Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

The Effect of Real Earnings Management on Economic Value Added: Listed Companies of Dubai Financial Market

Authors: Ibrahim R. I. Elmadhoun, Dr. Gaddam Naresh Reddy

DOI Link: https://doi.org/10.22214/ijraset.2022.40071

Certificate: View Certificate

Abstract

In this paper, we reviewed the impact of Real Earnings Management on the Economic Value Added. The real earnings management value was calculated for (52) companies listed on the Dubai Financial Market through (Sales Manipulation, Production Costs Manipulation, and Discretionary Expenses Manipulation), the period of study 5 years from 2014 to 2018, the results showed that companies practiced real earnings management activities in varying proportions. In addition, we calculated the economic value added without adjustments and with additional adjustments for all sample companies. To test the validity of the hypothesis, we used a regression analysis by applying the three empirical models. Through the results of the analysis, we accepted the alternative hypothesis it\'s mean we funded the negative effect of real earnings management on economic value added (negative significance)

Introduction

I. INTRODUCTION

Profits play an important role in determining the financial policies and fateful decisions of companies, where profits are the most important element in the financial statements and are used by internal and external financial statement users. The internal use of financial statements contributes to setting the company's organizational strategies, and important decisions in the company such as employee bonuses, capital increase, and forward contracts.

As for the users of external financial statements, they depend entirely on financial reports in making investment decisions. The task of financial reports is to reflect the true image of the company’s performance, especially the item of profits and income generation, Confidence in financial statements is the basis for investors and users of financial statements.

Given the powers that managers possess and the extent of their influence on the preparation of financial reports, there is a fear that managers may exercise earnings management to reflect a good image of the company’s performance to achieve their interests and attract new investors to the company in addition to increasing share prices in the financial market.

The company's performance can be measured by many financial and economic measures. The measure of the economic value added is one of the leading measures in this field, but most of the measures as well as the economic value added depend on the data published in the financial statements issued by the company. In the case of earnings management practice, this negatively affects the scale of economic value added, Earnings management is divided into two parts: Real earnings management and Accrual earnings management. Where we will address in this paper the real earnings management and the extent of their impact on the scale of economic value added and we will discuss methods of real earnings management and how to measure the practice of earnings management using the Roychowdhury model through a sample from the Dubai financial market.

II. LITERATURE REVIEW

Before talking about earnings management, it is necessary to discuss the basic theory on which earnings management is built, which is the separation of management from ownership, or what is excused by the agency theory.

Agency Theory is a theory of how things happen. Among the theories of earnings management that have been proposed, agency theory is one of the more famous ones. (Jensen and Meckling, 1976), When managers aim to enhance their own utility at the expense of shareholders, there is a conflict of interest between them. It is because of this dispute that agency expenses have been accrued. agents will offer shareholders with an accurate image of the company's financial situation in order to protect or maximise their interests (Bhundia, 2012). However, agency problems arise when the maximization of the agent’s wealth does not necessarily lead to the maximization of shareholders’ wealth. Managers or agents may have an incentive to manipulate earnings in order to maximize their self-interest.

A. Concept of Real Earnings Management

Real earnings management occurs when managers intentionally make operational decisions that have actual cash flow implications with a view to altering reported earnings. For example, a company may provide product promotions to give consumers more flexible credit terms to quickly raise sales profits. Managers also can opportunistically minimize spending on research and development to reduce expenditure in the income statement (Skinner and Dechow, 2000). Managers may also delay maintenance expenses to increase registered profits. Where the concept of real earnings management depends on the decisions of operational activities, the structure of real deals, the timing of sales of assets, and other activities that relate to the operational operations of the company.

Xu et al. (2007) defined REM as, “Real Earnings Management involves management attempts to alter reported earnings by adjusting the timing and scale of underlying business activities.”

They further divide REM into two categories: controlling operating and investing activities. Examples include capital spending, growth, inventory, and selling, long-term asset sales, investment transaction structuring to take advantage of alternative accounting choices. Financing activities manipulation. Examples include stock repurchases, stock options, financial instruments, investment transactions structuring to benefit from alternative accounting choices.

In additionally Roychowdhury (2006) defined real earnings management as: “Real activity manipulation is defined as departures from normal operational practices, motivated by managers’ desire to mislead at least some stakeholders into believing certain financial reporting goals have been met in the normal course of operations”

Also, Zang (2007) defined them as : “Measures aimed at changing the declared profits in a specific direction. This change is achieved through structuring transactions and manipulating timing or financial transactions to reach the optimum level. Real earnings management is based on the availability of two basic elements, which are real decisions and means operations and investment activities such as decisions to accelerate sales Reducing research and development expenditures from activities, and these transactions usually affect cash flows, and Tthe second element is that managers take measures to deviate and move away from ideal procedures, and this component is the basis for the problem of agency theory”. Also (Choen et al; 2019) defined REM: “It represents the measures taken by managers to change the real activities of the company to achieve the desired goals of financial reports”.

Through the foregoing, the concept of real earnings management can be summarized as a set of actions taken by managers in order to influence the declared profits through structuring transactions and manipulating timing or financial transactions to reach the optimum level.

B. Activity of Real Earnings Management Techniques

Different forms of real earnings management were examined in the literature, including production control, sales and inventory control, sales of fixed assets, and the control of discretionary expense (e.g. R&D) as well as sales, general and administrative expense (SGA) (Xu et al., 2007).

Where prior earnings management literature has concentrated primarily on four types of Real Earnings Management:

- Sales manipulation.

- Overproduction

- Discretionary expenditure manipulation

C. The Relationship between Real Earnings Management and Economic Value Added

As the calculation of the economic value added depends on the information issued by the companies through the financial statements, for this reason, it is possible to find a relationship between the economic value added and the real earnings management. The relationship between the Real Earnings Management and the economic value added is represented in the cost of capital. The cost of capital refers to the amount of return a firm should have on a given investment after accounting for the cost of capital. The rate of return necessary to attract investors to finance a capital budgeting project is generally determined by the cost of capital. Companies evaluate the cost of capital internally to assess if the resource investment is worthwhile in pursuing a capital project. Investors evaluate the cost of capital to estimate the risk of investing money in a capital project. The cost of capital is heavily dependent on the type of financing used in the business. A business can be financed through debt or strictly through equity. However, most companies employ a mixture of equity and debt to finance their businesses.

As a result, the weighted average cost of all capital sources, or the weighted average cost of capital, determines the cost of capital. Companies should only invest in projects that provide a higher rate of return than their cost of capital. It establishes a standard that must be reached by the project's conclusion.

Brown and Higgins (2001) also found that REM is linked to higher capital costs because it alters a company's fundamentals. Furthermore, it raises earnings distortion or mistakes and lowers investor expectations for future cash flow levels. As a result, listed company executives try to implement earnings management through REM, which may raise capital costs and lower EVA.

By reviewing previous studies, the results of the (Liu and Wang,2017) study conducted on African companies and on the G20 group to study the relationship between Real Earnings management and economic value added showed that there is a negative relationship between real earnings management and economic added value, especially in the G20 group. In addition, the results of the (Liu, 2016) study, which was conducted on a sample of companies among nations of the North American Free Trade Agreement (NAFTA), Association of Southeast Asian Nations (ASEAN), European Union (EU), and those classified as a newly industrialized country (NIC) indicated that a significant inverse relationship exists between earnings management through real earnings management (REM) activities and EVA in NAFTA and EU nations. Moreover, a significantly positive relationship exists between earnings management through REM and EVA in ASEAN and NIC nations.

Because there have been few studies that have discussed the relationship between real earnings management and economic value added, this study aims to investigate the relationship between REM and EVA by a selected a sample of companies listed on the Dubai Financial Market and calculating the real earnings management through (sales manipulation, production costs manipulation, and discretionary expenses manipulation) and the economic added value. Then, using regression equations, determine the connection between the two sides.

III. METHODOLOGY OF THE STUDY

In order to achieve the objectives of the study, we used the descriptive-analytical approach, through which he tries to describe the phenomenon, the subject of the study, and analyze its data, the relationship between its components, the opinions raised about it, the processes it includes, and the effects that they cause.

A. Data Collection

The sample for this study was obtained from the FINBOX database and the annual financial reports for companies published on the Dubai Financial Market website between 2014 and 2018 (5 years).

B. Sample Size

The sample includes 52 companies listed on Dubai Financial Market (DFM). The sample included all companies that were listed on the market and published their financial statements before 2014. However, 13 companies are excluded from this research because they are listed in DFM after 2014.

C. Period of the Study

The present study is covered 5 years from 2014 to 2018. However, this research does not include the annual reports of 2019 and 2020 due to the effect of Covid – 19. In fact, Covid - 19 has affected all life aspects and had to shut down all stock markets in the globe. The effect of Covid-19 is still affecting the all-life sectors tills the date of this study. Therefore, for quality purposes, this research studied only the annual reports that are published between 2014 to 2018.

D. Hypotheses of Study

REM is seldom exposed to external monitoring or inspection, and it is difficult to identify using internal monitors such as a board of directors or audit committee. External investors have difficulties judging business performance since REM may not be limited by effective governance systems. Where Kim and Sohn (2013) discovered that the cost per capita is positively related to the degree of REM activities aimed at earnings manipulation, contending that REM activities raise the cost of equity. Furthermore, Brown and Higgins (2001) discovered that REM is positively related to capital expenses because it distorts a business's fundamentals. REM also adds noise or mistakes in results and lowers investor expectations of future cash flow levels. EVA is a firm's profit minus the cost of financing the firm's capital. As a result, more capital indicates a lower EVA in a company. also reviewing previous studies that dealt with the relationship between earnings management through real activities and economic value added (Liu and wang, 2017 & Liu,2016). As a result, we suggested Hypothesis as follows:

H0: Earnings management through REM activity manipulation is no significantly negatively related with EVA

H1: Earnings management through REM activity manipulation is significantly negatively related with EVA.

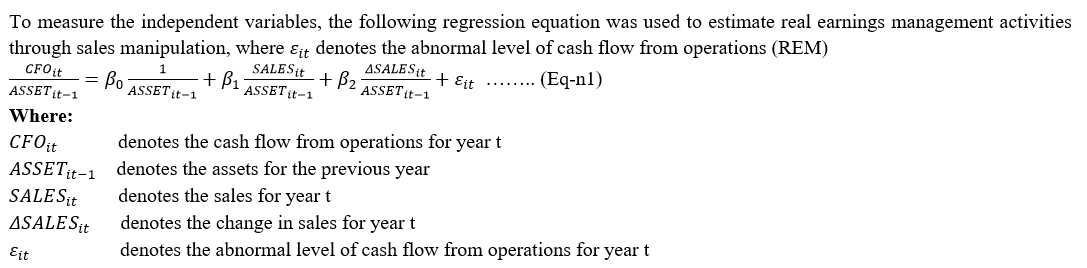

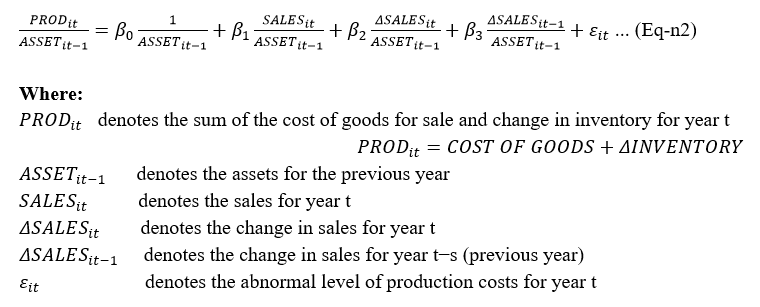

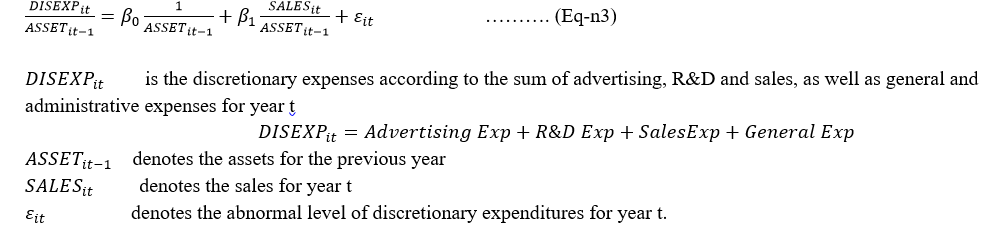

To measure the relationship between the variables, a model was used Roychowdhury (2006), where developed empirical models for estimating the typical levels of real business activities, as reflected in the cash flow from operations, production costs, and discretionary expenditures. We used Models 1-3 to estimate the absolute value of ε_it to measure the abnormal level of REM

E. The Independent Variables Studied Under Real Earnings Management Is Presented As Follows

- Sales Manipulation: Sales are the biggest profit items for companies, so managers may seek to increase the company's profits by manipulating sales. Where it is one of the tools and methods of real earnings management activities. Manipulating sales is defined as the administration’s attempt to temporarily increase the company's sales before the end of the fiscal year. As the management takes measures that affect the process and the volume of sales (Gunny, 2010; Roychowdhury, 2006). Others have seen that managers try to increase sales during the year to increase the targeted profits from sales.

2. Production Costs Manipulation: There are many and varied optional expenditures that can be manipulated in the amounts related to them (Research and Development Expenditures, Advertising and Advertising Expenditures, General and Administrative Expenses), and are subject to manipulation by managers to reduce these expenditures and recognize them as revenue expenses during the year of their occurrence to affect profits or record and measure expenditures and their capital expenditures. Over the years, the process of reducing optional expenditures is considered a method used by managers when these expenditures represent a large proportion of the total expenses incurred by the company.

3. Discretionary Expenses Manipulation: It is one of the means of real earnings management and the idea of overproduction depends on increasing the number of units produced to reduce the cost of finished products sold, and in this method, the focus is on production costs about sales and the cost of finished products sold is defined in addition to changes in inventory during the period (Roychowdhury, 2003). Managers increase production to meet expected demand in light of higher levels of production, the fixed costs of the product are distributed over a larger number of units, and this lowers the ratio of fixed costs per unit, and because this reduction is not matched by any increase in the marginal costs of the unit, the total unit costs decrease, which leads to reduce the cost of complete production sold in company reports. (Rovchowdhurv.2006)

Through this equation, we will measure the extent to which Dubai Financial Market companies practice real earnings management by Discretionary Expenses Manipulation.

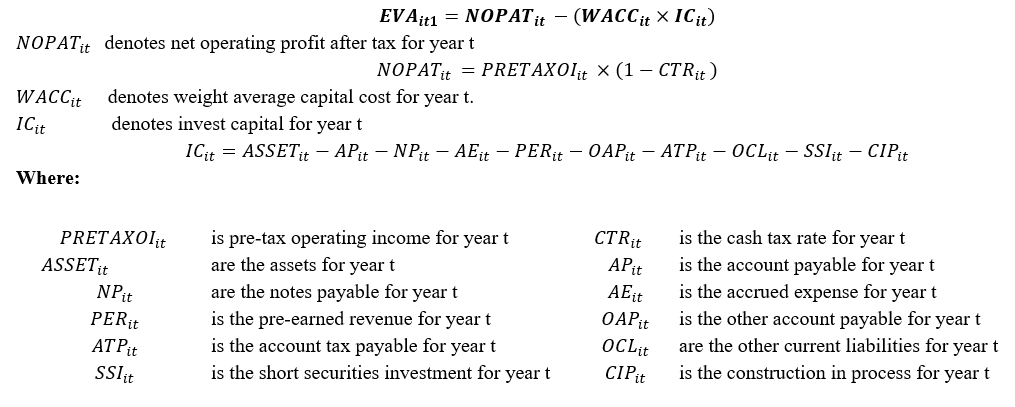

F. The Independent Variables - Measurement of Economic Value Added

Economic Value Added (EVA), often known as Economic Profit, is a method of determining profitability that is based on the residual income methodology. His fundamental belief is that true profitability is achieved when more wealth is generated for shareholders, and that projects should yield returns that are greater than the cost of capital incurred.

- Unadjusted EVA: Economic value-added, according to Stewart (1991) and Stern (1993), is a method of measuring a company's financial success by taking into account all of the company's cost of capital, including both debt and equity. EVA is measured in many steps:

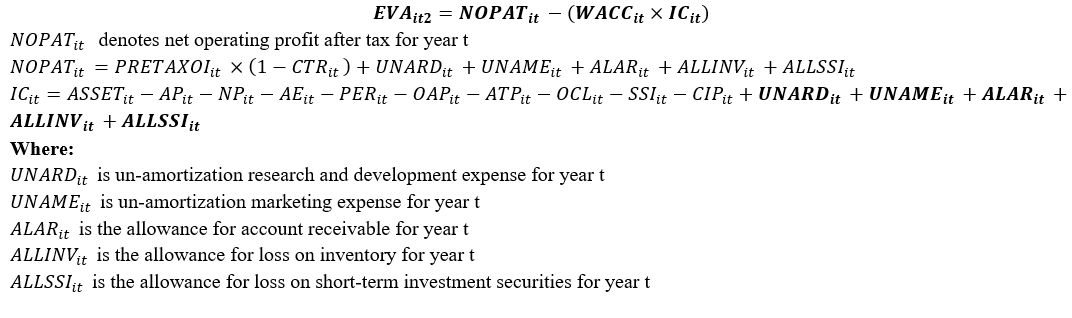

2. Adjusted EVA Join Adjusted Items: The second step of calculating the added economic value is to add the accounting adjustments. This study, adopted the adjustments for research and development, marketing expenses, allowance for account receivable, allowance for loss on inventory, and loss on short-term investment securities. Accounting adjustments according to the following equations:

3. Adjusted EVA Join Adjusted Items and Economic Depreciation Adjusted Items: In this step, the economic depreciation is added to the adjustments, unlike accounting depreciation, economic depreciation represents the real change in the value of assets over time. If no information on economic depreciation is provided, applicants should presume that accounting depreciation is a good estimate. Adjustments according to the following equations:

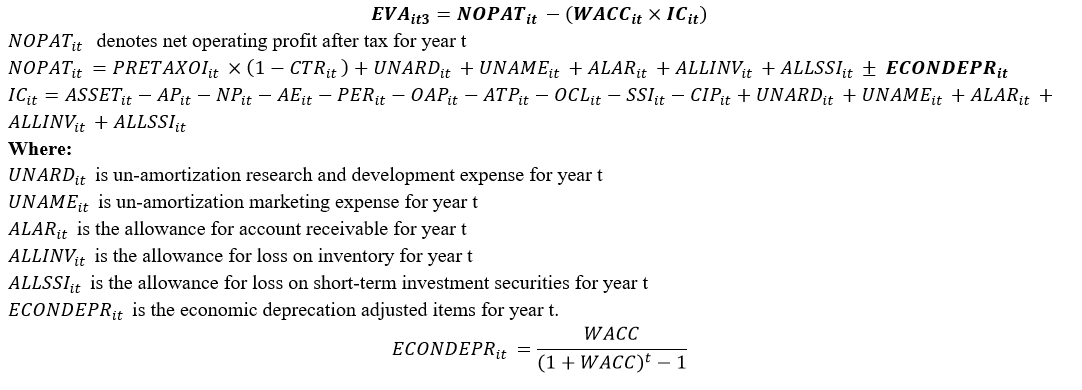

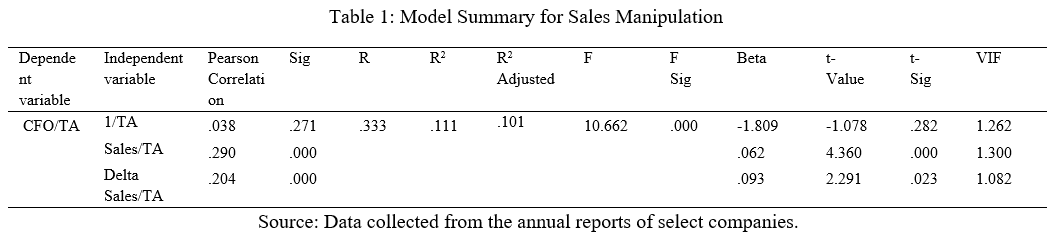

G. Empirical Model for the relationship between Real Earnings Management and Economic Value Added

As the calculation of the economic value added depends on the information issued by the companies through the financial statements, for this reason, it is possible to find a relationship between the economic value-added and real earnings management, this relationship can be explained by the following regression equations

IV. ANALYSIS AND DISCUSSION

A. Measuring Real Earnings Management

The real earnings management was measured through three activities, which are as follows:

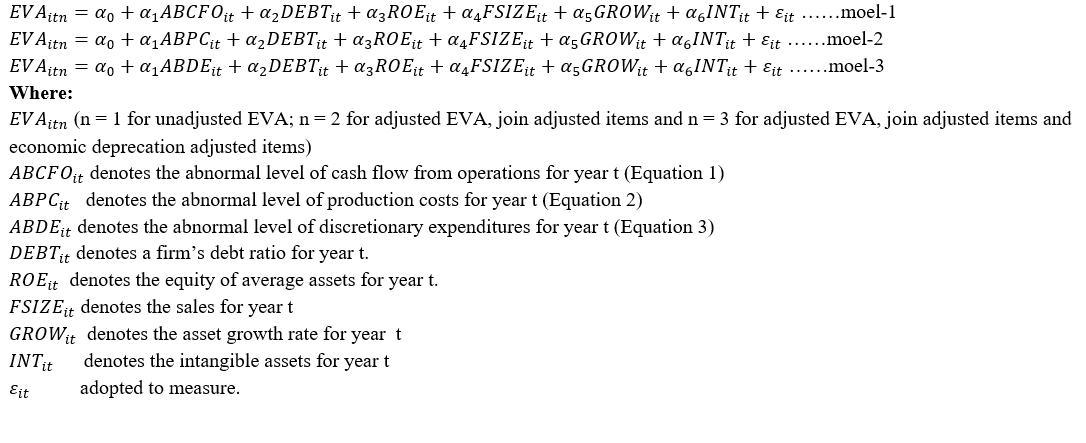

- Sales Manipulation: The table (1) shows the Pearson Correlation between the variables of the regression model, where the correlation coefficient was the highest between CFO and Sales where the value is 0.290 and significant 0.000 less than 0.05 this means that there is a statistical significance between the variables and an association between the variables. The correlation coefficient between CFO and TA is the value of the variables is 0.038 and significant 0.271 greater than 0.05. That is means that there is no correlation between cash flow from operating and total assets.

The previous table shows regression results between the dependent variable (Cash flow from operating) and the independent variables (total assets, current sales, and change in sales). The value of R 0.333, determination parameter value of R2 is 0.111 and R2 adjusted is 0.101. As it is known statistically that the value of (R) measures the extent of the strength of the relationship (correlation) between the dependent variable and the independent variables included in the model. While R2 measures the percentage of change in the dependent variable due to the change in the independent variables included in the model. Each one is measured with the level of significance reflected in the value of F-Sig change and also statistically. The closer the value of F-Sig change is to zero, the more this indicates the significance of the relationship. Based on this, the following results can be drawn:

- The effect between the dependent variable and the independent variables in this model appears to be a weak effect, as the correlation coefficient is 0.333. However, the percentage change in the dependent variable due to the change in the independent variables appears weak as it is 0.111, and the level of significance indicates that this relationship is significant.

- That is, the independent variables (total assets, current sales, and change in sales) explain 11% of the variance in cash flow from operations.

Additionally shows the results of the ANOVA analysis to test the significance of the regression. The value of the significance is 0.000, which is less than 0.05, and therefore the regression is significant, and the F value greater than F-Table that means there is an effect of the independent variables 1/TA, sales, and delta sales on the dependent variable (cash flow from operations).

Also, the value of the variance inflation factor coefficients showed that there is no problem of linear multiplicity between the variables where the inflation coefficients were less than (3).

Throughout the previous analysis, the significance of the estimator t-value was shown, as the level of statistical significance is less than 0.05, between (CFO, the sales of companies, and the change of sales) and (t) value greater than the t-table where the value of (t) are equal 4.360 and 2.291, while t-table 1.984, and this indicates a positive effect between cash flows and current sales and a positive effect between cash flows and change in sales. Also, it is clear that no significant between CFO/TA and a total 1/TA the level of significance is greater than 0.05.

Finally, the regression equation can be written as:

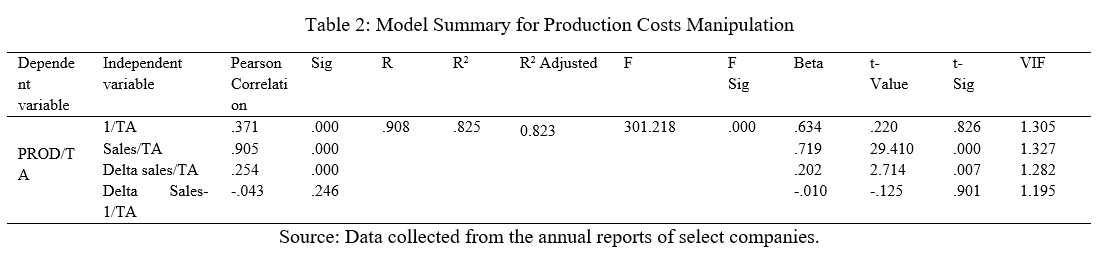

2. Production Costs Manipulation: Table (2) shows the regression analysis between the variables, where the correlation coefficient was the highest between PROD and sales where the value is 0.905 and significant 0.000 less than 0.05 this means that there is a statistical significance between the variables and an association between the variables. The correlation coefficient between PROD and the change in sales in the previous year is the least among the variables its -0.043 and significant 0.246 more than 0.05. This means that there is a correlation between these variables.

In addition to this shows regression results between (total assets, current sales, change in sales, and change in sales at the previous year) and the independent variables (PROD), where the value of R is 0.908, determination parameter value R2 is 0.825, and adjusted determination parameter value is 0.823, That means the independent variables (total assets, current sales, change in sales, and change in sales at the previous year) explain 82% of the variance in product cost manipulation.

Also shows the results of the ANOVA analysis to test the significance of the regression. The value of the significance is 0.000, which is less than 0.05, and therefore the regression is significant, and the (F) value greater than (F-Table) that means there is an effect of the independent variables (total assets, current sales, change in sales, and change in sales at previous year) on the variance in product cost manipulation.

Moreover, the value of the variance inflation factor coefficients showed that there is no problem of linear multiplicity between the variables where the inflation coefficients were less than (3).

Throughout the previous analysis, the significance of the estimator t-value was shown, as the level of statistical significance is less than 0.05, between (product cost, the sales of companies, and change of sales) the (t) value greater than the t-table where the value of (t) is equal to 29.410 and 2.714 while t-table is 1.984, and this indicates a positive effect between product cost and current sales and a positive effect between product cost and change in sales. Also, it is clear that is no significant between product cost and total assets. Also, there is no effect between product cost and change of seals in the previous year because the level of significance is greater than 0.05.

Finally, the regression equation can be written as:

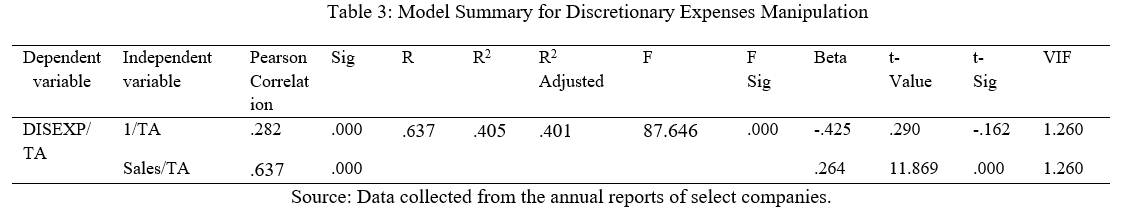

3. Discretionary Expenses Manipulation: The table (3) shows the correlation matrix between the variables of the regression model, where the correlation coefficient was the highest between DISEXP and previous sales where the value is 0.637 and significant 0.000 less than 0.05. This means that there is a statistical significance between the variables and an association between the variables, and the correlation coefficient between DISEXP and the asset in the previous year is the least value of the variables is 0.282 and significant 0.000 less than 0.05. This means that there is a correlation between these variables.

The previous table (3) shows regression results between the dependent variable and the independent variables, where the value of R is0.637, and adjusted determination parameter value is 0.401 determination parameter value R2 is 0.405, which means the independent variables (1/TA and sales/TA) explain 40% of the variance in discretionary expenses manipulation.

As well as shows the results of the analysis to test the significance of the regression. The value of the significance is 0.000, which is less than 0.05, and therefore the regression is significant, that is, there is an effect of the independent variables (1/TA and sales/TA) on the discretionary expenses. Also, in the value of the variance inflation factor coefficients, there is no problem of linear multiplicity between the variables where the inflation coefficients were less than (3).

Throughout the previous analysis, the significance of the estimator t-value was shown, as the level of statistical significance is less than 0.05, between (discretionary expenses manipulation and sales) the (t) value greater than t-table where the value of (t) is 11.869 while t-table 1.984, and this indicates a positive relationship between product cost and current sales and a positive relationship between discretionary expenses manipulation and sales. Also, it is clear that there is no significant between discretionary expenses manipulation and total assets because the level of significance is greater than 0.05.

Finally, the regression equation can be written as:

B. Calculating EVA without Adjusted and with Adjusted

The following table (4) shows the descriptive analysis of calculating the Economic Value Added, which are (EVA1 without adjustment, EVA2 Adjusted join adjusted items and EVA3adgusted with depreciation).

It is noted in the table, the highest value of EVA1 (6375.6) AED Millions to Emirates NBD Bank PJSC in 2018, also the minimum value (-1948.04) AED Millions to National Industries Group Holding-KPSC in 2014. On the other hand, the highest value of EVA2 (32845.74) AED Millions to Emirates NBD Bank PJSC in 2018, also the minimum value (-1893.65) AED Millions to National Industries Group Holding-KPSC in 2017. Also, the highest value of EVA3 (33259.84) AED Millions to Emirates NBD Bank PJSC in 2018, also the minimum value (-1811.89) AED Millions to National Industries Group Holding-KPSC company in 2017. and the value of the standard deviation its high this is due to the different companies and sectors, in addition to the difference in net income, invested capital, and Weight Average Capital Cost.

C. The Results of Empirical Models to Measure the Effect of REM on EVA

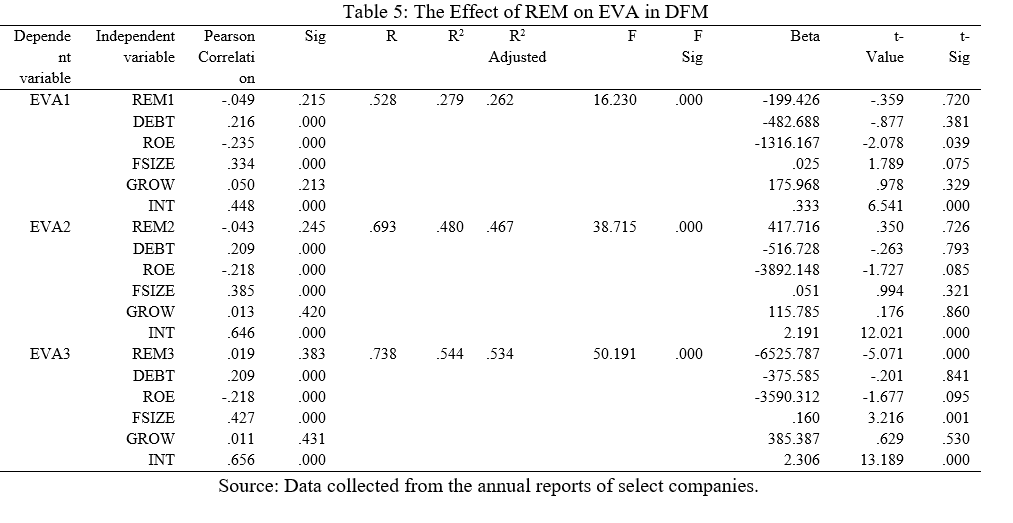

The following table shows the results of the multiple linear regression analysis to find the effect of real earnings management on the economic value added at the DFM:

The results of the regression model showed in the table (5) that the regression model is significant through the value of (F) of model-1, model-2, and model-3 are 16.230, 38.715 , and 50.191, and they are greater than (F-table) distribution it's (2.10) at the level of significance less than 0.05 this indicates that the proposed model has great suitability and explanatory power at the listed companies on DFM. The results explain that the explanatory variables explain 27%, 48%, and 54%of the variation in the economic added value. Looking at the coefficient of determination (R2), it is noticed that the explanatory relationship between the variables in the first model is weak, as it is less than 50% also, the R2 adjusted value were 0.26, 0.046, and 0.53.

For the purpose of determining the effect of performance indicators on the change in the economic value added of the individual companies, it relied on the outputs of the multiple regression test as follows:

- It is noted from the previous table that the calculated absolute value of (t) in model-3 amounted to -5.071 which is greater than its t-table of 1.6508, and this result is supported by the value of the significant significance (Sig-t), which was less than 0.05, where its value reached 0.000 according to the decision rule that states to accept the hypothesis if the calculated absolute value of (t) is greater than its tabular value when a significant value of Sig t is less than 0.05. Therefore, accepted the null hypothesis there is no effect of real earnings management through (sales manipulation and production costs manipulation) on economic value added at listed companies on Dubai Financial Market. Also accepted alternative hypothesis there is a negative effect of real earnings management through discretionary expenses manipulation on change of the economic added value of a listed company on DFM.

- Moreover, there is an effect on intangible assets value and economic value added (EVA, EVA2, and EVA3), where the (t) calculated value more than t-table it was 6.541, 12.021 and 13.189, also the (Sig-t) less than the significant level 0.05, there is a positive effect of intangible assets on economic value added at DFM.

- Also, there is an effect of Sales (FSIZE) on the economic value added in model-3 because the calculated value of (t) 3.216 is greater than the value of t-table 1.6508 and this result is supported by the value of the significant (Sig-t), which was less than 0.05, it is mean it is a positive effect of sales on economic value added in model-3 at the DFM.

- Moreover, there is an effect on equity of average assets (ROE) and economic value added (EVA1), where the (t) calculated value more than t-table it was -2.078, and (Sig-t) less than the significant level 0.05, there is a negative effect of equity of average assets (ROE) on economic value added at the in DFM, and no effect on EVA2 and EVA3.

- By looking at the results in the previous table, it is clear that there is no effect of the (debt ratio (DEBT) and asset growth (GROW)), on the change in the economic value added (EVA1, EVA2, EVA3), because the (Sig-t) is greater than 0.05 in DFM.

- Finally, the regression equation can be written as:

Conclusion

In this paper, we reviewed the impact of Real Earnings Management on the Economic Value Added. The real earnings management value was calculated for (52) companies listed on the Dubai Financial Market through (Sales Manipulation, Production Costs Manipulation, and Discretionary Expenses Manipulation), the results showed that companies practiced real earnings management activities in varying proportions. In addition, in this section, we calculated the economic value added without adjustments and with additional adjustments for all sample companies. On the other hand, to test the validity of the hypothesis, regression analysis for a sample of the study ?was applied to confirm the hypothesis (Earnings management through REM activity manipulation ?is significantly ?negatively related with EVA) the results showed the acceptance of the alternative ?hypothesis that there is an effect of real earnings management. Finally, we accepted the alternative hypothesis Earnings management through REM activity ?manipulation is significantly ?negatively related with EVA.?

References

[1] Bhundia, A., (2012), “A Comparative Study between Free Cash Flows and Earnings Management”, Business Intelligence Journal, 5(1): 123-129. [2] Brown, L. D., & Higgins, H. N. (2001). Managing earnings surprises in the US versus 12 other countries. Journal of Accounting and Public Policy, 20(4-5), 373-398. [3] https://doi.org/10.1016/S0278-4254(01)00039-4 [4] Cohen, D., Pandit, S., Wasley, C. E., & Zach, T. (2019). Measuring real activity management. Contemporary Accounting Research, 37(2), 1172-1198. [5] https://doi.org/10.1111/1911-3846.12553 [6] Cohen, D. A., & Zarowin, P. (2010). Accrual-based and real earnings management activities around seasoned equity offerings. Journal of Accounting and Economics, 50(1), 2-19. [7] https://doi.org/10.1016/j.jacceco.2010.01.002 [8] Dechow, P. and Skinner, D., (2000), “Earnings Management: Reconciling the Views of Accounting Academics, Practitioners, and Regulators”, Accounting Horizons, 14: 235-250. [9] http://dx.doi.org/10.2139/ssrn.218959 [10] Gunny, K. A. (2010). The relation between earnings management using real activities manipulation and future performance: Evidence from meeting earnings benchmarks. Contemporary Accounting Research, 27(3), 855-888. [11] https://doi.org/10.1111/j.1911-3846.2010.01029.x [12] Jensen, M. and Meckling, W., (1976), “Theory of the Firm: Managerial Behaviour, Agency Costs and Ownership Structure”, Journal of Financial Economics, 3(4): 305-360. [13] https://doi.org/10.1016/0304-405X(76)90026-X [14] Kim, J.B. & Sohn, B.C., (2013), ‘Real earnings management and cost of capital’, Journal of Accounting and Public Policy 32, 518–543. [15] https://doi.org/10.1016/j.jaccpubpol.2013.08.002 [16] Liu, Z. J. (2016). Effect of earnings management on economic value added: A cross-country study. South African Journal of Business Management, 47(1), 29-36. [17] 10.4102/sajems.v20i1.1729 [18] Liu, Z. J., & Wang, Y. S. (2017). Effect of earnings management on economic value added: G20 and African countries study. South African Journal of Economic and Management Sciences, 20(1), 1-9. https://doi.org/10.5430/afr.v4n3p9

Copyright

Copyright © 2022 Ibrahim R. I. Elmadhoun, Dr. Gaddam Naresh Reddy. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET40071

Publish Date : 2022-01-25

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online