Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Stock Market Prediction

Authors: Mr. E. Sankar, Nunna Sai Charan, P Venkata Sai Pavan

DOI Link: https://doi.org/10.22214/ijraset.2023.51018

Certificate: View Certificate

Abstract

Business and finance sector have come the leader of the world’s frugality moment. The stock request trading is one of the major practices in the finance sector. In the literature, unwanted stock data have been reused which leads to destruction of time and memory space. The vaticination of unborn stock price by SVM and Backpropagation algorithm is less effective because of processing unwanted data. In this paper, LSTM grounded recommender system for safe stock trading is proposed. The standard stock datasets similar as AMD, Google and Tesla were employed for trial of the proposed work. Further, deep literacy libraries similar as Keras API module and Tensor Flow along with python were employed for enforcing the proposed work. In the living workshop, the authors achieved the delicacy in the range of 60 to 70 and in this proposed work, the delicacy rate is bettered to 75 in prognosticating the stock. The performance of the proposed work is also compared with three stock datasets considered for comparison. The successful vaticination of the stock request will have a veritably positive impact on the stock request institutions and the investors also. It finds the accurate value of the coming day closing value that helps the investors to invest or vend their shares. In future, the work can be extended by enforcing with better dimensionality reduction ways.

Introduction

I. INTRODUCTION

Stock price Vaticination is a popular yet grueling task and deep literacy provides the means to conduct the mining for the different patterns that spark its dynamic movement. This design can give an effective result for easy investment in the stock and the most important thing the followership won't miss any point of your donation Business and finance sector is moment the leader of the world's frugality, stock request trading is a major practice in the finance sector. We propose a Machine Learning Algorithm which will be trained from different datasets of some companies available from the history to make near effective prognostications. Fiscal exchange prognostications are always trickier when it comes to stock request prognostications. It's principally a fashion where one tries to prognosticate the unborn value of current stocks of a company to avoid the loss or maybe gain profit. This design will demonstrate a machine literacy approach to prognosticate the same using colorful amounts mentioned latterly in the report. We propose a Machine Learning Algorithm which will be trained from different datasets of some companies available from the history to make near effective prognostications .

II. LITERATURE SURVEY

- we propose a Machine learning (ML) approach that will be trained from the available stocks data and gain intelligence and also use the acquired knowledge for an accurate vaticination. Advantages are Used in SVM ways, supervised literacy, machine literacy styles to gain colorful features selection schemes. Disadvantages are the model proposed at the original step towards the enhancement in the fashion for request vaticination isn't good. The delicacy of this paper is only 68.5.

- The efficient market hypothesis states that it is impossible to forecast the future price of an asset based on the information contained in the historical prices of an asset. Advantages are Two techniques are used to benchmark the AI techniques, namely Autoregressive Moving Average (ARMA) which is linear modeling technique and random walk (RK) technique.

- Stock m previous work has proposed effective styles to learn event representations that can capture syntactic and semantic information over textbook corpus. Advantages are Proposed Deep long short- term memory neural network with bedded subcaste and the long short- term memory neural network with automatic encoder to prognosticate the stock request. Disadvantages are Their delicacy of two models is 57.2 and 56.9.

- Proposed a robotic trading system that integrates fine functions, machine literacy, and other external factors. Advantages are to achieve this thing, trained Machine literacy algorithms and created/ trained multiple deep literacy models. Disadvantages are Accuracy was achieved using SVM for AppleInc.( APPL) stock is 60.

III. PROBLEM STATEMENT

The Stock Market vaticination task is intriguing as well as divides experimenters and academics into two groups those who believe that we can concoct mechanisms to prognosticate the request and those who believe that the request is effective and whenever new information comes up the request absorbs it by correcting itself, therefore there's no space for vaticination. Some of the styles involved in Machine literacy are – Long Short Term Memory, Support Vector Machine( SVM), intermittent Neural Networks( RNN).

IV. SCOPE OF THE PROJECT

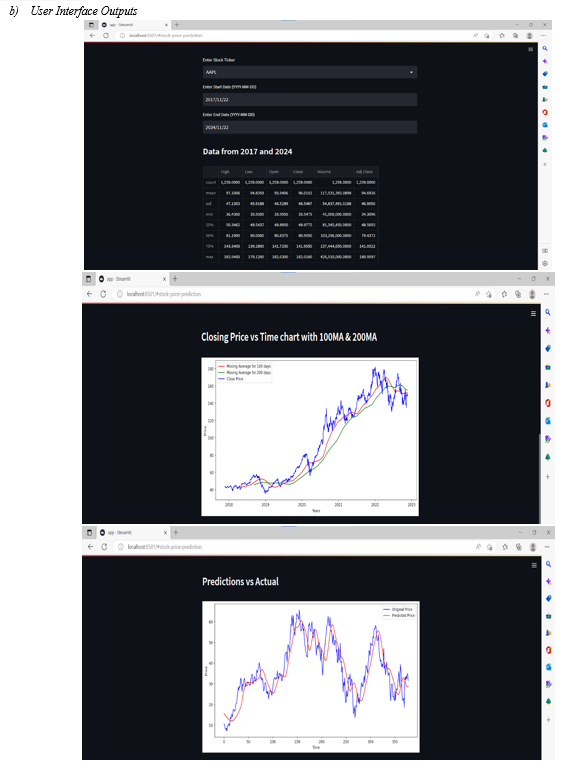

The Stock Market Prediction model use a mongrel of different machine learning algorithms by combining the traditional and ultramodern approaches in order to directly prognosticate the ending prices of the stock request. The model uses literal data from the data- set of any establishment and time- confines as the input point, it trains itself on the base of the former trends and oscillations and undergoes training. The model also provides us with an in- depth analysis of the entire stock of the establishment during that particular time period and also provides a cast on the unborn trend of the stocks. We've used a irregular and a normal graphical representation to present the analysis and vaticination of the stock. also, we've used graphs to give a more scrutable pictorial representation of the trend of the stocks to help our users understand the analysis and vaticination duly.

V. PROPOSED SYSTEM

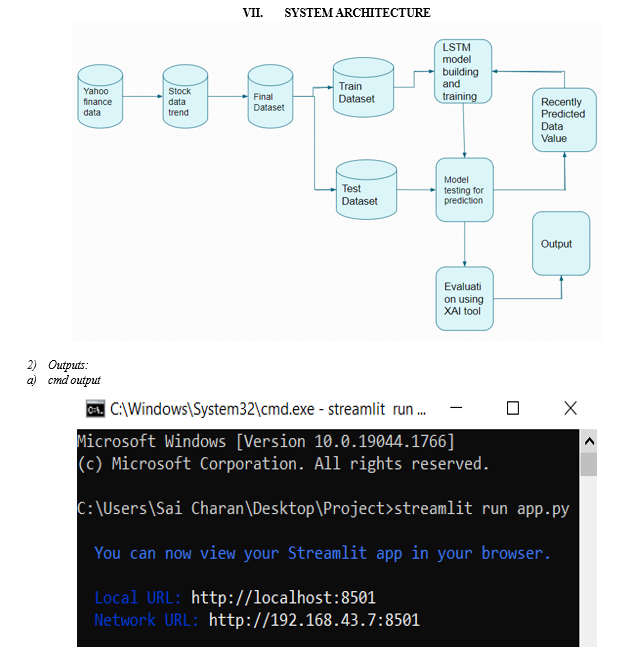

In the proposed system, we will get data directly from the yahoo finance system. We will also apply the supervised algorithm on the stored data. The supervised algorithm used in our system is Long Short-Term Memory (LSTM). The results of the algorithms i.e., the stock price vaticination will be represented in a graphical manner. The proposed system is more effective than the being one. This is because we will be suitable to know how the statistics determined from the representation of the result can have an impact in a particular field. Despite numerous short- term reversals, the overall trend has been constantly higher. However, the stylish vaticination for hereafter’s request price is simply moment’s price, plus a veritably small increase, If stock returns are basically arbitrary. The algorithm of stock price is enciphered in its demand and force. A share sale takes place between a buyer and a dealer at a price. The price at which the sale is executed sets the stock price.

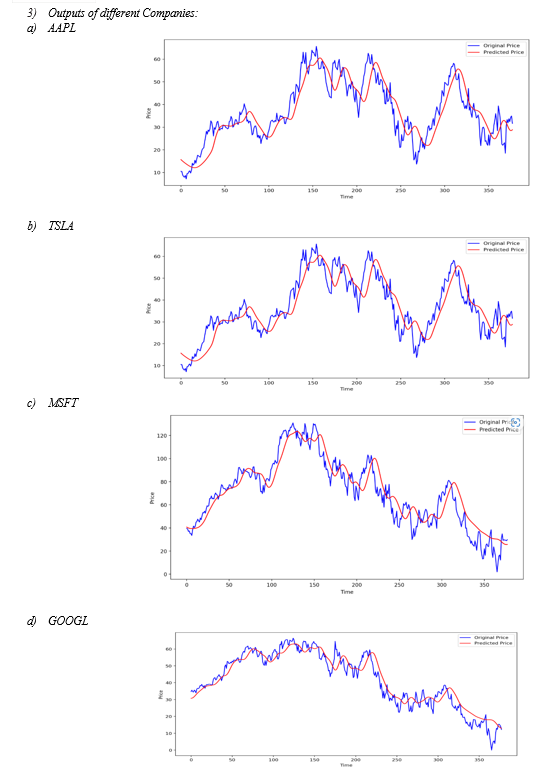

The Advantages of proposed system are the successful vaticination will maximize the benefit of the client. In this paper we have bandied colorful algorithms to prognosticate the same. In this paper we used stock data of five companies from the Huge Stock request dataset conforming of data till 2023 to train different machine learning algorithms.

|

Method |

Linear Regression |

LSTM |

|

R - Squared |

0.73 |

0.93 |

|

MAE |

2.53 |

1.33 |

|

MSE |

10.37 |

2.51 |

Hence, LSTM is a better method to predict the stock market.

VI. ALGORITHM

- Artificial Neural Network: Artificial Neural Networks are computational models inspired by the mortal brain. numerous of the recent advancements have been made in the field of Artificial Intelligence, including Voice Recognition, Image Recognition, Robotics using Artificial Neural Networks. Artificial Neural Networks are the biologically inspired simulations performed on the computer to perform certain specific tasks like Clustering, Bracket and Pattern Recognition.

Minmax Scaler

- Scales range of values between 0 and 1.

- It doesn't perform well on features that have outliers.

- For each point X, we calculate the minimal value (Xmin) and maximum value (Xmax)

- For each value in that point X(Xi), calculate

New X1 = (Xi- Xmin)/( Xmax- Xmin)

LONG SHORT TERM MEMORY

It is a special kind of intermittent neural network that is suitable of learning long term. LSTM is a type of neural network. In intermittent Neural Networks the affair from the last step is fed as input in the present step. LSTM was designed by Hochreiter & Schmidhuber. It dived the problem of long- term dependences of RNN in which the RNN can't predict the word stored in the long- term memory but can give more accurate prognostications from the recent information. As the length of the gap becomes more intermittent Neural Network does not give an effective performance. LSTM by nature it can retain the information for very long time. It is very useful for processing a data set, predicting, and classifying on base dataset.

Conclusion

The fashion capability of stock request trading is growing swiftly, which is encouraging researchers to find new styles for the prophecy using new ways. The auguring fashion is not only helping the researchers but it also helps investors and any person dealing with the stock request. In order to help predict the stock pointers, a auguring model with good delicacy is demanded. In this work, we have used one of the most precise auguring technologies using the Long Short- Term Memory unit which helps investors, judges or any person interested in investing in the stock request by furnishing them a good knowledge of the future situation of the stock request. When compared with ARIMA( Auto Regressive Integrated Moving Average) algorithm, it\'s shown that ARIMA algorithm understands the formerly data and does not concentrate on the seasonal part. therefore delicacy is less. LSTM provides more accurate results than other algorithms. The future enhancement includes comparing the delicacy of LSTM with other prophecy algorithms. LSTM is more accurate than any other prophecy algorithms. To conclude stock is an changeable medium which follows the parts of the chain and the dependences of the same are changeable. It\'s defined to be a wind which keeps on changing and turning the price from low to high and vice-versa. As the integration of the same is advanced with other dependences so leaving dependences compromise the position of delicacy. delicacy isn\'t the term used over in stock as the factual vaticination isn\'t possible for any financial days it keeps on changing and turning the tables day and night. Having advanced element means and the dependences makes it more doable and flexible in nature causing it indeed harder to prognosticate. The approximate values are taken into consideration and the megahit or profit or the gain rate is calculated for the same. In the design colorful high position machine literacy algorithms are enforced and integrated and the affair is generated from the same making a stoner visible with the labors in the form of graph which makes it easier for them to see and interpret what’s the script and they can decide on the same to invest and get the benefit out of it.

References

[1] S.Liu and G.Liao and Y.Ding ,“Stock transaction prediction modeling and analysis based on LSTM”,2018 13th IEEE Conference on Industrial Electronics and Application(ICIEA), pp. 2787-2790, 2018. [2] T.Gao and Y.Chai and Y.Liu, “Applying long short term memory neural networks for predicting stock closing price”, 2017 8th IEEE International Conference on Software Engineering and Service Science (ICSESS), pp. 575 - 578, 2017. [3] M.Usmani, S.H.Adil, ,K.Raza and S.S.A.Ali, “Stock market prediction using machine learning techniques”, 2016 3rd International Conference on Computer and Information Sciences(ICCOINS), pp.322-327,2016. [4] H.Gunduz and Z.Cataltepe and Y.Yaslan, “Stock market direction prediction using deep neural networks:, 2017 25th Signal Processing and Communications Applications Conference (SIU), pp. 1-4, 2017. Publisher: IEEE – 2020 Author: Md. Arif Istiake Sunny, Mirza Mohd [5] Stock Market Prediction Using Machine Learning, Publisher: IEEE – 2018, Author: Ishita Parmar, Navanshu Agarwal [6] Predicting Stock market trends using Machine Learning and Deep Learning Algorithms, Publisher: IEEE – 2020, Author: Mojtaba Nabipour, Pooyan Nayyeri [7] Stock Trend Prediction Using Candlestick Charting and Ensemble Learning, Publisher: IEEE – 2021, Author: Yaohu Lin, Shancun Liu, Haijun Yang. [8] Stock Price Manipulation Detection Using Deep Unsupervised Learning, Publisher:IEEE – 2021, Author: Teema Leangarun, Poj Tangamchit. [9] Integrated Long-Term Stock Selection Models Based on Feature Selection And Machine Learning Algorithms, Publisher: IEEE – 2020, Author: Xianghui Yuan, JinYuan [10] Deep Reinforcement Learning Approach for Trading Automation in Stock Market, Publisher: IEEE – 2022, Author: Taylan Kabbani, Ekrem Duma

Copyright

Copyright © 2023 Mr. E. Sankar, Nunna Sai Charan, P Venkata Sai Pavan. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET51018

Publish Date : 2023-04-25

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online