Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Stock Market Analysis and Prediction using Machine Learning Algorithm

Authors: Dr. Shashikala S V, Harshitha H S

DOI Link: https://doi.org/10.22214/ijraset.2023.54812

Certificate: View Certificate

Abstract

The prediction of a stock market direction serves as an unseasonable recommendation of system for short-term investors and before time financial distress warning system for long-term shareholders. Forecasting accuracy is the most important part in selecting any forecasting technique. Research efforts in upgrading the accuracy of forecasting models are increasing from the last decade. The appropriate stock selections those are fit for investment is a challenging task. The key factor for each investor is to be paid maximum profits on their investments. In this paper Support Vector Machine Algorithm (SVM) is handed down. SVM is a very specific kind of learning algorithms characterized by the volume control of the decision function, the work of the kernel functions and the scarcity of the compound. In this paper, we investigate the predictability of economic movement with SVM.

Introduction

I. INTRODUCTION

We all have get the word stock one way or the another. Particularly stock is connected with the associates and companies which are commercialized and are to sort out in the world of marketization. The additional word used for stock is part which is prominently used in a day to day life. People even term is as an investment plan and it is something people see as a long-term investment that secures and provides an abundant funds during the retirement age. Buying a company stock is purchasing a small part of it. People invest on the identical to get a long-term benefit which they think is less value for now but has to potential to grow with the time. It is an expenditure that provides the long-time slide and deals with long time goals with the upright aim. The value of part you invest today must present with you a yield of best tomorrow but it is not the alike. Market is uncertain so are the resources and the elements that are taken to drive it off or on the set. It has never been on the same level and the pattern of the same is still unpredictable till the time. Some vicinity and prediction method had been derived and approximates values and the rough build are generated hoping for the finest but all the resource cannot be believed in and are still unpredictable in nature. Knowing the market situation and researching on the matching is the best way to observe the reliability for which there are numerous agents who have taken the matching as a profession and are building a fortune out of it. They forecast and guide but the advisory fetch and the charge is higher and the stock rating is never less the same. Market is swap in an instantaneous rate even in a day there are several highs and lows in the market and having said the resources and the timing the outermost and innermost agent. Stock is a fascinating resource to start with. individual and the company. Stock is there from the start and due to its tendency of uncertainty it has been a word of fancy. People study on the same and implementing on the everyday basis had made a fortune out of it. There are several agents available in market for making you know and invest on the same and the impose of the same are hectic and insanely exorbitant. The major resources for the company are the collection to carry out the daily task and create an account out of it. In time of need for a giant budget estimation and to beset from the resources they need the pay for and undergoing a finance loan for acceptance, passing, and having one is hectic and the banks are predator for which the interest rate is higher than the other form of investment in consequence limiting the margin of the outcome. Stock is another way for company to collect revenue and boost up the production for the upper yield and to gain the most out of the business plan for the bigger pictures. This is found to be an effective way to invest and grow in the commercial field and a better alternative to tackle the financial crisis during the requirement. For an investor it’s a risk phenomenon where they invest their saving and hope it brings back the return in higher yield. If the evaluation of the same increases, then the stock evaluation and its price increases causing the financial gain to both the parties. In Indian Society it is even consider as a side point business and people trusted it as a hand of luck. When a particular purchases of company stock then they are referred as a shareholder and they will get a part out of the identical as they have invested in their profit or the gain. An investor can sell and buy the stock as per their desires. The stock market is basically an accumulation of various clients and vendors of stock. A stock in general represents ownership claims on business by a particular discrete or a group of people. The seek to determine the time ahead value of the stock market so called stock market prediction.

II. LITERATURE SURVEY

In their study, M Umer Ghani, M Awais and Muhammad Muzammul, Year of publishing 2019, the Paper Title Machine learning algorithms Implementations for Stock Predication. Stocks are possibly the markets so that nowadays nearly anybody can own stacks. since couple of decades, the most admired financial instrument design for building prosperity and are the centerpiece of some investment portfolio. The advances in trading technology have opened explosive increase in the average person’s interest for stock market. In an economically explosive market , as the stock exchange. The merits are to research helps a lot of new investors in deciding when to buy or sell a particular stock. Demerits are Current research makes use of neural networks which have the drawback of slow convergence rate and local optimum. outlined in their literature review.

K. Hiba sadiya, Adarrsh paul, Saurav Sanyal. 2019 conducted an analysis in their study of Algorithmic sign prediction and covariate selection across eleven international stock markets. In economic markets, a machine learning (ML) has become a powerful analytical tool used to help and manage investment efficiently. ML has been widely used in the economic sector to provide a new mech- anism that can help shareholders make better decisions in both share and management to achieve better performance of their securities investment. Equity securities are one of the most traded securities. the Merits are Historic data are of great values and that been proved by Sathik and Sekhar[1]. They derived a hidden patterns from the dataset and have out generated an investment decision plan using different data mining technologies. Demerits is does not well work for nonlinear series.

Romon Lawrence, Dos, Anjos, Gustavo L. in the year 2018, Stock Market Prediction Using Hybrid Approach. study the Objective of this paper is to construct a model to predict Stock value movement using the option mining and clustering method to predict National Stock Exchange (NSE). It used domain in specific approach to predict the stock with maximum capitalization. Topics and related opinion of shareholders are automatically extracted from the writings in a message board by utilizing our proposed strategy alongside isolating clusters of comparable softbot stocks from others using clustering algorithms.

Merits are Compared to common shares; preferred shares tend to pay higher dividends. Demerits of the shares market is extremely volatile as there are numerous factors affecting the value of sharing like government policies, budget, sectoral events, company disclosure, change in management of company etc.

In their study, Stock market prediction system with modular neural networks by T.KIMOTO, M YODA. in the Year 2018. A discussion is presented of a getting and vending time prediction system for stocks on the Tokyo Stock Exchange and the analysis of inner representation. The system is based on commutable neural networks. The writer developed a numerous of learning algorithms and forecast methods for the TOPIX (Tokyo Stock Exchange Prices Indexes) prediction method. The prediction order achieved accurate forecast, and the simulation on stocks dealing showed a beneficial. Merits are the Stocks can be a precious items role of your investment portfolio. to be paid stocks in varies companies can help you to grow your savings, preserve your money from inflation and taxes, and the maximize earnings from your investments. Demerits are to Risk You could no longer have your entire investment. If a company does poorly, investors will sell, sharing the stock price plummeting. When product you sell, you will mislay your initial investment.

Deep Learning for Stock Market Prediction Using Technical Indicators and Financial News Articles. by R. Vargas, Carlos E. M. dos Anjos, Gustavo L G. Bichara, Alexandre G. Evsukoff. Year of publication 2017. This work uses deep learning models for daily directional movements prediction of a stock price using financial of a stock price using financial news titles and technical indicators as input. A comparison is made between two different sets of technical indicators,set 1: stochastic (%k), stochastic (%D), Momentum, Rate of change, Williams (%k), Accumulation/Distribution (A/D) oscillator and Disparity 5; Set 2: Exponential Moving Average, Moving Average Convergence- Divergence, Relative Strength Index, on Balance Volume and Bollinger Bands. Merits are the biggest advantage of share market investment is that it has the potential to generate inflation-beating returns within a short period of time as compared to other investment avenues like bank FDs, saving accounts etc. Demerits are Investments in the share market are considered risky since the markets are volatile and shares can fluctuate and even hit lower circuits. Utilizing Long Short – Term Memory (LSTM) Networks for the odelling and trending of financial indices. by Mohammad Asiful Hossian, Rezaul Karim, Ruppa Thulasiram, Yang Wang. Year of publication 2017 This paper aims to find a superior strategy for the daily trading on a portfolio of stocks for which traditional trading strategies perform poorly due to the low frequency of new information. The experimental work is divided into a set of traditional trading strategies and a set of long short- term memory networks.

The networks incorporate general and specific trading patterns, where the former takes into account the universal decision factors for trading across many stocks, while the latter takes into account stock-specific decision factors. Our research shows that both long short-term memory networks, regardless of whether they are based on universal or stock-specific decision factors, significantly outperform traditional trading strategies.

Interestingly, however, on average neither has the edge compared to the other, thus remaining ambivalent as to whether universality or specificality is to be preferred when it comes to designing long short-term memory networks for optimal trading. Merits are Takes advantage of a growing economy: As the economy grows, so do corporate earnings. That's because economic growth creates jobs, which creates income, which creates sales.

Demerits are You could lose your entire investment. If a company does poorly, investors will sell, sending the stock price plummeting. When you sell, you will lose your initial investment.

A Hybrid Fuzzy Time Series Model Based on ANFIS and Integrated Nonlinear Feature Selection Method for Forecasting Stock. by Chung-HO Su, Ching-Hsue Chang. Year of publication 2016. Forecasting stock price is a hot issue for stock investors, dealers, and brokers. However, it is difficult to find out the best time point to buy or to sell stock, due to many variables will affect the stock market, and stock data dataset is time series data.

Therefore, many time series models have been proposed for forecasting stock price, furthermore the previous time series methods still have some problems. Hence, this paper proposes a novel ANFIS (Adoptive Neuro Fuzzy Inference System ) time series model based on integrated nonlinear feature selection (INFS) method for stock forecasting.

Merits are the process of analyzing time series data using statistics and modeling to make predictions and inform strategic decision-making. Demerits are Time series analysis also suffers from a number of weaknesses, including problems with generalization from a single study, difficulty in obtaining appropriate measures, and problems with accurately identifying the correct model to represent the data.

III. PROPOSED SYSTEM

Stock is unpredicted and liberal in nature. The follow of the same is impressive and reluctant in nature. Finding the predictability and getting the nearest is the best hit goal for the same. The exact and accurate estimation of the same is never-less possible. There are various constrains that in-fluctuate the pricing and the rate of stock. Those constrains had to be taken in consideration before jumping to the conclusion and report derivation.

As many have invested their time and effort in this world trade for getting it closer and more reliable to the people for carrying out the resources and make their lifestyle more deliberate than the previous. In the past few years various strategies and the plans had been derived and deployed ever since it’s continuation and the topic is still a point of research where people are coming up with ideas to solve. Intelligence fascinates mankind and having one in machine and integrating on the same is the hot key of research. There are various people contributing on the same research. ASheta tried its invention on two nonlinear process and had come up with TS which is used as a model for fuzzy sets. All the learning system from the past are limited and are simplest in nature where learning of the simple algorithm for a computational mean is not enough which can even be done by human brain itself.

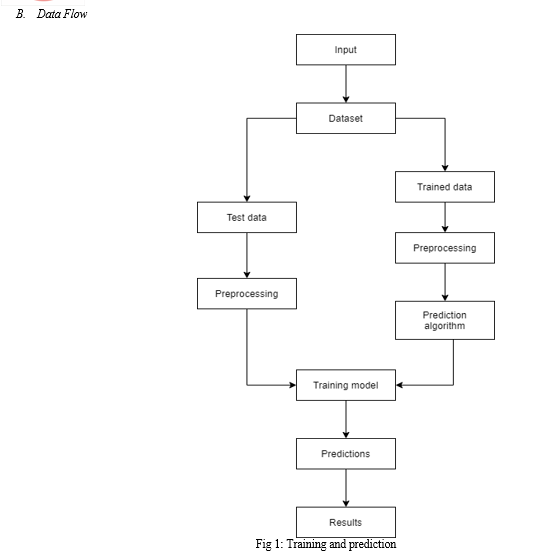

A. System Processing

System design of the prediction system used for forecasting directional changes over stock prices is displayed in Figure For each data point, ten input features are used. To understand whether the relationship between the system performance and the combination of the input window length and the forecast horizon depends on a chosen approach, several machine learning techniques including the SVM, ANN and KNN are employed.

A system is trained and tested. System processing of Stock analysis Prediction with the help of LSTM and XAI. display how the information is processed in the initial, cutdown into training and testing set to build remaining predictions and check the biases using XAI.

The creation of a predictive system that works forecasts future changes of a stock price is crucial for dealer's management and algorithmic trading.

The use of every technical analysis for the financial prediction has to been successfully employed by many researchers. Input has window length is a time frame parameter required to be set of instruction when calculating several. The important problems are the most sensitivity of a strategy to challenging performance to little parameter changes and number of local extrema distributed over the answers space in an no way of regular. The stock market is very difficult and volatile. It is impacted by a positive and negative sentiments in which are based on media releases. A design graph in programming and hierarchical hypothesis is an outline which shows the breakdown of a framework to its least reasonable levels. They are utilized in organized programming to orchestrate program modules into a tree.

B. System Analyses

The JupyterLab is an electronic intelligent improvement climate for journals, code, and information. Its adaptable connection point permits clients to design and organize work processes in information science, logical registering, computational news coverage, and AI. A secluded plan considers expansions that grow and improve usefulness. The IPython Note pad is currently known as the Jupyter Journal. It is an intuitive computational climate, where you can join code execution, rich text, science, plots and rich media.

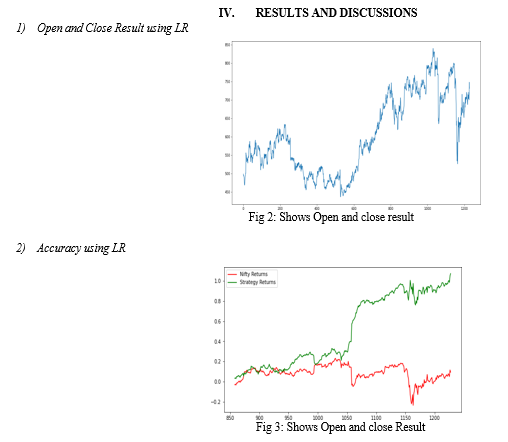

In this venture we analyze AI calculations utilizing financial exchange dataset. We perform explores different avenues regarding different calculations on securities exchange dataset and noticed the mean square mistake to foresee precision utilizing four calculations to be specific Strategic relapse, SVM and Irregular Backwoods. We utilized Python libraries like pandas, numpy to stack the dataset and to perform numerical estimations individually and we utilized sklearn to demonstrate different AI calculations. We use dataset to test our model. We can reason that SVM, Arbitrary Timberland and Strategic Relapse have better correctnesses. We have plotted three of five best playing out calculations' mean square mistake for each organization to analyze execution of every calculation. SVM, Irregular Timberland and Strategic Relapse yielded best outcome. The outcome can additionally be improved by handling information appropriately as there are enormous variances in financial exchange.

Conclusion

I have already discussed all the important features of the datasets and their visualization in one of the above sections. But to conclude my report I would choose my final model visualization, which is improved version of LSTM by fine tuning parameters. As I was very impressed on seeing how close I have gotten to the actual data, with a mean square error of just 0.0009. . The prediction can be more accurate if the model will train with a greater number of data set. besides, in the case of forecast of numerous shares, there may be several scope of certain business analysis. We can work the disparate pattern of the design price of disparate sectors and can examine a graph with more unlike time span to fine tune the validity.

References

[1] K. Senthamarai Kannan, P. Sailapathi Sekar, M.Mohamed Sathik and P. Arumugam, \"Monetary financial exchange forecastusing information mining Strategies\", 2010, Procedures of the worldwide multiconference of designers and computerscientists. [2] Tiffany Hui-Kuang yu and Kun-Huang Huarng, \"A Brain network-based fluffy time series model to improveforecasting\", Elsevier, 2010, pp: 3366-3372. [3] Md. Rafiul Hassan and Baikunth Nath, \"Financial exchange guaging utilizing Stowed away Markov Model: Another Methodology\", Continuing of the 2005 fifth Worldwide gathering on astute Frameworks Plan and Application 0-7695-2286-06/05, IEEE 2005. [4] Bonde, Ganesh, and Rasheed Khaled. \"Extricating the best elements at foreseeing stock costs utilizing machine get the hang of ing.\" Procedures on the Worldwide Gathering on Man-made brainpower (ICAI). The Directing Advisory group of The World Congress in Software engineering, PC Designing and Applied Registering (WorldComp), 2012. [5] P.Hajek,ForecastingStockMarketTrendusingPrototypeGenerationClassifiers,WSEAS Exchanges on Frameworks, Vol.11, No. 12, pp. 671-80, 2012. [6] Hagenau, Michael, Michael Liebmann, Markus Hedwig, and Dirk Neumann. \"Computerized news perusing: Stock cost expectation in view of monetary news utilizing setting explicit highlights. \"InSystem Science (HICSS), 2012 45th Hawaii Global Gathering on, pp. 1040-1049. IEEE, 2012. K. Senthamarai Kannan, P. Sailapathi Sekar, M.Mohamed Sathik and P. Arumugam, \"Monetary financial exchange forecastusing information mining Strategies\", 2010, Procedures of the worldwide multiconference of designers and computerscientists. [7] Tiffany Hui-Kuang yu and Kun-Huang Huarng, \"A Brain network-based fluffy time series model to improveforecasting\", Elsevier, 2010, pp: 3366-3372. [8] C. Dance, J. Willamowski, L. Fan, C. Whinny and G. Csurka, Visual Classification with Packs of Central issues, In ECCV Global Studio on Measurable Learning in PC Vision. [9] S. Lazebnik, C. Schmid and J. Ponce, Past Packs of Highlights: Spatial Pyramid Matching for Perceiving Normal Scene Classes, In IEEE PC Society Meeting on PC Vision and Example Acknowledgment, IEEE 2006, vol. 2, pp. 2169-2178. [10] L. Shapiro and G. Stockman, PC Vision. Prentice Corridor, Upper Seat Waterway, NJ. [11] C.Carson, M. Thomas, S. Belongie, J. Hellerstein, J. Malik Blobworld: A framework for Locale Based Picture Ordering and Recovery Visual Data and Data Frameworks, pp. 509-517 View in ScopusGoogle Researche [12] D. Lowe Unmistakable Picture Highlights from Scale-Invariant Central issues Global Diary of PC Vision, 60, pp. 91-110 View in ScopusGoogle Researcher [13] H. Narrows, A. Ess, T. Tuytelaars, L. Van Gool Speeded-Up Powerful Highlights (SURF) PC Vision and Picture Getting it, 110, pp. 346-359 View PDFView articleView in ScopusGoogle Researcher

Copyright

Copyright © 2023 Dr. Shashikala S V, Harshitha H S. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET54812

Publish Date : 2023-07-16

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online