Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

Stock Market Prediction Using Fuzzy Logic and Technical Indicators: A Case Study of Indian Banks

Authors: Dr. Swathi Yandamuri, D Gokila, Sahajpreet Kaur, Ms. Prerna Chanana, Ms. Harpreet Kaur , Ms. R. Soniya, A. Elizabeth Prema, V. Manopriya

DOI Link: https://doi.org/10.22214/ijraset.2024.64130

Certificate: View Certificate

Abstract

This study presents a decision support system for stock market investors that combines technical analysis with fuzzy logic. The system utilizes four essential technical indicators—Moving Average Convergence/Divergence (MACD), Relative Strength Index (RSI), Stochastic Oscillator (SO), and On-Balance Volume (OBV)—to predict future price movements. These indicators are mapped as inputs into a fuzzy inference system, where fuzzy rules and membership functions are applied to generate trading recommendations, categorized as Bullish, Neutral, or Bearish. Experiments using MATLAB with data from 10 Indian banks demonstrate that the system effectively predicts stock movements and improves investment decisions when integrated with additional market information and investor insights

Introduction

I. INTRODUCTION

Forecasting price movements in financial markets is essential for constructing portfolios aimed at achieving excess returns. Traders typically integrate information from various sources with their evolving trading strategies, which they adjust over time to adapt to shifting market conditions. Although the predictability of financial markets remains a topic of debate, many traders believe that markets are not entirely efficient and that temporary "pockets of predictability" exist. These can be leveraged to earn returns that surpass the market average. As a result, financial institutions have developed decision support systems to help traders and analysts make faster and more informed decisions. Murphy, (1999), Pring, (2002) Technical analysis is one approach used in financial markets to inform buying and selling decisions. It is based on the idea that securities follow trends and patterns that continue for short periods until a change in market conditions triggers a new trend. However, the effectiveness of technical analysis depends heavily on how signals are interpreted, making human expertise crucial. Experienced traders are often better equipped to identify subtle shifts in market trends and conditions. Traditional decision support systems that rely on technical analysis often use quantitative measures without directly incorporating traders' expertise Fama, (1970). Venugopal et al, (2024) Fuzzy systems, however, can bridge this gap. A fuzzy system processes data numerically while also being expressible through linguistic rules, making it more user-friendly for traders. It may even be possible to design a system that replicates the reasoning and decision-making process of a human trader using technical analysis, provided the necessary expertise is captured. In this study, we introduce a fuzzy logic-based trading system designed to predict price movements in financial markets. The system is crafted to identify various market regimes and generate buy or sell signals for traders investing in a diversified portfolio of European, American, and Japanese bonds and currencies. The fuzzy system's structure is deliberately aligned with the reasoning methods of financial experts, utilizing expert knowledge to guide its design. Although the system's signals are primarily intended for human traders, they can also be integrated with an automated portfolio allocation mechanism.

The system's performance is assessed through different performance allocation strategies. Zadeh (1965) the fuzzy system's parameters are optimized using a real-coded genetic algorithm, allowing it to learn from past experiences and adapt to evolving market conditions. The effectiveness of the fuzzy system is compared against two benchmark strategies: a buy-and-hold strategy and an existing system at a financial institution that uses a committee-of-experts approach to advise traders Lin & Zhang, (2004) ,Venugopal et al, (2024), Venugopal et al, (2024), Veeramani et al,(2023).

II. LITERATURE REVIEW

Fama, (1970).Fama's work on the Efficient Market Hypothesis (EMH) suggests that financial markets are fully efficient, implying that price movements cannot be predicted based on available information. However, this theory has faced criticism, leading to debates on market predictability. Murphy, (1999). Murphy's book is a seminal guide to technical analysis, emphasizing the role of trends, patterns, and indicators in predicting market movements. It remains a foundational text for traders and analysts. Pring,(2002).Pring provides a comprehensive overview of technical analysis, focusing on how price patterns can be used to forecast future market behavior. The book highlights the importance of understanding market psychology. Lam, & Lam, (2004).The authors develop a fuzzy logic decision support system for risk analysis in engineering projects, illustrating the applicability of fuzzy logic in managing uncertainty across various domains, including finance. Kulkarni & Venayagamoorthy (2007).This paper presents a fuzzy logic-based trading system, optimized using genetic algorithms, and demonstrates its ability to adapt to changing market conditions and improve trading decisions. Kwon & Moon (2007). The authors propose a fuzzy rule-based approach to volatility estimation, demonstrating how fuzzy logic can enhance the accuracy of risk assessment in financial markets. Coakley & Brown (2000).Coakley and Brown review the application of artificial neural networks in accounting and finance, highlighting the growing importance of AI in these fields. Venugopal et al, (2024) Study presents a fuzzy inference system for predicting daily stock trading decisions, demonstrating its effectiveness in enhancing decision-making accuracy in volatile markets. The system is evaluated through extensive simulations, showing improved trading performance compared to traditional methods. Venugopal et al, (2024).The authors propose an integrated approach combining Neutrosophic DEMATEL, TOPSIS, and GRA to evaluate the financial ratio performance of NASDAQ-listed companies. This comprehensive method addresses the complexities of financial decision-making by incorporating multiple criteria and uncertainty into the evaluation process. Veeramani et al,(2023) This exploration delves into the application of fuzzy inference systems for daily trading decisions, utilizing fuzzy MCDM methods for performance analysis. The study highlights the potential of these systems to outperform conventional trading strategies in complex financial environments. Venugopal et al, (2024). The paper introduces a novel fuzzy indicator to enhance daily stock trading, with performance analyzed using the Z-number based fuzzy TOPSIS method. The results indicate that this approach significantly improves the accuracy and reliability of trading decisions in uncertain market conditions. In this study, we gathered insights from various experienced trading experts and formulated fuzzy rules based on their recommendations. These rules were then used in the fuzzy inference system to generate daily trading signals.

A. Technical Analysis

Technical analysis involves studying historical price data and market trends to predict future price movements. It relies on patterns, indicators, and charting tools to guide trading decisions, often independent of a security's intrinsic value. In this study, we consider four technical indicators as follows:

- Moving Average Convergence/Divergence (MACD) (Appel, (1979)).

- Relative Strength Index (RSI) (Wilder, J. W. (1978)).

- Stochastic Oscillator (Lane, G. (1984)).

- On-Balance Volume (OBV) (Granville, J. E. (1963)).

III. FUZZY INFERENCE SYSTEM

A fuzzy inference system uses fuzzy logic to model complex systems and decision-making processes by applying linguistic rules to numerical data. It interprets imprecise or ambiguous inputs and generates outputs based on the degree of truth of these inputs, mimicking human reasoning. In this study technical indicator as input to fuzzy inference system. In this study, we gathered insights from various experienced trading experts and formulated fuzzy rules based on their recommendations. These rules were then used in the fuzzy inference system to generate daily trading signals. The example few fuzzy rule as follows. The more fuzz rule are . Ijegwa (2014).

If RSI is Low and SO is Low, then OBV is Increasing and MACD is Bullish.

If RSI is Low and SO is Medium, then OBV is Increasing and MACD is Bullish.

If RSI is Low and SO is High, then OBV is Stable and MACD is Neutral.

If RSI is Medium and SO is Low, then OBV is Increasing and MACD is Bullish

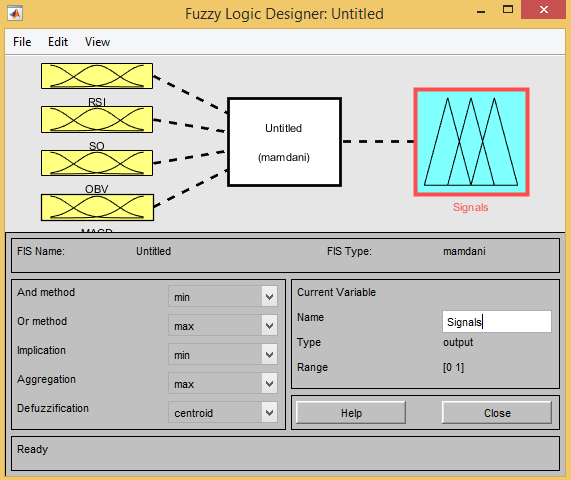

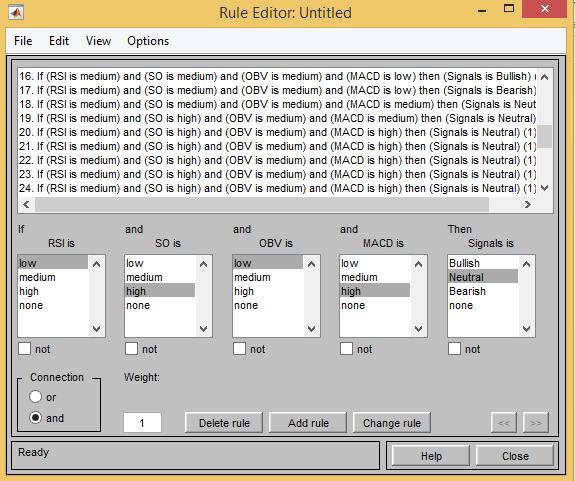

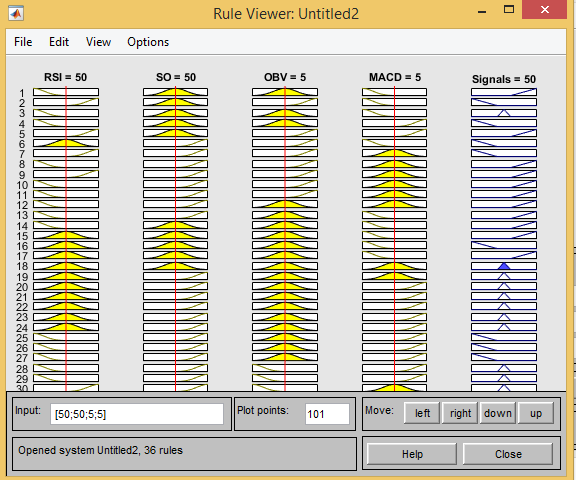

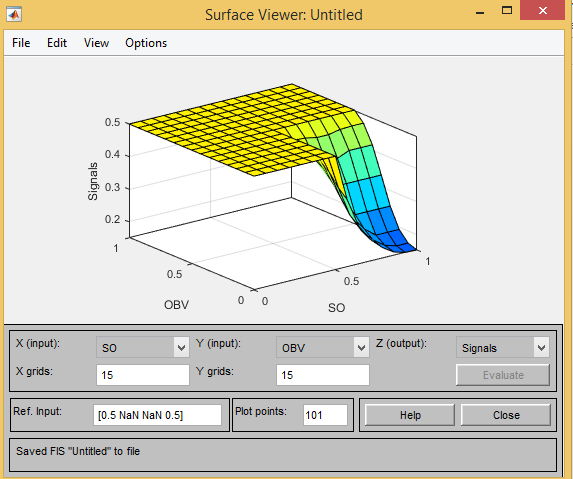

Figure 2 illustrates the input and output variables mapped in the fuzzy inference system, where RSI, MACD, SO, and OBV are used as inputs. After defining the membership functions, the fuzzy rules generate trading signals. The fuzzy rules and their corresponding outputs are depicted in Figures 2 3, and 4. The buy and sell signals followed by Veeramani et al,(2023), Ijegwa (2014).

Fig1: input and output variable

Fig2: Fuzzy rule viewer

Fig3.Rule Viewer

Fig4: Surface Plot

IV. RESULTS AND DISCUSSION

The proposed decision support system effectively integrates technical analysis and fuzzy logic to assist stock market investors. By utilizing Moving Average Convergence/Divergence (MACD), Relative Strength Index (RSI), Stochastic Oscillator (SO), and On-Balance Volume (OBV) as inputs, the system has demonstrated satisfactory performance in predicting stock price movements. The system processes these indicators through a three-module approach: the technical analysis module computes the indicators, the convergence module translates these into new input variables, and the fuzzy inference module applies rules and membership functions to generate trading recommendations. Experimental results using MATLAB with actual stock data from 10 Indian banks confirmed the system's ability to provide reliable trading signals. The use of four diverse technical indicators combined in the fuzzy logic framework contributed to a more robust and accurate prediction model. The system’s recommendations—buy, sell, or hold—aligned well with market trends, validating its practical effectiveness.

Conclusion

This study presents a robust decision support system combining technical analysis and fuzzy logic, tailored for stock market investors. The system leverages MACD, RSI, SO, and OBV to generate actionable trading signals through a structured fuzzy inference process. The experiments with real stock data from Indian banks demonstrated the system’s effectiveness in predicting price movements and providing reliable trading recommendations. Integrating multiple technical indicators in the fuzzy logic framework has enhanced the system’s predictive accuracy and overall reliability.

References

[1] Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work. Journal of Finance, 25(2), 383-417. [2] Murphy, J. J. (1999). Technical Analysis of the Financial Markets: A Comprehensive Guide to Trading Methods and Applications. New York Institute of Finance. [3] Pring, M. J. (2002). Technical Analysis Explained. McGraw-Hill. [4] Lin, W., & Zhang, J. (2004). A fuzzy systems approach for stock market index forecasting. Expert Systems with Applications, 27(4), 1009-1016. [5] Ijegwa, A.D., Rebecca, V.O., Olusegun, F. and Isaac, O.O., 2014. A predictive stock market technical analysis using fuzzy logic. Computer and information science, 7(3), p.1. [6] Venugopal, R., Veeramani, C. and Muruganandan, S., 2024. An effective approach for predicting daily stock trading decisions using fuzzy inference systems. Soft Computing, 28(4), pp.3301-3319. [7] Venugopal, R., Veeramani, C. and Das, A., 2024. INTEGRATED NEUTROSOPHIC DEMATEL, TOPSIS, AND GRA APPROACH FOR FINANCIAL RATIO PERFORMANCE EVALUATION OF NASDAQ EXCHANGE. International Journal of Industrial Engineering: Theory, Applications and Practice, 31(1). [8] Veeramani, C., Venugopal, R. and Muruganandan, S., 2023. An exploration of the fuzzy inference system for the daily trading decision and its performance analysis based on fuzzy MCDM methods. Computational Economics, 62(3), pp.1313-1340. [9] Venugopal, R., Veeramani, C. and Edalatpanah, S.A., 2024. Enhancing daily stock trading with a novel fuzzy indicator: Performance analysis using Z-number based fuzzy TOPSIS method. Results in control and optimization, 14, p.100365. [10] Lam, K. C., & Lam, M. H. (2004). A fuzzy logic decision support system for risk analysis in engineering projects. Engineering Applications of Artificial Intelligence, 17(3), 345-351. [11] Kulkarni, A. J., & Venayagamoorthy, G. K. (2007). Fuzzy logic based trading system. IEEE Transactions on Neural Networks, 18(4), 889-899. [12] Kwon, Y. K., & Moon, K. C. (2007). Fuzzy rule-based approach to volatility estimation. Expert Systems with Applications, 32(3), 798-808. [13] Coakley, J., & Brown, C. (2000). Artificial neural networks in accounting and finance: Modeling issues. International Journal of Intelligent Systems in Accounting, Finance & Management, 9(2), 119-144. [14] Appel, G. (1979). The Moving Average Convergence Divergence Trading Method. Signalert Corporation. [15] Wilder, J. W. (1978). New Concepts in Technical Trading Systems. Trend Research. [16] Lane, G. (1984). Lane\'s Stochastics: The Ultimate Momentum Indicator. Commodities Magazine.. [17] Granville, J. E. (1963). Granville\'s New Key to Stock Market Profits. Prentice-Hall.

Copyright

Copyright © 2024 Dr. Swathi Yandamuri, D Gokila, Sahajpreet Kaur, Ms. Prerna Chanana, Ms. Harpreet Kaur , Ms. R. Soniya, A. Elizabeth Prema, V. Manopriya. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET64130

Publish Date : 2024-08-31

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online