FinTech applications, a permissioned blockchain offers numerous advantages. Enhanced security is achieved through restricted access, significantly reducing the risk of malicious attacks. Regulatory compliance is more straightforward to implement and enforce, addressing a critical concern in the financial sector. Scalability is improved, as these systems can typically handle higher transaction volumes compared to public blockchains.

Cost efficiency is realized through lower computational requirements for consensus mechanisms. Additionally, the customizability of permissioned blockchains allows network rules and features to be tailored to specific use cases, providing flexibility for diverse FinTech applications.

Permissioned blockchains represent a middle ground between fully centralized systems and public blockchains, striking a particularly suitable balance for FinTech operations. This approach implements partial decentralization, where multiple parties validate transactions, reducing single points of failure while maintaining centralized control over network participation. Shared governance allows participants to collectively decide network rules and upgrades, fostering a collaborative ecosystem. Balanced transparency ensures that information is shared on a need-to-know basis within the network, addressing privacy concerns while still providing the benefits of a distributed ledger [12].

This balanced approach allows FinTech companies to leverage the benefits of blockchain technology while maintaining necessary control and compliance measures. For instance, in cross-border payments, permissioned blockchains can provide the speed and transparency of blockchain technology while ensuring that all participants are known and vetted, addressing regulatory requirements. In trade finance, permissioned blockchains can streamline processes and reduce fraud while maintaining the confidentiality of sensitive business information.

As the FinTech industry continues to evolve, permissioned blockchains will likely play an increasingly important role. Their ability to combine the benefits of blockchain technology with the control and compliance features required in financial services makes them a compelling solution for many FinTech applications. However, challenges remain, including standardization across different permissioned blockchain networks and ensuring interoperability with other financial systems. As these challenges are addressed, permissioned blockchains have the potential to significantly transform various aspects of the FinTech landscape, from payments and lending to asset management and regulatory compliance.

|

Feature |

Centralized Systems |

Public Blockchain |

Permissioned Blockchain |

|

Transaction Speed (TPS) |

1000 |

7 |

3000 |

|

Privacy (1-10 scale) |

8 |

3 |

9 |

|

Regulatory Compliance |

High |

Low |

Very High |

|

Scalability (1-10 scale) |

6 |

4 |

8 |

|

Cost Efficiency (%) |

60 |

40 |

80 |

|

Customizability (%) |

70 |

30 |

90 |

|

Decentralization (%) |

0 |

100 |

50 |

|

Security (1-10 scale) |

7 |

8 |

9 |

Table 2: Comparison of Blockchain Types for FinTech Applications [11, 12]

VII. SCALABILITY: A KEY FOCUS FOR BLOCKCHAIN IN FINTECH

Scalability is a critical factor for the widespread adoption of blockchain technology in FinTech applications. The importance of scalability stems from the high transaction volumes inherent in financial systems, which often process millions of transactions daily. Additionally, many financial operations require near-instantaneous execution, necessitating real-time processing capabilities. As transaction volumes increase, cost-effectiveness becomes crucial, with the expectation that the cost per transaction should decrease. Furthermore, scalable systems are essential for future-proofing, ensuring the ability to handle growing user bases and expanding services [13]. Traditional blockchain networks face several scalability challenges that must be overcome for effective implementation in FinTech. Public blockchains like Bitcoin suffer from throughput limitations, processing only a limited number of transactions per second. Latency is another significant issue, particularly in proof-of-work systems, where confirmation times can be slow. As the blockchain grows, data storage requirements become increasingly demanding, posing challenges for node operators. Network congestion during high usage can lead to increased fees and slower transaction times, potentially impacting user experience and adoption. Several innovative approaches are being developed and implemented to address these scalability challenges. Layer-2 solutions, such as the Lightning Network, offer off-chain processing techniques for faster and cheaper transactions. Sharding, which involves dividing the network into smaller, more manageable pieces, can significantly increase overall capacity. Consensus mechanism optimization explores alternatives to proof-of-work, such as proof-of-stake or delegated proof-of-stake, to improve efficiency and throughput. Sidechains, which are separate blockchains running parallel to the main chain for specific use cases, can offload some of the transaction volume. Optimized data storage techniques, like pruning, help reduce the blockchain's size and manage growing storage requirements [14]. By focusing on these scalability solutions, FinTech companies can build blockchain systems capable of handling the demands of global financial operations. For instance, implementing sharding in Ethereum 2.0 aims to increase the network's transaction processing capacity dramatically. The Lightning Network, designed initially for Bitcoin, has shown promise in enabling fast, low-cost micropayments, which could be particularly valuable for FinTech applications like mobile banking in developing countries. As these scalability solutions evolve and mature, they pave the way for more robust and efficient blockchain implementations in FinTech. This progress is crucial for addressing the industry's high-volume, real-time, and cost-effective transaction processing needs. The successful implementation of these scalable blockchain solutions could revolutionize various aspects of financial services, from payments and remittances to asset trading and settlement systems.

VIII. BLOCKCHAIN INTEROPERABILITY: PREPARING FOR FUTURE GROWTH

Blockchain interoperability, a concept crucial for the future growth of blockchain technology in FinTech, refers to the ability of different blockchain networks to exchange and leverage data between one another seamlessly. This capability enables cross-chain transactions, facilitates data sharing between various blockchain-based systems, and allows smart contract interactions across multiple chains. As the blockchain ecosystem expands and diversifies, interoperability becomes essential for creating a cohesive and efficient financial technology landscape [15].

The role of interoperability in FinTech expansion cannot be overstated. It allows different FinTech solutions to work together cohesively, creating an integrated ecosystem offering users more comprehensive and efficient services. Interoperability enhances liquidity by enabling the seamless movement of assets across various blockchain networks, which is particularly important for financial applications. It also improves efficiency by reducing the need for intermediaries in cross-chain operations, lowering costs, and increasing transaction speeds. Furthermore, interoperability facilitates innovation by encouraging the development of more complex, interconnected financial products that can leverage the strengths of multiple blockchain networks.

Several projects and standards are being developed to address the challenge of blockchain interoperability. Atomic swaps allow for direct exchanges between cryptocurrencies without intermediaries, enhancing security and reducing costs. Cross-chain communication protocols, such as those developed by projects like Polkadot and Cosmos, aim to create ecosystems of interconnected blockchains, allowing for seamless interaction between different networks. Wrapped tokens, such as Wrapped Bitcoin on Ethereum, provide a way to represent assets from one blockchain on another, increasing interoperability between different asset types and networks [16].

The Interledger Protocol (ILP) is another significant development in this space, offering a standardized way to route payments across different ledgers. This protocol can potentially create a truly interconnected financial system where value can flow freely between different blockchain networks and traditional financial systems. Additionally, the ISO 20022 standard for financial messaging is being explored as a potential facilitator for blockchain interoperability, providing a common language for financial transactions that could bridge the gap between different blockchain networks and traditional financial systems.

As these interoperability solutions mature, they will be crucial in creating a more interconnected and efficient blockchain-based financial ecosystem. This increased interoperability could lead to the development of new financial products and services that leverage the strengths of multiple blockchain networks, potentially revolutionizing areas such as cross-border payments, asset trading, and decentralized finance (DeFi).

However, challenges remain in achieving true blockchain interoperability, including technical complexities, regulatory considerations, and the need for standardization across different blockchain protocols. As the FinTech industry continues to evolve, addressing these challenges and advancing interoperability solutions will be crucial for realizing the full potential of blockchain technology in financial services.

IX. BUILDING TRUST-BASED MODELS WITH BLOCKCHAIN

Blockchain technology has emerged as a powerful tool for enhancing trust in financial transactions, addressing many trust issues in traditional financial systems. The inherent features of blockchain, including immutability, transparency, decentralization, and cryptographic security, provide a robust foundation for building trust-based models in FinTech. Once recorded on a blockchain, transactions cannot be altered or deleted, ensuring the integrity of financial records. The transparency of the shared ledger allows all network participants to view and verify transactions, promoting accountability. Decentralization eliminates single points of failure and reduces the risk of manipulation by any one entity. Advanced encryption techniques secure transactions, protecting sensitive financial data [17].

Several FinTech companies are leveraging these trust-enhancing features of blockchain to build innovative trust-based models. In supply chain finance, platforms like we. Trade utilizes blockchain to provide unprecedented transparency in trade finance transactions, allowing parties to track the flow of goods and funds in real-time. Digital identity verification projects, such as Civic, use blockchain to create secure, self-sovereign identity systems, giving individuals greater control over their data while providing financial institutions with reliable identity verification methods. In decentralized lending, platforms like Aave enable peer-to-peer lending without traditional intermediaries, leveraging smart contracts to automate and secure lending processes. Insurtech companies are also adopting blockchain technology, using smart contracts to bring transparency and efficiency to claims processing, reducing fraud and improving customer satisfaction.

The potential impact of blockchain-based trust models on customer relationships and market growth in FinTech is significant. Enhanced customer confidence, resulting from increased transparency and security, can lead to greater trust in financial services, potentially increasing customer loyalty and adopting FinTech solutions. The immutability and traceability of blockchain records can significantly reduce fraud, protecting customers and financial institutions. Streamlined processes and faster transactions, enabled by blockchain technology, can improve the overall customer experience, leading to increased satisfaction and retention [18].

Furthermore, trust-based models built on blockchain have the potential to open up new market opportunities, particularly in enabling financial inclusion for underserved populations. By providing a secure and transparent financial infrastructure, blockchain can help extend financial services to individuals and businesses excluded from traditional banking systems. This could lead to significant market growth in emerging economies and underserved sectors.

The increased trust facilitated by blockchain can also foster collaborative ecosystems within the FinTech industry. As trust barriers are reduced, partnerships and collaborations between different FinTech companies and between FinTech firms and traditional financial institutions become more feasible. This could lead to the developing more comprehensive and innovative financial solutions, further driving market growth and innovation in the sector.

By building trust-based models with blockchain, FinTech companies have the potential to revolutionize customer relationships, enhance market efficiency, and drive significant growth in the financial services sector. As these models continue to evolve and mature, they will likely play a crucial role in shaping the future of finance, creating a more transparent, secure, and inclusive financial ecosystem.

X. ROI PREDICTIONS AND ECONOMIC IMPACT

Projecting the Return on Investment (ROI) for blockchain implementation in FinTech requires a comprehensive analysis of various factors. These include initial implementation costs such as technology infrastructure, integration, staff training, and ongoing operational costs like maintenance, upgrades, and energy consumption. However, these costs are often offset by significant savings from reduced intermediaries, faster transactions, and improved efficiency. Additionally, blockchain implementation can generate revenue through new products, services, and market opportunities [19].

While exact ROI figures vary depending on specific use cases and implementations, several studies suggest substantial potential returns. Accenture estimates blockchain could help banks save up to $12 billion annually by 2025. Similarly, a report by Santander InnoVentures predicts that blockchain technology could reduce banks' infrastructure costs by up to $20 billion a year by 2022. These projections underscore the significant economic potential of blockchain technology in the financial sector.

Blockchain technology offers cost-saving opportunities across various FinTech sectors. In the payments sector, blockchain can significantly reduce cross-border payment transaction fees and processing times. For securities trading, blockchain can lower settlement times and reduce the need for reconciliation. In compliance, blockchain enables automated regulatory reporting and can reduce costs associated with Know Your Customer (KYC) and Anti-Money Laundering (AML) processes. The insurance sector can benefit from streamlined claims processing and reduced fraud, while the lending sector can see lower operational costs for peer-to-peer lending platforms. Beyond immediate cost savings, the long-term economic benefits of blockchain adoption in FinTech are far-reaching. Blockchain can increase financial inclusion by enabling unbanked populations to access financial services. This could lead to significant economic growth in developing regions. Enhanced market efficiency is another long-term benefit, as faster and more transparent transactions can lead to more efficient markets overall [20].

Job creation is another significant economic impact of blockchain adoption. As the technology becomes more widespread, new roles will emerge in blockchain development, implementation, and management. This could lead to a new wave of high-skilled jobs in the financial sector.

Blockchain can also spur innovation by enabling the development of new financial products and services. This innovation boost could increase competitiveness in the financial sector and drive economic growth. Moreover, the decentralized nature of blockchain and its improved transparency can potentially reduce systemic risk, enhancing overall financial system stability.

XI. IMPLEMENTATION ROADMAP

Implementing blockchain technology in FinTech requires a structured approach to ensure successful integration and maximize the benefits of this transformative technology. A step-by-step guide to blockchain integration typically begins with a thorough assessment and planning phase. This involves identifying specific use cases and pain points within the organization, evaluating different blockchain platforms and solutions, and developing a detailed implementation plan. This initial phase is crucial for establishing a successful blockchain implementation [21].

Organizations should develop a proof of concept (PoC) following the planning phase. This involves creating a small-scale prototype of the blockchain solution and testing it in a controlled environment. The PoC phase allows organizations to gather valuable feedback and refine the concept before committing to a larger-scale implementation. Once the PoC is successful, the next step is to launch a pilot project. This involves implementing the solution on a larger scale but with a limited scope, integrating it with existing systems where necessary, and collecting performance and user feedback data.

After successfully completing the pilot project, organizations can move towards scaling and full implementation. This phase involves gradually expanding the solution across the organization, providing comprehensive training for staff and end-users, and continuously monitoring and optimizing performance. The final phase of the implementation roadmap focuses on maintenance and upgrades, ensuring the blockchain solution remains up-to-date, secure, and aligned with the latest developments in blockchain technology.

Throughout the implementation process, organizations must anticipate and mitigate various challenges. Common challenges include resistance to change, integration with legacy systems, regulatory uncertainty, scalability issues, and security concerns. To address these challenges, organizations should implement comprehensive change management and education programs, develop robust APIs and middleware solutions, engage with regulators early and maintain open communication, choose blockchain solutions designed for enterprise-level performance, and implement rigorous security protocols [22].

The adoption timeline for blockchain implementation in FinTech can vary depending on the project's complexity and the organization's size. However, a typical timeline might span 18-24 months, with the first three months dedicated to assessment and planning, the next three months for proof of concept development and testing, and six months for pilot project implementation and evaluation. The subsequent year would focus on gradual scaling and full implementation, ongoing maintenance, upgrades, and continuous improvement.

Key milestones in the implementation process include the successful completion of the proof of concept, the pilot project launch, the first real-world transaction processed on the blockchain, full integration with existing systems, and the achievement of target performance metrics such as improved transaction speed and cost savings. These milestones are important checkpoints in the implementation process, allowing organizations to assess progress and make necessary adjustments.

By following this structured implementation roadmap and effectively addressing potential challenges, FinTech organizations can integrate blockchain technology into their operations, paving the way for increased efficiency, enhanced security, and innovative financial products and services.

XII. CASE STUDIES

The successful implementation of blockchain technology in FinTech has already yielded significant results across various use cases. One prominent example is Ripple's cross-border payments solution, revolutionizing international money transfers. By leveraging blockchain technology, Ripple has onboarded over 300 financial institutions and significantly reduced transaction times and costs. This implementation demonstrates the potential of blockchain to address long-standing inefficiencies in the global financial system [23].

Another noteworthy case study is R3's Corda platform for trade finance. This blockchain-based solution has streamlined trade finance processes, reducing transaction times from days to hours and increasing transparency in supply chain finance. Corda's success highlights the transformative potential of blockchain in complex, multi-party financial transactions.

JPMorgan's Quorum for Interbank Information Network provides another compelling example of blockchain's impact in FinTech. This initiative has enhanced information sharing among banks, with over 400 banks joining the network. The result has been improved efficiency in resolving cross-border payment issues, showcasing how blockchain can foster collaboration and streamline operations in the banking sector.

Early adopters of blockchain technology in FinTech have provided valuable lessons for future implementations. These include starting with a clear use case and value proposition, prioritizing interoperability and scalability from the outset, and engaging with regulators early and often. Additionally, investing in education and change management has proven crucial for successful adoption, as has being prepared for a longer-than-expected implementation timeline.

Based on these experiences, several best practices for blockchain integration in FinTech have emerged. Companies should choose the right blockchain platform for their needs, ensuring it aligns with their use case and scalability requirements. Robust security measures are paramount, given the sensitive nature of financial data. User experience and interface design should be a focus to ensure adoption and ease of use [24].

Developing a comprehensive data governance strategy is essential for managing the vast amounts of data generated and stored on the blockchain. Continuous performance monitoring and optimization are necessary to maintain efficiency and address any issues. Finally, fostering a culture of innovation and adaptability within the organization can help navigate the rapidly evolving blockchain landscape and capitalize on new opportunities.

By following these best practices and learning from successful implementations, FinTech companies can maximize the benefits of blockchain technology while minimizing risks and challenges. As the technology continues to mature and more use cases are explored, the potential for blockchain to transform the FinTech industry becomes increasingly evident. The lessons learned from these early adopters and case studies provide valuable insights for companies leveraging blockchain technology in their financial services offerings.

XIII. REGULATORY CONSIDERATIONS

The regulatory landscape for blockchain in FinTech is rapidly evolving, with different countries adopting diverse approaches ranging from supportive to restrictive. Regulators primarily focus on Anti-Money Laundering (AML) and Know Your Customer (KYC) compliance, consumer protection, and maintaining financial stability. Many jurisdictions have established regulatory sandboxes to allow controlled testing of blockchain solutions, recognizing the need for innovation while managing potential risks. Additionally, there's an increasing focus on regulating cryptocurrencies and token offerings and addressing data protection concerns, particularly in light of regulations like the General Data Protection Regulation (GDPR) in Europe [25].

FinTech companies implementing blockchain solutions face several regulatory challenges. The rapidly evolving regulatory landscape creates uncertainty, making long-term planning difficult. Compliance costs can be substantial and resource-intensive, particularly for smaller companies. Differing regulations across jurisdictions complicate cross-border operations, while some inherent features of blockchain technology, such as immutability, may conflict with specific regulations.

To navigate these challenges, FinTech companies can employ several strategies. Proactive engagement with regulators and participation in industry working groups can help shape favorable regulatory frameworks. Implementing regulatory technology (RegTech) solutions can automate and streamline compliance processes, reducing costs and improving efficiency. Designing flexible system architectures that can adapt to changing regulatory requirements is crucial. Collaboration with other industry players to develop standards and best practices can also create a more cohesive and compliant blockchain ecosystem in FinTech.

Ensuring compliance in blockchain-based FinTech solutions requires a multi-faceted approach. Companies should implement robust KYC/AML processes, leveraging blockchain's transparency to enhance these critical compliance areas. Maintaining detailed audit trails is essential, taking advantage of blockchain's immutability for comprehensive record-keeping. Balancing transparency with data protection requirements is crucial, particularly concerning regulations like GDPR. Clear governance structures should be established, including protocols for decision-making and dispute resolution [26].

One of the key challenges in ensuring compliance is the need to monitor and adapt to regulatory developments continuously. FinTech companies must stay informed about changes in the regulatory landscape and adjust their strategies accordingly. This may involve regular training for staff, ongoing legal consultations, and participation in industry forums and regulatory discussions.

Implementing blockchain in FinTech also raises new questions about regulatory jurisdiction and enforcement. Blockchain's decentralized nature can make it challenging to determine which regulatory body has authority over a particular transaction or service. This underscores the need for international cooperation and harmonization of regulatory approaches to blockchain in financial services.

As the regulatory landscape continues to evolve, FinTech companies must remain agile and proactive in their approach to compliance. By embracing regulatory challenges as opportunities for innovation and collaboration, companies can help shape a regulatory environment that fosters the responsible development and adoption of blockchain technology in financial services.

XIV. FUTURE OUTLOOK

The future of blockchain in FinTech is being shaped by several emerging trends that promise to revolutionize the financial services industry. One of the most significant developments is the exploration of Central Bank Digital Currencies (CBDCs) by numerous central banks worldwide. These blockchain-based digital currencies can transform monetary policy implementation and enhance financial inclusion. Simultaneously, the rapid growth of Decentralized Finance (DeFi) platforms is challenging traditional financial intermediaries by offering decentralized lending, borrowing, and trading services [27].

Non-Fungible Tokes (NFTs) are finding potential applications in representing unique financial assets, opening up new possibilities for asset tokenization and fractional ownership.

The development of quantum-resistant blockchain systems is gaining importance as the threat of quantum computing attacks looms. Additionally, there is an increasing focus on green blockchain solutions, with efforts to develop energy-efficient consensus mechanisms and sustainable blockchain infrastructures to address environmental concerns.

Blockchain technology has the potential to disrupt traditional financial services in several ways. Disintermediation is a key factor, as blockchain can reduce the need for intermediaries in various financial processes, potentially lowering costs and increasing efficiency. The democratization of finance is another significant impact, with blockchain enabling broader access to financial services and investment opportunities, particularly for underserved populations. Real-time settlements enabled by blockchain technology can dramatically reduce settlement times for various financial transactions, improving liquidity and reducing counterparty risk.

The concept of programmable money, facilitated by smart contracts, enables automated, condition-based financial transactions, which could revolutionize areas such as insurance claims processing and supply chain finance. Enhanced transparency through blockchain technology improves risk management and reduces fraud by providing increased visibility into financial transactions and asset ownership [28].

As blockchain technology continues to evolve, several key areas require further research and development. Scalability remains a critical challenge, with ongoing efforts to improve transaction throughput and speed to meet the demands of global financial systems. Interoperability is another crucial area, focusing on developing standards and protocols for seamless interaction between blockchain networks to create a more interconnected financial ecosystem.

Privacy-preserving technologies are gaining importance as the industry seeks to balance blockchain's transparency with the need for confidentiality in financial transactions. This includes the development of zero-knowledge proofs and other cryptographic techniques to protect sensitive financial information while maintaining blockchain transparency's benefits.

Regulatory compliance continues to be a significant focus, with efforts to create tools and frameworks that streamline compliance processes on blockchain systems. This includes the development of "RegTech" solutions that can automate reporting and monitoring functions, reducing the compliance burden on financial institutions.

Improving user experience is critical for the mainstream adoption of blockchain-based financial applications. To make blockchain technology more accessible to the average user, this involves simplifying complex blockchain concepts, developing more intuitive interfaces, and creating seamless integrations with existing financial systems.

As these trends and research areas continue to develop, the future of blockchain in FinTech looks promising. It has the potential to create a more efficient, inclusive, and transparent financial system. However, realizing this potential will require ongoing collaboration between technologists, financial institutions, regulators, and policymakers to address challenges and harness the full capabilities of blockchain technology.

Conclusion

As blockchain technology matures and evolves, its potential to revolutionize the FinTech industry becomes increasingly evident. The journey from conceptualization to widespread adoption presents challenges and opportunities, requiring collaboration among technologists, financial institutions, regulators, and policymakers. By addressing key issues such as scalability, interoperability, regulatory compliance, and user experience, blockchain can create a more efficient, transparent, and inclusive financial ecosystem. As FinTech companies embrace blockchain solutions and learn from early adopters, they can unlock new levels of innovation, reduce costs, and enhance customer experiences. The future of FinTech, powered by blockchain, promises to democratize finance, streamline operations, and foster trust in ways previously unimaginable, ultimately reshaping the global financial landscape for the better.

References

[1] S. Nakamoto, \"Bitcoin: A Peer-to-Peer Electronic Cash System,\" 2008. [Online]. Available: https://bitcoin.org/bitcoin.pdf [2] M. Iansiti and K. R. Lakhani, \"The Truth About Blockchain,\" Harvard Business Review, vol. 95, no. 1, pp. 118-127, 2017. [Online]. Available: https://hbr.org/2017/01/the-truth-about-blockchain [3] Grand View Research, \"Fintech Market Size, Share & Trends Analysis Report By Deployment (Cloud, On-premise), By Application (Payment & Fund Transfer, Loans, Insurance & Personal Finance), By Region, And Segment Forecasts, 2022 - 2030,\" 2022. [Online]. Available: https://www.grandviewresearch.com/industry-analysis/fintech-market [4] E. Schueffel, \"Taming the Beast: A Scientific Definition of Fintech,\" Journal of Innovation Management, vol. 4, no. 4, pp. 32-54, 2016. [Online]. Available: https://journals.fe.up.pt/index.php/IJMAI/article/view/228 [5] M. Mainelli and M. Smith, \"Sharing ledgers for sharing economies: an exploration of mutual distributed ledgers (aka blockchain technology),\" The Journal of Financial Perspectives, vol. 3, no. 3, pp. 38-69, 2015. [Online]. Available: https://www.ey.com/Publication/vwLUAssets/ey-sharing-ledgers-for-sharing-economies-an-exploration-of-mutual-distributed-ledgers/$FILE/ey-sharing-ledgers-for-sharing-economies-an-exploration-of-mutual-distributed-ledgers.pdf [6] D. Tapscott and A. Tapscott, \"How blockchain will change organizations,\" MIT Sloan Management Review, vol. 58, no. 2, pp. 10-13, 2017. [Online]. Available: https://sloanreview.mit.edu/article/how-blockchain-will-change-organizations/ [7] A. Mackenzie, \"The Fintech Revolution,\" London Business School Review, vol. 26, no. 3, pp. 50-53, 2015. [Online]. Available: https://doi.org/10.1111/2057-1615.12059 [8] D. W. Arner, J. N. Barberis, and R. P. Buckley, \"The Evolution of Fintech: A New Post-Crisis Paradigm?,\" Georgetown Journal of International Law, vol. 47, pp. 1271-1319, 2016. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2676553 [9] A. Rossi, S. Borrelli, G. Ciaburri, and G. Cesaroni, \"An Interpretable Machine Learning Approach to Errors Management in Banking Services,\" IEEE Access, vol. 8, pp. 120622-120637, 2020. [Online]. Available: https://ieeexplore.ieee.org/document/9127874 [10] M. Avramidis, A. Karlis, and E. Papathanasiou, \"Algorithmic Trading and Machine Learning in Financial Markets: An Overview,\" Journal of Risk and Financial Management, vol. 14, no. 10, p. 481, 2021. [Online]. Available: https://www.mdpi.com/1911-8074/14/10/481 [11] V. Buterin, \"On Public and Private Blockchains,\" Ethereum Blog, 2015. [Online]. Available: https://blog.ethereum.org/2015/08/07/on-public-and-private-blockchains/ [12] M. Pilkington, \"Blockchain Technology: Principles and Applications,\" in Research Handbook on Digital Transformations, F. Xavier Olleros and Majlinda Zhegu, Eds. Edward Elgar Publishing, 2016, pp. 225-253. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2662660 [13] S. Kasireddy, \"Fundamental challenges with public blockchains,\" Medium, 2017. [Online]. Available: https://medium.com/@preethikasireddy/fundamental-challenges-with-public-blockchains-253c800e942 [14] A. de Vries, \"Bitcoin\'s growing energy problem,\" Joule, vol. 2, no. 5, pp. 801-805, 2018. [Online]. Available: https://www.cell.com/joule/fulltext/S2542-4351(18)30177-6 [15] V. Buterin, \"Chain Interoperability,\" R3 Research Paper, 2016. [Online]. Available: https://www.r3.com/wp-content/uploads/2017/06/chain_interoperability_r3.pdf [16] R. Belchior, A. Vasconcelos, S. Guerreiro, and M. Correia, \"A Survey on Blockchain Interoperability: Past, Present, and Future Trends,\" ACM Computing Surveys, vol. 54, no. 8, pp. 1-41, 2021. [Online]. Available: https://dl.acm.org/doi/10.1145/3471140 [17] S. Nakamoto, \"Bitcoin: A Peer-to-Peer Electronic Cash System,\" 2008. [Online]. Available: https://bitcoin.org/bitcoin.pdf [18] M. Iansiti and K. R. Lakhani, \"The Truth About Blockchain,\" Harvard Business Review, vol. 95, no. 1, pp. 118-127, 2017. [Online]. Available: https://hbr.org/2017/01/the-truth-about-blockchain [19] M. Morini, \"From \'Blockchain Hype\' to a Real Business Case for Financial Markets,\" Journal of Financial Transformation, vol. 45, pp. 30-40, 2017. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2760184 [20] G. W. Peters and E. Panayi, \"Understanding Modern Banking Ledgers Through Blockchain Technologies: Future of Transaction Processing and Smart Contracts on the Internet of Money,\" in Banking Beyond Banks and Money, P. Tasca, T. Aste, L. Pelizzon, and N. Perony, Eds. Cham: Springer International Publishing, 2016, pp. 239-278. [Online]. Available: https://link.springer.com/chapter/10.1007/978-3-319-42448-4_13 [21] D. Tapscott and A. Tapscott, \"How blockchain will change organizations,\" MIT Sloan Management Review, vol. 58, no. 2, pp. 10-13, 2017. [Online]. Available: https://sloanreview.mit.edu/article/how-blockchain-will-change-organizations/ [22] M. Iansiti and K. R. Lakhani, \"The Truth About Blockchain,\" Harvard Business Review, vol. 95, no. 1, pp. 118-127, 2017. [Online]. Available: https://hbr.org/2017/01/the-truth-about-blockchain [23] R. Guo and H. Qi, \"Blockchain adoption in the finance industry: A systematic literature review and meta-analysis,\" International Journal of Information Management, vol. 63, 102456, 2022. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0268401221001845 [24] F. Casino, T. K. Dasaklis, and C. Patsakis, \"A systematic literature review of blockchain-based applications: Current status, classification and open issues,\" Telematics and Informatics, vol. 36, pp. 55-81, 2019. [Online]. Available: https://www.sciencedirect.com/science/article/pii/S0736585318306324 [25] D. Zetzsche, R. P. Buckley, and D. W. Arner, \"The Distributed Liability of Distributed Ledgers: Legal Risks of Blockchain,\" University of Illinois Law Review, vol. 2018, no. 4, pp. 1361-1406, 2018. [Online]. Available: https://illinoislawreview.org/print/volume-2018-issue-4/the-distributed-liability-of-distributed-ledgers-legal-risks-of-blockchain/ [26] P. Yeoh, \"Regulatory issues in blockchain technology,\" Journal of Financial Regulation and Compliance, vol. 25, no. 2, pp. 196-208, 2017. [Online]. Available: https://www.emerald.com/insight/content/doi/10.1108/JFRC-08-2016-0068/full/html [27] M. Atzori, \"Blockchain Technology and Decentralized Governance: Is the State Still Necessary?,\" Journal of Governance and Regulation, vol. 6, no. 1, pp. 45-62, 2017. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2709713 [28] K. Werbach, \"Trust, But Verify: Why the Blockchain Needs the Law,\" Berkeley Technology Law Journal, vol. 33, no. 2, pp. 487-550, 2018. [Online]. Available: https://btlj.org/data/articles2018/vol33/33_2/Werbach_Web.pdf

Copyright

Copyright © 2024 Jaydeep Tase. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63843

Publish Date : 2024-08-01

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online