Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

The Ripple Effect of FDI: A Deep Dive into Indian Economic Growth

Authors: Nithyhashree S, Dr. M. Jegadeeshwaran

DOI Link: https://doi.org/10.22214/ijraset.2025.65925

Certificate: View Certificate

Abstract

India is one of the fastest-growing economies with enormous investment opportunities, especially for foreign investors. Emerging technology, political stability, infrastructure, laws and so on attract the flow of Foreign Direct Investment in India. According to the Economic Survey 2024: The decline in Global Foreign Direct Investment has impacted the flow of FDI into India, compared to FY2023-FY2024. This research paper aims to analyze and examine the trend, impact, and relationship of FDI on selective sectors of NSE and the factors that affect the FDI inflow in India using statistical tools like Descriptive statistics, Correlation, and Regression Analysis. The outcome of the research concluded that even though FDI plays a pivotal role in the economy’s growth it does have only a moderate relationship and slight impact on the factors and sectors of the economy.

Introduction

I. INTRODUCTION

Foreign Direct Investment (FDI) plays an influential role in economic growth of a country by shaping the country’s economic landscape. As per United Nations Conference on Trade and Development (UNCTAD) World Investment Report 2024, “FDI flows in India has decreased 43% in 2023 and Global FDI flow has also fell 2% in 2023 due to the stress of Trade and Geopolitical issues that resulted in a slow global economy” says the report.

Over the past Decennium, India has become the most attractive country for FDI by its emerging digital technologies, industries, improved Government policies and developed market. The period of 2013-2023 has made an enormous transition in our economic landscape. Start-up Initiatives like “MAKE IN INDIA” have resulted in increased inflows of FDI in various sectors.

The total FDI inflow in India for the Financial Year 2023-2024 is $70.95 Billion and the FDI equity inflow was $44.42 Billion. Among those inflows Mauritius, Singapore, the USA, Netherlands, and Japan were the top 5 countries in FDI equity inflows. In harmony with Sector-wise, the top 5 inflows were into the Service sector, computer & hardware, Trading, Telecommunication and Automobile sector. Based on the assertion of Finance Minister, Nirmala Sithraman, India is aiming to accomplish an objective of attaining $100 Billion in FDI inflows for the upcoming period from the $70 Billion that was made during the Financial year 2023-24 by introducing more liberalization norms in Foreign Investments.

II. REVIEW OF LITERATURE

Girish et al., (2022) found that the liberalization of foreign direct investment in India's essential utilities sector has resulted in a connection between economic growth, power consumption, and foreign direct investment. From the standpoint of a policymaker, the research study sheds insight on the Indian electrical industry and the regulations controlling foreign direct investment. According to the study, policies should support power providers in providing the best possible service to both commercial and residential customers in order to boost economic growth. To meet its economic growth targets, India needs top-notch infrastructure, fair and efficient regulatory procedures, rising living standards for all socioeconomic strata, a healthy environment that is conducive to business, and a government that is consistent.

Kumar et al., (2022) Examine how the floods affected India's economic development between 1980 and 2019, accounting for foreign aid and foreign direct investment. The study found a long-term correlation between floods, foreign aid, economic growth, and FDI. According to the ARDL and FMOLS models, floods had a short-term and long-term negative impact on India's economy. Foreign aid and FDI also contribute to economic growth. The study suggests that the Indian government ought to spend more money on research and development related to flood management. To effectively implement flood prevention measures both before and after a storm, institutions must be strengthened. Water management and disaster finance has to be given top priority. Foreign investment is encouraged by fortifying international ties.

Ling et al., (2021) examined the connection between rising FDI levels and developing nations' economic expansion. The study's findings show that FDI has a favorable impact on economic growth. There will be a rise in the amount of foreign direct investments, which will speed up the rate of economic growth in emerging nations. The study showed that the rate of economic growth and unemployment has a negative association, but both FDI and economic growth in developing nations had a positive link.

A. Statement of the problem

In accordance to the statement given by the Government of India, India amasses the highest FDI inflows from Singapore for the year 2023-24 by obtaining 31.55% of equity inflows and Mauritius leads as the second largest investor. But there was also a decrease in the flows of FDI compared to the previous financial year. And these were due to trade and political pressures that occurred during this period. FDI leads to various changes that are to be made on economic indicators of a country and various sectors of an economy. This research aims to study and investigate the impact of FDI on various sectors of the economy and focusing on the factors that affect the inflow of FDI in India. This study is analyzed using statistical tools such as Descriptive Statistics, Correlation and Regression.

B. Research Question

- What are recent trends of FDI on India’s growth?

- How has FDI impacted on selective sectors on Indian Economy?

- What are the factors affecting the inflows of FDI?

C. Objectives of the Study

- To analyse the recent trend of FDI among top nations.

- To examine effects of FDI inflow in selective sectors of NSE.

- To study the factor affecting FDI in flow in India.

D. Hypothesis of the Study

H1: There is no significant relationship between FDI on selective sectors of NSE

H2: There is no significant effect of FDI on selective sectors of NSE.

H3: There is no significant relationship between factors affecting FDI inflows in India

H4: There is no significant impact of factors affecting FDI inflows in India.

III. RESEARCH METHODOLOGY

This research is analytical. Analysis is based on the secondary data. Data is collected from the official website of World Bank of India, Reserve Bank of India. This period of the study covers from 2013-2023. The analyses are made using the statistical tools such as Descriptive Statistics, Correlation analysis and Regression analysis.

IV. ANALYSIS AND INTERPRETATION

TABLE 1.1: Trend analysis of FDI Inflows in India for the period of 2013 - 2023

|

YEAR |

SINGAPORE |

TREND |

MAURITIUS |

TREND |

USA |

TREND |

|

2013-14 |

4.42 |

2.55 |

3.70 |

3.95 |

6.17 |

2.29 |

|

2014-15 |

5.14 |

4.38 |

5.88 |

4.34 |

1.98 |

2.98 |

|

2015-16 |

1.25 |

6.22 |

7.45 |

4.73 |

4.12 |

3.67 |

|

2016-17 |

6.53 |

8.05 |

1.34 |

5.13 |

2.14 |

4.36 |

|

2017-18 |

9.27 |

9.88 |

1.34 |

5.52 |

1.97 |

5.04 |

|

2018-19 |

16.2 |

11.72 |

8.1 |

5.91 |

3.1 |

5.73 |

|

2019-20 |

14.7 |

13.55 |

8.2 |

6.30 |

4.1 |

6.42 |

|

2020-21 |

17.4 |

15.39 |

5.6 |

6.69 |

13.8 |

7.11 |

|

2021-22 |

15.9 |

17.22 |

9.4 |

7.08 |

10.5 |

7.80 |

|

2022-23 |

17.2 |

19.05 |

6.1 |

7.47 |

6 |

8.48 |

|

NETHERLANDS |

TREND |

JAPAN |

TREND |

UAE |

TREND |

GERMANY |

TREND |

|

1.16 |

2.02 |

1.80 |

2.38 |

2.39 |

5.07 |

6.50 |

8.77 |

|

2.15 |

2.28 |

2.02 |

2.36 |

3.27 |

4.74 |

9.42 |

7.66 |

|

2.33 |

2.54 |

1.82 |

2.33 |

9.61 |

4.40 |

9.27 |

6.56 |

|

3.23 |

2.80 |

4.24 |

2.30 |

6.45 |

4.06 |

8.45 |

5.46 |

|

2.68 |

3.06 |

1.31 |

2.27 |

4.08 |

3.73 |

1.10 |

4.35 |

|

3.9 |

3.31 |

3.0 |

2.24 |

0.90 |

3.39 |

0.9 |

3.25 |

|

6.5 |

3.57 |

3.2 |

2.22 |

0.3 |

3.06 |

0.5 |

2.15 |

|

2.8 |

3.83 |

1.9 |

2.19 |

4.2 |

2.72 |

0.7 |

1.05 |

|

4.6 |

4.09 |

1.5 |

2.16 |

1 |

2.38 |

0.7 |

-0.06 |

|

2.5 |

4.35 |

1.8 |

2.13 |

3.4 |

2.05 |

0.5 |

-1.16 |

|

UK |

TREND |

CANADA |

TREND |

SOUTH KOREA |

TREND |

|

1.11 |

2.91 |

1.10 |

2.87 |

1.89 |

2.85 |

|

1.89 |

2.74 |

1.53 |

2.59 |

1.38 |

2.57 |

|

8.42 |

2.57 |

5.20 |

2.30 |

2.41 |

2.30 |

|

1.30 |

2.40 |

3.20 |

2.01 |

4.66 |

2.02 |

|

0.72 |

2.23 |

2.74 |

1.73 |

2.93 |

1.74 |

|

1.4 |

2.06 |

0.6 |

1.44 |

1.0 |

1.47 |

|

1.3 |

1.89 |

0.2 |

1.16 |

0.8 |

1.19 |

|

2.0 |

1.72 |

0.0 |

0.87 |

0.4 |

0.92 |

|

1.6 |

1.55 |

0.5 |

0.59 |

0.3 |

0.64 |

|

1.7 |

1.38 |

0.8 |

0.30 |

0.3 |

0.37 |

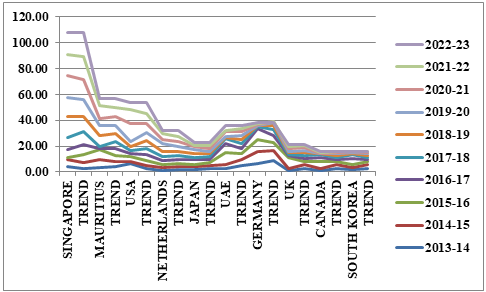

Figure 1. Trend analysis of FDI inflows in India

Source: Computed using MS-EXCEL

Table 1.1 shows the trend of the country-wise FDI inflows in India for the period of 2013-2023. It is observed that over this period, the major contributors are Singapore, Mauritius, the USA, and the Netherlands which remained growing over the upcoming years and created a increasing and positive trend. The emerging regions such as Japan show a stable trend, the UAE shows significant decline from 2019-2020 to 2022-23. The small and consistent contributors like the UK, Canada, and Germany show minor variations over the years with declining trends over the Upcoming years. Further, South Korea is small yet shows a stable and minor variations with a moderate trend in inflows of FDI.

TABLE 2.1: Descriptive statistics for FDI and Selective sectors of NSE for the period of 2013 - 2023

|

|

Mean |

Std. Deviation |

Skewness |

Kurtosis |

||

|

Statistic |

Statistic |

Statistic |

Std. Error |

Statistic |

Std. Error |

|

|

NiftyFS |

2790874.77 |

1224111.232 |

.386 |

.661 |

-1.154 |

1.279 |

|

NiftyIT |

4249744.24 |

2220699.390 |

.860 |

.661 |

-1.045 |

1.279 |

|

NiftyM |

866004.81 |

377540.028 |

1.057 |

.661 |

-.372 |

1.279 |

|

NiftyB |

6332688.74 |

2512704.916 |

.391 |

.661 |

-.802 |

1.279 |

|

NiftyOG |

1193109.22 |

481255.433 |

.536 |

.661 |

-1.001 |

1.279 |

|

NiftyP |

2634348.35 |

572887.917 |

-.029 |

.661 |

-1.163 |

1.279 |

|

NiftyAuto |

2301705.51 |

677840.227 |

.369 |

.661 |

.429 |

1.279 |

|

NiftyFMCG |

7105291.29 |

2530430.656 |

.804 |

.661 |

.100 |

1.279 |

|

FDI |

1.6536 |

.41683 |

-.223 |

.661 |

1.445 |

1.279 |

Source: Computed using SPSS

Table 2.1 Descriptive statistics for Foreign Direct Investment on specific sectors in India for the period 2013 – 2023. The mean value is found to be high in the NiftyFMCG sector with the value of 7105291.29. The value of skewness is positive for the sectors like NiftyFS, NiftyIT, NiftyM, NiftyB, NiftyOG, NiftyAuto and NiftyFMCG i.e., the tail on the right side of the distribution is larger. The value of skewness is negative for the sector NiftyP and Foreign Direct Investment i.e., the tail on the left side is shorter. The value of Kurtosis for the sectors like NiftyFS, NiftyIT, NiftyM, NiftyB, NiftyOG and NiftyP is negative and the distribution is platykurtik, for NiftyAuto and NiftyFMCG is positive and Foreign Direct Investment has peaked here with more than 1.

H1: There is no significant relationship between FDI on selective sectors of NSE

TABLE 2.2: Correlation Analysis for FDI and selective sectors of NSE for the period of 2013-2023

|

Correlations |

|||||||||

|

|

NiftyFS |

NiftyIT |

NiftyM |

NiftyB |

NiftyOG |

NiftyP |

NiftyAuto |

NiftyFMCG |

FDI |

|

Nifty FS |

1 |

|

|

|

|

|

|

|

|

|

Nifty IT |

.958** |

1 |

|

|

|

|

|

|

|

|

Nifty M |

.882** |

.903** |

1 |

|

|

|

|

|

|

|

Nifty B |

.993** |

.933** |

.895** |

1 |

|

|

|

|

|

|

Nifty OG |

.984** |

.957** |

.927** |

.980** |

1 |

|

|

|

|

|

Nifty P |

.708* |

.787** |

.687* |

.699* |

.689* |

1 |

|

|

|

|

Nifty Auto |

.812** |

.744** |

.858** |

.860** |

.830** |

.753** |

1 |

|

|

|

Nifty FMCG |

.980** |

.927** |

.900** |

.983** |

.968** |

.687* |

.849** |

1 |

|

|

FDI |

-.506 |

-.497 |

-.778** |

-.555 |

-.552 |

-.290 |

-.640* |

-.573 |

1 |

|

**. Correlation is significant at the 0.01 level (2-tailed). |

|||||||||

|

*. Correlation is significant at the 0.05 level (2-tailed). |

|||||||||

Source: Computed using SPSS

Table 2.2 shows the Relationship between Foreign Direct Investment and specified sectors of National Stock Exchange. There is a positive relationship between Nifty FS and Nifty IT, Nifty M, NiftyB, NiftyOG, NiftyP, NiftyAuto, NiftyFMCG. Further NiftyIT has a strong positive relationship with NiftyM, NiftyB, NiftyOG, NiftyP, NiftyAuto, NiftyFMCG. Then NiftyM has a positive relationship with NiftyB, NiftyOG, NiftyP, NiftyAuto, NiftyFMCG and has negative relationship with FDI. Then NiftyB has a positive relationship with NiftyOG, NiftyP, NiftyAuto, NiftyFMCG.

Then NiftyOG has a positive relationship with NiftyP, NiftyAuto, NiftyFMCG. Then NiftyP has a positive relationship with NiftyAuto, NiftyFMCG. Then NiftyAuto has a positive relationship with NiftyFMCG and a negative relationship with FDI. Further NiftyFMCG has a positive relationship with FDI. Therefore, it can be concluded that the null hypothesis is rejected for NiftyM and NiftyAuto and accepted for NiftyFS and NiftyIT, NiftyB, NiftyOG, NiftyP, NiftyFMCG.

H2: There is no significant effect of FDI on selective sectors of NSE.

Regression analysis for Foreign Direct Investment and selective sectors of NSE for the period of 2013 – 2023

TABLE 2.3: Model summary and ANOVA for FDI and selective sectors of NSE for the period of 2013-2023

|

Model Summaryb |

ANOVA |

||||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Durbin Watson |

F |

Sig. |

|

Nifty FS |

.506a |

.256 |

.173 |

1113073.044 |

.286 |

3.095 |

.112b |

|

Nifty IT |

.497a |

.247 |

.163 |

2031650.473 |

.433 |

2.948 |

.120b |

|

Nifty M |

.778a |

.605 |

.561 |

250026.061 |

.792 |

13.801 |

.005b |

|

Nifty B |

.555a |

.308 |

.231 |

2203584.221 |

.319 |

4.002 |

.076b |

|

Nifty OG |

.552a |

.305 |

.228 |

422933.307 |

.416 |

3.948 |

.078b |

|

Nifty P |

.290a |

.084 |

-.018 |

577966.986 |

.835 |

.825 |

.387b |

|

Nifty Auto |

.640a |

.410 |

.344 |

549042.270 |

.689 |

6.242 |

.034b |

|

Nifty FMCG |

.573a |

.329 |

.254 |

2185653.851 |

.436 |

4.404 |

.065b |

|

a. Predictors: (Constant), FDI |

|

|

|||||

Source: Computed using SPSS

Table 2.3 reflects the model summary and ANOVA of selective sectors of NSE and FDI. In Model Summary, Keeping NiftyFS, NiftyIT, NiftyM, NiftyB, NiftyOG, NiftyP, NiftyAuto, NiftyFMCG as dependent variable, which denotes that there is strong positive relationship for the sectors such as NiftyFS, NiftyM, NiftyB, NiftyOG, NiftyAuto, NiftyFMCG with R variable as .5 and >.5, whereas NiftyIT and NiftyP denotes a negative relationship with R variable as <.5. The Adjusted R square is <5 for the sectors like NiftyFS, NiftyIT, NiftyB, NiftyOG, NiftyP, NiftyAuto, NiftyFMCG which means the model is not good to fit the analysis and .5 for NiftyM representing that the model is good to fit the analysis. The value of Durbin Watson statistics is less than 2 for all the models which represents a positive autocorrelation. Further in ANOVA, the significant value is greater than 0.05 whereas the null hypothesis is accepted, concluding that there is no impact of FDI on NiftyFS, NiftyIT, NiftyB, NiftyOG, NiftyP and NiftyFMCG and whereas the significant value is lesser than 0.05 whereas the null hypothesis is rejected, concluding that there is a impact of FDI on NiftyM and NiftyFMCG.

TABLE 2.4: Coefficient for FDI and selective sectors of NSE for the period of 2013-2023

|

Coefficientsa |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

|

(Constant) |

5247391.267 |

1436168.467 |

|

3.654 |

.005 |

|

Nifty FS |

-1485516.958 |

844441.631 |

-.506 |

-1.759 |

.112 |

|

|

|

Nifty IT |

-2646250.980 |

1541327.632 |

-.497 |

-1.717 |

.120 |

|

|

Nifty M |

-704673.294 |

189684.240 |

-.778 |

-3.715 |

.005 |

|

|

Nifty B |

-3344537.817 |

1671766.524 |

-.555 |

-2.001 |

.076 |

|

|

Nifty OG |

-637550.131 |

320861.684 |

-.552 |

-1.987 |

.078 |

|

|

Nifty P |

-398272.352 |

438479.206 |

-.290 |

-.908 |

.387 |

|

|

Nifty Auto |

-1040674.823 |

416535.242 |

-.640 |

-2.498 |

.034 |

|

|

Nifty FMCG |

-3479672.508 |

1658163.508 |

-.573 |

-2.099 |

.065 |

Source: Computed using SPSS

Table 2.4 shows the Co-efficient for the selective sectors of NSE and FDI. It is analysed that the significant value is greater than 0.05 whereas the null hypothesis is accepted, concluding that there is no impact of FDI on NiftyFS, NiftyIT, NiftyB, NiftyOG, NiftyP and NiftyFMCG and whereas the significant value is lesser than 0.05 whereas the null hypothesis is rejected, concluding that there is a impact of FDI on NiftyM and NiftyFMCG.

H3: There is no significant relationship between factors affecting FDI inflows in India

TABLE 3.1: Correlation Analysis for FDI and factors affecting FDI inflows in India for the period of 2013-2023

|

|

GDP |

Export of goods |

Import of goods |

Broad money |

Tax revenue |

Reserve and related items |

FDI |

|

GDP |

1 |

|

|

|

|

|

|

|

Export of goods |

-.046 |

1 |

|

|

|

|

|

|

Import of goods |

-.048 |

.951** |

1 |

|

|

|

|

|

Broad money |

-.746** |

-.355 |

-.362 |

1 |

|

|

|

|

Tax revenue |

-.793** |

.029 |

.138 |

.434 |

1 |

|

|

|

Reserve and related items |

-.032 |

-.463 |

-.632* |

.497 |

-.357 |

1 |

|

|

FDI |

-.527 |

-.470 |

-.553 |

.649* |

.162 |

.399 |

1 |

|

**. Correlation is significant at the 0.01 level (2-tailed). |

|||||||

|

*. Correlation is significant at the 0.05 level (2-tailed). |

|||||||

Source: Computed using SPSS

Table 3.1 shows the Relationship between Foreign Direct Investment and various factors affecting FDI. There is a negative relationship between GDP and Export of goods, Import of goods, Broad money, Tax revenue, Reserve and related items and FDI. Further Export of goods has a strong positive relationship with Import of goods and Tax revenue and has a negative relationship with Broad money, Reserve and related items and FDI. Then Import of goods has a positive relationship with Tax revenue and has negative relationship with Broad money, Reserve and related items and FDI. Then Broad money has a positive relationship with Tax revenue, Reserve and related items and FDI. Then Tax revenue has a negative relationship with Reserve and related items and a positive relationship with FDI. And Further, Reserve and related items has a positive relationship with FDI. Therefore, it can be concluded that the null hypothesis is rejected for Broad money and accepted for GDP, Export of goods, Import of Goods, Tax Revenue and Reserve Related Items.

H4: There is no significant impact of factors affecting FDI inflows in India.

Regression analysis for Foreign Direct Investment and factors affecting FDI inflows in India for the period of 2013 – 2023

TABLE 3.2: Model summary and ANOVA for FDI and factors affecting FDI inflows in India for the period of 2013-2023

|

Model Summaryb |

ANOVA |

||||||

|

Model |

R |

R Square |

Adjusted R Square |

Std. Error of the Estimate |

Durbin-Watson |

F |

Sig. |

|

GDP |

.527a |

.278 |

.197 |

52331820972230.22000 |

.383 |

3.459 |

.096b |

|

Export of goods |

.470a |

.221 |

.135 |

2.09757 |

.759 |

2.557 |

.144b |

|

Import of goods |

.553a |

.305 |

.228 |

2.43729 |

1.091 |

3.958 |

.078b |

|

Broad money |

.649a |

.421 |

.357 |

25.55268 |

2.026 |

6.554 |

.031b |

|

Tax revenue |

.162a |

.026 |

-.082 |

6.00729 |

.526 |

.242 |

.635b |

|

Reserve and related items |

.399a |

.159 |

.066 |

34918524127.60379 |

2.390 |

1.707 |

.224b |

|

a. Predictors: (Constant), FDI |

|||||||

Source: Computed using SPSS

Table 2.3 reflects the model summary and ANOVA of factors affecting FDI inflows and FDI. In Model Summary, Keeping GDP, Export of goods, Import of goods, Broad money, Tax revenue and Reserve and related items as dependent variable, which denotes that there is strong positive relationship for the factors such as GDP, Import of goods and Broad money with R variable as .5 and >.5, whereas Export of good, Tax revenue and Reserve and related items denotes a negative relationship with R variable <.5. The Adjusted R square is <5 for all the factors such as GDP, Export of goods, Import of goods, Broad money, Tax revenue and Reserve and related items which means the model is not good to fit the analysis. The value of Durbin Watson statistics is less than 2 for the model GDP, Export of goods, Import of goods and Tax revenue which represents a positive autocorrelation and greater than 2 which represents no autocorrelation. Further in ANOVA, the significant value is greater than 0.05 whereas the null hypothesis is accepted, concluding that there is no impact of FDI on GDP, Export of goods, Import of goods, Tax revenue and Reserve and related items; whereas the significant value is lesser than 0.05 whereas the null hypothesis is rejected, concluding that there is a impact of FDI on Broad money.

TABLE 3.3: Coefficient for FDI and factors affecting FDI inflows in India for the period of 2013-2023

|

Coefficientsa |

||||||

|

Model |

Unstandardized Coefficients |

Standardized Coefficients |

t |

Sig. |

||

|

B |

Std. Error |

Beta |

||||

|

|

(Constant) |

311883374476945.100 |

67522353114521.040 |

|

4.619 |

.001 |

|

GDP |

-73843801973514.670 |

39701948136211.980 |

-.527 |

-1.860 |

.096 |

|

|

Export of goods |

-2.545 |

1.591 |

-.470 |

-1.599 |

.144 |

|

|

Import of goods |

-3.679 |

1.849 |

-.553 |

-1.990 |

.078 |

|

|

Broad money |

49.628 |

19.386 |

.649 |

2.560 |

.031 |

|

|

Tax revenue |

2.240 |

4.557 |

.162 |

.492 |

.635 |

|

|

Reserve and related items |

34610713148.495 |

26491213341.169 |

.399 |

1.306 |

.224 |

|

Source: Computed using SPSS

Table 3.3 shows the Co-efficient for the factors affecting FDI inflows and FDI. It is analyzed that the significant value is greater than 0.05 whereas the null hypothesis is accepted, concluding that there is no impact of FDI on NiftyFS, NiftyIT, NiftyB, NiftyOG, NiftyP and NiftyFMCG and whereas the significant value is lesser than 0.05 whereas the null hypothesis is rejected, concluding that there is a impact of FDI on NiftyM and NiftyFMCG.

V. FINDINGS

- It can be concluded that the null hypothesis is rejected for Nifty M and Nifty Auto concluding that there is a strong negative relationship among Foreign Direct Investment inflows and the hypothesis is accepted for Nifty FS and Nifty IT, Nifty B, Nifty OG, Nifty P, Nifty FMCG explaining that there is no relationship prevailing between the selective sectors and FDI.

- There is no impact of Foreign Direct Investment on Nifty Financial Services.

- There is no impact of Foreign Direct Investment on Nifty IT.

- There is impact of Foreign Direct Investment on Nifty M.

- There is no impact of Foreign Direct Investment on Nifty B.

- There is no impact of Foreign Direct Investment on Nifty OG.

- There is no impact of Foreign Direct Investment on Nifty P.

- There is impact of Foreign Direct Investment on Nifty Auto.

- There is no impact of Foreign Direct Investment on Nifty FMCG.

- It can be concluded that the null hypothesis is rejected for Broad money concluding that there is a strong negative relationship with Foreign Direct Investment and hypothesis is accepted for GDP, Export of goods, Import Of Goods, Tax Revenue And Reserve Related Items that there is no relationship prevailing between the factors affecting Foreign Direct Investment inflows and Foreign Direct Investment.

- There is no impact of Foreign Direct Investment on GDP.

- There is no impact of Foreign Direct Investment on Export of goods.

- There is no impact of Foreign Direct Investment on Import of goods.

- There is impact of Foreign Direct Investment on Broad money.

- There is no impact of Foreign Direct Investment on Tax revenue.

- There is no impact of Foreign Direct Investment on Reserve and related items.

Conclusion

According to the survey by World Investment report, India ranked 15th in terms of FDI inflows among top 20 economies for the year 2023. Whereas, the Financial Year 2024 reports a decline in FDI inflows to the service sector and therefore the overall inflows towards India is comparatively less. So this study is mainly focusing on the impact and its relationship of FDI inflows with respective selected sectors and the macroeconomic variable, where it is evident that FDI is negatively correlated with Nifty Metal and Nifty Auto, other service sectors don’t have any relationship with FDI even though all the service sectors have their inflows. When it comes to macroeconomic indicators the Broad money has positive relationship due to the direct effect of FDI on Broad money, when it comes to the impact of FDI on macroeconomic variables again Broad money alone is having its impact with FDI. India is a hub of numerous industrial zones, workforce, low labor cost which is the main factor making FDI attractive towards India. Whereas, the results of the study make us clearly understand the true picture of the FDI’s impact on service sector as well as economy, concluding that how well it is related to the growth of service sector and the economy.

References

[1] https://www.rbi.org.in/Scripts/AnnualReportPublications.aspx?Id=1424 [2] https://databank.worldbank.org/source/world-development-indicators [3] https://www.ibef.org/economy/foreign-direct-investment [4] https://www.thehindu.com/business/Economy/india-receives-highest-fdi-from-singapore-in-2023-24-mauritius-second-biggest-investor-government-data/article68242434.ece [5] https://www.livemint.com/economy/economic-survey-2024-indias-fdi-inflows-slows-down-11721632363987.html [6] https://ijcrt.org/papers/IJCRT2211088.pdf

Copyright

Copyright © 2025 Nithyhashree S, Dr. M. Jegadeeshwaran. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET65925

Publish Date : 2024-12-14

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online