Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Review Report on NFT Marketing

Authors: Sharvari Raut, Shruti Thakare, Yamini Pohane, Bhramari Deharkar

DOI Link: https://doi.org/10.22214/ijraset.2024.64925

Certificate: View Certificate

Abstract

This review paper examines the rising influence of Non-Fungible Tokens (NFTs) in the field of marketing,focusing on how these unique digital assets are changing brand strategies and consumer interactions. Businesses are increasingly using NFTs to offer exclusive experiences, strengthen customer loyalty, and promote ownership of digital products like virtual collectibles, art, and branded content.The paper provides a comprehensive overview of the current applications of NFTs in marketing, including digital collectibles, virtual real estate, branded content, and customer incentives. It also addresses the challenges and risks, such as market volatility, environmental concerns, regulatory uncertainties, and the evolving consumer perception of digital ownership. Additionally, the study explores future developments, such as the convergence of NFTs with the metaverse and social platforms, and the growing importance of gamification in brand storytelling. By synthesizing existing researchand how marketers can effectively use NFTs while managing risks in this rapidly changing digital environment.

Introduction

I. INTRODUCTION

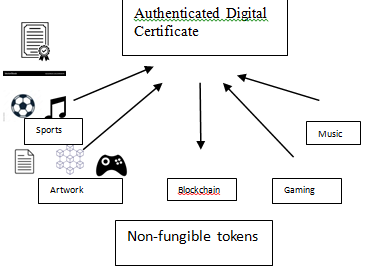

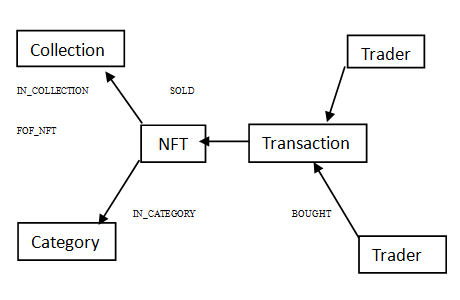

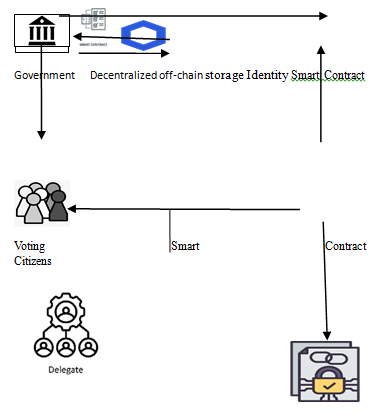

Non-Fungible Tokens (NFTs) are a type of digital asset that represent ownership of unique items, stored on blockchain technology. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and interchangeable, NFTs are one-of-a-kind and cannot be exchanged on a one-to-one basis. This uniqueness allows them to represent digital assets like art, music, videos, and even virtual real estate, offering a new way for creators to monetize their work in the digital realm. Each NFT contains distinct information, ensuring that its authenticity and ownership are verifiable through the blockchain, making them ideal for collectible items, rare digital art, and exclusive content. At a technical level, NFTs are smart contracts—self-executing pieces of code that run on the blockchain. When an NFT is minted, a unique token ID is assigned, along with specific metadata that typically includes a link to an external file (such as a digital artwork or other digital assets) stored on decentralized storage systems like IPFS (InterPlanetary File System). This metadata distinguishes the NFT from others, while the smart contract governs the ownership rights, royalties, and transferability of the token. Every time an NFT is transferred between parties, the transaction is recorded in the blockchain, ensuring that the ownership chain is transparent and immutable. The underlying technology behind NFTs is most often the Ethereum blockchain, utilizing standards like ERC-721 or ERC-1155 to ensure the token’s uniqueness and secure ownership. Transactions related to buying, selling, or transferring NFTs are recorded on the blockchain, providing a transparent and immutable history of ownership. While NFTs offer exciting possibilities for the future of digital ownership, they also raise questions about environmental impact due to the energy consumption of blockchain networks, as well as legal issues around copyright and intellectual property. Nevertheless, NFTs represent a groundbreaking shift in how we perceive and trade digital assets.3

NFTs have gained popularity in various fields, especially in the world of digital art and gaming. Artists can mint their creations as NFTs, allowing them to sell directly to buyers without intermediaries, while also earning royalties from future sales. This model has revolutionized the way artists and creators can profit from their work. Similarly, in the gaming world, NFTs represent in-game assets, such as virtual characters, skins, or items, which players can buy, trade, or sell. Other uses include tokenized real estate in virtual worlds, sports collectibles, and even digital fashion. Technically, NFTs are implemented as smart contracts—self-executing protocols with the terms of the asset encoded directly in code—on blockchain platforms like Ethereum. The most commonly used standards for NFTs are ERC-721 and ERC-1155. The ERC-721 standard defines the protocol for single non-fungible tokens, assigning each token a tokenId that ensures its uniqueness. Meanwhile, ERC-1155 allows for both fungible and non-fungible tokens, streamlining transactions by supporting batch transfers, which is particularly useful in sectors like gaming, where users may possess numerous in-game items. NFT transactions are facilitated through blockchain networks, and each transfer incurs a cost in the form of gas fees, which compensate the network for the computational work required to validate and record the transaction. Moreover, NFTs often incorporate royalty mechanisms, allowing creators to receive a percentage of resale proceeds in secondary markets, a feature that is automatically enforced by the underlying smart contract.

While this technology introduces new possibilities for digital ownership and asset management, it also raises considerations around scalability, environmental impact due to high energy consumption on proof-of-work blockchains, and legal questions surrounding intellectual property and the ownership of digital assets.

II. LITERATURE SURVEY

Non-Fungible Tokens (NFTs) have emerged as a pivotal innovation in blockchain technology, enabling the digital ownership and verification of unique assets. The literature on NFTs is diverse, covering aspects of their technical foundations, economic implications, environmental impact, and legal considerations. This review examines key themes in the existing body of research on NFTs, providing a comprehensive understanding of their significance and challenges. This literature review synthesizes key research areas related to NFTs, focusing on their technical foundations, market dynamics, environmental implications, regulatory challenges, and cultural impact.

A. Technical Foundations of NFTs

NFTs are primarily implemented on blockchain platforms, with Ethereum being the predominant network. The ERC-721 standard, as introduced by Buterin (2018), facilitates the creation of unique tokens, each identifiable by a distinct token id. This protocol ensures that NFTs are indivisible and verifiably scarce, differentiating them from fungible tokens like cryptocurrencies.

The ERC-1155 standard, discussed by Witek Radomski et al. (2019), enhances efficiency by allowing batch transfers and supporting both fungible and non-fungible assets within a single contract. This dual functionality optimizes transactions for applications such as gaming, where users may own multiple in-game items. Several works explore the integration of decentralized storage systems, such as IPFS, in the NFT ecosystem to handle large asset files (Benet, 2014). This architecture enables off-chain storage while keeping critical ownership and metadata on-chain, though challenges related to the permanence of off-chain data and the risk of broken links remain under discussion (Sharma & Steinmetz, 2021).

B. Economic Impact and Market Dynamics

NFTs have led to a reconfiguration of the digital economy, particularly in the creative and gaming industries. In the realm of digital art, authors such as Nadini et al. (2021) analyze how NFTs disrupt traditional art markets by allowing creators to bypass intermediaries, such as galleries, and directly engage with buyers. This direct-to-consumer model is further enhanced by the implementation of smart contracts that automatically enforce royalty payments upon resale, as highlighted in the work of Dowling (2022).

Gans and Halaburda (2021) explore the speculative nature of NFT valuations, noting that market volatility is driven by subjective assessments of value and consumer sentiment. The phenomenon of high-profile sales, such as Beeple’s "Everydays: The First 5000 Days," illustrates the potential for price bubbles and raises questions regarding the long-term viability of NFT markets.

C. Environmental Impact

The environmental footprint of NFTs, particularly due to their reliance on energy-intensive proof-of-work (PoW) blockchain technologies, has garnered significant academic attention. Studies such as De Vries (2020) quantify the carbon emissions associated with NFT transactions, positing that the minting and trading of NFTs contribute to substantial ecological concerns.

The transition to more sustainable consensus mechanisms, such as proof-of-stake (PoS), is examined in light of Ethereum’s planned upgrade to Ethereum 2.0 (Vitalik, 2021).

Literature also addresses layer-2 scaling solutions, including ZK-rollups and sidechains, as potential strategies to reduce the environmental impact of NFT transactions by alleviating network congestion (Kalodner et al., 2018). Proposals for layer-2 scaling solutions, such as ZK-rollups and sidechains, are also discussed in the literature as potential ways to mitigate environmental concerns by reducing the computational load of NFT transactions (Kalodner et al., 2018). However, despite these innovations, the environmental critique remains a central theme in the discussion of NFTs, particularly as the market expands.

D. Legal and Regulatory Challenges

The legal landscape surrounding NFTs is still evolving, with several unresolved questions regarding intellectual property (IP), ownership rights, and regulatory frameworks. One of the primary legal debates centers on whether ownership of an NFT equates to ownership of the underlying asset. Authors such as Fairfield (2021) argue that NFT ownership primarily grants the right to transfer the token itself, not necessarily the copyright or commercial rights to the associated digital file, leading to confusion in secondary markets. Regulatory uncertainty is further compounded by the classification of NFTs within existing securities frameworks. Hinman (2018) outlines the SEC's considerations regarding whether specific NFTs may fall under securities regulations, emphasizing the need for clarity in legal definitions. Scholarly discussions by Finck and Moscon (2019) highlight the difficulties regulators face in adapting traditional legal frameworks to encompass decentralized technologies, stressing the necessity for cohesive international regulatory approaches.

E. Cultural and Social Dimensions

The cultural implications of NFTs have been examined in relation to their impact on digital creativity and community formation. McCormack (2021) articulates the democratizing potential of NFTs, suggesting that they enable artists and creators to monetize their work independently of traditional gatekeepers. However, this commercialization of creativity raises concerns regarding the commodification of culture, as articulated by van Dijck (2021).

The formation of communities around NFTs, such as those associated with CryptoPunks and Bored Ape Yacht Club, reflects the social dynamics inherent in digital ownership. Lehdonvirta (2021) analyzes how these communities foster exclusivity and identity among participants, although the high cost of entry into these spaces raises issues related to accessibility and social equity.

III. CHALLENNGES

The rise of Non-Fungible Tokens (NFTs) has introduced numerous opportunities in the digital economy, but it has also brought forth several challenges that stakeholders must navigate

A. Environmental Impact

One of the most significant criticisms of NFTs is their environmental impact due to the energy-intensive processes required for minting and trading tokens on proof-of-work (PoW) blockchains, such as Ethereum. The high energy consumption associated with these networks contributes to increased carbon emissions, raising concerns about sustainability. Although some platforms are exploring more energy-efficient alternatives like proof-of-stake (PoS) or layer-2 scaling solutions, the environmental debate remains a crucial challenge for the NFT ecosystem. . This leads to significant carbon emissions due to high computational requirements. Each transaction involves multiple validations by network nodes, resulting in substantial energy consumption. Transitioning to proof-of-stake (PoS) mechanisms or implementing layer-2 solutions (e.g., zk-rollups) may mitigate these concerns but requires widespread adoption and infrastructure changes.

B. Legal and Regulatory Uncertainty

The legal status of NFTs is still ambiguous, particularly concerning intellectual property rights and consumer protections. Questions arise about whether ownership of an NFT equates to ownership of the underlying digital asset and what rights (if any) are transferred to the buyer.

Additionally, regulatory frameworks are often outdated or unclear, leading to potential conflicts regarding the classification of NFTs as securities. The lack of comprehensive regulations can expose creators and investors to legal risks and uncertainties. The legal framework governing NFTs is fragmented and evolving. Key issues include:

- Intellectual Property Rights: Ambiguity exists regarding whether NFT ownership grants full rights to the underlying digital asset or merely a limited license.

- Securities Classification:NFTs may be categorized as securities, requiring compliance with regulatory frameworks like the Howey Test, which assesses investment contracts.

- Consumer Protections:Lack of standardized regulations can expose buyers to fraud and unclear return policies.

C. Market Volatility and Speculation

NFT markets exhibit extreme price volatility, often driven by speculative behavior and trends. The valuation of NFTs can fluctuate dramatically, leading to potential asset bubbles. For instance, price distortions can occur based on hype, celebrity endorsements, or market manipulation, creating risks for investors and creators alike. This volatility can lead to bubble-like scenarios, where assets are overvalued and susceptible to sharp declines in price. For new investors and creators, the speculative nature of NFTs can pose significant financial risks and lead to losses.

D. Accessibility and Inclusivity

While NFTs have the potential to democratize access to digital art and collectibles, there are still barriers to entry that can limit participation. The high costs associated with minting NFTs, transaction fees (gas fees), and the complexity of setting up cryptocurrency wallets can deter less tech-savvy individuals or those without substantial financial resources. As a result, there is a risk that NFTs could perpetuate existing inequalities in the digital economy. Barriers to entry in the NFT space include:

High Transaction Fees: Gas fees associated with minting and transferring NFTs can be prohibitively expensive, especially on networks with high congestion.

Technical Complexity: The need for cryptocurrency wallets and an understanding of blockchain technology can deter participation from less technically adept individuals or those lacking financial resources.

E. Digital Ownership and Rights Management

The concept of ownership in the digital realm is complex and often poorly understood. Many NFT buyers may not fully grasp what rights they are acquiring with their purchase. This ambiguity can lead to misunderstandings regarding copyright, usage rights, and resale opportunities. Additionally, some creators may inadvertently infringe on existing copyrights when minting NFTs, leading to potential legal disputes. Defining ownership in the digital context is complex:

- Ambiguous Rights: Buyers may not fully understand what rights they acquire with an NFT purchase, leading to potential disputes over usage and resale rights.

- Copyright Infringement:Creators may inadvertently violate copyrights by minting NFTs of digital works without proper licensing, risking legal repercussions.

F. Scalability Issues

As the NFT market grows, the underlying blockchain networks face scalability challenges. High transaction volumes can lead to network congestion, resulting in increased gas fees and slower transaction times. This issue can hinder the user experience and discourage participation in the NFT space. While various solutions, such as layer-2 technologies, are being developed, achieving scalable and efficient systems remains an ongoing challenge. NFT transactions can lead to network congestion, particularly during high-demand periods:

- Throughput Limitations: Most PoW blockchains have limited transaction throughput, causing delays and increased gas fees.

- Scalability Solutions: Implementing layer-2 scaling solutions (e.g., rollups) or transitioning to more efficient consensus mechanisms is necessary to enhance transaction speeds and reduce costs.

G. Fraud and Security Risks

The NFT space has been plagued by instances of fraud, scams, and hacks. Issues such as phishing attacks, counterfeit NFTs, and unauthorized sales of digital art can undermine trust in the market.

Additionally, the irreversible nature of blockchain transactions means that once a fraudulent transaction occurs, it can be difficult or impossible to recover lost assets. Ensuring security and protecting buyers from scams are critical challenges for the industry. NFT markets are susceptible to various security vulnerabilities:

- Phishing Attacks:Users can be targeted through phishing schemes to access their wallets or steal assets.

- Counterfeit NFTs:The ease of minting NFTs can lead to the proliferation of counterfeit assets, undermining market integrity.

IV. APPLICATIONS

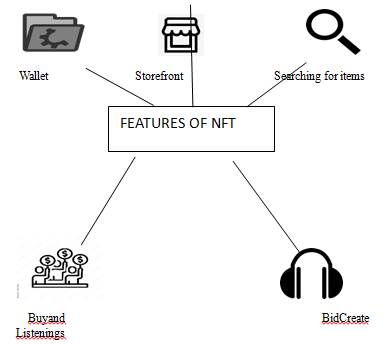

An NFT marketing application is a platform designed to help creators, businesses, and brands promote their NFTs (non-fungible tokens) effectively. NFTs, being unique digital assets, require a specific marketing approach to stand out in the competitive digital marketplace. Here's how an NFT marketing application can streamline this process:

- NFT Creation and Minting: The application should have tools for creating and minting NFTs on various blockchain platforms like Ethereum, Solana, and Polygon.Users can upload digital assets (art, music, videos, etc.) and easily convert them into NFTs.

- Campaign Management: The app enables users to design marketing campaigns to promote NFTs across multiple channels, including NFT marketplaces (OpenSea, Rarible), social media (Twitter, Instagram), and email.Automated scheduling of posts and promotional activities ensures timely and consistent exposure.

- Targeted Audience Reach: The app allows creators to define their target audience based on interests, demographics, and behavior.This targeting helps reach NFT collectors, fans, or specific buyer personas most likely to be interested in the creator’s NFTs.

- Marketplace Integration:Integration with leading NFT marketplaces such as OpenSea, SuperRare, and Rarible allows for seamless listing and tracking of NFT sales.Users can manage their listings, update details, and promote specific assets directly from the app.

- Social Media Integration: The app provides integration with social media platforms (e.g., Twitter, Discord, Instagram) for easy sharing and engagement.This feature helps build a community around the NFTs, which is critical for driving interest and engagement.

- Influencer CollaborationThe app may offer a database of NFT influencers who can help promote NFT projects to a larger audience.Creators can collaborate with influencers for campaigns, increasing exposure through trusted voices in the NFT community.

- Analytics and Performance Tracking: Built-in analytics tools help track the performance of campaigns, providing insights on traffic, sales, and engagement.Users can see which strategies are working best and adjust their marketing approach accordingly.

- SEO and Content Optimization: The app can provide SEO tools to optimize NFT listings and websites for search engines, increasing organic visibility.It may also help with content creation and marketing strategies like blogging or newsletters to attract potential buyers.

- Email Marketing Tools: The application can include features for email marketing, allowing creators to nurture relationships with collectors. Users can send newsletters, promotional offers, or updates to their email lists, driving continued interest in their NFTs.

- Community Engagement: Strong community engagement is crucial for NFT success. The app might provide features for running events like giveaways, airdrops, or exclusive community access, ensuring ongoing interest and participation.

V. USE CASES

NFT (Non-Fungible Token) marketing is a strategy where businesses or individuals use NFTs to promote their products, services, or brands. NFTs are unique digital assets that can represent ownership of items like art, music, videos, or even virtual goods. NFT marketing involves using NFTs as a tool to engage customers, build brand awareness, and create value through unique digital assets.

- Creating Unique Digital Assets: Businesses can create exclusive digital items, such as artwork, collectibles, or experiences, that are tied to NFTs. These unique assets can be sold or given away, providing customers with a sense of ownership over something special..

- Building Community Engagement: NFTs can help brands build a stronger connection with their audience. For instance, a company can release NFTs that come with access to exclusive content, private events, or behind-the-scenes experiences. This creates a sense of community, where NFT owners feel like they are part of something special.

- Rewarding Loyal Customers: NFTs can be used as a reward system. Companies can offer NFTs as a bonus for loyal customers or as prizes in contests. These NFTs might hold value because they are rare or come with additional benefits

- Generating Buzz and Hype: Since NFTs are relatively new and exciting, they can generate a lot of attention. Brands can use this buzz to create marketing campaigns around NFT drops (the release of new NFTs). This can help attract new customers and keep existing ones excited about the brand.

- Monetizing Digital Content: NFTs provide a new way for content creators, such as artists, musicians, and writers, to make money. By selling their digital creations as NFTs, they can reach a wider audience and earn revenue, sometimes even getting a percentage of future resales of their work.

- VIP Access and Experiences: NFTs can grant special privileges, such as access to exclusive events, early product releases, or behind-the-scenes content. This turns NFTs into valuable assets that go beyond digital ownership.

- Collaborations and Partnerships: Brands can collaborate with NFT artists, influencers, or other companies to release co-branded NFT collections. These collaborations generate excitement and attract new audiences from different communities.

- Gamified Marketing:Brands can create games or contests where users collect or earn NFTs by participating in activities. These NFTs could represent achievements or rewards and could be traded or redeemed for real-world benefits.

NFT Use Case

VI. COMPARATIVE AYALYSIS OF DIFFERENT APPROACHES OR METHODS

- Expansion into New Industries: Beyond art and collectibles, NFTs are being adopted in real estate, music, gaming, fashion, and sports. Companies in these industries will likely leverage NFTs for marketing to enhance customer engagement and loyalty through unique digital assets.

- Brand and Influencer Collaborations: Brands and influencers can use NFTs to offer exclusive digital content, merchandise, and experiences to fans, creating a direct marketing channel that enhances brand loyalty and community building.

- Virtual Reality and Metaverse:NFTs will play a significant role in marketing within virtual environments (like the metaverse), where brands can sell virtual goods, services, and experiences. This offers marketers a new frontier to reach audiences through immersive experiences.

- Personalized Marketing:NFTs enable companies to provide customers with personalized, one-of-a-kind experiences, such as limited-edition products or access to VIP events. This exclusivity can drive engagement and create a sense of ownership and status.

- Loyalty Programs: Companies may use NFTs to revolutionize loyalty programs by offering digital collectibles that provide perks or access to special services, encouraging long-term customer relationships.

- Token-Gated Communities:Brands can create token-gated communities where access to content or experiences is limited to NFT holders, driving exclusivity and community engagement.

- Sustainability and Innovation:As blockchain technology becomes more energy-efficient, it will address concerns regarding environmental impact, leading to more widespread adoption of NFTs in marketing strategies.

- Diverse Industries:NFTs will expand beyond art into areas like gaming, fashion, real estate, and sports.

- Brand Engagement: Brands and influencers will use NFTs for exclusive digital products and experiences to build loyalty.

- Metaverse Integration: NFTs will play a key role in marketing within virtual worlds, offering new ways to reach audiences.

- Loyalty Programs:NFTs can revolutionize customer loyalty by offering unique rewards and access.

- Token-Gated Communities: Exclusive content or experiences limited to NFT holders will drive engagement.

Conclusion

NFT marketing represents a groundbreaking shift in how creators, brands, and consumers interact within the digital economy. By leveraging the unique properties of Non-Fungible Tokens, NFT marketing enables direct ownership, verifiable scarcity, and personalized experiences, fundamentally altering traditional marketing dynamics. As industries such as art, music, gaming, fashion, and real estate embrace NFT technology, the potential applications continue to grow, offering innovative ways to monetize digital assets, engage audiences, and create new revenue streams. Brands can forge deeper connections with consumers by fostering community-driven approaches and offering exclusive experiences that resonate with modern audiences. However, the journey of NFT marketing is not without challenges. Issues such as market volatility, environmental concerns, regulatory uncertainties, and the need for technological understanding must be addressed to ensure sustainable growth and wider acceptance. As the landscape evolves, marketers must remain adaptable, exploring new strategies that align with consumer values and technological advancements. In conclusion, NFT marketing stands at the forefront of the digital transformation, offering unique opportunities for creators and brands to thrive in an increasingly digital world. By harnessing the power of NFTs, stakeholders can redefine their engagement strategies, foster community connections, and tap into new markets, paving the way for a more vibrant and innovative future in marketing. As NFT technology matures, it will be essential for marketers to stay informed, embrace creativity, and navigate the complexities of this exciting

References

[1] Pink Brains\' 2024 NFT Marketing Guide: Highlights strategies such as exclusive airdrops, collaborations, and community building. Physical events and limited-edition releases are also emphasized to create exclusivity and urgency. [2] NinjaPromo’s 27 NFT Marketing Strategies: This guide lists strategies like social media promotion, influencer marketing, and leveraging SEO. It also discusses building NFT communities and using blockchain ad networks to target niche audiences. [3] GrowthChain\'s NFT Marketing Strategy: Focuses on influencer collaborations, social media marketing, SEO, and NFT listing calendars. It also stresses community engagement and using email newsletters to keep users informed about NFT drops. [4] Medium’s NFT Marketing Overview: Discusses comprehensive strategies such as content marketing, utilizing Telegram and Discord for community engagement, and influencer partnerships for targeted promotions. [5] Rarible’s NFT Marketing Tips: Provides advice on how to promote NFTs on various platforms like Twitter and Instagram, using organic methods as well as paid advertisements to maximize reach. [6] These resources collectively offer a range of NFT marketing strategies, covering SEO, influencer marketing, community-building, and advertising. [7] https://pinkbrains.io/nft-marketing-guide-7-strategies-examples/ [8] https://ninjapromo.io/nft-marketing-guide [9] https://www.growthchain.io/blog/nft-marketing-strategy

Copyright

Copyright © 2024 Sharvari Raut, Shruti Thakare, Yamini Pohane, Bhramari Deharkar. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64925

Publish Date : 2024-10-31

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online