Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

A Comparative Study of Sampling Techniques for Imbalanced Credit Card Fraud Detection

Authors: Shyam Penumala, Dr. K. Santhi Sree

DOI Link: https://doi.org/10.22214/ijraset.2024.63637

Certificate: View Certificate

Abstract

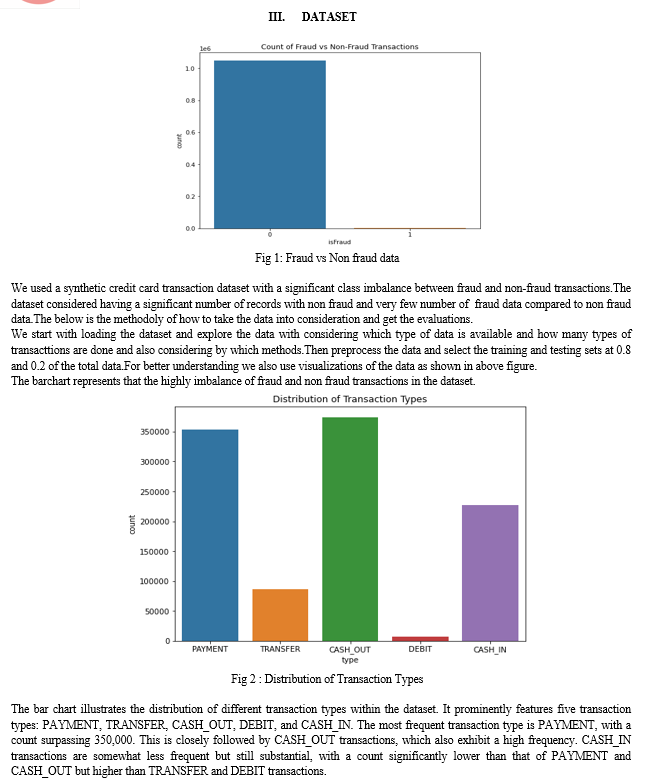

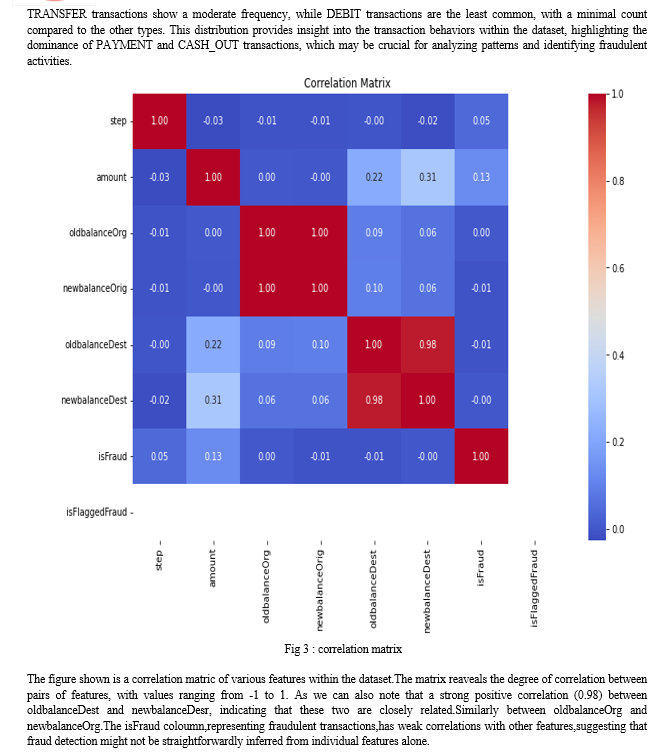

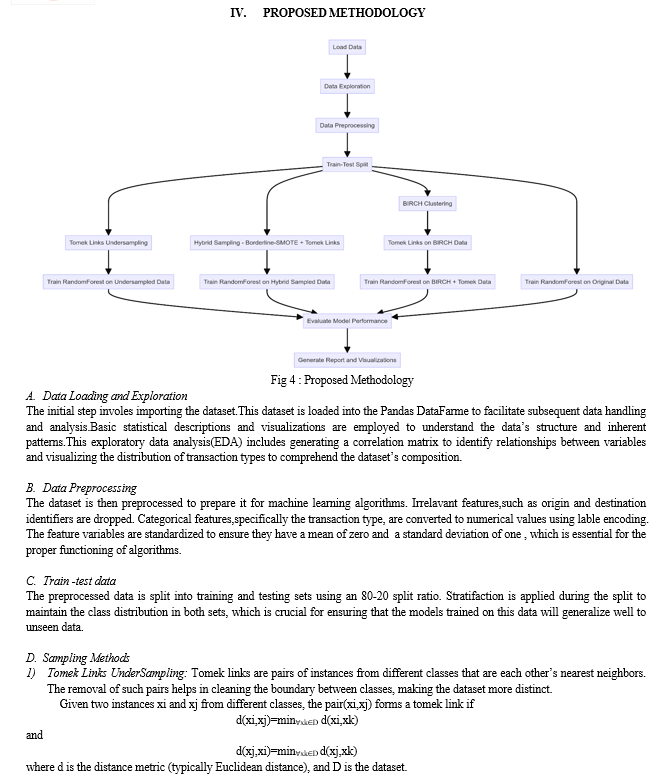

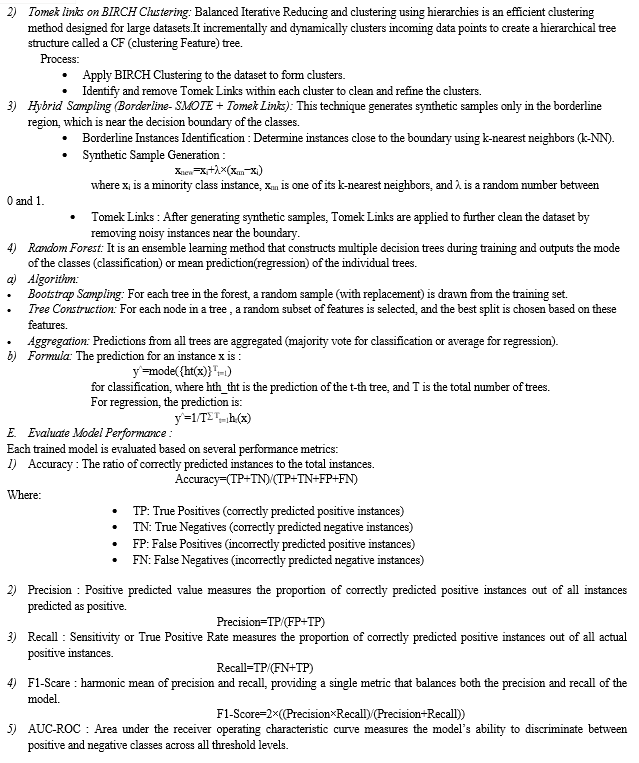

Credit card fraud detection remains a critical challenge for financial institutions due to the highly imbalanced nature of the data, where fraudulent transactions are vastly outnumbered by legitimate ones. This study presents a comparative analysis of various sampling techniques to address this imbalance and enhance fraud detection performance. We explore and evaluate methods including Tomek Links Undersampling, Borderline-SMOTE, and hybrid techniques combining Borderline-SMOTE with Tomek Links and BIRCH Clustering. Using a synthetic dataset from the PaySim, we assess the effectiveness of these techniques across multiple machine learning models. Our results demonstrate that hybrid approaches, particularly those integrating both oversampling and undersampling, significantly improve classification metrics such as F1-score, ROC-AUC, and precision-recall. This comprehensive evaluation provides valuable insights into the strengths and limitations of each method, offering practical guidelines for selecting appropriate sampling strategies in fraud detection systems.

Introduction

I. INTRODUCTION

The rapid growth of online transactions has brought unprecedented convenience to consumers and businesses alike. However, it has also led to a surge in fraudulent activities, posing significant challenges to financial institutions. Credit card fraud detection has thus become a critical area of research, aiming to identify and prevent unauthorized transactions while minimizing false positives. One of the primary challenges in this domain is the highly imbalanced nature of fraud datasets, where legitimate transactions vastly outnumber fraudulent ones. This imbalance often leads to suboptimal performance of conventional machine learning models, which tend to be biased towards the majority class.

To address this issue, various sampling techniques have been proposed to balance the datasets before applying machine learning algorithms. These techniques can be broadly categorized into undersampling, oversampling, and hybrid methods. Undersampling reduces the number of majority class instances, whereas oversampling increases the minority class instances. Hybrid methods combine both approaches to leverage their complementary strengths. This study aims to conduct a comparative analysis of different sampling techniques, including Tomek Links Undersampling, Borderline-SMOTE, and hybrid methods combining Borderline-SMOTE with Tomek Links and BIRCH Clustering, to evaluate their effectiveness in detecting credit card fraud.

By utilizing a Synthetic dataset from the Paysim data, we systematically evaluate the performance of these sampling techniques across multiple machine learning models. Our evaluation metrics include F1-score, ROC-AUC, and precision-recall, which provide a comprehensive assessment of model performance in the presence of imbalanced data. The findings of this study offer valuable insights into the relative strengths and limitations of each sampling method, guiding practitioners in selecting the most appropriate technique for their fraud detection systems.

II. RELATED WORK

The problem of class imbalance in credit card fraud detection has garnered significant attention in recent years. Various sampling techniques have been proposed to address the challenges posed by skewed datasets.

Alamri and Ykhlef proposed a hybrid sampling method combining Tomek links, BIRCH clustering, and Borderline-SMOTE to handle imbalanced credit card data. Their method initially applies Tomek links to remove majority class instances that are borderline or noisy. This is followed by BIRCH clustering to group similar instances and finally, Borderline-SMOTE is used to oversample the minority class within these clusters. The approach showed superior performance compared to baseline methods, achieving an F1-score of 85.20% using a Random Forest classifier [1].

Liu et al. introduced the Synthetic Minority Over-sampling Technique (SMOTE), which generates synthetic examples by interpolating between minority class instances. While SMOTE effectively addresses class imbalance, it can lead to overfitting, especially when combined with oversampling techniques that do not account for the presence of noise or the structure of the data. To mitigate this, extensions such as Borderline-SMOTE and SMOTE-ENN have been proposed. Borderline-SMOTE focuses on generating synthetic instances near the decision boundary, whereas SMOTE-ENN integrates edited nearest neighbors (ENN) to remove noise from the majority class [2].

Other researchers have explored ensemble methods for fraud detection. Chen et al. utilized a combination of boosting and bagging techniques to enhance the detection of fraudulent transactions. Their approach leverages the strengths of multiple weak classifiers to improve overall performance.

Ensemble methods, when combined with sampling techniques like SMOTE or undersampling, have shown promising results in dealing with imbalanced datasets [3].

Another notable approach is the use of cost-sensitive learning, where different misclassification costs are assigned to different classes to bias the learning process towards the minority class. Elkan discussed the theoretical foundations of cost-sensitive learning and its application to imbalanced datasets, highlighting its potential to improve classification performance in fraud detection scenarios [4].

In the realm of clustering-based methods, BIRCH (Balanced Iterative Reducing and Clustering using Hierarchies) has been applied to preprocess data before applying sampling techniques. BIRCH effectively handles large datasets by creating a compact representation of the data, which can then be used to guide the oversampling process. This method helps in maintaining the structure of the minority class while reducing the computational complexity of the sampling process [5].

Hybrid sampling methods combining both oversampling and undersampling techniques have also shown promise. Shamsudin et al. conducted a comparative study on credit card fraud detection, demonstrating that a combination of these techniques can improve classification performance by balancing the dataset more effectively [6]. Soh and Yusuf employed similar methods to predict credit card fraud, reinforcing the efficacy of hybrid approaches in managing imbalanced data [7].

Kaur and Gosain compared the behavior of oversampling and undersampling methods under noisy conditions, concluding that a combination of both techniques offers better resilience and performance in fraud detection [8]. Qaddoura and Biltawi further explored different oversampling techniques, highlighting their impact on improving fraud detection rates in imbalanced class distributions [9].

Praveen Mahesh et al. provided a comparative analysis of data sampling and classification techniques, emphasizing the importance of selecting appropriate methods to enhance the detection of fraudulent transactions [10]. Rtayli proposed an efficient deep learning classification model specifically designed for predicting credit card fraud on skewed data, showcasing the potential of advanced neural networks in this domain [11].

Akinwamide's study on predicting fraudulent transactions using machine learning techniques highlighted the significance of model selection and feature engineering in handling imbalanced datasets [12]. Li and Xie introduced a behavior-cluster based imbalanced classification method, demonstrating how clustering techniques can be integrated with sampling methods to improve fraud detection accuracy [13].

Esenogho et al. utilized a neural network ensemble with feature engineering to enhance credit card fraud detection, illustrating the benefits of combining multiple models and data preprocessing techniques [14]. Yi et al. proposed ASN-SMOTE, a synthetic minority oversampling method with adaptive qualified synthesizer selection, to address the challenges of imbalanced data in fraud detection [15].

Ullastres and Latifi's research on ensemble learning algorithms for credit card fraud detection highlighted the effectiveness of combining multiple classifiers to improve detection rates [16]. Zhu et al. introduced the NUS (Noisy-sample-removed undersampling scheme) to address imbalanced classification, demonstrating its application in fraud detection scenarios [17].

Lopez-Rojas et al. developed PaySim, a financial mobile money simulator for fraud detection, providing a realistic dataset for evaluating different fraud detection techniques [18]. Arfeen and Khan conducted an empirical analysis of machine learning algorithms for detecting fraudulent electronic fund transfers, reinforcing the importance of algorithm selection in handling imbalanced data [19].

Mondal et al. explored handling imbalanced data for credit card fraud detection, emphasizing the significance of integrating sampling techniques with advanced classifiers [20].

Conclusion

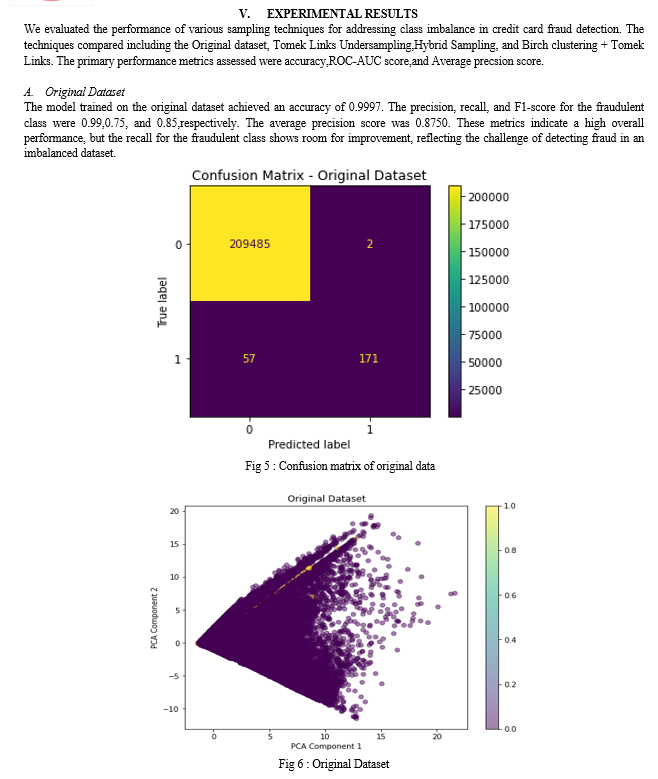

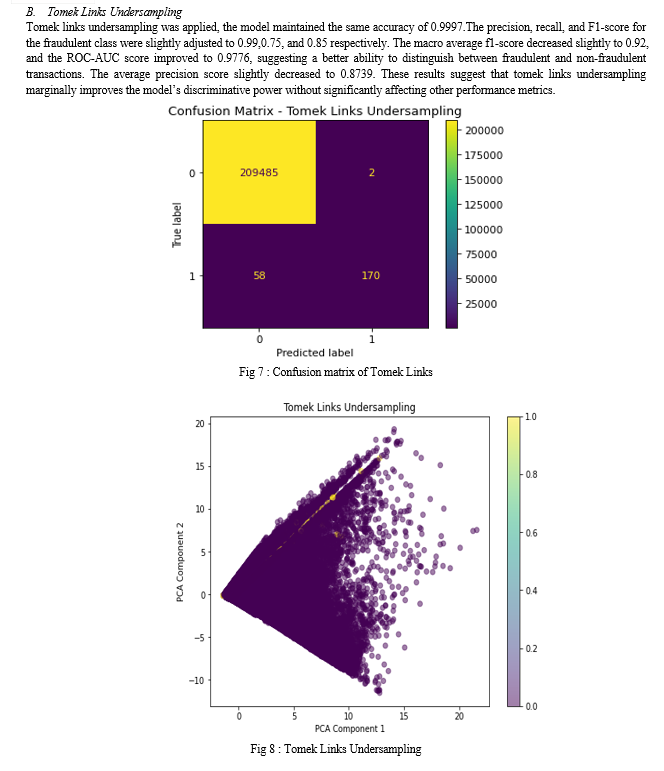

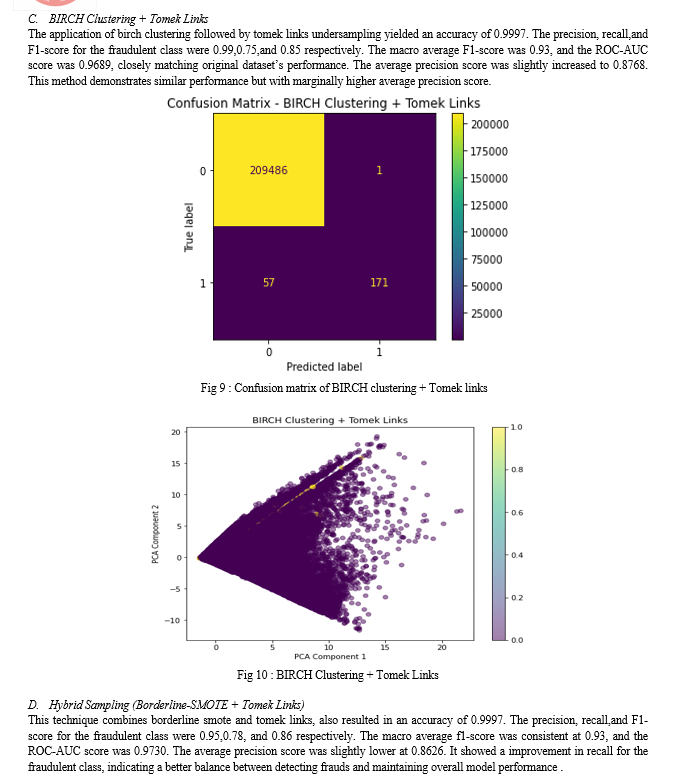

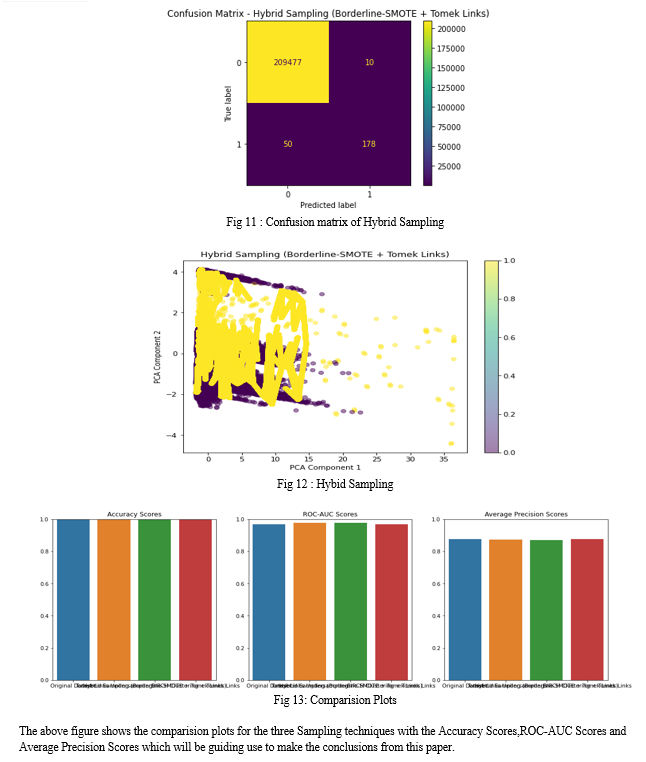

The experimental analysis conducted in this research aimed to evaluate the effectiveness of various sampling techniques in addressing class imbalance for credit card fraud detection. The methods assessed include the Original Dataset, Tomek Links Undersampling, Hybrid Sampling (Borderline-SMOTE + Tomek Links), and BIRCH Clustering + Tomek Links. The key performance metrics analyzed were Accuracy, ROC-AUC Score, and Average Precision Score. All methods demonstrated an exceptionally high accuracy of 0.9997, indicating that the models are highly effective in classifying transactions overall. However, more granular analysis of the performance metrics revealed important insights into the strengths and weaknesses of each sampling technique.The baseline model performed well but had room for improvement in recall for the fraudulent class, with a ROC-AUC score of 0.9688 and an average precision score of 0.8750. Tomek Links Undersampling slightly improved the ROC-AUC score to 0.9776, indicating enhanced ability to differentiate between fraudulent and non-fraudulent transactions. The average precision score decreased marginally to 0.8739, suggesting a trade-off between precision and discriminative power. Hybrid Sampling Borderline-SMOTE + Tomek Links showed a notable improvement in recall for the fraudulent class, achieving a ROC-AUC score of 0.9730 and an average precision score of 0.8626. This indicates a better balance in detecting frauds, though with a slight reduction in precision. BIRCH Clustering + Tomek Links performance was similar to the original dataset, with a marginally higher average precision score of 0.8768 and a ROC-AUC score of 0.9689. This demonstrates its robustness and slight advantage in precision. In conclusion, while all sampling techniques maintain a high level of overall accuracy, the choice of method depends on the specific requirements of the fraud detection application. Tomek Links undersampling enhances discriminative power, Hybrid Sampling improves recall, and BIRCH Clustering maintains a robust overall performance with slight gains in precision. These findings provide valuable insights into the trade-offs involved in selecting appropriate sampling techniques for imbalanced datasets, contributing to more effective and balanced fraud detection systems. This comprehensive analysis underscores the importance of tailored sampling strategies in handling imbalanced datasets, guiding future research and practical applications in the domain of credit card fraud detection.

References

[1] H. Shamsudin, U. K. Yusof, A. Jayalakshmi, and M. N. A. Khalid, ‘‘Combining oversampling and undersampling techniques for imbalanced classification: A comparative study using credit card fraudulent transaction dataset,’’ in Proc. IEEE 16th Int. Conf. Control Autom. (ICCA), Oct. 2020, pp. 803–808, doi: 10.1109/ICCA51439.2020.9264517. [2] W. W. Soh and R. Yusuf, ‘‘Predicting credit card fraud on a imbalanced data,’’ Int. J. Data Sci. Adv. Anal., vol. 1, no. 1, pp. 12–17, Apr. 2019. [Online]. Available: http://ijdsaa.com/index.php/welcome/article/view/3 [3] P. Kaur and A. Gosain, ‘‘Comparing the behavior of oversampling and undersampling approach of class imbalance learning by combining class imbalance problem with noise,’’ in Advances in Intelligent Systems and Computing. Singapore: Springer, 2017, pp. 23–30, doi: 10.1007/978-981-10-6602-3_3. [4] R. Qaddoura and M. M. Biltawi, ‘‘Improving fraud detection in an imbalanced class distribution using different oversampling techniques,’’ in Proc. Int. Eng. Conf. Electr., Energy, Artif. Intell. (EICEEAI), Nov. 2022, pp. 1–5, doi: 10.1109/EICEEAI56378.2022.10050500. [5] K. Praveen Mahesh, S. Ashar Afrouz, and A. Shaju Areeckal, ‘‘Detection of fraudulent credit card transactions: A comparative analysis of data sampling and classification techniques,’’ in Proc. J. Phys., Conf., Jan. 2022, vol. 2161, no. 1, Art. no. 012072, doi: 10.1088/1742-6596/2161/1/012072. [6] N. Rtayli, ‘‘An efficient deep learning classification model for predicting credit card fraud on skewed data,’’ J. Inf. Secur. Cybercrimes Res., vol. 5, no. 1, pp. 57–71, Jun. 2022, doi: 10.26735/tlyg7256. [7] S. O. Akinwamide, ‘‘Prediction of fraudulent or genuine transactions on credit card fraud detection dataset using machine learning techniques,’’ Int. J. Res. Appl. Sci. Eng. Technol., vol. 10, no. 6, pp. 5061–5071, Jun. 2022, doi: 10.22214/ijraset.2022.44962. [8] Q. Li and Y. Xie, ‘‘A behavior-cluster based imbalanced classification method for credit card fraud detection,’’ in Proc. 2nd Int. Conf. Data Sci. Inf. Technol. New York, NY, USA: ACM, Jul. 2019, pp. 134–139, doi: 10.1145/3352411.3352433. [9] E. Esenogho, I. D. Mienye, T. G. Swart, K. Aruleba, and G. Obaido, ‘‘A neural network ensemble with feature engineering for improved credit card fraud detection,’’ IEEE Access, vol. 10, pp. 16400–16407, 2022, doi: 10.1109/ACCESS.2022.3148298. [10] X. Yi, Y. Xu, Q. Hu, S. Krishnamoorthy, W. Li, and Z. Tang, ‘‘ASN-SMOTE: A synthetic minority oversampling method with adaptive qualified synthesizer selection,’’ Complex Intell. Syst., vol. 8, no. 3, pp. 2247–2272, Jun. 2022, doi: 10.1007/s40747-021-00638-w. [11] E. F. Ullastres and M. Latifi, ‘‘Credit card fraud detection using ensemble learning algorithms MSc research project MSc data analytics,’’ M.S. thesis, Nat. College Ireland, Dublin, Ireland, May 2022. [12] H. Zhu, M. Zhou, G. Liu, Y. Xie, S. Liu, and C. Guo, ‘‘NUS: Noisy-sample-removed undersampling scheme for imbalanced classification and application to credit card fraud detection,’’ IEEE Trans. Intell. Transp. Syst., vol. 23, no. 9, pp. 17601–17611, Sep. 2022, doi: 10.1109/TITS.2022.3165638. [13] E. G. Lopez-Rojas, A. Elmir, and S. Axelsson, ‘‘PaySim: A financial mobile money simulator for fraud detection,’’ in Proc. 28th Eur. Modeling Symp. (EMS), Oct. 2014, pp. 249–255, doi: 10.1109/EMS.2014.50. [14] A. Arfeen and F. H. Khan, ‘‘Empirical analysis of machine learning algorithms for detecting fraudulent electronic fund transfers,’’ J. Artif. Intell. Data Sci., vol. 1, no. 2, pp. 71–80, Dec. 2021, doi: 10.47693/jaids.v1i2.50. [15] H. Mondal, ‘‘Handling imbalanced data for credit card fraud detection using various algorithms: An empirical study,’’ in Proc. 2nd Int. Conf. Smart Technol. Intell. Syst. (STIS), Nov. 2022, pp. 1–8, doi: 10.1109/STIS57120.2022.10000935. [16] K. Yi, X. Zhang, and J. Li, ‘‘Hybrid approach to detect credit card fraud using under-sampling and SMOTE,’’ Int. J. Adv. Comput. Sci. Appl., vol. 8, no. 4, pp. 1–7, Apr. 2017. [Online]. Available: https://thesai.org/Downloads/Volume8No4/Paper_1-Hybrid_Approach_to_Detect_Credit_Card_Fraud.pdf [17] A. Bolaji, A. Adegoke, and G. Adewale, ‘‘Comparative evaluation of machine learning algorithms for credit card fraud detection using SMOTE and grid search CV,’’ Adv. Sci., Technol. Eng. Syst. J., vol. 6, no. 2, pp. 155–165, Mar. 2021, doi: 10.25046/aj060218. [18] P. K. Patil and J. S. Lamba, ‘‘Comparative study of various machine learning techniques for detecting credit card fraud,’’ in Proc. IEEE 4th Int. Conf. Inf. Technol., Inf. Syst. Electr. Eng. (ICITISEE), Nov. 2019, pp. 5–8, doi: 10.1109/ICITISEE48480.2019.9003915. [19] F. Lin, ‘‘Hybrid sampling method for imbalanced data classification: Combining SMOTE with boosting,’’ in Proc. 2nd Int. Conf. Mach. Learn. Comput. (ICMLC), Feb. 2019, pp. 146–150, doi: 10.1109/ICMLC.2019.8618484. [20] • W. Lin, ‘‘Data mining techniques for credit card fraud detection,’’ in Advances in Knowledge Discovery and Data Mining. NewYork, NY, USA:ACM,2018,pp.307–315,doi:10.1145/3136625.3136714.

Copyright

Copyright © 2024 Shyam Penumala, Dr. K. Santhi Sree. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET63637

Publish Date : 2024-07-15

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online