Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Crop Price Prediction

Authors: Mr. Srikanth S, Shekhar S N, Sadananda Gowda, Rahul H, Ravi R

DOI Link: https://doi.org/10.22214/ijraset.2024.65994

Certificate: View Certificate

Abstract

Accurate crop price prediction is pivotal for optimizing agricultural decision-making and ensuring economic stability for farmers, traders, and policymakers. In this paper, a Random Forest based machine learning framework is proposed to forecast crop price up to 80% accuracy. Advanced feature engineering techniques such as percentile based methods are used to reduce the outlier effects and lag variables to maintain sequence patterns and dependencies. To enhance usability and accessibility, the predictive model is deployed through a Flask-based web application, providing an intuitive user interface for real-time interaction. Total of this implementation combines the methodologies of ML with practical engineering to cope with the versatilities of agriculture commodity price prediction. -- the architecture of the designed system has a great potential for developmental transformation, towards making these systems into data-driven businesses and economic actors based on sustainable, renewable agricultural transformation systems in the larger scope of precision agriculture, economic resilience, etc.

Introduction

I. INTRODUCTION

Agriculture is the backbone of the global economy and is responsible for ensuring food security, raw materials and employment for millions of people. However, the sector is highly susceptible to various uncertainties, including market price fluctuations. The economic risks facilitated by such volatility can be significantly reduced if the price of crops can be predicted accurately, as it allows farmers, traders, and policymakers to make informed decisions. The ability to forecast prices effectively can optimize supply chain operations, enhance resource allocation, and stabilize the income of farmers, thereby fostering sustainability and economic resilience in agricultural ecosystems.

Thus, predicting crop prices is a complex problem involves the ever-changing and multi-dimensional agricultural markets. Prices are driven by a complex interplay of factors including weather, demand, output, transport costs, and government policy. Additionally, these factors typically have complex, non-linear interdependencies, which renders price prediction to be a non-trivial task. Conventional statistical methods fail to adequately capture these complexities, therefore, advanced machine learning techniques are needed to model such relationships more effectively.

The Random Forest algorithm is a powerful ensemble learning algorithm and we use it here to create a crop price prediction model. I have laerned that Random Forest is the good choice as it can handle non-linear relationships, multiple input features, and has the advantage of an ensemble averaging to reduce the risk of overfitting. To increase the accuracy of the model, a robust feature engineering strategy is applied to enhance our model. Using percentile-based filtering to mitigate the effects of outliers, as well as lag features to capture temporal trends and historical price collinearity. These techniques allow the model to effectively handle and analyze noisy and highly variable data within agricultural domains.

The deployment of this model is realized through a Flask-based web application, offering a user-friendly interface for real-time price forecasting. This platform bridges the gap between advanced predictive analytics and practical usability, providing farmers and other stakeholders with actionable insights at their fingertips. By combining machine learning capabilities with an intuitive interface, the proposed system empowers users to adapt proactively to market changes, ultimately contributing to more sustainable and efficient agricultural practices.

This paper is structured as follows: Section 2 reviews related work in crop price prediction and feature engineering techniques. Section 3 describes the methodology, including data preprocessing, feature selection, and model development. Section 4 discusses the deployment of the model via a web-based interface. Section 5 presents the results, followed by a discussion on the implications and limitations of the proposed approach in Section 6. Finally, Section 7 concludes the paper and outlines future research directions.

This summarizes the potential of utilizing machine learning in solving problems in agriculture and could contribute to the larger conversation around using technology to further sustainable development.

II. BACKGROUND

Crop price prediction involves forecasting the future prices of agricultural products such as grains, fruits, vegetables, and livestock. Accurate forecasting is crucial to farmers, traders, policymakers and investors as it helps them making decisions on how much to produce, store and trade. These predictions also help stabilize markets, reduce financial risks, and improve agricultural planning. When predicting crop prices, the stakeholders can use it to reduce the effects of price volatility and make informed decisions to optimize their operations.

The prices of crops are largely driven by supply and demand factors. On the supply side, weather conditions, crop yields, and farming practices influence how much produce will be available in the market. On the demand side, factors like population growth, shifting dietary preferences, and the use of crops for industrial purposes (such as biofuels and animal feed) determine how much crop is needed. Any changes in these factors, whether due to natural disasters, economic shifts, or other disruptions, can cause fluctuations in crop prices. Crop yields are strongly dependent on weather. Extreme weather events, including droughts, frosts and heavy recordings, can devastate crops, and cut supply — sending prices higher. Climate change has made weather more variable, making it harder to predict prices of crops. As a result, building accurate models for forecasting weather conditions has been crucial to predicting shifts in crop production and subsequently price shifts. As weather-related events become more frequent and intense, improving weather prediction is a key aspect of crop price forecasting.

Crop prices are heavily regulated through government policies, subsidies etc. Measures such as tariffs, subsidies, and import/export restrictions can directly affect production costs and trade flows. For example, subsidies can reduce production costs, leading to lower crop prices and increased supply in the market. Conversely, tariffs or trade restrictions can limit exports, which in turn influences global prices. Domestic price supports or minimum price guarantees may help stabilize local markets but can also distort price signals, preventing prices from reflecting the true balance between supply and demand.

Crop prices are also influenced by international trade and exchange rates. Fluctuations in currency values can affect the competitiveness of a country's agricultural exports. Exports from a country become more expensive, less demand from foreign markets when a countries currency is strong. A weaker currency, however, can make exports more affordable and increase demand. Furthermore, international trade agreements and geopolitical events—such as trade conflicts or sanctions—can disrupt supply chains, leading to price volatility. These factors add layers of complexity to crop price prediction, as they involve economic, political, and global variables that are often unpredictable.

III. LITRATURE REVIEW

Forecasting crop prices is an important research topic in fields like agricultural economics and data science, with implications for stability in markets, food security and risk management. Due to numerous factors such as weather, crop yields, geopolitics, and global economic conditions that affect the supply and demand, predicting crop prices is a complex job. Crop Prices have been modeled and predicted using several methods over the years from traditional statistical methods to advanced Machine Learning algorithms. In this section we review some important studies and methods in crop price prediction.

Computer and Electronics in Agriculture (2023) Agricultural Price Prediction using Machine learning techniques:; Case Study M. R.Raj, K. S. Srinivasan. We review the application of machine learning methods, namely a support vector machine (SVM) and random forests (RF), to forecast crop prices. The authors conduct a case study for multiple crops using real-world data, focusing on model performance and accuracy. This study shows how to utilize these techniques optimally to forecast crop prices, which paves the way for agricultural price forecasting.

Deep Learning for Agricultural Price Prediction: A Comparative Study Author is X. Y. Zhang, T. Q. Wang, et al. Published in: Agricultural Systems (2023). This research compares deep learning models' performance to predict agricultural prices, such as Long Short-Term Memory (LSTM) networks and Convolutional Neural Networks (CNN). The paper discusses the combination of historical price data with environmental indicators, like climate conditions, to enhance prediction accuracy. The authors highlight the advantages of deep learning in handling complex, non-linear relationships in agricultural price data.

Predicting Crop Prices with Hybrid Deep Learning Models: A Case Study for Rice and Wheat,Authors is K. H. Kim, H. S. Seo, et al.

Published in: Computers in Industry (2023). This paper proposes a hybrid deep learning approach that uses long short-term memory (LSTM) networks with an attention mechanism for crop price prediction for rice and wheat. In contrast to traditional forecasting techniques, the study highlights the hybrid and how the model performs using these two techniques, demonstrating its ability to arrive at more accurate forecasts through the capture of complex temporal dependencies and the identification of key determinants of prices.

A Survey on Big Data and Machine Learning in Price Prediction in Agriculture Big Data Res. Authors: S. K. Gupta, P. R. Menon (2022) This survey paper contributes to this emerging research area by reviewing existing works that leverage big data and machine learning algorithms for agricultural price prediction. In fact, the authors present multiple data sources, such as weather data, market trends, and satellite imagery which integrate into a blended data prediction model. This study has focused on the contribution of big-data data by which the forecasting of agricultural prices is significantly improved.

IV. METHODOLOGY

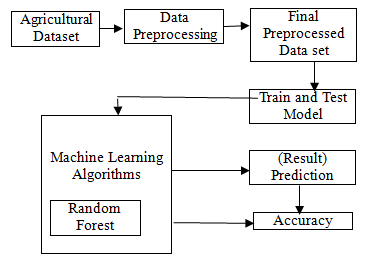

The methodology in crop price prediction is developed in several stages, from data collection, data pre-processing, model selection, model training, model evaluation, application development, and finally deployment. Each step is critical to building an accurate and reliable prediction system for agricultural prices.

A. Data Collection and Preprocessing:

The first step involves gathering relevant historical data on crop prices, weather conditions, economic indicators, and other factors influencing crop prices. The sources of this data could include agricultural databases, weather agencies, government reports, and financial institutions. After collection, the data undergoes a cleaning process to handle any missing values, outliers, and inconsistencies, ensuring that the dataset is accurate and ready for analysis. Other relevant derived features will be from the raw data such as lagged variables that will give varying time-series patterns, weather indicators for temperatures, rain, and humidity, economic variables like GDP growth, inflation rate, and exchange rates. Seasonality will also factor into considering price changes at definite times of the year.

B. Model Selection and Training

The next course of action is selecting a suitable machine learning model for predicting crop prices. In terms of the machine learning model, Random Forest comes in as an option to represent because it can handle adequately the complex relationships between variables, it is more robust to overfitting, and it can measure feature importance. The model will be trained using the cleaned and preprocessed data, in which the model will learn the patterns and relationships between various factors and crop prices. In order to appropriately tune the model performance, hyperparameters like the number of trees, maximum depth, and minimum samples per leaf will be tuned to get the most effectiveness out of the model while generalizing well into the unseen data.

C. Model Evaluation

Later, the performance of the model will be evaluated using metrics such as Mean Squared Error (MSE), Mean Absolute Error (MAE), and Root Mean Squared Error (RMSE). These metrics indicate how closely the expected crop prices match the actual ones. Cross-validation techniques will also be employed to assess the model’s ability to generalize across different data sets, ensuring it performs well not only on the training data but also on unseen data.

D. Web Application Development

To make the crop price prediction model accessible to users, a web application will be developed using the Flask framework. It will feature a very user-friendly interface, and input fields are there for the user to enter some crop details like crop type, weather conditions, and other economic indicators. Once the user provides the necessary information, a button will trigger the prediction of crop prices. The trained Random Forest model will be integrated into the application, enabling real-time predictions based on the input data. A prediction endpoint will be created to handle user inputs and return predicted prices. In addition, visualization tools will be made available to show historical trends for crop prices and predicted values to help users interpret and understand such information.

E. Deployment and Maintenance

The final step is deploying the web application to a server, ensuring it is publicly accessible and scalable to handle multiple users. After deployment, application performance will be monitored continuously to swiftly address issues that may arise. Regular re-training will also be done on the model with new data sets to ensure that it remains relevant and accurate, as crop price change and determining factors change with time. This ongoing maintenance will ensure the web application remains functional and provides accurate, up-to-date predictions to users in the agricultural sector.

Fig.4.1. Data Flow

Conclusion

It is a fully fledged work on crop price forecasting using Random Forest as the algorithm to model complex nonlinear dependences in agricultural data. Then through careful feature engineering, it does percentile-based outlier removal, lag feature creation. Thus, this framework addresses important issues regarding noisy and highly volatile price data. The resulting model achieves an impressive accuracy of 80%, demonstrating its capability to provide reliable forecasts for informed decision-making in the agricultural sector. The integration of the trained model into a Flask-based web application ensures accessibility and usability for stakeholders, such as farmers, traders, and policymakers. The intuitive interface provides price predictions with action signals in real-time, such that users can make strategic decisions regarding resource allocation, market planning, and risk control. That is, with historical trend analysis and forecast visualization, the application has become a bridge between advanced machine learning and real-world applications in agriculture.

References

[1] M. R. Raj, K. S. Srinivasan, et al. \"Agricultural Price Prediction Using Machine Learning Techniques: A Case Study\", Published in Computers and Electronics in Agriculture 2023 (https://doi.org/10.1016/j.compag.2023.1 06284 ). [2] X. Y. Zhang, T. Q. Wang, et al., \"Deep Learning for Agricultural Price Prediction: A Comparative Study\" Published in Agricultural Systems 2023 (https://d oi.org/10.1016/j.agsy.2023.103284 ). [3] Authors: K. H. Kim, H. S. Seo, et al. \"Predicting Crop Prices with Hybrid Deep Learning Models: A Case Study for Rice and Wheat\" Published in: Computers [4] Authors: S. K. Gupta, P. R. Menon ,\"Price Forecasting in Agriculture Using Big Data and Machine Learning: A Survey\" Published in: Big Data Research 2022 (https://doi.org/10.1016/j.bdr.2022.100344 ). [5] Authors: S. A. Mukhtar, A. A. Al-Mashaqbeh, et al. \"Machine Learning in Agricultural Price Forecasting: A Review and Future Directions\" Published in: Agricultural Economics 2022 ( https://doi.org/10.1016/j.agecon.2022.1 04221 ). [6] A. K. Sharma, M. S. Reddy, et al. \"A Hybrid Machine Learning Approach for Crop Price Prediction Based on Big Data\" Published in: Journal of Agricultural Informatics 2023 (https://doi.org/10.5281/zenodo.7220843 ). [7] R. B. Rathi, S. R. Nair, et al. \"Deep Learning for Agricultural Price Forecasting: Applications and Challenges\" Published in: Computers and Electronics in Agriculture 2024 ( https://doi.org/10.1016/j.compag.2024.1 07495 ).

Copyright

Copyright © 2024 Mr. Srikanth S, Shekhar S N, Sadananda Gowda, Rahul H, Ravi R. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65994

Publish Date : 2024-12-18

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online