Ijraset Journal For Research in Applied Science and Engineering Technology

- Home / Ijraset

- On This Page

- Abstract

- Introduction

- Conclusion

- References

- Copyright

The Growth of Alternative Investment Funds in India

Authors: Hamsaveni D

DOI Link: https://doi.org/10.22214/ijraset.2024.66024

Certificate: View Certificate

Abstract

The Securities and Exchange Board of India (SEBI) launched alternative investment funds (AIFs) in India in 2012. This study investigates the organizational structure of AIFs and their progression since their establishment. The analysis considers several factors, such as the commitments raised, funds generated, and investments executed, employing both graphical and inferential analysis techniques. The results reveal that AIFs have made considerable strides as a viable investment option, primarily due to the numerous benefits and diverse opportunities they provide to investors, along with the creative freedom granted to fund managers. In the years ahead, there is significant potential for this emerging investment alternative to experience substantial growth in both the Indian and global markets, which will largely depend on SEBI\'s regulatory decisions regarding the AIF framework.

Introduction

I. INTRODUCTION

The Knight Frank World Wealth Report 2020 reveals that the number of Ultra-high-net-worth individuals (UHNWI) worldwide is forecasted to grow by 27% over the next five years. Among the twenty countries experiencing the fastest growth, six are located in Asia, with India expected to lead with a 73% increase. Additionally, the Capgemini World Wealth Report 2020 ranks India as one of the top five Asian Pacific countries for High-Net-Worth Individuals (HNWIs). The report discusses the growth of the HNWI population in India in comparison to the Asia Pacific region, stating that, with a few exceptions, the HNWI demographic in India has been expanding significantly.

Until 2012, the investment management regulations of the Securities and Exchange Board of India (SEBI) were limited to Mutual Funds, Collective Investment Schemes, and Venture Capital Funds (VCFs). Among these, the VCF route was the most widely adopted for investments. This was primarily because there were no dedicated regulations for private pools of capital and investment vehicles. Additionally, the benefits and concessions typically available to VCFs could not be extended to other types of funds. However, this limitation hindered VCFs from fulfilling their primary objective of promoting early-stage firms. As a result, SEBI recognized the need to classify such other funds as a distinct asset class. In August 2012, SEBI introduced the Alternative Investment Fund (AIF) regime to facilitate capital flows into alternative asset classes.

The asset classes listed below summarize the various investment instruments identified in India:

- Mutual Funds and Exchange Traded Funds

- Collective Investment Schemes

- Alternative Investment Funds (AIFs)

- Category I AIF

- Category II AIF

- Category III AIF

- Foreign Portfolio Investors

- Real Estate Investment Trusts and Infrastructure Investment Trusts

An Alternative Investment Fund (AIF) is a privately pooled investment vehicle that gathers capital from both local and international investors. The funds are then invested according to a predetermined investment policy, with the objective of benefiting the investors.

AIFs present various schemes that align with the risk profiles of their investors. Generally, those who engage with alternative funds are known as Limited Partners (LPs). The individual or group that initiates an AIF is referred to as the Sponsor, while the person or team overseeing the fund is designated as the Manager. To manage an AIF effectively, a Manager must have the appropriate qualifications as outlined by SEBI. Furthermore, a Sponsor may act as a Manager if they possess the necessary expertise.

Typically, AIFs are held by institutional investors or accredited high-net-worth individuals (HNWIs) due to their complex nature, regulatory constraints, and comparatively lower liquidity than other investment options. Walker (2019) indicates that numerous large institutional funds, such as pension schemes and private endowments, have begun to allocate a segment of their portfolios to alternative investments. He emphasizes that the main reason for this trend is the low correlation.

As the presence of Alternative Investment Funds (AIFs) continues to expand within the portfolios of institutional investors and high-net-worth individuals (HNWIs), it becomes essential to analyze the emerging trends associated with this asset class in India.

II. CONCEPTUAL FRAMEWORK

A. Meaning and Definition of AIF

Alternative Investment Funds (AIFs) are explicitly defined and categorized in detail under Regulation 2 (1) (b) of the SEBI (Alternative Investment Funds) Regulation, 2012, with the most recent amendment occurring on May 10, 2019. An AIF is recognized as any fund that is established or incorporated in India, which may take the form of a trust, company, limited liability partnership, or body corporate. These funds act as privately pooled investment vehicles that aggregate capital from investors, whether they are Indian or foreign, for the purpose of investing in line with a clearly defined investment policy that benefits the investors. It is important to note that A

B. Categories of Alternative Investment Fund

In India, alternative investments can be classified into three distinct categories, as illustrated below.

1) Category I includes funds that focus on investing in start-ups, small and medium enterprises (SMEs), and new businesses with considerable growth potential. These projects are deemed socially and economically viable, as they contribute to economic growth and job creation. As a result, the government supports investment in these initiatives by providing various incentives. This category is divided into the following sub-categories:

- Venture Capital Fund: These funds provide early-stage investments in start-ups that show high growth potential but struggle to secure funding during their initial or expansion stages.

- Infrastructure Fund: These funds are aimed at developing public assets and infrastructure. Investors who are optimistic about infrastructure growth can invest in this fund.

- Angel Fund: Established venture capital funds typically shy away from investing in companies with uncertain growth trajectories. To address this, angel fund managers pool resources from angel investors to support start-ups.

- Social Venture Fund: The trend of socially responsible investing has led to the creation of this fund, which primarily invests in companies that prioritize social impact and aim to effect positive change in society.

2) Category II includes funds that invest in a variety of equity and debt securities. This category is designated for funds that do not fall under Categories I or III as defined by SEBI. There are no government incentives or concessions associated with investments in these funds. The sub-categories in this category are:

- Private Equity Fund: - Unlisted private companies, unable to raise capital through equity or debt instruments, often seek investment from private equity funds, which acquire ownership stakes in these firms.

- Debt Fund: - These funds target companies that exhibit high growth potential and strong corporate governance but are currently facing financial difficulties, making them attractive investment opportunities.

- Fund of Funds: - As the name implies, this fund is a composite of various Alternative Investment Funds (AIFs). Its investment approach focuses on building a portfolio that invests in other AIFs rather than creating its own distinct portfolio.

- Category III consists of funds that target short-term returns. These funds implement a range of sophisticated and varied trading strategies to achieve their objective of short-term capital growth. The category is divided into the following sub-categories:

- Hedge Fund: - This fund aggregates capital from institutional and accredited investors to invest in both domestic and global markets. Hedge funds are characterized by their high leverage and aggressive portfolio management style aimed at generating substantial returns.

- Private Investment in Public Equity Fund: - This fund focuses on purchasing shares of publicly listed companies at a reduced price. This approach allows investors to acquire a stake in the company while simultaneously providing a capital boost to the company that is selling its shares.

C. Registration of Alternative Investment Fund

To operate as an Alternative Investment Fund (AIF) within one of the specified categories, obtaining a registration certificate from SEBI is mandatory. Prospective investors must complete an application form and submit a bank draft of ?1,00,000 to SEBI. Following this, SEBI will assess the application and inform the investor of the outcome within 21 days. If the application is accepted, the investor is required to pay the necessary registration fee to function as an AIF in India.

Once SEBI grants the registration certificate, the AIF may seek to list on the exchanges. It is important to note that an AIF cannot alter its category post-registration without SEBI's consent, and such changes are permissible only if no funds have been raised from investors. While there are no fees associated with changing categories, a new application form must be submitted.

D. Key Eligibility Features and Reporting Requirements of AIFs in India

According to SEBI regulations, the minimum corpus amount required is ?200 million. However, Angel Funds, classified as a subcategory of Category I AIFs, are an exception to this rule, as they have a reduced minimum corpus requirement of ?100 million. Additional important characteristics of the three categories are outlined here.

1) AIF Category I

Closed-end funds in this category require a registration fee of ?5,00,000 and set a minimum investment threshold of ?10 million. They come with a lock-in period of three years and are capped at 1,000 investors. The limit for investment in any one investee company is restricted to 25 percent of the total investable fund. Moreover, the fund manager's continuing interest must not exceed the lower of 2.5 percent of the initial corpus or ?5 crore.

2) AIF Category II

Closed-end funds in this category require a registration fee of ?10,00,000 and set a minimum investment threshold of ?10 million. This category mirrors category I with a three-year lock-in period and allows for a maximum of 1,000 investors. The investment limit in any one investee company is capped at 25 percent of the total investable fund. Furthermore, the fund manager's continuing interest must not exceed 2.5 percent of the initial corpus or ?5 crore.

3) AIF Category III

This category allows both open-ended and close-ended funds, requiring a registration fee of ?15,00,000 and a minimum investment of ?10 million. There is no lock-in period, but the maximum number of investors is 1,000. The investible limit for any individual investee company is 10 percent of the total fund, and the fund manager's interest must not exceed 5 percent of the initial corpus or ?10 crore.

In April 2021, SEBI revised the reporting requirements for AIFs in India, mandating quarterly activity reports for all categories, to be submitted within ten days after each quarter ends. Category III funds must also disclose leverage details.

E. Elements Favoring the Expansion of Alternative Investment Funds in India

According to the findings from the Emerging Markets Private Equity Association, India has gained significant appeal as an investment destination within the emerging markets sector. It has been among the top three emerging markets for limited partners to allocate their capital in recent years, which has led to a notable increase in capital flows into the country. Soni (2019) reinforces this notion by emphasizing that long-term sustainable growth is a vital factor in attracting private capital to India. He also points out that alternative investments are on the rise and are increasingly being added to the portfolios of high-net-worth individuals, as they typically do not correlate with the stock market. This quality of alternative investments enhances portfolio diversification and assists in managing volatility.

The regulatory landscape surrounding AIFs has shown to be more effective for investors, prompting an increasing number of fund managers to pursue capital deployment through this method (Dhanjal, 2019). As noted by Kelly (2019), SEBI took significant steps in 2018 to encourage the AIF sector to return from offshore hubs like Mauritius and Singapore by permitting AIFs to operate from the International Finance Services Centre (IFSC) located in Gift City. This innovative AIF platform at IFSC allows private equity investors to launch funds at a low cost. Additionally, the dollar-based nature of AIFs from IFSC has simplified the process of raising foreign capital across various investment strategies.

In a recent development, the Ministry of Finance has granted permission for private Provident Funds to invest in categories I and II of Alternative Investment Funds (AIFs), albeit with certain limitations.

This announcement, made in March 2021, is anticipated to catalyze notable changes in the Indian AIF sector. Consequently, these funds are likely to attract a wider range of investors, enhancing their relevance in the market.

III. RESEARCH DESIGN

This study relies on secondary data obtained from various published sources. The primary source of this secondary data includes reports released by SEBI. Data categorized by commitments raised, funds raised, and investments made has been compiled over a span of 32 quarters, specifically from the third quarter of FY 2013 to the second quarter of FY 2024. The research employs both graphical and inferential analysis to examine the trends in commitments, funds, and investments throughout the specified quarters.

Evolution of Regulatory Framework for Alternative Investment Funds (AIFs) (2012–2024)

2012 & 2013

- SEBI introduced the Alternative Investment Funds (AIFs) Regulations 2012 in May 2012.

- Periodic reporting to SEBI by AIFs was mandated.

- A risk management framework was introduced for Category III AIFs, covering:

- Calculation of exposures and NAV.

- Obligations of AIFs and custodians in case of limit breaches.

2014 & 2015

- Enhanced transparency through disclosure of fees, charges, and litigation in the Private Placement Memorandum (PPM).

- Compliance oversight was strengthened by mandating the preparation and submission of compliance test reports.

- Guidelines for overseas investment by AIFs/VCFs were issued, broadening investment options.

2017 & 2018

- SEBI launched an online system for AIF registration, reporting, and filing.

- Enhanced reporting formats for Category III AIFs to include investments in commodities.

- Guidelines were issued for AIF operations in International Financial Services Centers (IFSC), addressing operational requirements, conditions, and restrictions.

2020

- Standardized disclosure norms to improve transparency in AIF operations.

- Accountability assigned to Investment Committee members for AIF investment decisions.

- Mandatory performance benchmarking and annual audit of PPMs introduced.

- Templates for PPMs were standardized.

2021

- Introduced a framework for AIFs to invest in units of other AIFs, expanding the investor pool.

- Implemented a Code of Conduct for AIFs.

- Introduced a new category of accredited investors.

- Mandatory filing of PPM through SEBI-registered merchant bankers.

- Co-investment by AIF investors to be routed through co-investment portfolio managers under SEBI (PMS) Regulations 2020.

- Enhanced disclosure practices:

- Introduction of an Investor Charter.

- Disclosure of changes in Key Managerial Personnel (KMPs) to investors and SEBI.

- Maintenance of data on investor complaints in a specified format.

2022

- Special situation funds were introduced for investments in distressed assets.

- Appointment of a compliance officer made mandatory to align AIFs with other investment products.

- Guidelines for Large Value Funds (LVFs) for accredited investors issued.

- Operational standardization introduced, including:

- Guidelines on first close, tenure calculation, fees, and changes in management/sponsorship.

- Removed the requirement for an Indian connection for overseas investments, broadening opportunities.

- Discontinuation of the priority distribution model, promoting investor equality.

2023

- Introduction of direct plans for AIF schemes and a trail model for distribution commissions.

- Mandate for AIFs to conduct at least 10% of secondary market trades in corporate bonds via the RFQ platform.

- Requirement for all AIF schemes to dematerialize their units within a specified timeframe.

- Standardized valuation approach for AIF investment portfolios.

2024

- Standardized reporting format introduced, facilitated by AIF associations.

- Mandatory online submission of PPM audit reports to SEBI.

- Alternative Investment Funds (Second Amendment) Regulations 2024 notified, featuring:

- Permission for Category I and II AIFs to create encumbrances on the equity of investee companies for borrowing.

- Enhanced due diligence requirements for AIF managers, KMPs, and investors to prevent regulatory circumvention.

- Introduction of a Dissolution Period under Regulation 29B and discontinuation of the Liquidation Scheme under Regulation 29A.

- Relaxation of intimation requirements for changes in PPM terms through merchant bankers.

This progression highlights SEBI’s consistent efforts to enhance transparency, improve compliance, and expand investment avenues for AIFs, ensuring alignment with global best practices.

An overview of significant terminology related to AIF regulations, as specified by SEBI, is presented in this section.

- Regulation 2(1)(h) defines 'Corpus or Commitments Received' as the total funds that investors have committed to the Alternative Investment Fund (AIF) through formal contracts or equivalent documents as of a designated date.

- 'Funds Raised' indicates the actual financial contributions deposited by investors into the AIF.

- As outlined in Regulation 2(1)(p), 'Investible Funds or Investment Made' signifies the corpus of the AIF, excluding projected costs associated with its administration and management. This term essentially reflects the genuine amount expended from the AIF after the funds have been raised.

The AIF sector in India has experienced consistent growth over the years, prompting CRISIL to establish a benchmark for AIFs. This benchmark evaluates the performance of AIFs across different categories on an aggregate basis. Private pension funds, now permitted to invest in AIFs, are restricted to those with a rating of AA or higher. To formulate its benchmark, CRISIL calculates three key ratios: distributions to paid-in capital (DPI), residual value to paid-in capital (RVPI), and total value to paid-in capital (TVPI). DPI represents the ratio of total distributions to the paid-in capital, while RVPI indicates the ratio of the remaining value of investments in the fund after distributions to the paid-in capital. TVPI, also referred to as the investment multiple, is the ratio of the combined total distributions and residual value to the total paid-in capital. Under the new SEBI regulations for AIFs, categories I and II are required to disclose DPI, RVPI, and TVPI.

IV. DATA ANALYSIS AND INTERPRETATION

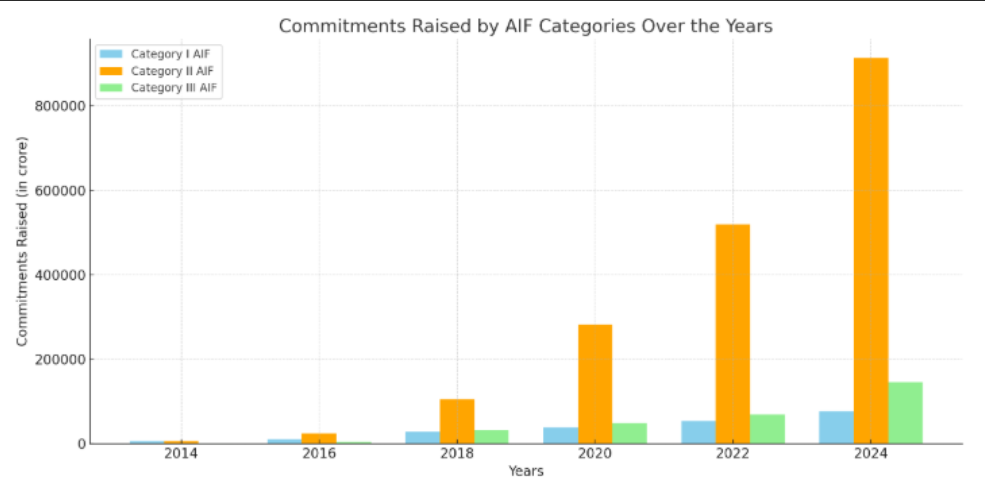

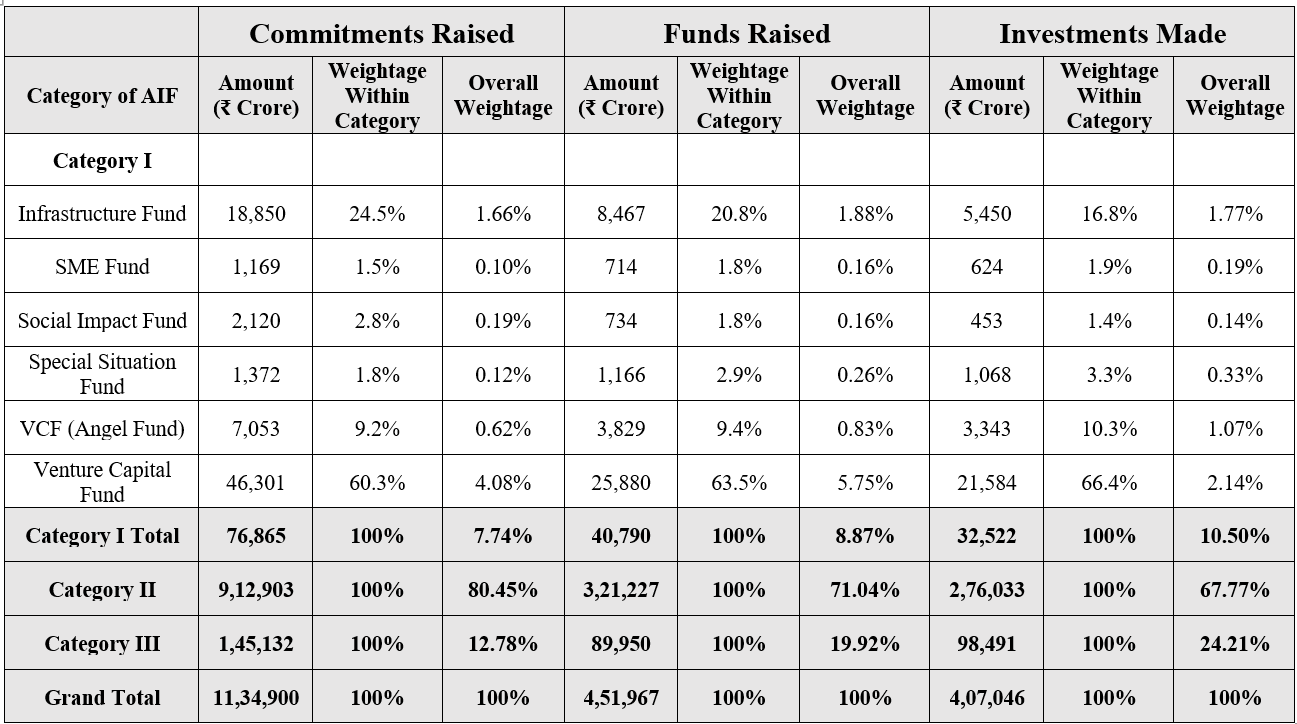

Over the last decade, Alternative Investment Funds (AIFs) in India have experienced significant growth, emerging as a favored option for high-net-worth individuals (HNWIs). As per the latest data from SEBI as of March 2024, total commitments have escalated to ?11,349 billion (?11.35 lakh crore), a remarkable rise from ?200 billion in 2014. Within the three AIF categories, 42% of commitments have been allocated, and 87% of the raised funds have been deployed while maintaining a cash reserve (dry powder) of ?28,285 crore.

Category II AIFs, which include private equity, real estate, and debt funds, continue to lead the market with commitments totaling ?9,12,903 crore. This category has successfully raised ?3,21,227 crore and invested ?2,76,033 crore, resulting in an investment-to-commitment ratio of 81%.

In contrast, Category III AIFs, encompassing hedge funds and trading strategies, have demonstrated superior capital efficiency, with total commitments of ?1,45,132 crore, funds raised at ?89,950 crore, and investments exceeding ?98,491 crore. This category boasts an impressive 90% investment-to-commitment ratio and an 82% investment-to-funds raised ratio, highlighting effective fund management and minimized dry powder.

Category I Alternative Investment Funds (AIFs), which include venture capital funds, social venture funds, infrastructure funds, and small and medium enterprise (SME) funds, have achieved total commitments of ?76,865 crore. Of this amount, ?40,790 crore has been successfully raised, while ?32,522 crore has been allocated for investments. Within this category, Venture Capital Funds (VCFs) represent the largest portion, accounting for 68% of total commitments as of March 2024. Infrastructure funds follow with 23%, social venture funds contribute 6%, and SME funds make up 3%.

This information illustrates the consistent growth of AIFs, with Category III enhancing fund efficiency, Category II leading in total commitments, and Category I demonstrating considerable growth potential, especially within India's burgeoning venture capital landscape. The ongoing expansion of AIFs reflects strong investor confidence and the increasing sophistication of alternative investment approaches in India's financial sector.

Commitments Raised, Fund Raised, and Investment Made under the AIF Categories Since Inception till March 2024

COMMITMENTS RAISED FROM 2014 to 2024 (Sources from SEBI)

A. Analysis of Trends

- Category I AIFs, particularly Venture Capital Funds (VCF), continue to lead in terms of commitments raised, with ?46,301 crore in commitments as of March 2024, representing the growing interest in early-stage investments, startups, and technology-driven ventures. The Social Impact Fund and Infrastructure Fund within this category also show continued growth, although their proportions have decreased relative to the dominant VCF segment.

- Category II, which focuses on private equity, debt funds, and real estate funds, continues to dominate in terms of the total amount raised. The large volume of funds raised by Category II reflects investor confidence in stable, low-risk assets compared to the higher volatility seen in Category III.

- Category III, representing hedge funds and complex trading strategies, shows strong deployment of raised funds, with an investment-to-fund ratio of around 90%. This category is associated with more aggressive investment strategies and has continued to attract sophisticated investors looking for high-risk, high-reward opportunities.

B. Performance and Returns:

- Over the years, Category III AIFs have delivered strong returns, although the average annualized rolling returns for Category III have seen a decline, from double-digit growth to around 4.52% as of the last recorded period in 2020. This is largely due to the tax structure affecting this category, which does not allow for tax pass-through benefits and may affect investor returns over the long term.

- Conversely, Category I AIFs, particularly Venture Capital Funds, continue to attract significant interest, with a higher unallocated capital indicating the potential for more fundraising and investment activity in the coming years.

C. Correlation Analysis:

- The correlation between funds raised and investments made is strong across all categories, particularly in Category III, which has a correlation coefficient of 0.95, reflecting the efficient use of raised funds.

- Category I, on the other hand, shows weaker correlations (0.13 for funds raised and 0.026 for investments made relative to commitments), suggesting that Category I funds have a substantial amount of dry powder, representing future investment opportunities.

Conclusion

The findings reveal that the AIF sector in India has rapidly expanded since SEBI implemented its regulations in 2012. Investors have long had access to a range of investment opportunities, such as real estate and complex infrastructure projects. Nevertheless, the AIF model has made these intricate investment processes more manageable. The pooling mechanism of AIFs has garnered significant interest, providing a variety of options across different categories and subcategories. Furthermore, AIFs deliver an attractive risk-return profile that is particularly appealing to ultra-high net-worth investors. Fund managers are also increasingly inclined towards AIFs, as they offer greater opportunities for innovation compared to traditional investment options. As a result, commitments for AIFs have risen dramatically, with FY \'20 accounting for over 31 percent of the total capital raised in prior years. However, industry experts believe that the amount of capital ready for deployment in India is much larger. With India well-positioned for growth among emerging markets, it is at a crucial juncture where both proactive regulatory changes and increased capital investment are necessary. Although it is still early to assess the returns from funds currently available, the future of the AIF industry looks very encouraging.

References

[1] Roshani, Puja, et al. \"Investments & alternate investment options in India.\" Analytics in Finance and Risk Management. CRC Press, 2023. 292-299. [2] Roshani, P., Bansal, D., Agarwal, S., & Bhardwaj, A. (2023). Investments & alternate investment options in India. In Analytics in Finance and Risk Management (pp. 292-299). CRC Press. [3] Bharathan, Sai Krishna, and Ganesh Rao. \"Alternative Investment Funds in India: Unlocking Sophisticated Investment.\" NLS Bus. L. Rev. (2017) [4] Shruti, Ananya, and Shashank Saurabh. \"Alternative Investments: Analyzing Its Practical Application in India.\" RGNUL Fin. & Mercantile L. Rev. 7 (2020): 139. [5] Mondal, Debmita, and Apoorvi Shrivastava. \"Angel Funds: The New Type of Alternative Investment Fund in India.\" IUP Law Review 6.4 (2016). [6] Mahato, Mritunjay. \"EXAMINING ALTERNATIVE INVESTMENT FUNDS OPERATED IN INDIA.\" [7] https://www.icsi.edu/media/webmodules/CSJ/July-2024/30.pdf [8] Mohanty, Rahul, and Devarshi Mukhopadhyay. \"Examining the SEBI (Alternative Investment Funds) Regulations 2012: A Capital Market Perspective of Hedge Fund Regulation in India.\" Business Law Review 38.3 (2017). [9] Mohanty, R., & Mukhopadhyay, D. (2017). Examining the SEBI (Alternative Investment Funds) Regulations 2012: A Capital Market Perspective of Hedge Fund Regulation in India. Business Law Review, 38(3). [10] Mohanty, Rahul, and Devarshi Mukhopadhyay. \"Examining the SEBI (Alternative Investment Funds) Regulations 2012: A Capital Market Perspective of Hedge Fund Regulation in India.\" Business Law Review [11] Securities and Exchange Board of India (SEBI) [12] https://www.crisil.com/content/dam/crisil/our-analysis/reports/Research/documents/2023/12/no-ifs-about-aifs.pdf

Copyright

Copyright © 2024 Hamsaveni D. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Download Paper

Paper Id : IJRASET66024

Publish Date : 2024-12-19

ISSN : 2321-9653

Publisher Name : IJRASET

DOI Link : Click Here

Submit Paper Online

Submit Paper Online