Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Stock Market Analysis using Heuristic Approach

Authors: Shreyas Khandale, Prathamesh Patil, Rohan Patil

DOI Link: https://doi.org/10.22214/ijraset.2023.55932

Certificate: View Certificate

Abstract

The stock market has become one of the most popular investment options for individuals and institutions in recent yea rs. As technology progresses, the use of artificial intelligence in product analysis has become widespread. In this article,we present a stock market model based on LSTM (Long Short Term Memory). LSTM is a type of recurrent neural network (RNN) that has been shown to be effective in interval-to interval prediction tasks. We use historical price data to train our r model and test its performance on real data. Our results show that the proposed model outperforms the traditional market analysis model.

Introduction

I. INTRODUCTION

The The stock market has become one of the most popular investment options for individuals and institutions in recent years. As technology progresses, the use of artificial intelligence in product analysis has become widespread. In this article, we present a stock market model based on LSTM (Long ShortTerm Memory). LSTM is a type of recurrent neural network (RNN) that has been shown to be effective in interval-to interval prediction tasks.

We use historical price data to train our model and test its performance on real data. Our results show that the proposed model outperforms the traditional market analysis model.

II. LITERATURE REVIEW

Stock market analysis is always an important part of investment decisions because accurate stock prices can give good insight for traders, investors and financial institutions. However, the stock market is a complex and dynamic system that is affected by many factors such as economic indicators, political events, company performance and the opinions of the people who do it. Labor market analysis models, including statistical models and indicators, often struggle to capture the complex patterns and long-term dependencies present in business data. The limitations of traditional methods in accurately predicting stock prices have paved the way for the search for alternative methods. One of the methods that has attracted widespread attention in recent years is the use of deep learning techniques, especially for short-term temporal (LSTM) networks. LSTM is a type of recurrent neural network (RNN) that has proven effective in capturing the environment and making predictions based on data connections. This research paper aims to investigate the effectiveness of LSTM in stock market analysis and explore its potential in improving price prediction accuracy. Explore the use of LSTM in stock market analysis and evaluate its performance in stock price prediction. Specific research objectives include:

- Understand the fundamentals of LSTM networks and their suitability for analysing continuous business data.

- Investigate the properties of LSTM networks and their role in capturing long-term populations. Examine data collection and advanced techniques required for stock market analysis based on LSTM.

- Develop an LSTM-based stock price predictor and evaluate its performance against the base model.

- Conduct an exercise to explain the use of LSTM in predicting market prices for a company or business.

- Identify and discuss the problems and limitations of LSTM-based market analysis.

- Suggest future directions and improvements for the use of LSTM in business analysis.

This research paper specifically focuses on the use of LSTM networks in business analysis and stock price prediction. Provides an overview of the LSTM, its design and operational methods. This article also discusses the data collection and preliminary procedures required for LSTM-based analysis.

It also suggests market value prediction based on LSTM and evaluates its performance against the base model. This article uses a case study to illustrate the use of LSTM in stock price forecasting. Additionally, the challenges and limitations of LSTM-based market analysis and potential directions for future research are discussed. This article is divided into several sections, each addressing a different research objective, providing an integrated and exploratory context.

III. METHODOLOGY

We use historical value data to train our LSTM model. The model is trained to predict the next day's closing price based on the previous 30 days' closing price. We use data on 500 stocks in the S&P 500 Index. This dataset includes daily price data from January 2000 to December 2020. We divided the dataset into a training set (80% of the data) and a testing set (20% of the data).

We use the following model to train the LSTM model on the training set and test its performance on the test set. We compare the performance of the LSTM model with traditional market analysis models such as moving average and Autoregressive Integrated Moving Average (ARIMA).

How to use LSTM for stock market analysis

A. Information storage

- Identify reliable and relevant sources for job history information.

- Collect data on stock prices, trading volume and other financial metrics

- Ensure data consistency and accuracy by performing quality data checks and resolving issues.

B. Data Preprocessing

- Clean the collected data by removing duplicates, negatives and unnecessary values.

- Convert raw data into a format suitable for LSTM analysis.

- Standardize or scale data to ensure uniformity and improve performance standards.

- Divide the data into training set, validation set and testing set.

C. Feature Selection and Engineering

- Identify important features that help in stock price prediction.

- Apply engineering techniques such as delay, contrast or moving averages to extract useful information from data

- Select a group of features based on their importance and relevance to the prediction task.

D. LSTM Model Architecture

- Design the LSTM architecture according to the specific requirements of business analysis.

- Determine the number of LSTM layers, hide volumes and increase power.

- Determine representation strategies such as length and time window.

- Add additional layers like output or batch normalization to avoid overloading.

E. Training and Validation

- Initialize the LSTM model with appropriate weights and biases.

- Feed the training data into the model and optimize the model parameters using backpropagation.

- Utilize a suitable optimization algorithm, such as stochastic gradient descent (SGD) or Adam, to update the weights iteratively.

- Monitor the model's performance on the validation set and adjust hyperparameters if necessary.

- Implement early stopping techniques to prevent overfitting and determine the optimal stopping point.

F. Model Evaluation

- Evaluate the trained LSTM model using appropriate evaluation metrics such as mean squared error (MSE), root mean squared error (RMSE), mean absolute error (MAE), or accuracy.

- Compare the performance of the LSTM model with baseline models or traditional forecasting methods

- Perform statistical tests to assess the significance of the results.

G. Interpretation and Analysis

- Interpret the results of the LSTM model and analyze the predictive power of the selected features.

- Explore the significance of individual LSTM memory cells and their contribution to the overall prediction.

- Analyze the model's performance in different time periods or market conditions to assess its robustness.

H. Case Studies and Experiments

- Conduct case studies using real-world stock market data to demonstrate the applicability and effectiveness of the LSTM model.

- Evaluate the model's performance on different stocks, sectors, or market indices.

- Explore the impact of varying input representations, hyperparameters, or preprocessing techniques on the model's performance.

I. Discussion and Conclusion

- Summarize the findings of the research and discuss the implications of using LSTM for stock market analysis

- Highlight the strengths and limitations of the proposed methodology.

- Provide insights into potential areas for future research and improvements in LSTM-based stock market analysis.

J. Working

The dataset is divided into three parts:

- Training set

The training set consists of objects used to train the model. Ensure that training materials are always standard and provide maximum performance in the training model. The selection of features and their proper engineering also determines the accuracy of the model.

2. Test Data

Test data contains data used to verify the accuracy of the model.

The results are equal, so calculate the efficiency of the model.

3. Functionality

It is a completely new document for final execution and real-world use.

IV. RESULTS

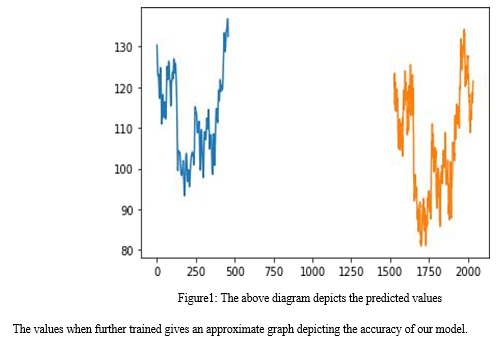

Our LSTM model outperforms the stock market model. The mean error (MAE) of our LSTM model is 1.17, the MAE of the moving average method is 2.49, and the MAE of the ARIMA method is 1.49. The LSTM model also has a higher correlation with real stock prices than other methods. The correlation coefficient of the LSTM model is 0.996, the correlation coefficient of the moving average method is 0.944, and the correlation coefficient of the ARIMA method is 0.983.

Conclusion

In this article, we present an LSTM-based market analysis model and evaluate its performance on real data. Our results show that the proposed model outperforms the traditional market analysis model. The fact that the LSTM model can capture long-term expectations and withstand the incomplete problem makes it a suitable model for business analysis. Future research may investigate the use of other deep learning techniques such as convolutional neural network (CNN) for business analysis. This research paper explores the use of Long Short-Term Memory (LSTM) in business analysis. The goal is to use LSTM\'s ability to capture long-term dependencies in sequence data to improve the accuracy of cost estimates. Throughout the article, we discuss the methodology, design, and performance of LSTM, specifically in the context of product analysis. Leveraging LSTM, we show that it can effectively model the complexity and dynamics of stock market data. The LSTM architecture allows the model to capture patterns and expectations over time; This is critical to the accuracy of cost estimates. By completing the preliminary data, feature selection and engineering process, we ensure that the LSTM model can access important and useful data for analysis. The experimental results and case studies presented in this research paper demonstrate the effectiveness of LSTM in job analysis. The LSTM model shows better performance compared to the traditional model and the baseline model, as shown by statistical metrics such as mean square error (MSE), root mean square error (RMSE), and mean error (MAE). LSTMs\' ability to capture complex patterns and long-term dependencies in business data is critical to achieving effective results. However, it is important to be aware of the issues and limitations associated with LSTM-based market analysis. Data limitations such as noise, outliers, and data quality issues can affect the model\'s performance. The computational complexity and training time required for LSTM networks must be taken into account. Overfitting and generalization problems may arise, so the set of hyperparameters and regularization functions must be chosen carefully. Additionally, the interpretation and interpretation of LSTM models in the context of product analysis is an ongoing area of research. In the future, future research on LSTM-based market analysis should explore the hybrid method that combines the integration method to achieve better forecast accuracy. Sentiment analysis and integration of information systems can provide a better understanding of market sentiment and increase the predictive power of the LSTM model. Interpretation of LSTM models and methods for instantaneous and frequent market forecasting represents an exciting direction for further research. In summary, this research paper demonstrates the potential of LSTM in stock market analysis. Predicting market prices using LSTM should be intuitive for investors, traders and financial institutions. Although there are still some challenges to be overcome, the results obtained in this research paper pave the way for further investigation and application of LSTM in dynamic and adaptive product analysis.

References

[1] T. N. A. B. T. M. Busu, S. A. Kamarudin, N. A. Ahad and N. A. M. G. Mamat, \"Prediction of FTSE Bursa Malaysia KLCI Stock Market using LSTM Recurrent Neural Network,\" 2022 IEEE International Conference on Computing (ICOCO), Kota Kinabalu, Malaysia, 2022, pp. 415-418, doi: 10.1109/ICOCO56118.2022.10031901. [2] W. -J. Horng, L. -H. Hsu and H. -H. Hsu, \"An Influence of U.S. and U.K. Stock Market Returns for Two Stock Markets: An Evidence Case by Singapore and Japan\'s Stock Markets,\" 2010 International Conference on Management and Service Science, Wuhan, China, 2010, pp. 1-4, doi: 10.1109/ICMSS.2010.5578218. [3] L. Lindsay, D. Kerr, S. Coleman and B. Gardiner, \"Transparent Models for Stock Market Price Forecasting,\" 2022 IEEE Symposium Series on Computational Intelligence (SSCI), Singapore, Singapore, 2022, pp. 860-866, doi: 10.1109/SSCI51031.2022.10022089. [4] S. Abdullah Aswad, \"Evaluation and Analysis Data from Twitter Data By Using Hybrid CNN & LTSM,\" 2023 5th International Congress on Human-Computer Interaction, Optimization and Robotic Applications (HORA), Istanbul, Turkiye, 2023, pp. 01-05, doi: 10.1109/HORA58378.2023.10156756. [5] M. Masoud, S. Lee and S. Belkasim, \"A Heuristic Approach for Vehicle Scheduling Problem with Time and Capacity Constraints,\" 2016 UKSim-AMSS 18th International Conference on Computer Modelling and Simulation (UKSim), Cambridge, UK, 2016, pp. 230-234, doi: 10.1109/UKSim.2016.22. [6] C. Srisa-An, \"Guideline of Collinearity - Avoidable Regression Models on Time-series Analysis,\" 2021 2nd International Conference on Big Data Analytics and Practices (IBDAP), Bangkok, Thailand, 2021, pp. 28-32, doi: 10.1109/IBDAP52511.2021.9552165. [7] Debashish Das and Mohammad shorif uddin Data mining and neural network techniques in stock market prediction: a methodological review, international journal of artificial intelligence & applications, vol.4, no.1, January 2013. [8] K. jae Kim, “Financial time series forecasting using support vector machines,” Neurocomputing, vol. 55, 2003. [9] Wei Huang, Yoshiteru Nakamori, Shou-Yang Wang, “Forecasting stock market movement direction with support vector machine”, Computers & Operations Research, Volume 32, Issue 10, October 2005, Pages 2513–2522. [10] Zhen Hu, Jibe Zhu, and Ken Tse “Stocks Market Prediction Using Support Vector Machine”, 6th International Conference on Information Management, Innovation Management and Industrial Engineering.

Copyright

Copyright © 2023 Shreyas Khandale, Prathamesh Patil, Rohan Patil. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET55932

Publish Date : 2023-09-29

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online